Oregon Bill of Sale Form

Oregon bill of sale can shield your rights during private deals and give more certainty on obtained property. A properly-filled document is beneficial both for a vendor and a buyer.

There are several types of bill of sale forms that you can choose depending on the type of item to be sold. If you need to create your own bill of sale form, it’s always available to download on our website. In addition, we’ve collected all the essential documents that may be needed during the vehicle or vessel registration and titling.

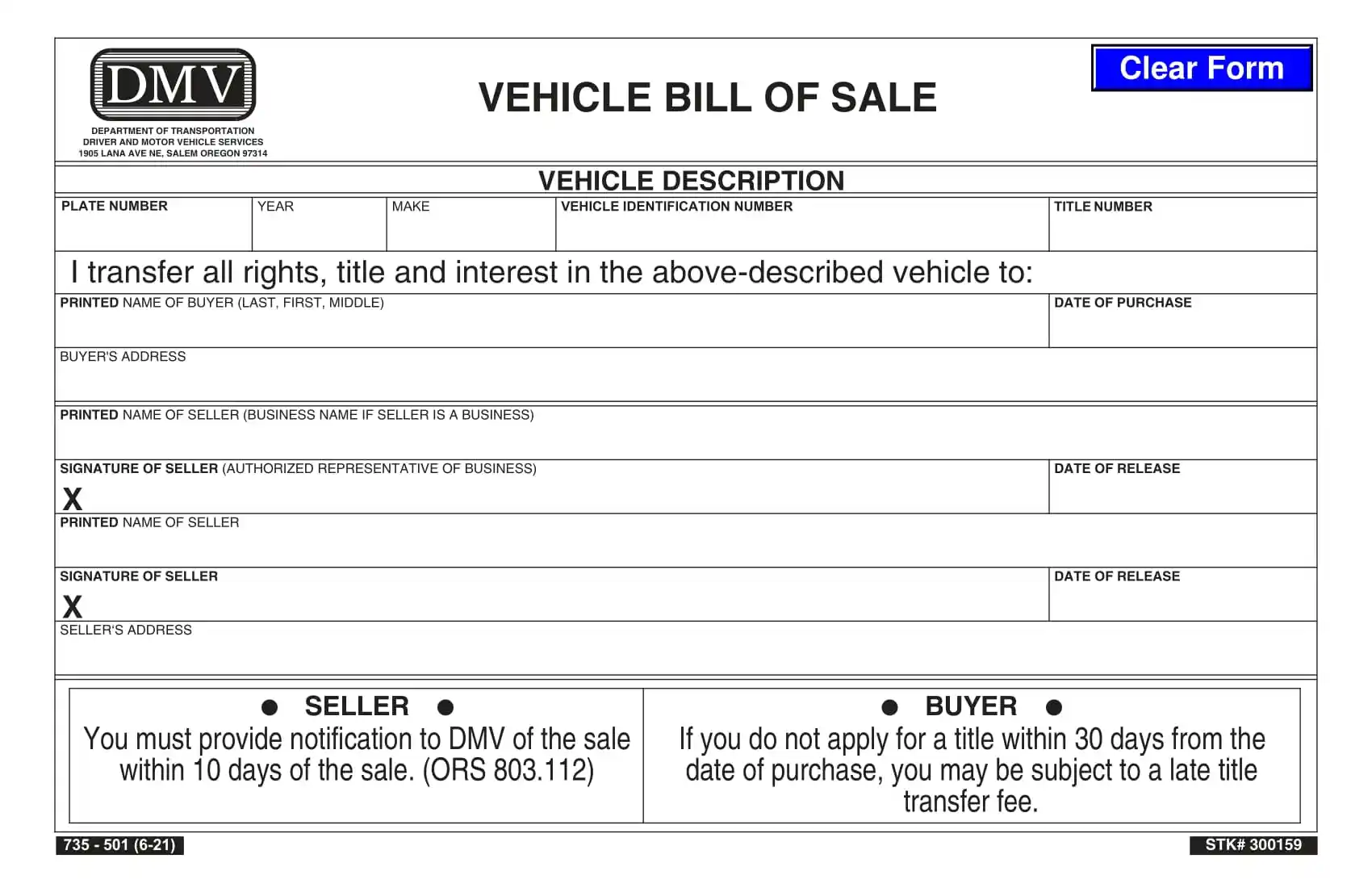

Residents of Oregon can use the official template provided by the Oregon DMV, known as Form 735-501, to sell or purchase a motor vehicle within the state. The document can act as proof of ownership over assets in legal and financial institutions, such as banks or courts.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | Oregon Vehicle Bill of Sale Form |

| Other Names | Oregon Car Bill of Sale, Oregon Automobile Bill of Sale |

| DMV | Oregon Department of Transportation |

| Vehicle Registration Fee | $122-152 (electric car – $306) |

| Bill of Sale Required? | No |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 15 |

Oregon Bill of Sale Forms by Type

All bills of sale are divided according to the type of product bought or sold. Oregon recognizes and accepts particular bill of sale forms for certain types of sales—such as weapons, vehicles, or vessels, and it is essential to know which one to choose.

