South Dakota Bill of Sale Form

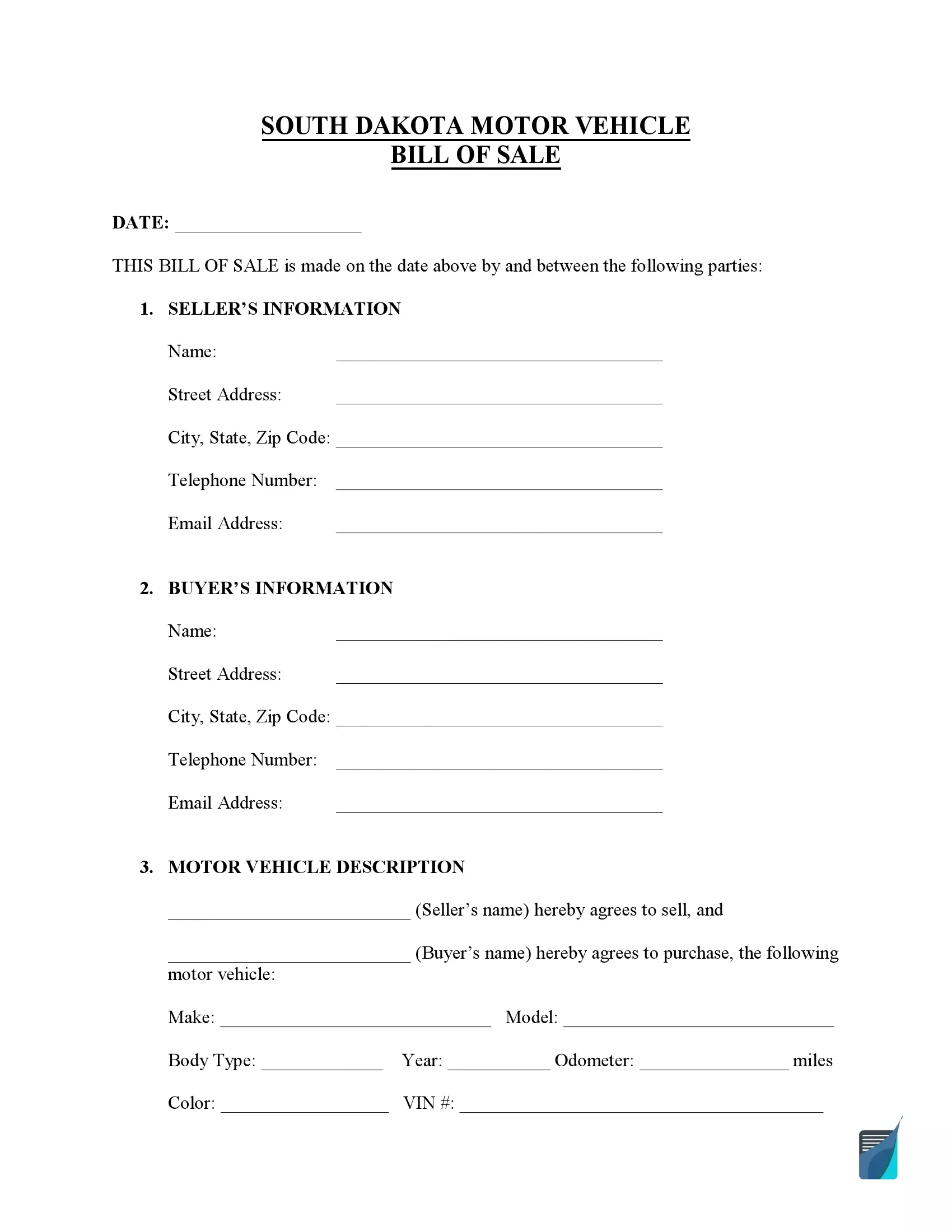

South Dakota bill of sale is a legal document used to transfer the ownership of a specific personal property from one party to another. Both parties fill the bill of sale template with their valid identifying data and details about the vehicle.

