North Carolina Bill of Sale Form

North Carolina bill of sale is used to record the transition of item ownership from one individual to another. By conducting a bill of sale, both vendor and buyer protect themselves from any allegations related to the transaction.

Get a customized form of a bill of sale on our website for any equipment type you intend to purchase or sell. Upload, edit, and download your personalized document that will fully meet your specific needs. In addition, you can use an official bill of sale form applicable in North Carolina to purchase or sell a vessel.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | North Carolina Motor Vehicle Bill of Sale Form |

| Other Names | North Carolina Car Bill of Sale, North Carolina Automobile Bill of Sale |

| DMV | North Carolina Division of Motor Vehicles |

| Vehicle Registration Fee | $38.75 |

| Bill of Sale Required? | No |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 59 |

North Carolina Bill of Sale Forms by Type

Bill of sale forms are conducted to support a fact of personal property ownership change for any transaction type. However, in most cases, it’s required to select a specific type of bill of sale, especially for high-value items such as cars, vessels, trailers, and handguns.

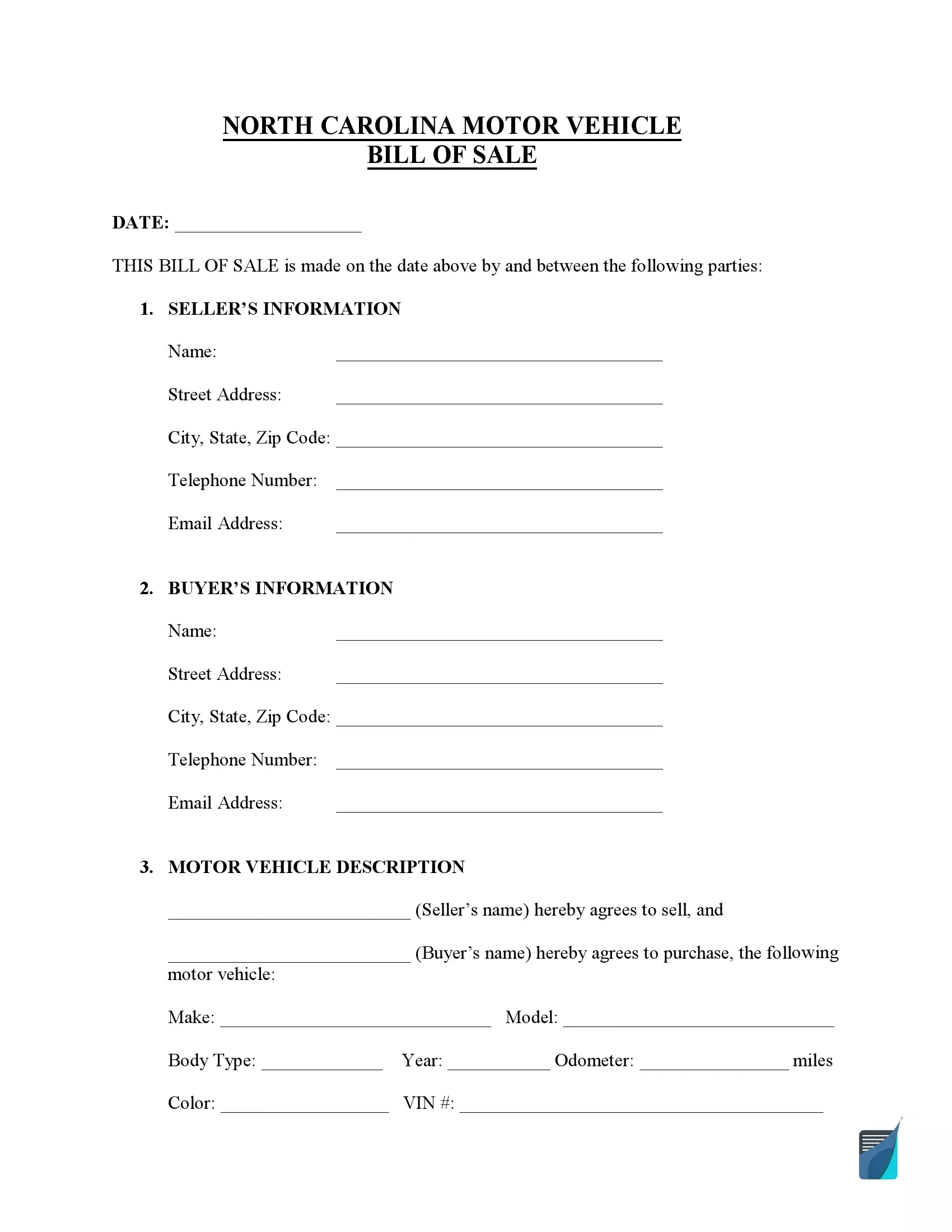

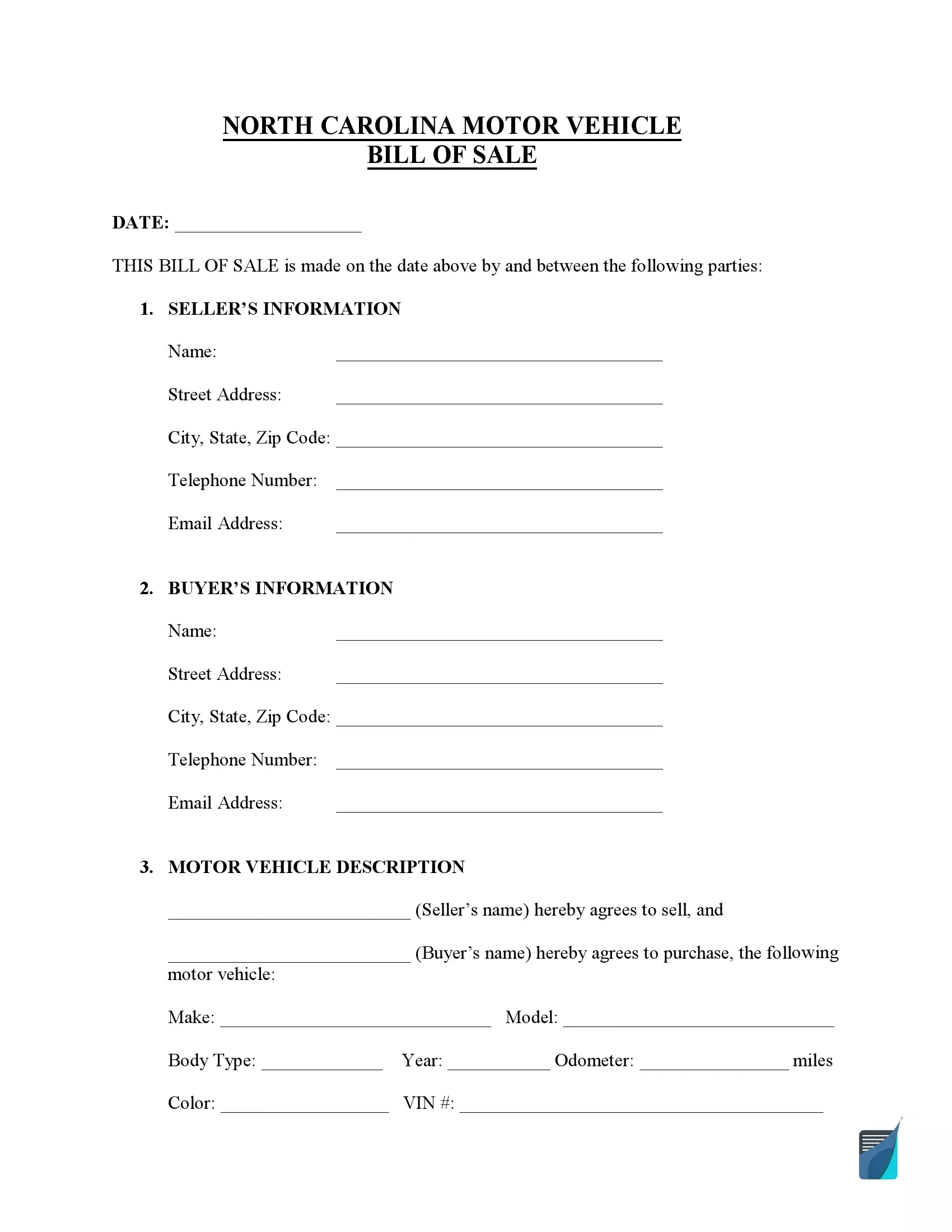

North Carolina vehicle bill of sale is needed during vehicle title transfer.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

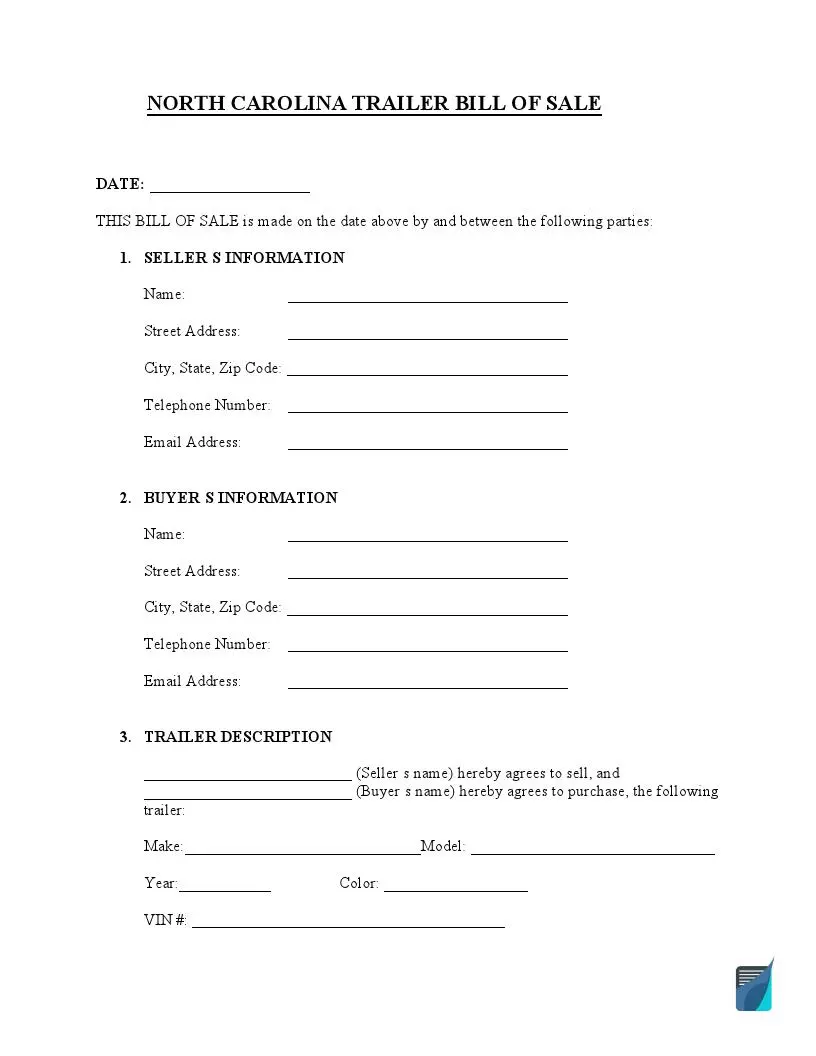

North Carolina trailer bill of sale records the title transfer when purchasing a trailer from a private party. Use this form to prove your rights for the mobile home during registration.

| Alternative Name | Trailer Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

