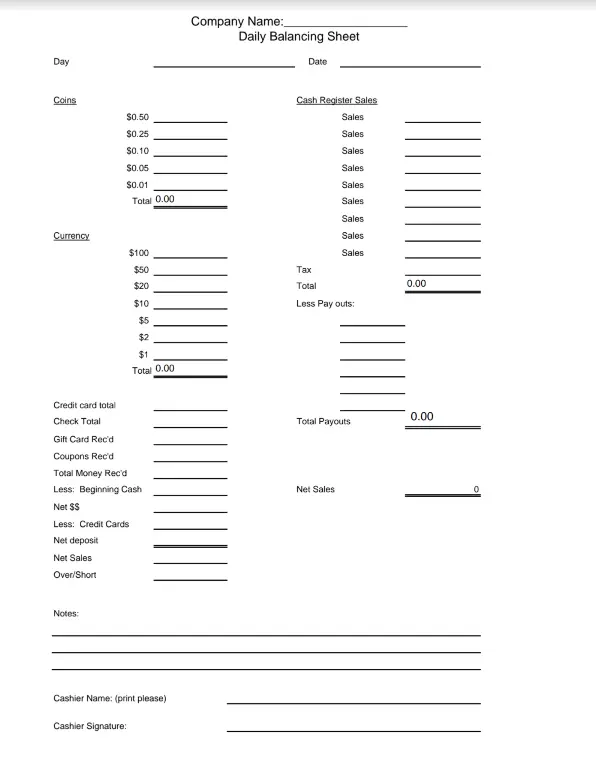

A Cash Drawer Count Sheet is a financial tool businesses use to record and tally the amount of cash in a register at the start and end of a trading day. This form helps track all currency denominations, including coins and notes, and often sections for checks and credit card transactions. It provides a systematic way to ensure that the cash totals match the sales recorded on the register, helping to identify discrepancies and maintain accuracy in daily financial reporting.

This count sheet provides a clear and accountable method for managing cash flow into and out of a business. It is used as an internal control measure to prevent theft, errors, and mismanagement of funds.

Other Financial Forms

Take a look at some other financial PDFs available for editing via our tool. Besides that, do not forget that you may upload, fill out, and edit any PDF document at FormsPal.

How to Keep Cash Records

Any business requires different solutions and cash register management. It all depends on the scope of your business, its scale, and development. However, every business needs to know a step-by-step plan for maintaining a cash drawer.

Get the POS Report Template

Before starting cash accounting, you need to get and print out a POS report template. This tool allows you to anticipate your entire budget and balance in advance. Create this document by the criteria for conducting transactions. Do not forget to specify the company’s name, the date, and the exact day.