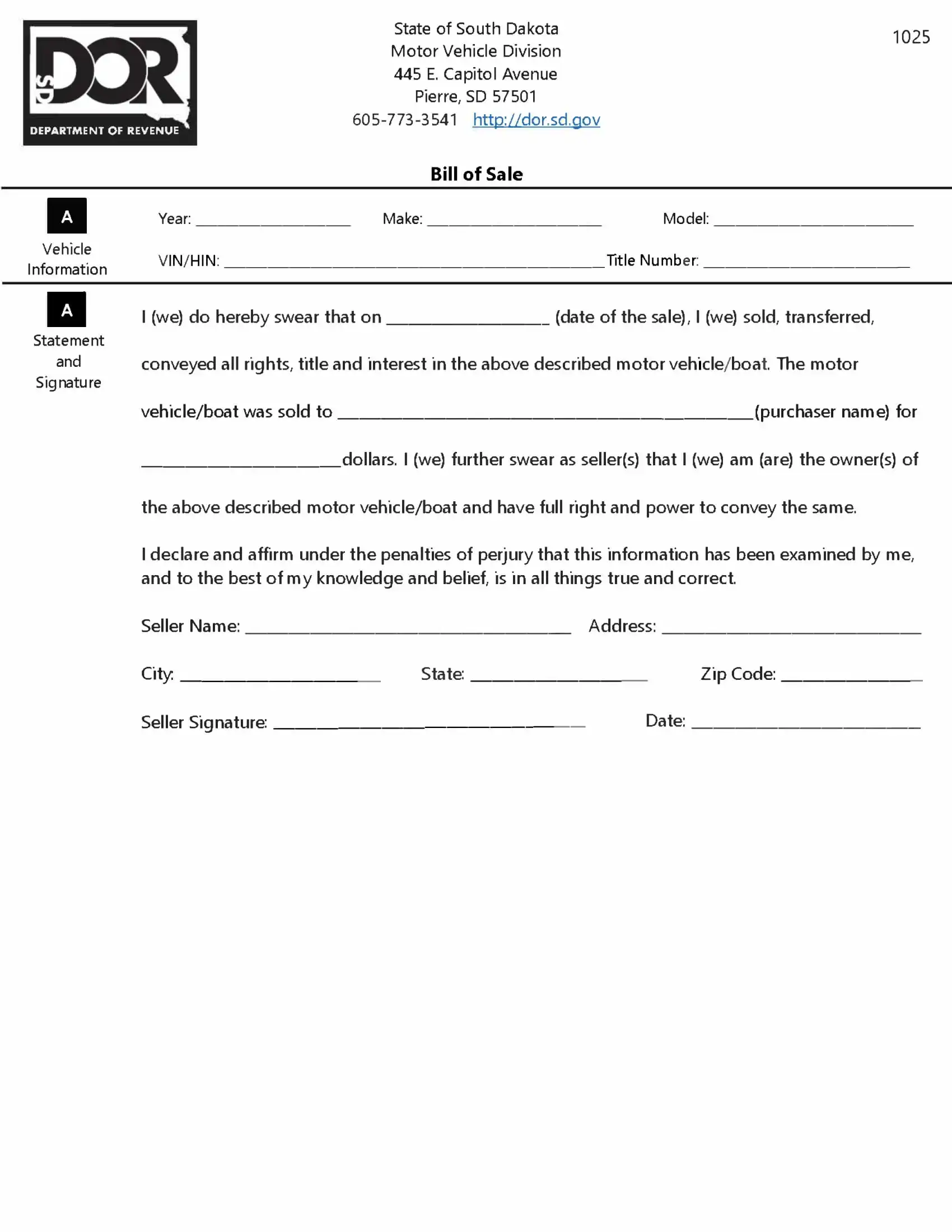

If you want to sell a part of your property, you are recommended to look through several types of South Dakota bill of sale forms and choose the one that fits your needs. You can use the official form to sell or purchase a vehicle or vessel in South Dakota. This document is known as Form 1025 and can be found below, along with other fillable bills of sale.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | South Dakota Vehicle Bill of Sale Form |

| Other Names | South Dakota Car Bill of Sale, South Dakota Automobile Bill of Sale |

| DMV | South Dakota Department of Revenue |

| Vehicle Registration Fee | $50.40-75.60 |

| Bill of Sale Required? | Yes |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 15 |

South Dakota Bill of Sale Forms by Type

Different transactions require you to prepare different types of bills of sale. It’s crucial because each type contains relevant information and details that need to be specified. You will have to go with the appropriate South Dakota bill of sale form and record it accordingly with your state.

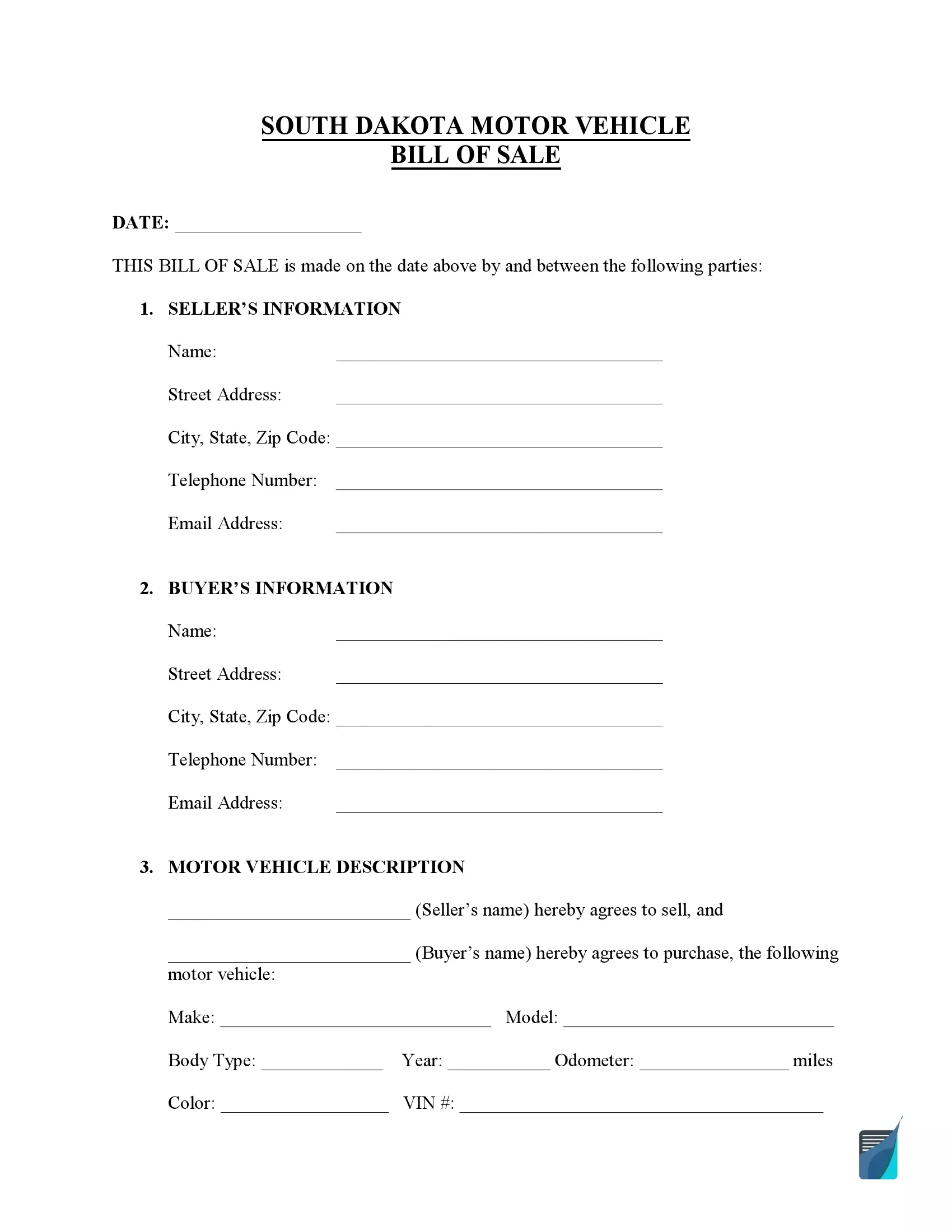

South Dakota bill of sale for a motor vehicle finalizes the sale of a motor vehicle. You may need to examine the vehicle so that both parties to the sale know about its condition. Vehicles should be registered within 30 days from the sale date or when a person moves to South Dakota.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

