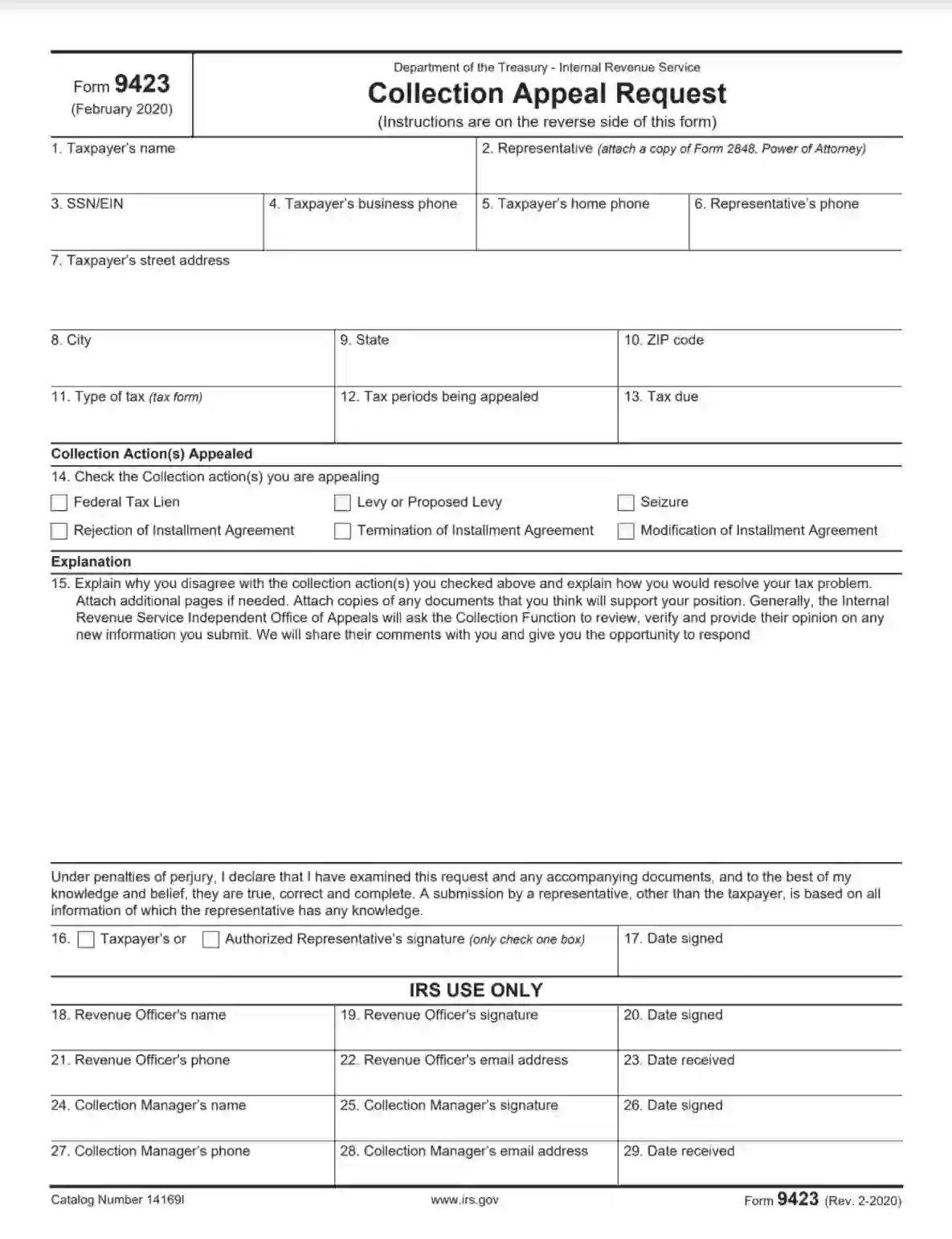

Form 9423 is a document used by the IRS titled “Collection Appeal Request.” This form allows taxpayers to request an appeals conference or hearing in response to certain actions taken by the IRS. The form is part of the Collection Appeals Program (CAP), which allows taxpayers to challenge and appeal various collection actions, including liens, levies, seizures, and denial or termination of installment agreements.

The purpose of Form 9423 is to ensure that taxpayers have a method to seek review and resolution of disputes related to IRS collection processes. By submitting this form, taxpayers can argue against the IRS’s proposed actions before they are implemented, allowing for reconsidering decisions that might adversely affect their financial situation.

