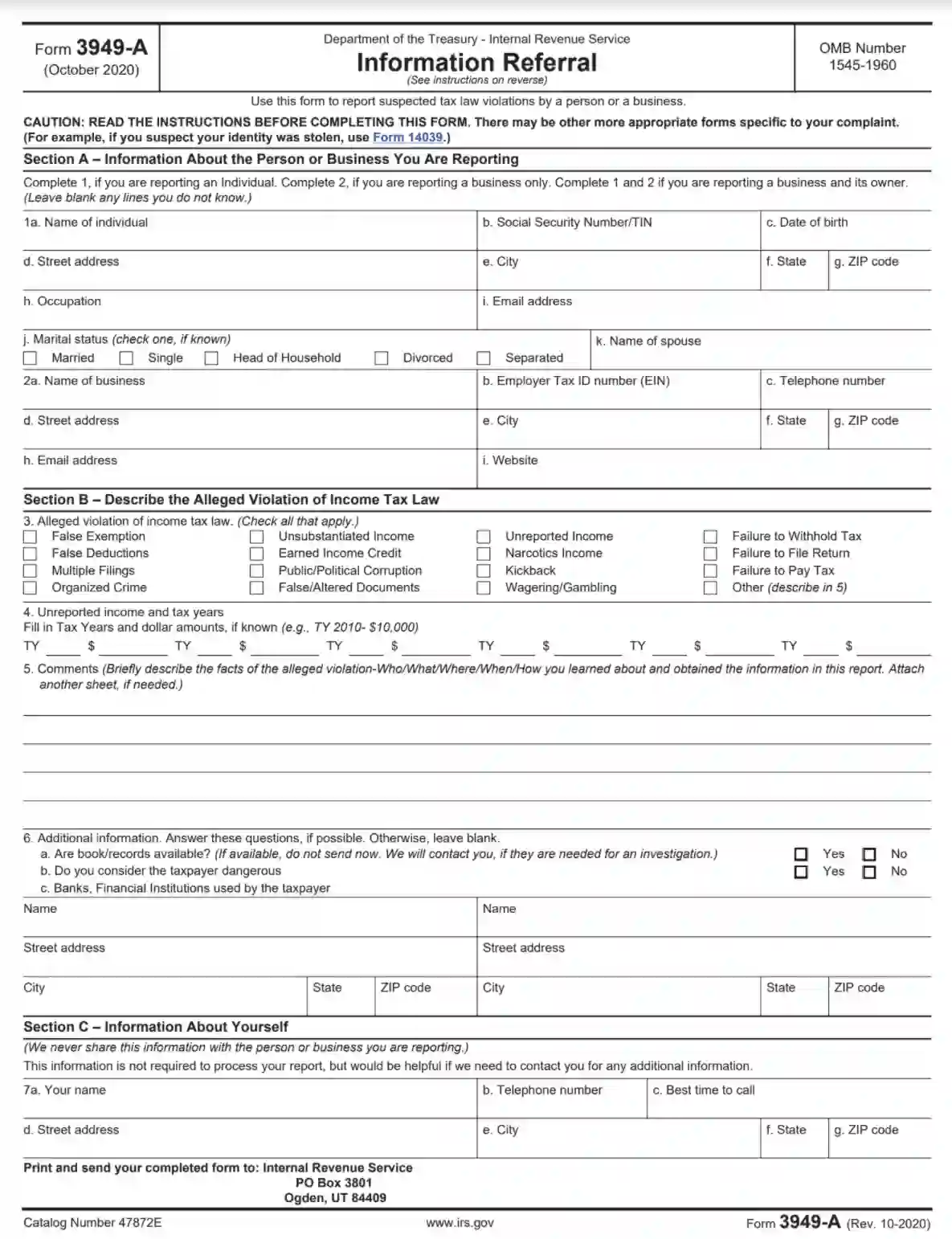

Form 3949-A is a document provided by the Internal Revenue Service (IRS) for individuals to report suspected tax fraud or misconduct by another party. Titled “Information Referral,” this form serves as a tool for taxpayers to confidentially report potential violations of tax laws, such as unreported income, false deductions, or fraudulent activities by individuals or businesses. It allows individuals to provide detailed information about the alleged wrongdoing, including the name and address of the suspected individual or entity, descriptions of the fraudulent activities, and any supporting evidence or documentation.

