Indiana Bill of Sale Form

Indiana bill of sale is a document used in private transactions within the state where the parties, a buyer and a seller, agree to transfer ownership to a particular personal property (motor vehicle, animal, equipment, etc.). The bill of sale form is used to prove ownership transfer and to protect both the buyer and seller.

As well as the necessary information on different bills of sale, you will find the State Form 44237 provided by the Indiana Bureau of Motor Vehicles, used in transactions involving vehicles and vessels. With our builder, you can get a completed form in no time.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | Indiana Vehicle Bill of Sale Form |

| Other Names | Indiana Car Bill of Sale, Indiana Automobile Bill of Sale |

| DMV | Indiana Bureau of Motor Vehicles |

| Vehicle Registration Fee | $21.35 |

| Bill of Sale Required? | No |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 26 |

Indiana Bill of Sale Forms by Type

As we have mentioned, bills of sale differ depending on the type of sale. This is why it is prudent to look through the forms that fit your needs before filling out any documents. There are various bills of sale, such as those used when selling cars, watercraft, and weapons. Some Indiana bills of sale must be completed before a notary public before they become enforceable.

Indiana vehicle bill of sale form is required by the IN BMV and is used in the vehicle titling and registration process. You must register your motor vehicle within 30 days of purchase or 60 days after moving to the state. The vehicle registration will cost you around $25; other fees and sales tax might be applied.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | ⇒ PDF Template ⇒ Form 44237 |