How to Fill out the Form

If you have decided to use CAP, you need to fill out a form. We invite you to use our form-building software to optimize the process. Also, below you will find our illustrated step-by-step guide to completing the application.

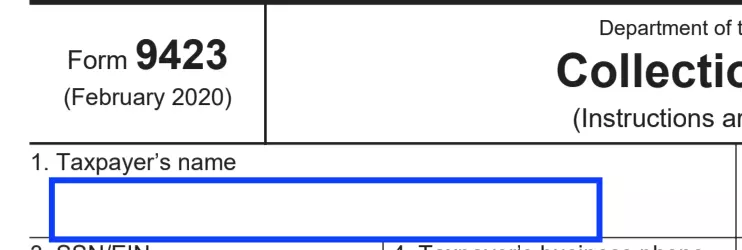

Identify the Taxpayer

Include the full name of the person filing the appeal.

Appoint a Representative

If you do not plan to negotiate with the officer yourself, then enter the name of your authorized representative. In this case, you must also provide Form 2848.

If you do not have a representative, please cross this paragraph.

Provide SSN and EIN

Enter your details:

- SSN

- EIN

Provide Phone Numbers

All required phone numbers must be specified. If you have a representative, also include their number. In this case, your numbers should also be indicated.

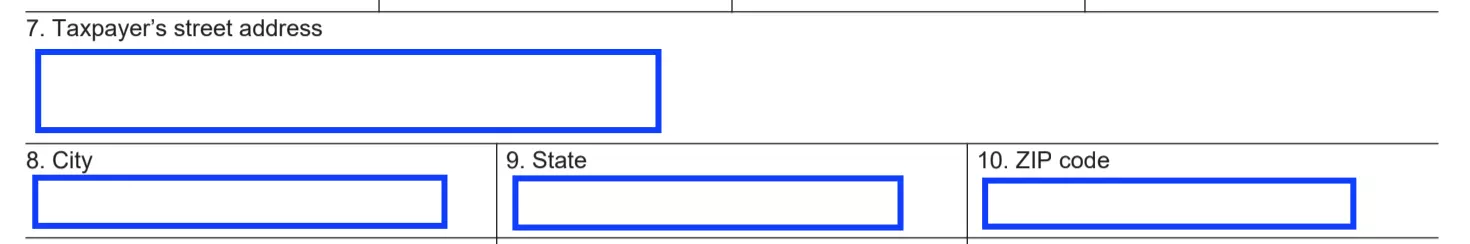

Enter the Address

Indicate the address of the taxpayer by entering in the appropriate columns:

- Street

- City

- State

- ZIP code

Give Tax Details

You should write:

- Tax form

- Tax periods being appealed

- Tax due

Select the Contested Action

You need to check the box next to the action you are going to appeal. You can choose several options. During the appeal period, these actions are usually suspended pending a decision.

Give an Explanation

Give a detailed explanation of the situation. Write not only why you disagree but also how you see the solution to the problem.

If you do not have enough space in paragraph 15, the good decision is to attach additional pages.

Your explanation will be reviewed, and a decision will be made.

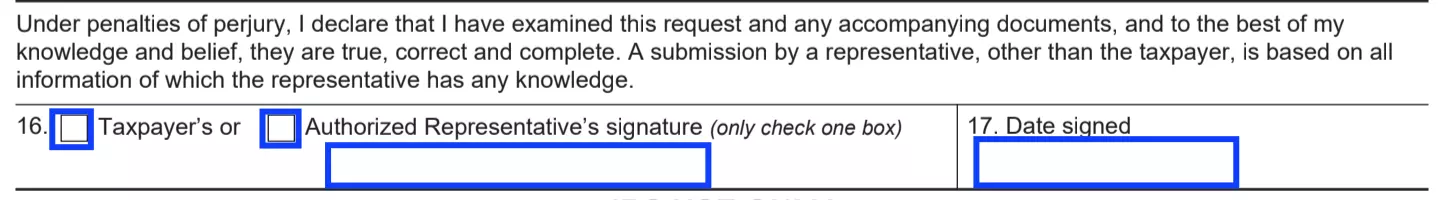

Sign the Document

The document must be signed by either you or your representative. Check the appropriate box, sign and date the paper.

Submit the Form

Submit the form to the Collection office as soon as possible. It must be received or at least postmarked within three business days of the conference with the manager.

Wait for the Decision

In most cases, a decision is made within five days from the time of submitting the application, after telephone conversations with you or your representatives. Although the decision cannot be appealed in court, there is the possibility of challenging the illegal fee. To do this, the third person must apply to the district court.