Pennsylvania Bill of Sale Form

Pennsylvania bill of sale is a legal document certifying personal property transfer from one individual to another. It’s a legally binding document as long as it’s filled out according to the state’s standards.

Bills of sale can come in various forms, depending on the state and type of transaction you plan to conduct. Here, you can get a bill of sale template suitable for your specific transaction type and complete official documentation accompanying the vehicle or boat registration process.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | Pennsylvania Vehicle Bill of Sale Form |

| Other Names | Pennsylvania Car Bill of Sale, Pennsylvania Automobile Bill of Sale |

| DMV | Pennsylvania Department of Motor Vehicles |

| Vehicle Registration Fee | $39 |

| Bill of Sale Required? | No |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 59 |

Pennsylvania Bill of Sale Forms by Type

Each Pennsylvania bill of sale serves a particular type of transaction. Thus, you must ensure you select one that corresponds to your case.

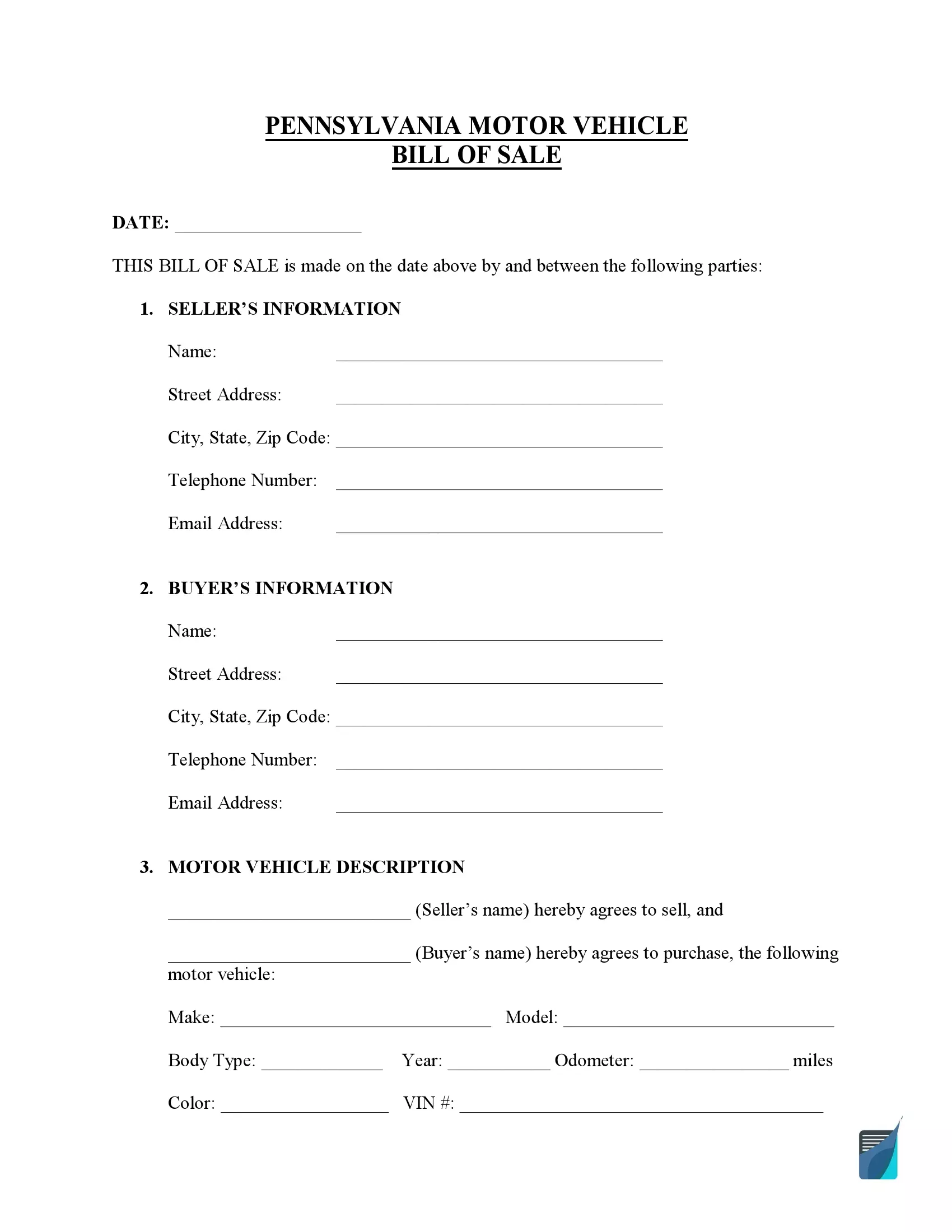

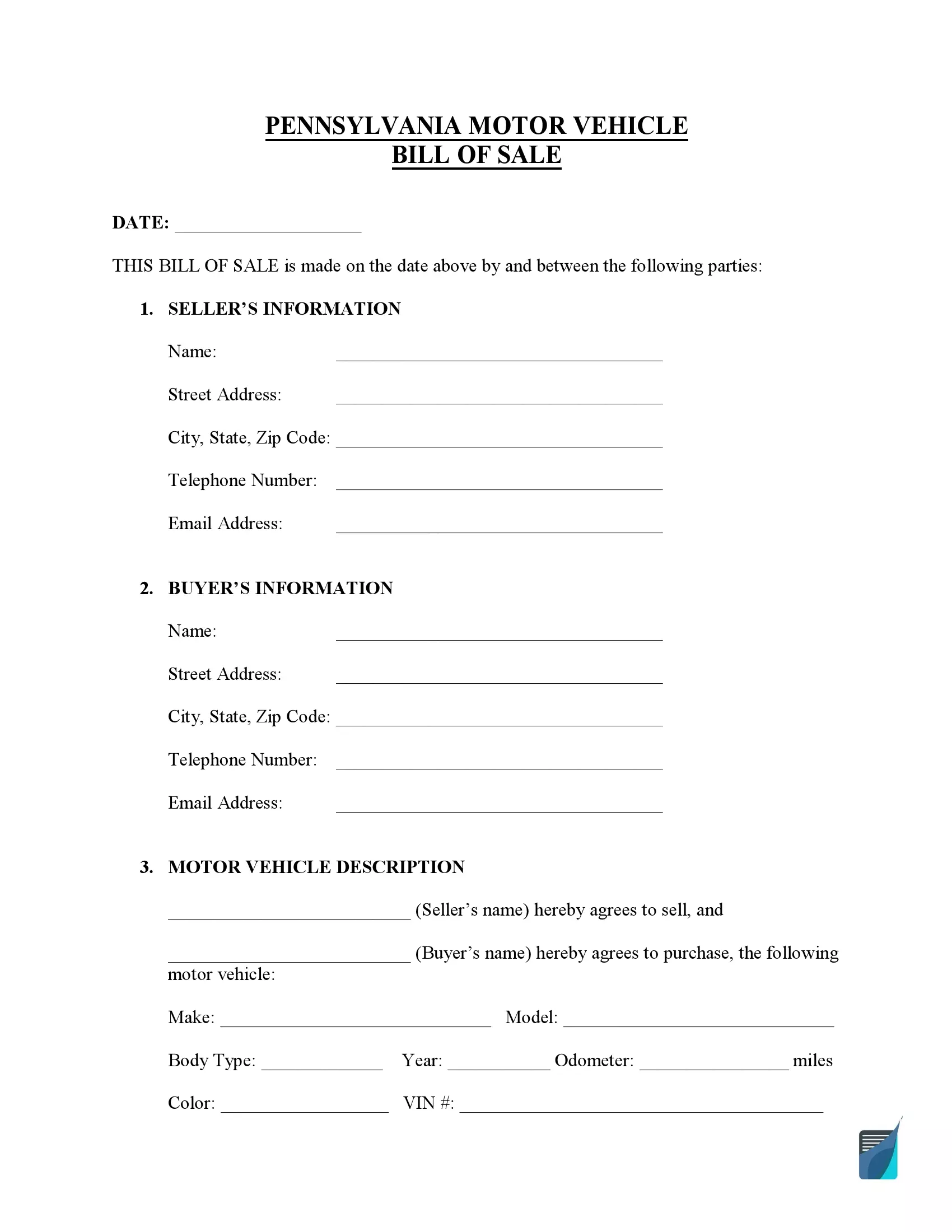

Use a vehicle bill of sale in Pennsylvania to formalize the private purchase. This document will be handy during registration and titling procedures. If you are dealing with an out-of-state title, you will have 20 days to register it after entering Pennsylvania.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

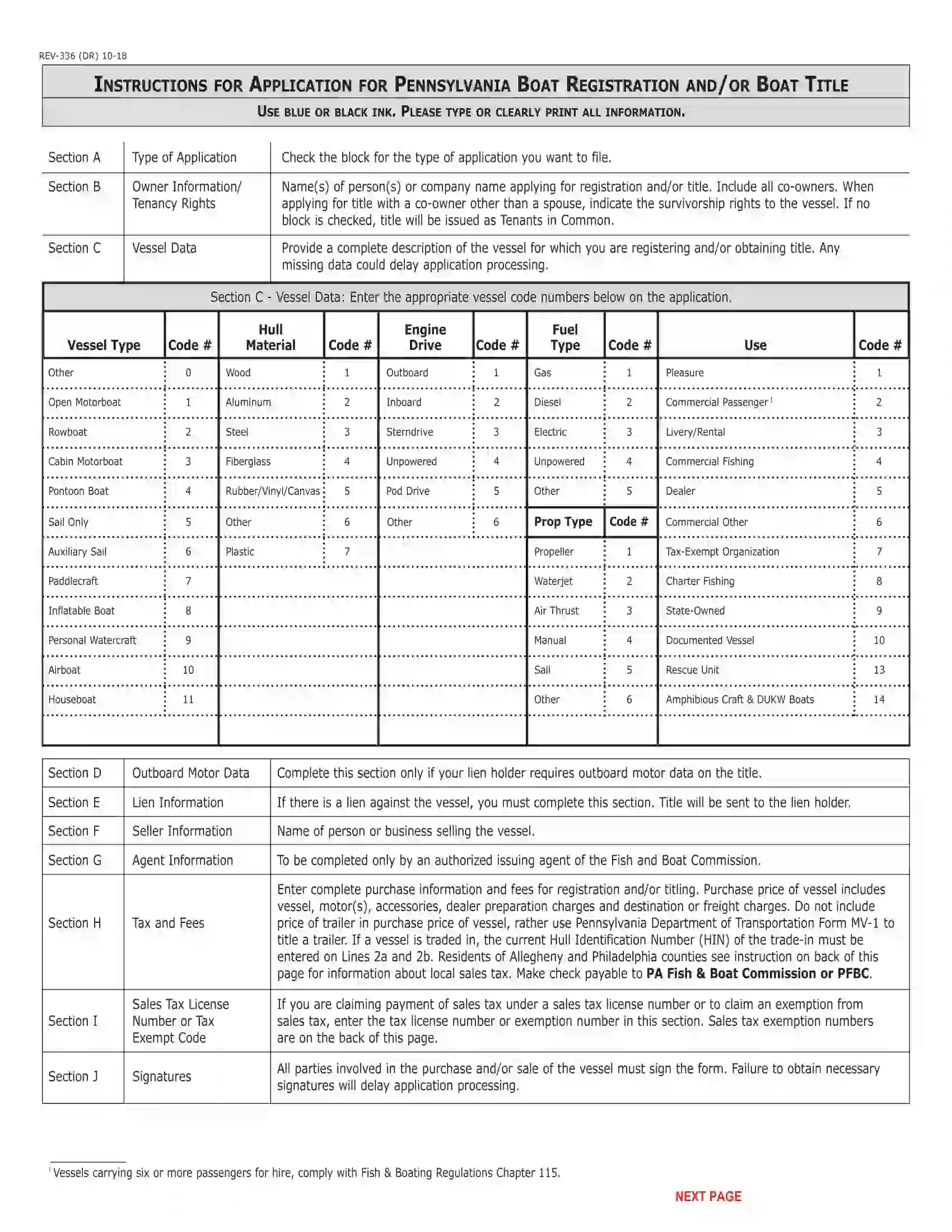

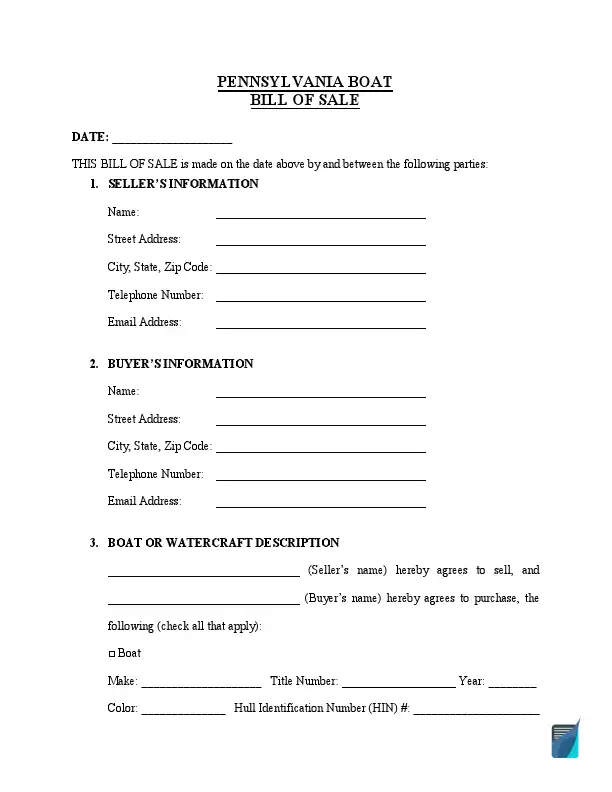

A boat bill of sale in PA formalizes the change of vessel’s owner. The signatures of both parties involved in the sale are sufficient for the document to have legal weight, but certification by a notary will be an additional guarantee. Recreational watercraft, motorized boats, and vessels with an outboard motor and sized 14 ft or longer must be titled and registered in PA.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

