Nevada Bill of Sale Form

Nevada bill of sale is a legal document that seals purchase deals and safeguards the rights of both the buyer and seller. The document simplifies the vehicle titling and registration process and can help you prove vehicle ownership.

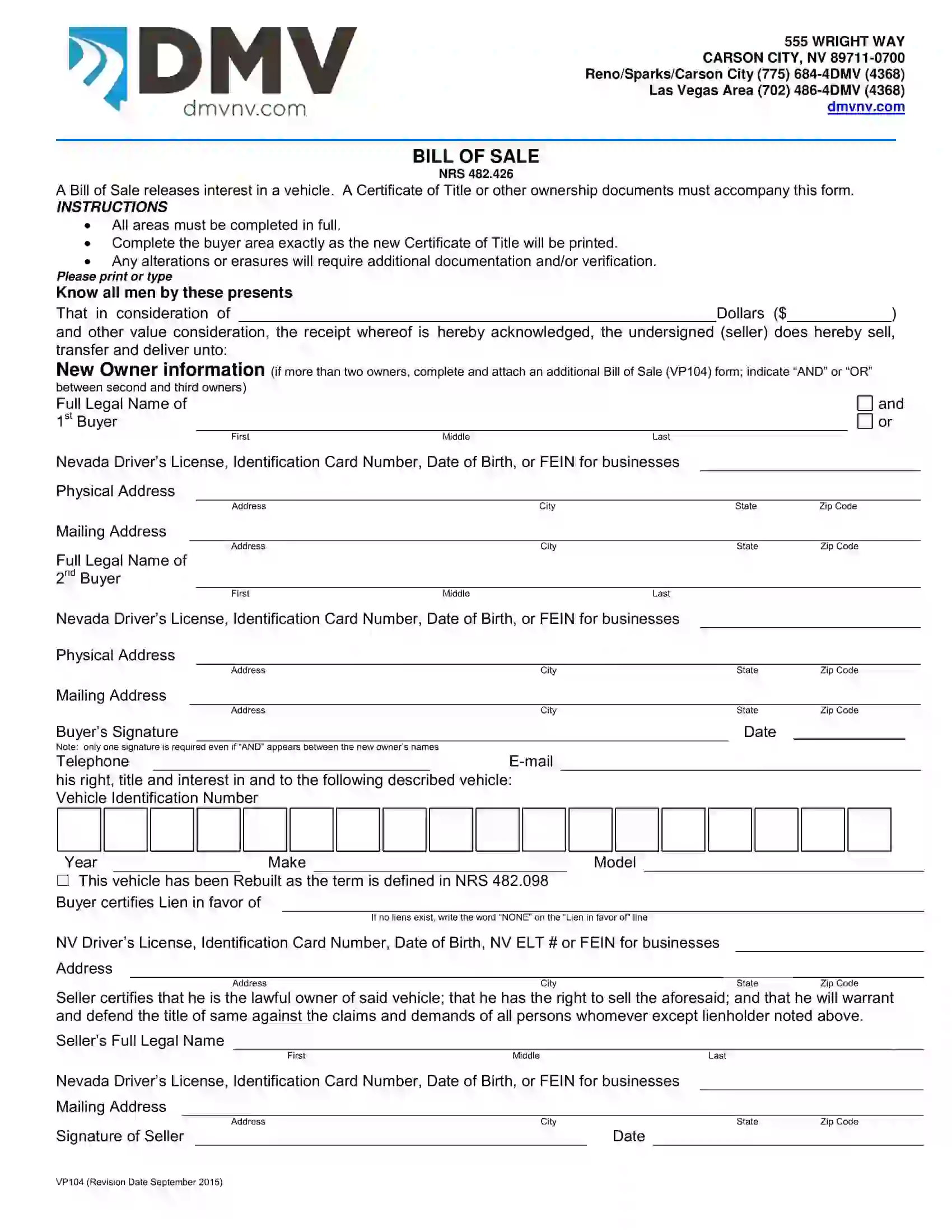

Our website provides various bill of sale templates for specific items you want to sell or buy. You can modify the documents to add individual conditions during the sale and purchase. In Nevada, vehicle owners can also use Form VP-104—an official template of a motor vehicle bill of sale provided by the Nevada DMV. You may get it down below, along with other official documentation.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | Nevada Vehicle Bill of Sale Form |

| Other Names | Nevada Car Bill of Sale, Nevada Automobile Bill of Sale |

| DMV | Nevada Department of Motor Vehicles |

| Vehicle Registration Fee | $33 |

| Bill of Sale Required? | Yes |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 53 |

Nevada Bill of Sale Forms by Type

The transaction type you intend to conduct determines the bill of sale template you need to prepare. You are recommended to ensure that the legal document of your choice corresponds to the type of item you plan to sell or buy.

