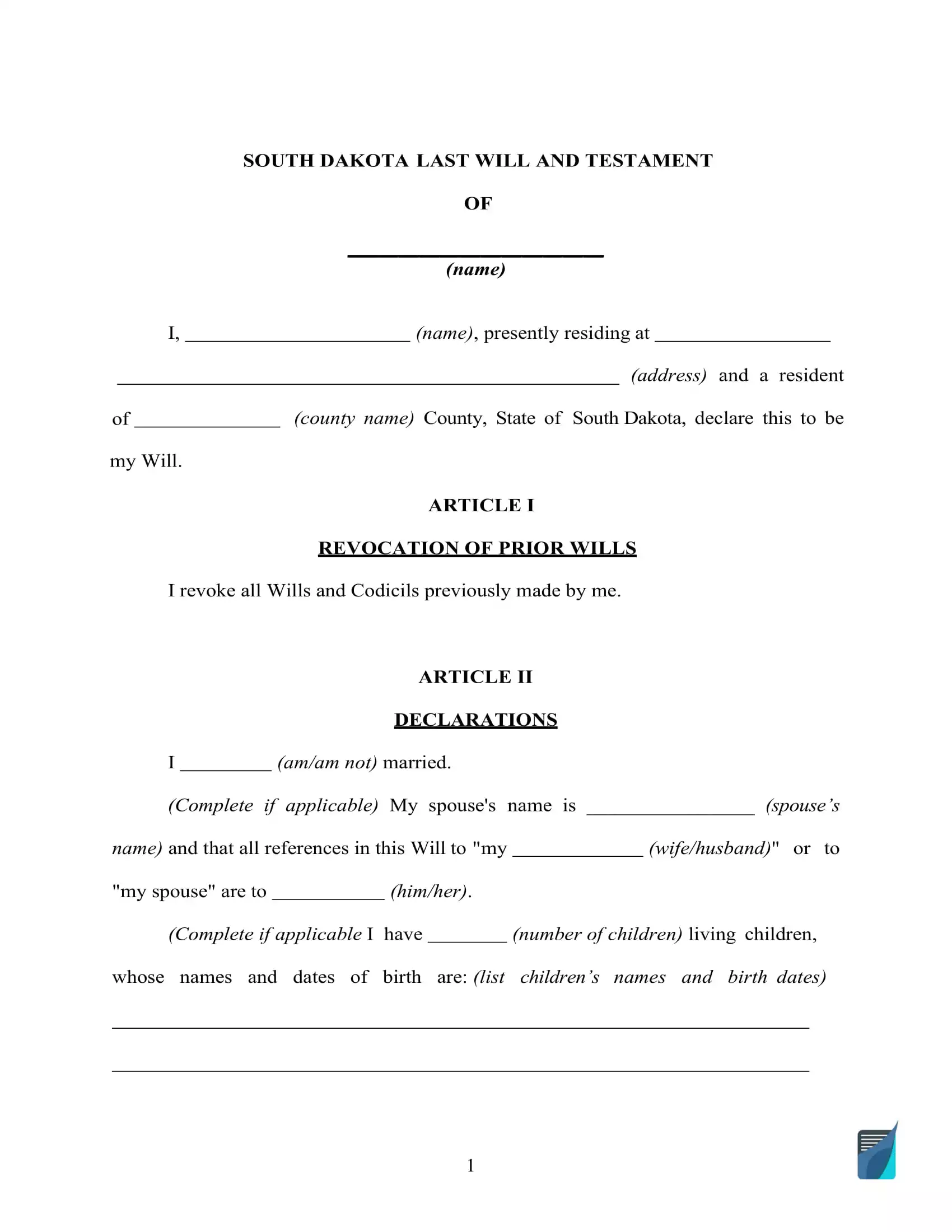

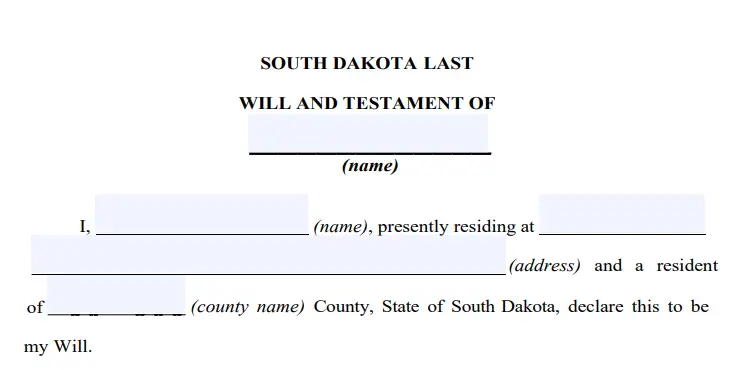

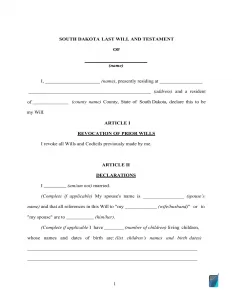

Free South Dakota Last Will and Testament Form

A South Dakota last will is a legal document that contains the directions of an individual (testator) pertaining to their estate distribution in case of their death, made in the form prescribed by the state law.

Here, you can download a free SD last will and testament form that you can fill in and print. On top of that, down below, there is plenty of guidelines in regard to the last will creation process and frequently asked questions.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

South Dakota Last Will Laws and Requirements

| Requirements | State laws | |

| Statutes | Chapter 29A-2 – Intestate Succession and Wills | |

| Definitions | Chapter 29A-1-201 – General definitions | |

| Signing requirement | Two witnesses | 29A-2-502. Holographic will–Validity of non-holographic will |

| Age of testator | 18 or older | 29A-2-501. Who may make a will |

| Age of witnesses | 18 or older | 29A-2-505. Who may witness |

| Self-proving wills | Allowed | 29A-2-504. Self-proved will |

| Handwritten wills | Recognized if meeting certain conditions | 29A-2-502. Holographic will–Validity of non-holographic will–Establishing intent |

| Oral wills | Not recognized | |

| Holographic wills | Recognized if meeting certain conditions | |

| Depositing a will | Possible with the South Dakota county circuit court A fee is $2 | 29A-2-515. Deposit of will with court in testator’s lifetime |