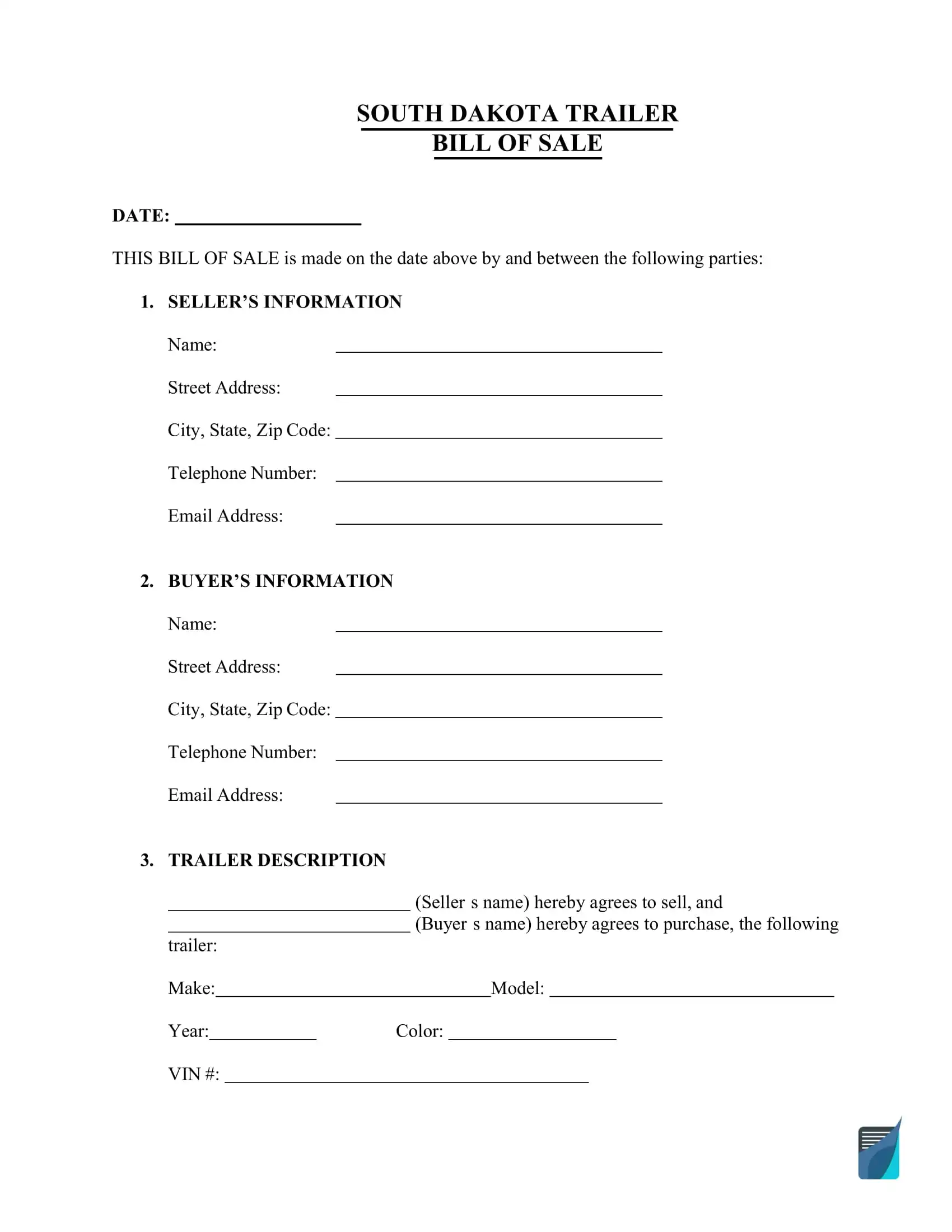

South Dakota bill of sale for trailers allows an individual to set the terms of the transaction and securely transfer the ownership of the trailer to another person. There are various trailer types, like low-loader dollies, tag trailers, and dog trailers. No matter the type, you’ll have to go through the vehicle registration, as with motor vehicles.

| Alternative Name | Trailer Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

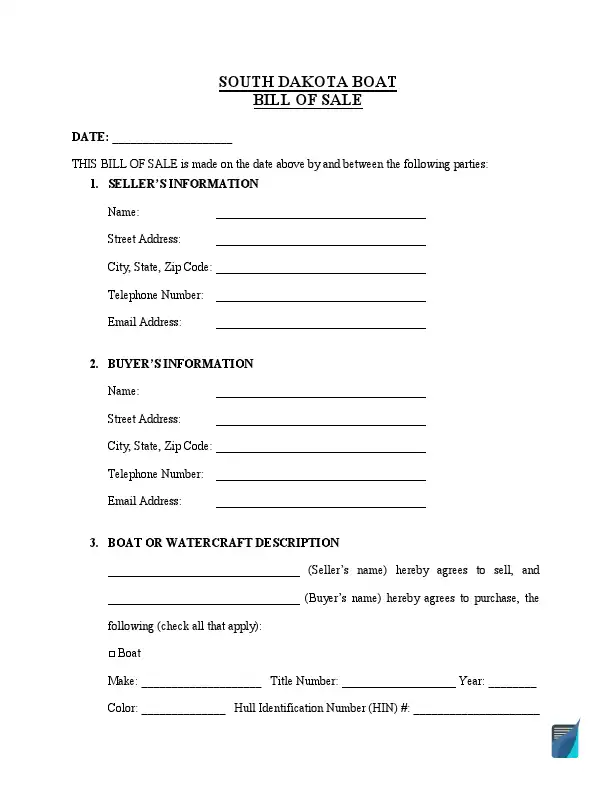

South Dakota boat bill of sale will help a seller determine all the transaction details and a buyer to ensure that they buy a vessel in good condition. Boats must be registered within 45 days of purchase. As a rule, boat registration in South Dakota is valid for one year. All motorboats and vessels longer than 12 feet have to be registered in the state. Your registration fee will depend on the vessel’s length and the type of propulsion.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

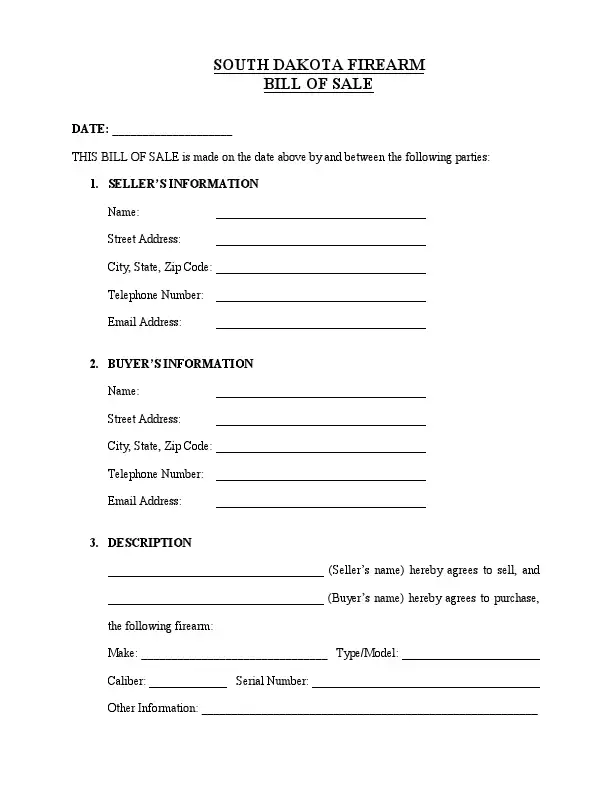

A firearm bill of sale is used to sell and purchase a gun in South Dakota. It’s not required to check buyers’ criminal records before the sale. There is no specific law in South Dakota demanding guns to be registered. South Dakota residents are allowed to carry handguns openly in the state provided they obtain a permit. A person who may lawfully possess a weapon, for example, active-duty military personnel, is not required to have a permit.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