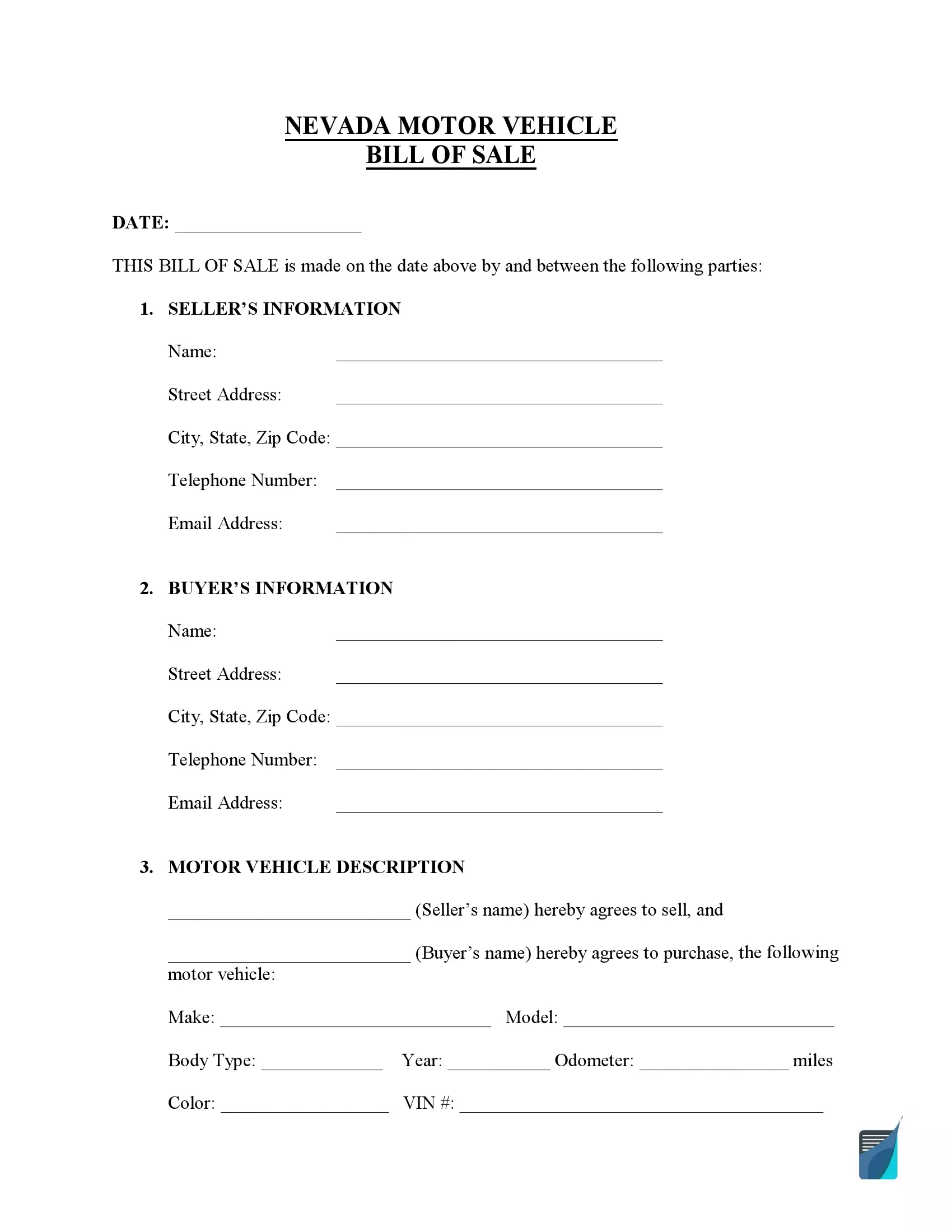

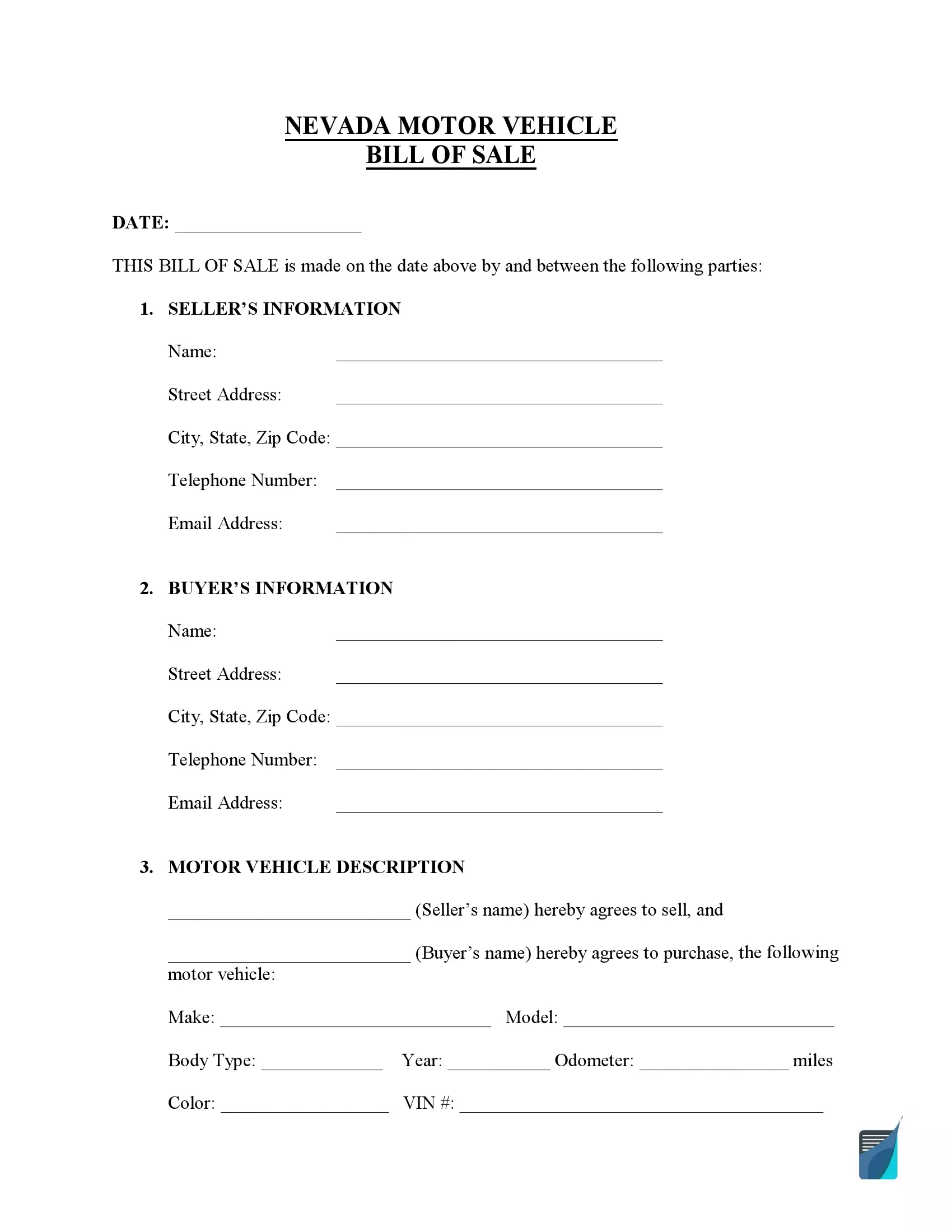

Nevada motor vehicle bill of sale signifies the act of vehicle ownership change through the private sale and purchase. If you buy a car, motorcycle, or any other vehicle from a private party or receive it as a gift, you will have to register it within 30 days in Nevada.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

