Connecticut Bill of Sale Form

Connecticut bill of sale is a legal document that acts as proof that a certain private transaction took place. This document records the seller’s and buyer’s contact details and contains identifying information about the item sold.

You can use our customized templates, made specifically for every popular property type, or you can also try our step-by-step bill of sale maker to create a personalized document valid in Connecticut. We also provide the official CT DMV form H-31 that can be used for any vehicles or vessels.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | Connecticut Vehicle Bill of Sale Form |

| Other Names | Connecticut Car Bill of Sale, Connecticut Automobile Bill of Sale |

| DMV | Connecticut Department of Motor Vehicles |

| Vehicle Registration Fee | At least $30 (electric car – $57) |

| Bill of Sale Required? | Yes |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 19 |

Connecticut Bill of Sale Forms by Type

Types of bills of sale forms in CT range according to the type of sale and terms of the transaction. Find a bill of sale form that suits your needs below and complete it accordingly.

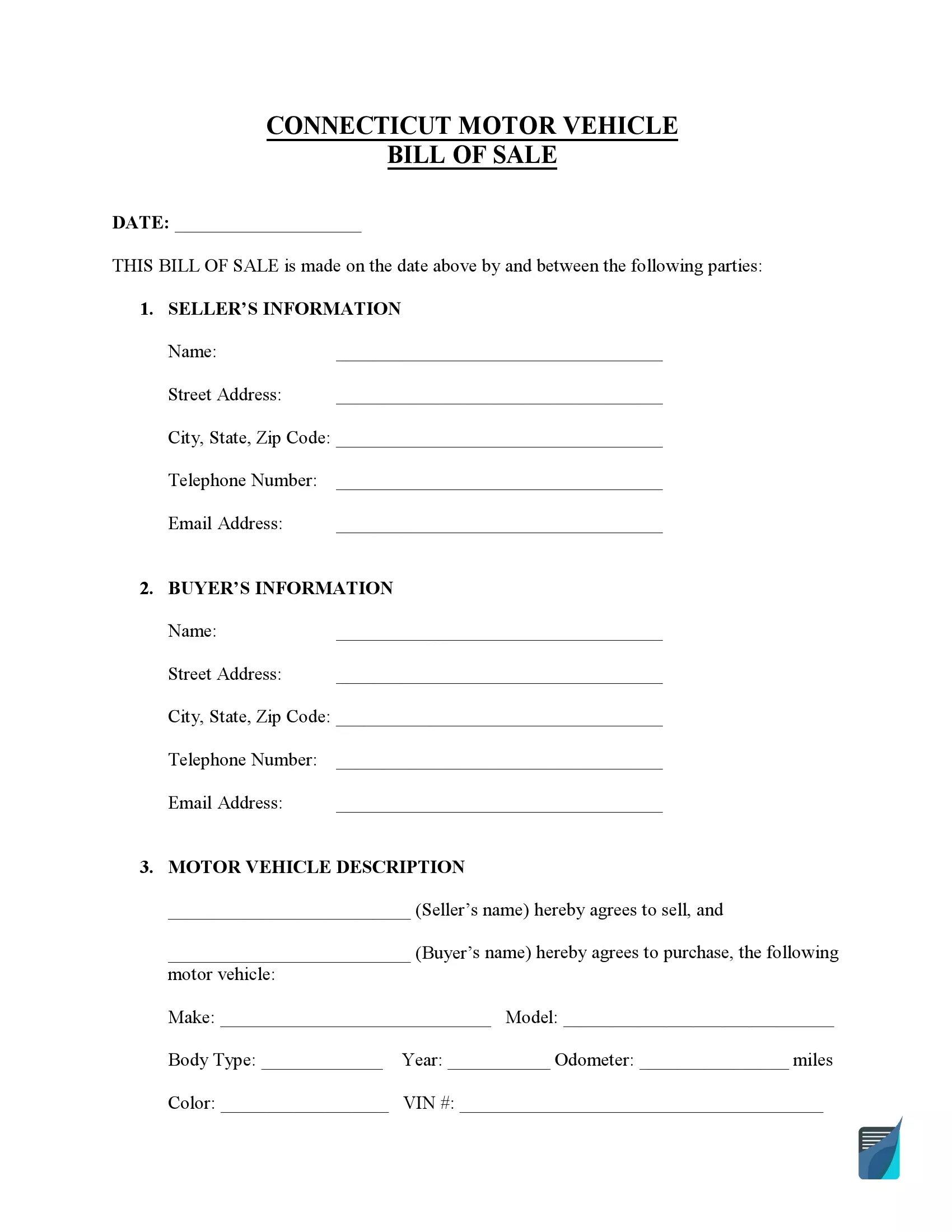

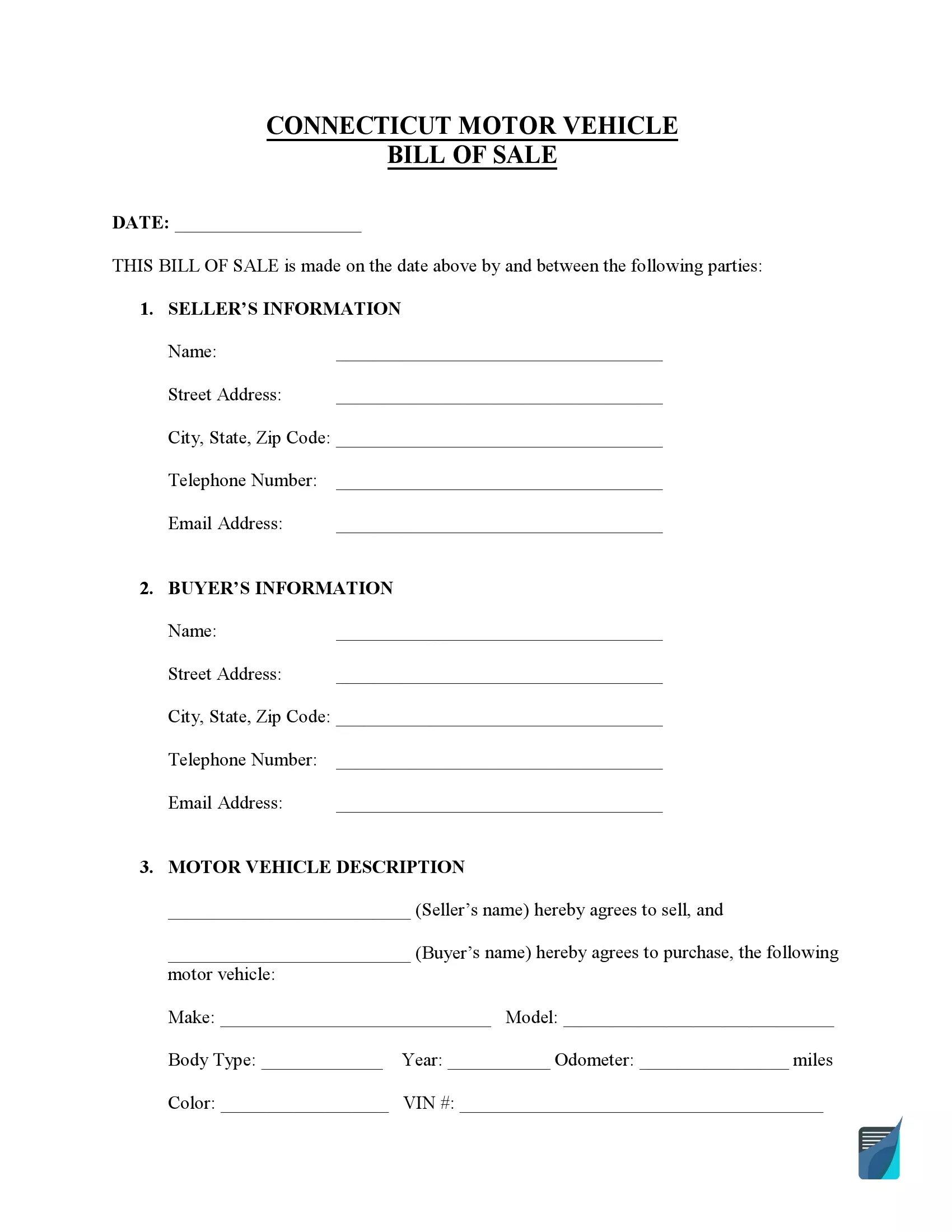

You can use a Connecticut motor vehicle bill of sale to sell vehicles of any kind. The buyer will need to present a sale proof in the DMV, and a bill of sale is a relevant document in this case. You will have 30 days from the time of the sale or 60 days from the moment you move to Connecticut to register a newly purchased vehicle.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

