Business Bill of Sale Form

A business bill of sale is contractual documentation between a buyer and seller as proof of legal transaction for the sale of a business. It is a binding document that reveals the intricate details of the contract. For instance, the business name, date of the agreement and sale, names of the seller and buyer, terms and conditions of payment, and transfer of the business. The bill of sale form is a vital document that acts as insurance confirming the sale. It serves both the interests of the buyer and seller since it prevents any breach of contract.

If you are purchasing a business, ensure that you understand the contents of the business sale agreement. You can seek professional advice from experts like accountants or lawyers to help you know what the transaction entails to prevent you from getting a raw deal or in case of any malpractice. Read on to gain more information on why you need a bill of sale before buying any business.

Why Use a Business Bill of Sale?

A business bill of sale is a critical document in the purchase or sale of a business. It is mandatory to establish the transfer of ownership from one party to the next. The state requires this essential document for legal reasons, tax purposes, and revenue collection.

If a seller does not incorporate a business bill of sale, the transaction may be questionable, and both parties may suffer legal consequences. It cushions the seller from scammers who may be transacting illegally and intending to defraud unsuspecting individuals. If a buyer purchases with cash, it may be challenging to track the money trail without a proper agreement. Thus, the bill of sale is crucial in providing proof of the purchase, the details of the payment, and any pending amount.

The bill of sale form certifies the ownership and property transfer of the business plus all the assets associated with the company.

Business Bill of Sale Form Details

| Document Name | Business Bill of Sale Form |

| Other Names | Bill of Sale for Business Assets, Corporation Bill of Sale |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 53 |

| Available Formats | Adobe PDF; Microsoft Word |

How To Sell Your Business

When you want to sell your business, ensure that you involve experts who understand the process. It is quite challenging to carry the burden of the sale alone. Hence, consult a lawyer or a sales broker to handle the sale processes.

Below are steps to follow to ensure a successful sale:

Step 1. Assemble Your Business Documentation

The first step in the business of sale is to gather all the documents relating to your business before expressing interest in selling to the public. Every detail should be in place to avoid any doubt on the buyer’s side. Some of the documents include:

- Business registration document;

- Current tax compliance records dating four years back;

- Business assets;

- Pictures;

- Human resources information, i.e., payroll and employee details;

- Finance records;

- Insurance details;

- Clients and suppliers’ list of goods or services.

Ensure that you have all of the company records available to enable proposed buyers to ascertain the transparency of the business before any commitments.

Step 2. Draft a Business Bill of Sale

You can approach professionals to assist you in drafting the business bill of sale and the business purchase agreement. Understanding the difference between the bill of sale and the purchase agreement is crucial.

While a business bill of sale executes the final transfer of ownership, a purchase agreement is a document that secures the sale and is used during the negotiation stages.

