Illinois Small Estate Affidavit Form

In every state of the U.S., including Illinois, when dealing with property transfer matters, to make the procedure easier and to save an individual’s time, one can complete specific forms. An Illinois Small Estate Affidavit form (SEA) is one of such documents. It is a way of claiming a deceased person’s estate by an individual who has a legal right to possess it (one of their close family members).

The small estate affidavit is usually filled out when the dead person (decedent) didn’t leave any paper with their wishes regarding their property. However, in Illinois, a will can be attached to the document. The form is the most convenient way to handle such situations as it helps heirs avoid going through a formal, tiresome, and time-consuming procedure in court.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Each state has its list of requirements for the form and information to include in it. In Illinois, the document is generated by the state, so you will not be at a loss when choosing the form you need.

Illinois Laws and Requirements

Remember that before completing the form, you are to check out the specific rules to follow. An Illinois resident can find all these rules in Chapter 755 of the state laws. In Article 25, one can even see the official template of the form.

According to the Illinois Probate Act, a small estate affidavit form may be created and signed only if the estate’s value does not exceed 100,000 US dollars. It is more than an average gross value in the US (estimated at 50,000 dollars.

Although there are no laws about the waiting period, it is recommended that the affiants submit the legal form within one or two months (as in most states) from the date of the decedent’s passing.

Sometimes, the US states may require that witnesses be present during the execution of the form or the document’s notarization by an official agent. When completing a small estate affidavit form in Illinois, the heir should provide their own signature and obtain a local notary agent’s signature. Besides, the document is not valid without a seal.

Illinois Small Estate Affidavit Laws Details

| Max. Estate | $100,000 |

| Min. Time to Wait After Death | Not specified |

| Filing Fee | Not specified |

| State Laws | Illinois Compiled Statutes, Chapter 755, Section 5, Article 9 |

We provide a variety of important Illinois forms to anybody striving for simplicity when dealing with various paperwork.

Filling Out the Illinois Small Affidavit Form

To make the process easier, we have provided instructions for completing an Illinois small estate affidavit form. Find these instructions below and use them for a better result.

Download the Template of a SEA Form

The state has its template, which is available online. Thus, all you need to do is make use of our form-building software and download the correct file.