How to Prepare a South Dakota Last Will

1. Consider your alternatives. Before starting, it’s best to decide if you would like to use the assistance of a legal professional or do the entire document yourself. If you wish to make the last will by yourself, pick the type you’ll go for: a handwritten (holographic) will or maybe a free will template.

2. Specify your details. Establish the testator and their details: full legal name and residence (city, county, and state). Check the information you entered along with the rest of the section, which includes “Expenses and Taxes.”

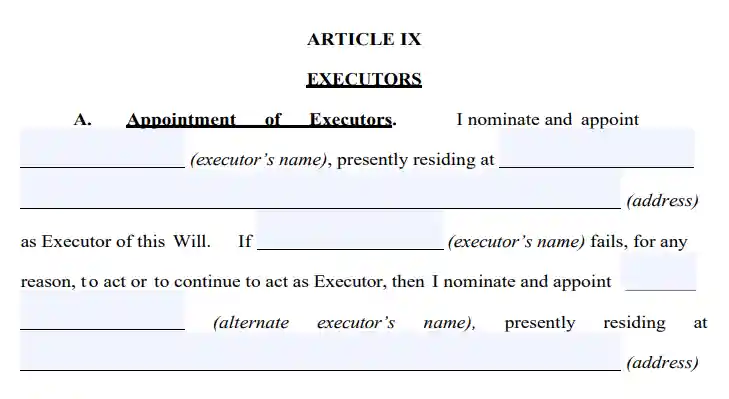

3. Specify the executor. This is the time to choose the executor of your last will, the person in charge of ensuring that every little thing you write in this document becomes a reality. To achieve that, you have to fill out the executor’s full legal name, together with their residence information (city, county, and state). Be sure you choose someone who resides in the same state as you do. Otherwise, there will be a lot more paperwork and unavoidable hassle identified with the process because of different individual policies every state has when it comes to out-of-state executors. As a precaution, you can designate a substitute executor of the will. By doing this, you’ll be able to ensure that even if the initially appointed executor is not able to carry out their obligations, there’s a second trustworthy person you can count on.