Step 3. Filling Out the Business Bill of Sale Form

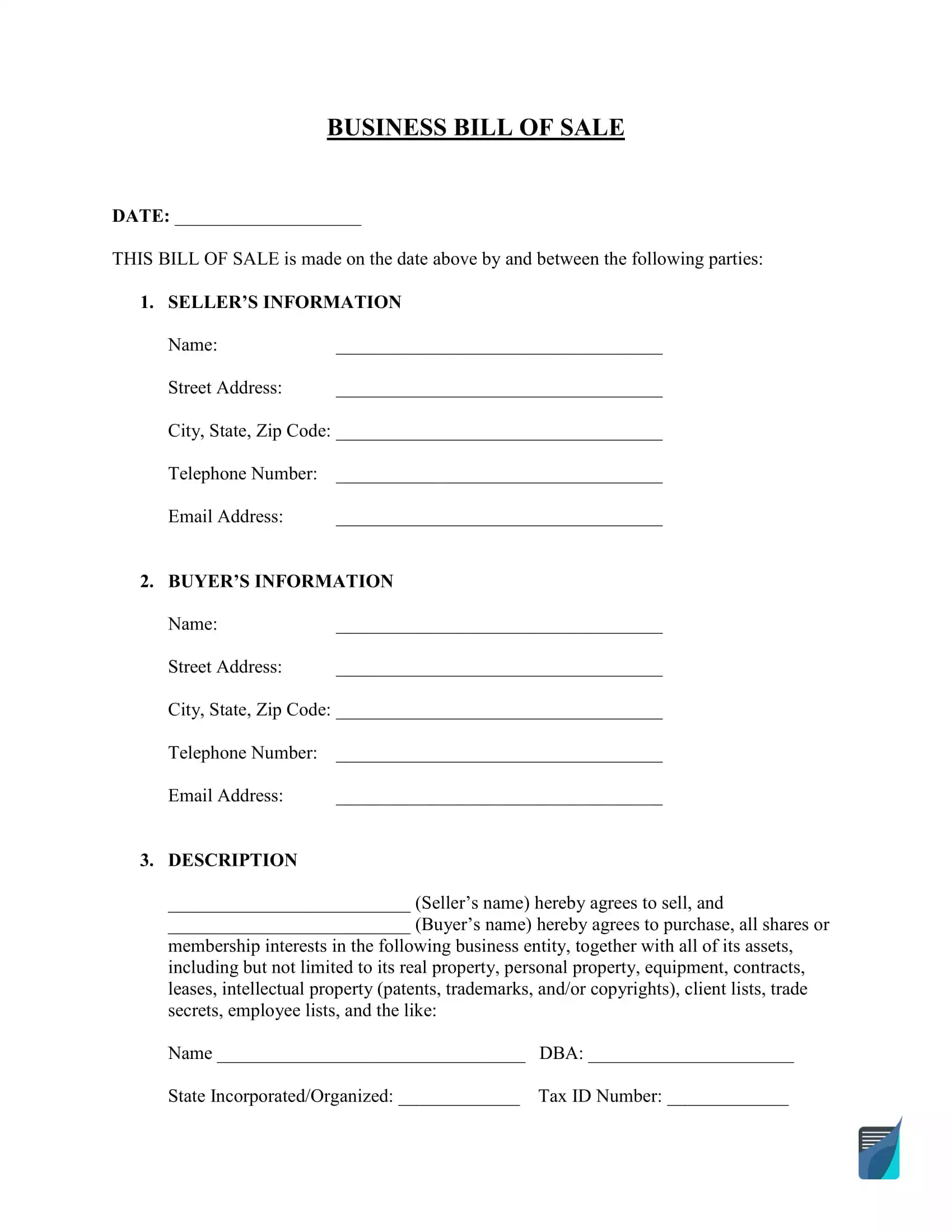

Finally, it is of paramount importance, either as a buyer or seller, to know the details in the Business Bill of Sale form. The following are particulars in the form:

- Date of sale;

- Name of the buyer and physical address;

- Name of the seller and physical address;

- The business name, including the state of incorporation, physical address, business assets, total number of shares, partners, and other crucial information;

- Payment information (i.e., purchase price, mode of payment, and date of transfer);

- Signatures of buyer and seller and the date of the agreement completion;

- The names of the witnesses, the date, and signatures;

- Acknowledgment Certificate from a notary public.

Step 4. Complete Business Sale

After filling out the business bill of sale, the buyer takes possession after the completion of payment at an agreed time and location. Both parties will sign the bill of sale, and the certificate title will now belong to the buyer. The seller then issues a receipt to confirm a successful sale. If you are the buyer, ensure that you mutually agree on the sales tax settlement to avoid penalties.

There may be other inclusions in a business bill of sale depending on the intricate details of your business, the terms of purchase, and state laws. You can get a variety of bill of sale templates with an editable file format from our site to guide you in drafting one that suits your business sale.

How to write a Business Bill of Sale?

Down below, you may find the instructions written by drawing upon the business bill of sale template created by our team. Yet, if there is a document provided by your local officials, it is always recommended to choose it in the deal.

Step 1: Indicate the date when the document is created.

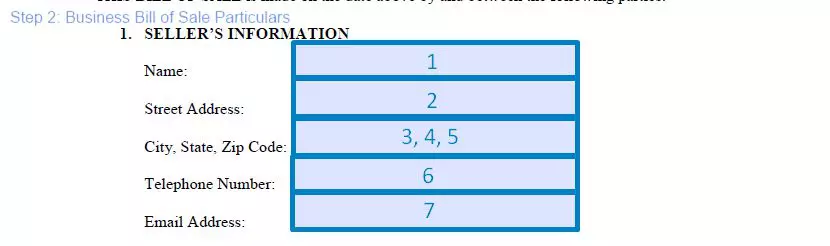

Step 2: Type in the specifics of each party (seller and purchaser):