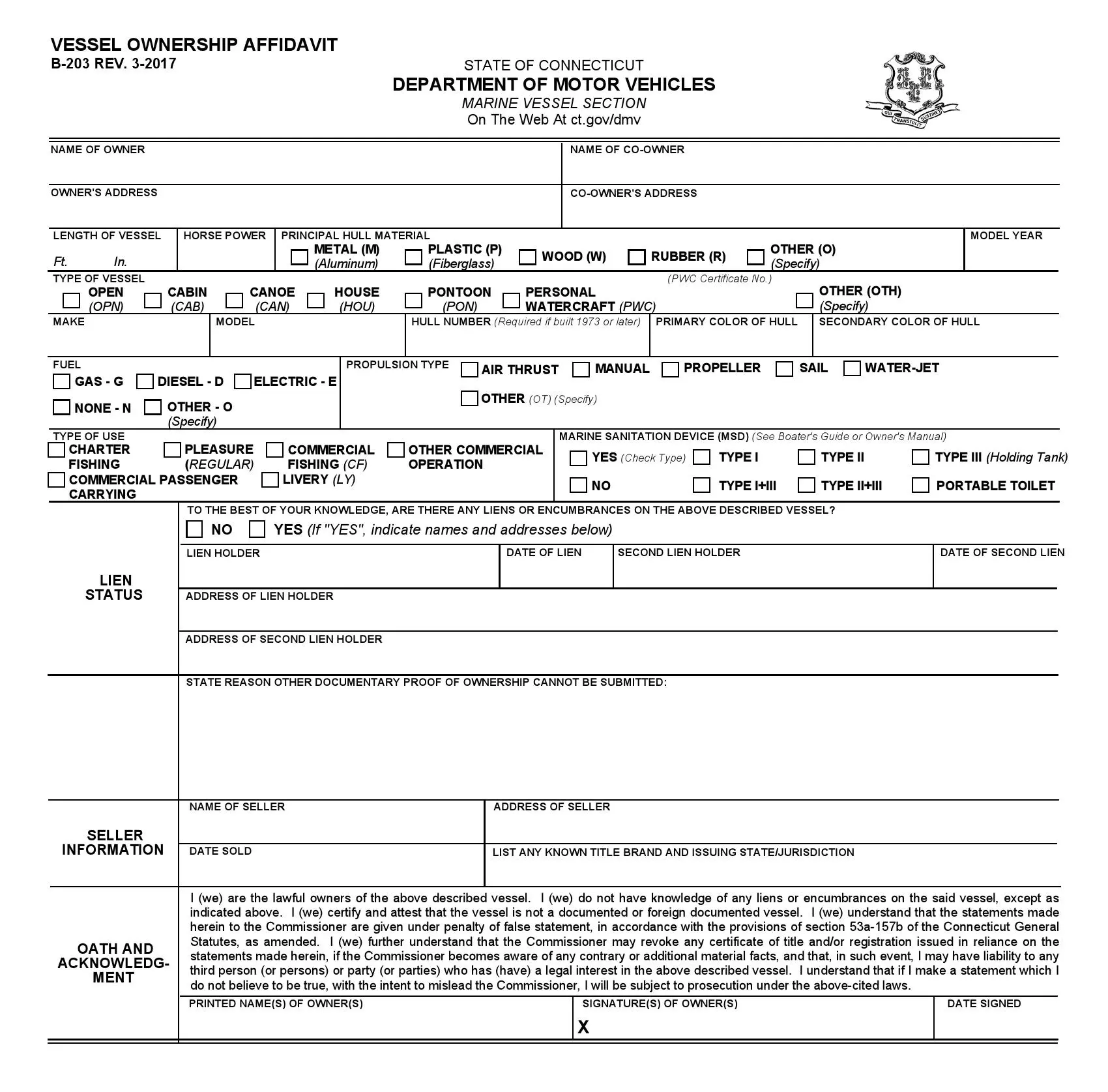

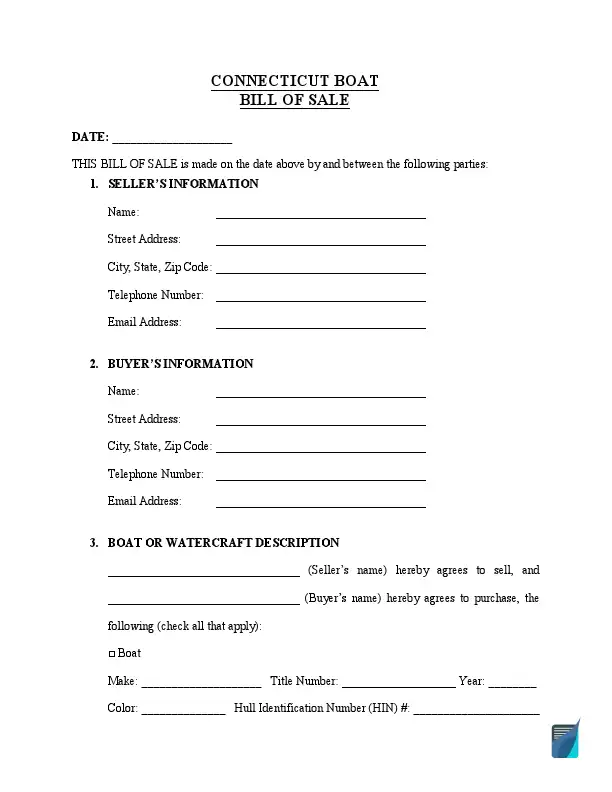

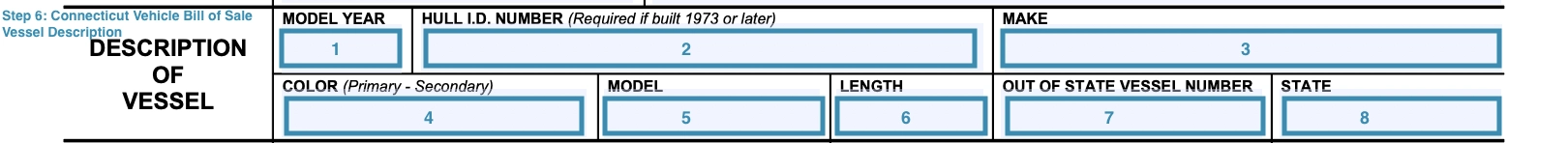

If you want to sell or buy a boat in Connecticut, use a boat bill of sale template. You’d need to indicate all the identifying details of the boat, including its make, model, year, HIN, and engine hours. All motorboats, personal watercraft, and sailboats 19.5 ft or longer have to be registered in CT. The registration fees are dependent on the boat’s length, type, and building materials.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

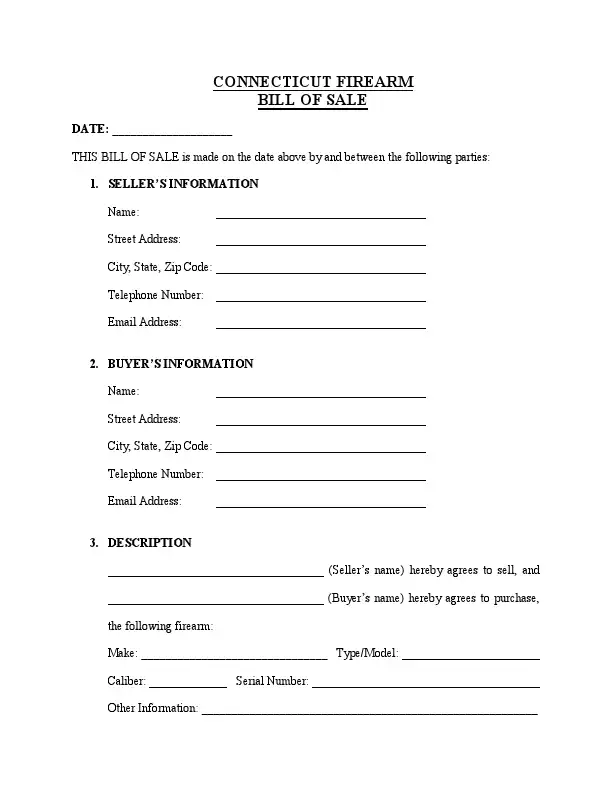