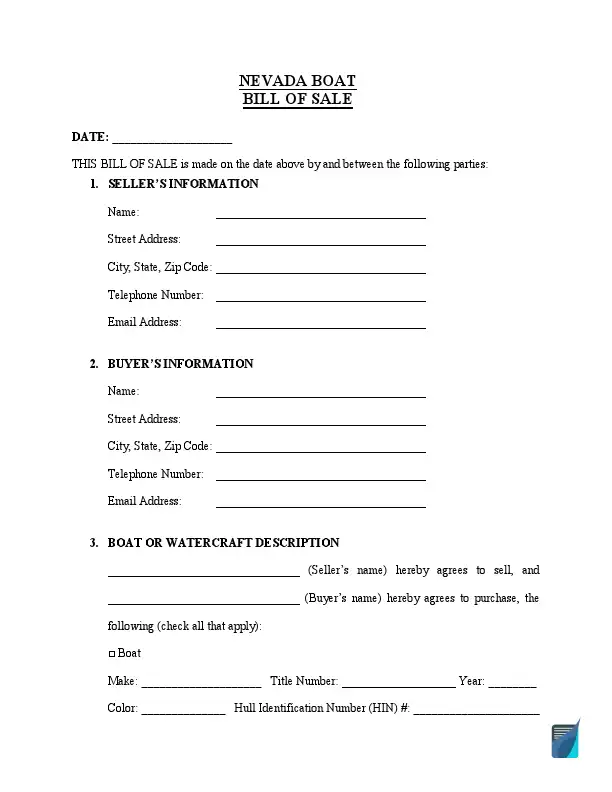

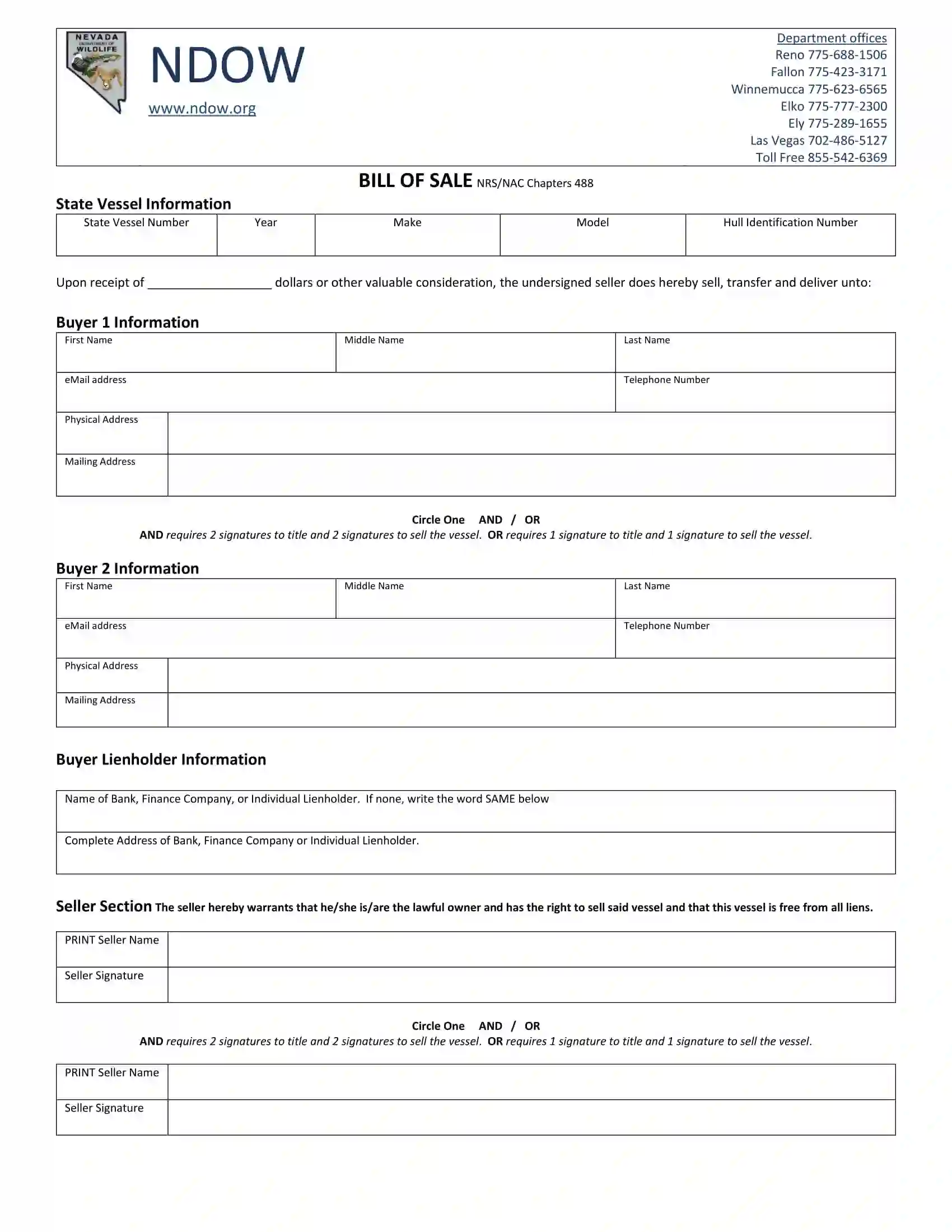

It’s recommended to use a boat bill of sale to safeguard the transfer of ownership rights during the watercraft purchase. All motorized boats (including jet skies) located in Nevada should be registered under 60 days. You also must notify the Department of Wildlife about the watercraft ownership change within ten days.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