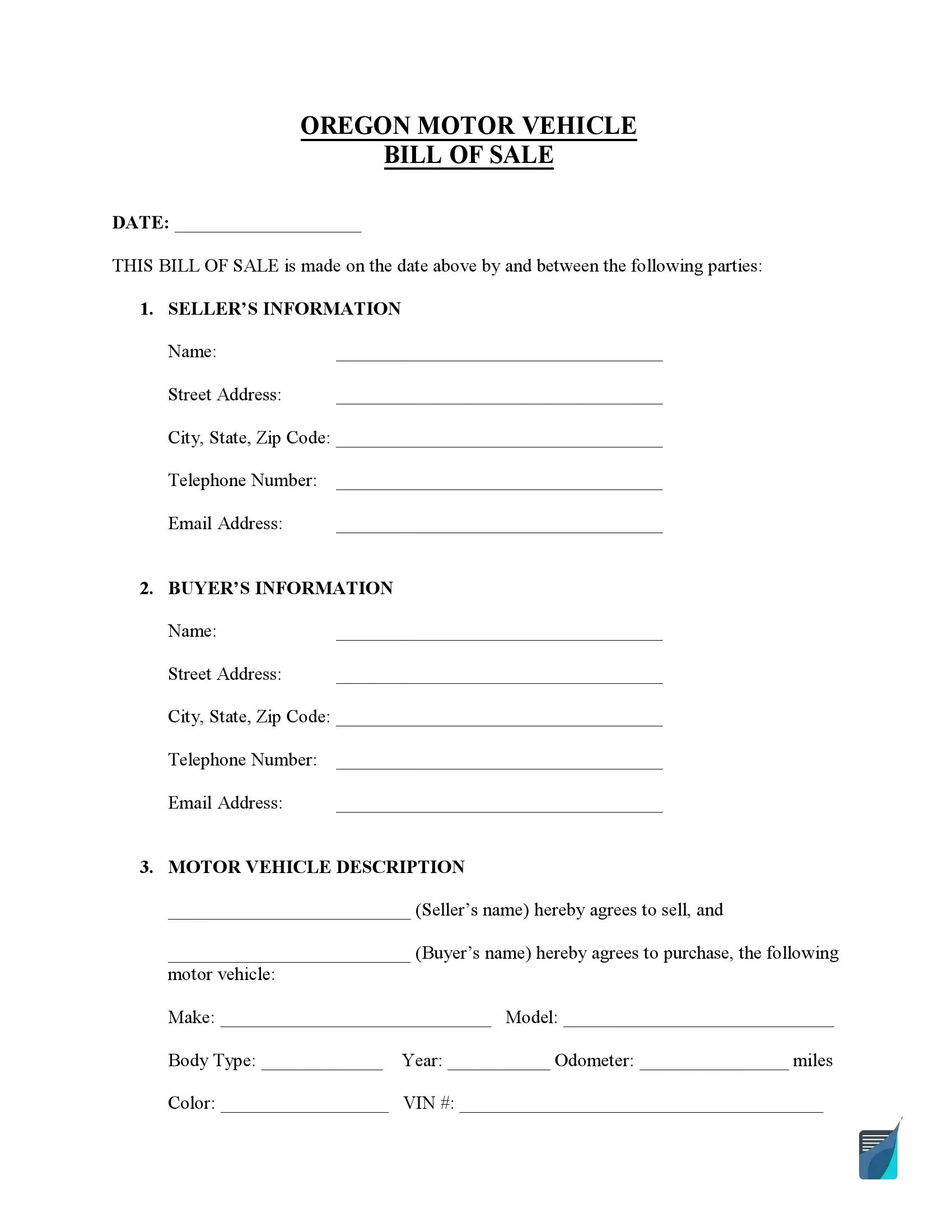

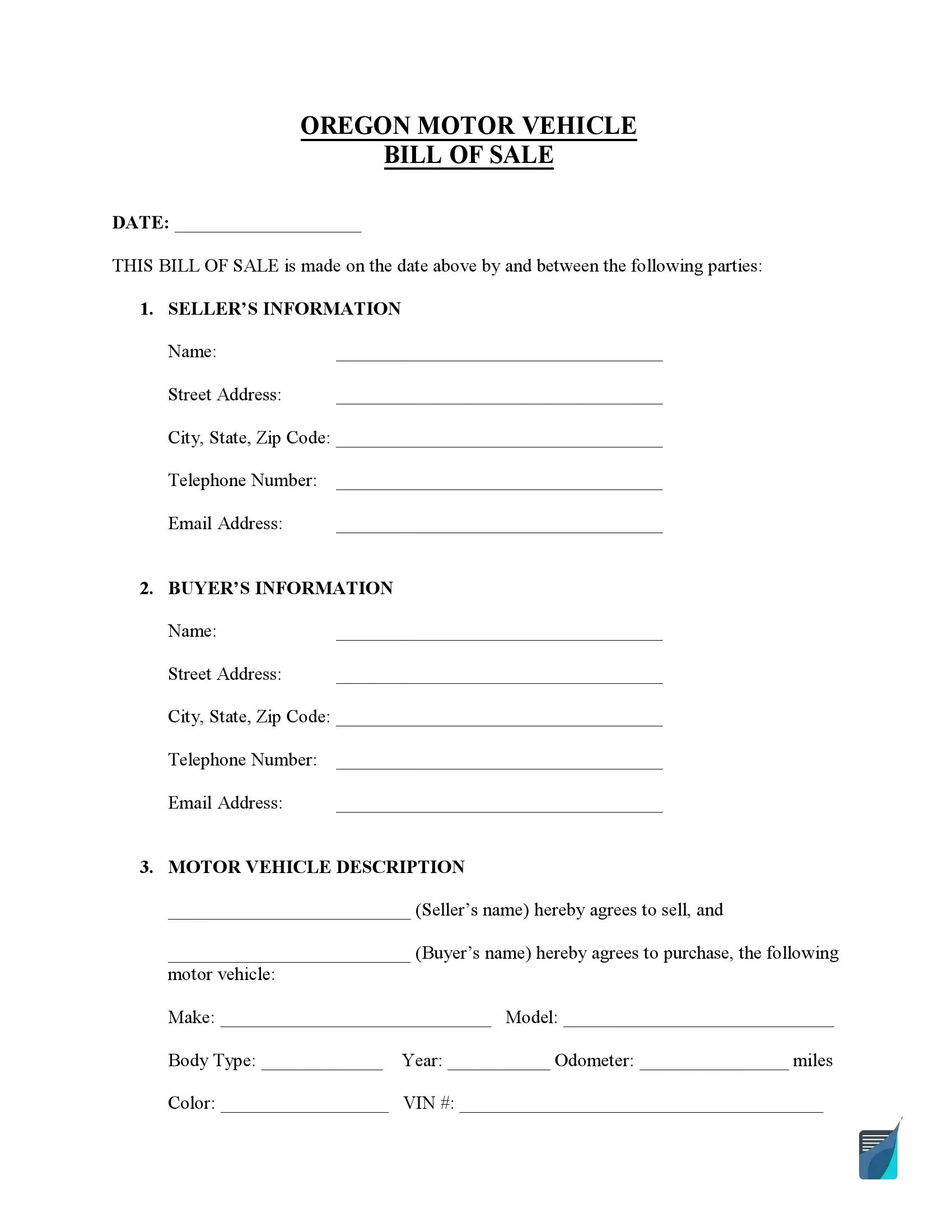

Use an Oregon motor vehicle bill of sale for title transfer. That’s how the buyer is protected from obtaining a vehicle with hidden defects, while the vendor gets free from partial liability. You will have 30 days from the vehicle transaction to apply for your registration. Ensure that all vehicle specifics contain no errors, and the document is signed by both the buyer and vendor.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

