Deed Forms for Property Transfer

In real estate, deed forms are essential when selling a property or transferring it under a new name. This document ensures the legality of the transaction between the former owner and the new owner, securing the grantee’s right to the property.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

What Are Deeds?

Simply put, a deed is a legal form used when selling a property or listing it under another name (e.g., transferring the land title from a parent to a child of legal age). It contains a detailed description of the property and all the required signatures, including that of the grantor, the grantee, and the witnesses. Once notarized and filed, the deed will serve as proof of ownership along with the land title.

Here are some essential terms you will encounter:

- Grantor — The grantor is the old property owner who holds the previous land title under their name. During the real estate transfer, the grantor shows a willingness to sell or give the property to someone else.

- Grantee — The grantee is either the buyer or the heir receiving the property from the grantor.

- Deed — The deed will serve as evidence of the legal transfer from the grantor to the grantee and protect the latter from any false claims to the property. It is a physical document that must be filed to your local government office.

- Deed Form — A deed form is a template that either the grantor, the grantee, or their agent can use to ensure a swift transaction. You may download Formspal’s free lawyer-reviewed deed form template on this site.

- Land Title — Unlike the deed, the land title is not a legal document but ownership of the property itself. The title is a concept but determines who has the power to use or transfer the property.

Deed Types

In the United States, a few deed types are available to make transfers easier and appropriate for the situation. Depending on your needs, you may want to look into the following deed types:

General Warranty Deed

This deed lists the past owners and includes the latest grantee as the current owner, enabling it to offer the new owner the highest protection. Also called a “statutory warranty deed,” General Warranty Deed is usually used when a purchase is made, so the corresponding purchase price is also listed.