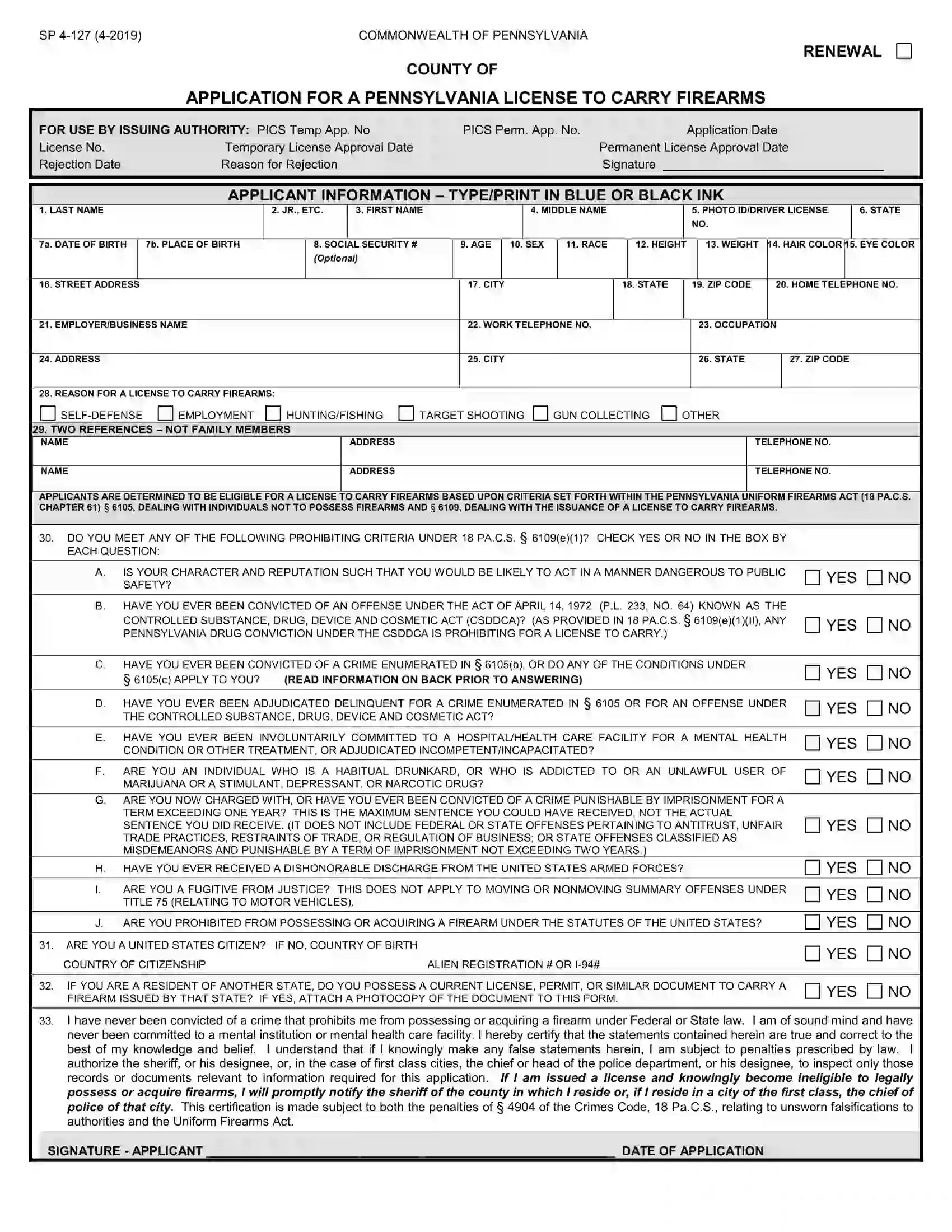

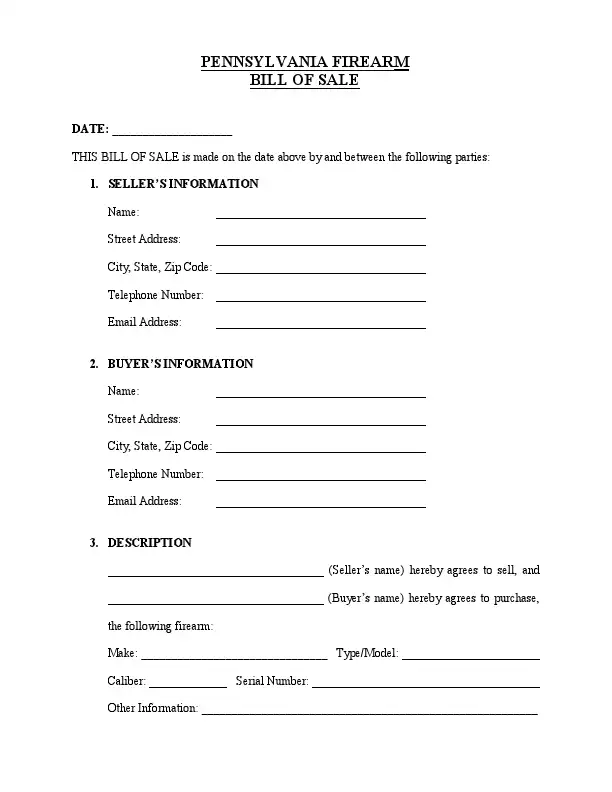

A gun bill of sale in PA formalizes the gun transfer from one individual to another through the purchase. All handgun purchases must be undertaken with the licensed dealer involved. Pennsylvania is an open carry state, except for Philadelphia, where you need a permit to carry a firearm. All handgun owners are obliged to obtain a lawfully issued license to carry the concealed gun within the PA lands.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

