Utah Small Estate Affidavit Form

Inheriting assets does not always require complicated legal procedures. In Utah, anyone willing to acquire a deceased person’s probate estate (fewer liens and encumbrances) uses the Small Estate Affidavit Form (also named Affidavit for Collecting Personal Property in a Small Estate Proceeding). This is possible if the said estate is not worth more than 100,000 US dollars.

Compared to probate, dealing with the affidavit is much simpler, faster, and less expensive for the grantees. Remember that the affiant has no right to collect real property using this type of document.

An affiant has to comply with the following terms to use the small estate affidavit:

- File for receiving property only of a person who resided in the state of Utah at the time of death (or possessed the property placed in Utah);

- The grantee may be a surviving spouse, child, or another legal heir of the decedent;

- If the deceased person has left the living will, and the successors were indicated there, they are the ones supposed to receive the property.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

The document has to be completed under oath and becomes valid after getting authenticated by a legal professional. If you are not sure about the process of submission, to seek legal assistance. Once you have prepared the Affidavit, present it, along with the Certificate of Death, to an individual with access to the asset.

Utah Laws and Requirements

The creation of the Utah Small Estate Affidavit Form is regulated by the UT Code Paragraph 75-3-1201 (2019).

According to this section, any individual owing to the person who passed away is obliged to pay the debt or deliver the tangible personal property to the person, claiming to be the successor, after 30 calendar days since the decedent’s death. The Affidavit will further be required when registering the ownership in the successor’s name. A transfer agent of any security needs to change records on an organization’s books from the decedent to the heir. If the grantee has obtained motor vehicles, such as boats, cars, trailers, or semi-trailers (not more than four), they should be retitled in the heir’s name as well.

The heir who is about to acquire the property has to be entitled to do so. Ensure that no application or request for designating a specific agent has been granted in any jurisdiction.

Utah Small Estate Affidavit Laws Details

| Max. Estate | $100,000 |

| Min. Time to Wait After Death | 30 days |

| Filing Fee | Not specified |

| State Laws | Utah Code, Sections 75-3-1201 to 75-3-1204 |

Looking for more Utah templates? We offer free templates and straightforward customization experience to everyone who prefers having fewer to none issues when facing documentation.

Filling Out the Utah Small Estate Affidavit Form

The paper is comparably short and simple to complete. Please use our form-building software to create the most recent personalized paper.

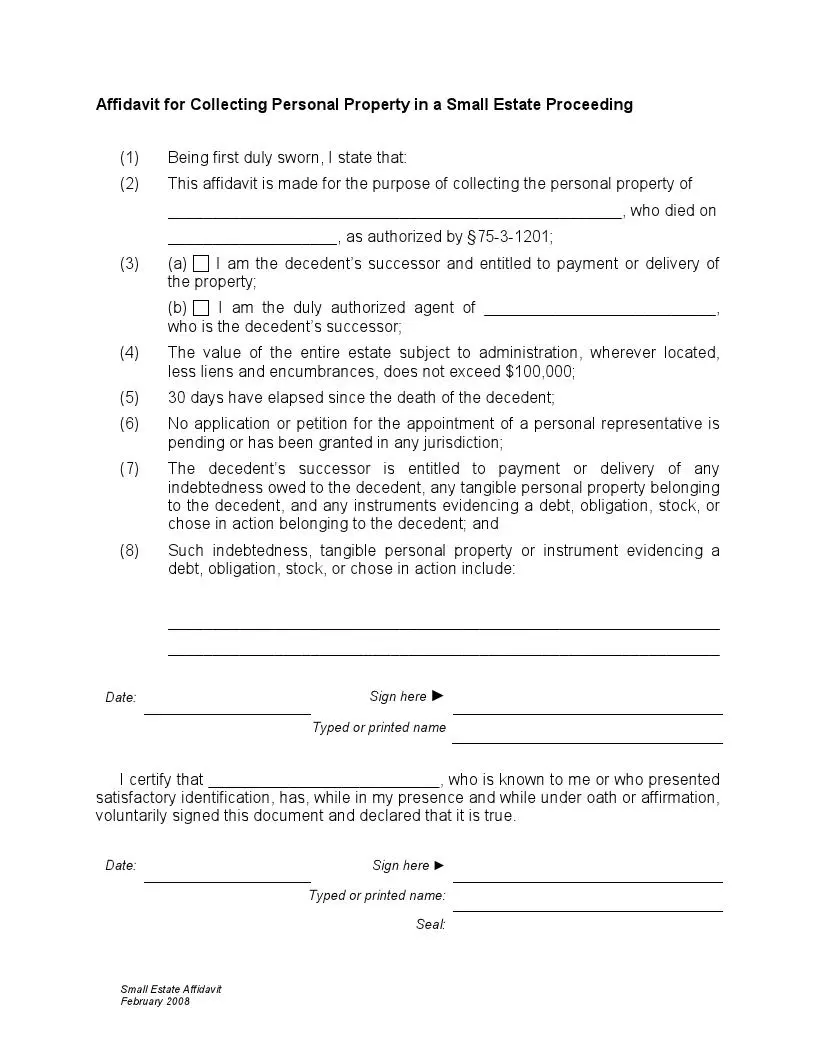

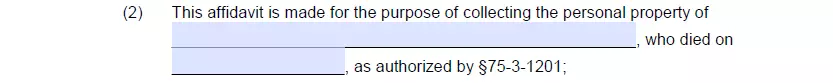

Input the Decedent’s Personal Information

Begin completing the document by entering the full name of the person who passed away. Write down the date (month, day, and year) of death as well.

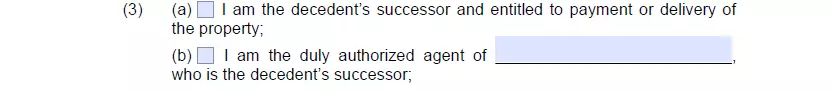

Indicate Your Status

You can either claim to be an affiant entitled to payment or delivery of the property or the duly authorized attorney of the decedent’s successor (in this case, provide the name of the person you are representing).

Provide Information about Indebtedness

The grantee is supposed to receive the personal property possessed by the decedent and any indebtedness, tangible personal property, or any other instruments evincing debt belonging to the deceased individual. If you are aware of any of the things mentioned above, provide details about them in Section Eight of the form.

Sign the Affidavit

Write down the date of the document becoming effective, affix your signature, and type or print your full name. Doing this, you confirm to have completed the form voluntarily and have not deliberately given any false or misleading data.

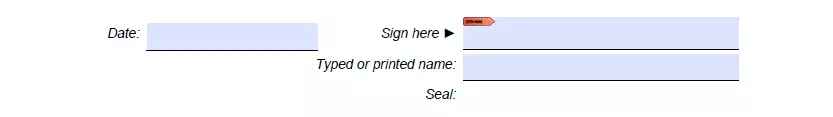

Authenticate the Paper

A licensed notary has to verify the information submitted, check the successor’s identity, date and sign the document, provide their full name in print (or type it), and affix the seal.