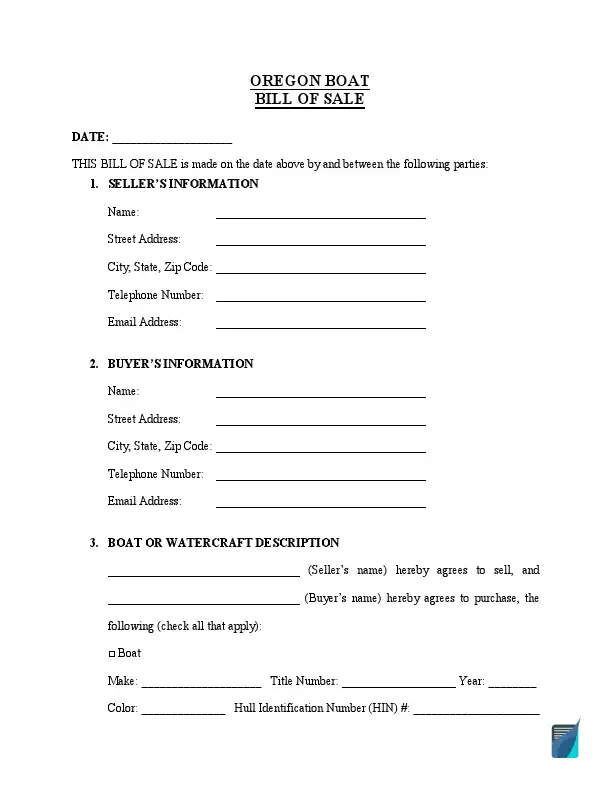

Completing an Oregon boat bill of sale form is beneficial for both sides of a deal. Before purchasing a boat, make sure the document lists the vessel’s ID number and registration plate. Anyone who buys a vessel in Oregon must notify NDV about an ownership transfer. If you have a recently purchased boat, you can apply for a temporary permit that allows you to operate the boat right away.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

