There's nothing complicated about filling in the illinois rut 25 form after you open our PDF editor. By following these simple steps, you will get the ready file in the minimum time period possible.

Step 1: Choose the button "Get Form Here".

Step 2: At the moment, you can start modifying your illinois rut 25 form. The multifunctional toolbar is available to you - insert, delete, adjust, highlight, and undertake other sorts of commands with the text in the file.

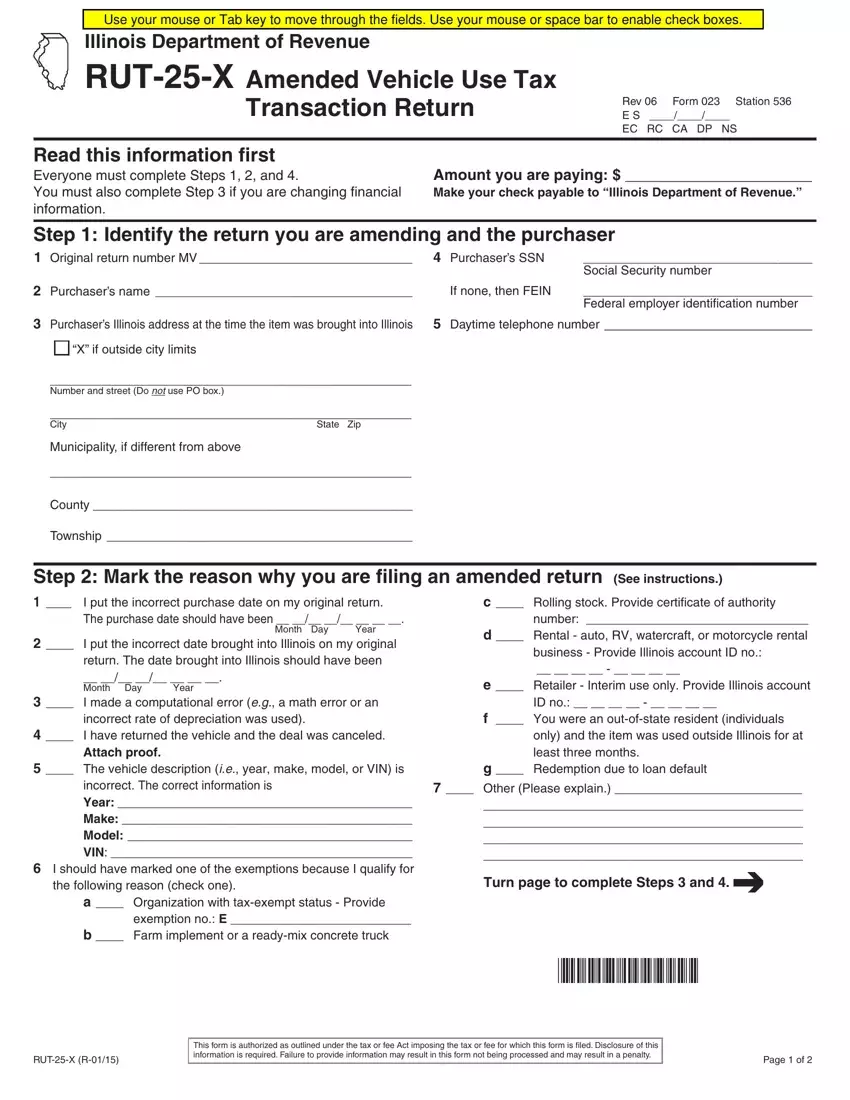

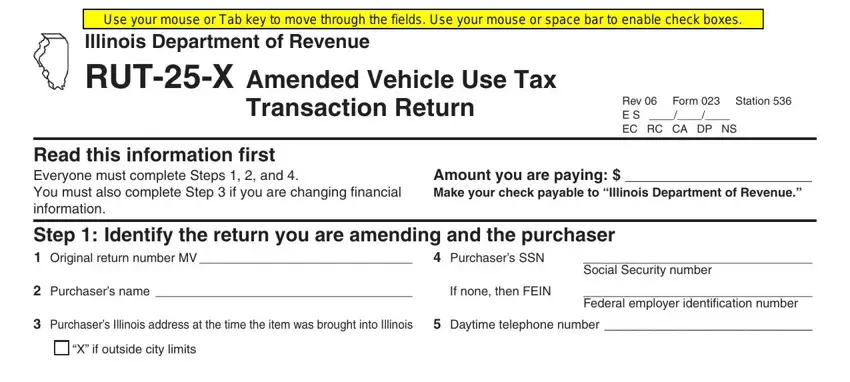

Fill out the illinois rut 25 form PDF by entering the data meant for each individual part.