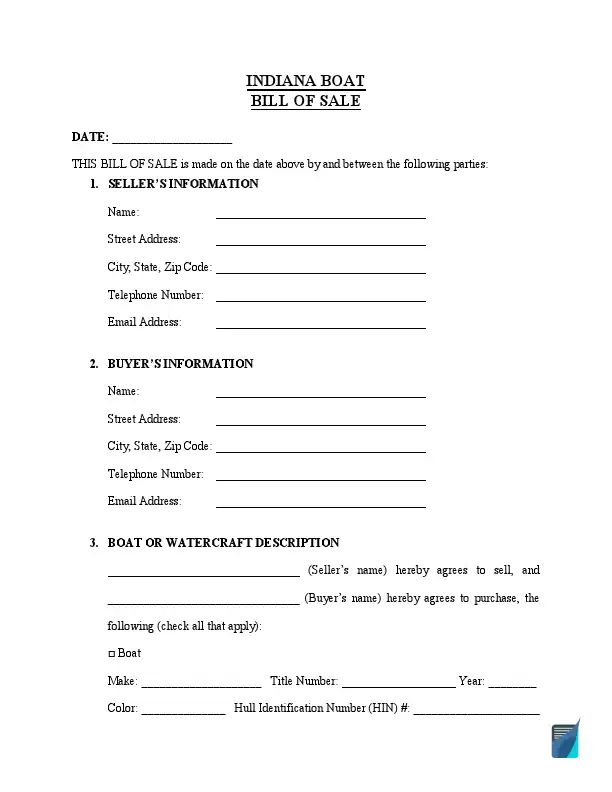

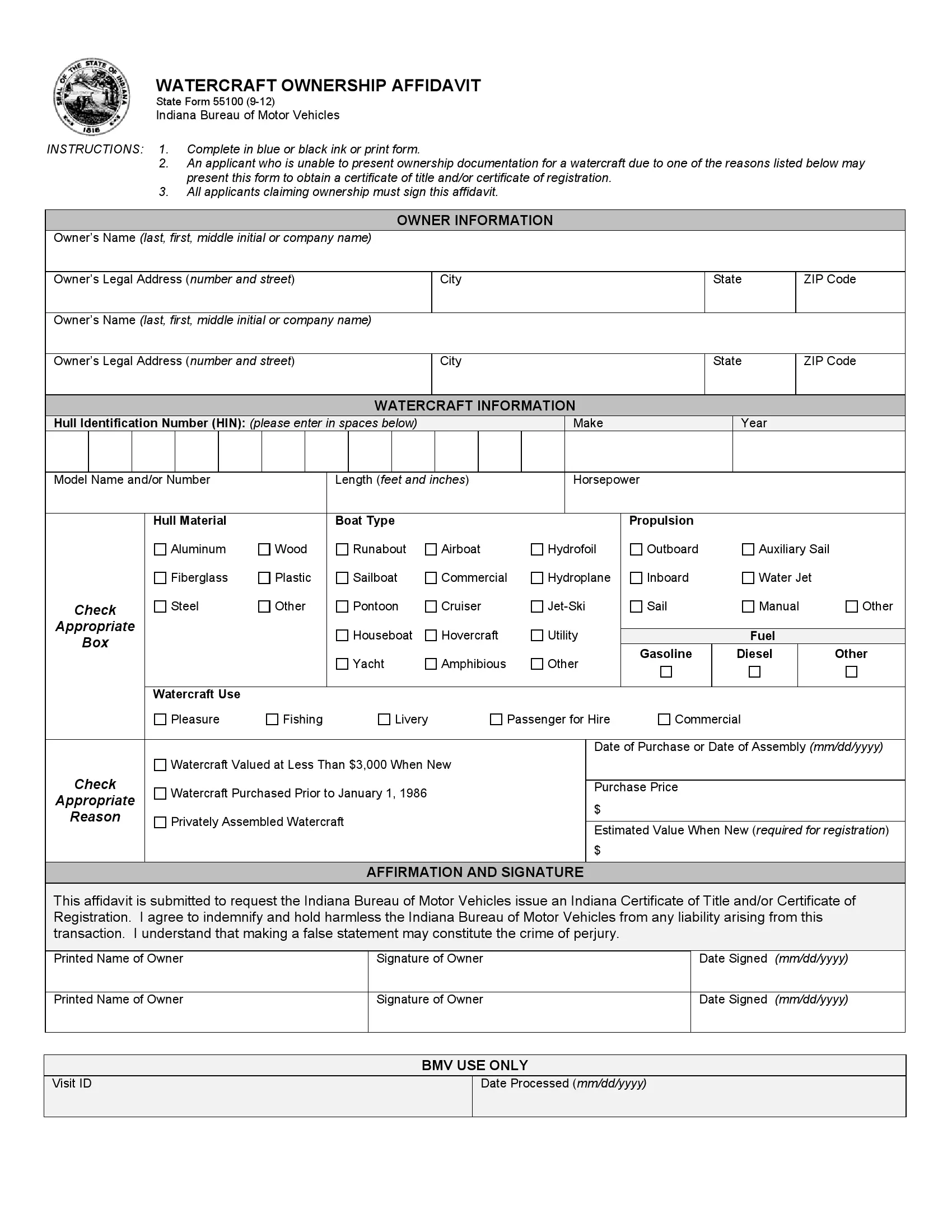

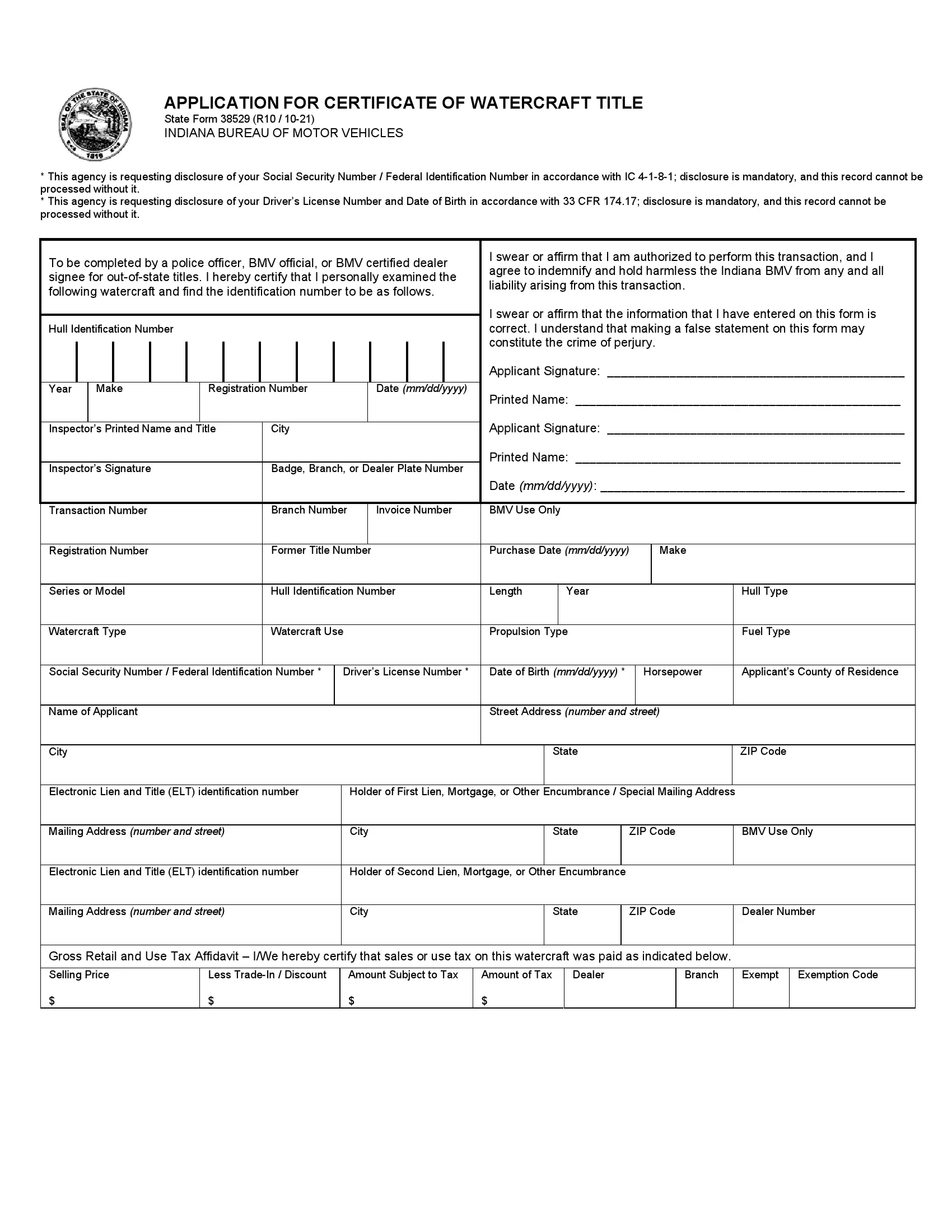

Indiana boat bill of sale helps record the state’s sale and purchase of watercraft. Indiana laws require all vessels powered by motors, including electric trolling motors, to be documented in the state registry. New boat owners have 45 days to register their boats; new state residents transferring a vessel from another state have 60 days. The registration should be renewed once a year.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | ⇒ PDF Template ⇒ Form 44237 |