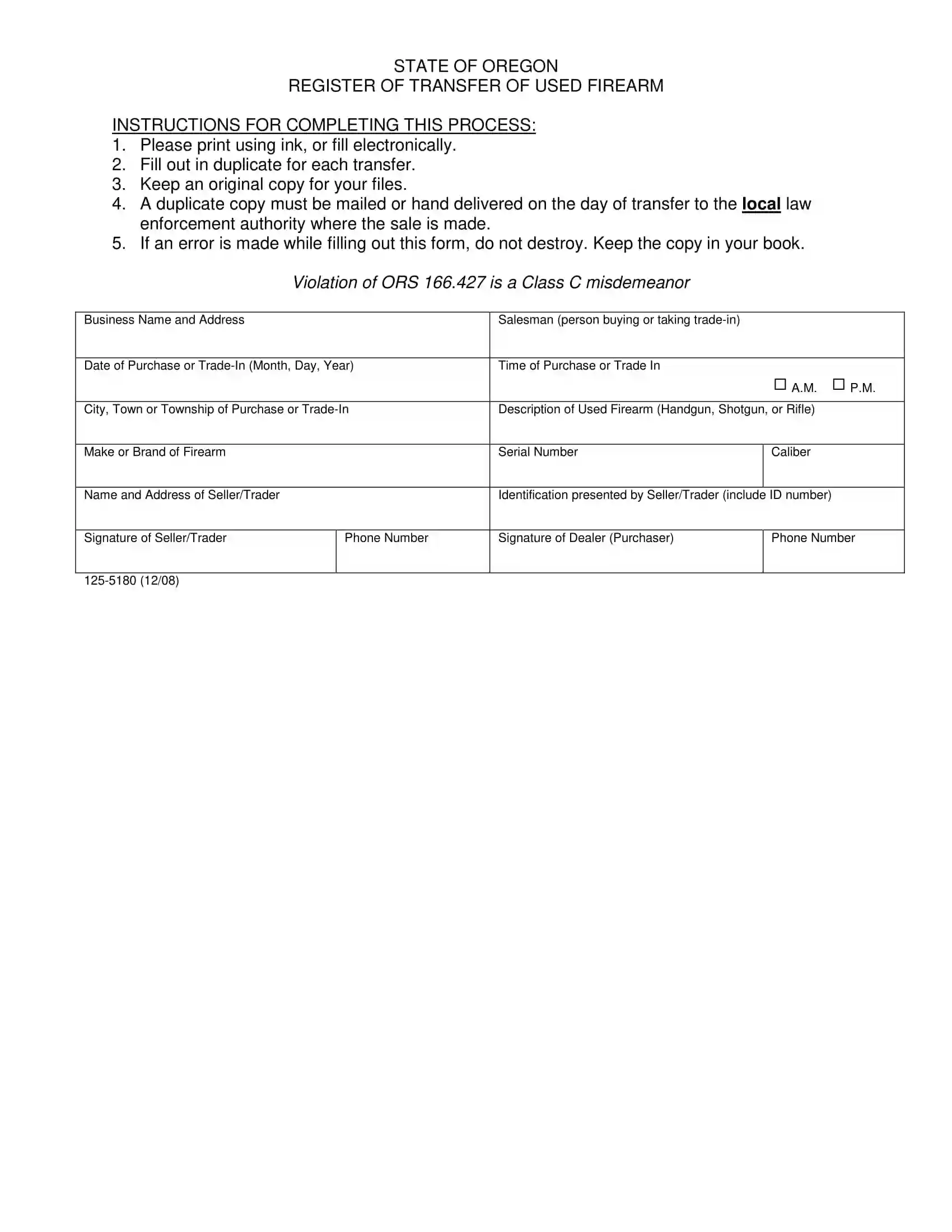

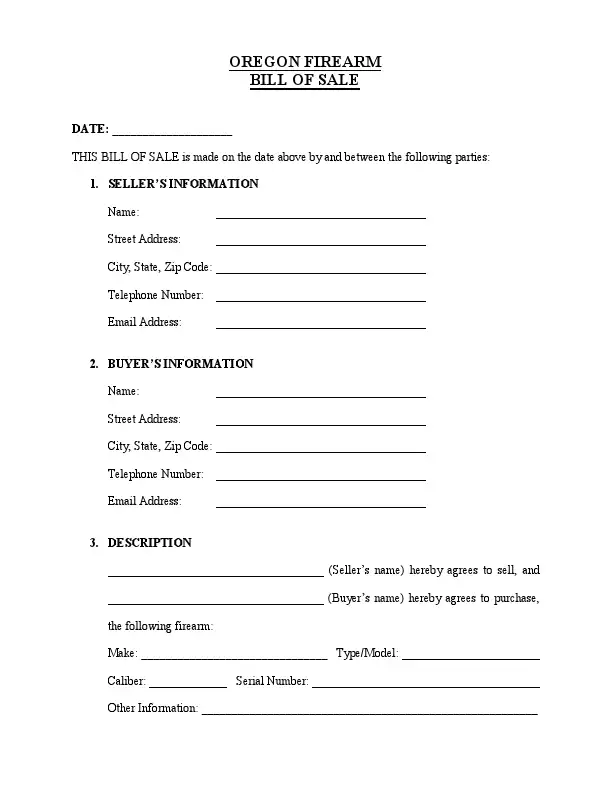

Oregon has less strict regulations for firearm buying and selling. However, having a gun bill of sale is crucial to keep watch on firearm transactions. Oregon residents are not required to obtain permits to purchase a firearm, as the gun laws within the state do not require it. Although there is no state gun registry, the purchase transaction records are monitored and kept for five years.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

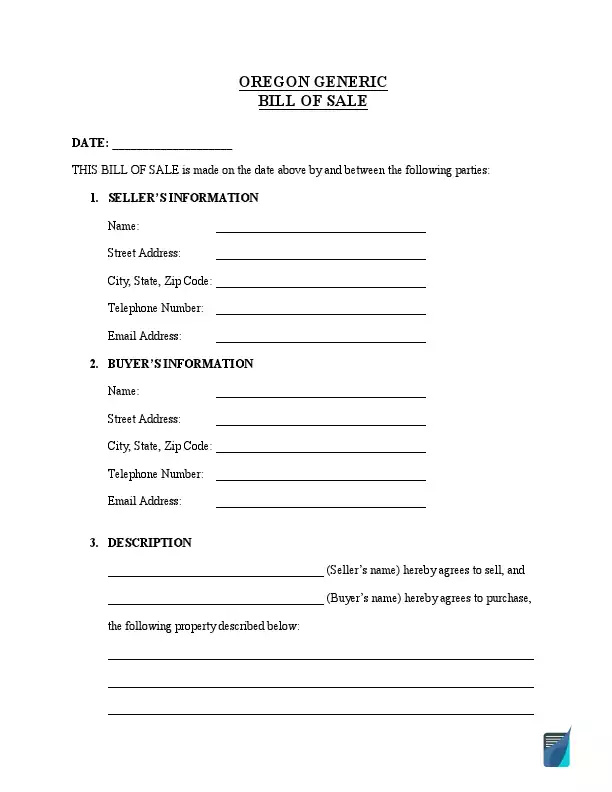

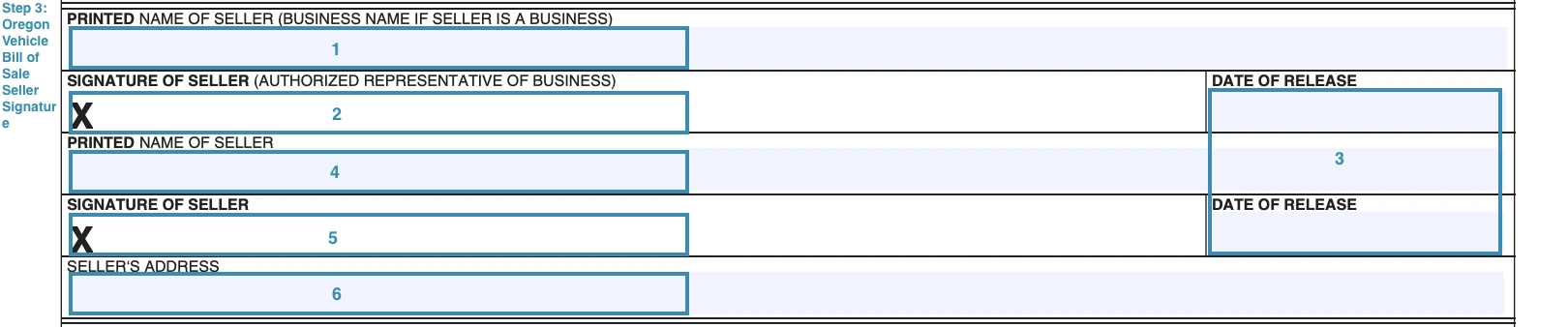

If the state of Oregon does not provide a specific form for the property you want to sell or obtain, you can use a general bill of sale. In this case, the document functions as a security measure both for the seller and buyer.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

How to Write an OR Vehicle Bill of Sale

In Oregon, you can use the official vehicle bill of sale template while conducting vehicle transaction. It is required for a buyer to apply for a title within 30 days after the purchase, and the vehicle bill of sale will be one of the documents that indicate the title transfer. The seller will have to provide a secure odometer disclosure form before transferring the vehicle ownership. If you don’t know how to fill out this form, below are simple instructions to follow.