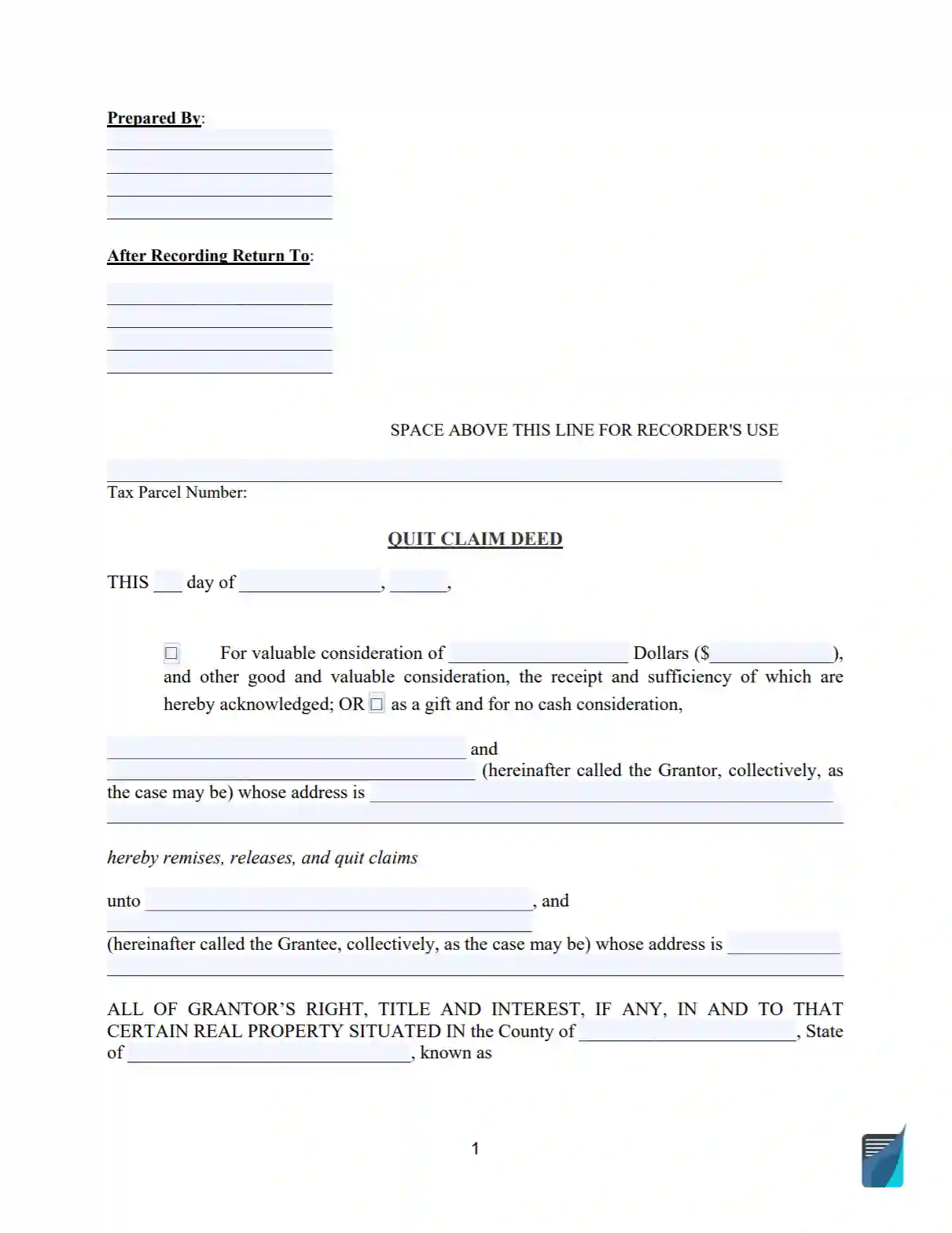

Quitclaim Deed

In contrast to the General Warranty Deed, the Quitclaim Deed is used when there are no financial transactions involved. Instead, it is the go-to template for transfers from grantors to their heirs or other cases like business property transfers, litigations, or divorce.

Transfer-on-Death Deed

A Transfer-on-Death Deed can only come into effect upon your death, so while you are still living, you have the power to revoke it. Typically, this would contain a list of your heirs, who would then be able to avoid a tiring court process or unnecessary additional taxes.

Lady Bird Deed

Like the Transfer-on-Death deed, the Lady Bird Deed will automatically be transferred to the heir or beneficiary upon the grantor’s death. It also comes with the same benefits: being safe from “estate recovery,” where the government takes a portion after selling your home to pay for remaining taxes, care facility fees, etc. While it seems advantageous, this type of deed is not available in all states.

Trust Deed

A Trust Deed is issued when the grantor wants to pay for their debts using their own property. While this is entirely voluntary, it is important to note that several responsibilities are attached to this type of deed, including strict payment schedules and disclosure of financial statements.

Gift Deed

This type of deed is used for donations from grantors to institutions to complete the transfer and grant an institution or individual the ownership of the property. The Gift Deed will still contain any wishes by the grantor, including specific instructions or property access.

Deed In Lieu of Foreclosure

In cases where a grantor can no longer pay for the mortgage, they may voluntarily turn over the property to the lending institution or bank. This would allow them to avoid foreclosure and other consequences that come with it. Usually, as a last resort, this “return” will need a specific type of deed called “Deed In Lieu of Foreclosure.”

Other Deeds:

- Special Warranty Deed — This deed will warrant ownership against the grantor’s action or inaction, but not of others’ actions.

- Correction Deed — This document is used when making corrections to an erroneous deed.

- Fiduciary Deed — Similar to a Quitclaim deed, this form is used by a grantor to claim that they are acting with their own authority when including a new trustee or executor.

- Mineral Deed — A mineral deed is a document that officially transfers the right to extract minerals from a property to the party receiving the deed.

- Sheriff’s Deed — This is a type of court order deed that does not need the grantor’s permission to take the property due to foreclosure.

- Bargain and Sale Deed — For purposes of transparency, this deed discloses that the seller or agent is not entirely in control of the foreclosed property being sold in terms of its title.

- Grant Deed — This form transfers any existing interest from the grantor to the grantee and ensures that the property is not attached to any debt.

- Security Deed — This type ensures “absolute title” and removes the interest from the grantor.

- Tax Deed — This deed transfers the property to the government when the owner fails to pay taxes.

- Executor’s Deed — This deed pertains to a sale or transfer conducted by the owner’s executor or legal representative.

- Administrator’s Deed — This is a deed that allows the transfer to happen after the owner passes away without a will or deed.

- Contract for Deed — A contract for deed is an agreement between a buyer and a seller, where the seller provides the buyer with a deed of title to property and allows them to take possession of the property before making full payment. For example, Texas Contract For Deed.

- Deed of Release — Finally, a Deed of Release allows the previous owner to grant the new owner absolute title once the mortgage is paid in full.

- Personal Representative Deed — This legal document is similar to a quitclaim deed. It allows you to transfer real estate title of a deceased owner to a beneficiary or a third party.

Signing and Recording

Once you have chosen the best deed type that fits your needs, you’ll need to undergo a signing and recording process, which varies from state to state. For your convenience, the different requirements are listed below:

| State | Signing | Recorder | Laws |

| Alabama | Notary Public or 2 Witnesses | Office of the County Probate Judge in the property’s jurisdiction | Alabama code Title 35, Chapter 4 |

| Alaska | Notary Public | One of the Recording Districts, depending on the property’s jurisdiction | Alaska Statutes Title 34, Chapter 15 |

| Arizona | Notary Public | County Recorder’s Office in the property’s jurisdiction | Arizona Statutes Title 33, Chapter 4 |

| Arkansas | Notary Public and 2 Witnesses | Circuit Court in the property’s jurisdiction | Arkansas Code Title 18, Chapter 12 |

