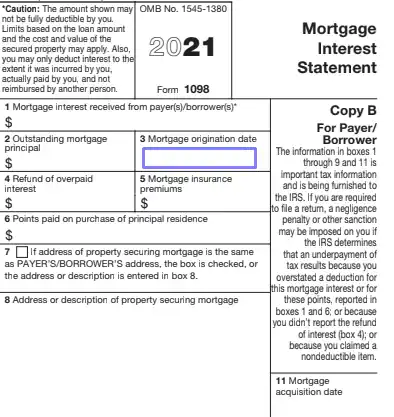

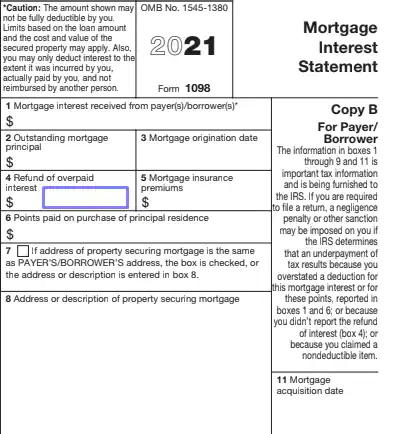

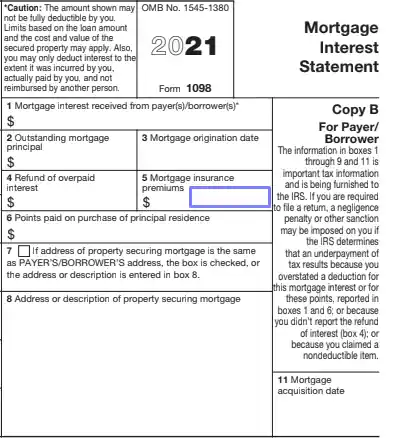

Form 1098 is a tax form used by lenders to report the amount of interest and related expenses paid on a mortgage during the tax year to borrowers and the Internal Revenue Service (IRS). This form is essential for homeowners because it provides the information to claim mortgage interest deductions on their federal income tax returns. By detailing how much interest a borrower paid during the year, Form 1098 helps taxpayers reduce their taxable income, potentially lowering their tax liability. This form may also report other information related to the mortgage, such as real estate taxes paid through escrow and points paid to obtain the mortgage.

Form 1098, titled “Mortgage Interest Statement,” facilitates accurately reporting deductible home mortgage interest. This deduction is significant for many homeowners, making the form an important piece of their annual tax filing. Lenders who receive mortgage interest payments of $600 or more must issue this form to the borrower. For the borrower, receiving Form 1098 simplifies determining how much interest they can deduct, ensuring compliance with tax laws, and maximizing potential tax benefits. This form not only aids in personal tax preparation but also serves as a critical document for the IRS to cross-verify the deductions claimed by taxpayers.

Other IRS Forms for Business

In our database, we have business forms for various types of employers and financial situations. Check some other IRS forms that are commonly used by other employers.

How to Fill Out the Form

Filling out this form might seem complicated at first glance. But no worries: we are here for you to help and show you how to make your own record quickly. Continue reading to understand how it works.

- Get the Template

As we have told you before, the proper template is essential, and if you have lost or damaged yours, you can get it from our website.

