Managing the if i donated to purple heart how do i get my receipt online document is a breeze using our PDF editor. Try out the following actions to obtain the document straight away.

Step 1: Initially, click the orange button "Get Form Now".

Step 2: Once you've accessed the if i donated to purple heart how do i get my receipt online editing page you'll be able to find each of the functions you may perform regarding your file from the upper menu.

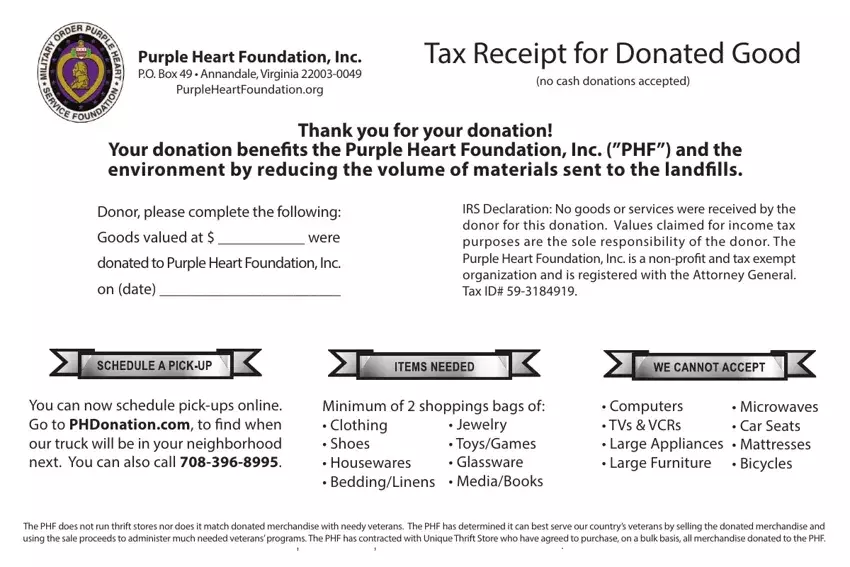

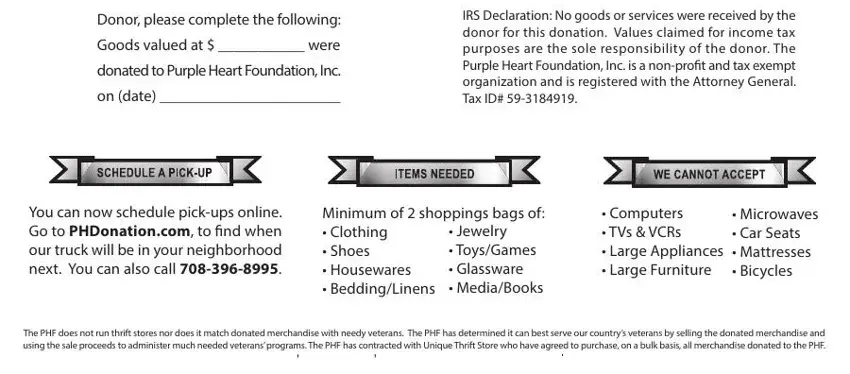

Type in the content requested by the application to prepare the form.

Step 3: As you click the Done button, the completed file is easily transferable to each of your devices. Or, you will be able to deliver it by means of mail.

Step 4: You should generate as many copies of your file as you can to avoid possible worries.