Florida Small Estate Affidavit Form

In the United States, including Florida, an individual’s death is followed by signing and submitting various documents. One of these documents is the Florida small estate affidavit (SEA) form. Relatives and other people considered heirs use the document to claim the deceased’s property without going to the courts. The small estate affidavit becomes especially handy if the decedent did not leave a will.

You will not find any unified form of such an affidavit in the US because of the rules for creating this form change from state to state. Typically, when making the document, you will have to include the following:

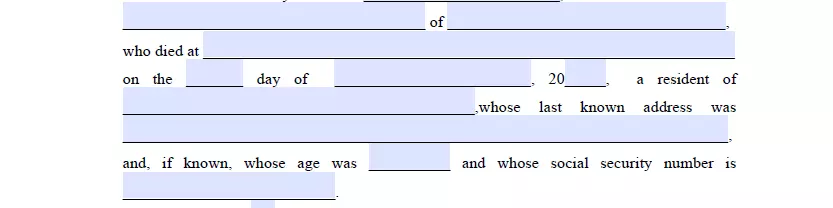

- Personal information of the decedent

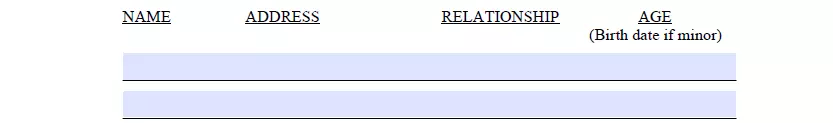

- Personal details of the successor (or successors)

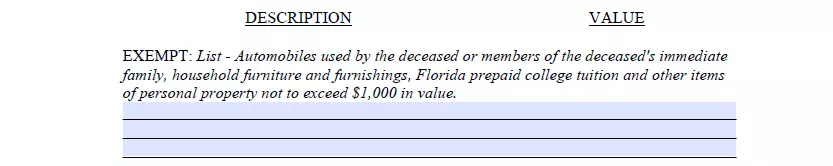

- Description of subject estate

And other details. Usually, the SEA form also reveals the decedent’s debts. The deceased person’s estate covers the debts in many cases.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Florida Laws and Requirements