With a firearm bill of sale, it’s possible to keep a check on the times a firearm changes ownership in Connecticut. You would also need a purchase permit from the Connecticut State Police to buy any gun. In Connecticut, you are required to have a permit to purchase handguns and carry them, but you do not have to register them.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

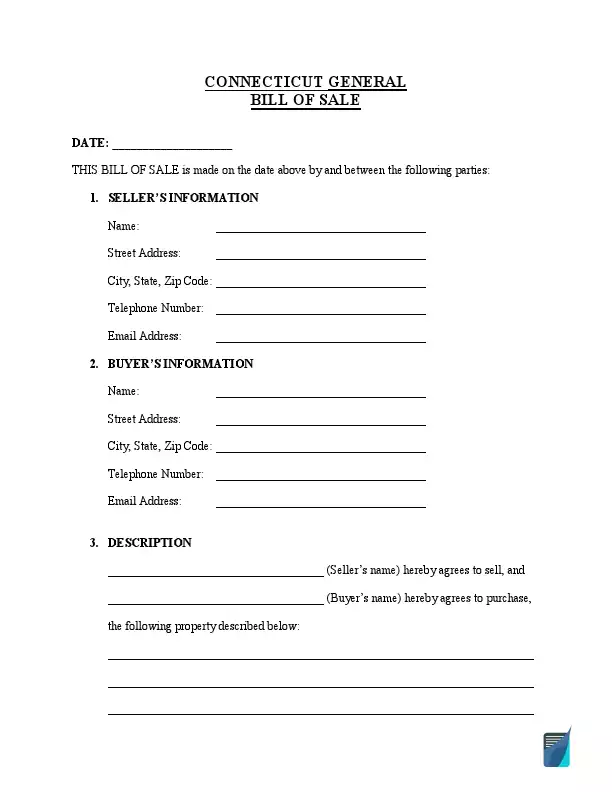

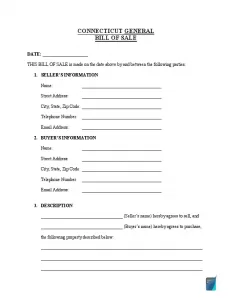

If you want to use a bill of sale for something other than vehicles, watercraft, or firearms, this general form will suit your needs. It contains all of the purchase details such as the buyer’s and seller’s names, signatures, purchase price, and other relevant information.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

