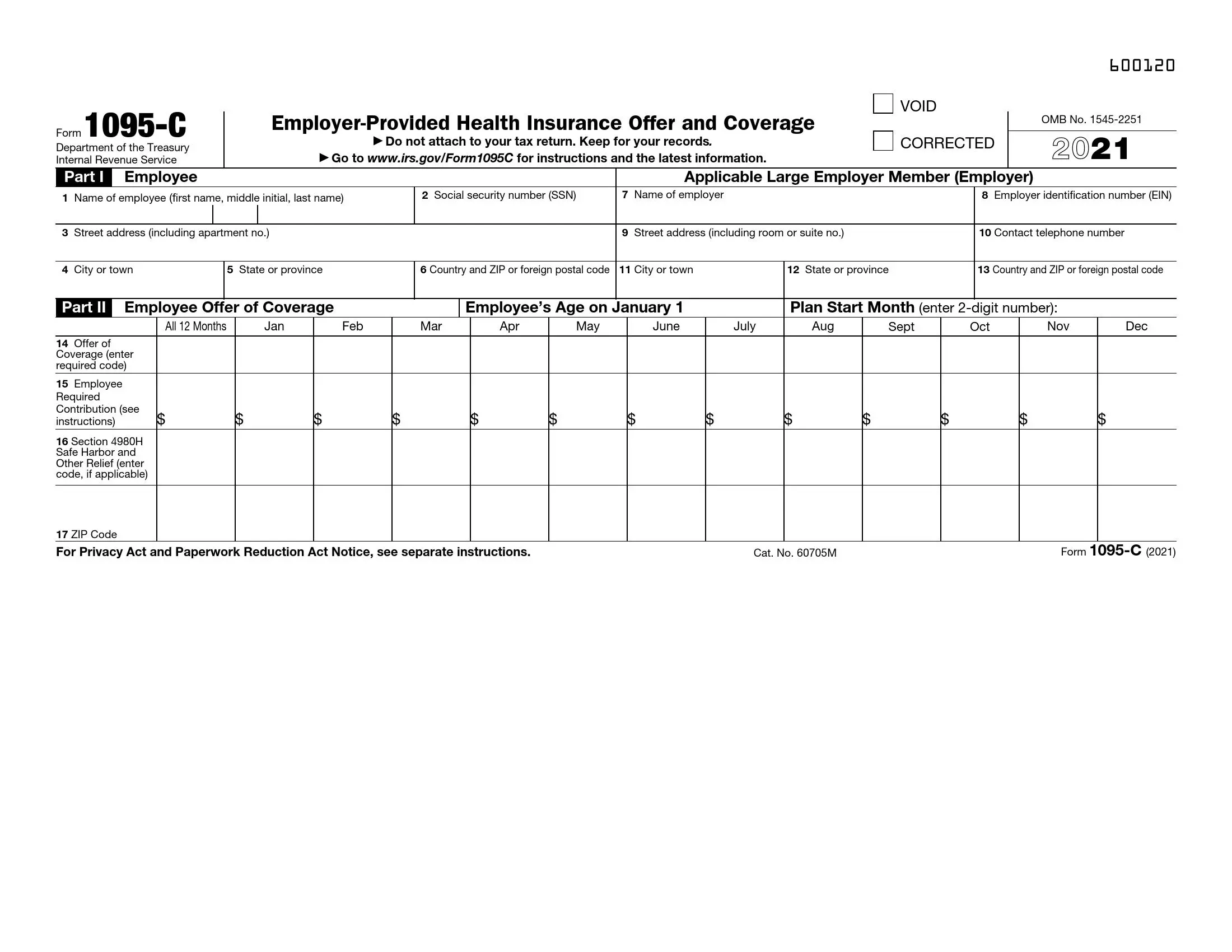

Form 1095-C is a tax form that employers with 50 or more full-time employees (including full-time equivalent employees) must provide. This form is part of the Affordable Care Act (ACA) requirements and reports information about the health insurance coverage offered to each employee. It details whether the coverage meets the minimum value standard and is affordable, as defined by the ACA. The form also indicates which months the employee was eligible for the coverage during the year. This information is crucial for the IRS to verify compliance with the ACA’s employer mandate and help employees determine eligibility for premium tax credits when purchasing coverage through the Health Insurance Marketplace.

