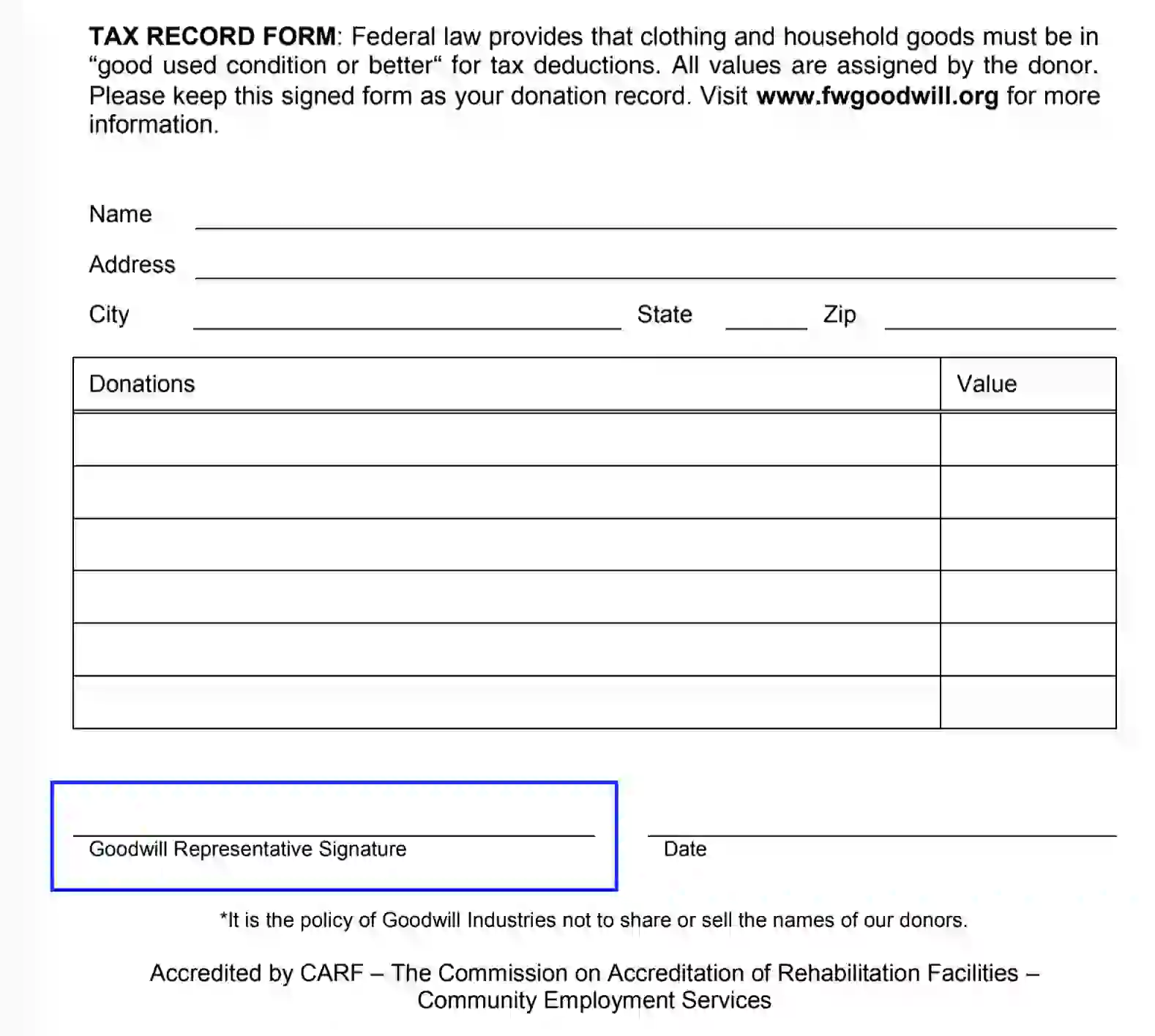

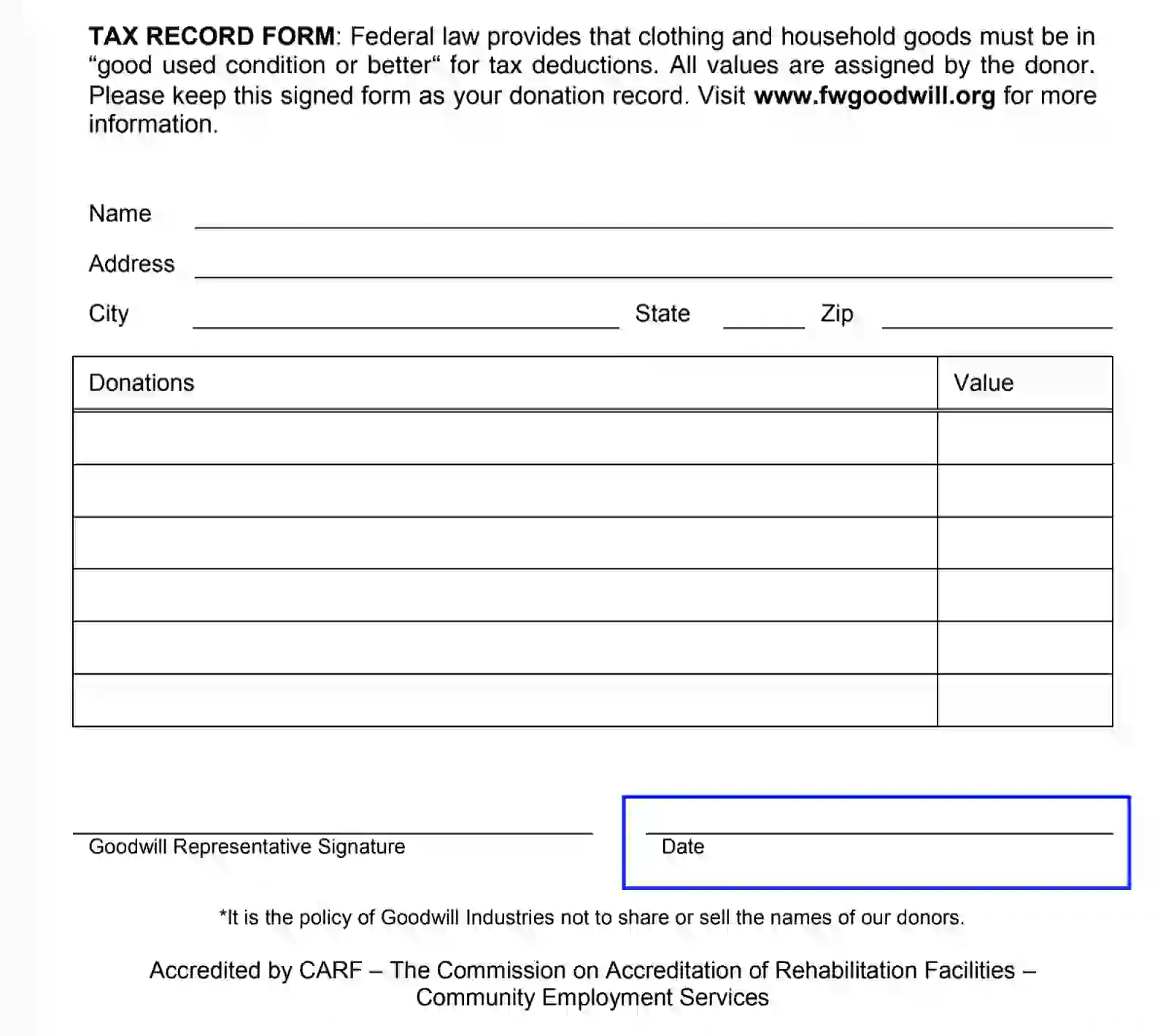

Goodwill Donation Receipt is a document issued by Goodwill Industries to individuals who donate items to their organization. This receipt acknowledges the donation of goods such as clothes, furniture, electronics, and other household items. It typically includes the date of the donation, a description of the items donated, and sometimes the location of the Goodwill store or drop-off point where the donation was made. The receipt does not assign a monetary value to the donated items; it serves as proof that a donation was made.

Keeping this receipt allows donors to substantiate their charitable contributions to the IRS. Moreover, the receipt serves as a record for the donor to track what they have donated over time. For Goodwill, these receipts also help maintain a transparent record of donations received, aiding in their inventory and donation management processes.

Other Financial Forms

Look at various financial PDFs available for editing in our editor. Additionally, keep in mind that it is easy to upload, fill out, and edit any PDF at FormsPal.

Filling Out Goodwill Donation Receipt

This type of tax record form is sufficiently straightforward and intuitive to fill out. We inspire you to use our advanced technologies to build up the required PDF document. The illustrated guide below will help you draft and fill out the Donation Receipt Form effortlessly and quickly.