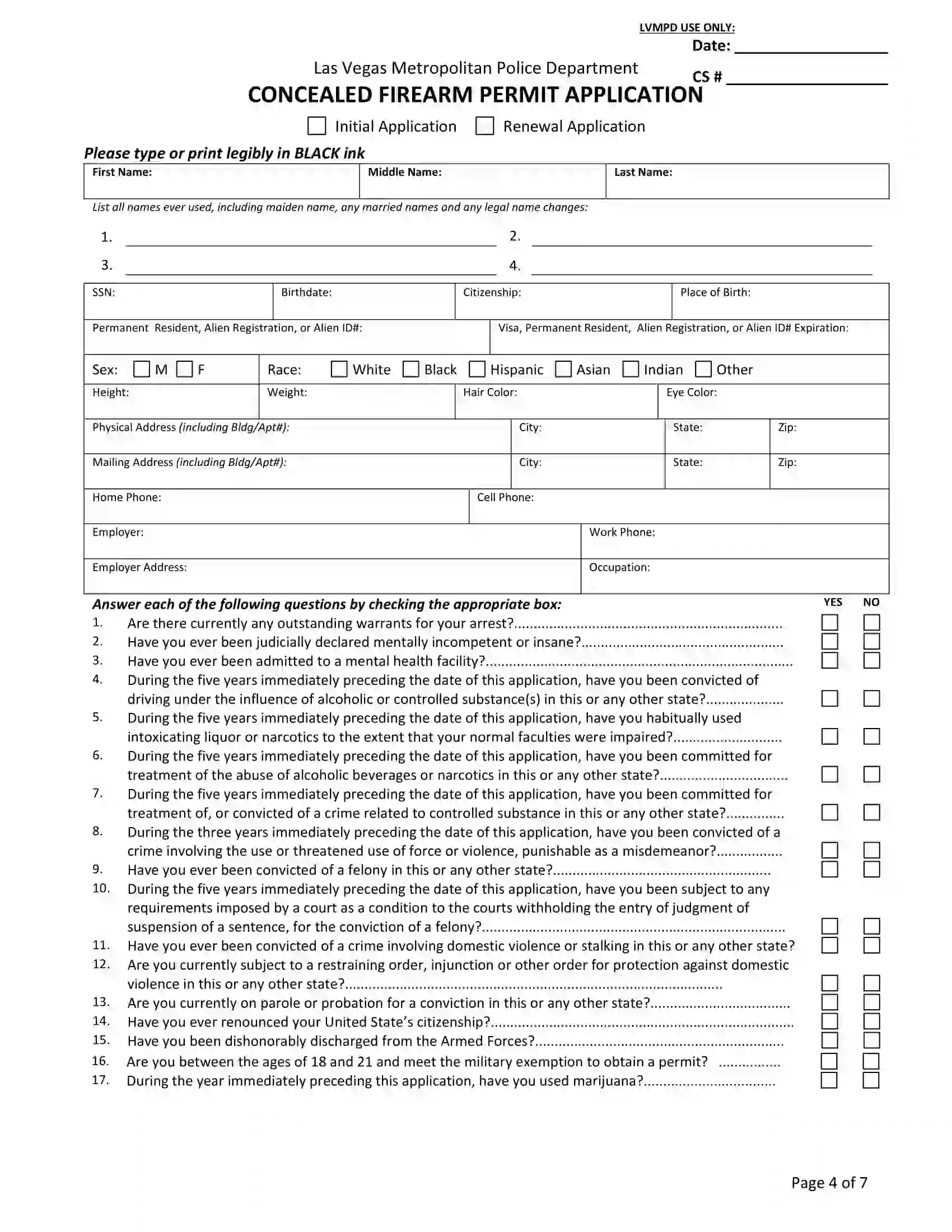

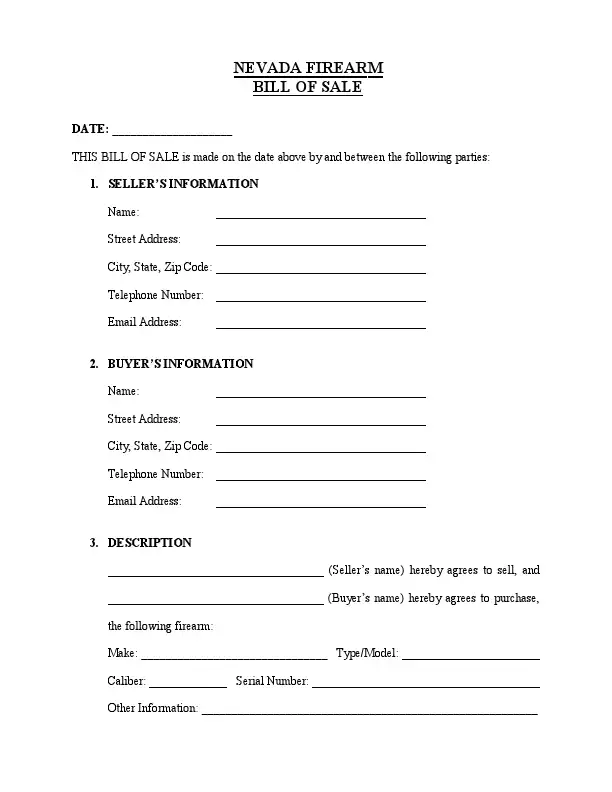

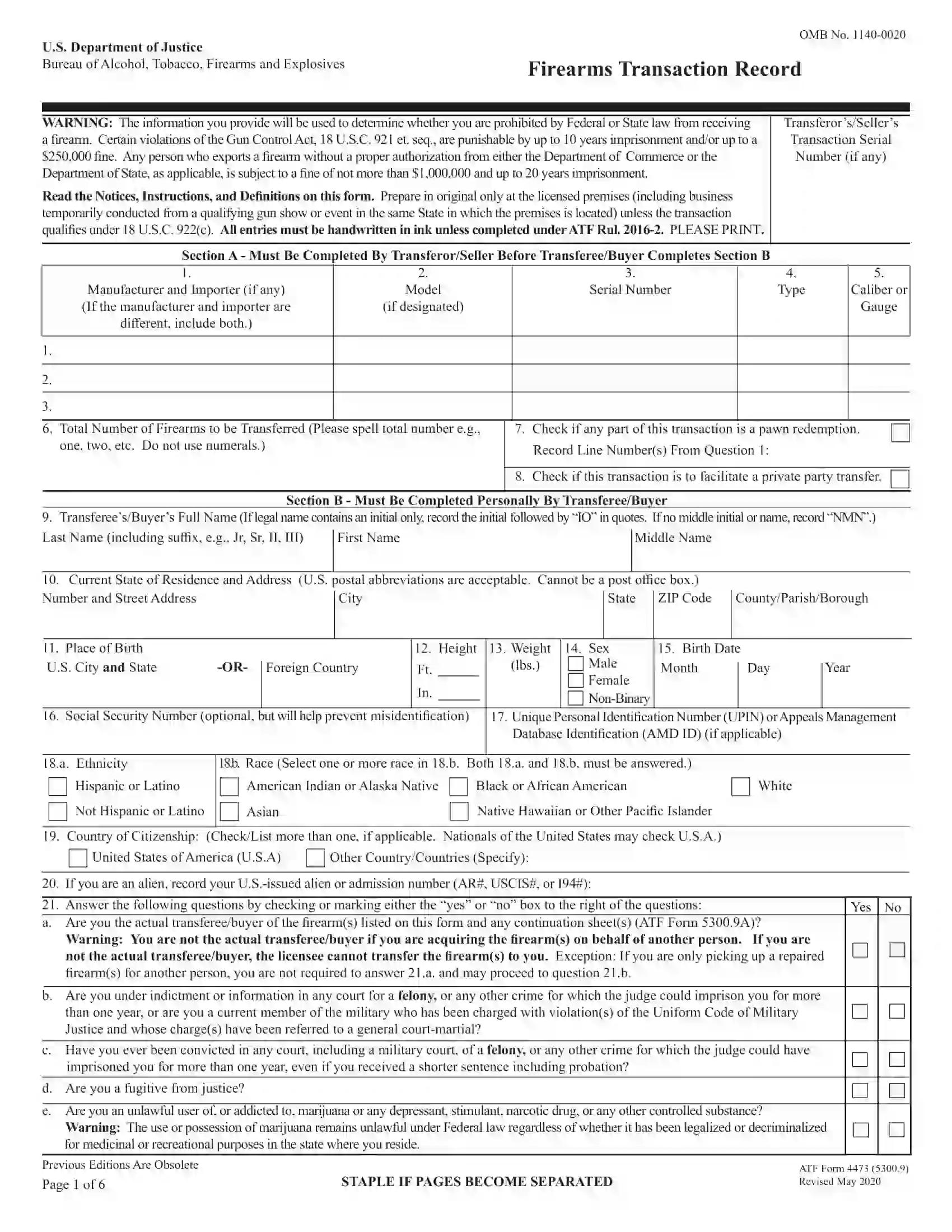

Nevada firearm bill of sale is used to register the firearm transfer between two parties. According to NRS 202.2547, the buyer can only purchase a gun from an unlicensed person if they undergo a background check by a licensed dealer (FFL).

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

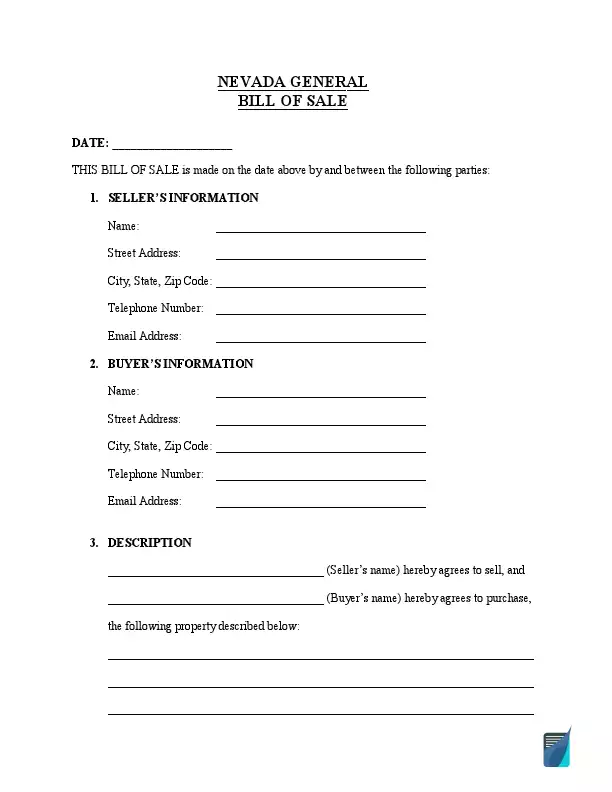

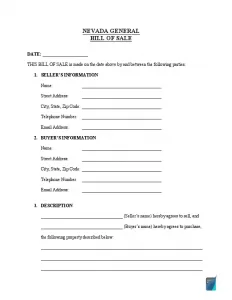

Use a general bill of sale to register any sale transaction between a buyer and a vendor. To complete