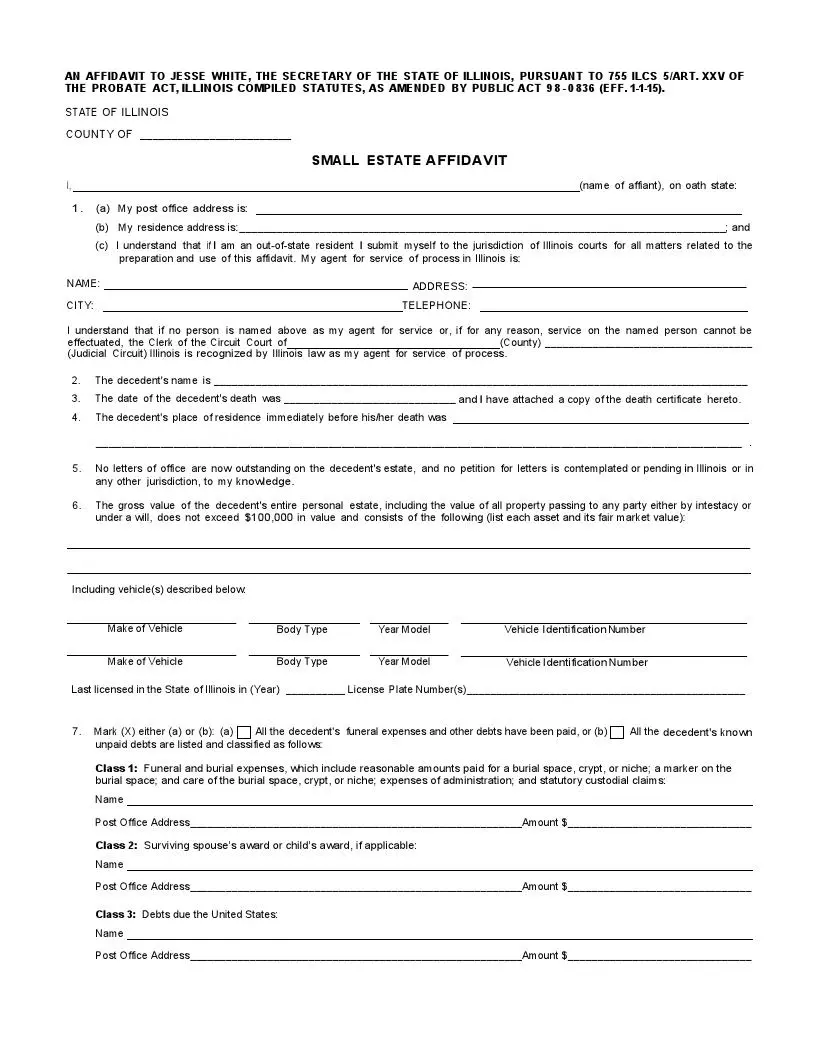

Specify the County

At the top of the first page, you should write the particular county where you are signing and submitting the document.

Add Your Personal Data

You (as an affiant) should insert your full name in the blank line. Besides that, provide your address (and mailing one if it is different). If you are not a resident of the state, you should appoint an agent who will complete the process on your behalf and insert their personal information. If there is no agent, indicate the name of the county clerk who will file all the documents with the court.

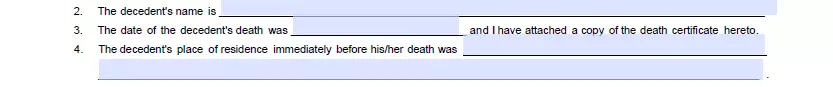

Insert the Decedent’s Info

Do not forget to mention the name of the dead person, the date they died, and the former address.

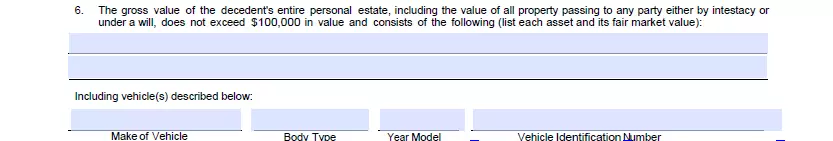

Indicate the Value of the Property

Here, you are to add the list of the property items and their value. If any vehicle is involved, insert its main characteristics. Also, state if there are any debts, expenses related to the funeral procedure, and other claims and indicate the amount of money spent.

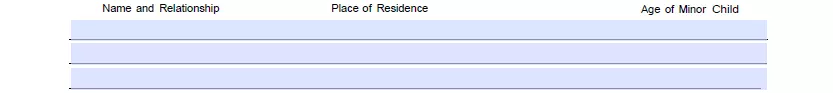

Add Info about the Potential Heirs

If some property is to be received by a specific descendant, state it in the form. Though the final decision is for the judge, you can still mention such details if you want to. Also, read the info about the award and fill in the required data.

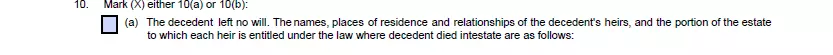

Specify if there is a Will

If the deceased person left a will before their death, you are to attach it to the SEA form and state which property items belong to each descendant.

State Your Relation to the Dead

Specify if you are a spouse, a child, or a parent of the person who died. In the next section below, you are to write the name of a person to whom the property is transferred after all debts are paid.

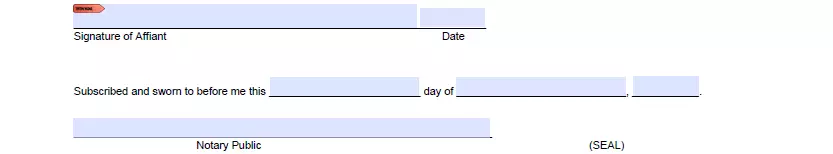

Sign the SEA From

Once you have added all details about the estate and heirs, sign the form, and add the date of signing. Moreover, as we have mentioned earlier, you must have this form acknowledged by a notary public.