How to Write a CT Vehicle Bill of Sale

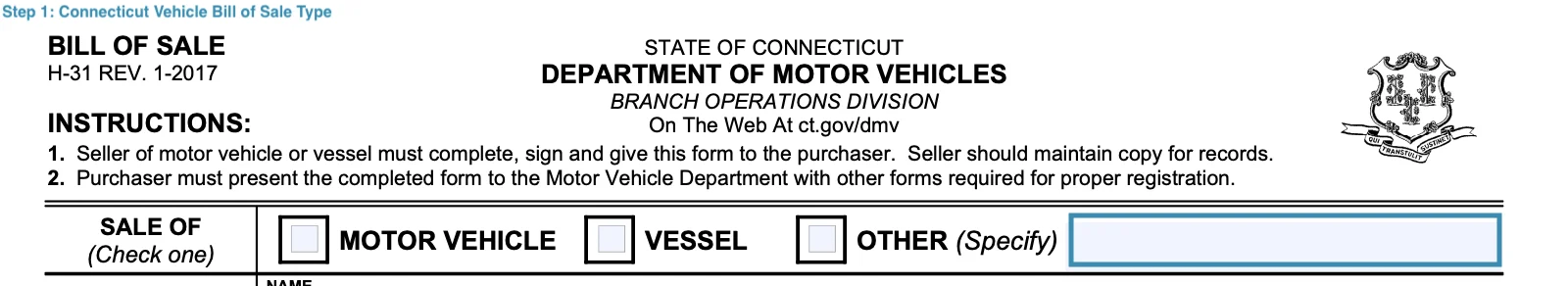

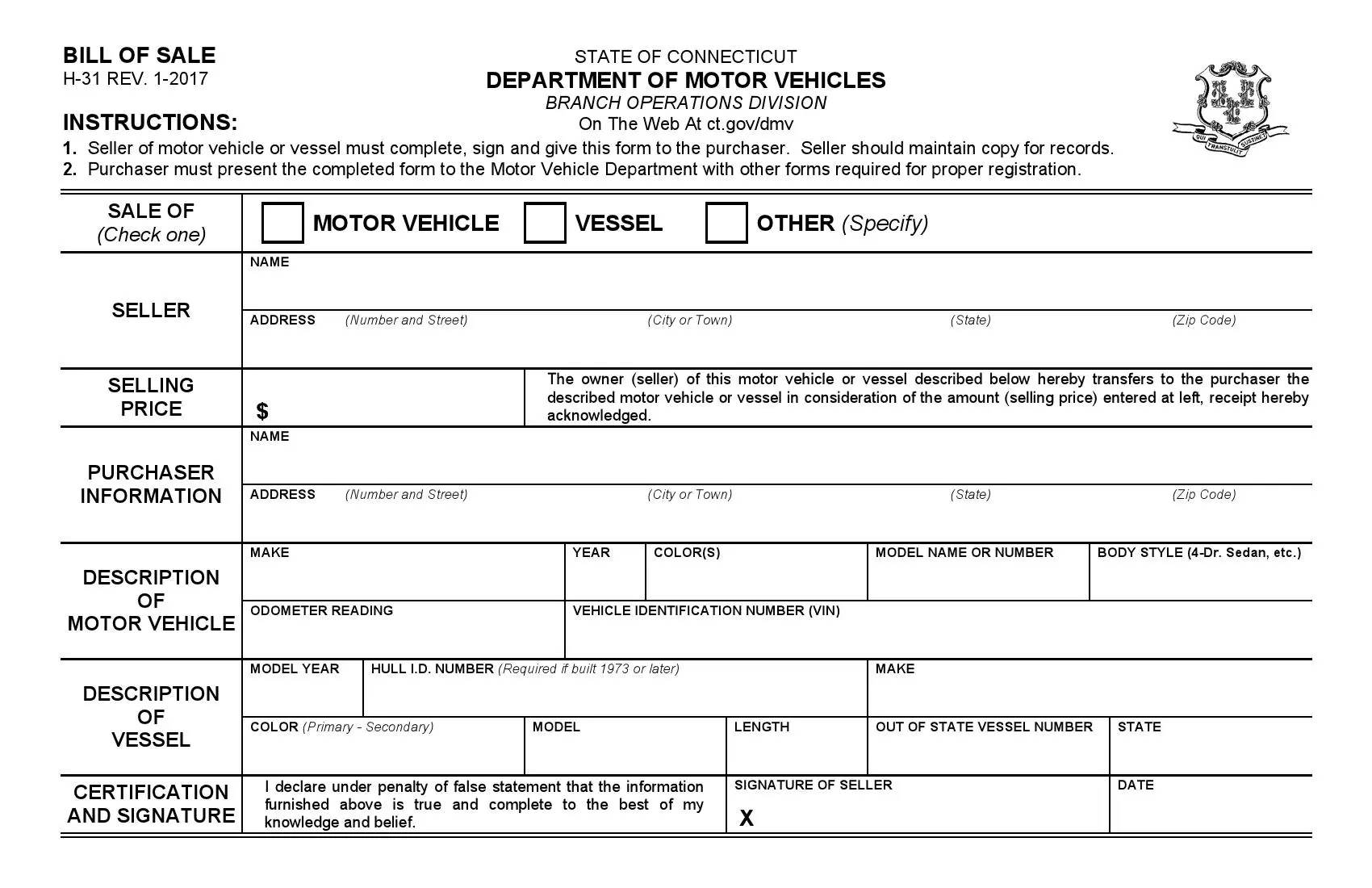

The Connecticut DMV website offers the official bill of sale that vehicle owners can use during the sale of motor vehicles or vessels. If you want to sell your car in Connecticut, you can use this template. You will complete the document within minutes by following these step-by-step guidelines.

Step 1: Check the vehicle box

The official form is designed for any type of vehicle, including watercraft. So, if you need to sell a motor vehicle, for example, a car, you will have to check the type in the first section.

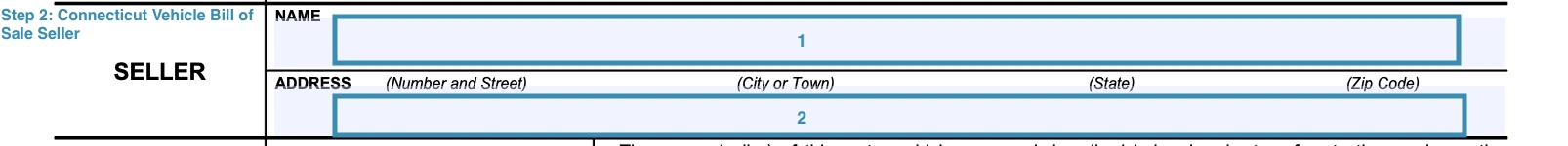

Step 2: Provide the seller’s contact details

Fill out the seller section by providing the seller’s legal name and address, including:

- Street name and number

- City of residence

- State

- Zip code

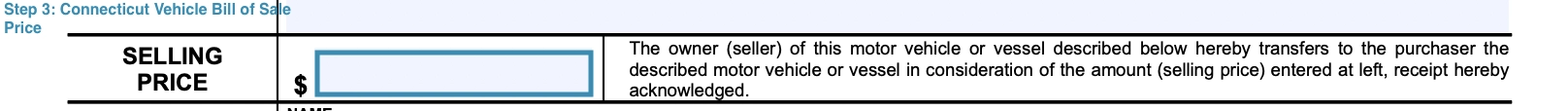

Step 3: Specify the selling price

Next, it’s necessary to provide the selling price—the amount of money the purchaser must pay the previous owner.

