New York Bill of Sale Form

New York bill of sale is a legal form used in a private sale between two parties. This document records the transaction details, which include the information about the personal property being sold, the parties involved, and the terms and conditions of the deal.

Bill of sale forms are used for legal protection and are often required as evidence during vehicle and vessel registration.

Here, you will find official forms for all major property types and will be able to use our customized templates valid in the State of New York.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | New York Vehicle Bill of Sale Form |

| Other Names | New York Car Bill of Sale, New York Automobile Bill of Sale |

| DMV | New York Department of Motor Vehicles |

| Vehicle Registration Fee | $26-140 |

| Bill of Sale Required? | Yes |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 16 |

New York Bill of Sale Forms by Type

There’s a variety of bills of sale, and each is required for different instances and specific types of transactions. Clearly, based on the kind of transaction conducted in New York, you will need the right bill of sale form to be applied and registered accordingly with the state if needed.

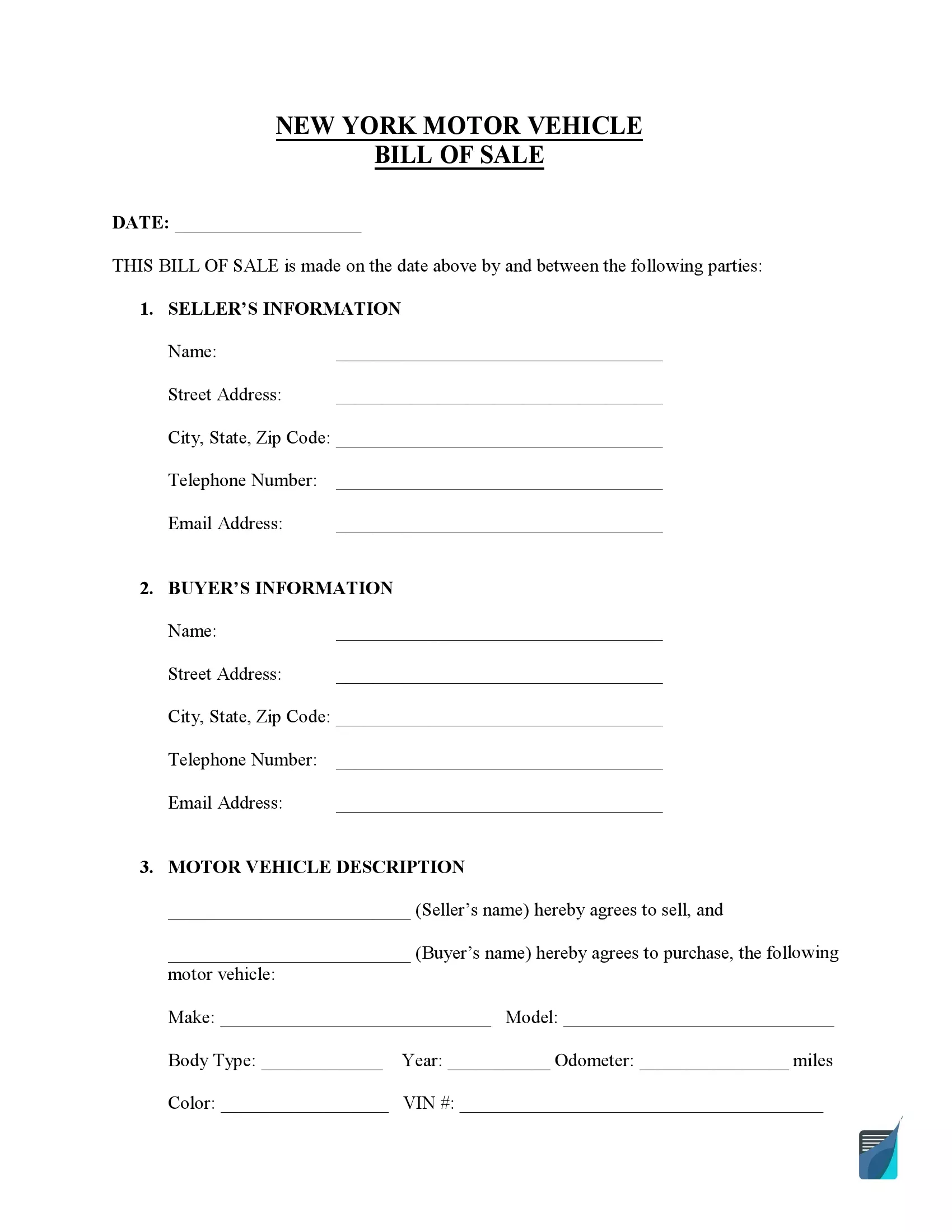

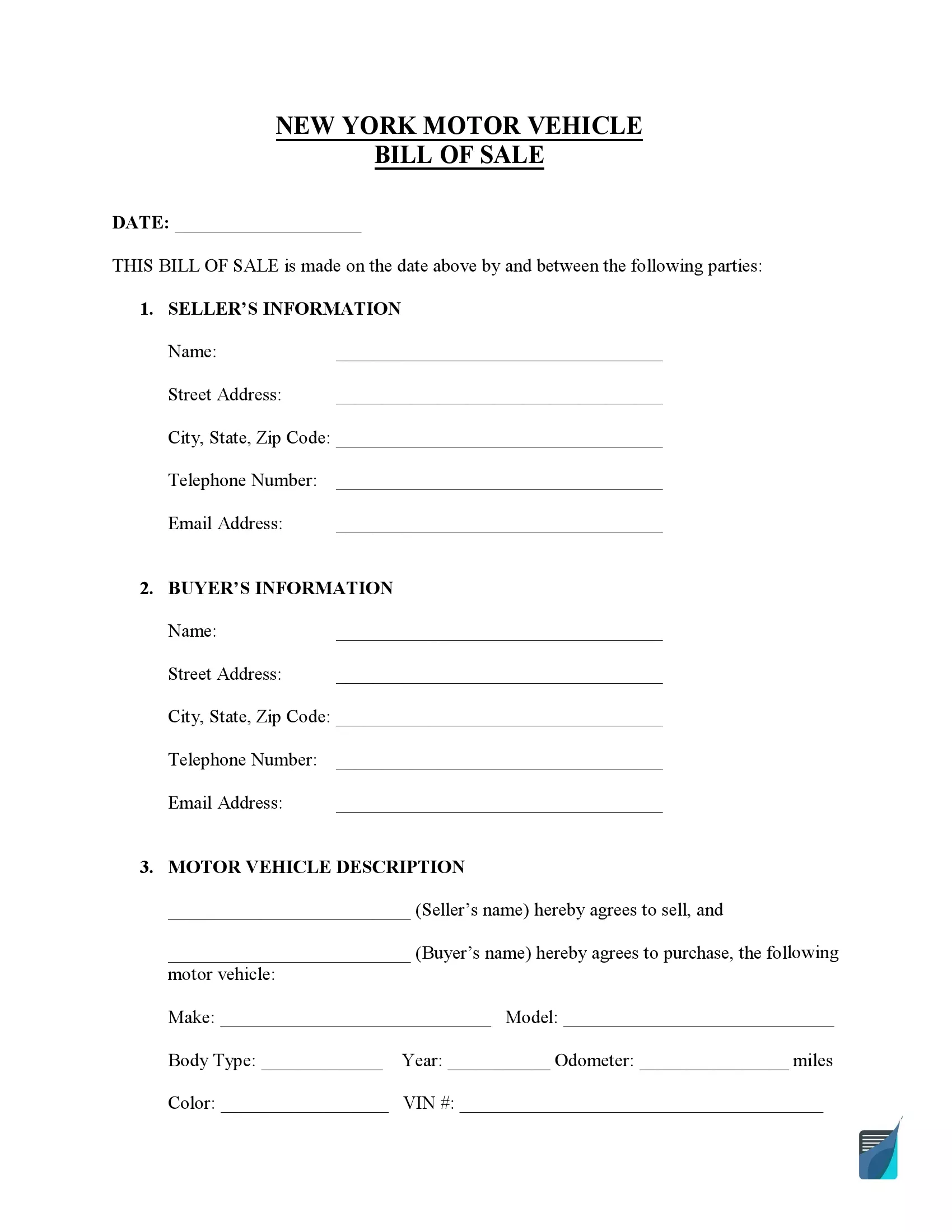

For New York motor vehicle bills of sale, you have to ensure that you get all the information of your vehicle right for the document to be legal. These bills of sale are believed to be one of the most generally chosen ones because they help both the buyer and the seller a lot. The former is guarded against purchasing a vehicle with hidden defects and the latter against partial liability in the event of any incidents.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

