Acord 50 WM is a specific version of the standard automobile insurance identification card the Association for Cooperative Operations Research and Development (ACORD) provides. This form is used primarily in Washington state, as indicated by the “WM” designation, which stands for Washington Motorist. The card serves as proof of insurance, verifying that the holder has the minimum auto insurance coverage mandated by Washington state law.

This identification card includes essential information such as the insurance company’s name, the policy number, and the effective and expiration dates of the policy. It also lists the insured vehicle’s make, model, year, and VIN (Vehicle Identification Number). Motorists must always carry this card to provide proof of insurance during traffic stops, at the scene of an accident, or when renewing vehicle registration. The Acord 50 WM facilitates quick verification of insurance coverage, helping to ensure compliance with local regulations.

Other PDF Forms

If you want to check more PDFs for you to edit and fill out here, listed here are a number of the more popular forms among our visitors. Also, remember that you can easily upload, fill out, and edit any PDF document at FormsPal.

How To Complete This Form

In every person’s life, some risks cause financial losses. Various dangers affect life, well-being, and property. Various phenomena and their consequences related to the activities of people can lead to them. Insurance allows you to avoid financial losses resulting from the implementation of risks. The insurance company takes responsibility for their accident in exchange for the receipt of insurance premiums.

When filling out any documents for insurance, you must provide comprehensive information without lies and confusion. It will allow you to minimize risks and save time. Write carefully, accurately, and legibly.

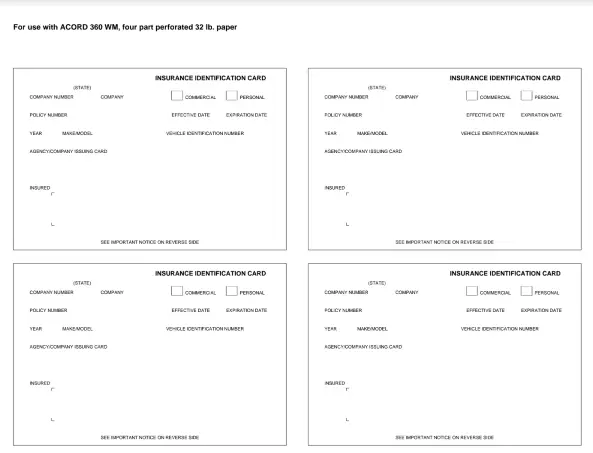

Insert the Insurance Identification Card

So, you need to fill out an insurance card with your details. Enter the US state where your business is located. Specify the company number, its name, and select the appropriate type (personal or commercial). You also need to specify the policy number and its validity date.

Fill in the Corresponding Year

This application requests information about your property for insurance, its number, and year. Do not forget to specify the insured business and the identification number.

In any case, filling out this card is not an intricate process, with enough attention and understanding of the issues. Do not rush when filling in the data and read all the points. Similar insurance forms are identical, and therefore you will be able to submit these applications to the organization without any problems in the future.