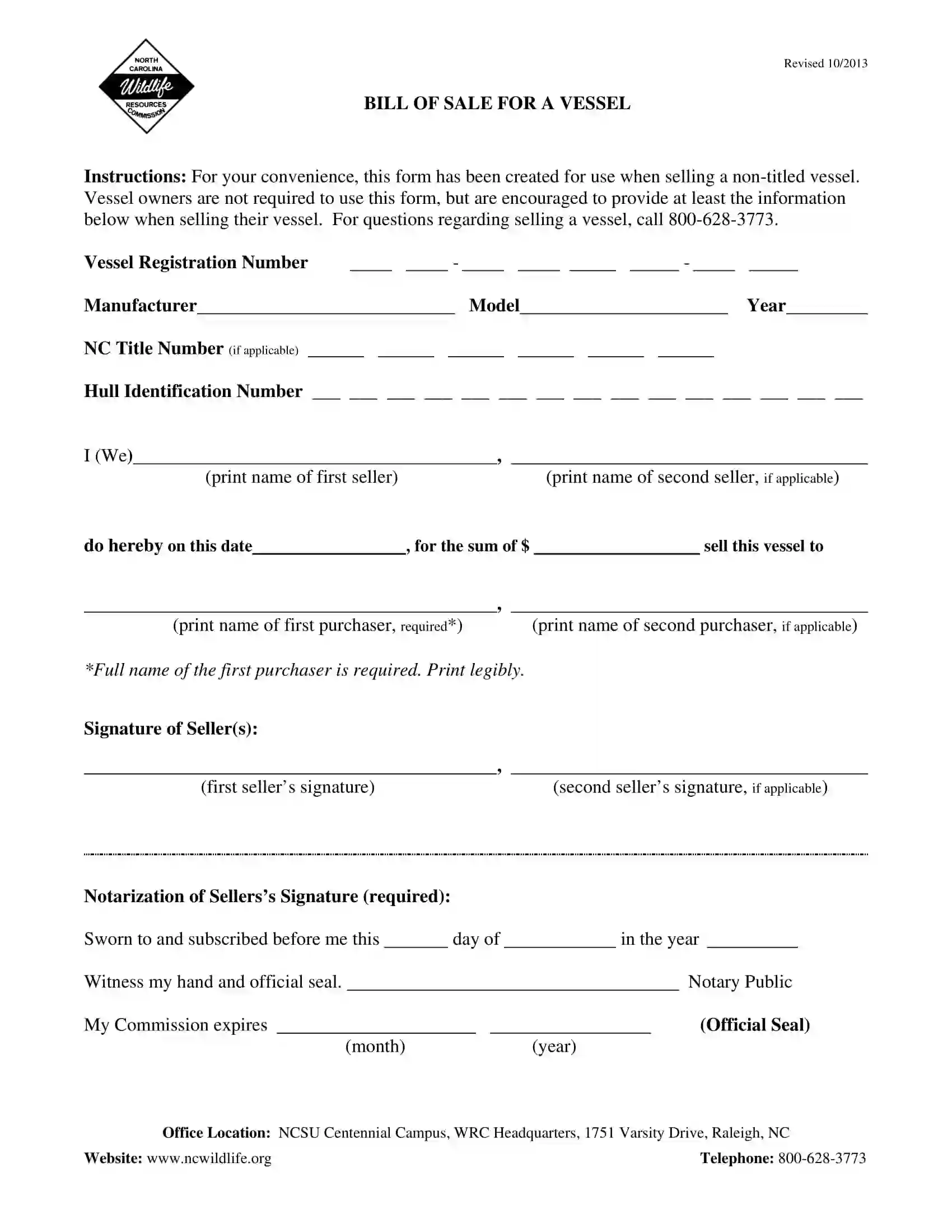

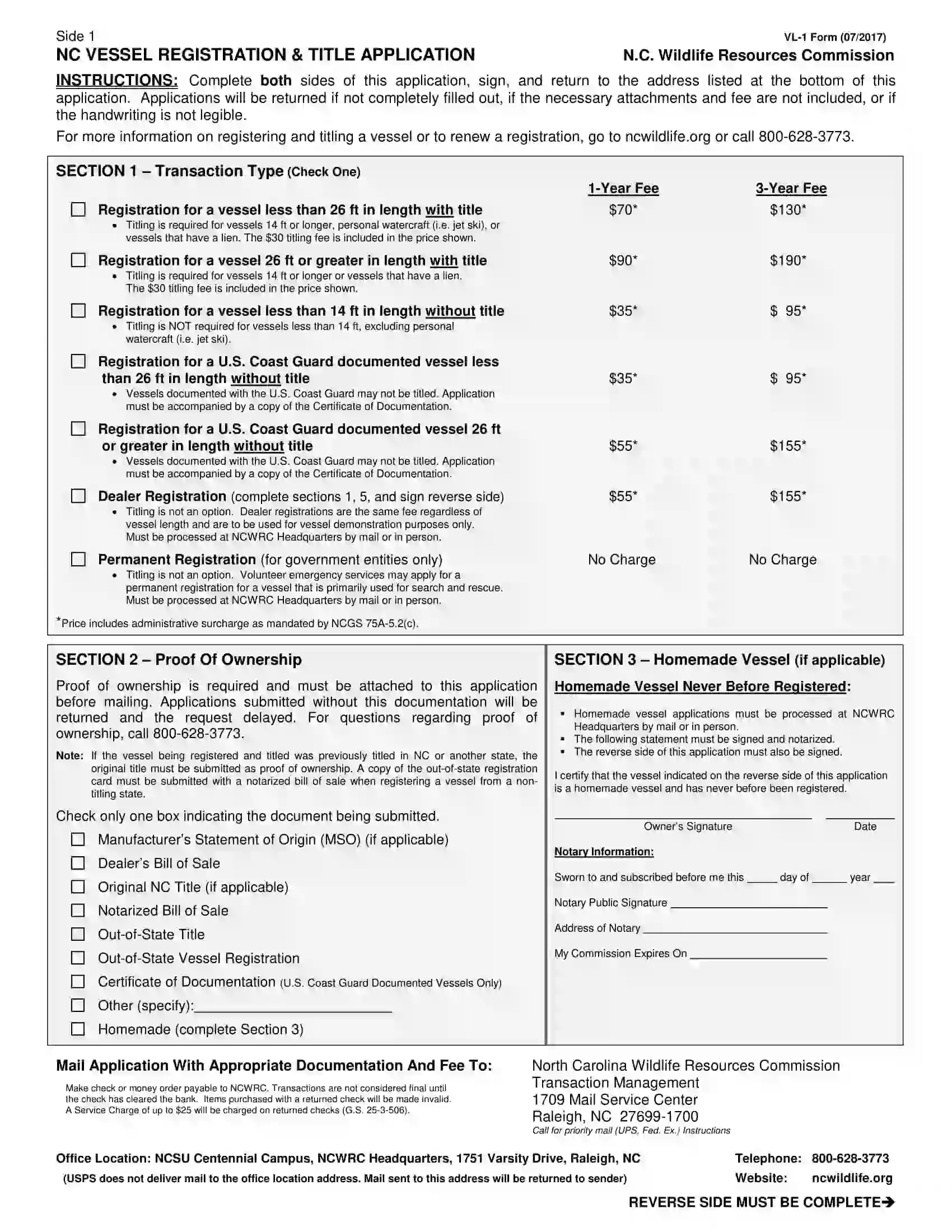

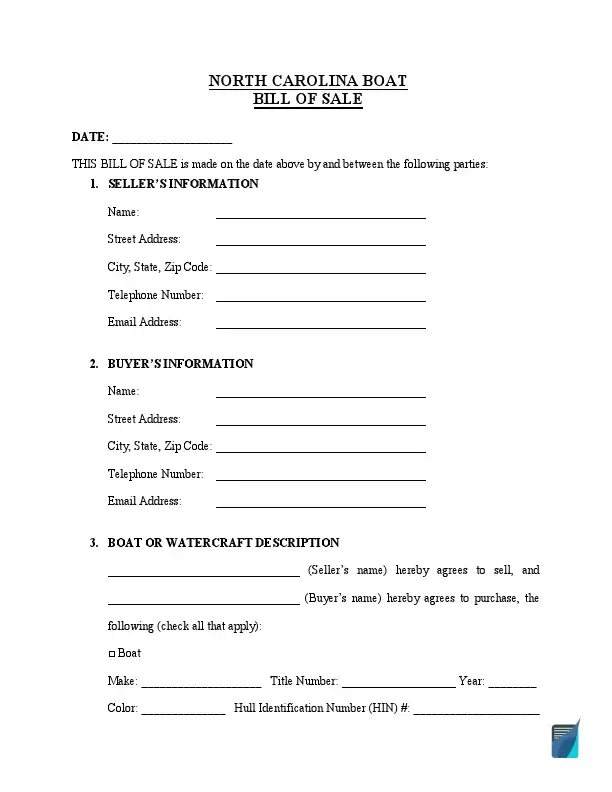

North Carolina boat bill of sale is one of the documents North Carolina residents must submit for a title application after buying a non-titled vessel.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