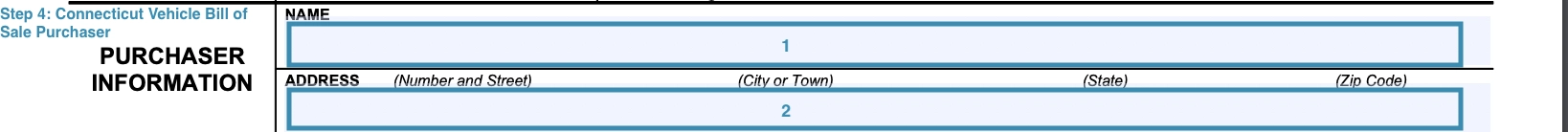

Step 4: Indicate the buyer’s contact information

You need to type in the legal name of the person who buys the vehicle and their address:

- Street name and number

- City of residence

- State

- Zip code

Step 5: Describe the motor vehicle

In this section, you need to clarify which vehicle you’re selling by entering the actual information regarding its:

- Make (manufacturer)

- Year

- Color

- Model name or number

- Body style

- Odometer reading

- Vehicle Identification Number (also known as VIN)

Step 6: Sign the document

Lastly, the seller affirms with their signature that the information is correct. It’s also required to specify the sale date. After that, the transaction is considered complete.

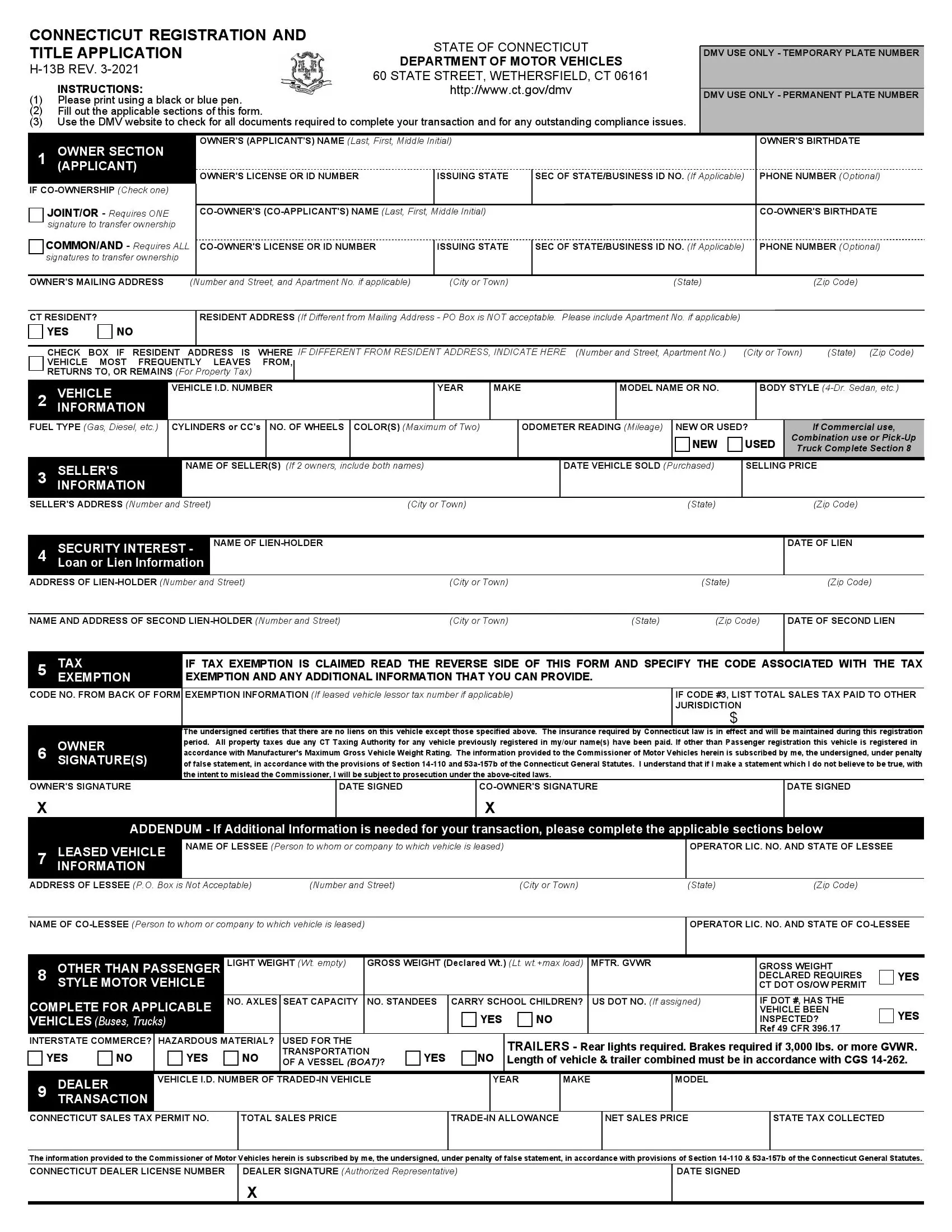

Registering a Motor Vehicle in Connecticut

After finalizing the motor vehicle sale, you must take it for registration. In Connecticut, all motor vehicles should be lawfully registered before operating on the highways. If you are new in Connecticut, the state allows a period of 60 days to register a vehicle.

If it is the first time to conduct a vehicle registration, it is imperative to note that there are essential documents that you must provide to complete the registration successfully. First, you have to book an appointment at your local Division of Motor Vehicle (DMV) office to process all of the paperwork.

You must have an emission inspection certificate since it is a law in Connecticut. However, you must research and find out if your county requires all cars to pass the test. If it is a requirement, you can find a test center nearby and take your vehicle for inspection.

If your county excludes the emission certificate, it is mandatory to get a vehicle inspection form (VIN) for verification purposes.

At the DMV office, you must fill an Application for Registration and Certificate Title (Form H-13) if your car is brand new. But, if it is a used car, you can provide the current registration and title certificate. Proof of identification is also necessary, and you can either use your State ID or driver’s license.

