Free Idaho Durable Power of Attorney Form

The Idaho durable power of attorney allows you to designate someone you trust (called an agent) to handle your financial affairs if you become incapacitated and cannot decide for yourself. The main advantage of a durable power of attorney is that it remains valid even after you become incapacitated, unlike a regular power of attorney that terminates upon your incapacity.

A durable power of attorney solely deals with your financial affairs, granting your agent the authority to handle your bank accounts, investments, real estate, and other financial assets. It does not extend to healthcare decisions. If you wish to designate someone to make healthcare choices on your behalf in case of incapacity, you’ll need other Idaho POA forms.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Idaho Signing Requirements and Laws

Under Idaho Statutes § 15-12-105, the principal must sign the durable power of attorney document or direct another individual to sign it in the principal’s presence and on their behalf. This signing must be done voluntarily and without coercion, and the principal must be competent and understand the nature and implications of the document at the time of signing.

Additionally, the document must be witnessed by a notary public to fulfill the state’s legal requirements. This notarization confirms the identity of the signer and their voluntary execution of the document. While Idaho law does not mandate the presence of additional witnesses apart from the notary, involving one or two disinterested witnesses can strengthen the enforceability of the document, especially in cases where the POA’s validity might later be contested.

Once properly executed, the durable power of attorney becomes an effective legal tool, allowing the agent to act on the principal’s behalf. Both the principal and the agent need to understand the extent of powers granted in the document. Here are the conditions under which a power of attorney terminates:

- The principal’s death,

- The principal’s incapacitation (if the POA is not durable),

- Revocation by the principal,

- Fulfillment of its purpose,

- Termination stipulated within the document.

Under Idaho Statutes Section 15-12-110, an agent’s authority also ends if revoked by the principal or if the agent dies, becomes incapacitated, resigns, or upon dissolution of marriage to the principal (unless specified otherwise in the POA).

Idaho Durable Power of Attorney Form Details

| Document Name | Idaho Durable Power of Attorney Form |

| Other Names | Idaho Financial Durable Power of Attorney, ID DPOA |

| Relevant Laws | Idaho Statutes, Section 15-12-105 |

| Signing Requirements | Notary Public |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 37 |

| Available Formats | Adobe PDF |

Popular Local Durable POA Forms

Durable POA documents are used in each and every state. Take a look at other popular DPOA forms frequently filled out by Americans.

Steps to Complete the Form

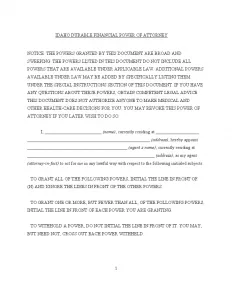

Filling out the Idaho durable power of attorney allows you to appoint someone as your agent, who will have the authority to act on your behalf regarding financial decisions. Here is a step-by-step guide to completing this form.

1. Designation of Agent

Fill in your full name at the top of the “Designation of Agent” section. Name the individual you appoint as your agent, providing their full name, complete address, and phone number. If a successor agent is necessary, supply their details similarly.

2. Grant of General Authority

Initial next to each financial category under “Grant of General Authority” for which you wish to grant your agent authority. These categories include assets like Real Property, Tangible Personal Property, Stocks, and Bonds, among others. If you want to give comprehensive powers across all categories, initial “All Preceding Subjects.”

3. Grant of Specific Authority (Optional)

Consider if you wish to grant specific authorities that can significantly affect your estate, such as making gifts or changing beneficiary designations. Initial next to each specific authority you choose to grant.

4. Special Instructions (Optional)

Use the “Special Instructions” section to provide further guidelines or restrictions on the powers granted to your agent.

5. Effective Date

Choose the durability type of the power of attorney by marking the appropriate box — Durable, Durable with Expiration Date, or Springing Durable. If selecting the second option, specify the expiration date.

6. Nomination of Conservator (Optional)

If appointing a conservator of your estate is necessary, enter the nominee’s name, address, and phone number in the designated area.

7. Signature and Acknowledgment

Sign and date the document in front of a notary public, and ensure that you print your name, address, and phone number below your signature. The notary public must complete their section to notarize the form properly.

Ensure that your agent, successor agent, and relevant financial institutions or entities receive copies of the completed and signed form.

Listed here are various other Idaho documents filled out by our users. Try our step-by-step builder to customize these forms to your needs.

Download a Free Idaho Durable Power of Attorney Form