the private sale successfully, you must include the parties’ contacts, property description, purchase price, and signatures in your legal document.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

How to Write a NV Vehicle Bill of Sale

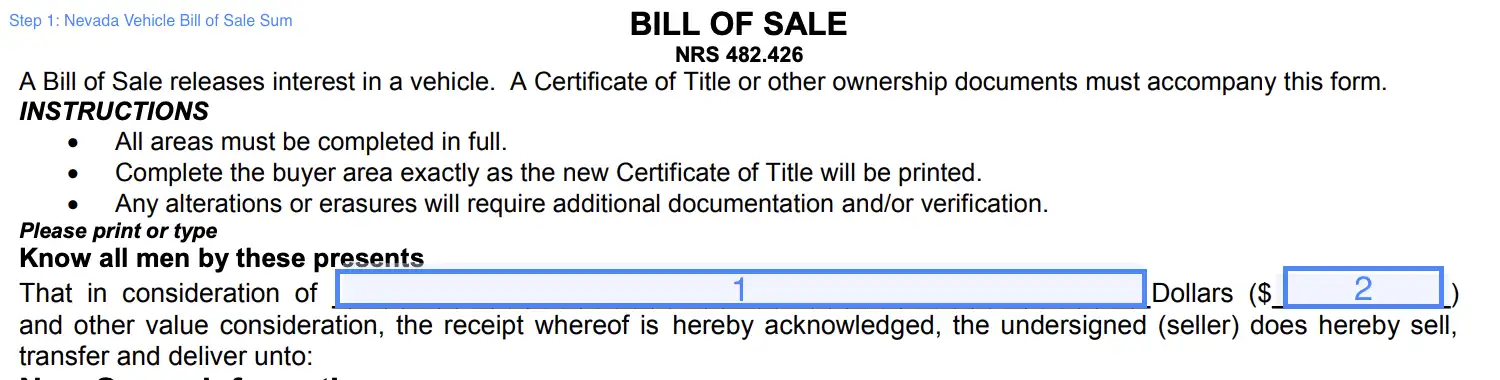

A vehicle bill of sale is an official document that certifies the vehicle ownership transfer from the vehicle owners to the purchaser. This form releases the seller’s interest in a vehicle and is used during the registration process in the Nevada DMV. Here are simple instructions on how to fill out this form error-free.