- Download the Goodwill Donation Receipt

If you decide to donate during working hours, you can ask the Goodwill representative for a relevant receipt template. Still, you can come with a pre-completed document generated via our software tools.

Following the IRS recommendations, the contributor should fill out the form and define the benefaction’s value. The rules and recommendations outlined below will help you do that.

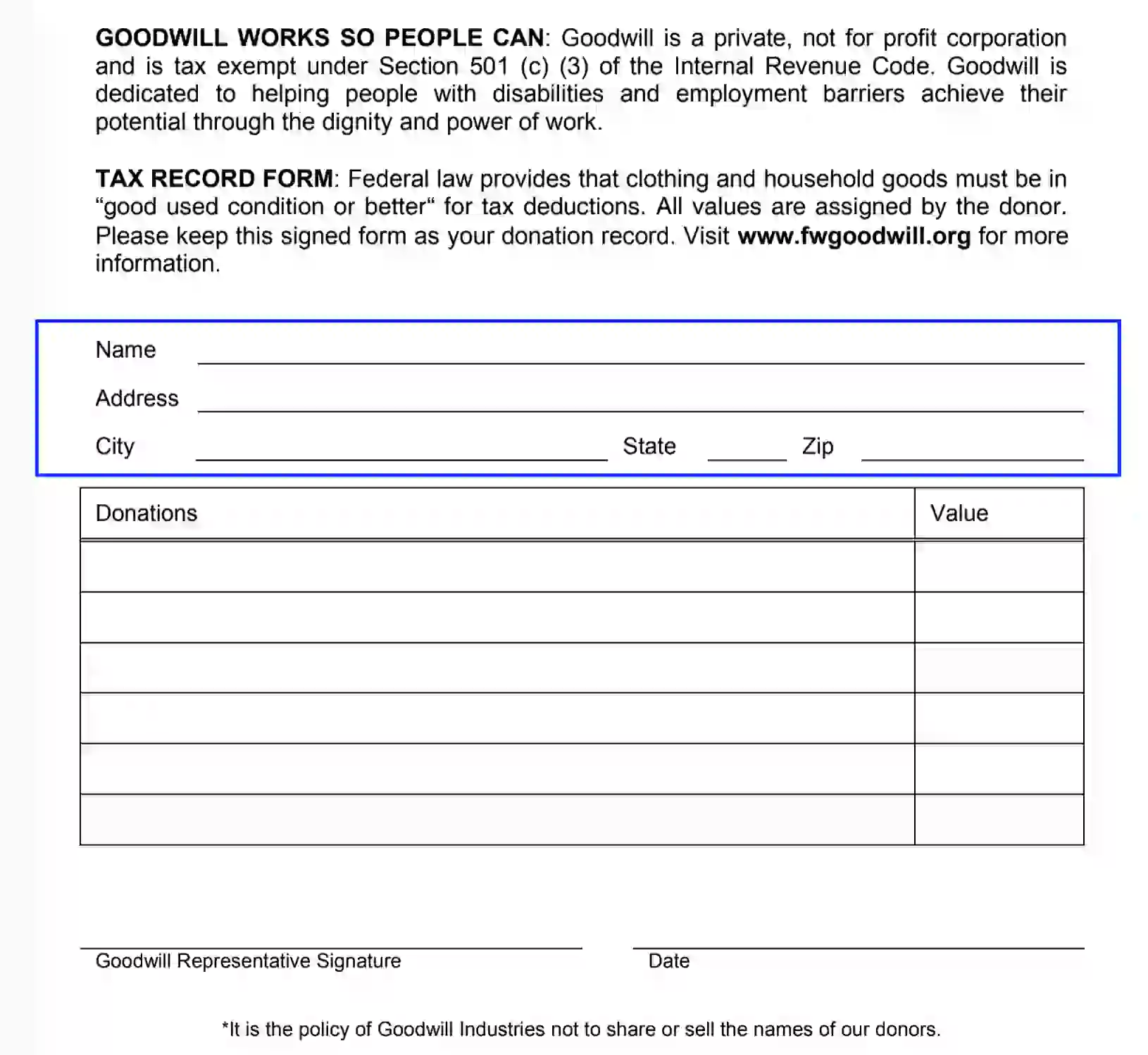

- Introduce the Donor

We suggest you begin completing the Goodwill tax record form by providing your first and last names and mailing addresses. Also, enter the city, domiciliary state, and ZIP code.