You will need to also present a complete vehicle bill of sale form detailing the vehicle transaction together with proof of insurance from a legit insurance agency with your particulars.

Note that the purchaser will pay the registration fees plus all other charges that might accrue in the process.

Below is a snippet of all the documents that you need to gather for presentation at the DMV office:

- Motor vehicle bill of sale

- Application for Registration and Title Certificate

- Title and Registration Certificate for used vehicles

- Proof of insurance

- Proof of identification – State ID or driver’s license

After you have all these documents, ensure that you personally present them at your local DMV office to finalize the registration process.

Relevant Official Forms

A bill of sale form provided by the Department of Motor Vehicles in the State of Connecticut.

Registration and Title Application with instructions is used to apply for a car title in CT.

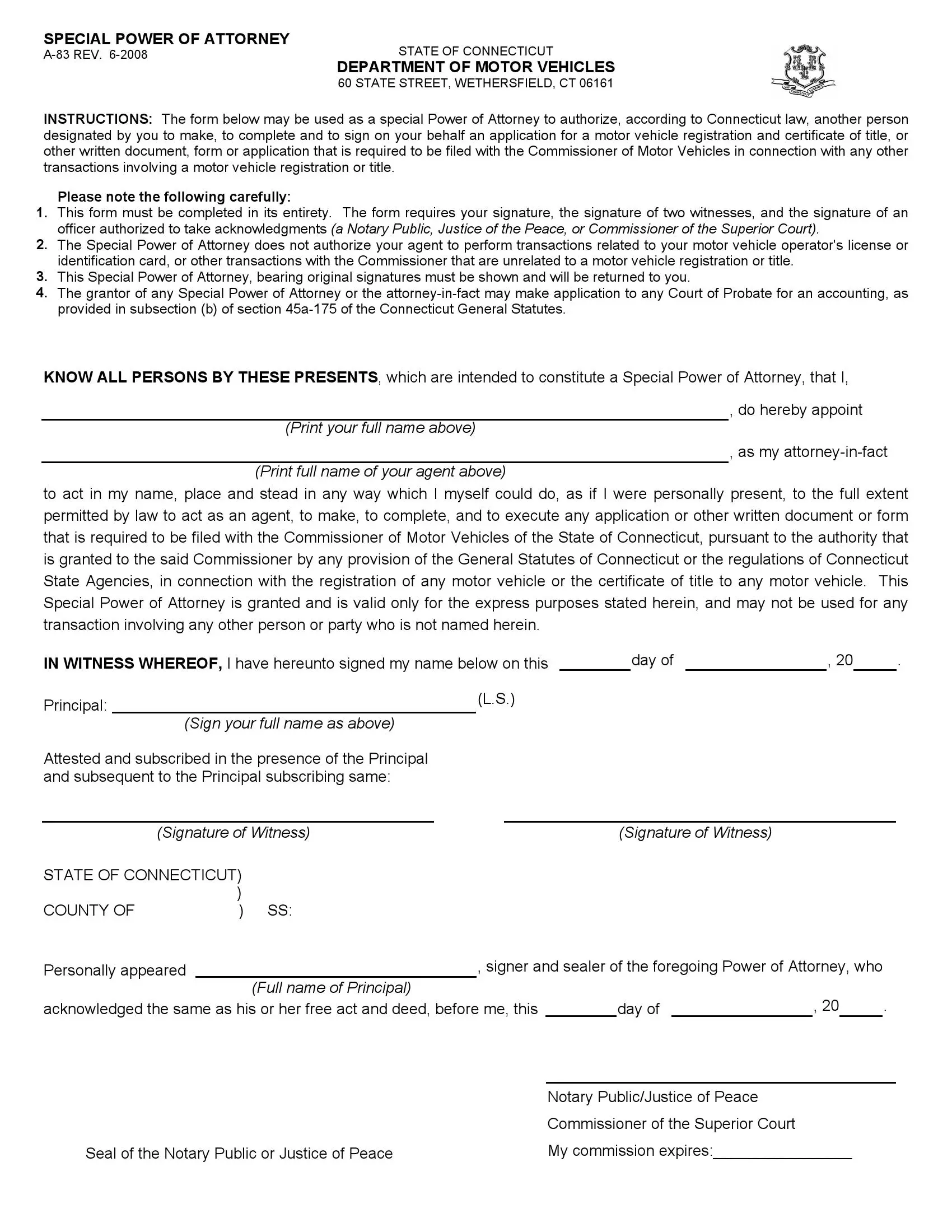

Special power of attorney for a vehicle is used to authorize someone to work with DMV paperwork on your behalf.