| California | Notary Public | County Recorder’s Office in the property’s jurisdiction | California Civil Code 1091-1134 |

| Colorado | Notary Public | County Recorder’s Office in the property’s jurisdiction | Colorado Statutes Title 38 |

| Connecticut | Notary Public and 2 Witnesses (a notary public may account as 1 of the witnesses) | City/Town Recording Office in the property’s jurisdiction | Connecticut General Assembly Chapter 821 |

| Delaware | Notary Public | Kent County, New Castle County, or Sussex County, depending on the property’s jurisdiction | Delaware Code Title 25 Chapter 1 |

| Florida | Notary Public and 2 Witnesses | Clerk of the Circuit Court in the property’s jurisdiction | Florida Statutes Title XL Chapter 689 |

| Georgia | Notary Public and 2 Witnesses (a notary public may account as 1 of the witnesses) | Clerk of the Superior Court in the property’s jurisdiction | Georgia Code Title 44 Chapter 5 Article 2 |

| Hawaii | Notary Public | Hawaii Bureau of Conveyances | Hawaii Administrative Rules Title 13 Chapter 16 |

| Idaho | Notary Public | County Recorder’s Office in the property’s jurisdiction | Idaho Statutes Title 55 Chapter 6 |

| Illinois | Notary Public | County Recorder’s Office in the property’s jurisdiction | 765 ILCS 5 |

| Indiana | Notary Public or Other Public Officers Authorized under § 2-3-4-1 | County Recording Office in the property’s jurisdiction | Indiana Code Title 32 |

| Iowa | Notary Public | County Recorder’s Office in the property’s jurisdiction | Iowa Code Chapter 558 |

| Kansas | Notary Public | County Recorder’s Office in the property’s jurisdiction | Kansas Statutes Chapter 58 Article 22 |

| Kentucky | Notary Public or 2 Witnesses | County Clerk’s Office in the property’s jurisdiction | Kentucky Revised Statutes Chapter 382 |

| Louisiana | Notary Public and 2 Witnesses | Clerk of Court’s Office in the property’s jurisdiction | Louisiana CC 1839 |

| Maine | Notary Public or Officer of the Court | Registry of Deeds in the property’s jurisdiction | Maine Revised Statutes Title 36 Chapter 711-A |

| Maryland | Notary Public or Officer of the Court | Clerk at the Circuit Court in the property’s jurisdiction | Maryland Code Real Property Title 2 (2-101 – 2-123) |

| Massachusetts | Notary Public | Registry of Deeds Office in the property’s jurisdiction | Massachusetts Laws Chapter 183 |

| Michigan | Notary Public | Registry of Deeds in the property’s jurisdiction | Michigan Legislature Chapter 565 |

| Minnesota | Notary Public | County Recorder’s Office in the property’s jurisdiction | Minnesota Statutes Chapter 507 |

| Mississippi | Notary Public | Clerk of the Chancery Clerk’s Office in the property’s jurisdiction | Mississippi Code Title 89 Chapter 1 |

| Missouri | Notary Public | County Recorder of Deeds in the property’s jurisdiction | Missouri Statutes Title XXIX |

| Montana | Notary Public | County Clerk and Recorder’s Office in the property’s jurisdiction | Montana Code Title 70 Chapter 20 and 21 |

| Nebraska | Notary Public | Register of Deeds in the property’s jurisdiction | Nebraska Revised Statutes Chapter 76 |

| Nevada | Notary Public | County Recorder’s Office in the property’s jurisdiction | NRS 111.105-111.235, 111.310-111.3655 |

| New Hampshire | Notary Public | County Registry of Deeds Office in the property’s jurisdiction | New Hampshire Revised Statutes Title XLVIII Chapter 477 |

| New Jersey | Notary Public | County Clerk’s Office in the property’s jurisdiction | New Jersey Revised Statutes 46:7-2 |

| New Mexico | Notary Public | County Clerk’s Office in the property’s jurisdiction | New Mexico Statutes Chapter 47 Article 1 |

| New York | Notary Public | County Court Clerk’s Office in the property’s jurisdiction | New York Laws Real Property Article 8 |

| North Carolina | Notary Public | Register of Deeds in the property’s jurisdiction | North Carolina General Statutes Chapter 47B |

| North Dakota | Notary Public | County Recorder’s Office in the property’s jurisdiction | North Dakota Code Chapter 47-10 |

| Ohio | Notary Public | County Recorder’s Office in the property’s jurisdiction | Ohio Revised Code Chapter 5302 |

| Oklahoma | Notary Public | County Clerk’s Office in the property’s jurisdiction | Oklahoma Statutes Title 16 |

| Oregon | Notary Public | Recorder’s Office in the County in the property’s jurisdiction | Oregon Statutes Chapter 93 |

| Pennsylvania | Notary Public | County Recorder’s Office in the property’s jurisdiction | Pennsylvania Statutes Title 21 Chapter 1 |