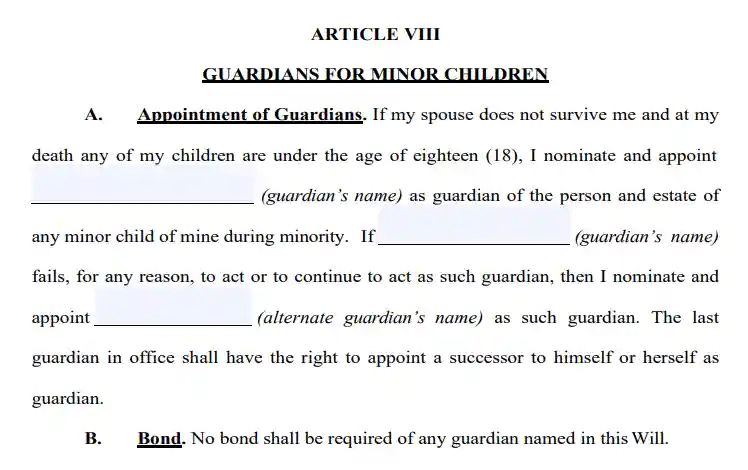

4. Establish the guardian (optional). If you have minor or dependent children and do not want the court to choose a guardian for the kids when you’re no longer here, it is possible to specify somebody you know as a guardian for your children.

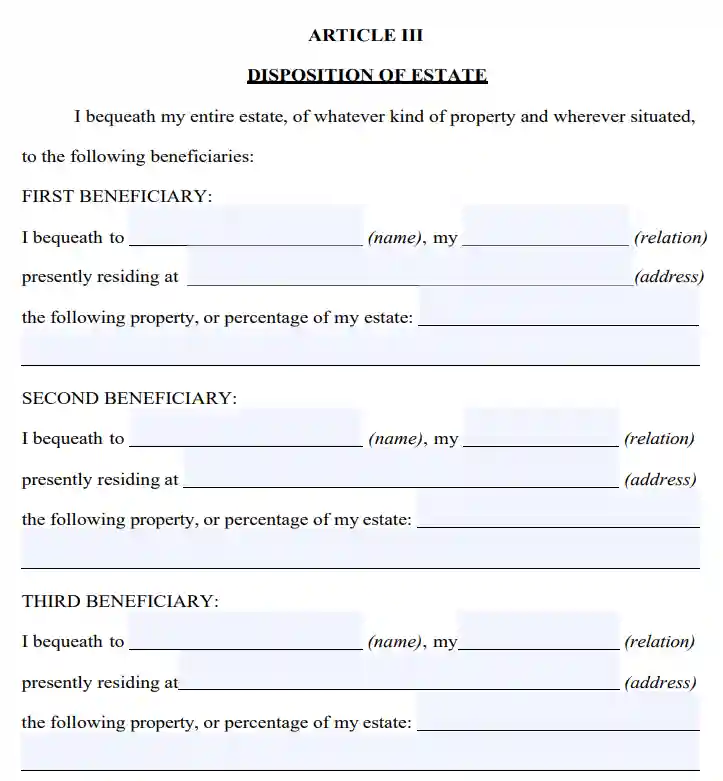

5. Establish your beneficiaries. At this point, establish individuals to whom you wish to pass down your estate, that is, your beneficiaries. For every inheritor, specify the following particulars: full legal name, address, and how they are related to you.

6. Allocate possessions. List your possessions and describe precisely how you wish to distribute them to your inheritors if you have something planned aside from dividing the estate commensurately. Property can include cash, shares, realty, company ownership, money for unsettled arrears, as well as any material items of monetary worth in your possession. Please notice that there are things that cannot be distributed in the will, such as shared and living will assets and life insurance.

