Texas Small Estate Affidavit Form

In Texas, this certificate is filed when a person dies with a wealth of less than $75,000. Also, the decisive factor is the absence of a will.

The important point is that the Texas Small Estate Affidavit can be completed 30 days after a person’s death. This does not require any other legal proceedings in the inheritance case. The form is filed if you want to hold the right to the deceased person’s belongings. Further, the small estate affidavit is accepted by the inheritance court in the district where the deceased lived before death. This is essential to subsequently recover their property.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Texas Laws and Requirements

The Texas laws (Sec. 205.001(3)) describe certain cases where you can complete the Small Estate Affidavit paper. The Texas Estates Code, Title 2 (Estates of decedents; Durable Powers of Attorney), Subtitle E (Intestate Succession), Chapter 205 (Small Estate Affidavit) contains many points that organize the SEA creation. The main ones are presented below:

Section 205.001 The right to real estate without the appointment of a person

Section 205.002 Requirements of the heir

Section 205.003 Verification and approval of the heir

Section 205.004 Copy of the affidavit to certain individuals

Section 205.005 Affidavit as a record of the local government

Section 205.006 The right to the house is transferred under affidavit.

Section 205.007 Responsibility of certain individuals

Section 205.008 Influence of the chapter

Section 205.009 Construction of certain links

Please, note that Harris County has its special filling form.

Texas Small Estate Affidavit Laws Details

| Max. Estate | $75,000 |

| Min. Time to Wait After Death | 30 days |

| Filing Fee | Varies by county |

| State Laws | Texas Statutes, Estates Code, Sections 205.001 to 205.009 |

We provide an array of popular Texas documents to anyone in quest of ease when filling out all sorts of paperwork in the state.

Filling Out the Texas Small Affidavit Form

Here is a step-by-step guide on how to fill the Small Estate Affidavit application properly:

1. Download the SEA Form

The very first thing to do when you are going to build the form is, of course, to download it with our software. Typically, the document is available in PDF format.