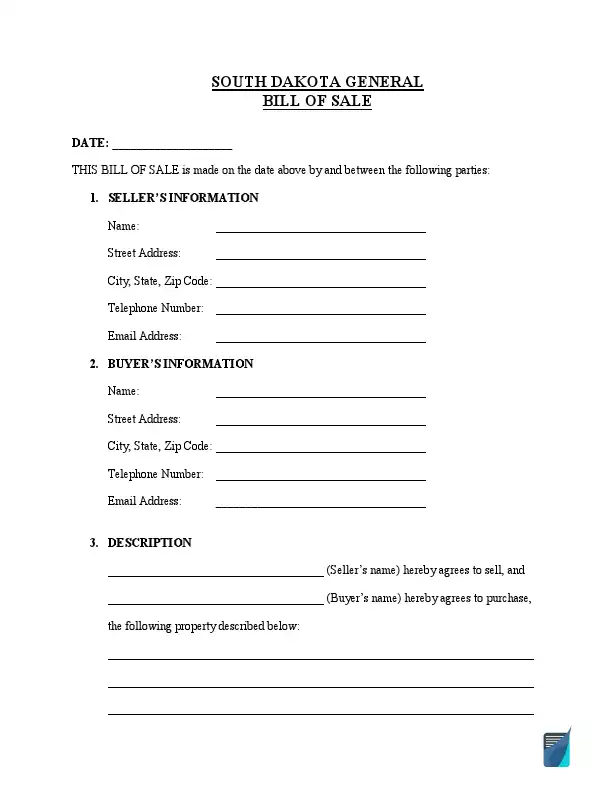

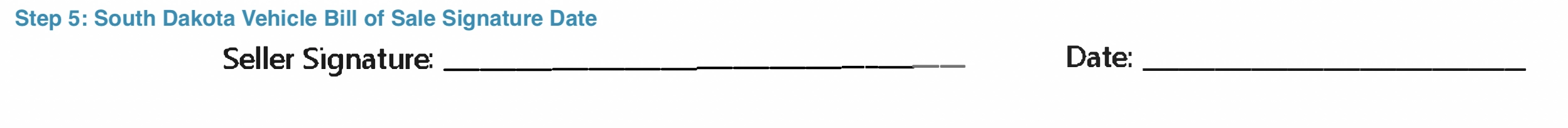

A general bill of sale may be used for nearly all types of transactions conducted in South Dakota if there is no specific form the sale may require. This template contains all the necessary sections to fill out, including the parties’ contact details, personal property description, price, and places for signatures.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

How to Write a SD Vehicle Bill of Sale

In South Dakota, you may use Form 1025 provided by the South Dakota Department of Revenue. Form 1025 is an official bill of sale document used for motor vehicle transactions in South Dakota. If you want to buy or sell your vehicle, having the official South Dakota bill of sale is the best way to make it right. Below you can find how to fill out this document correctly.

Remember that you must prepare other vehicle registration forms with your SD motor vehicle bill of sale form to complete the registration process successfully.

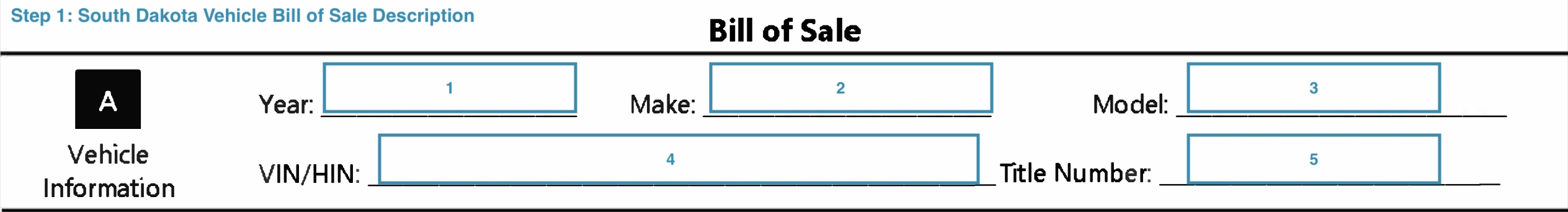

Step 1. Enter the vehicle information

The seller needs to indicate all the details regarding the motor vehicle they sell, including:

- Year of production

- Make of vehicle

- Model

- VIN

- Title number

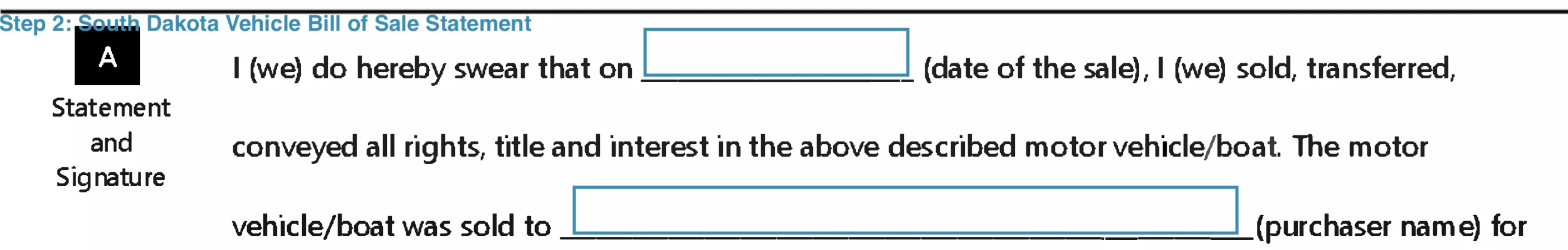

Step 2. Release the interest for the vehicle

In the statement section, the seller shows the desire to release the interest for the motor vehicle. To do this, you need to state the selling date and who you are transferring the vehicle to (the purchaser).

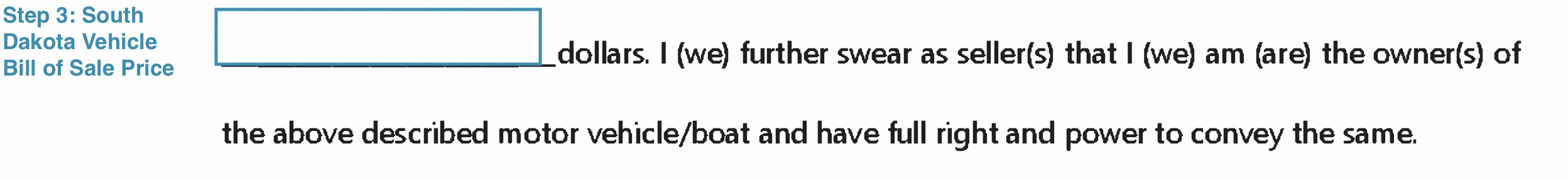

Step 3. Indicate the selling price for the vehicle

The following step is to indicate the vehicle’s purchase price.