Step 1. Provide vehicle description

In the first section, you need to describe the vehicle that is being sold, giving all crucial details, such as:

- Plate number

- Year

- Make

- VIN (vehicle identification number)

- Title number

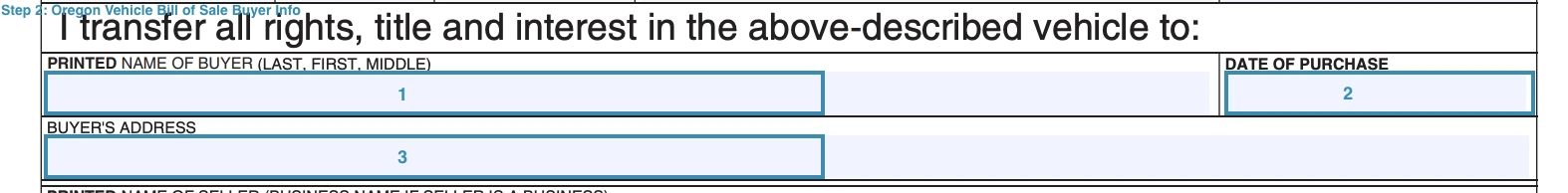

Step 2. Indicate the buyer’s identity

Type in or write in all capital letters the buyer’s full name. Next, provide the date of purchase and the buyer’s contact info (their mailing or physical address).

Step 3. Sign the document

Lastly, the seller must sign the document to confirm their willingness to release their rights on the vehicle. If there is more than one seller, both of them must type their name and sign the document. Also, it is necessary to provide the seller’s address and the date when the transaction happened.

There is no hard rule regarding the notarization of Oregon’s motor vehicle bill of sale. Any party can demand the notary public if they want to protect themselves against potential issues.

Registering a Vehicle in Oregon

An Oregon driver isn’t always required to use bills of sale when selling or purchasing a motor vehicle. A title release may be used to register or title a car instead of a motor vehicle bill of sale. However, it’s advised to sign the bill whenever possible since this document can resolve current and prevent future legal disputes. Bills of sale can also be used when filling in one’s tax statements or qualifying for a loan.

Oregon requires registering all types of vehicles that can be driven on public roads. A seller is obliged to contact the Oregon DMV office within 10 days from the transaction date.