Step 1. Indicate the price of the vehicle

In the first area, you need to indicate the full sum of the motor vehicle cost in letters (1) and numbers (2).

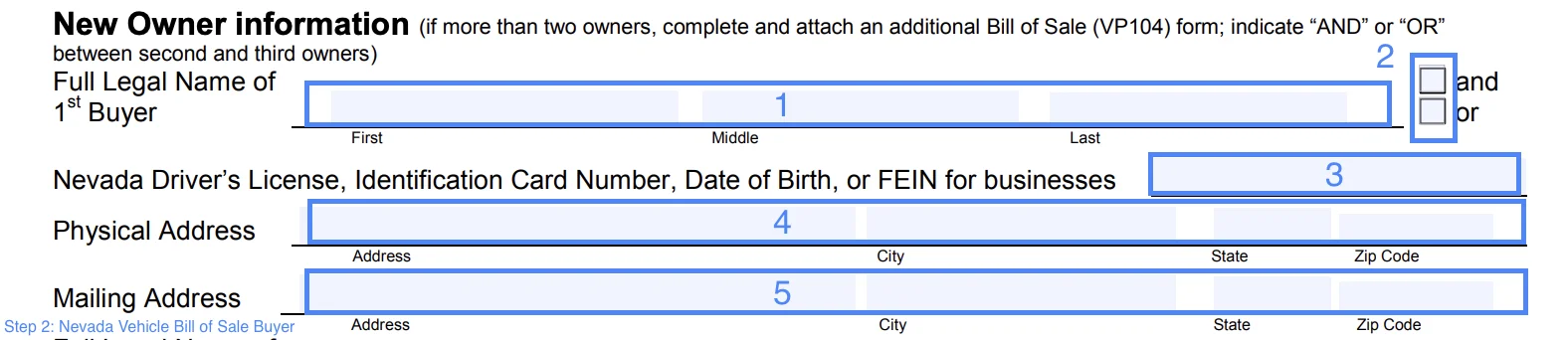

Step 2. Provide the new owner’s information

In this section, you need to print down all the required details regarding the vehicle’s buyer. If there is more than one buyer, you need to complete the copy of the bill of sale form and pick AND or OR in the provided checkbox (2). Other than that, be sure to fill out the required fields:

- Full Legal Name

- Identification Card Number, Driver’s License, Date of Birth, or FEIN (for business)

- Physical Address (Street, City, State, and Zip Code)

- Mailing Address (Street, City, State, and Zip Code)

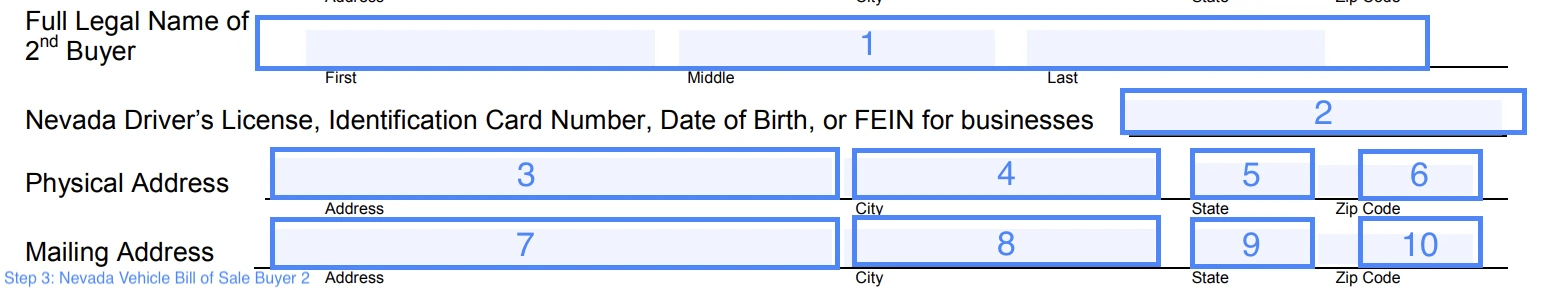

Step 3. Identify the co-owner

If there is a second buyer, you need to provide the same information about them. In the following section, include:

- The full legal name of the second buyer

- Identification Card Number, Driver’s License, Date of Birth, or FEIN for business

- Physical Address (Street, City, State, and Zip Code)

- Mailing address (Street, City, State, and Zip Code)

Skip this step if there is only one buyer.

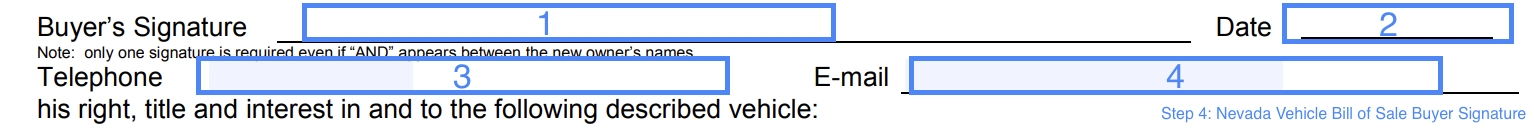

Step 4. Provide the buyer’s signature

The buyer needs to sign the document to confirm that the information is accurate, indicate the date of the signature, and provide additional contact details, such as phone number and email address.

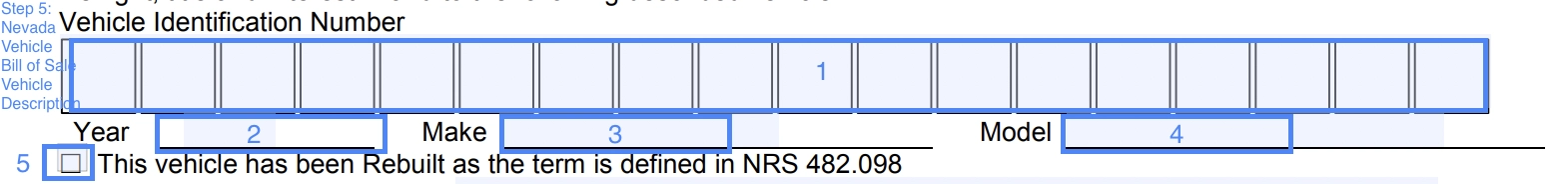

Step 5. Enter the vehicle details

In this section, the seller must indicate all the details regarding the motor vehicle being sold. The required fields are:

- VIN (vehicle identification number)

- Year

- Make

- Model

Also, you need to check the box if the vehicle was rebuilt.

