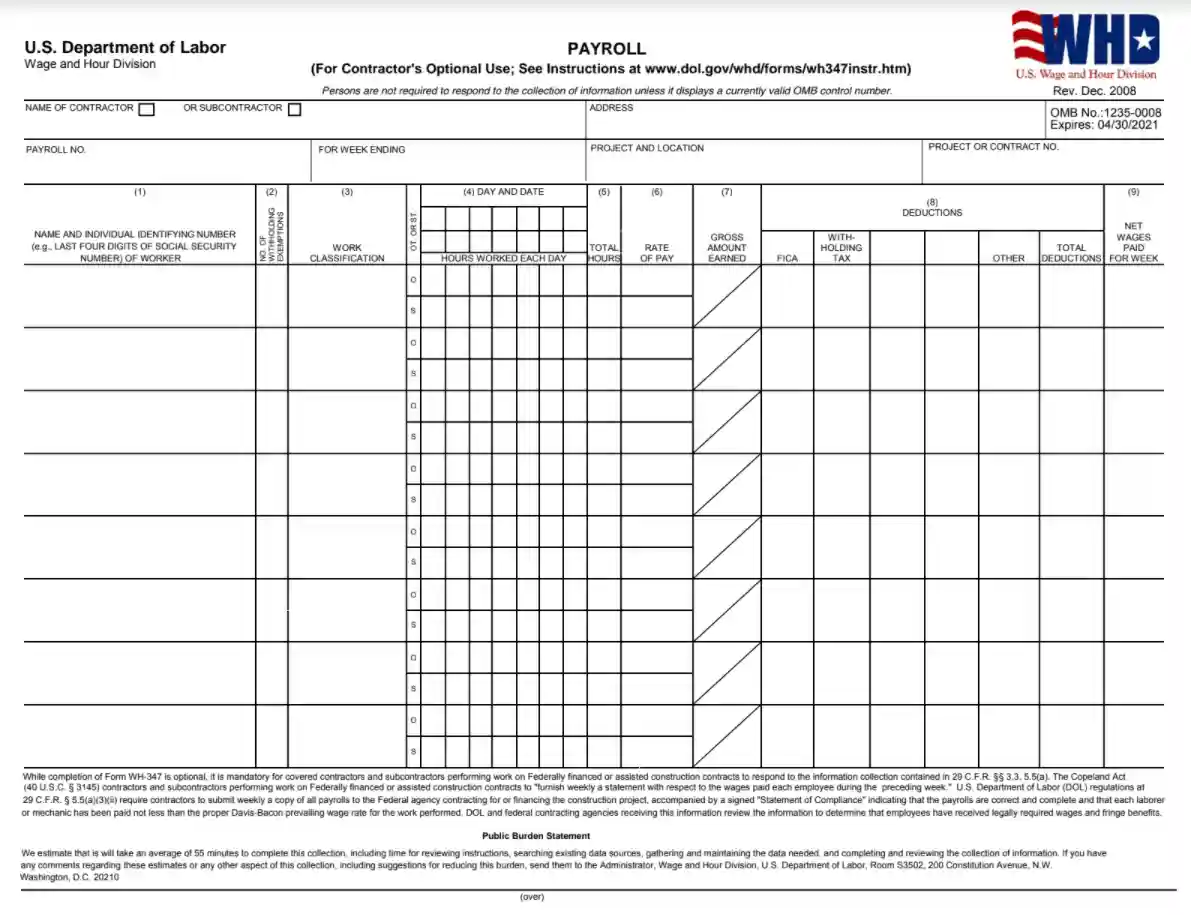

US DoL WH-347 is a standardized payroll form designed by the U.S. Department of Labor for contractors and subcontractors working on federally financed or assisted construction projects. This form reports weekly wages paid to each employee, ensuring compliance with the Davis-Bacon and related Acts, which require payment of prevailing wage rates determined by the Department of Labor. The form captures details such as worker identification, work classification, hours worked, pay rates, gross earnings, deductions, and net wages.

The purpose of Form WH-347 is to facilitate oversight and ensure that workers on public works projects are paid properly according to federal wage standards. It includes a certification section where the employer attests to the accuracy of the payroll records and compliance with wage payment requirements.

Other Financial Forms

If you’d like to check out more financial documents for you to edit and fill out online, the following are examples of the forms searched often by our visitors. Additionally, keep in mind that it is easy to upload, fill out, and edit any PDF document at FormsPal.

How To Fill Out WH-347 Payroll Form

Before we begin, it’s very important to know about Regulations, Parts 3 and 5 terms. The “Declaration of Conformity” (or “Statement of Compliance”) does not require notarization, but the description (on the second page of the WH-347 payroll form) is subject to punishments administered by 18 U.S.C. §1001. This can be either a fine or imprisonment (in fact, less than five years), but sometimes it’s even both. Hence, the signatory of the application must know that all the presented data is exact.