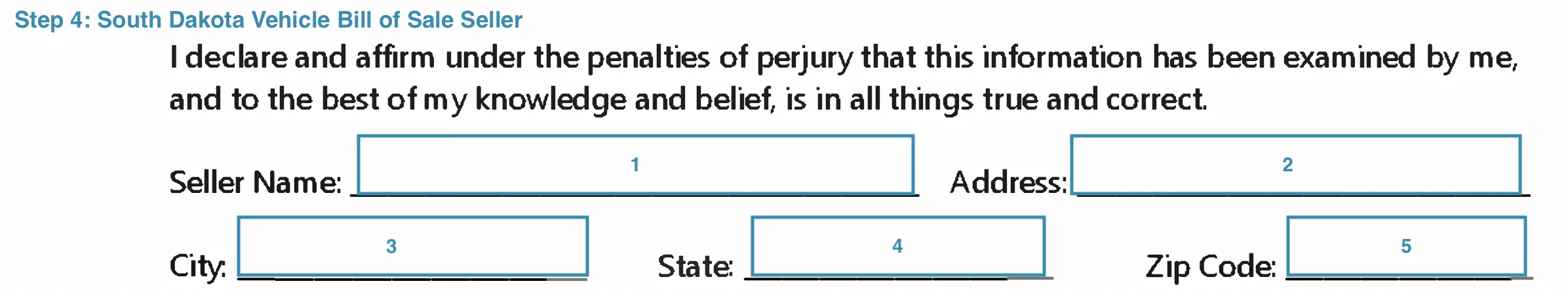

Step 4. Type in the seller’s contact information

You are expected to specify such seller’s contact details, as:

- Full Name

- Street Address

- City State, Zip Code

Step 5. Sign the document

Lastly, the seller leaves their signature and date when the document is signed.

Registering a Vehicle in South Dakota

Vehicle registration in South Dakota is required within 30 days after the completion of the purchase. To complete registration and obtain a new title of ownership for the vehicle, the new owner should visit a local County Treasurer’s Office and provide the following vehicle registration forms:

- A completed motor vehicle bill of sale

- A title signed over by the previous owner to the new one

- A Manufacturer’s Statement of Origin (MSO) or Manufacturer’s Certificate of Origin (MCO)

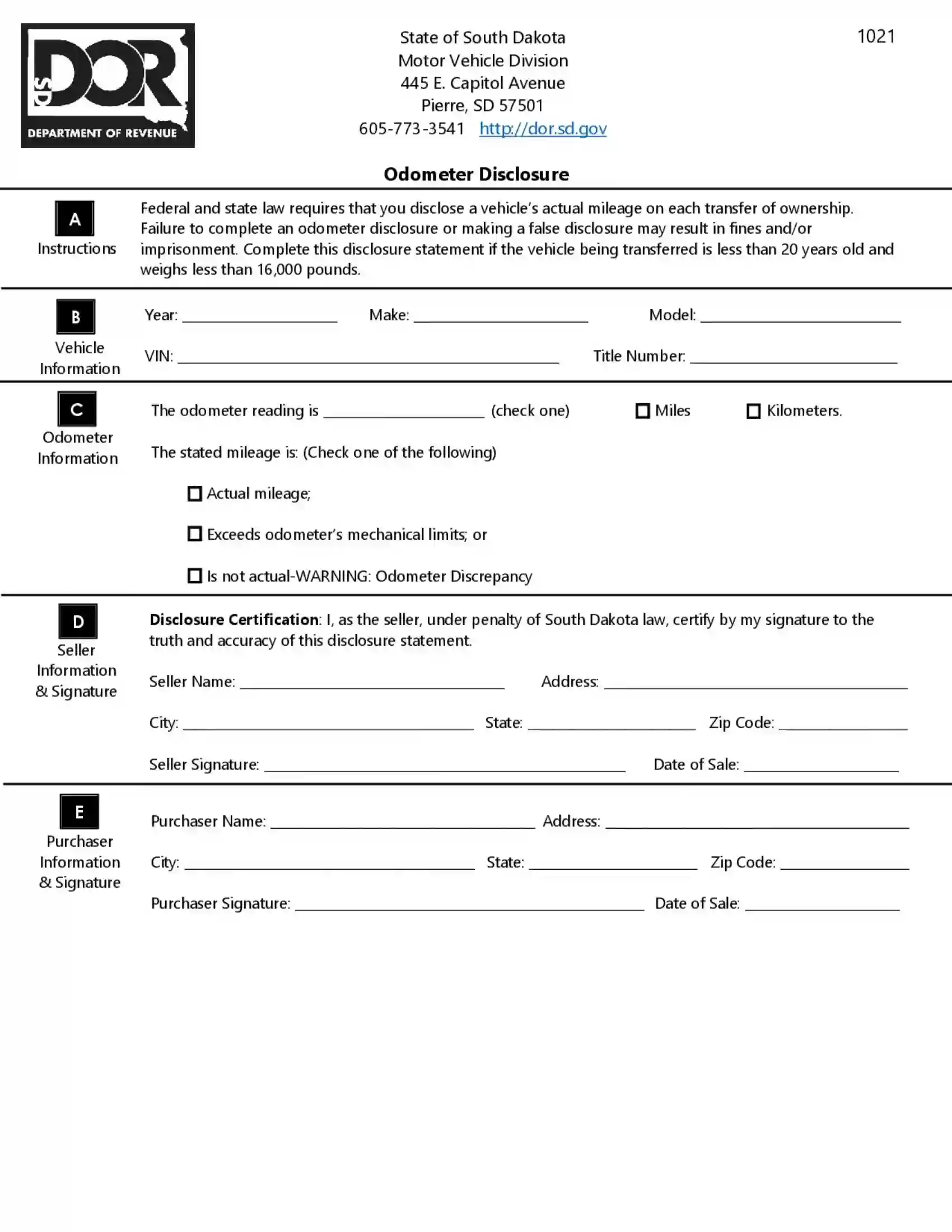

- An odometer disclosure statement (for vehicles less than 10 years old)