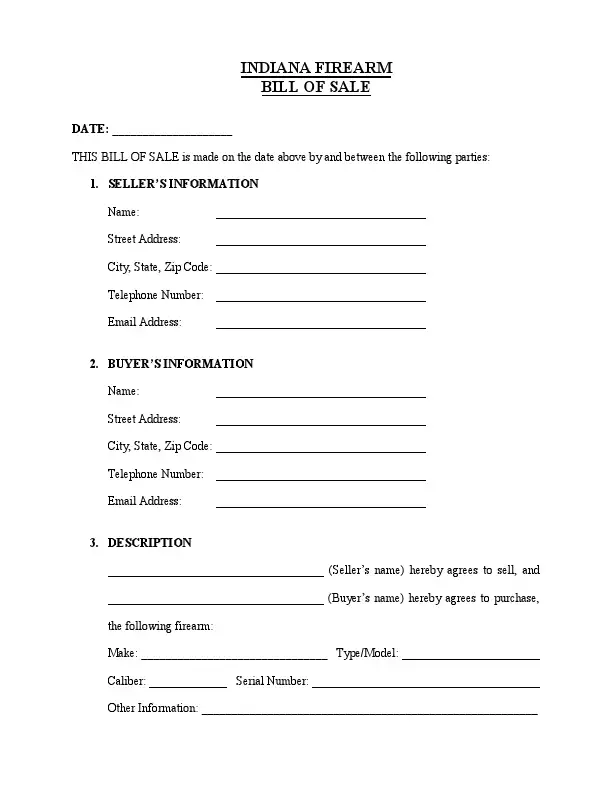

A firearm bill of sale is needed if you plan to purchase or sell a firearm in Indiana legally. No specific laws in the State of Indiana set the requirement for the registration of guns. Considering there is no firearms registry in Indiana, you also don’t have to register the change of gun ownership. Also, it is lawful for residents with an Indiana License to Carry a Handgun (LCH) and non-residents with any valid state license to carry.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

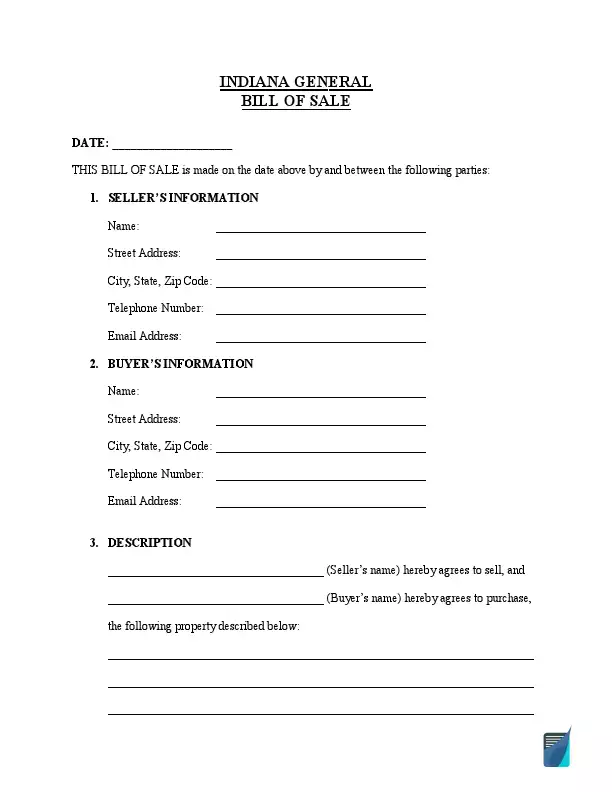

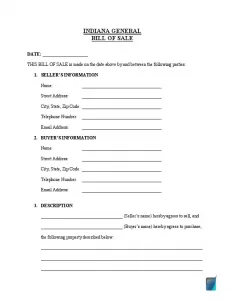

A general bill of sale in Indiana can be used for all types of personal property that can be sold and purchased. This template contains sections for the parties’ contact information, property description, selling price, and signatures. However, transactions involving vehicles and boats are better to be detailed in a specialized form.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