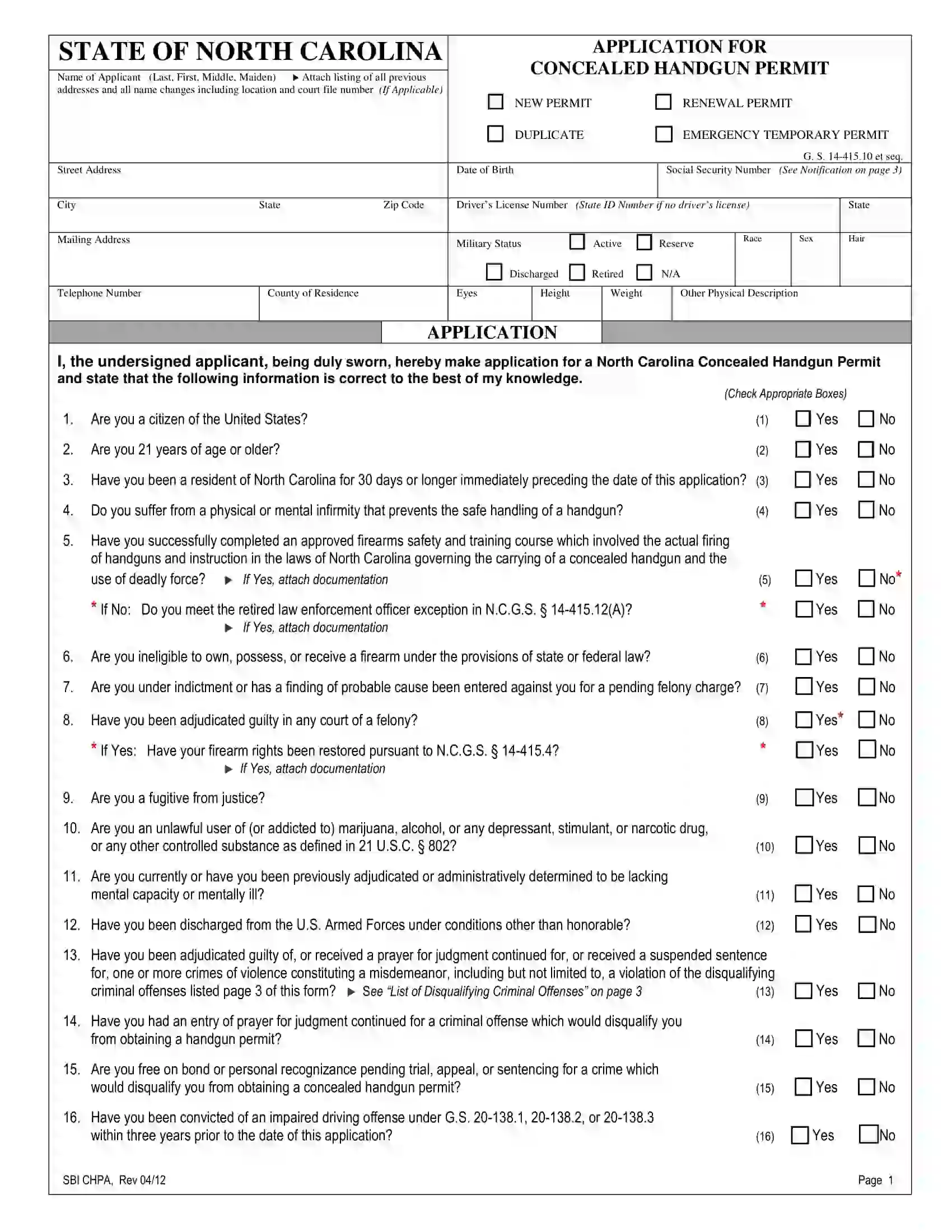

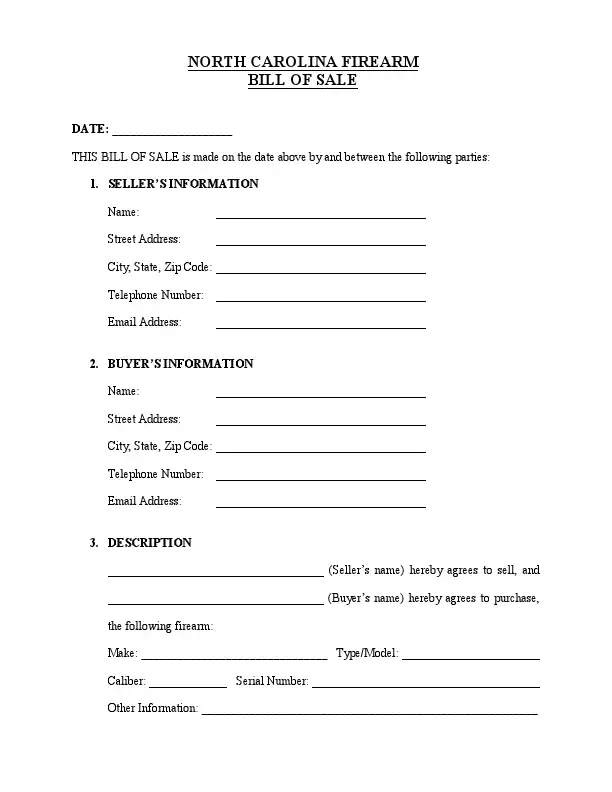

North Carolina handgun bill of sale is an additional document during a firearm owner change. Ensure that the seller and buyer obtain a pistol permit, or the deal will be considered a misdemeanor.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

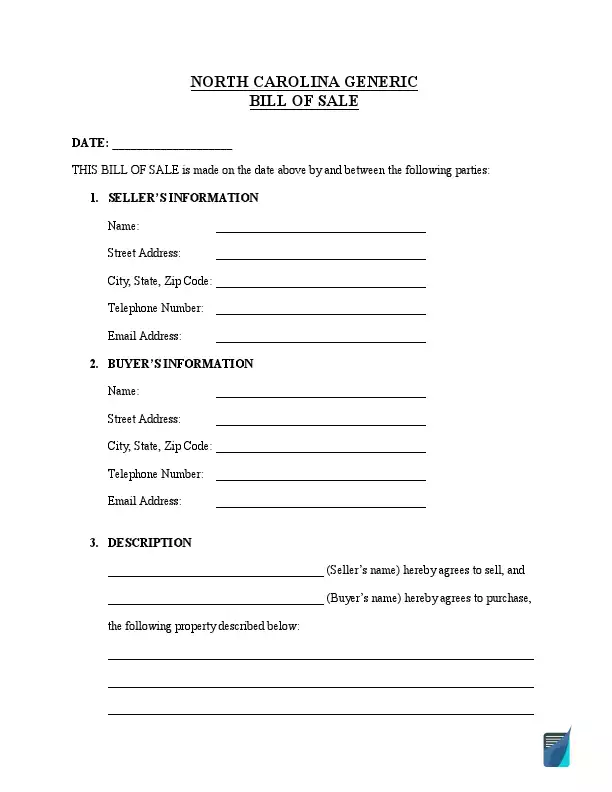

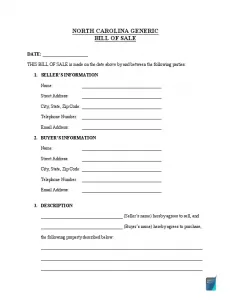

North Carolina general bill of sale form can come in handy during the transaction of any item to a new owner.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

How to Write an NC Vehicle Bill of Sale

Preparing a North Carolina bill of sale is an easy task if you follow the directions below. They are based on our custom-made bill of sale template and will help North Carolina residents get a high-quality document in less than ten minutes.