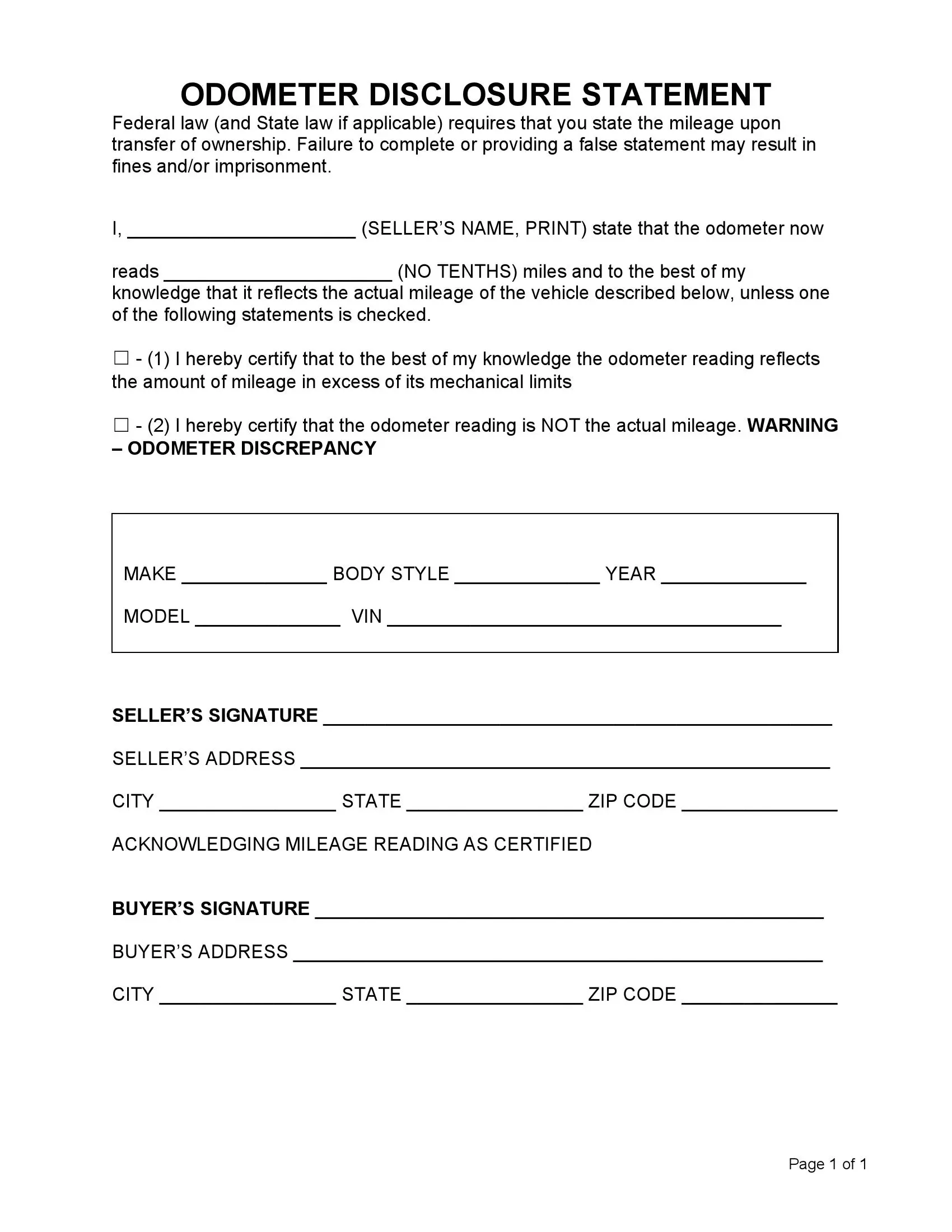

Required during ownership transfer to confirm the vehicle mileage.

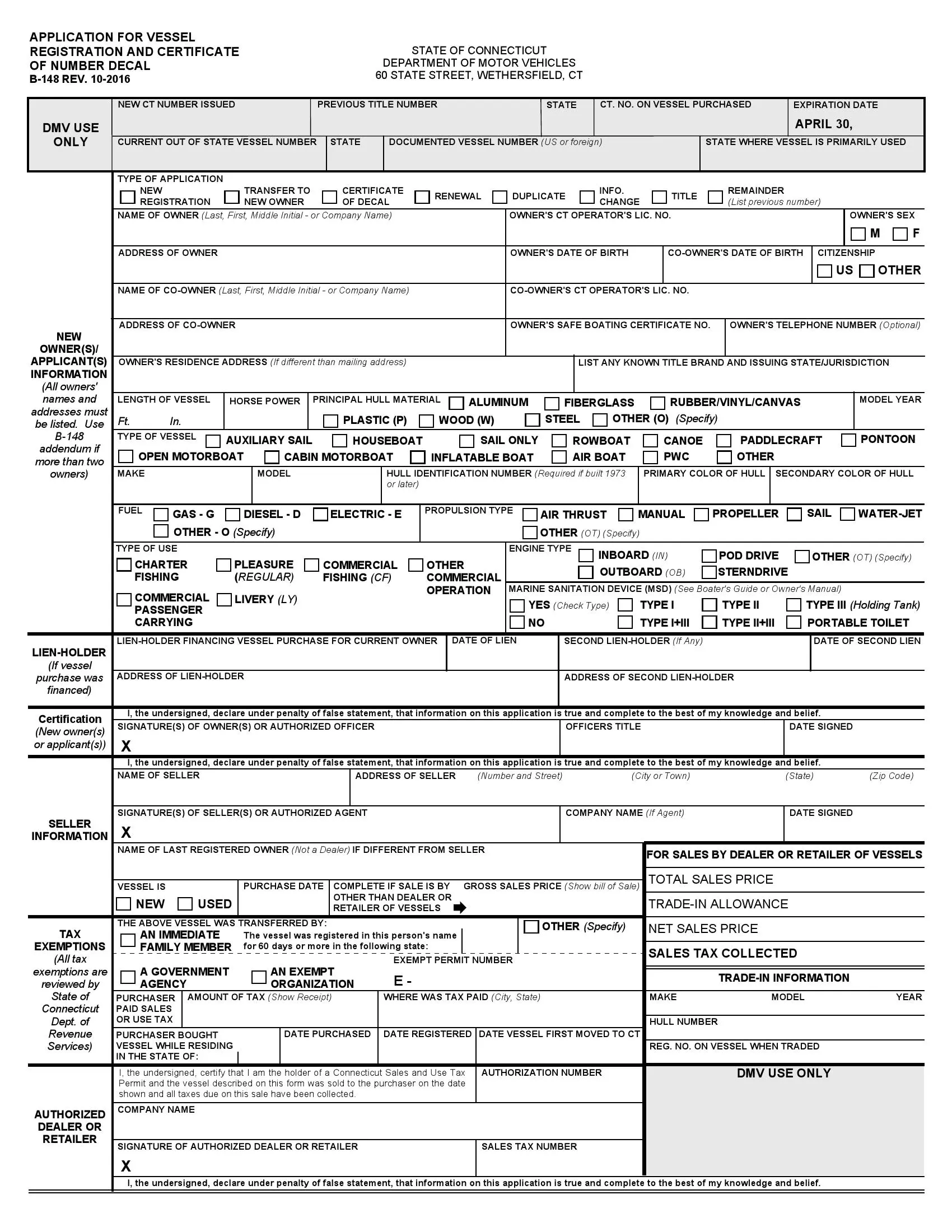

Application for Vessel Registration and Certificate of Number Decal with instructions.

