Indiana Small Estate Affidavit Form

In Indiana, when an individual dies, their successors have a legal right to claim the deceased person’s property (either tangible or intangible). They do this by completing a unique form called the Indiana Small Estate Affidavit form (SEA).

The small estate affidavit is filed if the decedent does not leave a written will with their wishes regarding distributing property items among their descendants. In that case, the document helps the potential heirs to avoid the complicated process of engaging probate courts, making the transfer much quicker.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

The document is submitted not to a court but to a company that possesses a specific property item. For example, to withdraw money from the deceased’s bank account, their spouse must produce the form to the bank. The deceased person is usually referred to as a “decedent,” while the one who completes the document is called an “affiant” or a “claimant.”

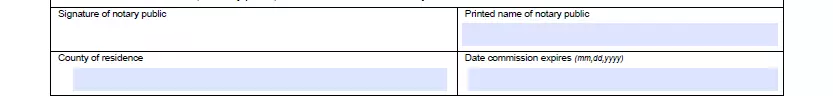

In Indiana, the template is created by the state and contains only one page. As any other small estate affidavit form, it comprises the following information:

- Details of the decedent and the affiant(s)

- The total value of the subject property items

- Signatures of the claimant(s) and a notary agent, and the date of the execution of the form

Indiana Laws and Requirements

In Indiana, all rules regulating completing a small estate affidavit are outlined in Chapter 8 of the Indiana Probate Code. This chapter is called “Dispensing with Administration” and covers all issues related to personal property distribution. You can read Section § 29-1-8-1 to learn the specific requirements and laws to consider before filling out the form.

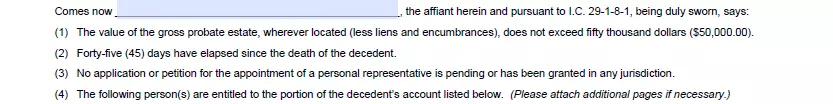

Several conditions must be met while filing a SEA. First, the subject property’s value should be $50,000 or less.

Secondly, the claimant must wait for at least 45 days from the day of death before filing the affidavit.

Additionally, the Indiana Probate Code has other requirements for affiants. For example, an individual cannot file the form if a personal representative has been officially assigned in court.

Indiana Small Estate Affidavit Laws Details

| Max. Estate | $50,000 |

| Min. Time to Wait After Death | 45 days |

| Filing Fee | Form is not filed in court. |

| State Laws | Indiana Code, Section 29-1-8-1 |

Need some other Indiana forms? We offer free templates and straightforward personalization experience to everyone who wishes for less hassle when dealing with forms.

Filling Out the Indiana Small Estate Affidavit Form

Once you are acquainted with all the specific requirements and laws for creating the Indiana small estate affidavit form, you can proceed with completing the document. Below is a comprehensive guide that will make the process much easier and less time-consuming.

Download the Template of the Indiana SEA Form

In the state of Indiana, there is an official template that you can obtain online. You may easily download the needed file with our form-building software and start inserting the data immediately.

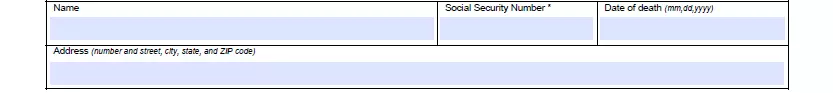

Provide Info about the Decedent

On the first page, there is a space for the deceased person’s name, the date of death, and former address (including a ZIP code). The form also requires the decedent’s Social Security Number (SSN) and Pension ID number.

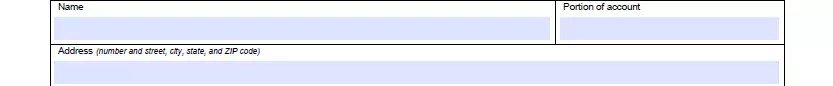

Add the Claimant’s Details

proceed to the section “Claimant Information” section and write your full name, date of birth, residential address, and SSN. Moreover, indicate the value of the claimed property. The document allows you to add one more affiant to the affidavit.

Confirm the Statements

In the next section, you must read the statements regarding the requirements mentioned in the Indiana statutes. If you agree to them, write your name at the beginning of your statement.

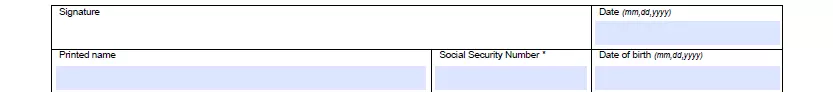

Provide Your Signature

All signatories must append their signatures, write their printed names, and the current date.

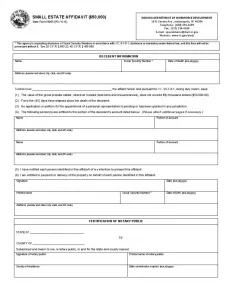

Notarize the SEA Form

In Indiana, like most US states, it is mandatory to notarize a SEA form. Having placed your signature and checked the information provided, ask a notary agent to verify and seal the document.