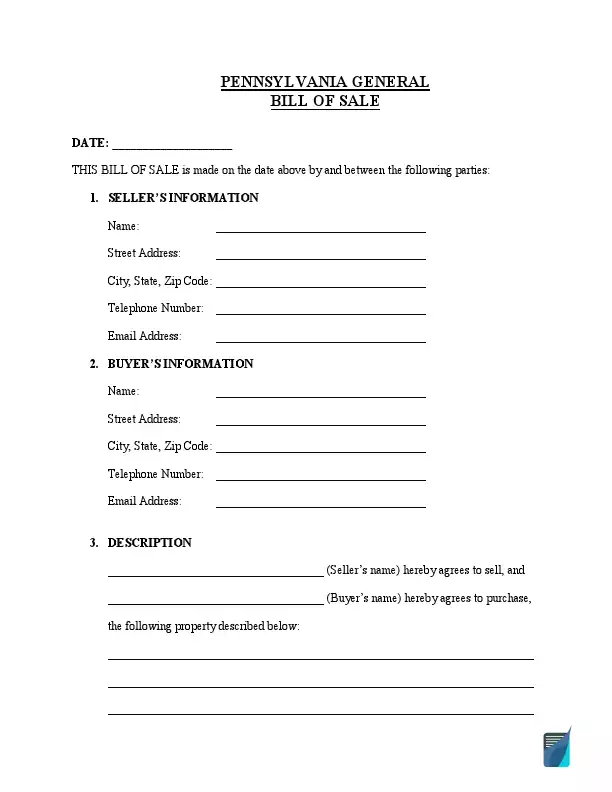

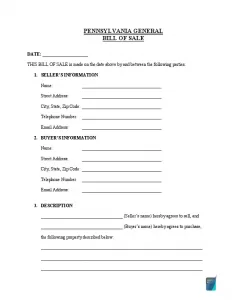

Pennsylvania general bill of sale guarantees that the personal property is legally handed over to another person.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

How to Write a PA Vehicle Bill of Sale

Pennsylvania vehicle bill of sale forms are used to sell and purchase all types of vehicles. This form helps transfer ownership from the seller to the purchaser and contains all details regarding the parties, descriptive information about the vehicle, and the signatures. To complete this form without no mistakes, follow these simple guidelines:

Step 1: Indicate the date

The document starts with the creation date, which you need to specify.

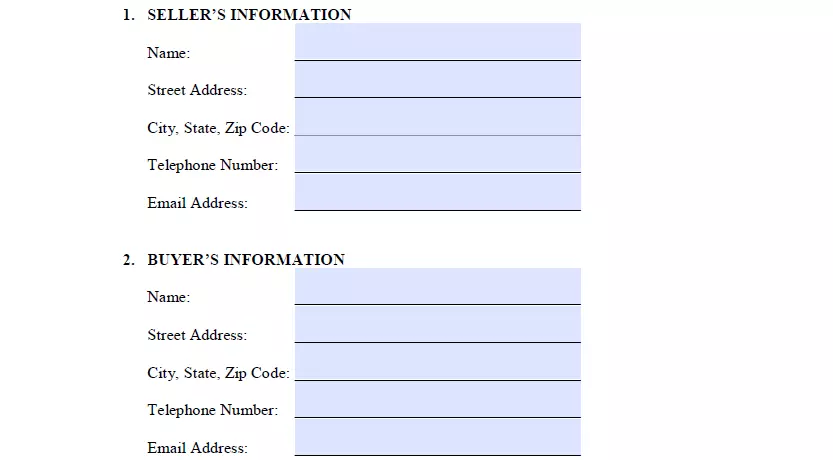

Step 2: Identify the parties

The following sections require you to provide the particulars of the seller and purchaser, such as:

- Full legal name

- Home address

- City

- State

- Area code

- Phone number

- Email address

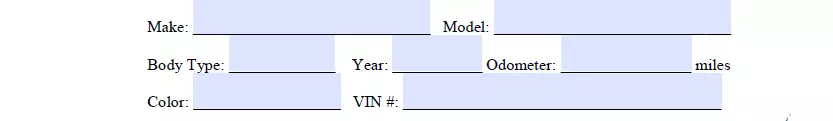

Step 3: Describe the vehicle

Next, you will have to provide the descriptive particulars of the motor vehicle:

- Make (manufacturer)

- Model

- Vehicle’s body type

- Year

- Odometer reading

- Automobile’s color

- VIN

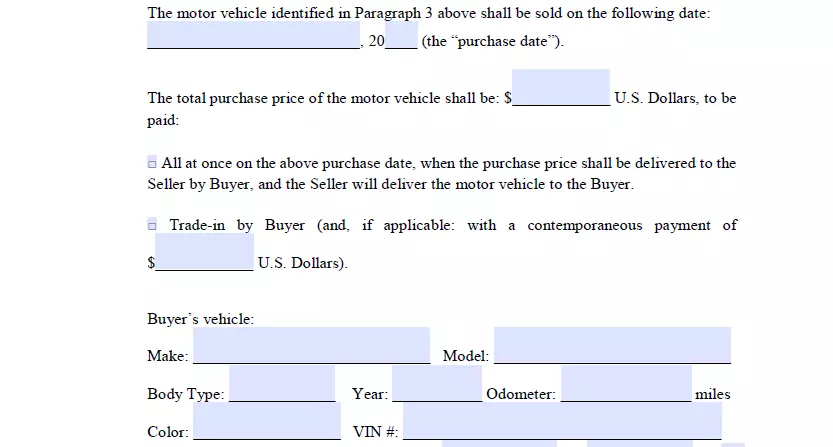

Step 4: Indicate the purchase date, price, and payment method

In this section, you are required to pick how the purchaser will buy the car and for what amount. After that, type in the transaction date, state the overall price that has to be paid for the vehicle, and choose one selling method:

- One-time transaction. There is nothing complex here: the person pays the whole sum in one payment and has the vehicle transported to them within the same day.

- Trade-in. If this particular option is picked, the selling individual trades their motor vehicle for the motor vehicle presented by the buyer. If the buyer’s motor vehicle is cheaper, they’ll have to even that out with a further payment. The buyer’s vehicle description must also be in the document.

- In installments. Using this method, you have to specify the dates when the purchaser must deliver the first and the final payments, along with their amounts.

After that, select one payment method:

- Cash

- Check

- Cashier’s check

- Money order

The last thing to complete in this section would be to determine whether all applicable taxes are included in the purchase price.

Step 5: Review the miscellaneous provisions

They typically say that the buyer acquires the property in “as-is” condition and is liable for it after the purchase is finished.