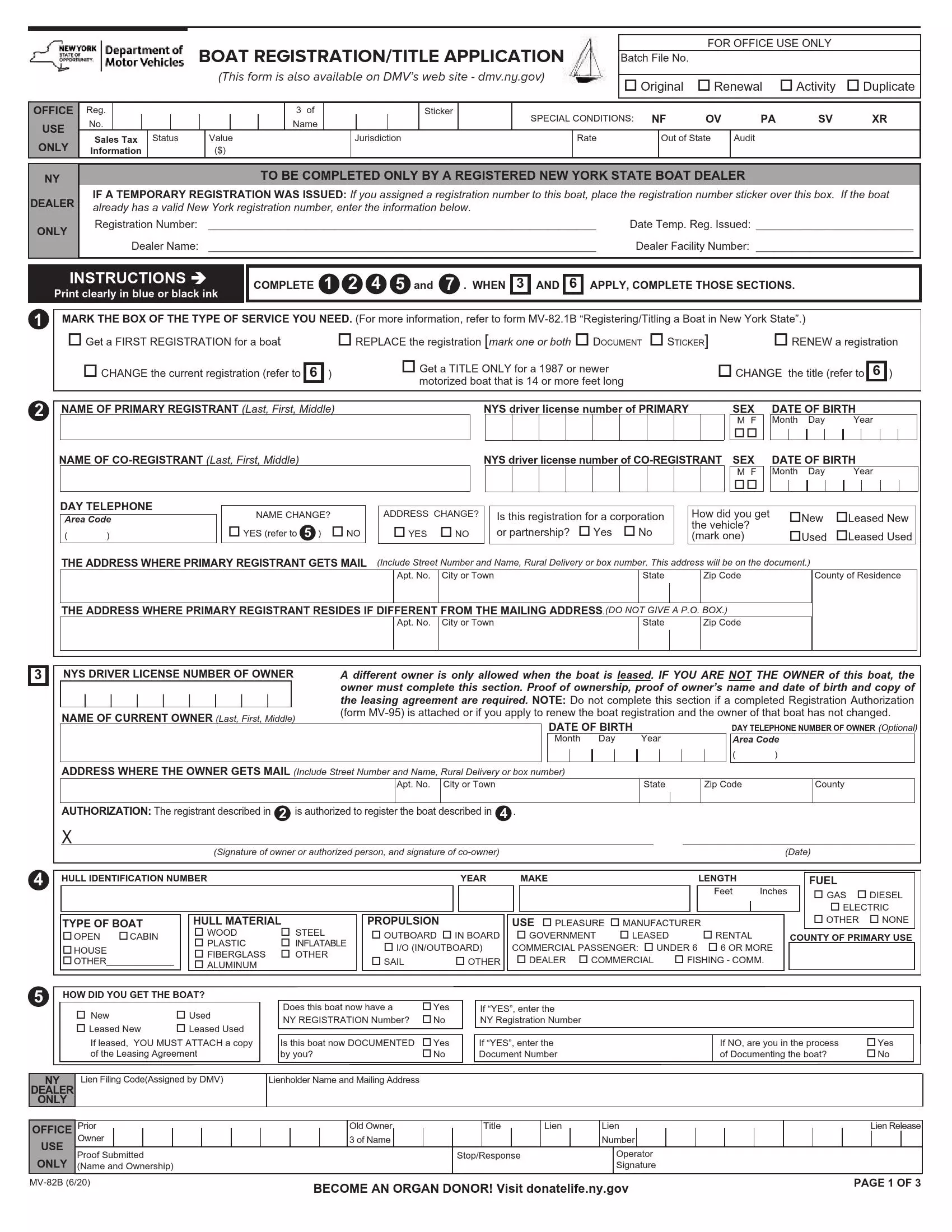

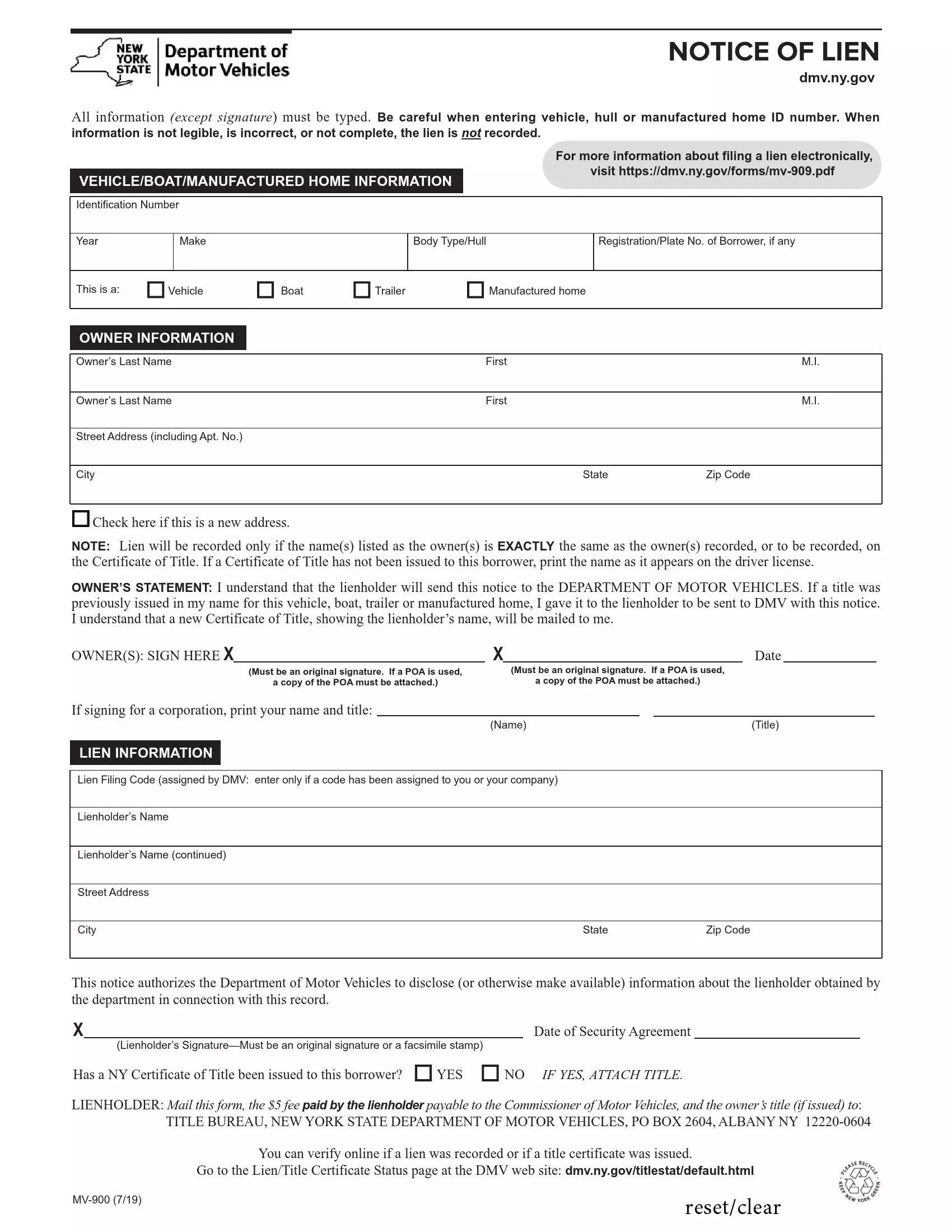

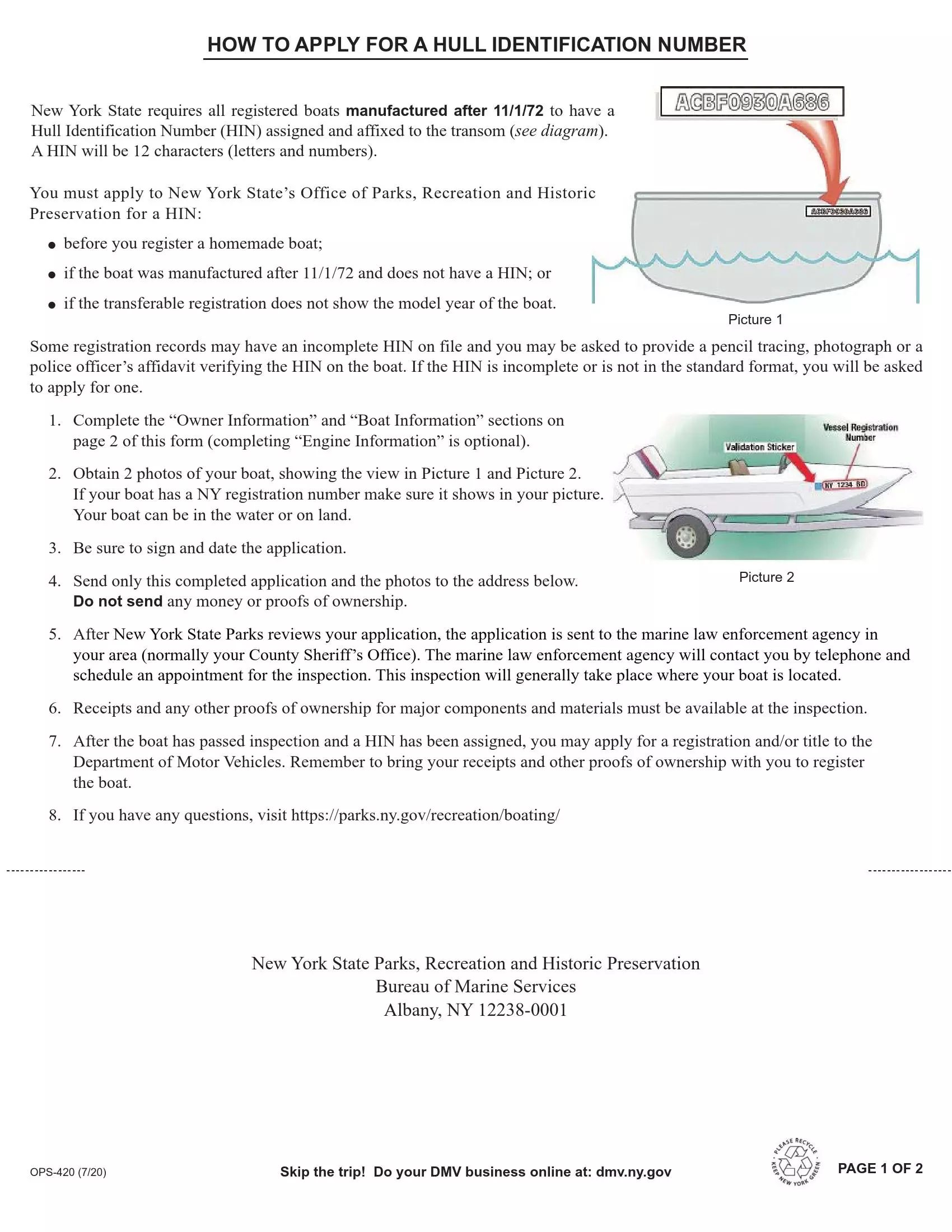

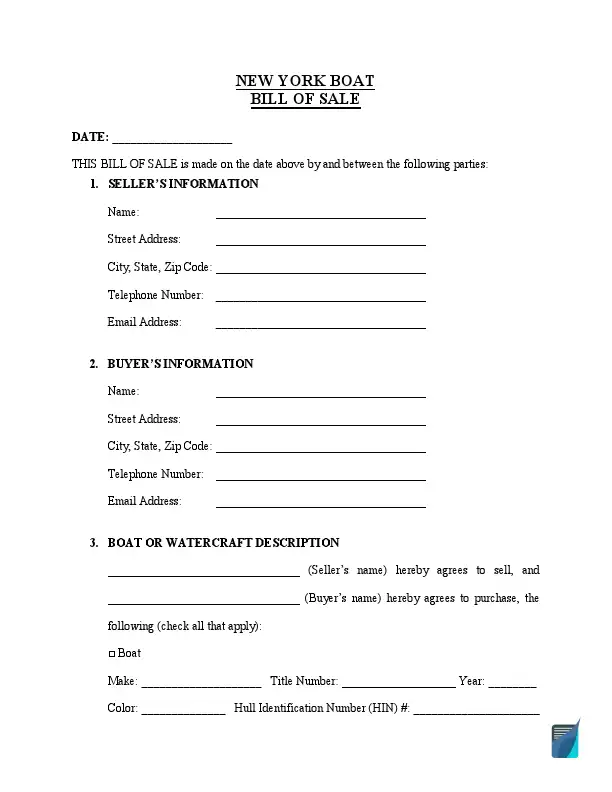

In the state of New York, a boat bill of sale is used during vessel registration. You’ll also need to get a verification form to ensure the boat’s identifying number and the number on the register match.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