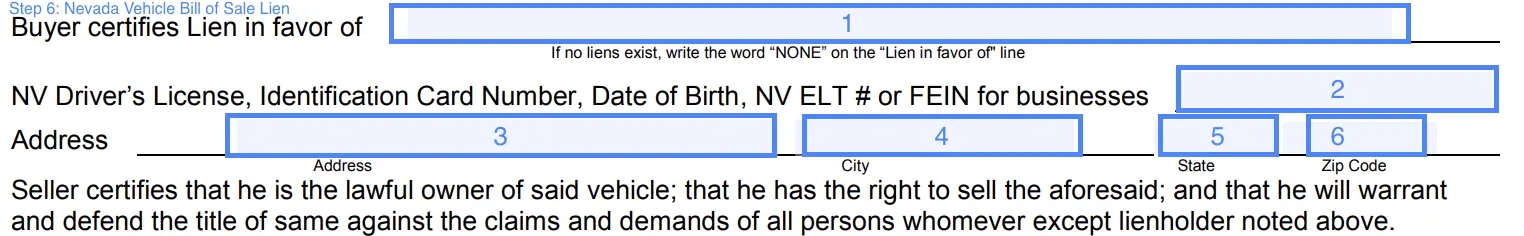

Step 6. Indicate the lien holder

If there are no liens for the motor vehicle, you can write down NONE in the first field (lien in favor of line) and skip the rest of the section. If there is a lienholder, you will have to provide the contact details of that person, including:

- Full Name of the Lienholder

- Identification Card Number, NV Driver’s License, Date of Birth, NV ELT, or FEIN for business

- Address (Street, City, State, and Zip Code)

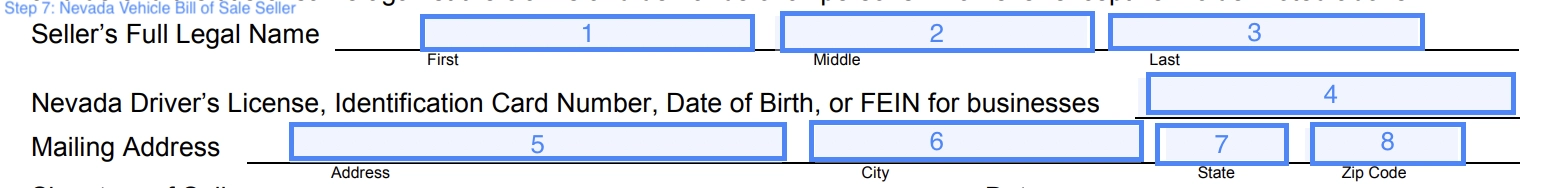

Step 7. Enter the seller’s information

Provide the details regarding the person who is selling the motor vehicle. The required details are:

- Full Name of the Seller

- Identification Card Number, NV Driver’s License, Date of Birth, or FEIN for business

- Address (Street, City, State, and Zip Code)

Step 8. Sign the document

Lastly, the seller must complete the form by signing and dating it. Nevada has no rule that the bill of sale form must be notarized. It is an optional action you may do if you want to seal the deal in the notary public’s presence.

Registering a Vehicle in Nevada

After the certified date of purchase, new vehicle owners will have 30 days to complete the vehicle registration of their purchased vehicle. If the motor vehicle is not certified within 30 days, it is subject to penalties and fees for Nevada highway and roadway improper operation. For registration, buyers must gather documents and present them in person at the Nevada DMV (Division of Motor Vehicles) that is to their convenience. Documents necessary for registration include:

