New Hampshire Last Will and Testament Form

A New Hampshire last will and testament is a legally binding document that expresses the testator’s last wishes in the form approved by the state law and establishes the appropriate distribution order of the testator’s assets subsequently after their passing.

If you are in search of a fillable and printable NH will template, you will find one on this page, along with the recommendations on will creation and answers to commonly asked questions (further below).

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

New Hampshire Will Laws and Requirements

| Requirements | State laws | |

| Statutes | Chapter 551 – Wills | |

| Signing requirement | Two witnesses | 551:2 Requirements |

| Age of testator | 18 or older or married minor | 551:1 Testators |

| Age of witnesses | 18 or older | 551:2 Requirements |

| Self-proving wills | Allowed | 551:2-a Self-Proved Wills |

| Handwritten wills | Recognized if witnessed according to the state law | 551:2 Requirements |

| Oral wills | Recognized if meeting certain conditions | 551:15 Nuncupative Will Validity |

| Holographic wills | Not recognized | 551:2 Requirements |

How to Make a Will in New Hampshire

1. Think about your possibilities. One important thing to take into consideration, first of all, is if you want to write the whole document by hand (holographic will) or use a fillable last will and testament form accessible here in two formats. Also, you can try our document wizard for more options and better personalization.

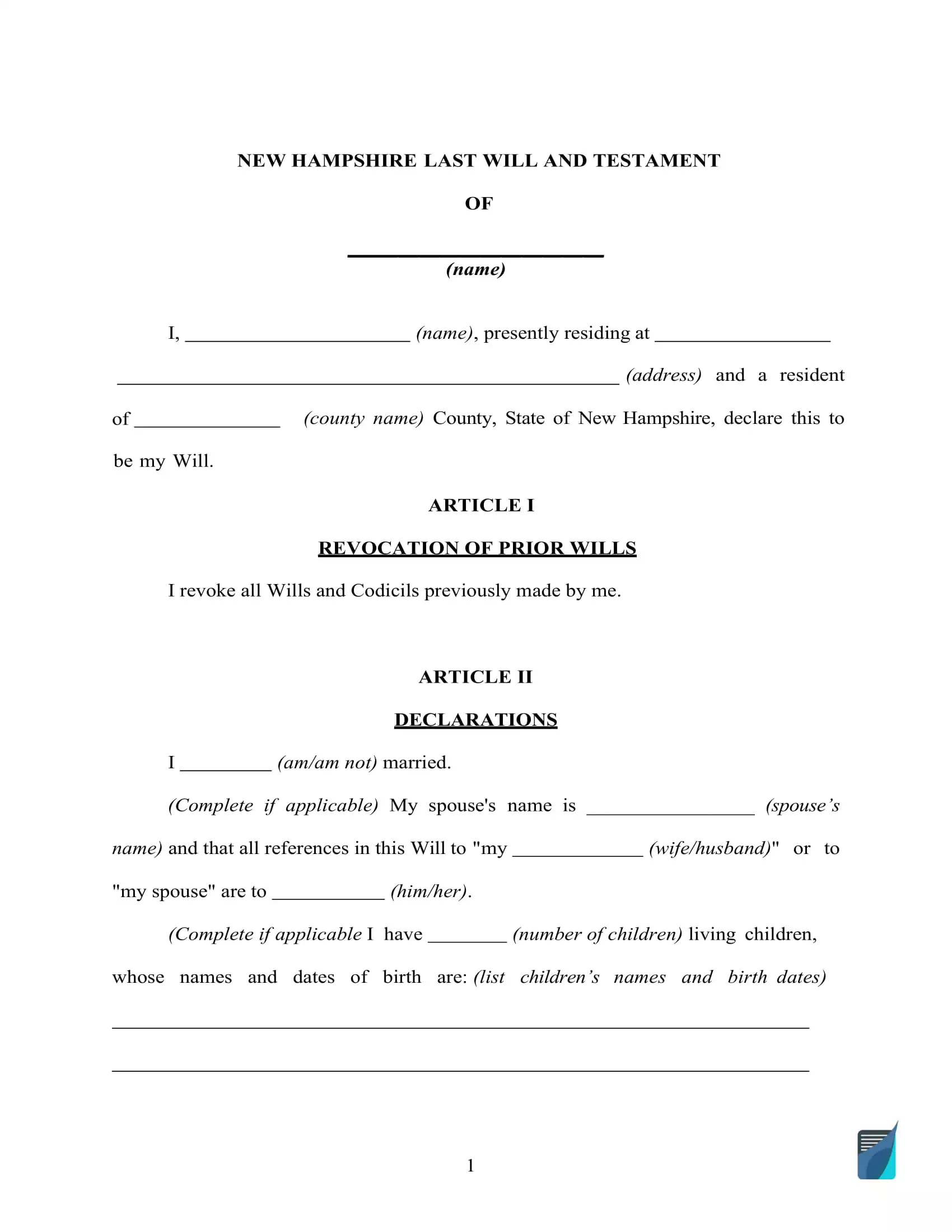

2. Indicate your (if you are the testator) information. Establish the testator and their details: full name and residence (city, county, and state). Reread the remaining portion of the section to check for errors.