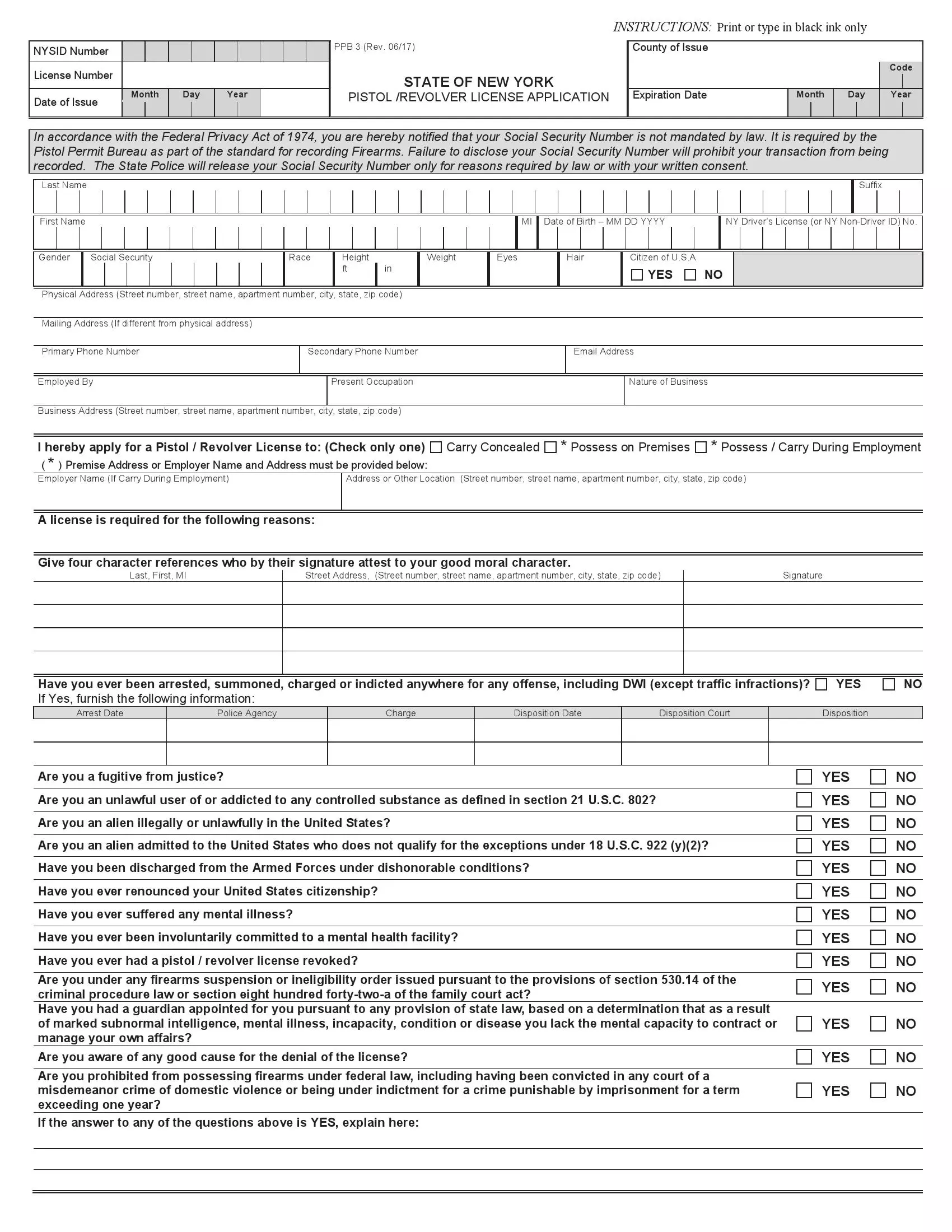

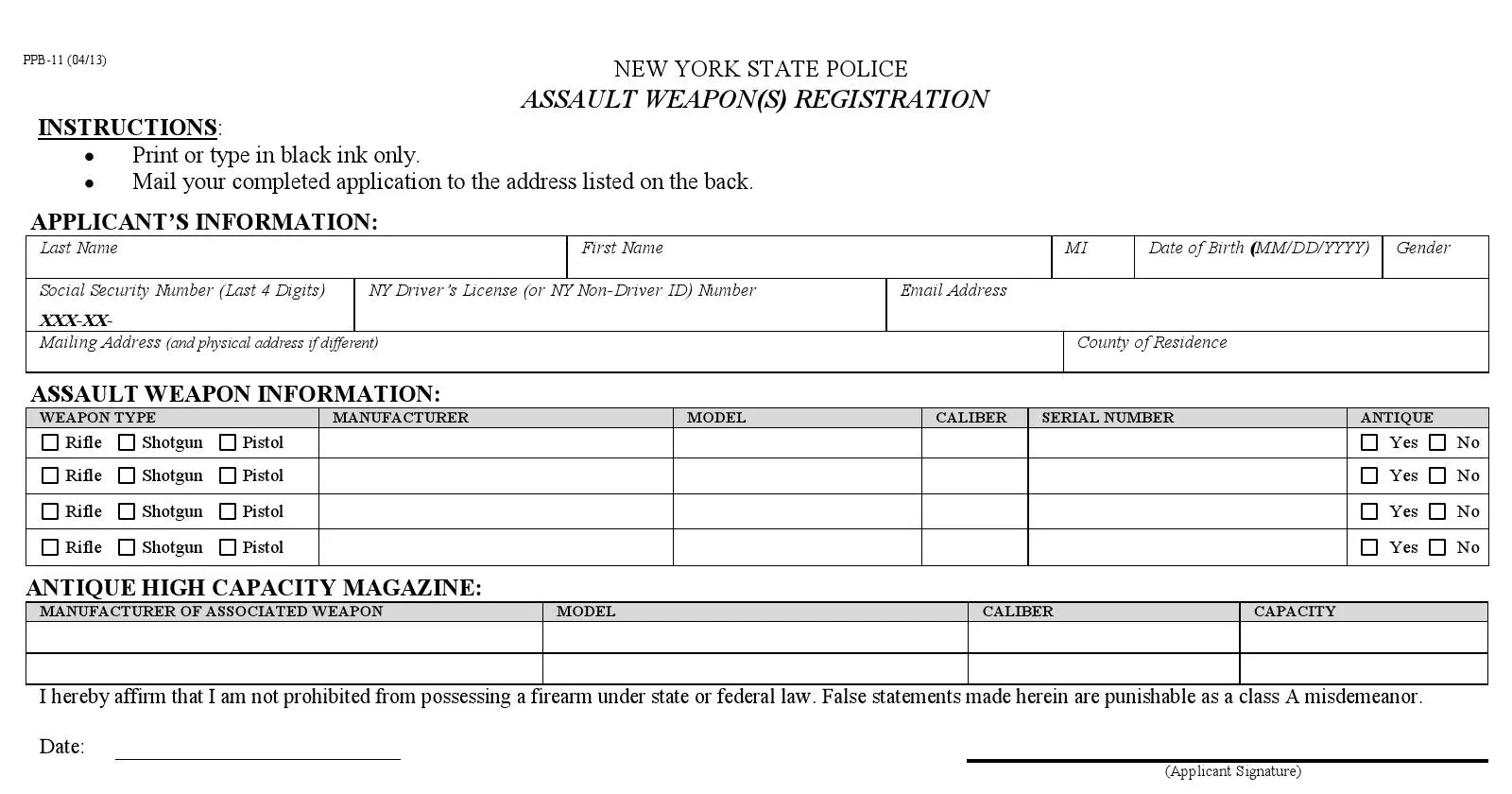

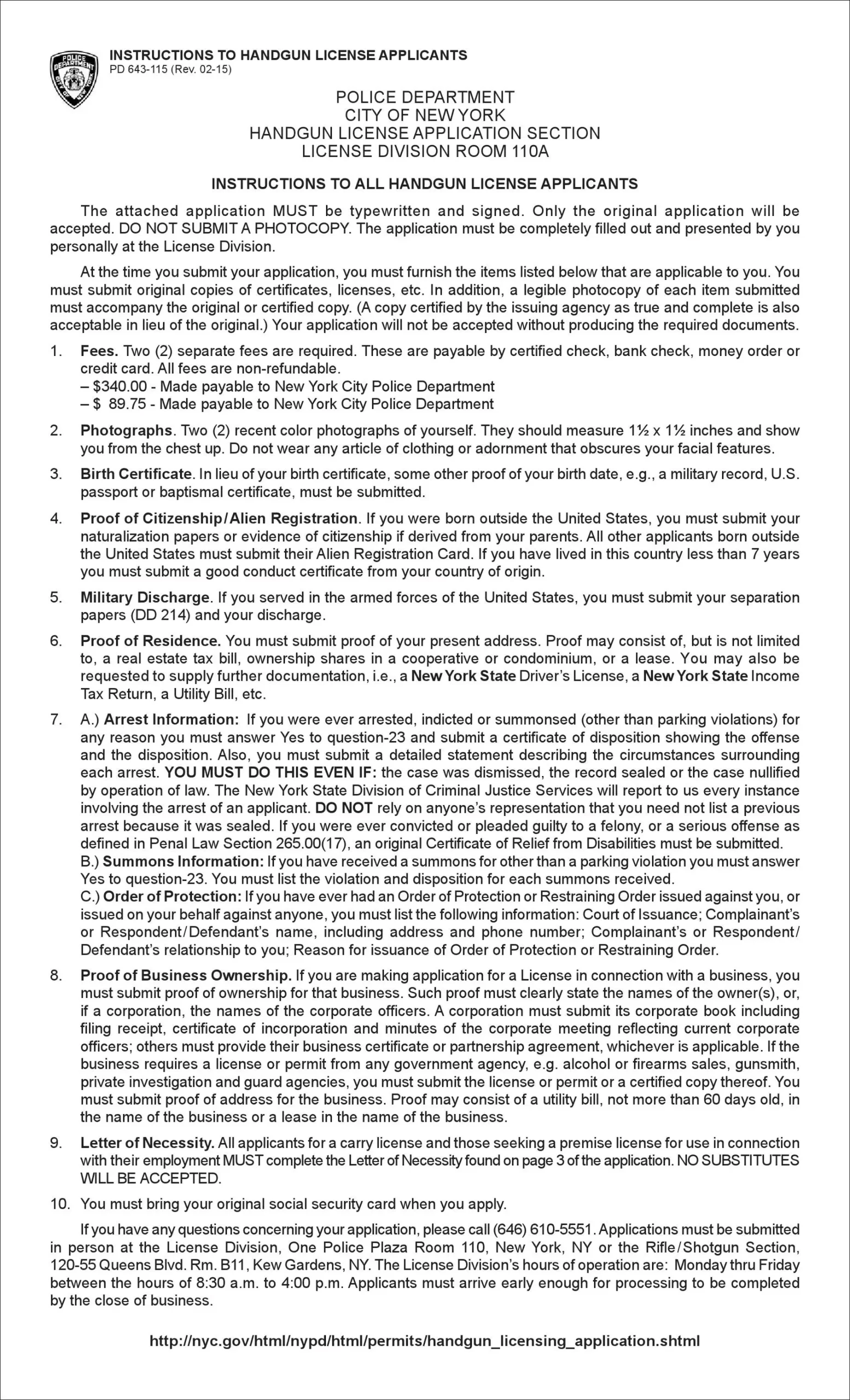

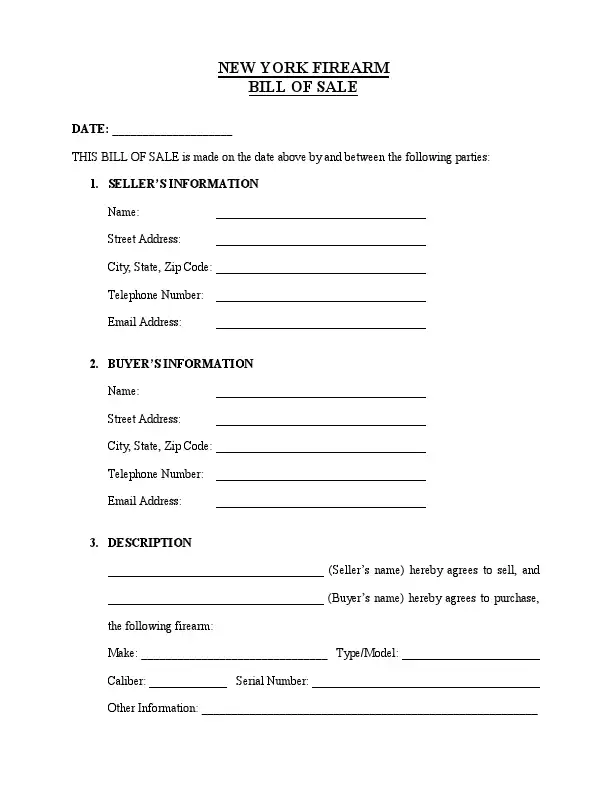

Bills of sale for firearms are believed to be especially crucial since these bills can help monitor each time a firearm is being sold. New York demands a background check by the dealer for any firearm sale to be possible.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