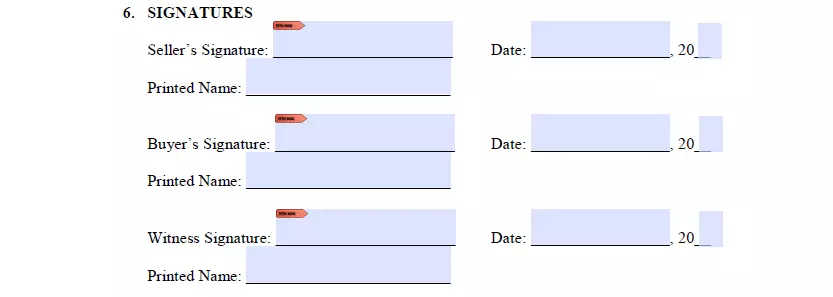

Step 6: Put the signatures

The consumer’s signature is generally not needed. Nonetheless, you are more protected from legal complications if all parties sign the bill of sale form. As an additional precaution, it is possible to have one or two individuals witness the process and sign the form.

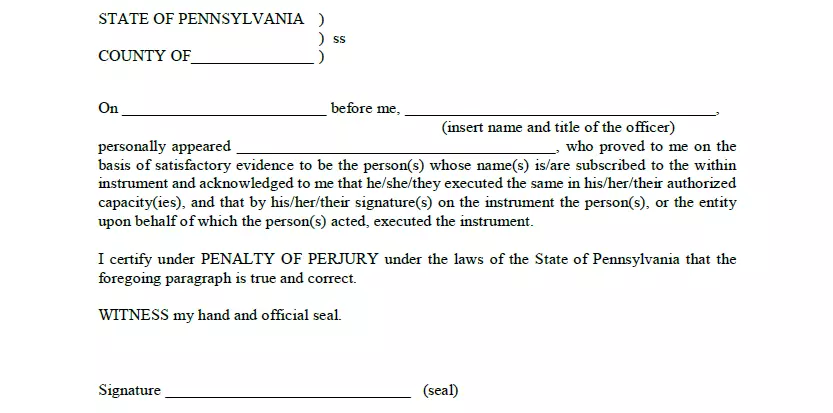

Step 7: Have a notary public certify the document

With this, you will get more legal protection. Yet, this is usually entirely optional.

In lots of states, a bill of sale could be required in the course of title transfer, so the buyer needs to keep the original. As a seller, you can either make a copy and store it or have two identical forms signed and filled out by both sides.

Registering a Vehicle in Pennsylvania

Those who purchase a new or used vehicle in Pennsylvania, whether the purchase is made within the state or outside, need to have their new item registered before operating on Pennsylvania roads. If a vehicle is purchased from an official dealer, the dealer’s representative submits all registration documents. Purchasing a motor vehicle in a private sale requires the new owner to visit one of the local PennDOT offices or the Bureau of Motor Vehicles to complete the registration procedure on their own.

The documents required for vehicle registration include:

- A certificate of ownership (signed over by the previous owner to the new one on the reverse side)

- A motor vehicle bill of sale

- An active Pennsylvania driver’s license

- A state ID card to prove the new owner’s identity

- A valid car insurance statement

- An odometer disclosure statement (for vehicles less than ten years old)

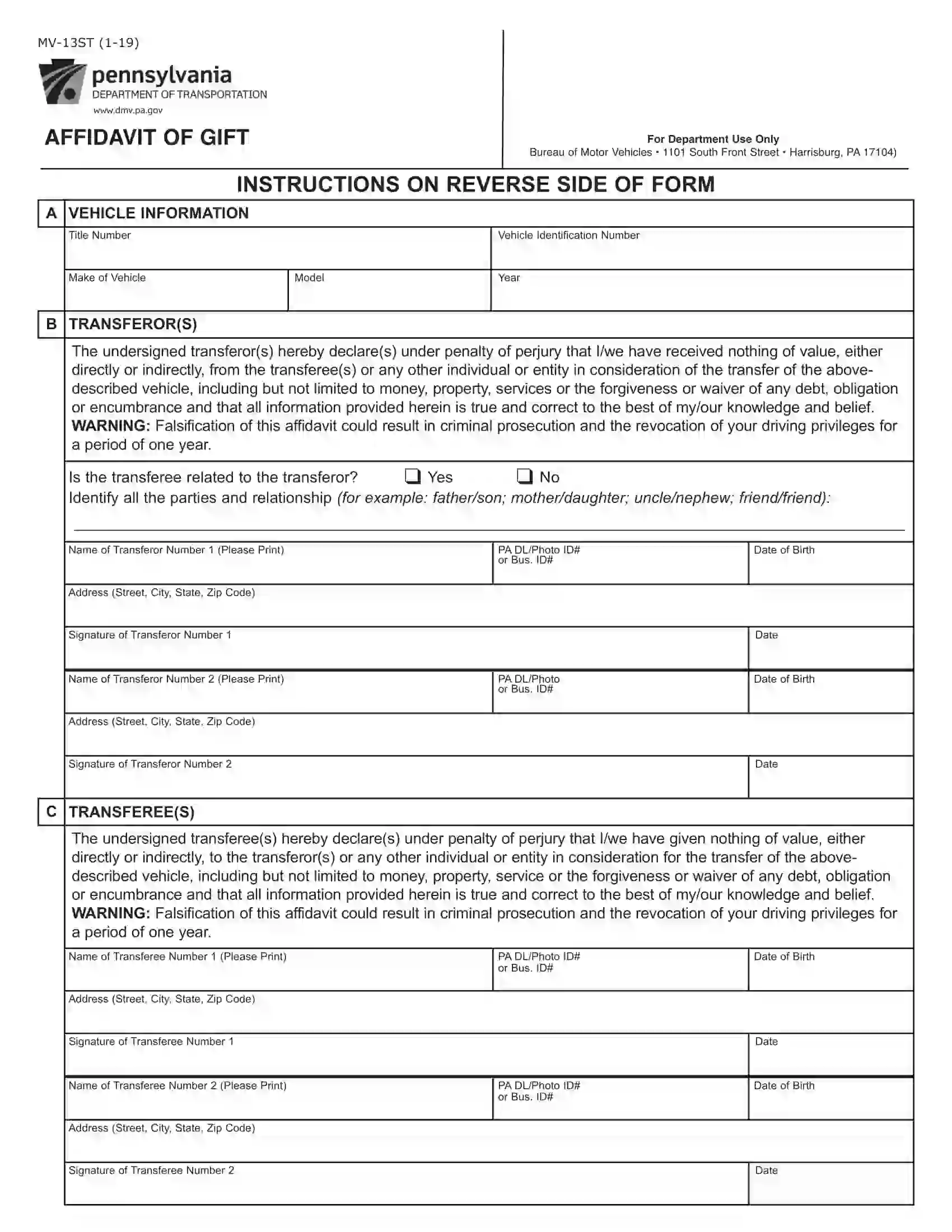

- A completed Motor Vehicle Verification of Fair Market Value by the Issuing Agent (use Form MV-13ST issued by PennDOT) – required for those who purchased their vehicles at a price 80% lower than the fair market price

- Receipt of taxes and fees paid for the registration

- Vehicle Sales and Use Tax Return/Application for Registration (form MV-4ST) – used for vehicles titled in Pennsylvania

If the buyer purchases a motor vehicle that has already been titled in Pennsylvania, the previous owner should sign and print their name in Section A on the back of the title statement in the presence of an authorized agent. The purchaser should also sign and print their name in the relevant sections of Section A of the title to have legal proof of the transfer of ownership. The title will then be submitted to PennDOT and reissued with the new owner’s title. If you need help, you can always address an authorized PennDOT agent.