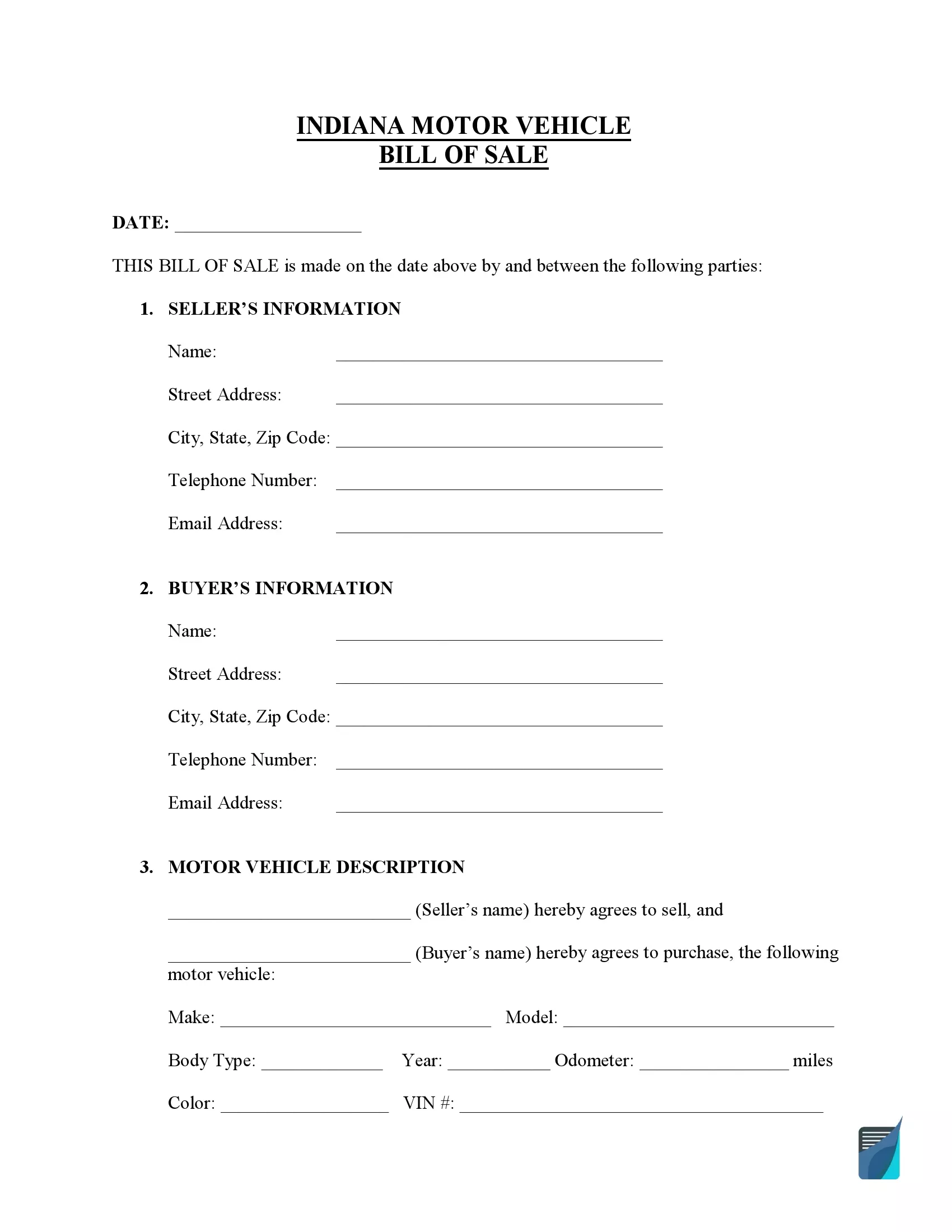

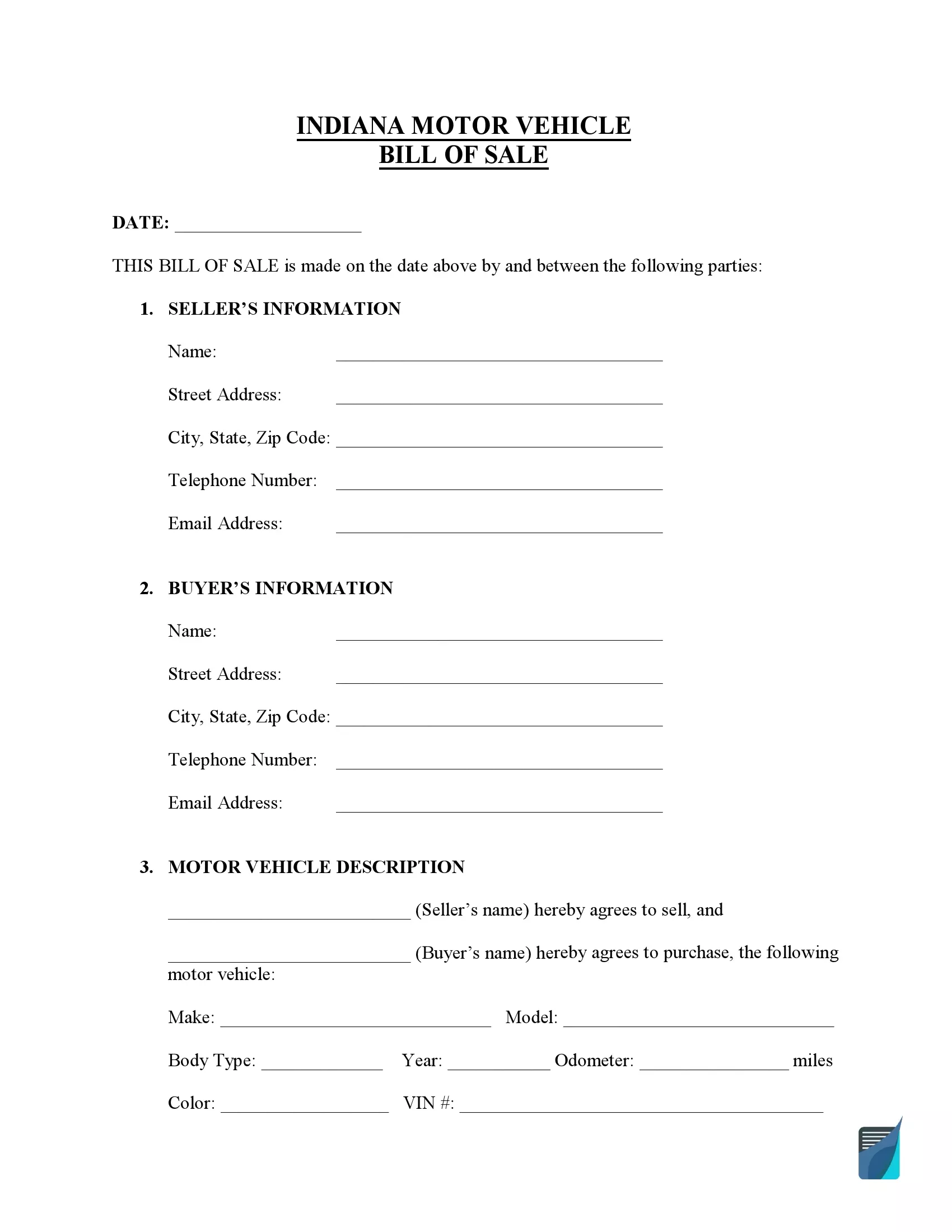

How to Write an IN Vehicle Bill of Sale

When transferring ownership of a car in a private transaction, a bill of sale is required. Indiana motor vehicle bill of sale is a legally binding document that vehicle sellers and buyers fill out as proof of transaction. Indiana laws don’t require notarizing the document, but it will provide additional protection for the parties.

