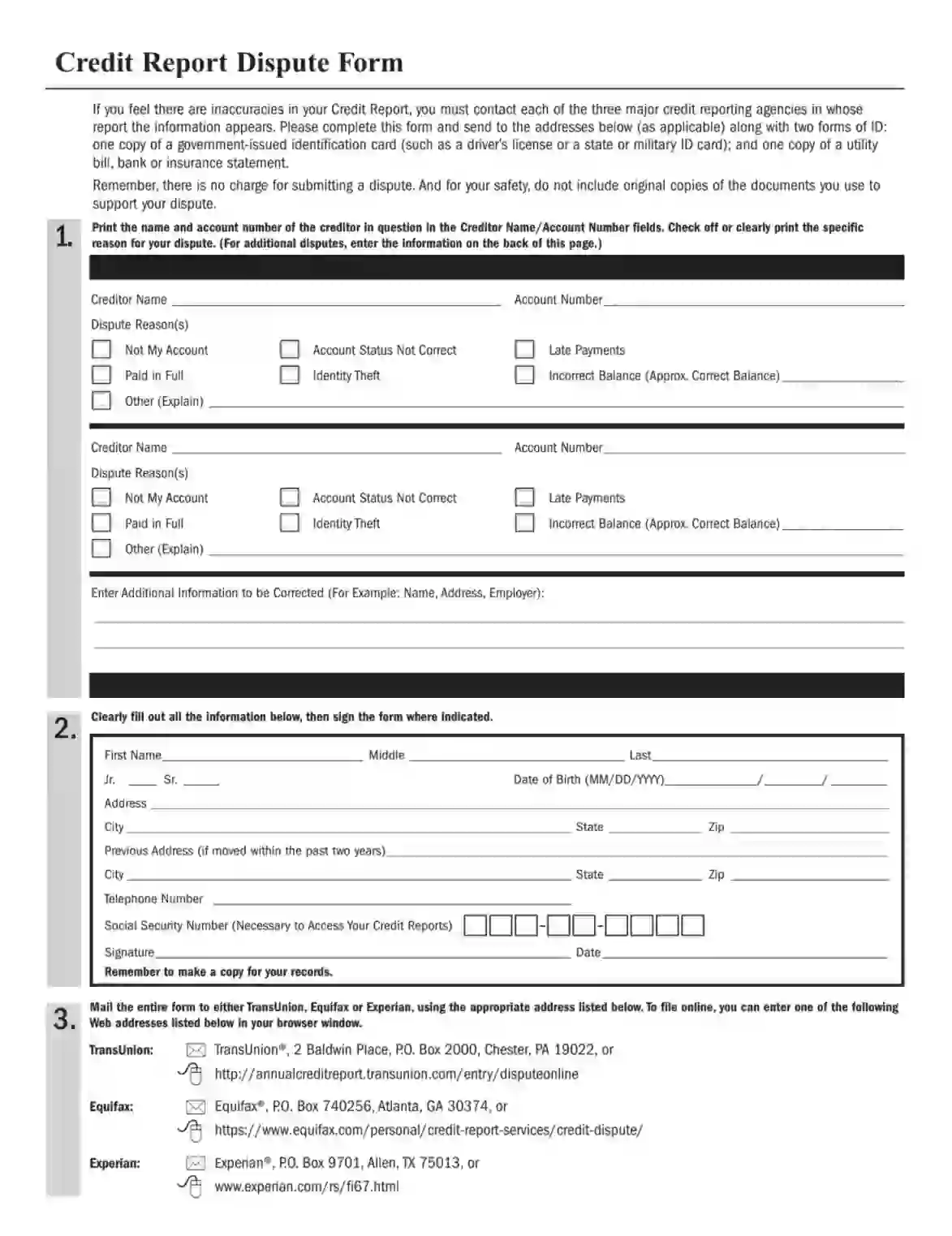

A Credit Report Dispute Form is a document individuals use to challenge inaccuracies or outdated information on their credit reports. This form can be submitted to major credit reporting agencies such as Equifax, Experian, and TransUnion. The form requires personal identification details, specific disputed items, and any evidence supporting the correction, such as account statements or letters from creditors. This formal notification is crucial for initiating the review process of the disputed entries.

Inaccurate information on a credit report can negatively impact an individual’s credit score, affecting their ability to obtain loans, secure housing, and sometimes even employment. By filing a dispute, individuals can have errors corrected, which improves their credit score. This process is a critical consumer right under the Fair Credit Reporting Act (FCRA), which mandates that credit bureaus investigate disputes within 30 days and remove inaccurate, incomplete, or unverifiable information.

Other Financial Forms

Should you want to check out more financial PDFs for you to edit and fill in here, here are some of the more popular forms among our users. Moreover, keep in mind that you can upload, fill out, and edit any PDF form at FormsPal.

How to Fill Out a Credit Report Dispute Form

Filling out a credit report dispute is fairly straightforward. Use our form-building software to achieve the best results in the shortest possible amount of time. Follow our step-by-step guide and send your credit report dispute form to the credit reference agency.

- State the Creditor Name and the Account Number

First, print the creditor’s name and the account number.

- Identify the Reason for Dispute

The credit dispute form allows you to address several dispute points. The most commonly appearing mistakes are listed in the form so that you can just check the box. Look at the suggested options and choose one that relates to your situation. You can also identify a different reason using the “Other (Explain)” option. Note that the second page of the form allows you to list more reasons.

- Add More Information

If any additional details need to be corrected, include them at the end of the section on the designated lines.

- Provide Your Full Contact Details

The next section requires you to print your full name (first, middle, and last), date of birth, address, and telephone number. Note that you need to include your previous addresses if you moved within the past two years.

At the end of the section, provide your social security number and signature.

- Mail the Form

Depending on what agency has made a mistake in the report, send the form to the address. You also have an option to submit it online on their websites.