| Rhode Island | Notary Public | City/Town of the property’s jurisdiction | Rhode Island Laws 34-11 |

| South Carolina | Notary Public and 2 Witnesses (a notary public may account as 1 of the witnesses) | County Recorders of Deeds in the property’s jurisdiction | South Carolina Code Title 30 Chapter 5 |

| South Dakota | Notary Public or 1 Witness | County Recorder’s Office in the property’s jurisdiction | South Dakota Laws Chapter 43-25 |

| Tennessee | Notary Public or 2 Witnesses | County Registers Office in the property’s jurisdiction | Tennessee Code Title 66 Chapter 5 Part 1 |

| Texas | Notary Public | Register of Deeds in the County Clerk’s Office | Texas Property Code Title 2 Chapter 5 |

| Utah | Notary Public | County Recorder’s Office in the property’s jurisdiction | Utah Code Title 57 Chapter 1 and 3 |

| Vermont | Notary Public | County Clerk’s Office in the property’s jurisdiction | Vermont Statutes Title 27 Chapter 5 |

| Virginia | Notary Public or 2 Witnesses | Clerk of the Circuit Court in the property’s jurisdiction | Virginia Code Title 55.1 Subtitle 1 |

| Washington | Notary Public | County Recorder’s Office in the property’s jurisdiction | Chapter 64.04 RCW |

| Washington D.C. | Notary Public or Certified Official of the Court | Recorder of Deeds office in the property’s jurisdiction | Code of D.C. Title 42 Chapter 6 |

| West Virginia | Notary Public or 2 Witnesses | County Court Clerk’s Office in the property’s jurisdiction | West Virginia Code Chapter 36 |

| Wisconsin | Notary Public | County Register of Deeds in the property’s jurisdiction | Wisconsin Statutes Chapter 706 |

| Wyoming | Notary Public | Recorder’s Office (usually the same as the County Clerk’s Office in most districts) | Wyoming Statutes Title 34 |

Deed vs. Title

Though the terms “Deed” and “Title” are sometimes used interchangeably, they are entirely different from each other, as explained in the first part of this article. To further understand the differences between them, these terms are compared and contrasted below:

Similarities:

- Both pertain to one’s ownership of a real estate property.

- Both serve as proof of your right to access the property.

Differences:

- A deed is a legal document, while a title is a “concept.”

- You “sign” a deed to “take title” of a property.

- Deeds can have several types, unlike a title.

- You cannot use a title to sell or transfer a property.

What a Property Deed Usually Contains

While a deed comes in several types for different purposes, these generally contain the following:

- A detailed overview and description of the property

This would include the official address of the property and its lot size. If there are any major improvements to be made, this must be included as well.

- Names of both the grantor and the grantee

The names of the parties involved should appear on the document. Typically, these are the grantor (seller or previous owner) and the grantee (buyer or new owner). Depending on the type of deed, the grantor may also be a donor, an executor, or an agent. At the same time, the grantee may be an heir, a beneficiary of a donation, a lending company, or even the government.

- Price

If the property is being sold, the total amount of the property should be reflected on the deed.

- Signatures

Lastly, all parties must sign the document on the last page along with their witnesses. This ensures the legality and enforceability of the deed.

More often than not, using a deed comes with certain restrictions. This includes limits on property use or any changes to its facade to comply with the area’s guidelines, such as the case in subdivisions where the community’s “character” or ambiance must be preserved. Typically, deed restrictions last up to 25 to 30 years, while others can stay as long as the property’s lifespan (also called perpetual ownership). Thanks to the Uniform Real Property Electronic Recording Act (URPERA), yes. While it is best to sign the deed in person, electronic signatures are still allowed, provided that other supporting documents “logically” match the deed’s contents. There is also no need for a stamp or seal to accompany the electronic signature. However, it is best to check your state’s laws regarding the use of electronic signatures because, though this may be the norm in some areas, others may still require you to sign legal papers using the traditional way. Yes, you may revoke a deed of donation in special cases. In the past, properties have been restored to the original owner due to gross ingratitude or mutual revocation. Take note, though, that sentiments may not be enough to revoke a donation. In most cases, a deed cannot be changed once it has been filed. Therefore, the best course of action would be to create a new deed when adding the name of the spouse, partner, or child. The same goes when removing names.Frequently Asked Questions

What are deed restrictions?

Can a deed be signed electronically?

Can I revoke a deed of donation?

How to add a name to a deed?

Real estate properties play an enormous part in people’s lives, mainly because of their value. It is therefore vital to use legally-reviewed deed forms when selling or transferring your home or land. Identifying the best deed type for you is the first step, followed by knowing the requirements and the basic contents of the document. Once the template is filled out, you may now file it and check if it has been added to your state’s registry of deeds.