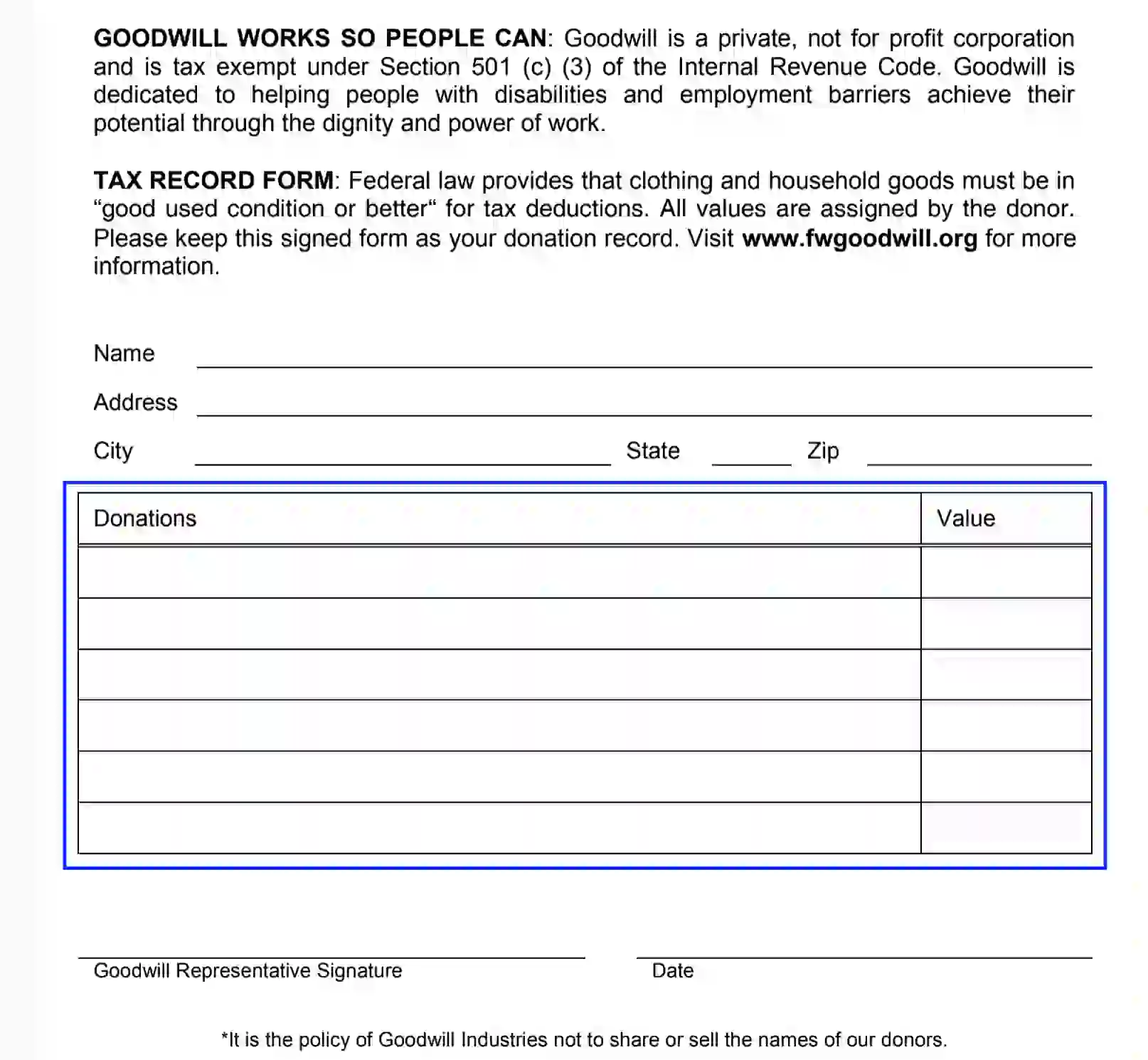

- Enter the Donation Assets

Complete the given table in the following order: list all assets you plan to donate, entering the description and the donation value. It is important not to misuse the items’ value, as the IRS may (and most probably will) carry out inspections.