Step 1: Specify the date of the sale

First, it’s necessary to indicate the date when the vehicle sale takes place.

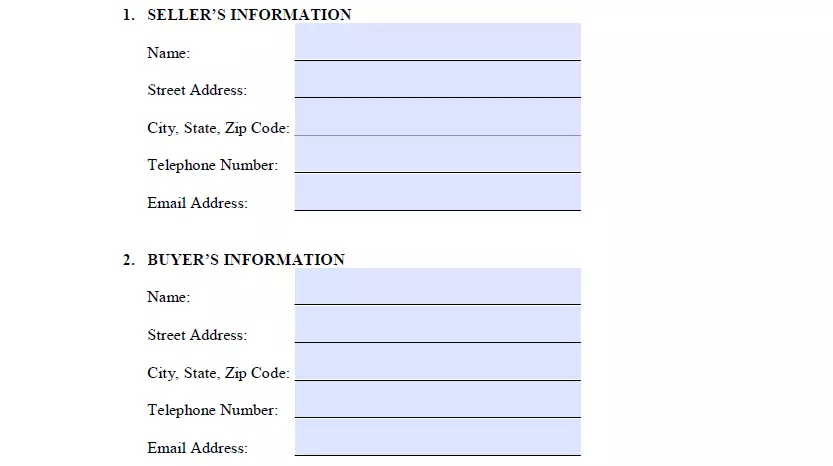

Step 2: Indicate the details of the buyer and seller

The next step is to identify the parties by providing their contact information. You will have to specify the following details for each of them:

- Full legal name

- Street address

- City

- State

- Postal code

- Telephone number

- Email address

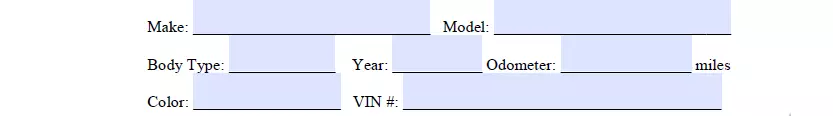

Step 3: Fill in the vehicle’s information

One of the essential sections is the information concerning the motor vehicle you want to sell. You are expected to specify the following vehicle’s details:

- Make

- Model

- Body type

- Year of manufacture

- Odometer reading

- Car’s color

- Vehicle Identification Number (VIN)