The purpose of Form 3949-A is to enable the IRS to investigate and take appropriate action against instances of tax fraud or non-compliance. By providing a means for individuals to report suspected violations anonymously, the form encourages citizens to play a role in maintaining the integrity of the tax system. This form is essential for identifying and addressing tax evasion and fraudulent activities, ultimately helping to ensure fairness and compliance within the tax system for all taxpayers.

Other IRS Forms for Individuals

On our website, you can find out more about other IRS forms that can be used in specific situations.

How to Fill Out the Template

The Service had probably tried to draw up a template as simple as possible because this document can be executed both by experts dealing with taxes regularly and ordinary people who might lack knowledge on the topic. If you feel like reporting possible tax fraud, you can easily fill the form out.

We have developed a general guide that will help you do so. Scroll down to see if you already have gotten the latest template. If not, you can either download it from the official Service’s web page or try generating it with our form-building software that is quite easy to use. We offer a proper IRS Form 3949-A you can get in seconds.

1. Read the Caution Note

The form starts with caution: every applicant must read it and ensure that this template fits the case. There are other relevant forms you can pick instead, so check the guide proposed by the Service before creating the form(you can find it by scrolling to the form’s second page).

2. Provide Details on the Fraudster

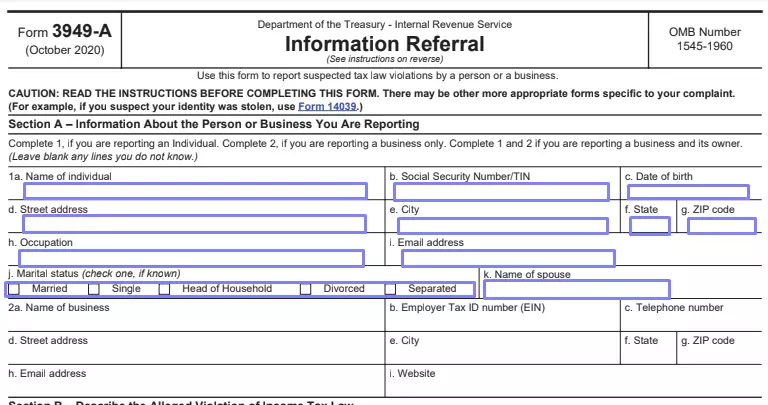

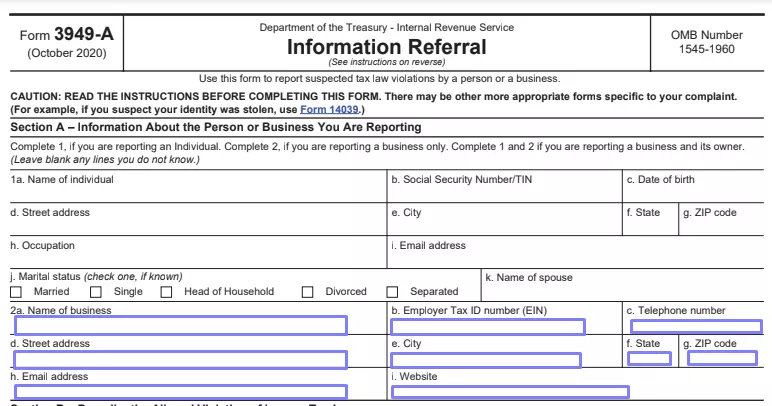

Unlike many other forms, you should start with describing the fraudster on who you are reporting and their unlawful actions. The whole Section A is about those things.

You can suspect either a person or an entity. Depending on who you suspect of fraud, you should select the part to fill out. The first part is dedicated to individuals, while the second one is meant for business entities.