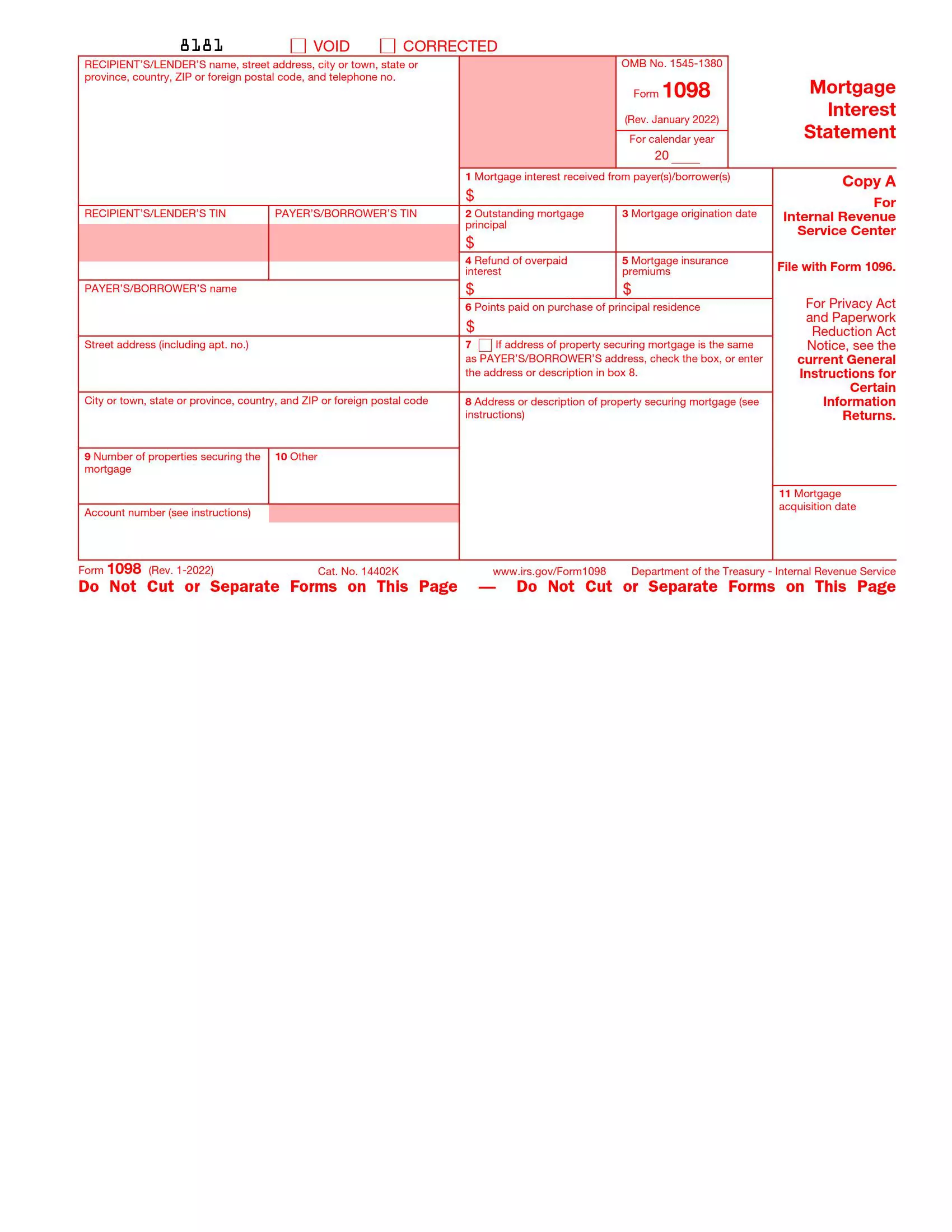

- Skip the “Copy A” Section

The “Copy A” section printed in red ink should be skipped by signatories. They do not have to include this page in the form and file it.