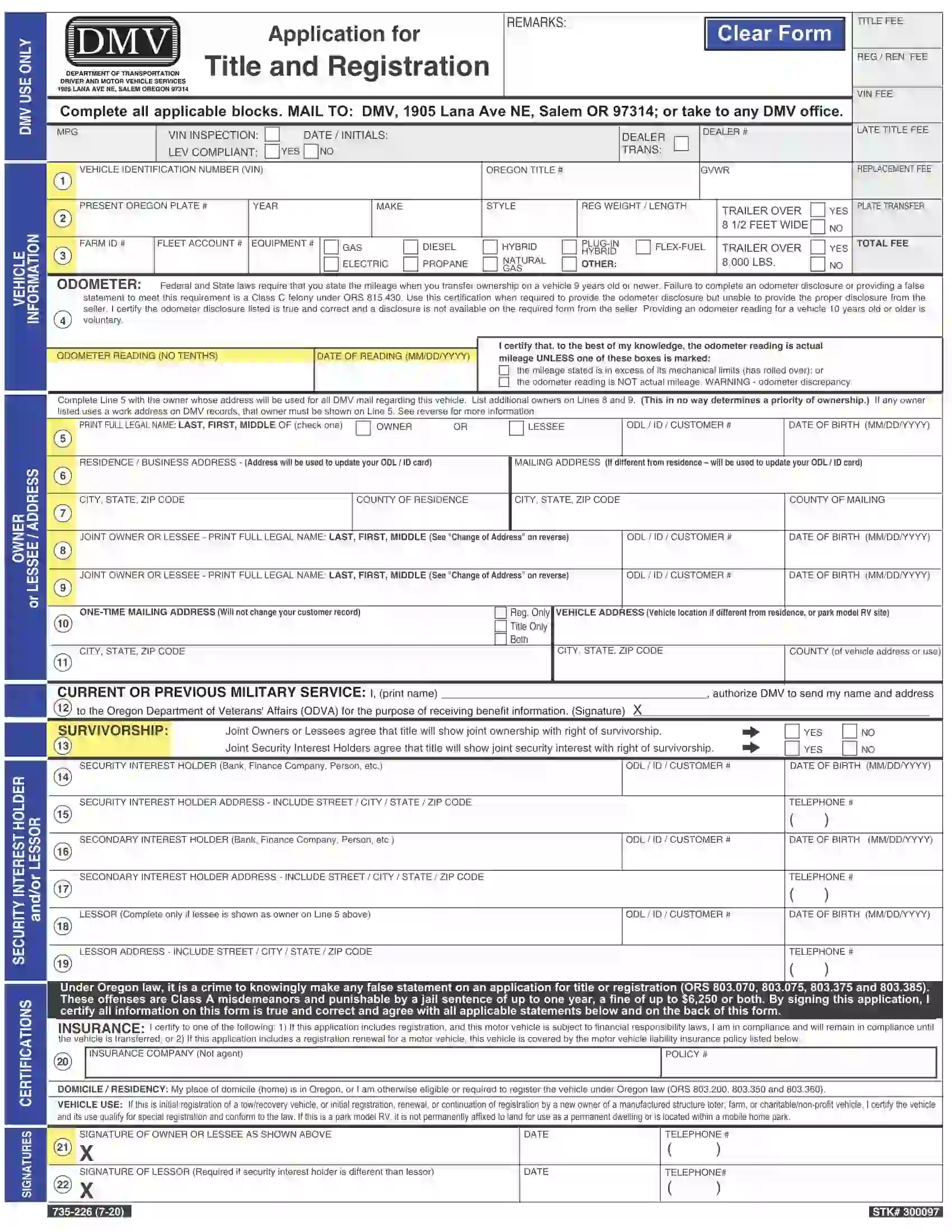

It’s worth noting that Motor Vehicle Services Division offices of Oregon are currently closed for visitors; all applications must be mailed to the DMV’s official address. The titling procedure must be completed within 30 days from the date of purchase or obtaining residency in Oregon. A list of papers required for registration is subject to changes (depending on the type and origin of the vehicle). Here are the documents that you need to provide to the Oregon DMV in any case:

- Form 735-226. Also known as an Application for Title and Registration, this form must be completed and signed by an applicant.

- Vehicle title. The previous owner is obliged to hand over the title to a buyer.

- Secure odometer disclosure statement. This document is not always necessary, so you should consult the official guide for details.

- Bill of sale. It may be replaced with an original release statement.

More documentation is required if you are registering an out-of-state car. For new cars without a title, you must also provide a Manufacturer’s Certificate of Origin, a vehicle identity inspection certificate, and the most recent out-of-state registration. A vehicle identity card can be obtained from the local DMV office, an authorized car dealer, or an emissions testing facility.

Registration fees may vary depending on the vehicle type you want to register. If you own a private car, the title charge is $98 for cars manufactured in 1999 or earlier and $103 for cars manufactured in 2000 or later. The cost is $187 if you need a registration for an electric car. It costs $24.50 to register a car that you purchased but does not have Oregon license plates.

Relevant Official Forms

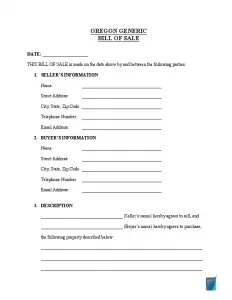

Form 735-6890 or Notice of Sale or Transfer of a Vehicle must be submitted within 10 days of transfer of a vehicle to notify the DMV about the vehicle sale. This form is not a bill of sale.

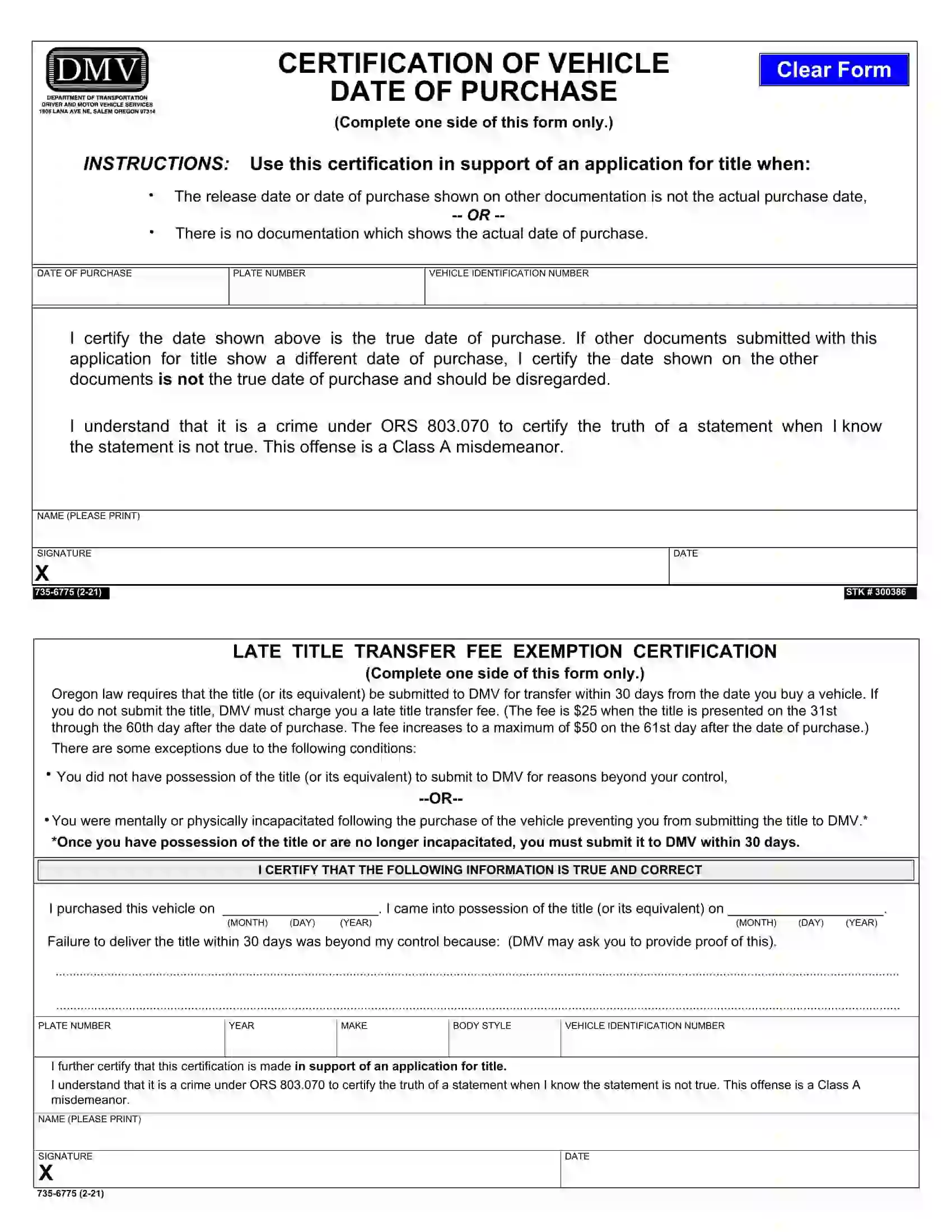

Certification of Vehicle Date of Purchase (Form 735-6775) is submitted together with an application of title when the date of purchase stated on the documentation is not the actual purchase date or when there is no records of the actual purchase date.