- Active auto insurance

- Active driver’s license valid in South Dakota

- A state ID verifying the buyer’s identity

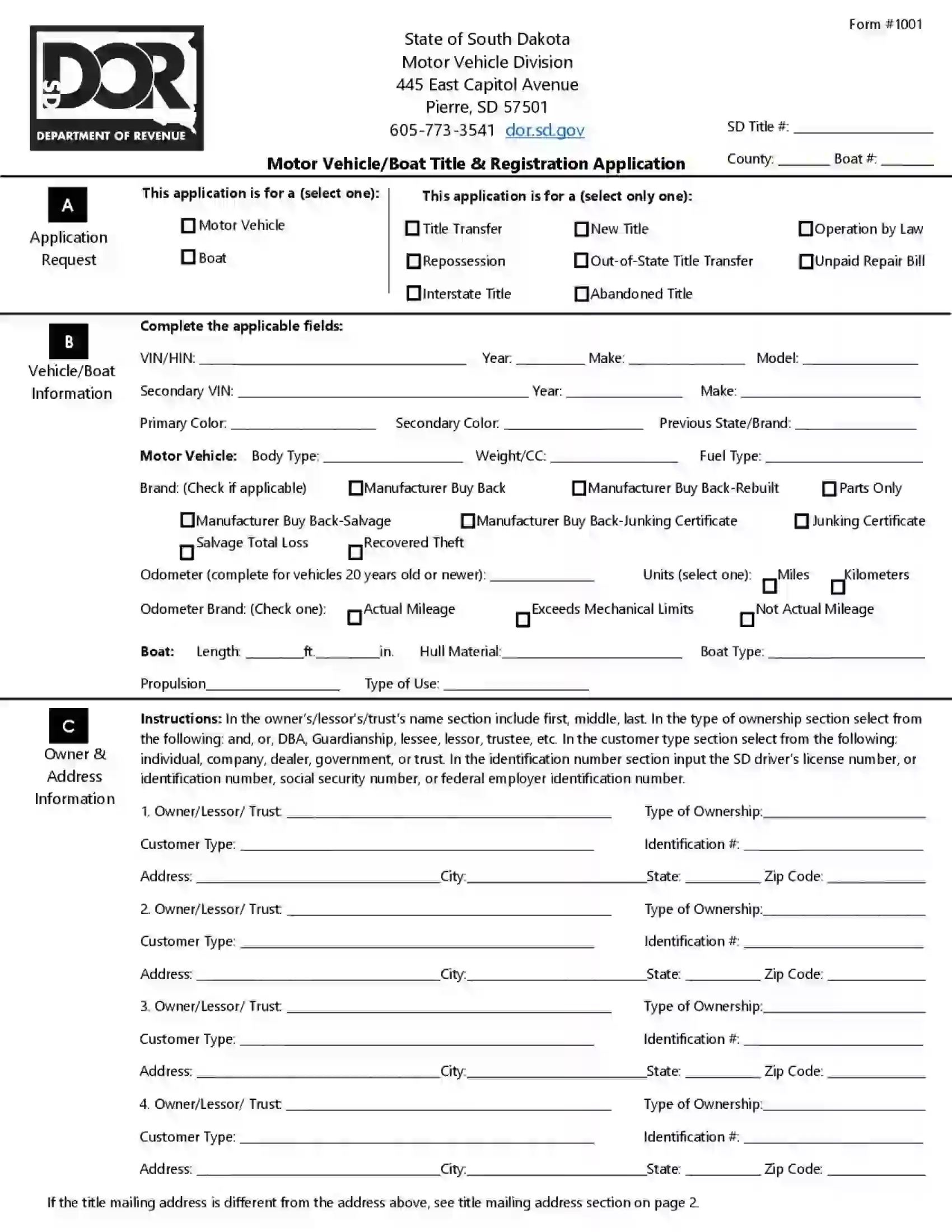

- Application for Motor Vehicle Title and Registration (Form MV-608)

Form MV-608 should be filled and signed both by the new owner of the motor vehicle and an authorized agent. It includes the purpose of the application request, the vehicle information (VIN, year, make, model, color, previous state or brand, and the motor vehicle type, weight, and fuel type), and the contact details about both the buyer and seller. The address information is also provided in that application, along with the title, mailing address, contact information, and purchase information. The document ends with an unsworn declaration of correct information contained in the form.

Besides that, the vehicle’s new owner should pay all taxes and fees related to the purchase. All vehicles purchased in South Dakota are subject to a 4% motor vehicle excise tax, while mobile and manufactured homes are taxed at 4% of the initial registration fee. Registration fees for non-commercial vehicles include $75.60 (for those below nine years old) and $50.40 (for vehicles older than nine years). Registration of motorcycles requires paying $18 for the registration ($12.60 for those older than nine years).

License plates will cost the new owner $10 (an initial plate fee), while those who receive them by mail will have to pay an extra mailing fee of $5. Vehicle inspection is not required for registration. You do not need to submit emissions testing statements even if you bought a vehicle outside South Dakota.

Relevant Official Forms

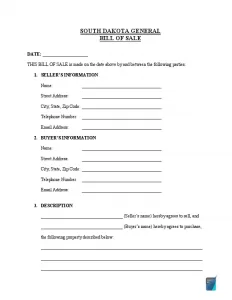

Form 1024 or Seller’s Report of Sale notifies the state about transferring of a vehicle/boat to another owner.