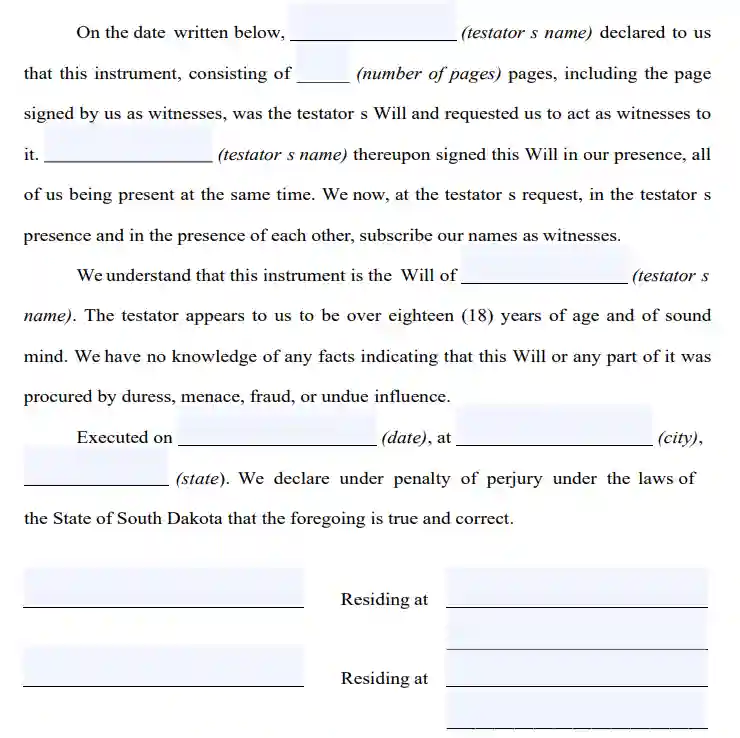

7. Ask witnesses to sign the document. South Dakota legislation stipulates that no less than two witnesses have to sign a last will and testament so that it is deemed valid. You may appoint another person as a witness on the condition that they are older than 18 years and are disinterested in your bequest. As a possible extra precaution against scenarios when your will is contested or any other problems, it seems sensible to assign a witness who’s younger than you to make sure they’ll be there after you pass away. After a complete review of every paragraph in your will, all parties involved (you and your two witnesses) will have to write their names and full addresses and sign the document.

Create a Free South Dakota Last Will

Frequently Asked Questions

Should I notarize my will in South Dakota for it to be valid?

In South Dakota, there’s no need to attest your will. However, it is possible to make your will self-proving by attaching an affidavit to the document, and you’ll need to go to a notary if you’d like to do that. Making your last will self-proving may be a good choice because it provides an extra layer of certainty in the event the will’s legitimacy is doubted.

In South Dakota, do I need a self-proving affidavit?

In accordance with South Dakota law, you don’t have to add a self-proving affidavit to your last will. Nonetheless, it will serve you well to attach this document. During probate, it would act as a substitute for the witness testimony in court and facilitate the process.

Can you exclude your children or spouse from a last will?

In regards to your marriage partner, it’s necessary to showcase that South Dakota is not a community property state, which does not require that any assets that were collected during the marriage or that increased with the capital earned in the stated marriage belong to both spouses evenly. In South Dakota, you can leave your spouse out of the will, but the law implies that your marriage partner is entitled to a certain minimum amount of your property.

With regard to other members of your family, you can lawfully disinherit anybody else. It concerns your adult children and any other member of the family; only include disinheritance clauses to the last will.

Can a signed, typewritten last will and testament be revised in South Dakota?

Yes, it’s possible.

Based on South Dakota law, you’re allowed to adjust or repeal the will in case you aren’t obliged by a legal agreement indicating otherwise.

Additionally, it will be a good idea to update your will whenever you go through a serious life event, including:

- Birth or adoption of a child

- You have married or divorced

- You sold or bought real estate or a large piece of property

- Your financial position has changed greatly

What should I do if my last will is lost?

In case the last will is lost or damaged, as indicated by South Dakota law, the court will admit it. However, nothing but the initial version of the will may be recognized by the probate court.

South Dakota law allows for a presumption that the will’s absence implies it has been canceled. This puts the responsibility on the proponent of the last will to give proof of the mentioned will.

The situation gets far more problematic when it comes to a holographic last will and testament. In order to provide proof of its legality, the court will require testimony and sword witnesses. In addition, you are to provide evidence as to why the will and its details cannot be presented in ways that will also confirm the will has not been repealed.

If I am physically incapable of signing my last will and testament, what am I to do?

South Dakota Estate Code makes it possible for another individual to sign your last will and testament solely per your directive and with you present. Oral communication, a positive response to a question, or body gestures are the means you can use to convey that you prefer a certain individual to sign your last will. A notary is allowed to sign the name of the testator in case the latter isn’t able to do so because of physical impairment. The notary must be directed to perform it in the presence of a witness.

It is important to note that such witnesses can’t have an interest (equitable or legal) in any of the properties and assets that are the subject or may be impacted by such a document (the last will and testament).

Other Documents Related to Wills in South Dakota

| Related documents | Cases when you might want to have one |

| Codicil | Your last will needs one or a couple of minor modifications. |

| Self-proving affidavit | You wish the probate to be quicker when the time comes. |

| Living will | You would like to express your wishes concerning the end-of-life health care and life-prolonging measures. |

| Living trust | You would like to look at an alternative to a will. |