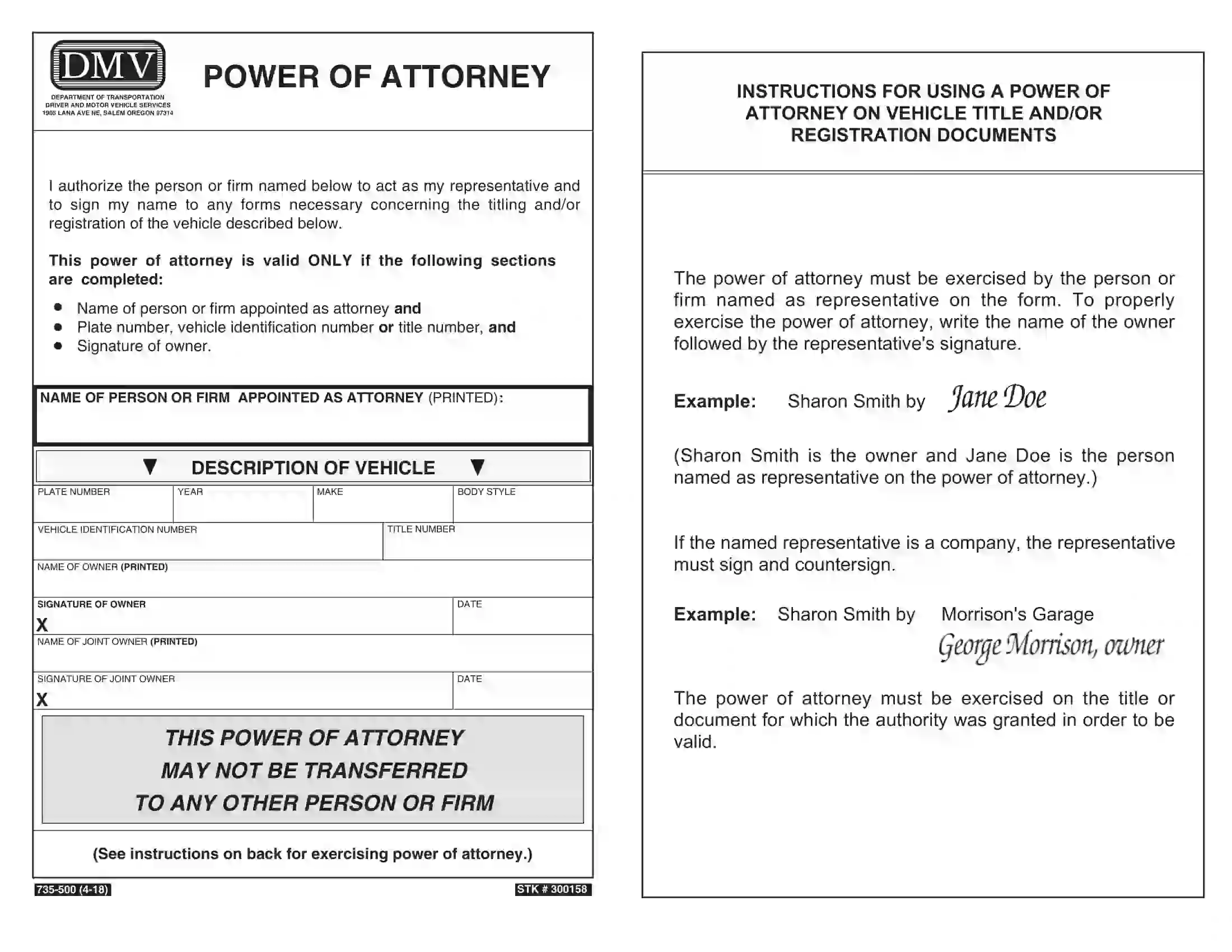

A motor vehicle power of attorney, known as Form 735-500 in Oregon, helps provide another person with authority to sign documents required for a title registration if you cannot be present.