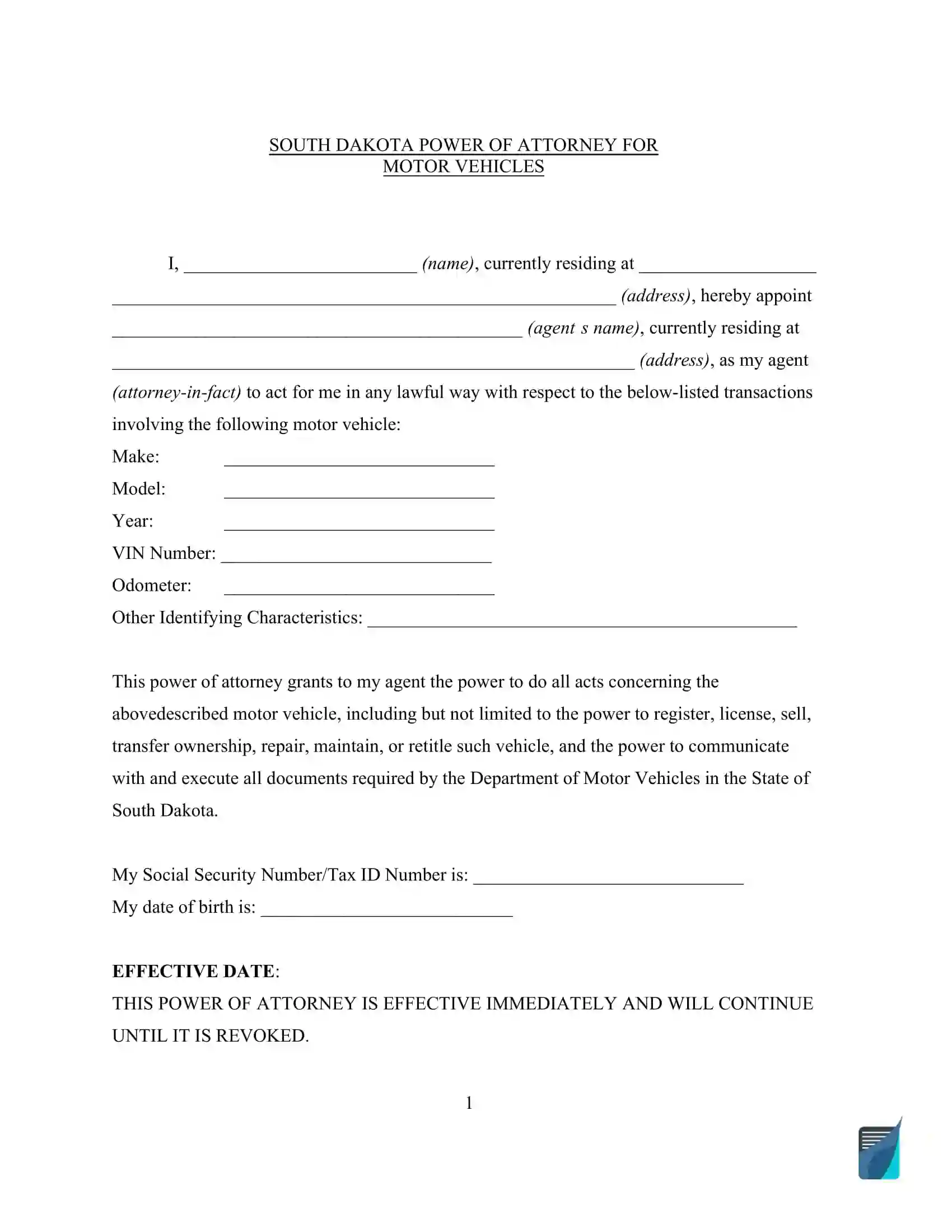

Use this form if you need to appoint someone else to control the matters regarding your vehicle.

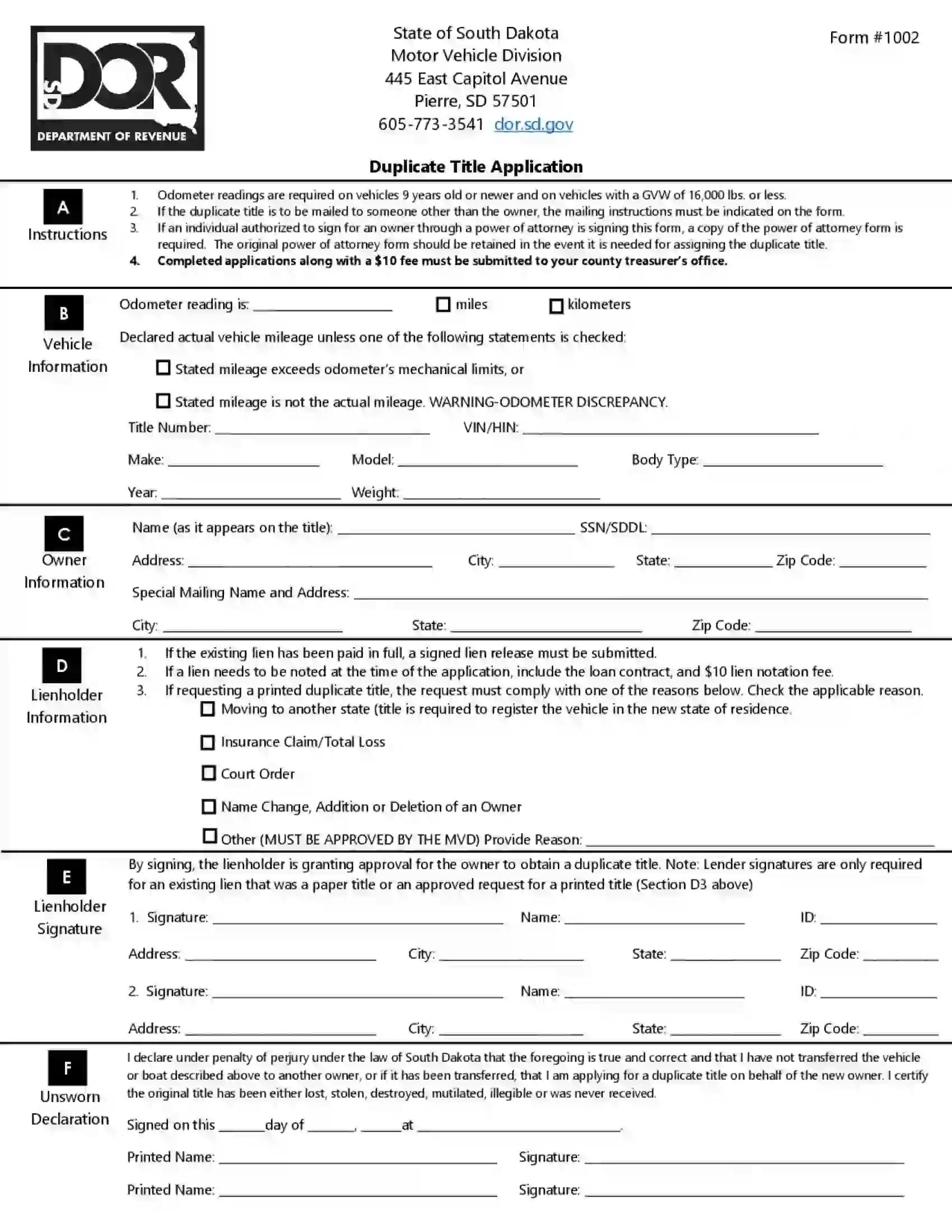

Duplicate Title Application (Form 1002) is submitted if the original title is lost, stolen, or damaged.