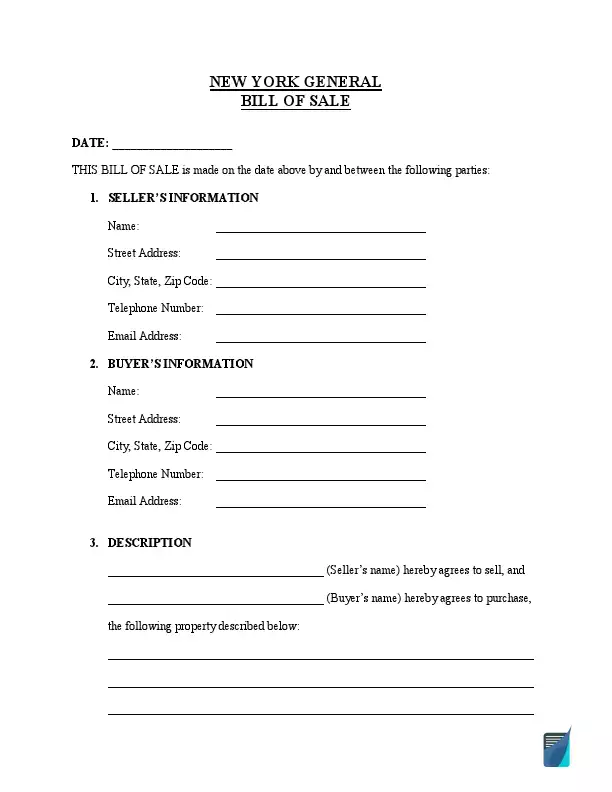

It’s possible to choose a general bill of sale that can be used for anything, but only if there is no more specific template for New York. General templates are far less special when compared to those tailored for specific property types.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

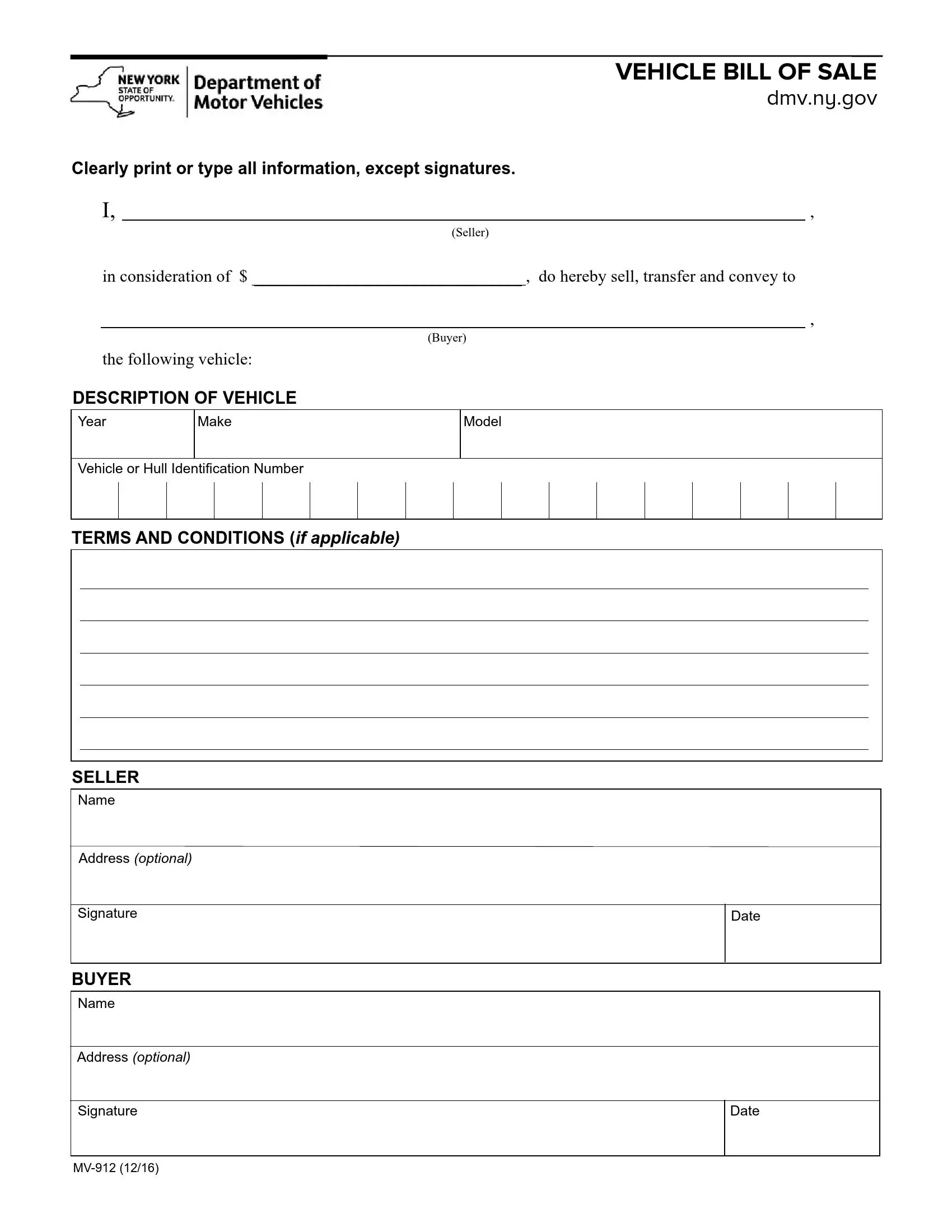

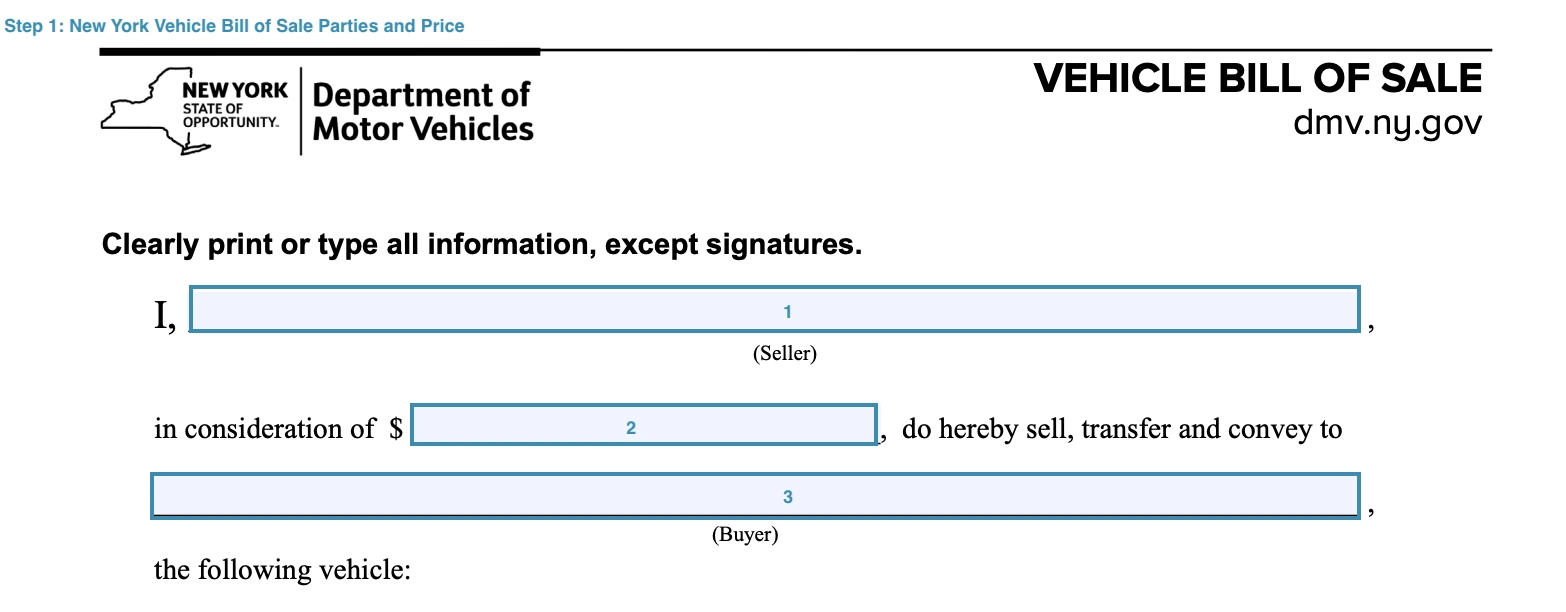

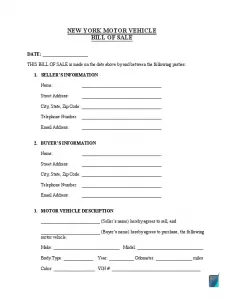

How to Write a NY Vehicle Bill of Sale

The New York DMV encourages all vehicle transactions to be verified by conducting a proper bill of sale during the purchase. If the transaction happens between private parties, it is recommended to have an officially recognized document as evidence of personal property ownership change.

Step 1.

In the first section, it is necessary to indicate the parties who participated in the transaction—the seller and the buyer. Provide their full legal names in the dedicated fields. Also, provide the selling price considered for the vehicle transfer.