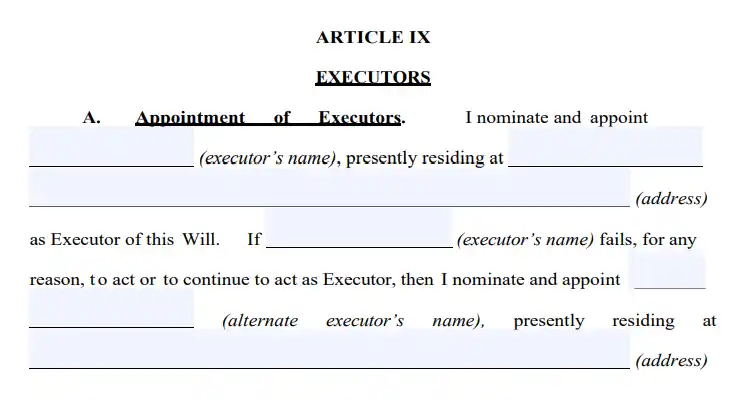

3. Indicate the executor. Choose a person to be the executor of your will and specify their full legal name and place of residence, which should preferably be within the same state the testator lives in due to special rules regarding out-of-state executors. In New Hampshire, an out-of-state executor must be first approved by the probate court judge. Then, this executor must appoint a person who resides in the state to serve as a resident representative and deal with paperwork. (553:5, 553.25)

It may happen that the primary representative will not be able to execute your last will. In such a case, the court can designate its own agent to undertake the duties. In order to avoid that, it is possible to choose an alternate executor under this section.

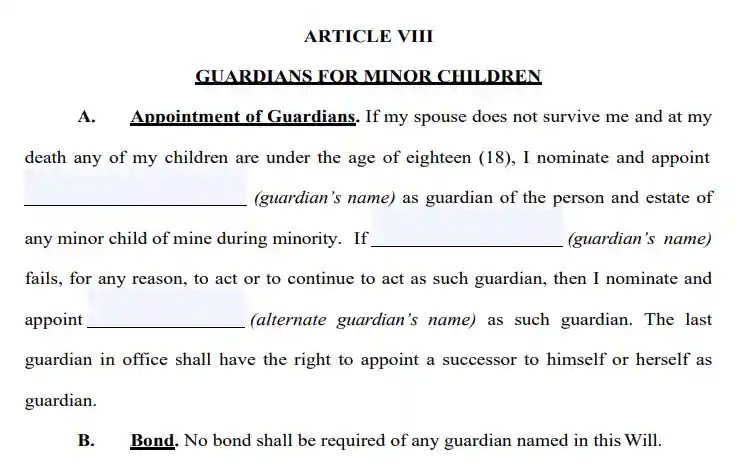

4. Choose the guardian (optional). It’s possible to choose a trusted person as a guardian if you have underage or dependent children that need to be taken care of. In case there are no directions regarding exactly who should take care of your kids, the guardian will be selected by the court.

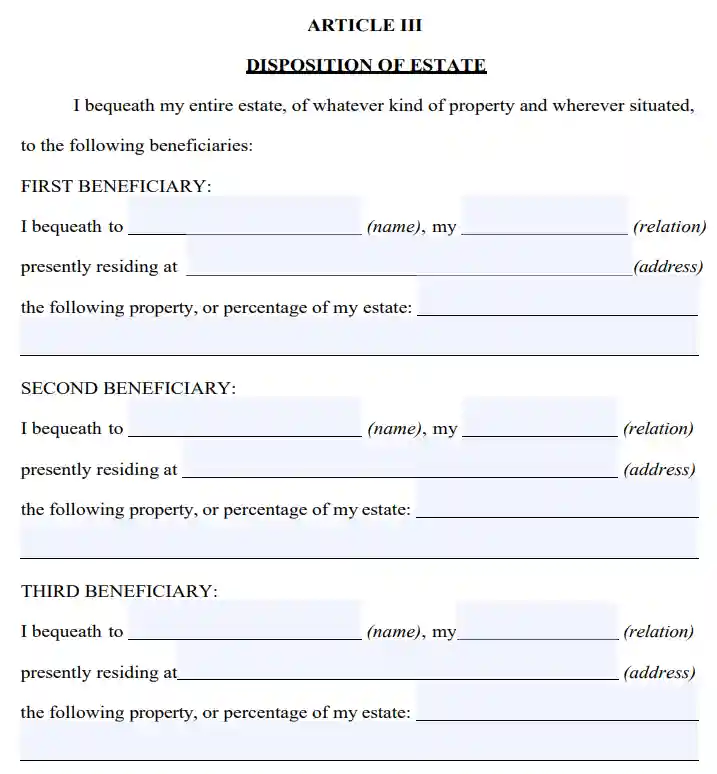

5. Specify your beneficiaries. At this point, establish people to whom you want to pass down your property, that is, your beneficiaries. Fill in their full names, places of residence, and your relationship to them (e.g., spouse, child, friend).