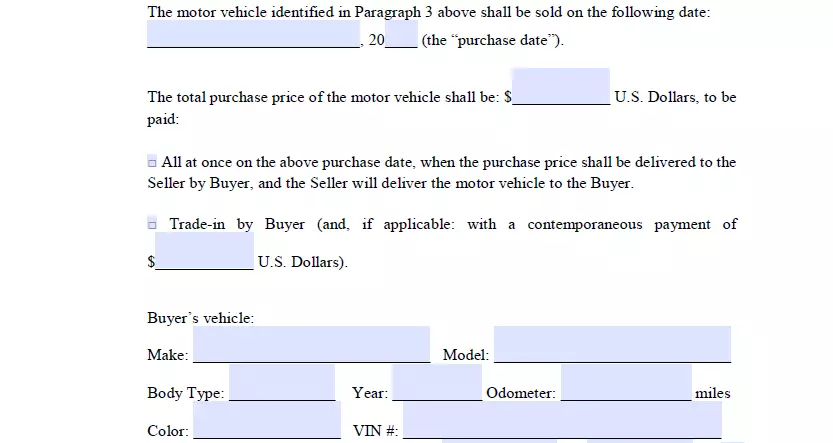

Step 4: Provide the payment details

At this point, you should specify how you will get money for the vehicle. This stage also requires indicating the exact date of the transaction and the total sum decided upon by both sides of the deal. In addition, you will need to specify the method of purchase:

- Providing the total amount as a one-time transaction. The seller acquires the full amount of money from the purchaser in a single payment and transfers the automobile to the purchaser within the same day.

- Trade-in. If this option is selected, the selling party trades their motor vehicle for the vehicle offered by the purchaser. If the buyer’s motor vehicle is cheaper, they will have to even that out with an additional payment. The document also has to incorporate the purchaser’s motor vehicle particulars in such a case.

- In installments. Enter the downpayment sum and the exact date when it must be given, along with the date by which the total sum has to be handed to the vehicle owner.

After that, you will need to specify how the purchaser will pay, for example, by cash, cheque, cashier’s check, or money order.

The last thing to do in this section is to choose whether or not all applicable taxes are included in the price.

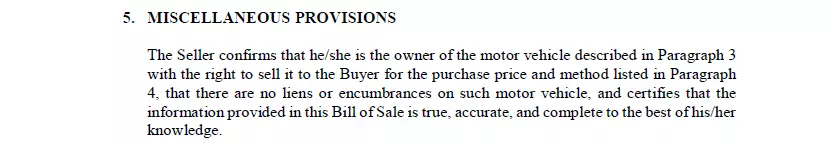

Step 5: Go over standard provisions

You are recommended to read the miscellaneous provisions and confirm that both parties are familiar with them.

This section generally has the “as-is” paragraph that indicates the vehicle is offered without warranties.

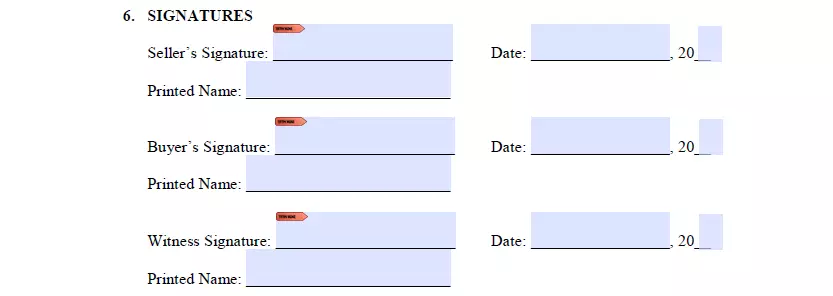

Step 6: Sign the form

The purchaser is generally not required to sign the form. Nonetheless, it’s recommended to get each party’s bill of sale signed. As an additional safety measure, you can have one or two individuals attest to the process and sign the bill of sale.

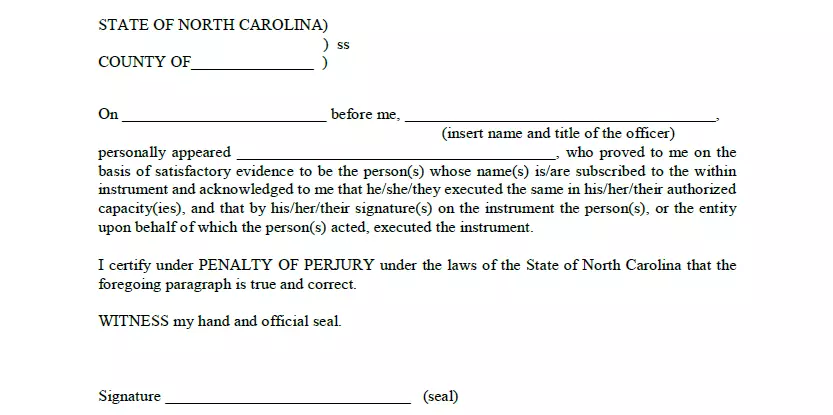

Step 7: Get a notary acknowledgment

By doing this, you will get even more legal protection. Nonetheless, this step is typically entirely elective.

In the majority of states, a bill of sale document might be necessary during title change, so the purchaser should have the original. As a seller, you could either get a copy and keep it or have a pair of identical documents signed and completed by both sides.

Registering a Vehicle in North Carolina

Those who register a newly acquired pre-owned motor vehicle in North Carolina have to file the following documents to the North Carolina DMV (Division of Motor Vehicles):