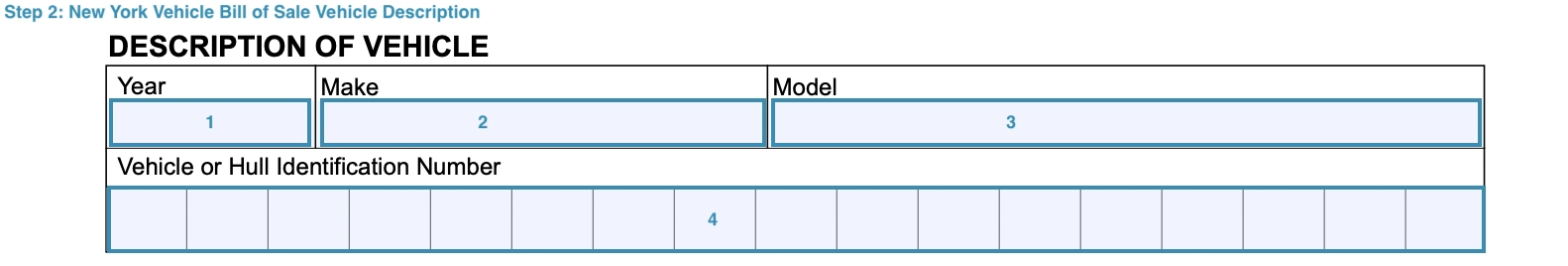

Step 2.

Next, provide the description of the motor vehicle. Fill in the corresponding fields the vehicle characteristics, such as:

- Year

- Make

- Model

- Vehicle Identification Number

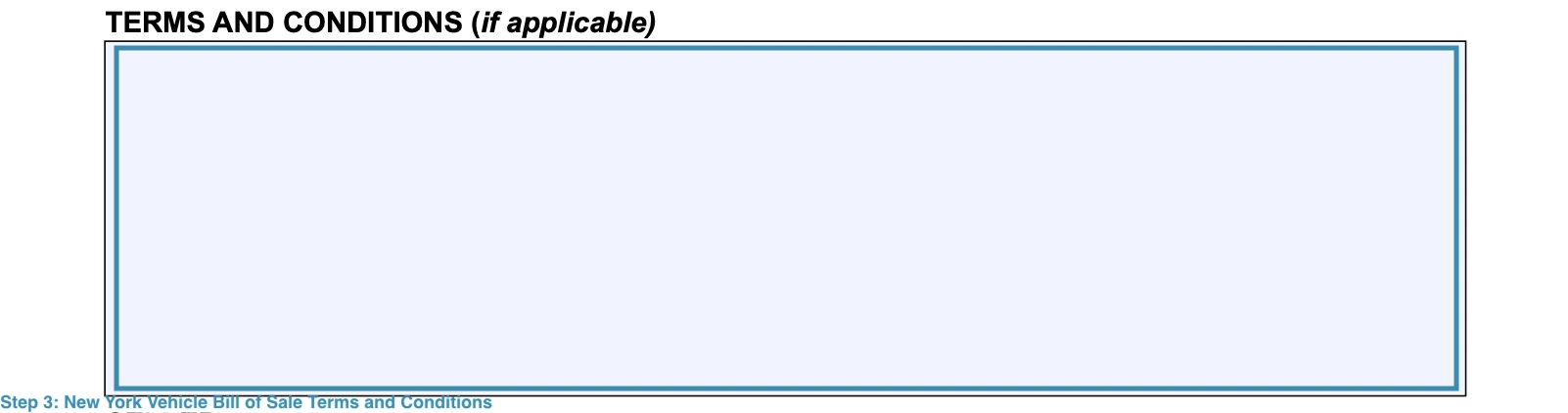

Step 3 (optional).

If there are any specific conditions for the transfer of ownership, you need to specify them in the following section. For example, the sum is divided into parts or the actual vehicle transfer is agreed on a different date.

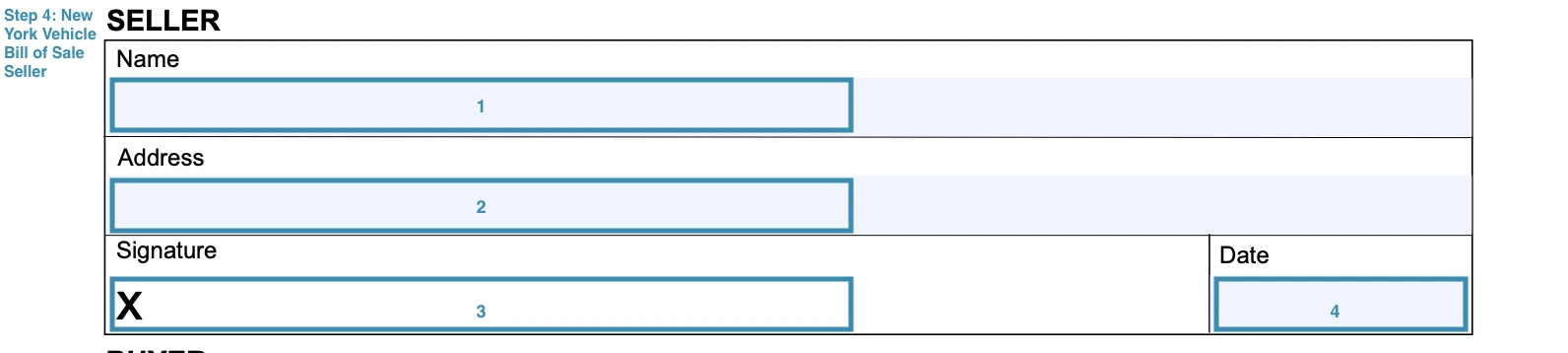

Step 4.

You need to type in the seller’s full name and their current address of residence. Then, the seller signs the document and writes the date the document is completed.

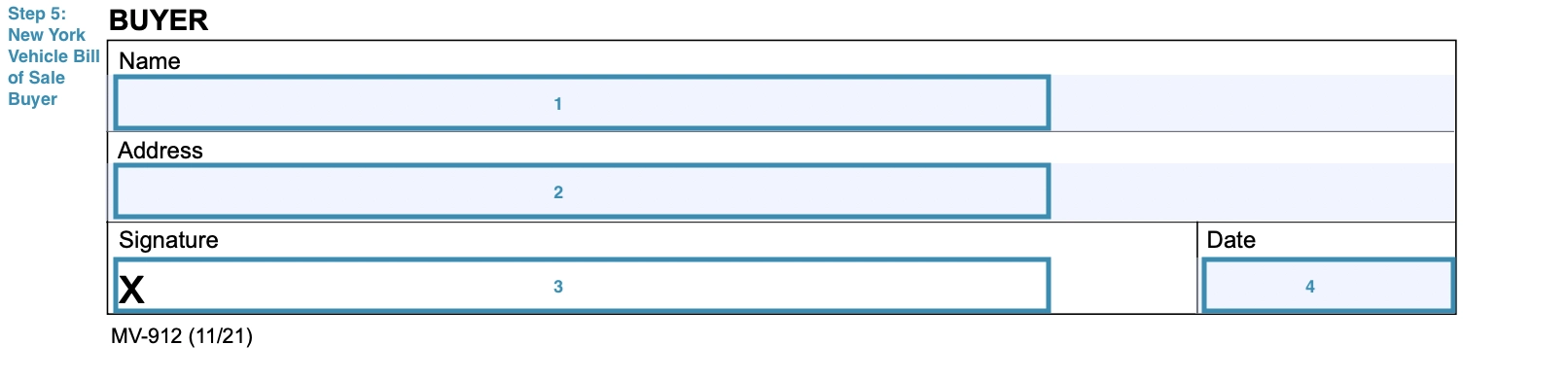

Step 5.

The buyer section should be completed in the same way. Please provide the full legal name of the buyer, their address of residence, and their signature.

The bill of sale will be valid without a notary acknowledgment, but you can notarize it by the parties’ demand.