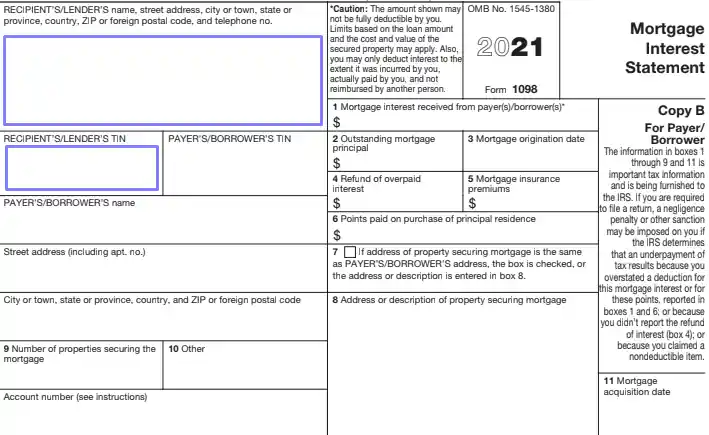

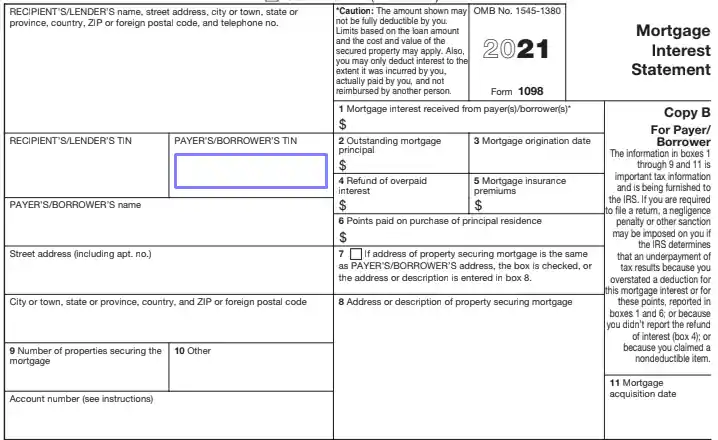

You should proceed to the next page where the “Copy B” section is included and start filling out the offered chart.

- Add the Lender’s Data

If you fill out the template given to you by your lender, skip this step because they should have completed the designated blank boxes by themselves. If you prepare the form fully by yourself, ask for the needed info: full address, phone number, and name. Then, insert their TIN (or tax identification number).

- Write Your TIN

Your TIN also should be included. Add it to the suitable blank box.

- Insert Your Name and Address

You have to introduce yourself as a payer and indicate your full address, too. If the lender has given you an account number that distinguishes you from other borrowers, insert this number as well.

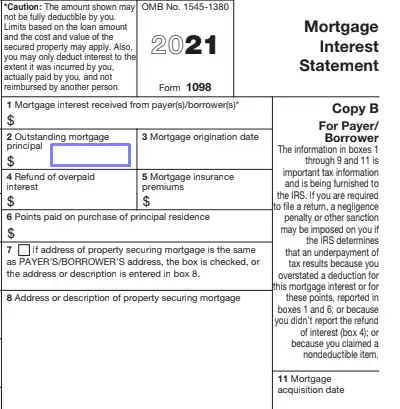

- Specify the Paid Interest

Then, proceed to the right-hand side of the form and insert how much you have paid to the lender as interest.

- State How Much Is Left to Pay

Next, write the amount you still should pay to the lender.

- Add the Date When You Received the Mortgage

This date is also called the “origination” date. Write the date in the relevant blank box.

- Answer If There Was a Refund

If you have paid more interest money than needed, and some of it were returned, write the sum in this blank field.

- Insert Premiums

In case you also pay insurance premiums for your mortgage, write the sums here.

- Write Spent Points (If Any)

If you have paid with any points for your current place of living, enter the sum here. They might be deducted by payers later. For more information, check Publication 936 issued by the IRS.

- Write the Address of the Property That Secures Your Mortgage

If this is the same address as your principal property has, put a tick in an empty designated box. If not, include another address in the following box. Then, indicate how many real estate pieces secure the mortgage. The lender also has to fill out the “Other” blank field and add the date when they acquired the mortgage (if needed).

- Duplicate the Stated Information

There is a “Copy C” section that comes after a “Copy B” section that you have just filled out. Duplicate all the info you have added to the template.

When you have finished working on your record, remember to go through the paper again and read everything again. You have to ensure that the information you add is truthful and correct. If public authorities somehow discover that you have reported the wrong data, you may be penalized.

After the template is filled out and everything is checked several times, return the document to the lender, so they submit it to the IRS. You, as a payer, do not have to deliver the form to the public authorities: the creditor should do it.

If you are the lender who wonders how to send the form, you can do it by either regular mail or a digital system of the IRS (also called the “e-file”). The deadline is normally the last day of February (depends on the year) if you file via regular mail or March 31 if the form is submitted digitally.