- Full name

- Street

- City

- State

- Zipcode

- Cell phone number

- Valid email address

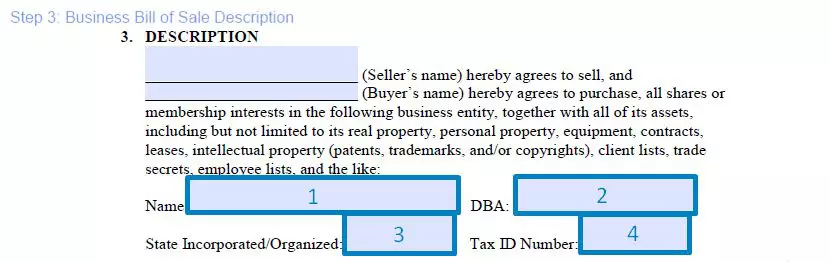

Step 3: In this section, you have to indicate that the seller agrees to sell all shares or membership interests in their business. They should also provide the following details pertaining to their business:

- Name

- Doing Business As name (also known as DBA)

- State where the business was incorporated or organized

- Tax ID number

- Secretary of State ID number

- Principal Office

- Other information related to the business that is being sold

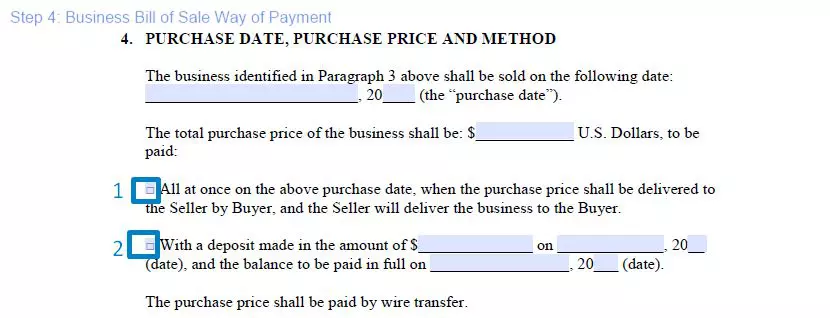

Step 4: Now, you should establish how you will be given money for the deal.

Type in the sale date and specify the entire amount that has to be paid for the business. You will have to indicate furthermore the selling method the buyer will go for:

- Providing the total amount as a single transaction. Nothing complicated here: the seller is provided with the full amount of money from the buyer in one payment and presents the business to the buyer within the agreed timeframe.

- Several payments. Using this method, you have to indicate the dates when the purchaser must provide the first and the last payments, as well as their amounts.

After that, the document should indicate that the purchase price should be paid by wire transfer.

Step 5: Go over standard terms and make sure that both sides are familiar with them.

The “as-is” provision points out that the business owner provides no warranties and does not have any liabilities regarding the business after the transaction.

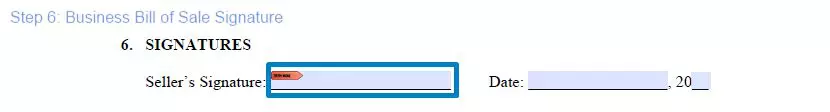

Step 6: Place your signature(s) in the appropriate areas.

It is prudent to make both parties sign the document. As a result, you are more protected from legal troubles that might arise after the deal. Just to be on the safe side, the buyer and seller could choose someone who can attest to the deal and sign the business bill of sale too.

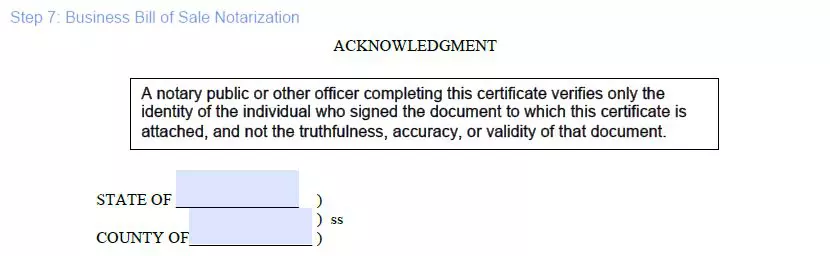

Step 7: Notarize the bill of sale

Notarization is an excellent way to add one more layer of legal protection to the deal. Both parties should also get the version of the document.