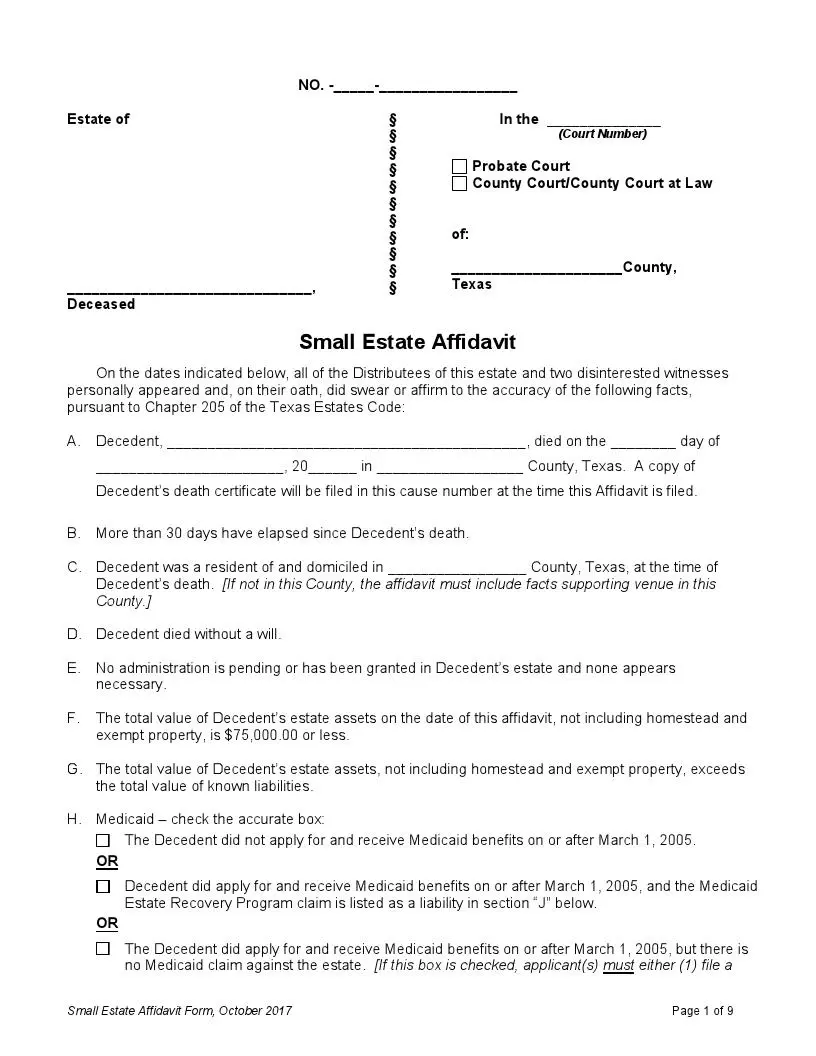

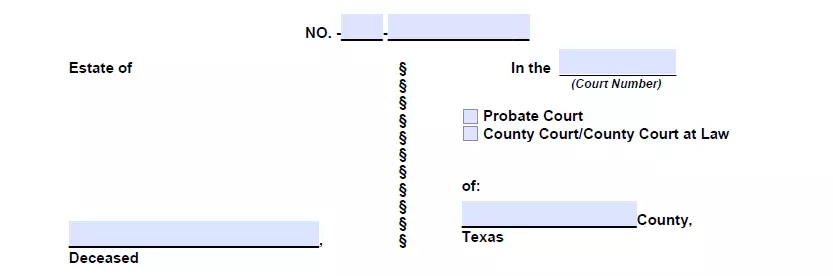

2. Choose the Heading

It is common for courts to require the clerk to complete the title. In most cases, information can be generated on your own after receiving it:

- Start by entering your property number at the top of the page;

- On the left, insert the name of the deceased;

- Now on the empty area on the right after the phrase “B,” enter the court’s number where this affirmation will be registered;

- Register the kind of court that will deal with this issue;

- Enter the name of the county in which these documents are located.

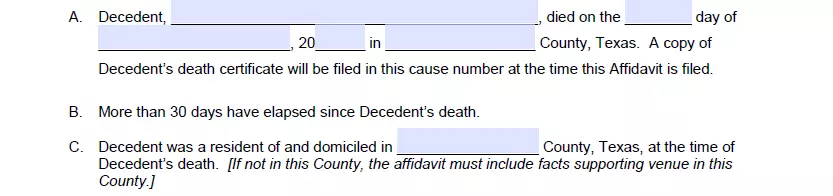

3. Bring the Specifics

This paper will note some important fulfillment conditions. What to indicate in point “A:”

- First, insert the full name of the deceased person;

- Next, write the full date of death, which is indicated on the death certificate;

- Write the name of the county where the deceased died (the county where the deceased lived should be listed under “C” if an individual died far from it).

The “H” section will provide three optional applications for determining the deceased person’s state in Medicaid:

- Check the first box to indicate that the deceased was applying or receiving Medicaid on or before March 1, 2005. Otherwise, specify a different period. If the deceased person asked for Medicaid on or later this time and there are no claims to the Assets, check the third box;

- If you chose the third box, add a Medicaid Property Recovery Program (MERP) Certificate stating that the claim does not cover the estate, or add the data confirming that a MERP Claim will not be registered.

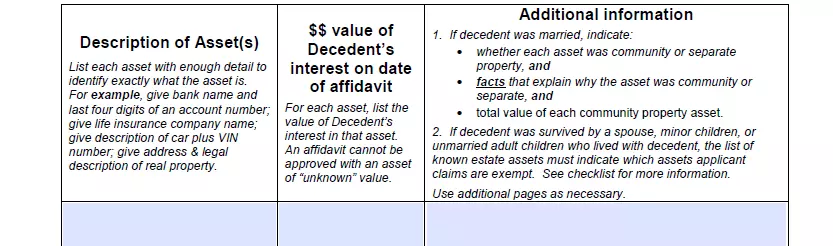

4. Describe the Deceased Property

The first part will show a table that needs information about the deceased person’s capital, which provides six rows under three column titles: Description of the Asset, the Interest Cost of the assets as of the date of the affidavit, and Additional Information.

Column 1: describe the state of the deceased person’s holdings at the point of death (the name of the heir’s bank onward with the latest four symbols of the account number, car make, model).

Column 2: enter the asset value from column one in US dollars.

Column 3: write a statement of the state of each asset for any spouse or children. Also, indicate whether the asset is held as a society asset (received during marriage without inheritance) or separate property (acquired before marriage, as a gift or inheritance). It is likewise crucial to point out the matter that the specified person has in the declared asset. There should be enough space in the list, and if not, then apply an extra blank.