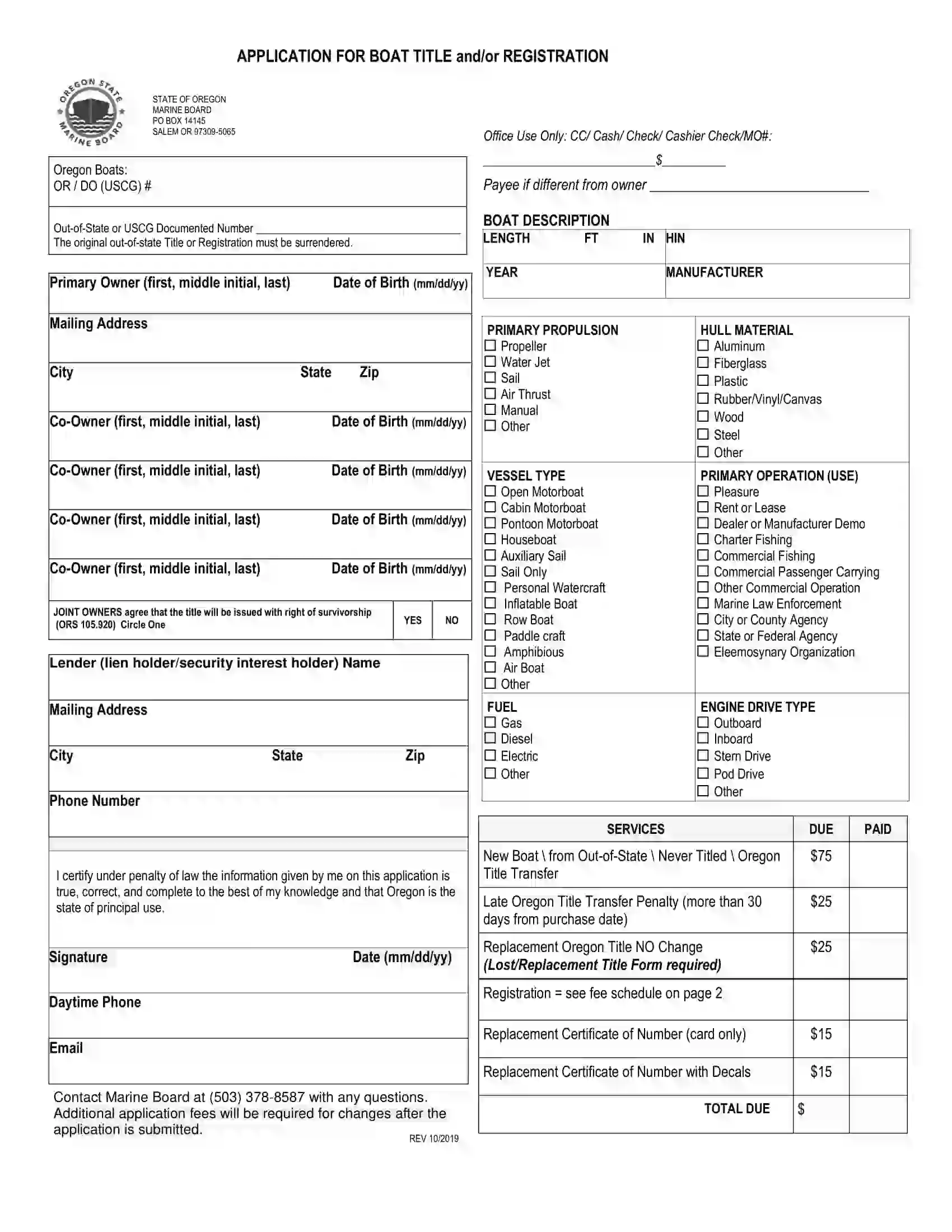

Application for Boat Title and/or Registration helps get a title and registration for your vessel.

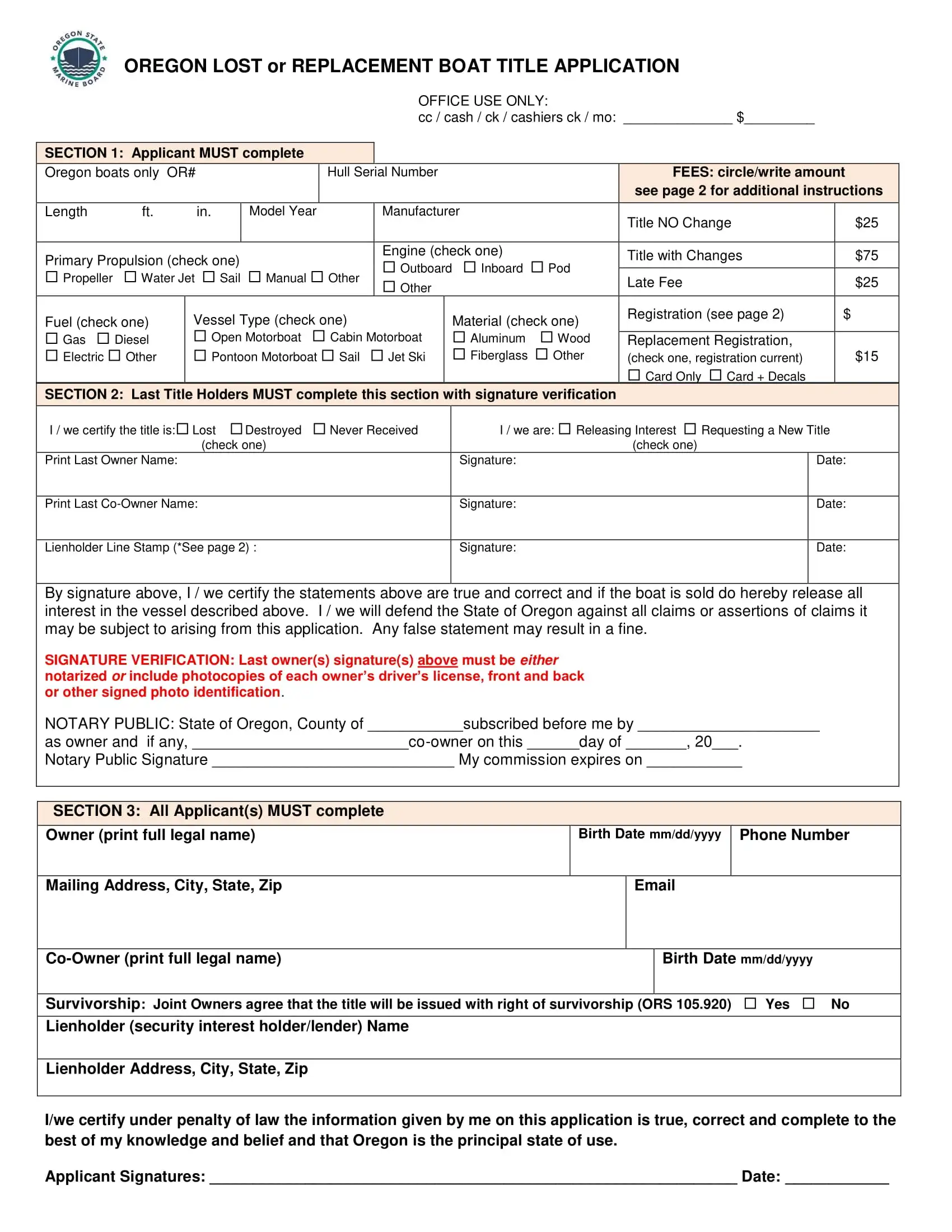

Lost or Replacement Boat Title Application is designed to obtain a boat title if it’s lost, stolen, or damaged.

Short Oregon Bill of Sale Video Guide