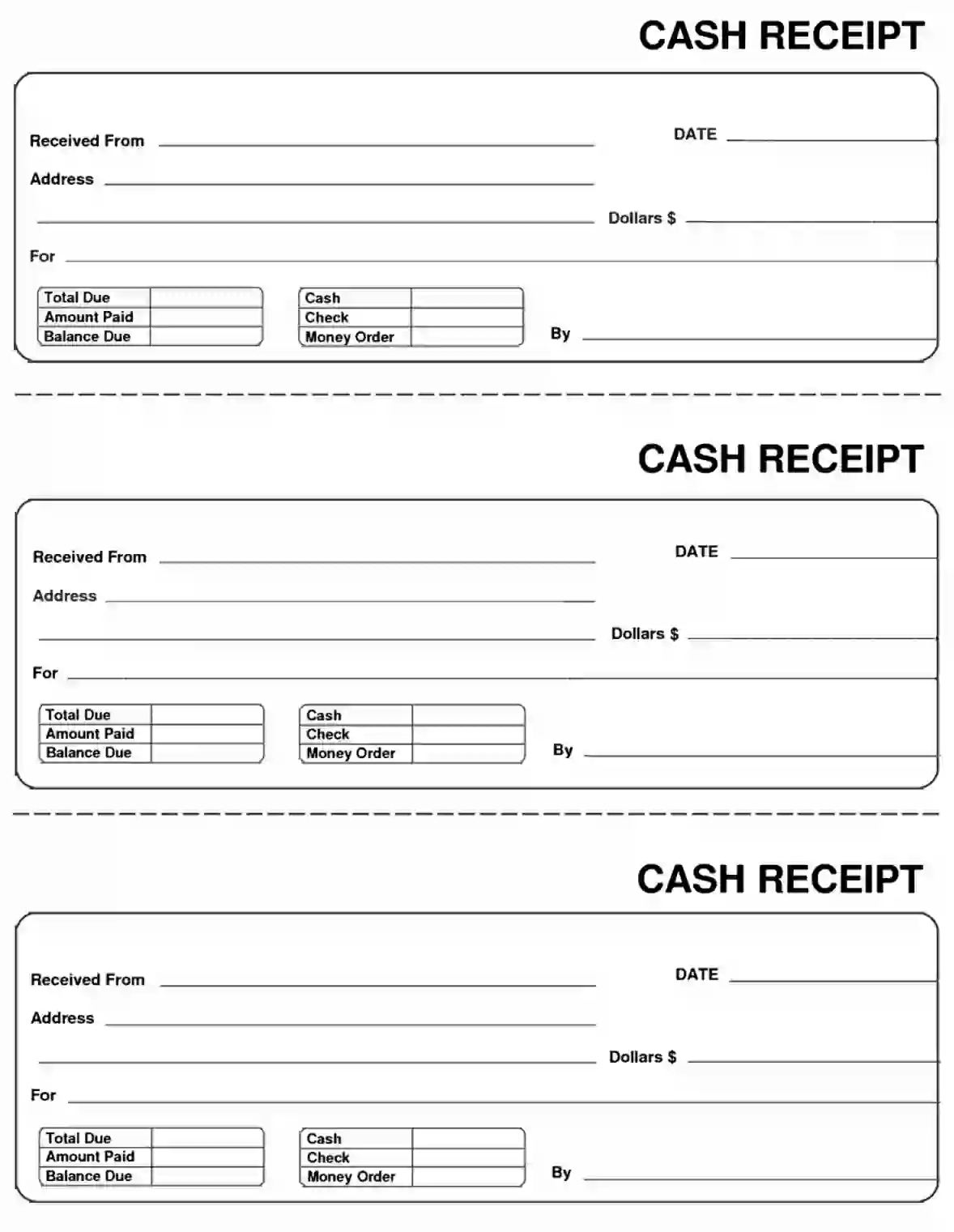

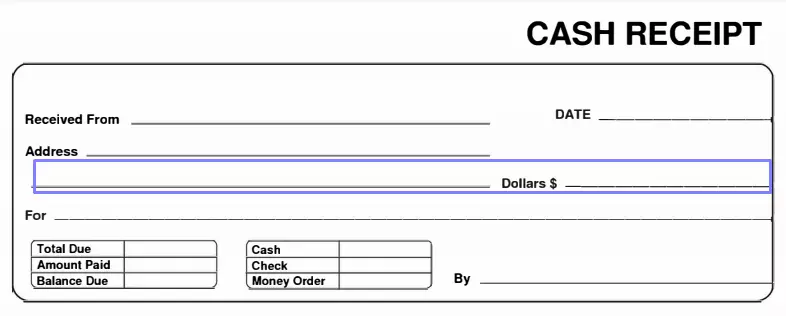

A Cash Receipt is a written acknowledgment that confirms the receipt of money following a transaction between two parties. It details the amount of cash received, the transaction date, the purpose or reason for the payment, and the payer and payee’s information. This form also includes a space for the signature of the person who received the money, providing an additional layer of verification.

The purpose of a Cash Receipt is to provide a tangible record of the transaction for both the giver and the receiver of the cash. It serves as proof of payment for the payer, which is crucial for financial record-keeping, resolving disputes, and, in some cases, tax documentation. For the recipient, it helps manage and track cash flow, ensure accurate accounting, and maintain detailed financial records.

Other Financial Forms