After the transfer of the title, the previous owner should remove their plates from the vehicle. The new owner will receive their plates after the registration process is complete. The purchaser should also pay a sales tax equaling 6% of the purchase price. The residents of Allegheny County and the City of Philadelphia pay 7%.

Relevant Official Forms

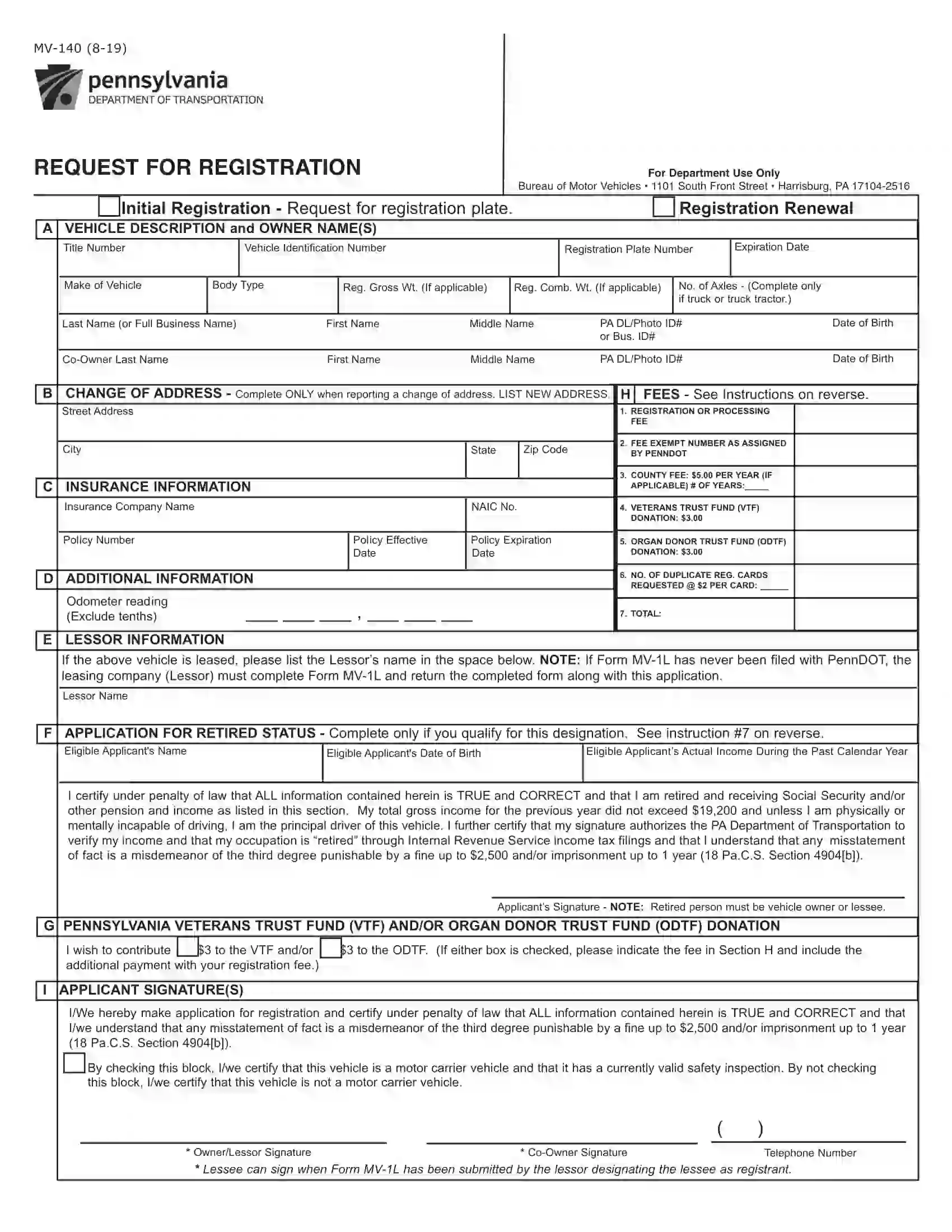

Form MV-140 or Request for Registration is designed to register a vehicle for the first time or renew the registration.