Gather Data on Cash Counting

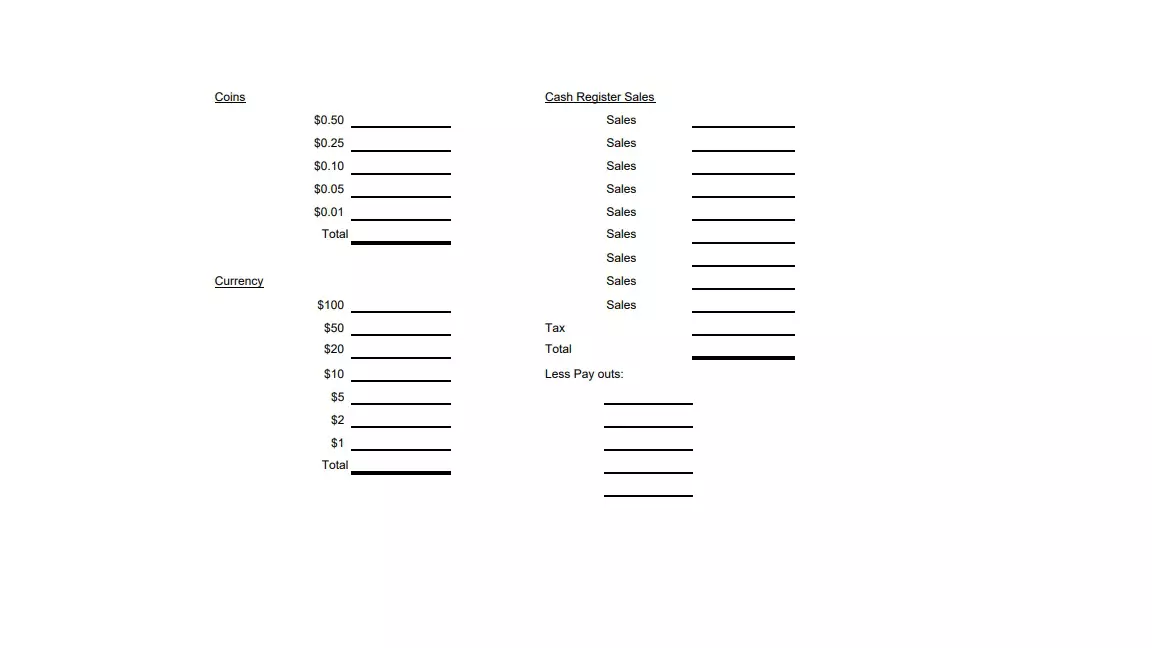

Usually, after the shift closes, employees have to do a cash count. At the beginning of each day, there is a generated register, where all the data about cash is entered. It ensures that you have enough money to give a change to your customers.

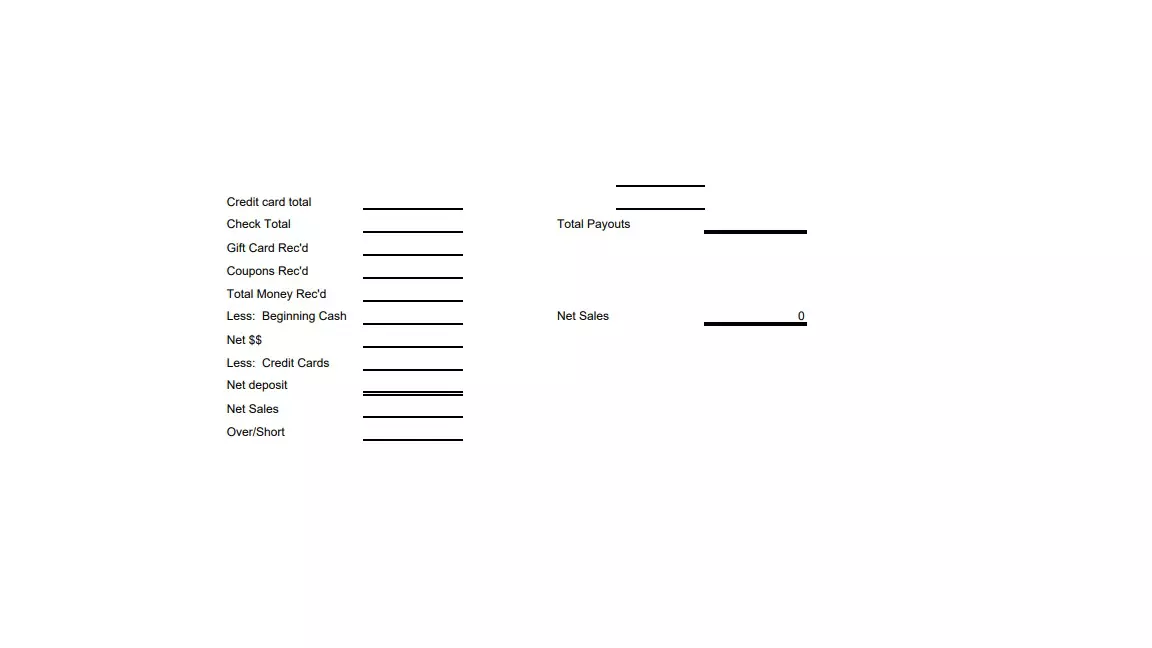

Count the money on all receipts, checks, and cards so that there is no confusion. To make the process less tedious, consider investing in a counting machine. Don’t forget to deduct your starting balance from your current one. In the end, all amounts must match your online system.

By the way, this report consists of the following columns:

- Coins

- Currency

- Sale

Write down the final amount. If you are missing some money, count again. If you keep this result, it is better to contact your boss.

Enter the Discrepancy Amount

Most discrepancies are caused by human factors, such as incorrect customer calculations.

Most often, such cases occur when money is lost or when it is stolen. In any case, if it is not a significant amount of money, do not worry. If you try to resolve the discrepancies, follow these steps:

- Recalculate all means, checks, and receipts

- View all transactions

- View transactions by bank

The cash report includes information about all online payments. Specify all data, all amounts, and expenses.

Sign the Report

After counting all the money, be sure to specify your last name and first name, position, and sign it. In general, this is a simple procedure where only minimal knowledge is required. There is also a special column for notes where you can specify additional information about closing the cash register.

Remember that in some companies, you may be liable for loss of money and even theft. Therefore, do not neglect your knowledge and responsibilities, not to find yourself in a force majeure situation.