Are you interested in other financial forms? Check the list down below to see what you’ll be able to fill out and edit with FormsPal. Moreover, keep in mind that you may upload, fill out, and edit any PDF document at FormsPal.

How to Fill Out a Cash Payment Receipt

The legal forms and receipts completion in the US can be tricky sometimes. That is why we have prepared helpful guidelines to complete a Cash Payment Receipt. Check out the steps below.

- Find the Proper Template

You should get the correct receipt template of the Cash Payment Receipt before completion. Our advanced form-building software will help you to generate any legal form template you need. We highly recommend using it to obtain the proper file.

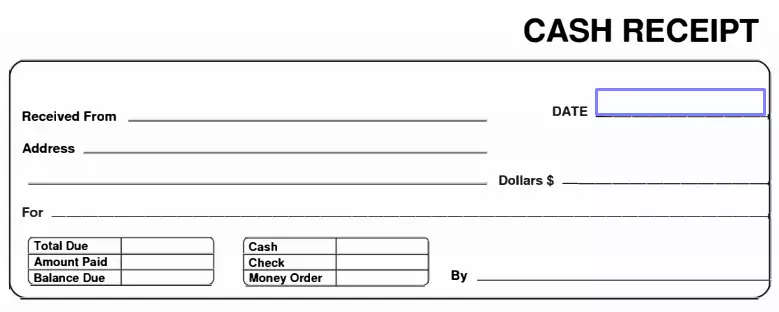

- Put the Current Date on the Receipt

On the right-hand side, you need to insert the receipt’s issuing date.

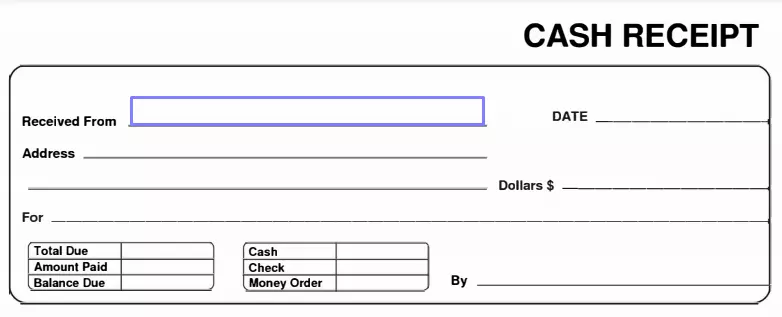

- Write the Customer’s Name

On the left-hand side, enter the full name of the person who gives you cash for services or goods.