The purpose of Form 1095-C is dual: it assists the IRS in enforcing compliance with the employer mandate. It provides employees the information to make informed decisions about their health insurance options. Employees use the data from Form 1095-C to ascertain if their employer offered them adequate and affordable coverage. If not, they may be eligible for premium tax credits if they purchase insurance through the Marketplace. This form is pivotal in ensuring that both employers fulfill their obligations under the ACA and that employees receive the information required to seek out the most beneficial and cost-effective health insurance options.

Other IRS Forms for Business

The IRS makes employers file different forms containing various financial information about their employees. Read about other IRS forms for employers you might need.

How to Fill Out the Template

The IRS Form 1095-C is rather simple compared to other templates issued by the Service. So, it is not necessarily your entity’s accountant who should fill the form out. Most likely, your human resources personnel may help with the form creation because this department usually has the most current and full information about every worker and their perks.

However, sending such forms is a huge responsibility, and the Service applies penalties to those who state incorrect information in their documents. So, we recommend taking the template seriously, asking for help via the Service’s official website and reading instructions thoroughly, or contacting your company’s accountant or tax assistant if something seems unclear. You may see the general instructions on the document creation below.

Get the Template

You cannot fill the template out without having the current version of it. So, you need to get one first. While the IRS furnishes all forms they require, and you can download them from their official website, we also offer our exemplary form-building software that will help you generate an already customized template for you in seconds. Download the file and proceed to the completion.

Specify the Employee

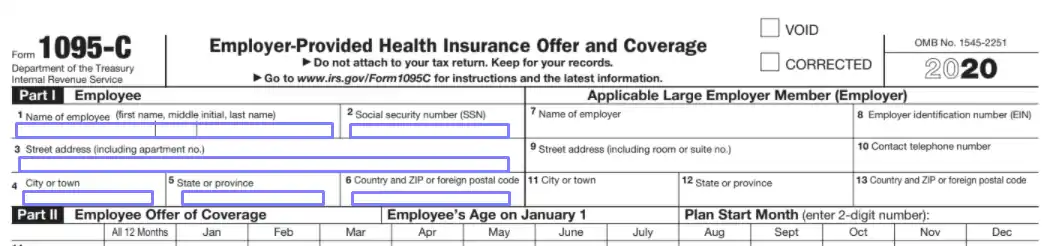

On the left, write the details about the employee for whom you are creating this form. You need to add their name, social security number (or SSN), and full address.

Introduce the Employer

Insert details about the employer on behalf of which this document is being completed. Enter the employer’s name, employer identification number (or EIN), full address, and phone number.