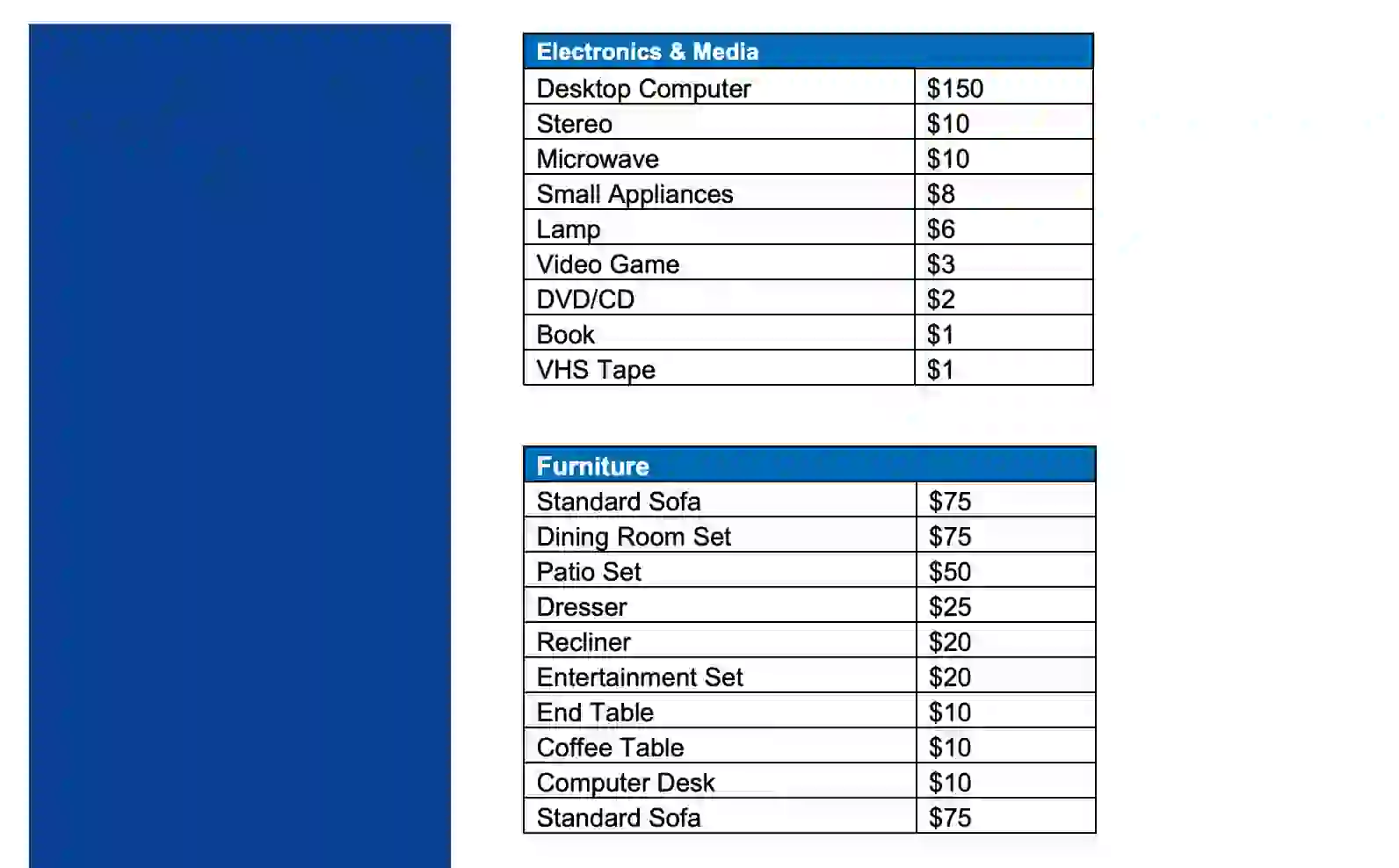

To assist contributors with evaluation, the Goodwill organization offers the Donation Valuation Guide. Here, you can correlate the charity assets with the average fair market price of items sold at Goodwill venues.

You must indicate the assets’ condition to meet the demands of the charity procedure. Please note that all donated items should be at least in “good used condition or better.” Provide the list of expected donation in the following manner:

- Item and its description

- Quantity of the donated items

- Total value in the US dollars

Following the rules described above, an example of your table recording may look like this: 10 New Chairs $40.

- Collect the Goodwill Donation Attendant’s Signature

To authorize the Donation Receipt, you need to collect the Goodwill representative’s signature. No further stamps or acknowledgment are required.

- Date the Document

Complete the receipt form by providing the full current calendar date.

All donors should keep the receipt for personal records, as the papers will be requested by the IRS to prove the lawfulness of the act of charity and estimated value.