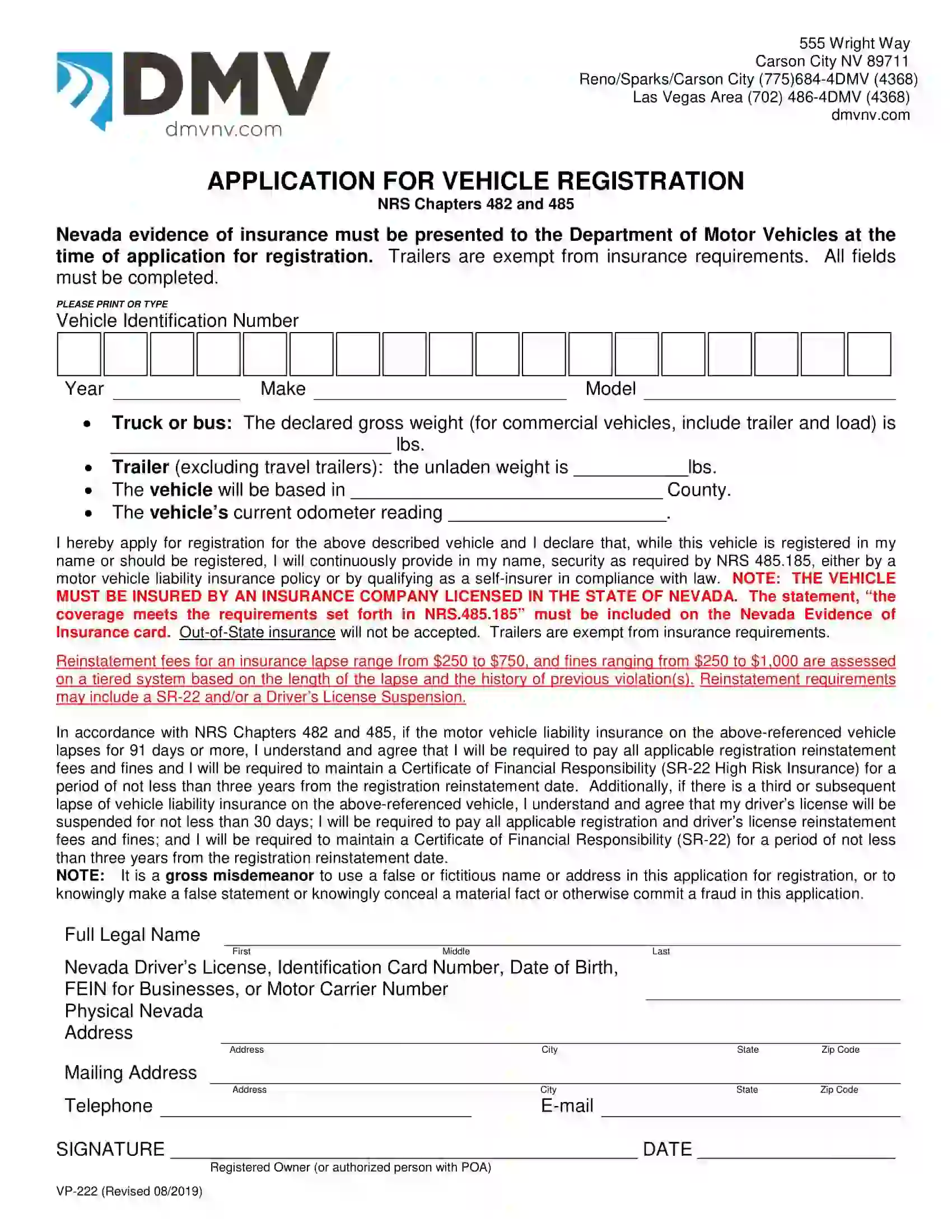

- Application for Vehicle Registration (Form VP-222)

- Proper title and odometer reading signed by the previous owner

- Vehicle bill of sale with the details of the buyer, seller, and motor vehicle

- Current and valid driver’s license

- Proof of insurance

- Nevada Emission Vehicle Inspection Report (only in some cases)

In addition to all listed documentation, some fees are required to complete title registration, including a $1 technology fee and a $6 safety fee for motorcycles. Registration fees for passenger vehicles and motorcycles are $33, and travel trailers are $27. Taxes are also due at the time of registration and are calculated based on the motor vehicle’s value at the time of purchase. The minimum amount of taxes for registration of a motor vehicle is $16.00, using the value of the car plus 35%. Nevada also takes depreciation into account, using that as part of their calculations in determining the final fee for taxes due at registration. Veterans or disabled are exempt from taxes and therefore must show proof of all therefore mentioned cases.

If a motor vehicle is purchased outside of Nevada, buyers will have to prove their taxes by a certified document. If not, taxes must be paid before the vehicle can be legally registered and driven in Nevada.

Relevant Official Forms

Application for Vehicle Registration (Form VP-222) is submitted to the Department of Motor Vehicles.

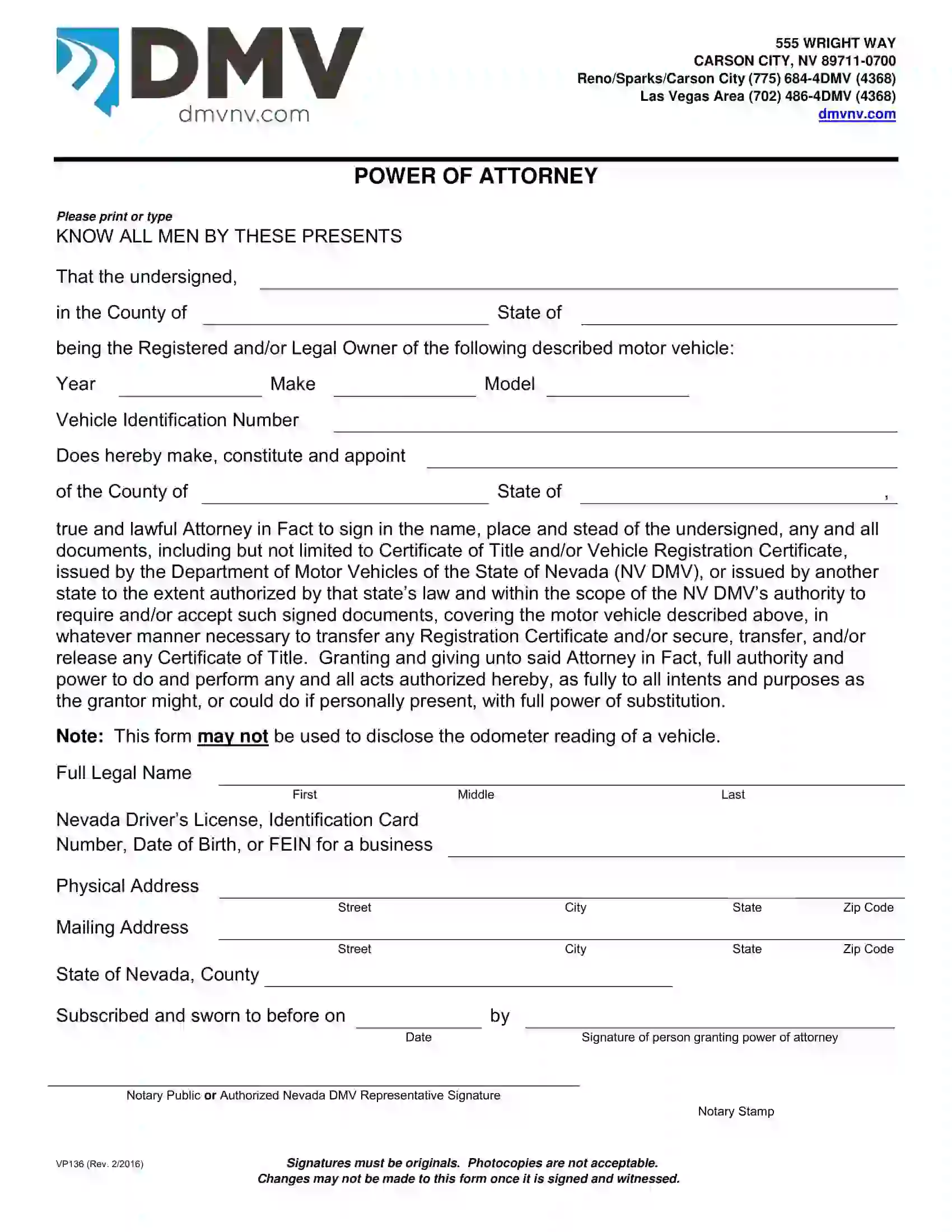

Use this vehicle power of attorney when you need to give a short-term permit to another person to act on your behalf.

A bill of sale to use for a watercraft title transfer authorized by Nevada state.

Firearms Transaction Record (Form 4473) is required for any firearm transfers and purchases.

Short Nevada Bill of Sale Video Guide

Other Bill of Sale Forms by State