Describe the Insurance Coverage

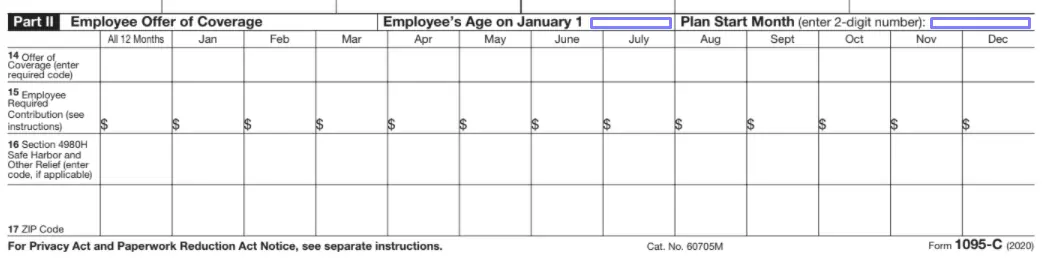

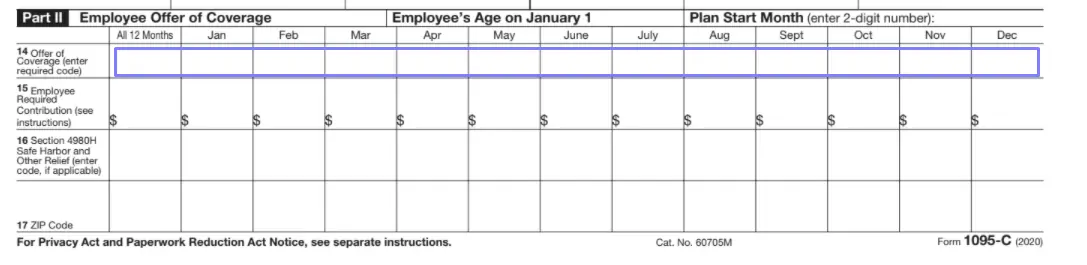

In the following section, you will describe the employee’s insurance coverage throughout the year. Above the chart, write the employee’s age on January 1 in the designated line. Nearby, enter the month when the coverage started (use two digits).

In the chart, you can add data in boxes for each month separately or the year as a whole, depending upon the used insurance plan. Write the applicable “Offer of Coverage” code (these codes define the insurance type and are proposed by IRS; you can find all of them on the form’s second page). There are almost 20 codes to choose from.

Complete the following section, “Employee Required Contribution,” only if the code you added to the previous section requires it. You can easily comprehend it by reading the Service’s instructions. This section states the compulsory employee’s sum to pay for the insurance per month; it also can be zero.

The next section should be filled out in conformity with the Service’s instructions and requires codes from Code Series 2. In some cases, you will leave it blank. Situations, when the employers need to use this section, are listed in the guidelines. Those may include cases when the worker was not employed in the company or was not a full-time employee during certain months of the fiscal year, had basic minimum insurance coverage for a specific period, and other reasons.

The following line also must be used only for certain insurance types. Here, you will enter a postal code: either from the worker’s address or the official workplace’s address. Check with the Service’s guide to ensure that you have inserted the correct code here.

Complete Part III (If Applicable)

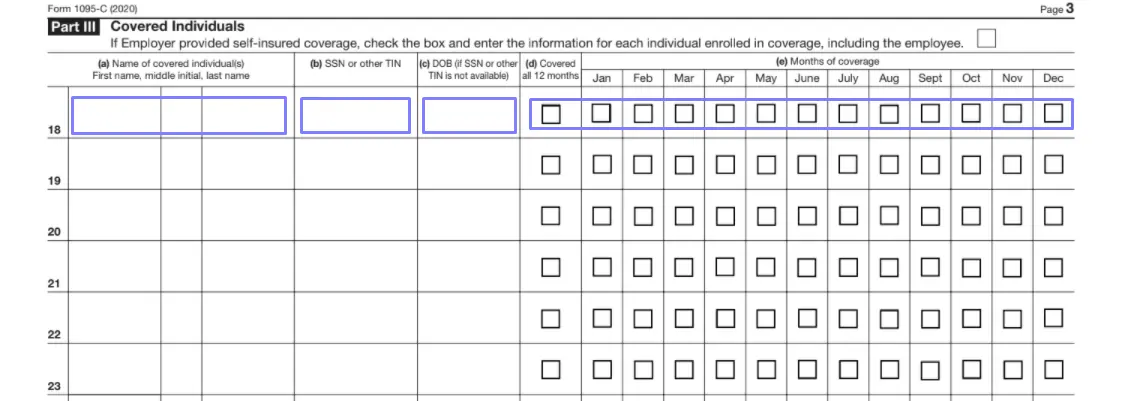

If the employer has opted for the plan defined as “self-insured,” they must fill out Part III of the form. Here, they will list every insured worker.

Check the box on top of the page before completing the offered chart. By checking, you verify that you are using the mentioned insurance plan.

Then, list the workers, including the one you have described previously: add their full names along with SSN or other tax ID numbers. If neither SSN nor other numbers are available, write their birth date. Then, mark the boxes that identify the months when each worker’s insurance was covered.

When Should I Submit the Record?

There are two deadlines for the employers to submit this form. One states the last day when workers may receive the document; another is for submission to the IRS.

Each concerned worker must get their copy no later than January 31. The last day of February is the Service’s deadline if you file your form by mail. If you decide to submit it online, your deadline is March 31.