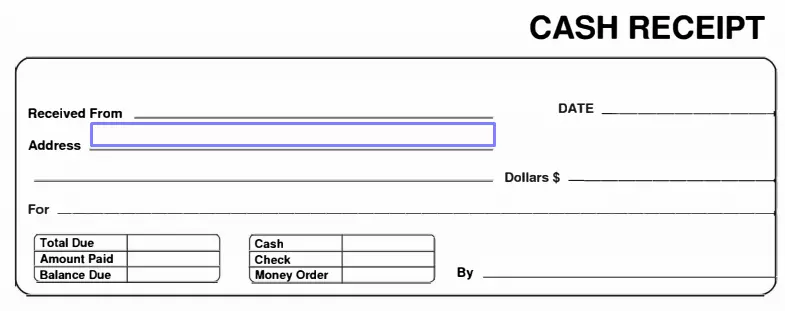

- Insert Your (or the Entity’s) Address

Next up, you should fill out the full address of the entity that receives the cash (or your address, if you are the cash recipient).

- Reveal the Given Sum

After adding the address, write the total payment amount in US dollars given to you by the payer. You should write it in letters first, and then repeat the sum in numbers.

- Describe the Services or Goods

In the Cash Payment Receipt, you should explain what you have received the money for. Add the services or goods that the customer has paid for in the relevant blank space.

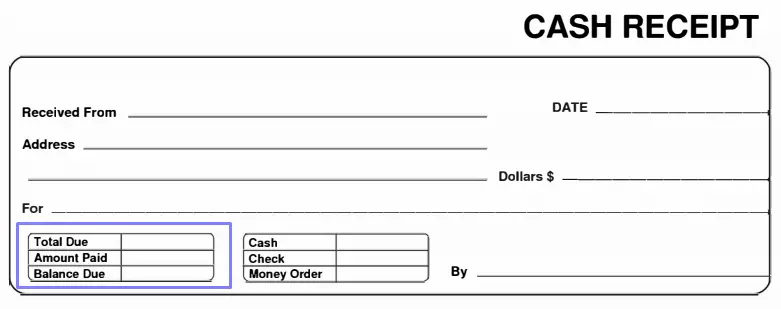

- Define the Debt (If Any)

If the customer pays you piece by piece, you can reflect this fact in the receipt. Near the “Total Due”, insert the amount the customer owes you in total. Below, you can enter the paid sum and the sum left to pay (“Balance Due”).

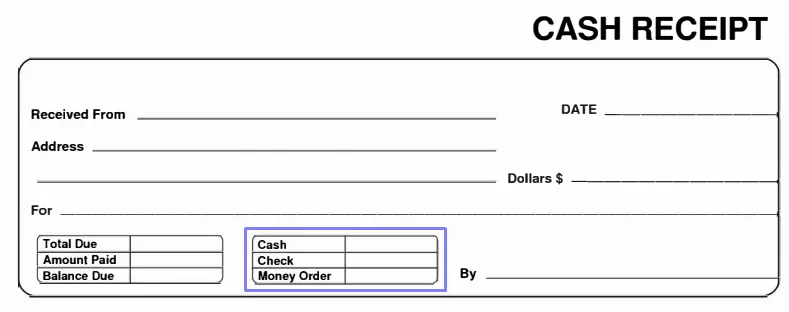

- Choose the Payment Method

You have to choose the payment method that the customer is willing to use between the three options: “Cash”, “Money Order”, or “Check”.

- Introduce the Recipient

Here, you should write either your name or the entity’s name (it depends on the recipient).

- Make the Copies

Each receipt should have at least two copies: one for the customer and another for the cash recipient. The third copy is made additionally, if you need to prove the payment in governmental institutions (for instance, for tax matters).