Here is a full guide on how to create a WH-347 Payroll Form, including all the details you might need:

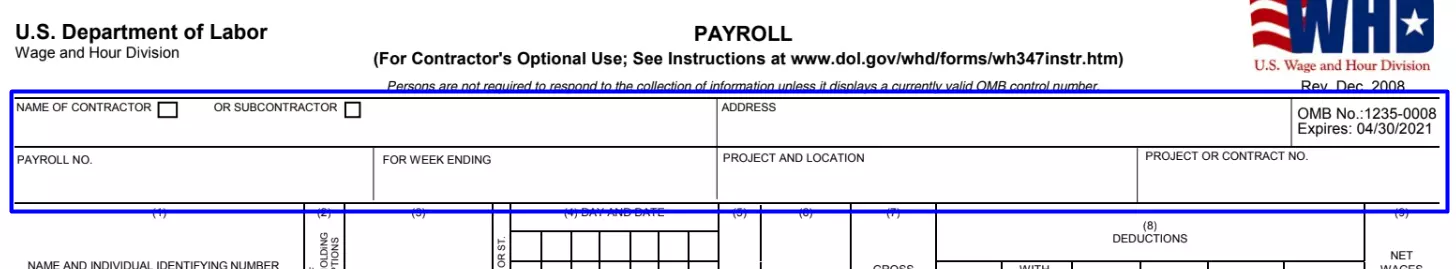

Enter the relevant contract information

- Start to fill out the WH-347 form by checking the suitable box and then write down the firm or company’s name below;

- Write the full legal firm’s address;

- Insert the payroll number to file opening with the number “1”;

- Enter the date when the workweek ends;

- Describe the project’s name and where it takes place;

- Enter the contract number or the project’s one if it’s more suitable.

Indicate each employee’s data (Column 1)

Register each worker’s full legal name and their individual ID numbers (you can write down the last four symbols of the employee’s SSN (social security number)) on every payroll you present.

Show the number of exemptions from withholding (Column 2)

This column is optional and is not required by the Regulations, Part 3 and 5. However, for the convenience of the employer, it can be completed.

Describe each employee’s post (Column 3)

In this column, register the rank of each laborer or mechanic and the job that they actually performed. To do this, refer to the specification of contracts (sections “Classification” and “Minimum Wage Schedule”). If the data given in the contract is not enough, an agency spokesperson or suitable employee should be contacted. This is suitable if the worker has multiple posts where the working hours are recorded separately on the presented payroll.

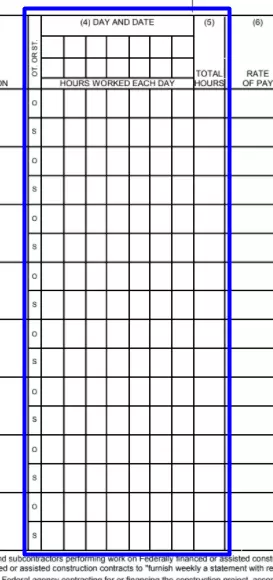

List each employee’s working hours and totals (Columns 4 and 5)

Provide all the related information about the employee’s working hours per week, including overtime hours as well. To do this, enter the exact date, hours worked, and overtime in the appropriate fields. Overtime hours are supposed to be hours above 40 hours per week (following the Contract Work Hours Standard Act). In column 5, add all hours in total.

Enter the payment rate along with additional benefits (Column 6)

List the exact rate for each worker in the “Direct time” field. In other words, the actual salary earned by the worker for hours worked. And also how all applicable benefits are paid. When you specify an hourly rate that differs from supplementary benefits, you must register it independently from the base rate. For instance, “$13/.50” would mean $13 in the hourly rate and $0.50 in extra benefits.

This is how the overtime salary is calculated. In this case, it is important to write the paid hourly rate and payment instead of additional benefits in the “overtime” field for each employee or mechanic. If not applicable, please leave this field blank.

If the sum of the main contract of the project plan is higher than $100,000, then the expense of wage for overtime hours will be somewhat for the time and half of the normal rate of payment, according to the Contract Work Hours Standard Act of the 1962 year.

In addition to paying at least a planned rate for the rank, the contractor must pay salaries that were previously identified as an additional benefit in the wage settlement that is part of a contract, an accredited additional benefit plan, fund, or program that can also be paid cash instead of additional benefits.