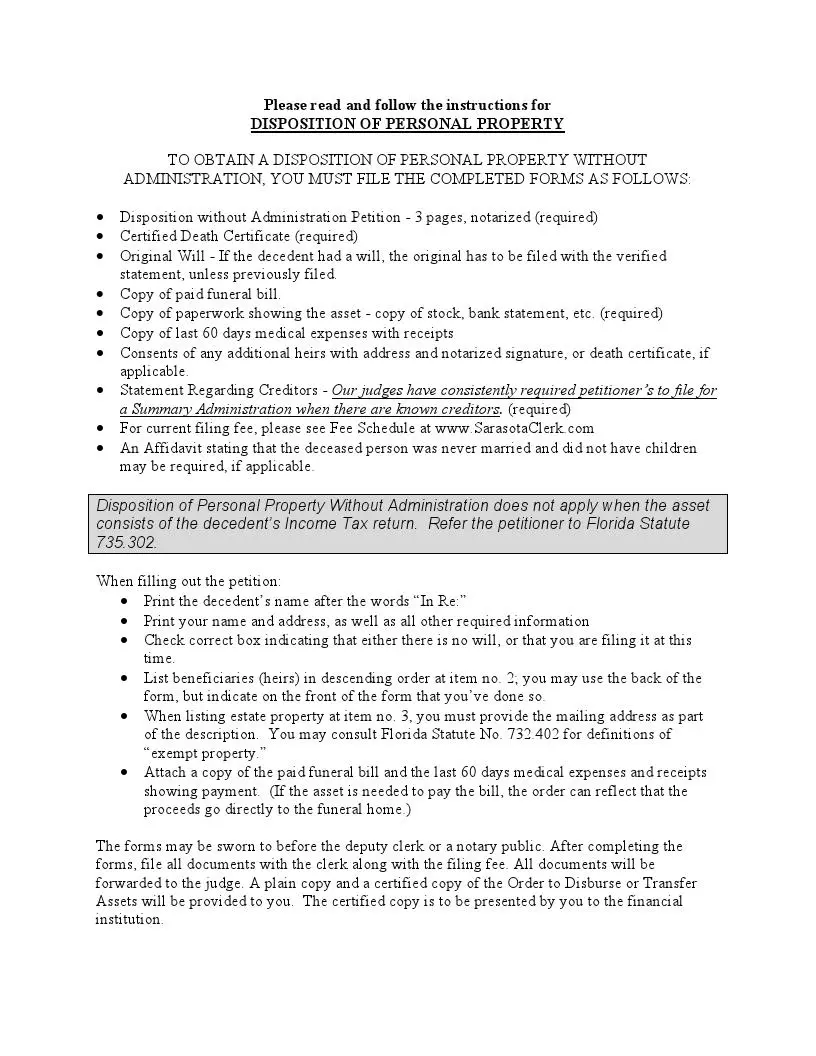

The Florida SEA form is officially called the “Disposition of Personal Property without Administration” form. The laws tied to this form and the whole process of filling it out are incorporated in Chapter 735 of the Florida Statutes that is called “Probate Code: Small Estates.”

To claim a property item using this document, its value should not be more than 75,000 US dollars, as stated in section 735.201 of the Florida Statutes.

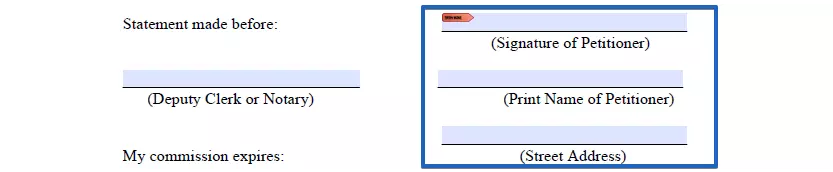

The Florida SEA form requires either the signature of the deputy clerk or a public notary acknowledgment.

Florida Small Estate Affidavit Laws Details

| Max. Estate | $75,000 and $10,000 (if decedent has died intestate) |

| Min. Time to Wait After Death | Not specified |

| Filing Fee | Varies by county |

| State Laws | Florida Statutes, Chapter 735 |

More important Florida templates available for download on our site and that can be customized in our hassle-free document constructor.

Filling Out the Florida Small Estate Affidavit Form

Below are instructions on how to file a small estate affidavit form in Florida successfully.

- Download a SEA Form Template

Ensure that you have the right template of the Florida SEA form and download it. Our form-building software will help you obtain the needed file.

You should know that people complete such a form for vehicles as well. In our case, we review a general SEA form, not the one for vehicles.

- Read and Understand the Information Therein

Ensure you read and understand the vital information first. If something is unclear, consult an expert.

- Indicate the County

On top of the SEA form, write the name of the county where you are signing and submitting the papers.

- Add the Petitioner’s Details

You (as a person who is signing, or the petitioner) should add your name and address along with the Social Security Number (SSN).

- Write the Name of the Decedent

After writing your details, add the information about the dead person (or decedent). Include their name, the type of relationship between you two, the date when the person passed away, the address, SSN, and age. State if the decedent left a will.

- Write the Successors’ Details

Enter details of all successors who aspire to inherit the estate. The information should include names, addresses, age, and their relation to the decedent.

- Describe the Property

Add a description of the property and its value. Also, list the debts and the expenses tied to the funeral and medical care. For those expenses, you will have to provide receipts.

- Sign the Form

Once you have given all details about estate and debts, sign the form. Add your name, address, and date.

- Ask a Notary or a Deputy Clerk to Sign

You should notarize a SEA form in Florida. Therefore, after signing it, ask a notary to sign it as well. A deputy clerk may sign instead of a notary.