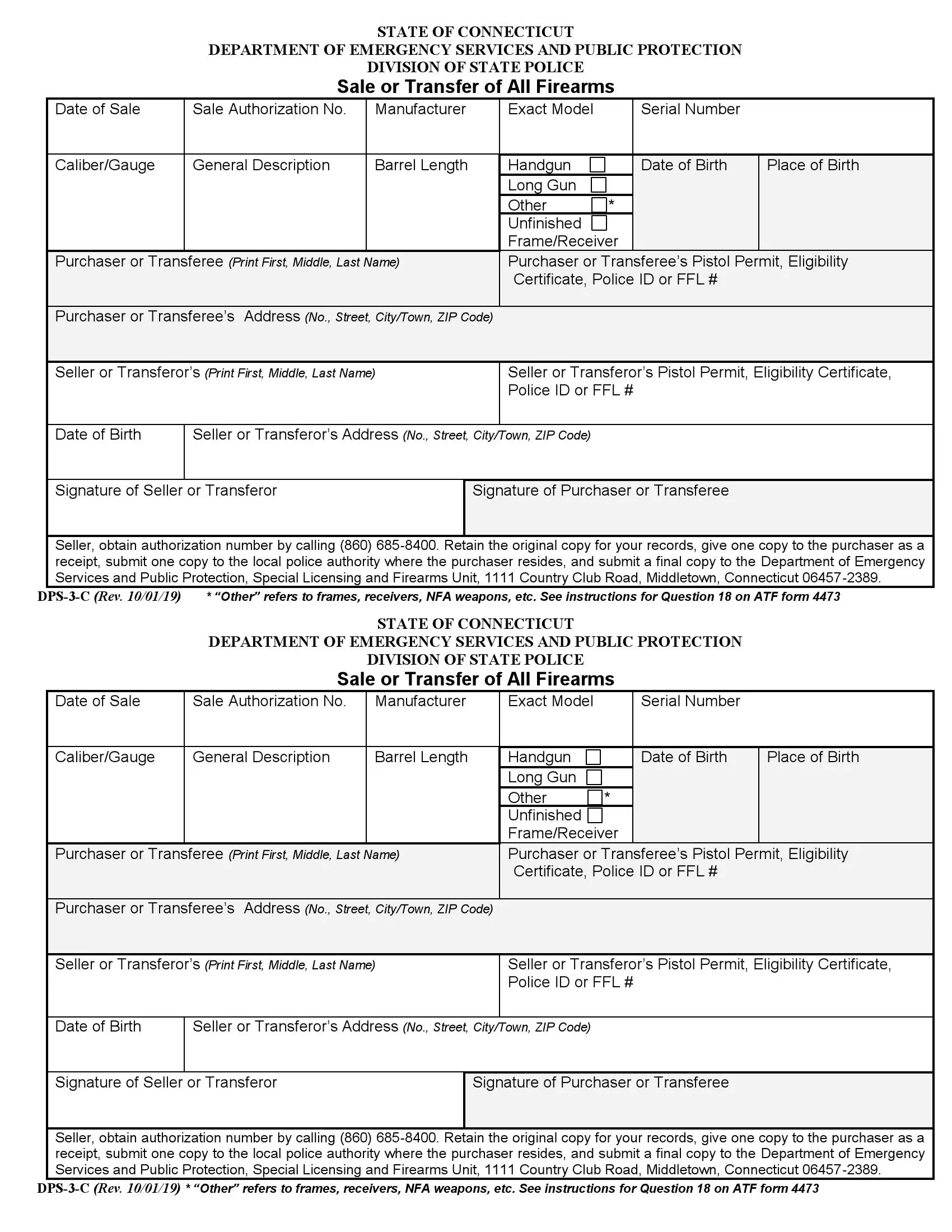

Sales of Transfer of All Firearms is used as a bill of sale during private transfers.

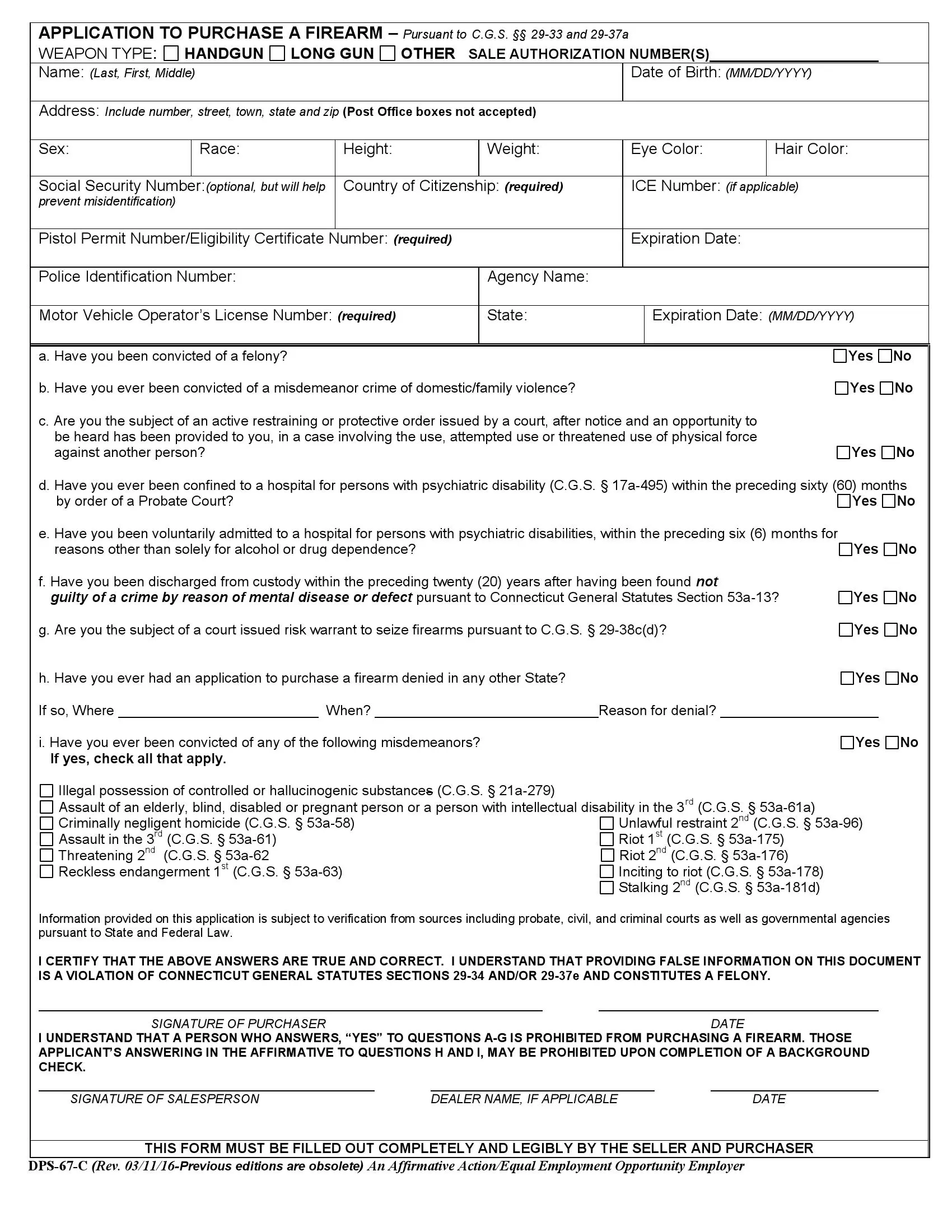

Application to Purchase a Firearm must be kept for 20 years, no filing required.

Short Connecticut Bill of Sale Video Guide