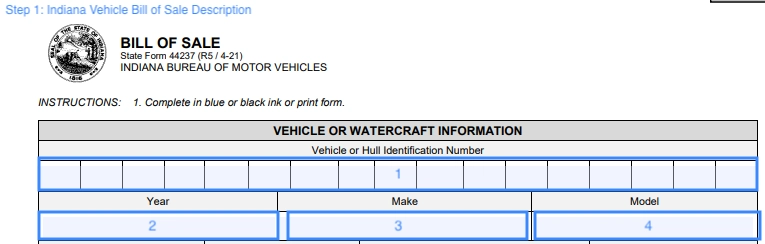

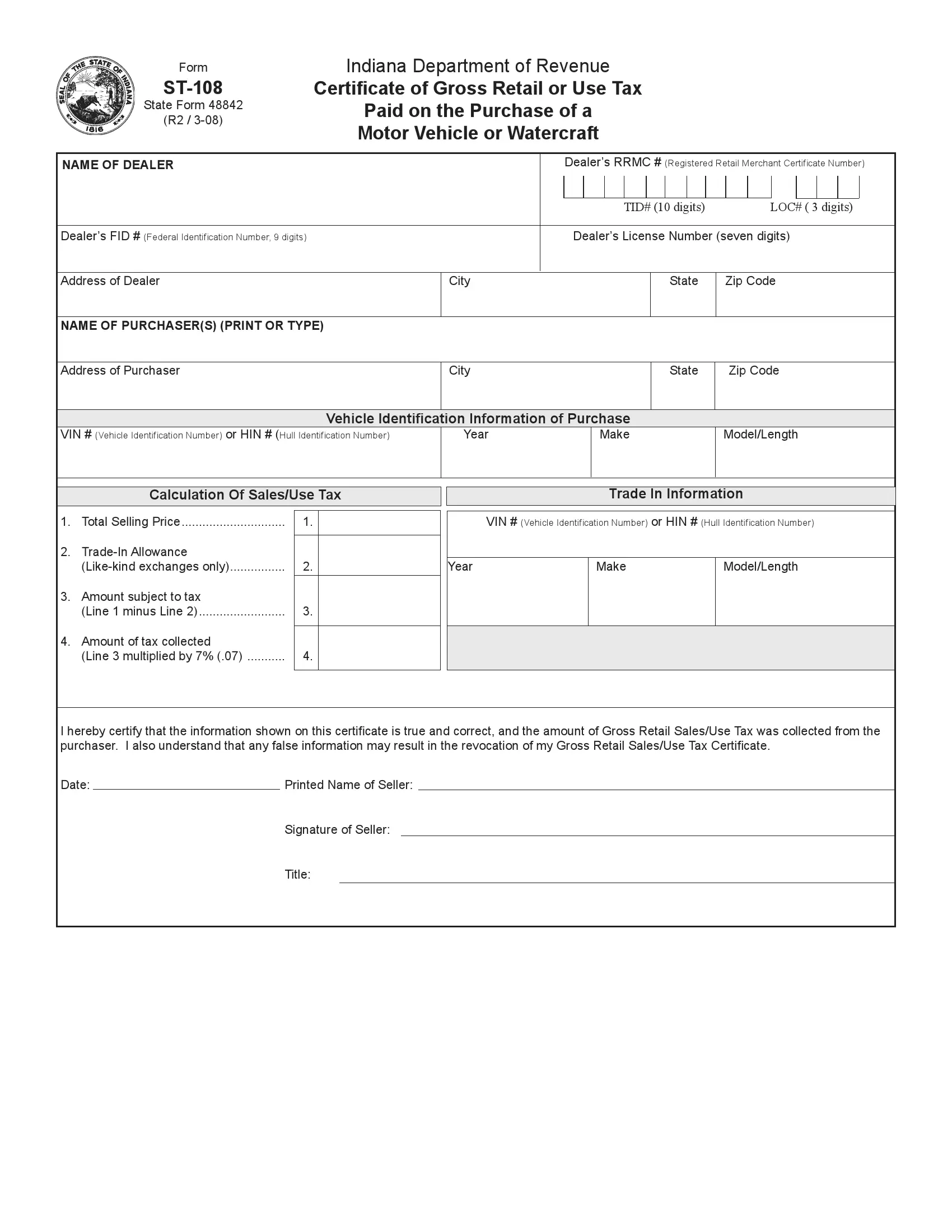

Form 44237 is the official bill of sale form authorized in Indiana for vehicle and vessel title transfers. You can use either a customizable template or a uniform one. Here is a step-by-step guide to help you fill it out within minutes.

Step 1: Enter the vehicle’s details

The first step is to enter the details regarding your vehicle. You will have to type in the following:

- Vehicle Identification Number (VIN)

- Year of manufacture

- Make

- Model

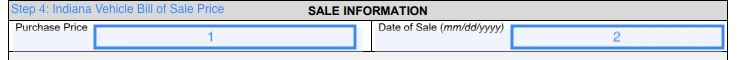

Step 2: Type in the vehicle price and date of the transaction

Next, you are required to specify the vehicle’s purchase price and the date of the transaction.

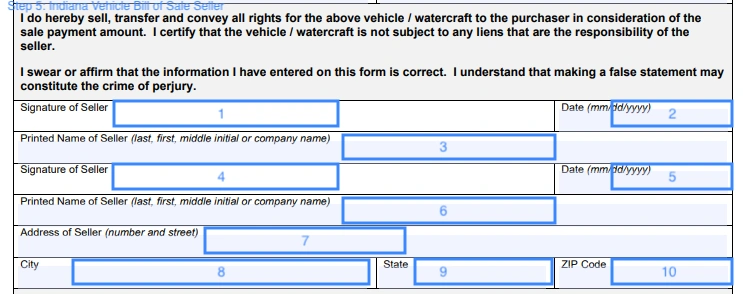

Step 3: Identify the seller

In this section, the seller provides their contact information, writes down the date, and signs the document to certify their will to transfer the vehicle title to another person for money exchange. The seller’s contact details include:

- Full name

- Street address

- City

- State

- Zip code

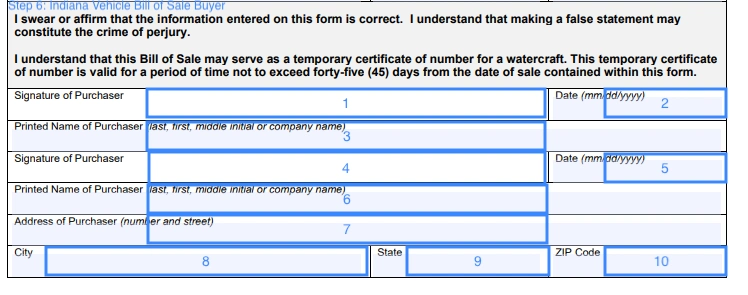

Step 4: Identify the purchaser

Both the buyer and seller must sign the form. The purchaser signs a document to affirm that they are aware of the information provided in the form and ready to register the vehicle within 45 days after the purchase. The bill of sale form will act as a temporary certificate during that period.