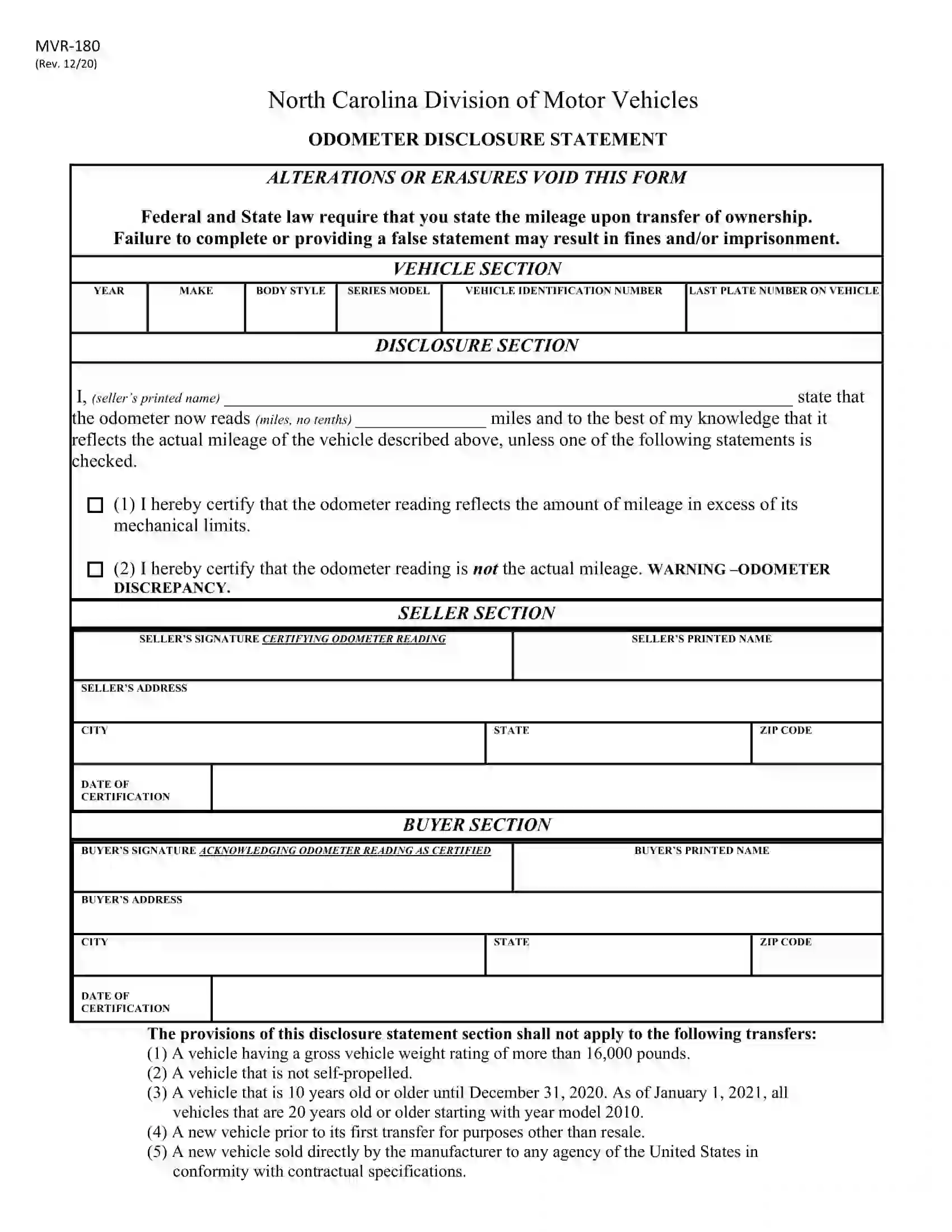

- Odometer Disclosure Statement (Form MVR-180) certifying the actual mileage of the vehicle recorded at the moment of sale (required for vehicles less than ten years old)

- Completed vehicle bill of sale template with relevant personal data of the seller and buyer, sale date, price, and specific details about the motor vehicle