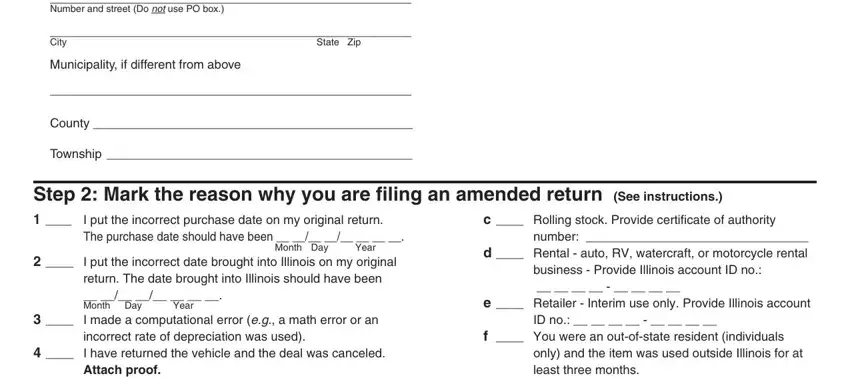

Remember to fill up the Number and street Do not use PO, State Zip, County, Township, Step Mark the reason why you are, c Rolling stock Provide, I put the incorrect purchase date, Month Day, Year, I put the incorrect date brought, return The date brought into, Year, number, d Rental auto RV watercraft or, and e Retailer Interim use only space with the necessary information.

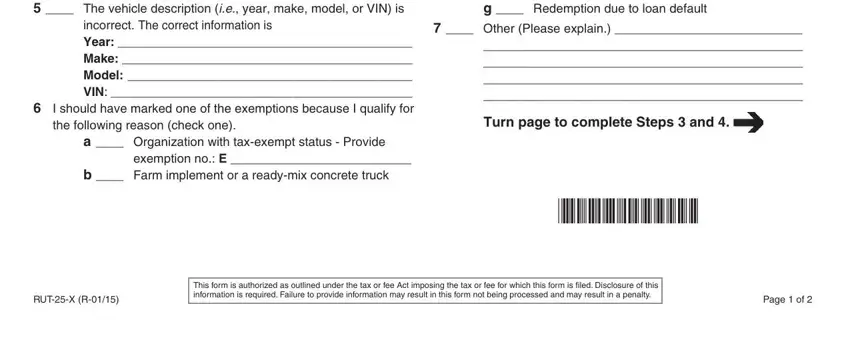

You can be requested for certain significant data if you need to fill up the The vehicle description ie year, g Redemption due to loan default, incorrect The correct information, a Organization with taxexempt, exemption no E, b Farm implement or a readymix, Other Please explain, Turn page to complete Steps and, RUTX R, This form is authorized as, and Page of area.

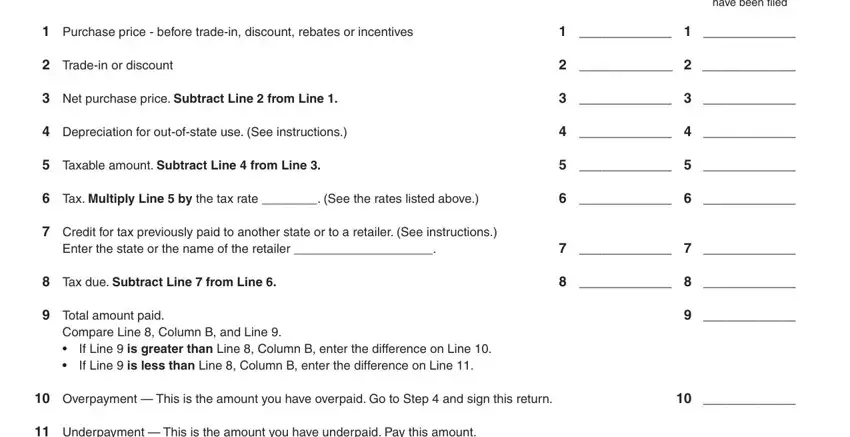

The field have been filed, Purchase price before tradein, Tradein or discount, Net purchase price Subtract Line, Depreciation for outofstate use, Taxable amount Subtract Line, Tax Multiply Line by the tax, Credit for tax previously paid to, Enter the state or the name of the, Tax due Subtract Line from Line, Total amount paid, Compare Line Column B and Line, If Line is greater than Line, Overpayment This is the amount, and Underpayment This is the amount should be where you add all sides' rights and responsibilities.

Review the sections RUTX R, and Page of and then fill them out.

Step 3: Click the button "Done". Your PDF form may be exported. You may download it to your device or send it by email.

Step 4: It's possible to make duplicates of the form tostay clear of any kind of future problems. Don't get worried, we cannot publish or track your information.