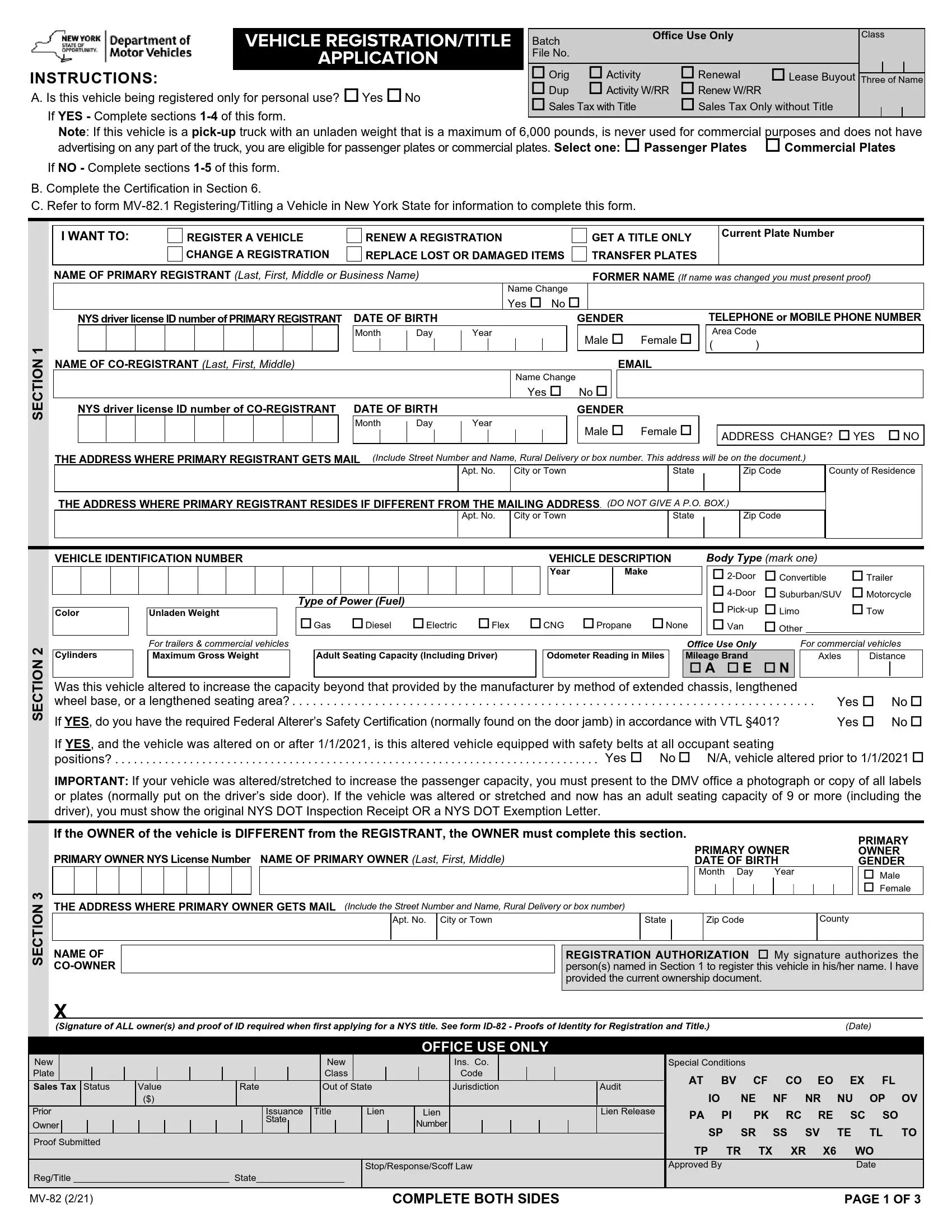

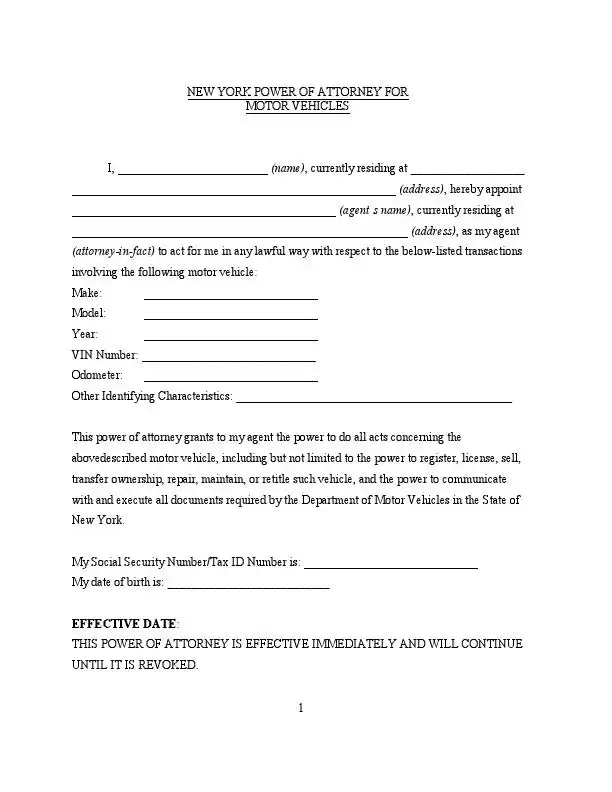

Registering a Vehicle in New York

It is mandatory for all motor vehicle owners in New York to have them registered regardless of whether they own or lease them. To get a motor vehicle registered, the new owner should have a valid license active within 180 days after the purchase. The registration is done after the new owner brings all the correct proof of personal identity and vehicle-related documents, including a filled out bill of sale template.

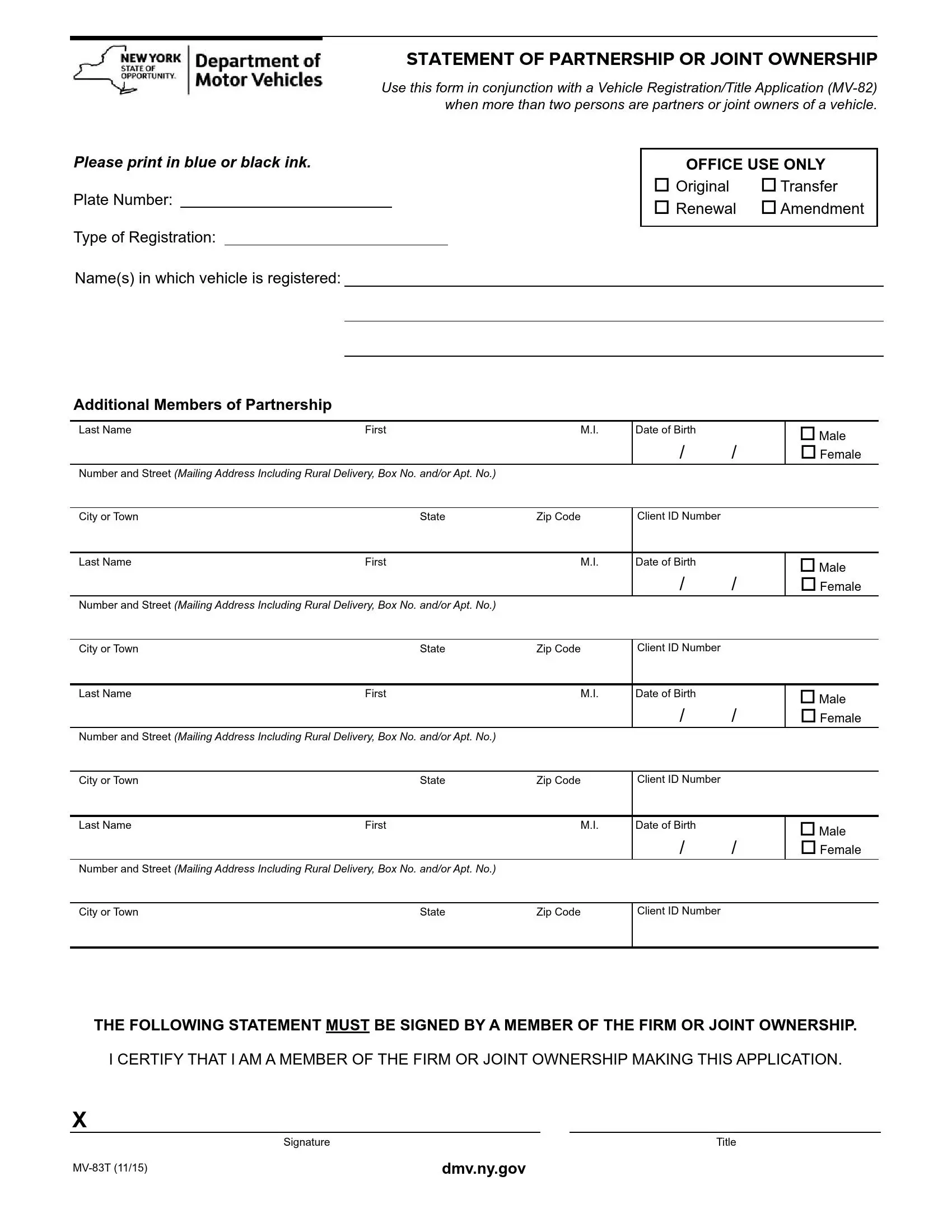

For the registration of a vehicle obtained in a private sale, the new owner should provide the following documents to the local DMV office:

- A properly filled Application for Vehicle Registration (form MV-82 in New York)

- Completed Statement of Transaction (sale or gift of the vehicle, with the indication of vehicle type)

- New York driver’s license or non-driver ID (with expiry date minimum two years after the purchase)

- A completed motor vehicle bill of sale form

- Receipts of the paid sales tax and fees

- The vehicle’s title or other proofs of ownership

- A valid New York insurance ID card

Residents of New York state can file the registration documents either at a local office or online. Upon applying for registration, they need to have the new motor vehicle inspected at a DMV-licensed inspection station. Such inspection should be performed every 12 months or at the moment of transfer of ownership.