If you want to make sure nobody doubts the credibility of the bill of sale form, you can opt for having a public notary certificate.

Registering a Vehicle in Indiana

Registering a vehicle in Indiana is easy if you follow the laid-down procedures. The law gives you 60 days to register the vehicle and get license plates if you recently moved to Indiana. Otherwise, you will be breaching the state’s motor vehicle laws. The previous owner must provide the Certificate of Title for the purchaser to be able to register their newly acquired vehicle after both parties have completed other necessary documents.

You must present yourself personally in any IN BMV offices across the state. However, the state allows online motor vehicle registration if you meet some conditions. For example, you should provide all essential documentation and complete the process in 45 days. After this period ends, you must present yourself at the vehicle department offices. You should also supply all the title details of your driver’s license and pay the registration fee. When appearing at the offices, you should supply the following registration forms:

- Your driver’s license;

- The vehicle’s original title duly signed by the vendor;

- If the vehicle’s title is not in your name, it’s mandatory to have extra documentation to facilitate the titling, such as:

- A mortgage or lease agreement to prove where you reside;

- Completed vehicle bill of sale template;

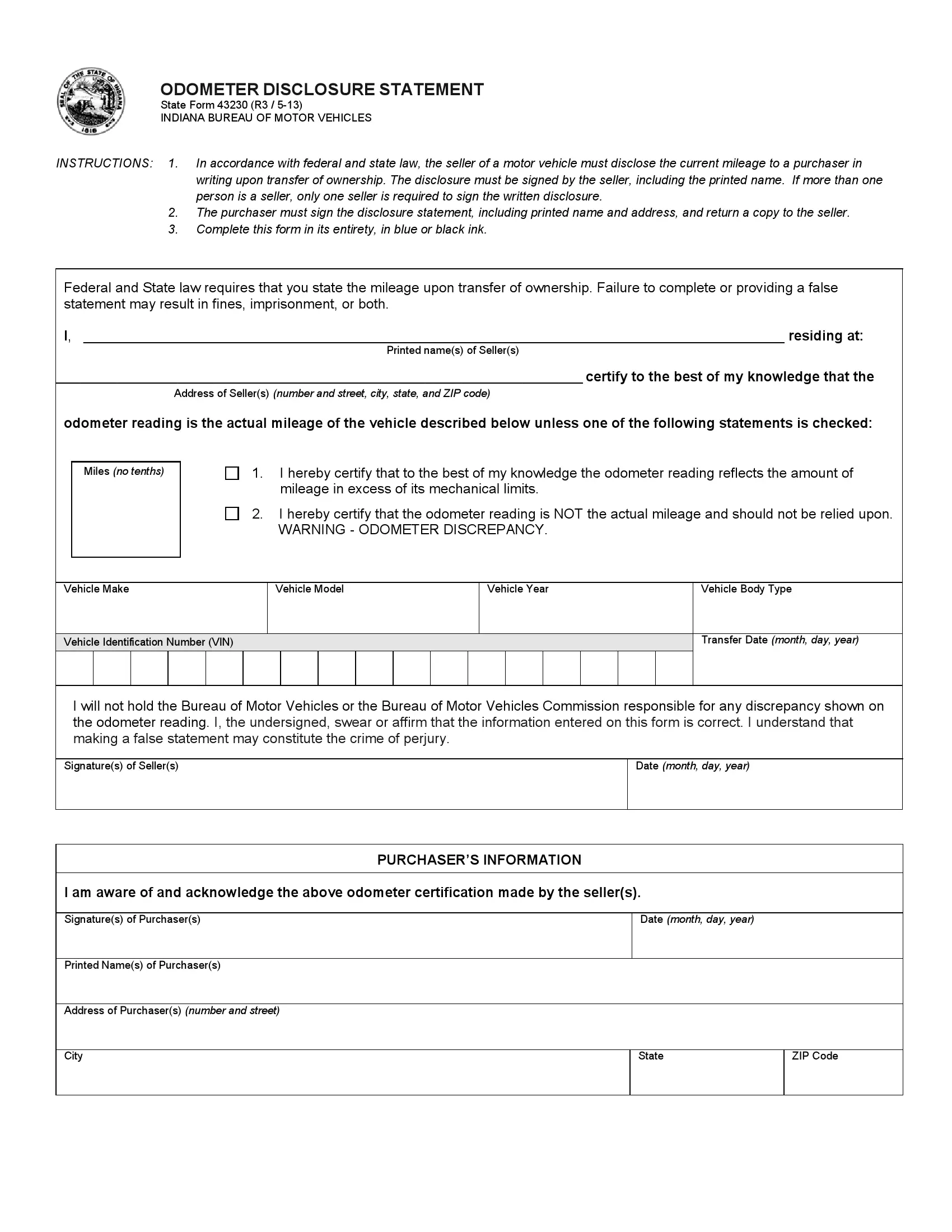

- Odometer disclosure statement showing the motor vehicle’s actual mileage;