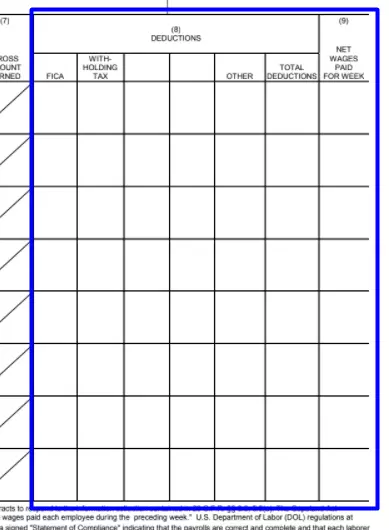

Register the total amount earned (Column 7)

In this section, you must provide the total amount earned by the employee on the project. If the worker earned money on projects other than the one specified in this payroll statement, then first indicate the amount earned in the project from the Federal budget in Column 7. And then the sum received per week for all projects in general. It will look like “$170.00/$395,00”. That is, $170 was earned on the construction-type project described here, and $395 on all projects, including this one.

List all of the deductions and hebdomadal net payments (Columns 8 and 9)

Section 8 has five columns. If the number of deductions exceeds the already indicated number, then the remaining ones must be filed in the “Other” column. To do this, in the General Deductions column, write the actual number of the deduction and then list each deduction from the “Other” column in the WH-347 payroll attachment.

If a worker has more than one post outside this particular project, it is required to determine the actual hebdomadal deductions from the gross salary for the week and register that these deductions are from the gross salary.

It is important to note that each deduction is directed to the rules of the Copeland Act, 29 CFR Part 3.

In the end, use Column 9 to enter the total worker or mechanic net earnings received in the week.

Insert the total sums

There is a special place at the bottom of each column to enter the total amount for the subject above. These fields can be filled in at the request of the contract holder and are optional.

Topics 1 and 2

In the WH-347 Form, between items (1) and (2), there is a specially allocated space for additional deductions. If all the deductions fit into the relevant column above, then simply write “See Deductions column in this payroll” in the blank field.

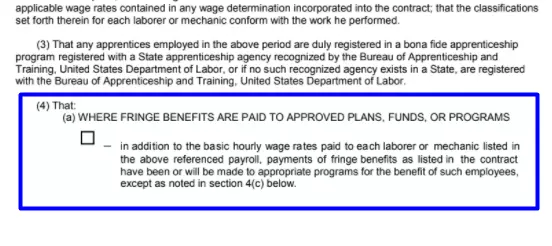

Topic 4 (a) and (b)

Here is a complete instruction on how to fill out clause four on additional payments:

1. (a) If you pay Additional/Fringe Benefits

If additional benefits are paid to previously confirmed plans, funds, or programs in numbers equal to or greater than those restricted in the relevant Secretary of Labor payments settlement, define the base hourly and overtime rate for each worker.

Check clause 4 (a) of the WH-347 payroll form on the second page to make sure that the sum is correct. If you do so, the account should be taken of any exceptions in section 4 (c) below.

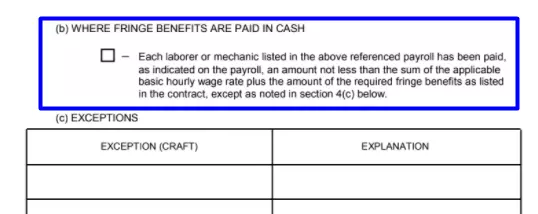

2. (b) If you do not pay Additional/Fringe Benefits

If additional benefits are not paid to either plans, funds, or any approved programs (in the number that were presented to the settlement of the Secretary of Labor), it will be essential to pay the entire remaining amount of fringe benefits to each of the employees, which will be more than the previously agreed upon in the contract standards for each post (write down in the “Straight Time” of the “Rate of Pay” column of the WH-347 payroll). To this is added the sum of extra benefits, which is specified in the wage settlement.

The overtime rate must be at least the pre-established standard rate (plus a regular rate half-day allowance and cash required instead of flat rate fringe benefits).

You will need to check section 4 (b) on the second page of the payroll form to indicate that additional cash benefits are being paid directly to workers. If you do so, the account should be taken of any exceptions in section 4 (c) below.

Topic 4 (c); Exceptions

In addition to the above rules from paragraphs 4 (a) and (b) on payments, there are exceptions that you can write down in paragraph 4 (c). To do this, in the “Exception” column, register the employee’s post, and in the “Explanation” column, two hourly amounts that the worker receives instead of additional benefits and is also paid as additional benefits to plans, funds, or programs.

The contractor pays an expense that is more than the named standard (plus the number of additional benefits as shown in Section 4 (c)) to each employee for all worked hours per week (unless it’s administered by the relevant statement of payments) at the Federal project level.

Write the full sum of the stake paid and the amount that was paid in cash of the additional hourly payments from Column 6. To complete these fields correctly, please refer to “If you do not pay Additional/Fringe Benefits” above to calculate the overtime rate.

Public Burden report

Usually, it takes less than an hour to accurately create the WH-347 form. This is taking into account the review and examination of all the basic instructions, the compilation of data required to create the report, as well as to recheck and fix some possible mistakes.

And don’t forget to use our form-building software to correctly and safely fill out and then download the WH-347 payroll application.