Fees that need to be paid for the vehicle’s purchase include a state sales tax, a registration transfer fee (or a plate fee), a title certificate fee, and a vehicle use tax. The registration fee differs depending on the chosen period (1 or 2 years) and the vehicle’s type. Vehicle plate registration costs $25 while the title certificate fee is priced at $50. The registration fee depends on the vehicle’s weight, starting from $26 for vehicles under 1,650 lbs, and equaling $140 for vehicles weighing 6,951 lbs and more.

The vehicle use tax in New York equals $15 per year, while the supplemental MCTD fee some residents require costs $25 per year. There are also some county-specific vehicle use taxes applied to the residents of the Metropolitan Commuter Transportation District (MCTD). For instance, Albany motor vehicle owners pay a supplemental fee of $5 per year for vehicles weighing 3,500 lbs and less, and $10 per year are charged for vehicles weighing more than 3,500 lbs. The same fees apply to Allegany, Broome, Cattaraugus, Chautauqua, Chemung, and Clinton areas, among others.

Relevant Official Forms

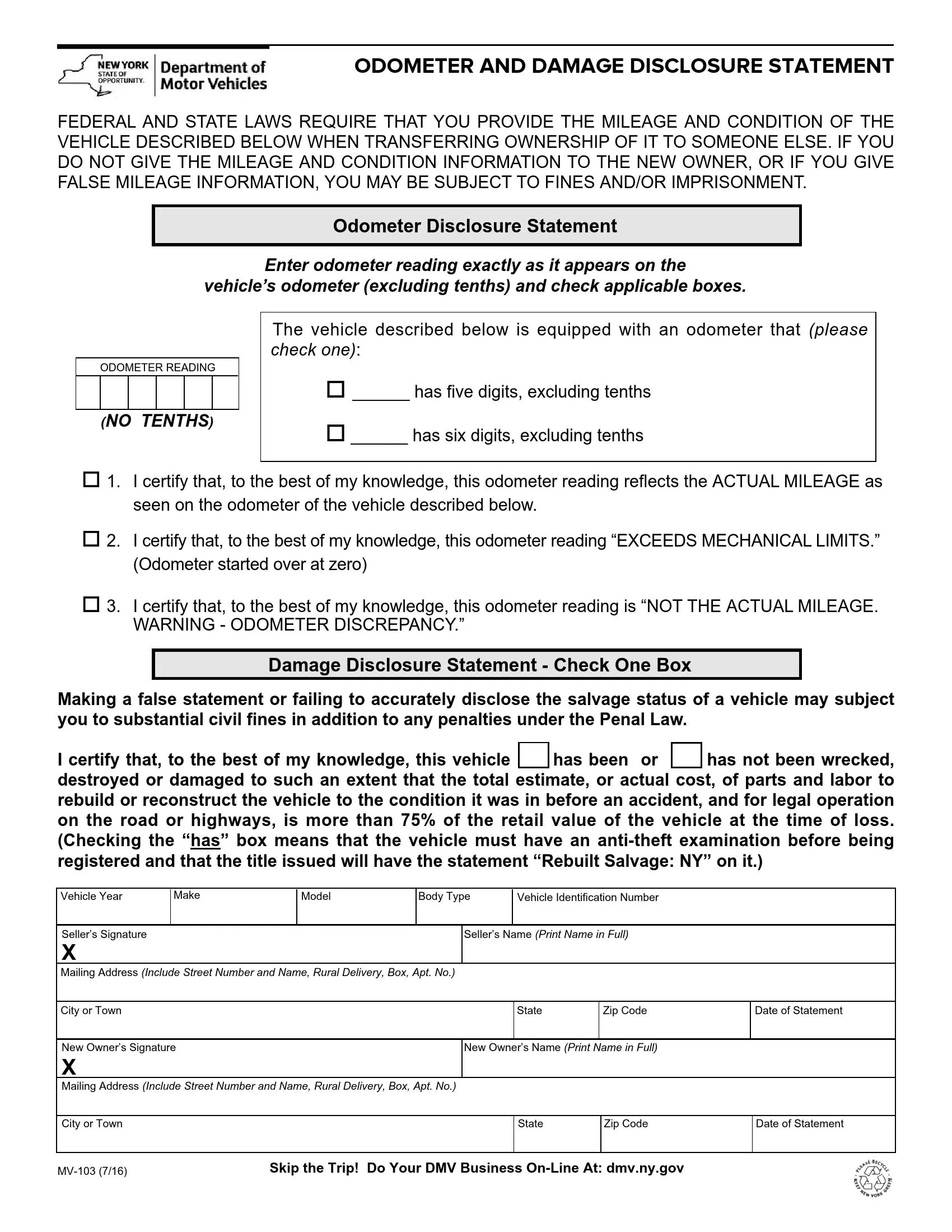

Odometer and Damage Disclosure Statements should be attached to your bill of sale.

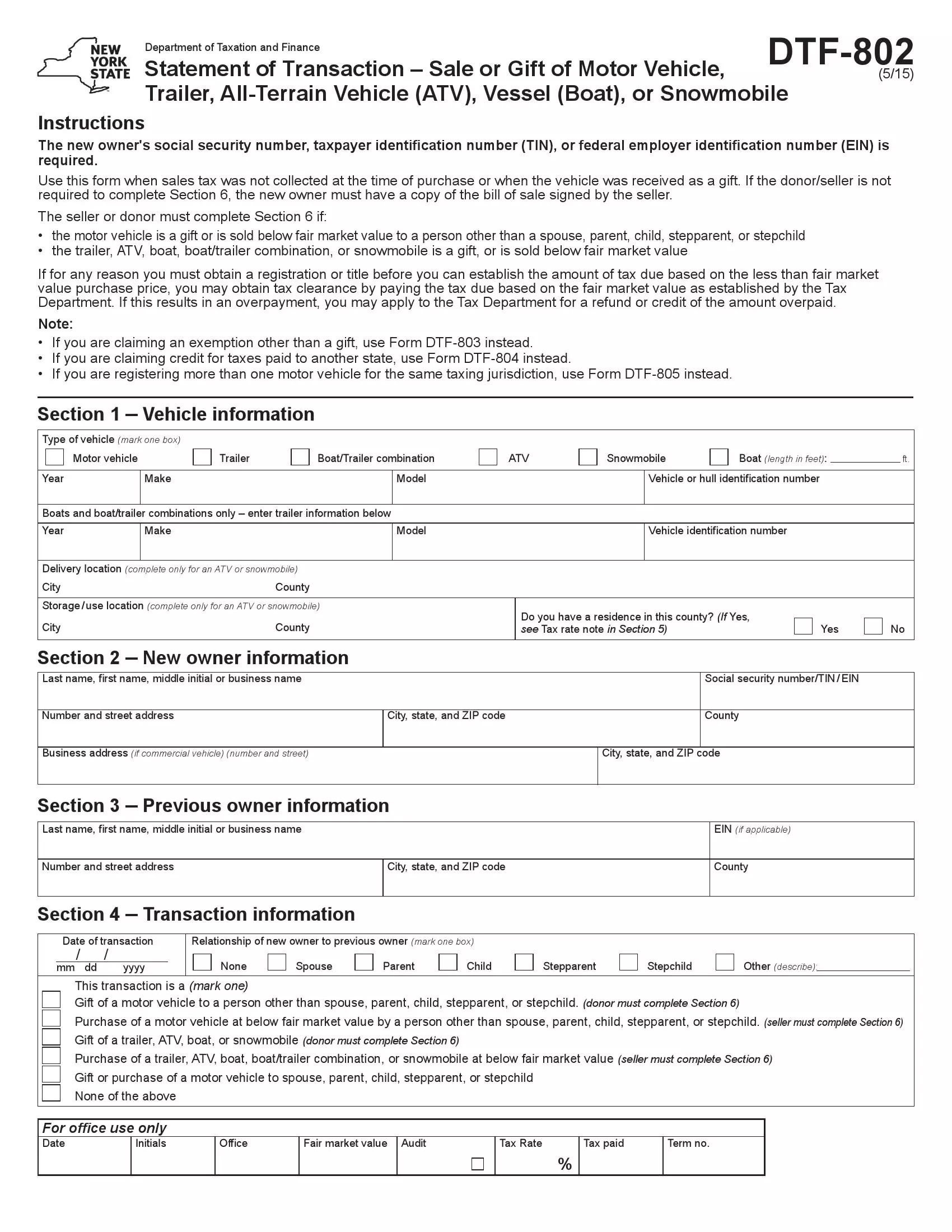

Statement of Transaction is used for gifted vehicles or deals without sales tax in the price.

Short New York Bill of Sale Video Guide