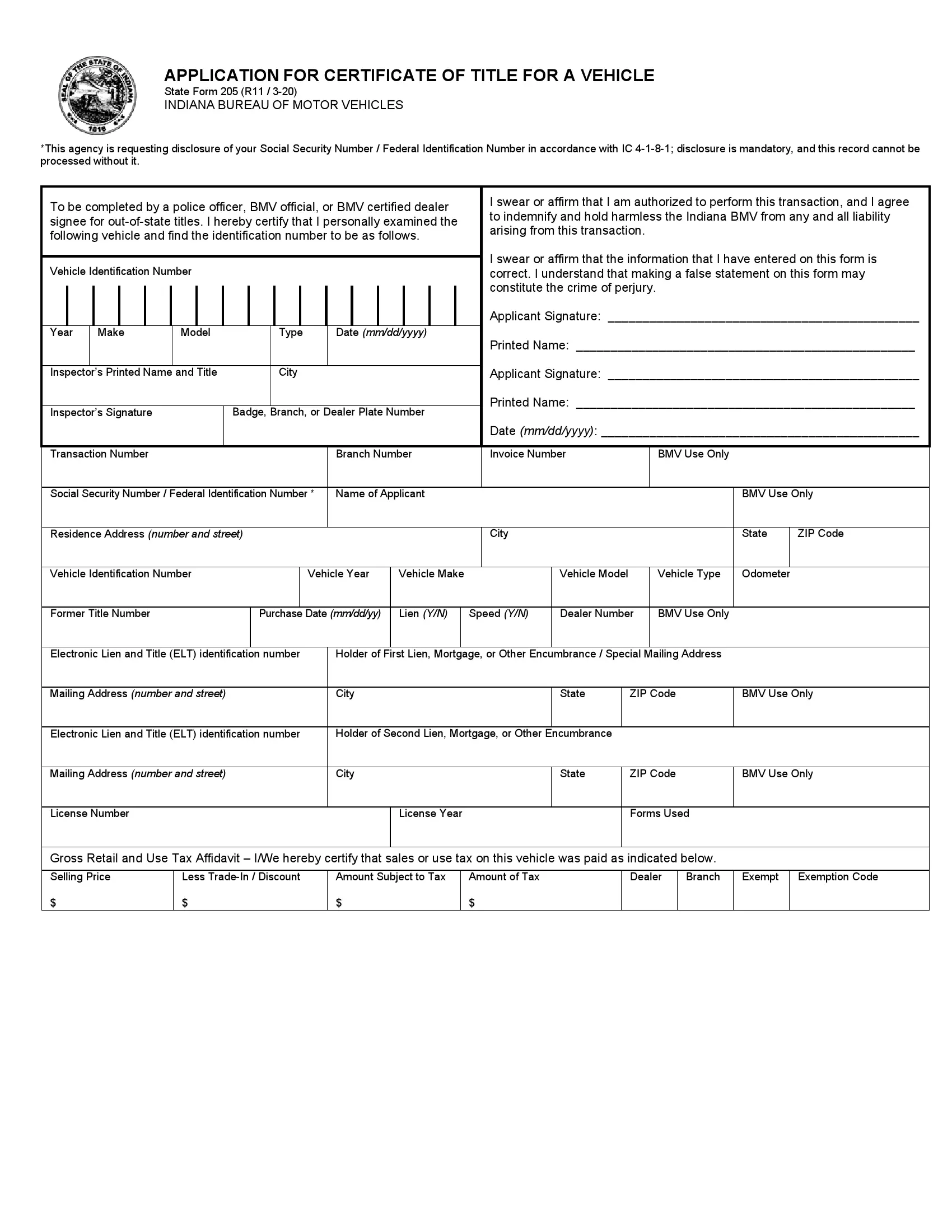

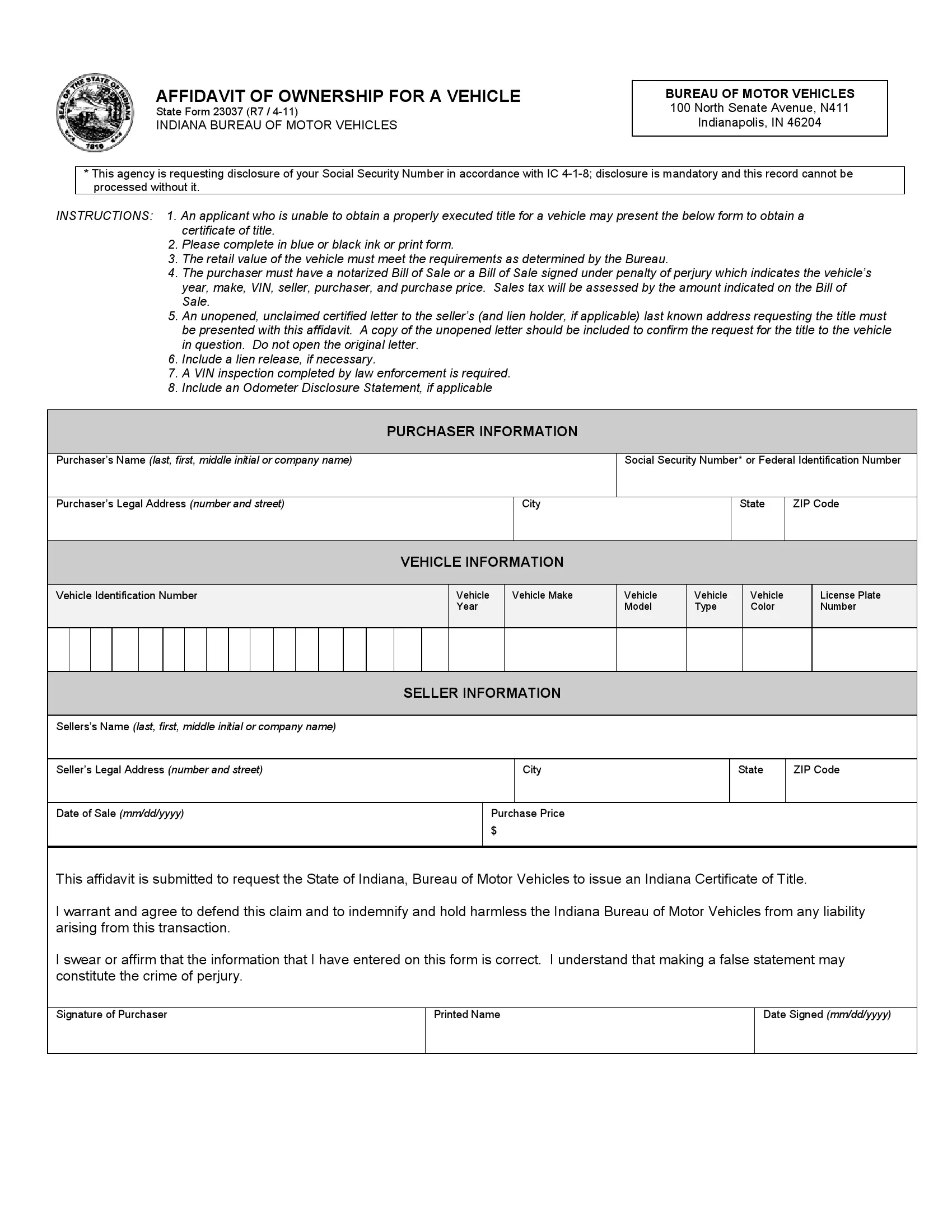

- A duly prepared Application for Certificate of Title (Form 44049);

- If the vehicle has a lien, it’s mandatory to supply the lien’s release;

- Provision of an agreement proving that you are paying for the vehicle (if you are).

If you want to register a motor vehicle personally, the process will take 31 days. You can’t drive a motor vehicle in the state during this period, regardless of whether you buy it from a dealer or an individual. Remember, it’s only mandatory to register your vehicle in person if it passes more than 60 days from its purchase date.

If you exceed the laid-down 60-day deadline, you should visit the nearest BMV with the following:

- Notarized bill of sale if you couldn’t obtain a title;

- Motor vehicle’s title with the owner’s signature;

- Indiana driver’s license;

- Evidence of your insurance coverage within the state;

- All the necessary fees for the registering process, which vary based on different circumstances.

The motor vehicle sale bill should include the seller’s and buyer’s legal names and physical addresses. It must also feature the automobile’s VIN (or hull identification number, if it’s a boat), year of manufacture, purchase price, and sale date.

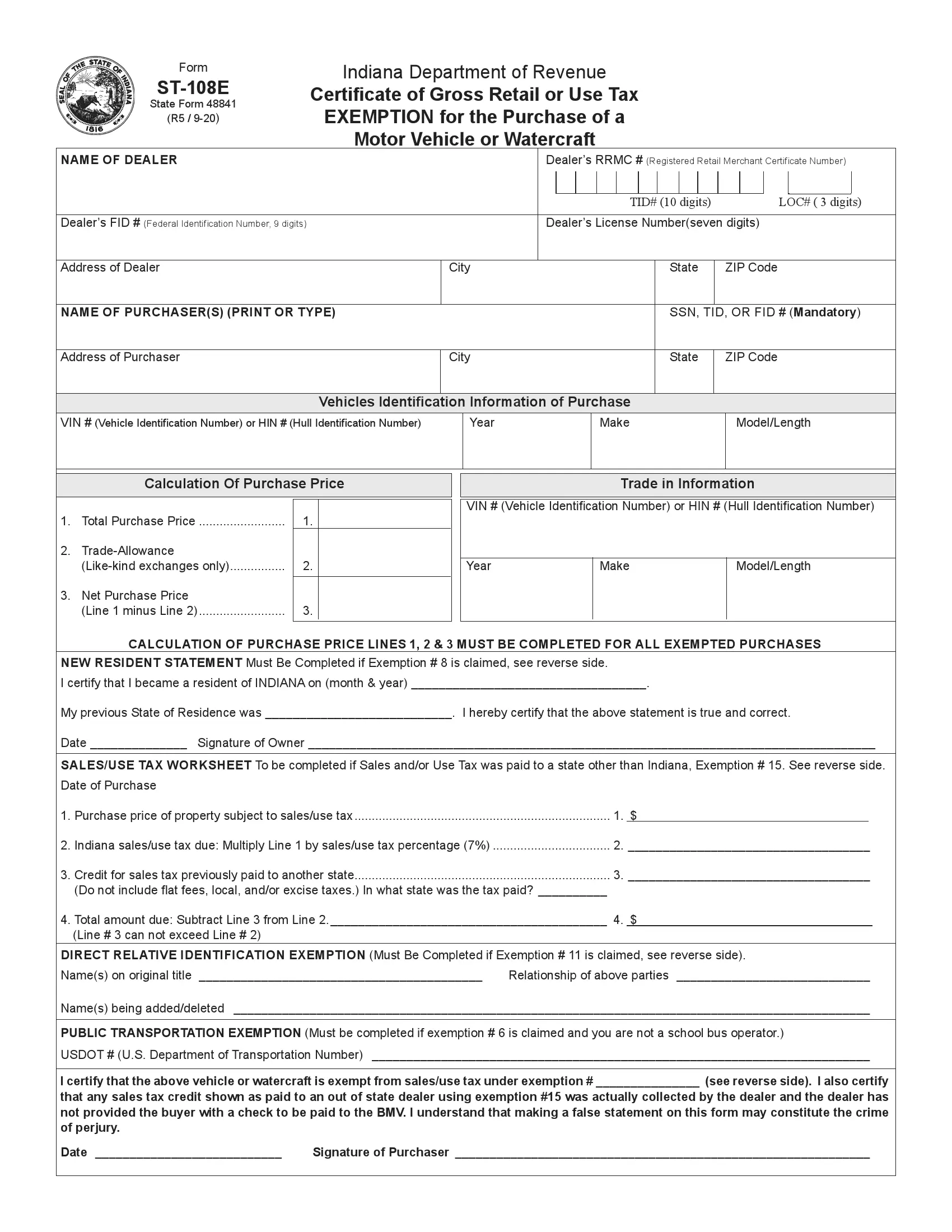

Relevant Official Forms

Use this form along with the bill of sale form 44237 to ensure there are no odometer discrepancies.

Short Indiana Bill of Sale Video Guide

Other Bill of Sale Forms by State