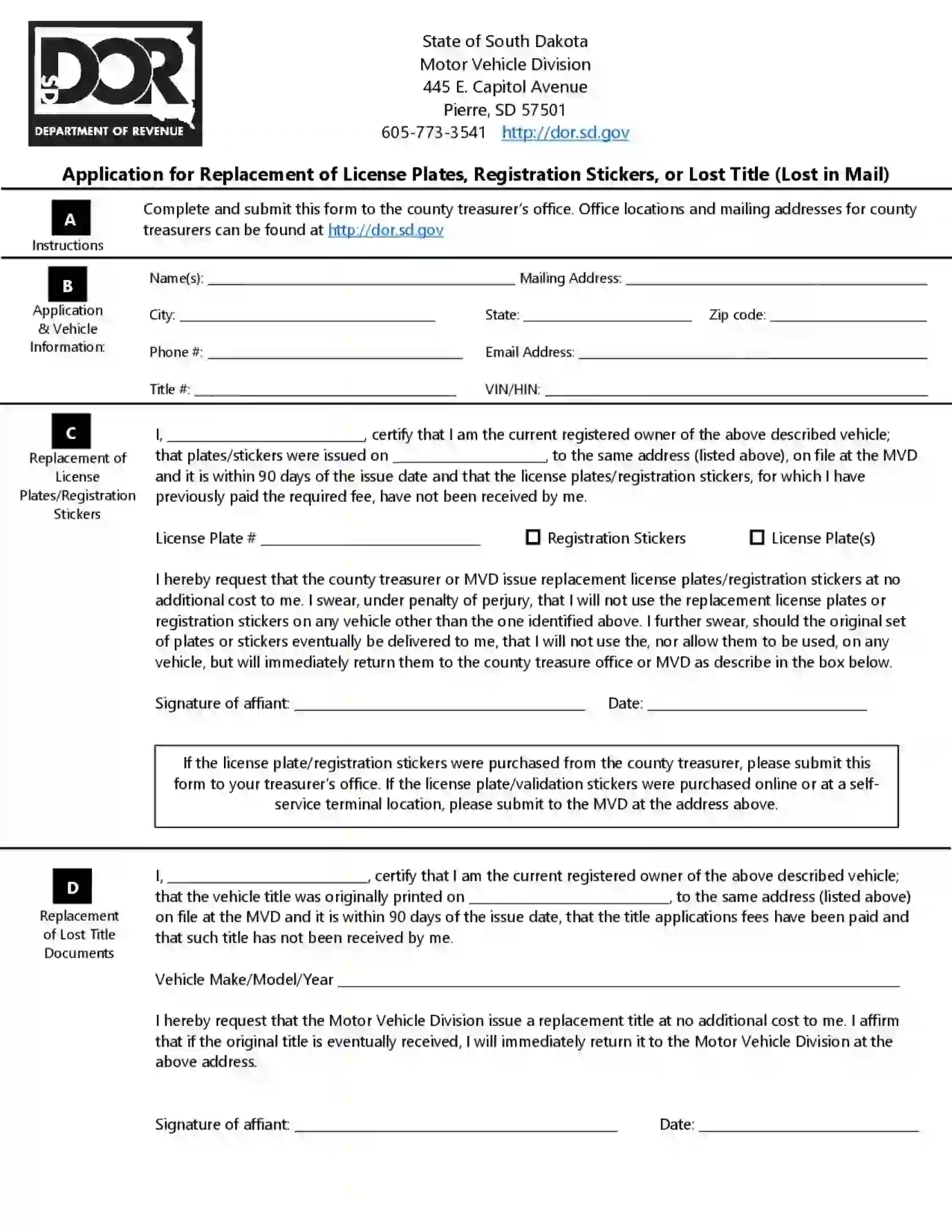

Application for Replacement can be submitted to a local county treasurer’s office to replace boat registration stickers that have been lost or damaged.

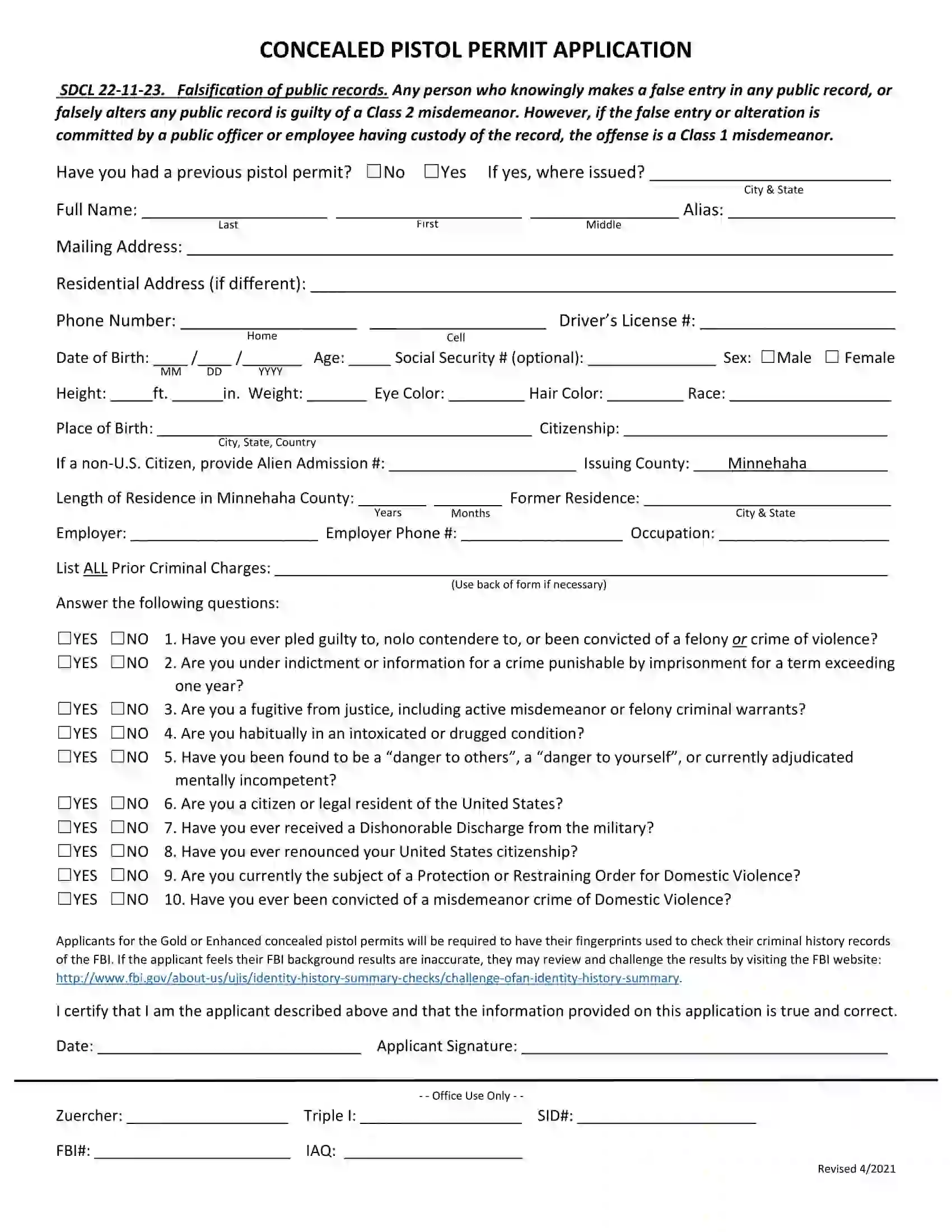

This Concealed Pistol Permit Application is used to apply for a concealed firearm permit in Minnehaha County.

Short South Dakota Bill of Sale Video Guide

Other South Dakota Forms