- A valid driver’s license

- A state ID card

- A notarized vehicle title

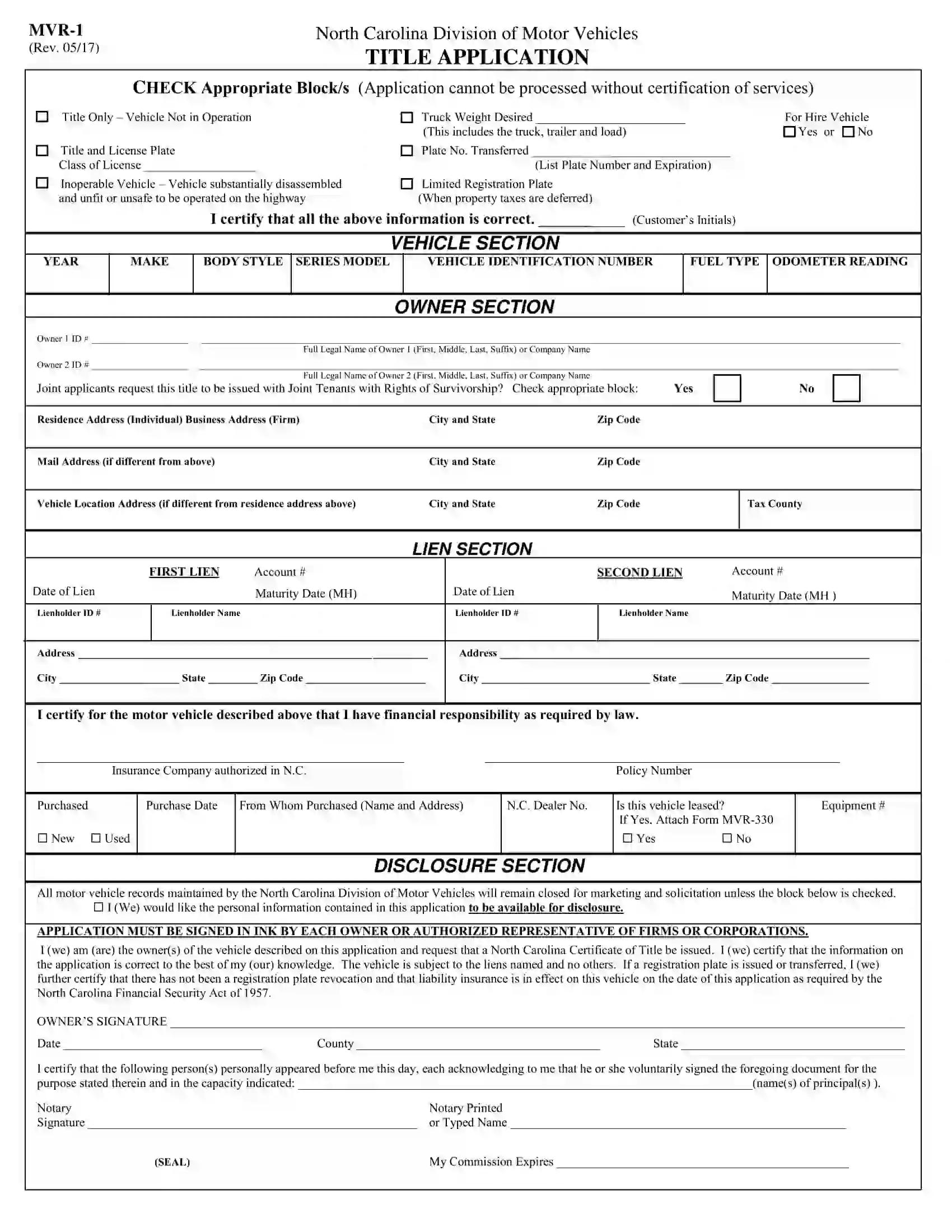

- Title application (form MVR-1) for the registration of title of ownership with the new owner

- Declaration of Eligible Risk (form MVR-615)

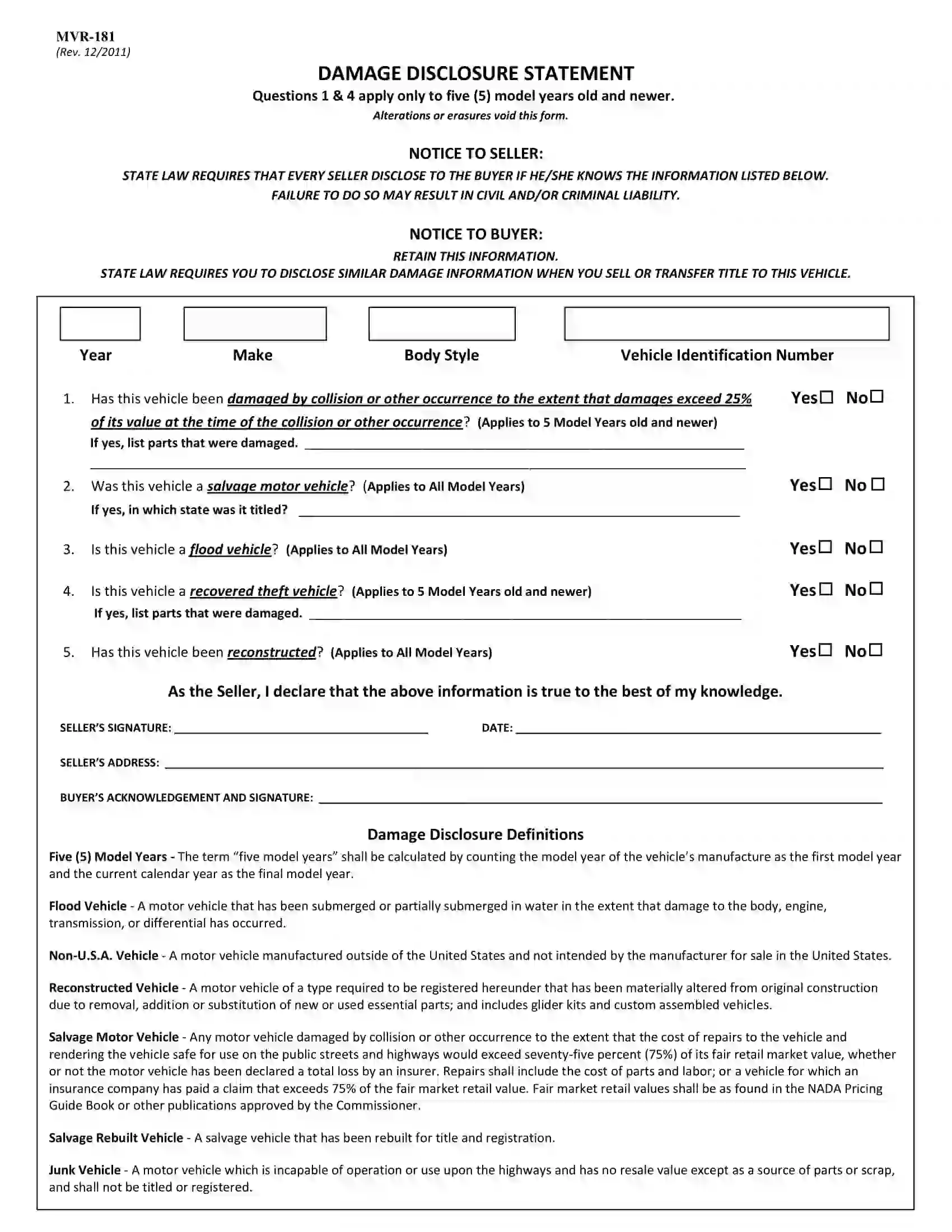

- Damage Disclosure Statement (form MVR-181)

- Receipt of registration fees and sales tax

Residents of North Carolina acquiring vehicles should first complete the registration procedure to start operating those vehicles on the state’s roads.

If a vehicle is transferred between family members, the new owner should file the Highway Use Tax Exemption Certificate (MVR-613).

Fees applicable to vehicle registration in North Carolina include the Certificate of Title fee ($56), highway-use tax (equaling 3% of the vehicle’s value, but not exceeding $250 for new residents moving to North Carolina), instant title fee ($105.75), and late penalty fee ($20) applied to those who register their vehicles later than 28 days after the date of vehicle’s acquisition.

The registration fees depend on the vehicle’s category. Thus, you’ll need to pay $15 for a house trailer, $25.50 for a moped, and $6 for a permanent or state-owned vehicle. Private passenger vehicles are typically charged at $38.75. Besides, residents registering their vehicles in a specific county will also need to pay regional fees and taxes ranging from $1 in Randolph to $7 in Durham, Orange, and Wake. Electric vehicle registration is subject to an additional $140.25 (added to the standard registration fee), while getting a personalized plate will cost $30.

Relevant Official Forms

Odometer Disclosure Statement (Form MVR-180) indicates the actual mileage of the vehicle to be sold.

Damage Disclosure Statement (Form MVR-181) is a document required by state law during vehicle sales to describe its actual condition.

Short North Carolina Bill of Sale Video Guide