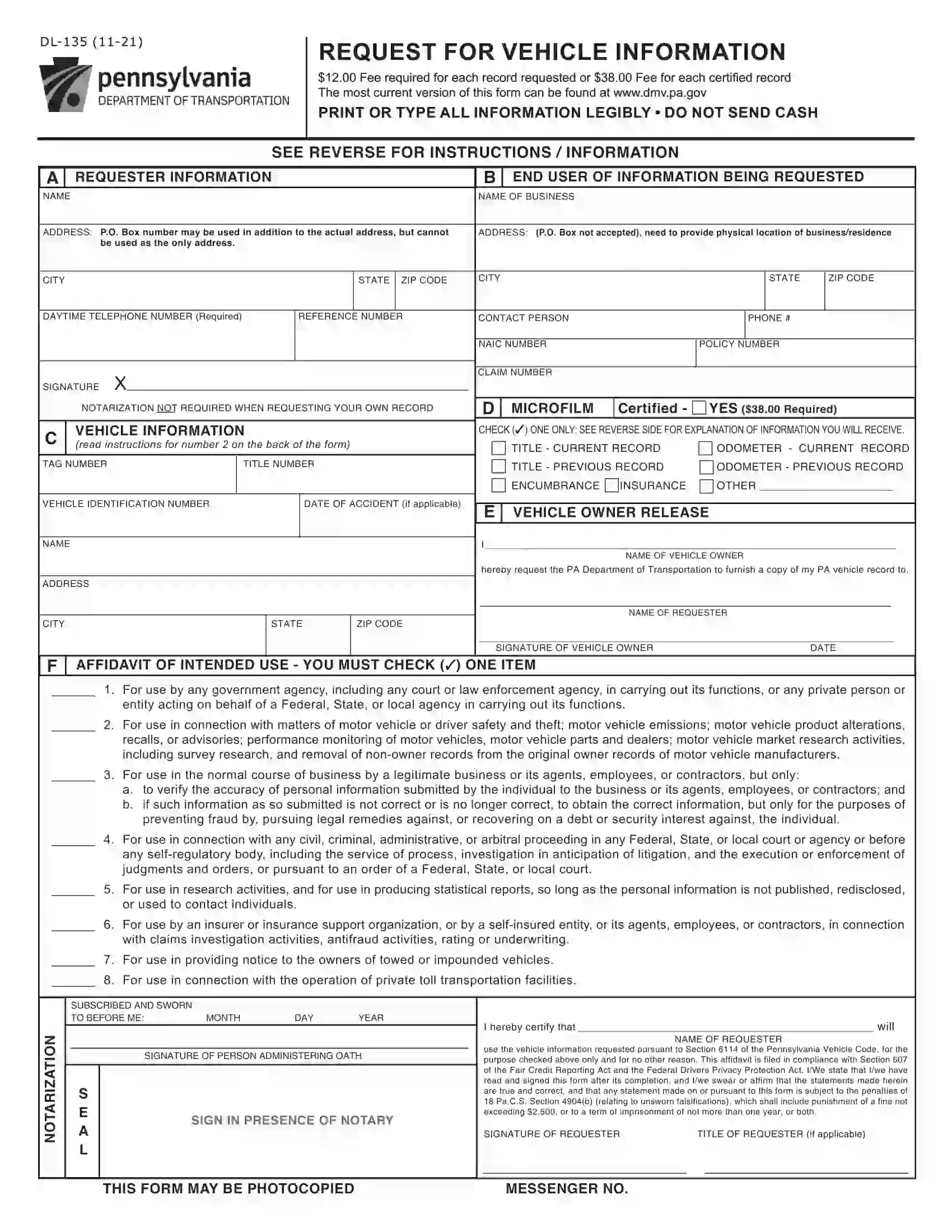

Request for Vehicle Information (Form DL-135) is used to obtain someone else’s or your own vehicle records. These records can only be used for the purpose specified in the document.

Affidavit of Gift, or Form MV-13ST, certifies that the vehicle is transferred without consideration, monetary or other.

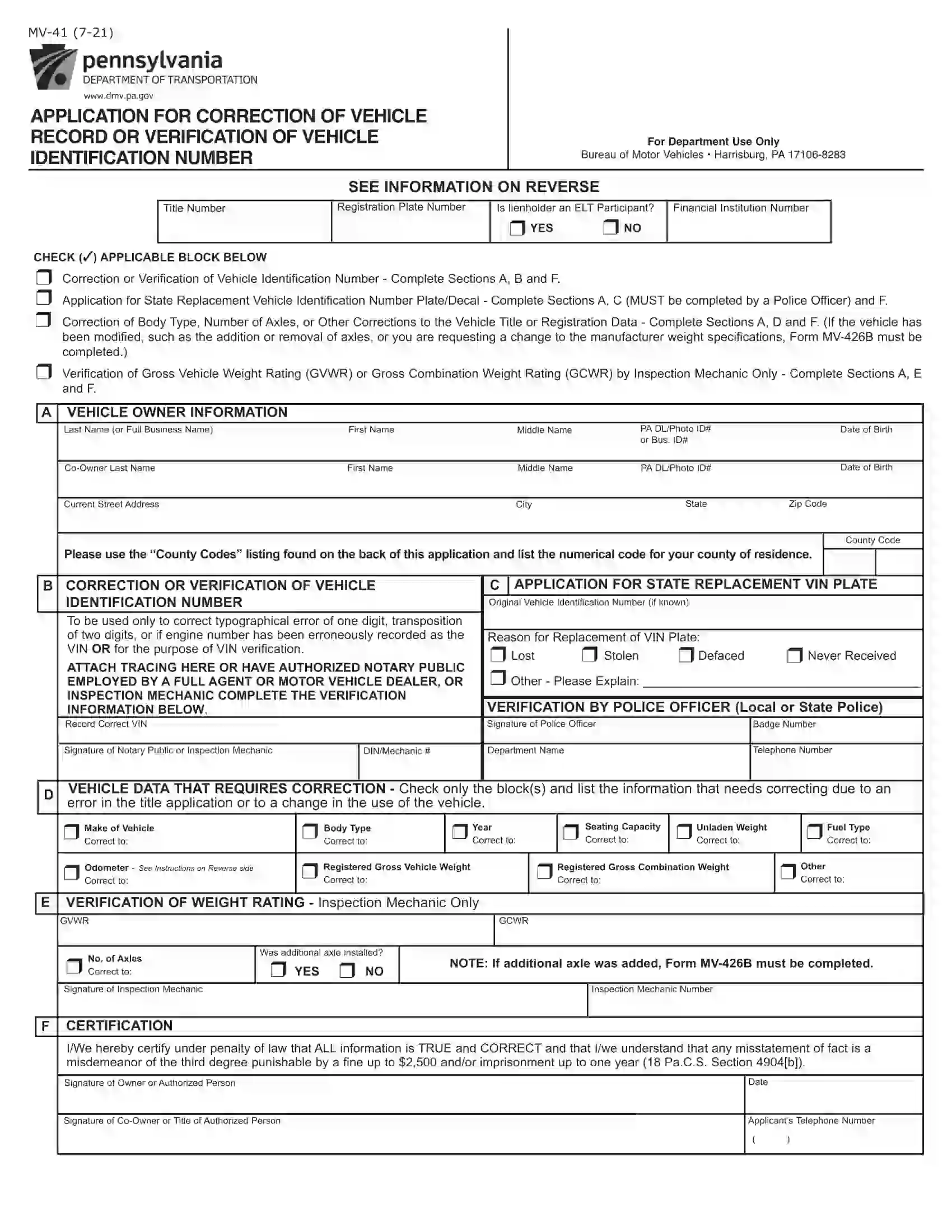

Application for Correction of Vehicle Record or Verification of Vehicle Identification Number (VIN)