In the first case, you should write all basic details about a person step by step: their full name, social security number (or SSN) or taxpayer identification number (or TIN), birth date, complete address (with a city, state, and postal code), occupation, and email address.

Below, you have to specify their marital status by checking a suitable box (if you do not know it, do not mark any of the boxes). If a suspected person is married, add their spouse’s name nearby.

For a business, provide its name, employer tax identification number (EIN), phone number, complete address, email address, and website.

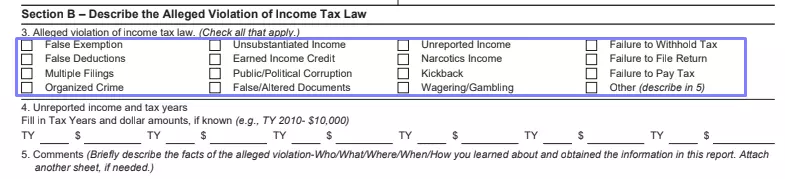

3. Outline What Had Happened

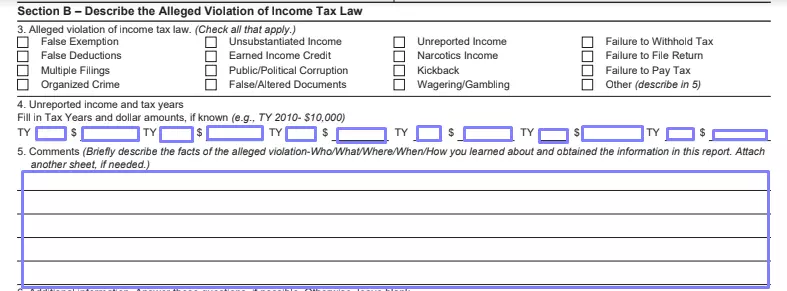

You should describe the fraud that you suspect had occurred. There are 16 options (organized crime, kickback, unreported or narcotics income, failure to cover taxes, and so on), and you must pick all that are applicable to the case. If you find any of the options not clear enough, you may see its definition on the form’s second page.

Mark all the relevant boxes. If something has happened that does not fit any of the boxes; you can check the last box and provide additional info in the designated lines further.

If you know the exact sums or unreported income during last years, feel free to fill out the next part where you can give info for six past years. Indicate the year and the sum in US dollars in the relevant lines.

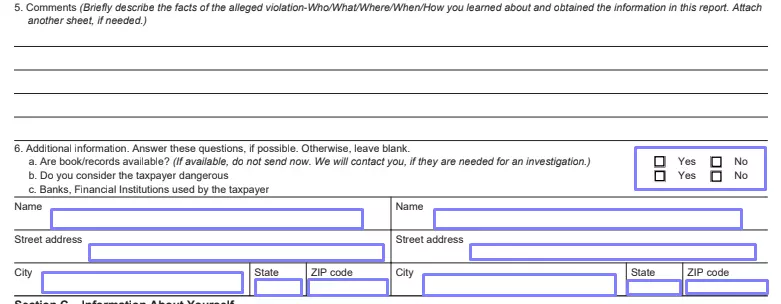

Then, you can add various comments to your statement in a couple of lines.

Under these lines, you will see three additional questions. You should only reply if you are sure of your answers. You will be asked if the taxpayer under review imposes danger to the public if you have access to any of their books or records, and if you have any info on what banks (or other financial institutions) the taxpayer is using to conduct the hoax.

The first two questions are “Yes” or “No,” and the last question demands to specify the institution’s name(s) and address(es). You can add up to two institutions here.

4. Provide Info about Yourself

Of course, if you make such a statement, the Service should be able to find and question you. Probably, you will be the main witness in their investigation. So, you should provide your details, too.

Write your full name and valid phone number. Specify the best time when you are available to talk on the phone. Add your full address below. No additional info is required.

How to File the Record

Under Section C (where you provide details about yourself), you will see the address where you must submit your record on the form’s first page. When you finish with the document creation, visit your local post office and send the papers to the indicated address.