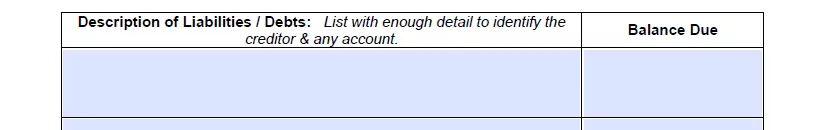

5. Insert the Responsibilities of the Principal

The table in section “J” must be filled out precisely as well. The “Description of Obligations or Debt” column describes what the deceased owed at the moment of death (account number, creditor name, contacts). In the field titled “Balance Due,” write the whole sum of the debts in column one.

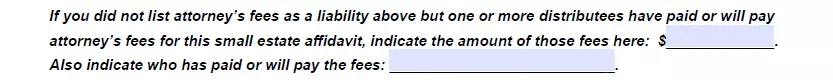

6. Specify all Legal Fees

In this part of the SEA statement, you need to register the advocates’ charges. Similarly, write the names of those who are obliged to pay all fees or those who will be accountable for this.

7. Describe the Deceased’s Family History

This piece is called “K” and consists of several parts that will need to be filled in with the necessary information completely:

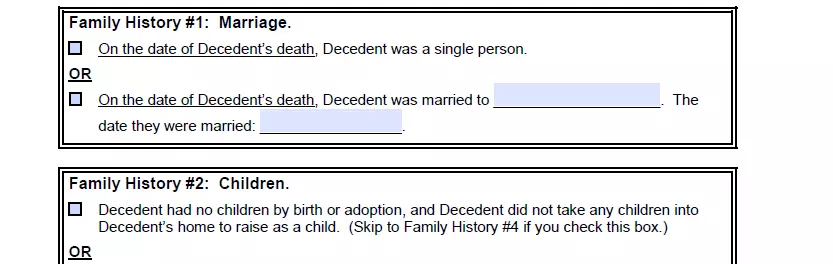

- “Family History No1, Marriage:” The deceased’s wedlock situation at the moment of death. Here, select the necessary item, whether the deceased person was wedded or not. If they had a spouse, write down the date of the wedding.

- “Family History No2, Children:” Whether the deceased person had children (biological, adopted, or state custody) or not. If there were children, you need to fill in the fields “Name of the child,” “Date of birth,” and “Name of the other parent of the child.”

- “Family History No3, Children, Part 2:” Here, you should report whether the deceased person’s children were alive at the moment of death. If not, enter the name of every child who died before deceased in the first column, the exact date the child died in the next column, and the name of every child, grandchild, or great-grandchild. If the deceased child has no descendants, point to the departed child’s name and the time of death.

- “Family History No4, Parents:” An optional field to fill in if the deceased person has descendants. Designate if the deceased person’s parents are still living (include parents’ full names and death date, if applicable).

“Family History No5: Sisters And Brothers:” This field contains two tables in which you must write each brother or sister, as well as the degree of their relationship, and whether they remained alive or not at the moment of death of the defunct (if they have gone, designate the full date of death).

8. Specify each Inheritor in the Estate

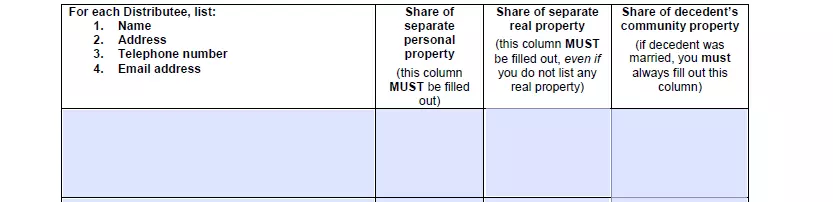

The field called “L” contains instructions and applications for the use of the property for probate in Texas and tables of inheritance distribution. You should fill in the table with each heir’s name and exact contacts.

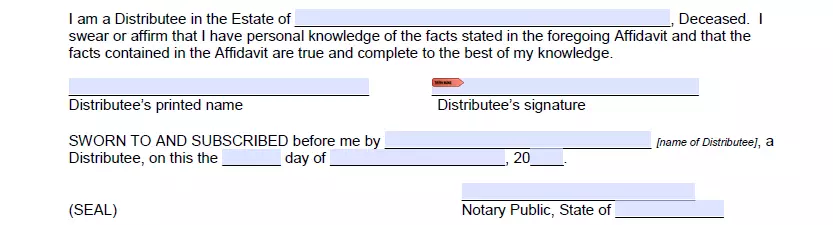

9. Sign the Form

This part of the SEA paper is called “M.” In this sector, you need to register the district in which the application is filed. Then each of the two distributors puts their notarized sign in the presence of two detached personalities.