6. Allocate property. In the event that you have got an asset allocation planned that’s different from even, you’ll be able to explain it in this part. Cash, stocks, real estate, company control, money for unpaid arrears, as well as any tangible items of financial worth in your possession, can be mentioned in your last will. Please notice that there are things that cannot be distributed in your last will and testament, such as joint and living will property and life insurance.

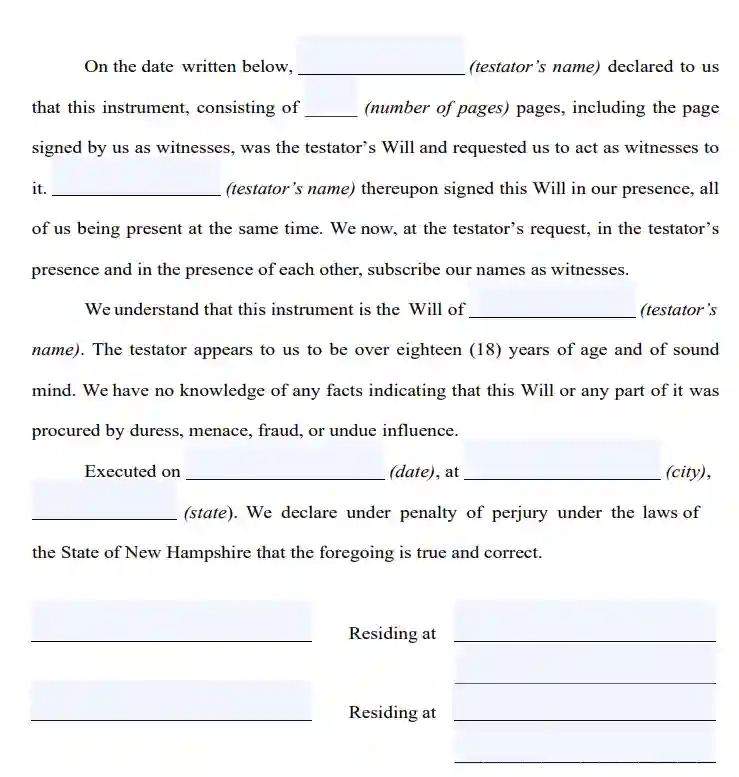

7. Proceed with the witnesses putting the signatures at the end of the document. According to the New Hampshire legislation, for any last will to be considered valid, it must be signed by two witnesses. Only somebody who is not your beneficiary and is of 18 years or more could be chosen as a witness. As an additional precaution against situations when your will is challenged or other problems, it might be wise to name a witness who is younger than you to be sure they will still be there after you die. After a thorough review of each paragraph in your will, all signatories (you and the two witnesses) must fill out their full names and full addresses and sign the document.

Create a Free New Hampshire Last Will and Testament

Frequently Asked Questions

Is last will notarization necessary by the New Hampshire statute?

In New Hampshire, there’s no need to notarize your will. However, in case you need to attach a self-proving affidavit to your last will and testament, you’ll need to notarize it. In the event that you make your last will self-proving, the court won’t need to make contact with the witnesses to ascertain the legality of the document, which will expedite the probate.

Does a last will require a self-proving affidavit in New Hampshire?

It’s not strictly necessary in New Hampshire. But, in case you wish to add a self-proving affidavit, it can be quite advantageous as the document functions as an alternative for in-court testimony of witnesses in the course of probate.

Can you leave out your spouse from your last will and testament?

No, in New Hampshire, you cannot disinherit your spouse. They will be able to receive a determined amount of your property (elective share) after signing a special waiver.

Can a signed, typewritten last will be altered in New Hampshire?

Based on New Hampshire law, it is possible to alter or revoke the will if you aren’t obligated by a legal agreement that indicates the opposite. Additionally, it will be a good idea to revise your last will at the time you undergo a significant life event, including:

- A child has been born or adopted

- Marriage or divorce

- Buying or selling real estate

- Your financial position has changed considerably

How must I act if my last will and testament has been lost?

In line with New Hampshire law, the absence of the will can be regarded as its revocation. That means the trustee should provide proof of the last will’s validity, which in turn may be found to be quite troublesome.

What should one do if they aren't physically able to sign their last will?

In accordance with the New Hampshire Estate Code, it is possible for someone to sign their will, providing that it’s your (as a testator) directive and with you present. It’s possible to give a particular instruction using some methods. They include verbal communication, a positive answer to a query, or a gesture.

You can get a notary to sign the name of a testator that is physically incapable of doing so if the latter guides the notary with a witness present. It is worth mentioning that these witnesses can’t have an interest (equitable or legal) in any of the assets that are the focus of or impacted by such a document (the last will).

Other Documents Related to Wills in New Hampshire

| Related documents | Instances when you may want to have one |

| Codicil | You want to make one or several minor adjustments to your will. |

| Self-proving affidavit | You want to avoid possible difficulties during the probate. |

| Living will | You would like to state your wishes concerning the end-of-life treatment and life-prolonging procedures. |

| Living trust | You need extra protection and confidentiality once the time to distribute your assets comes. |

Last Will and Testament Forms for Other States