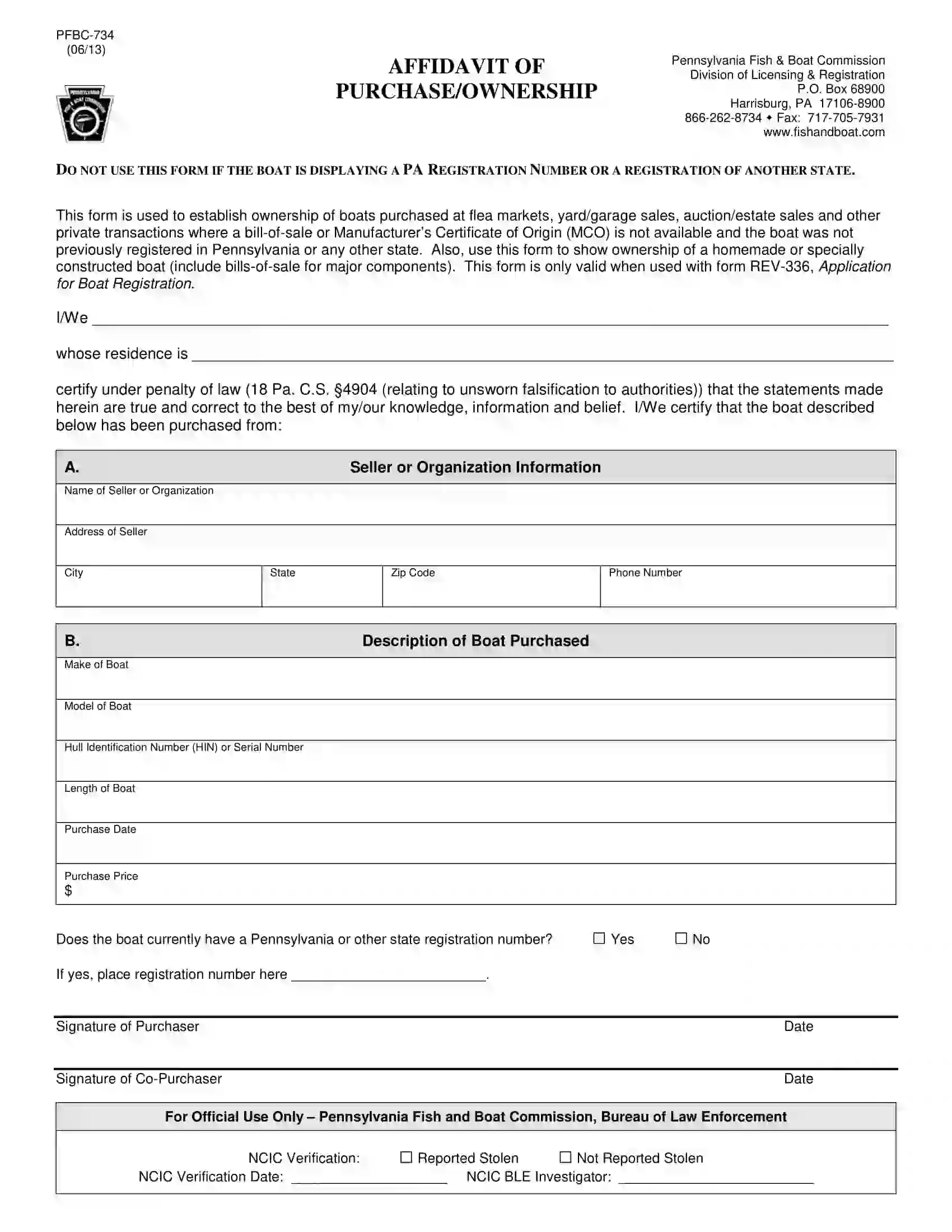

Form PFBC-734 or Affidavit of Purchase/Ownership is used to establish ownership of boats purchased at flea markets, garage sales, auction sales, and other private transactions.

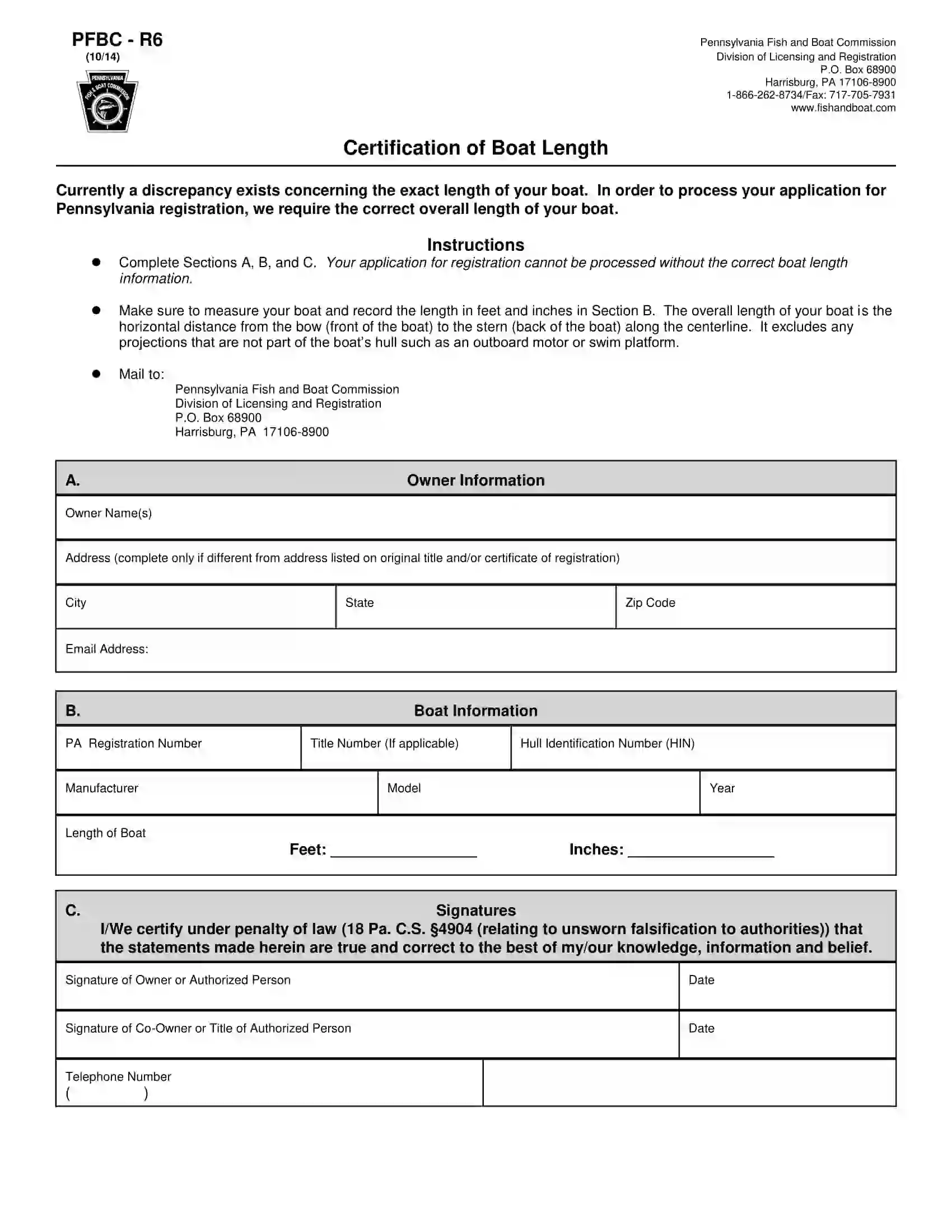

Certification of Boat Length (Form PFBC-R6) is used when there is a discrepancy concerning the exact length of the boat, and a correction is needed.

Short Pennsylvania Bill of Sale Video Guide

Other Bill of Sale Forms by State