Texas Bill of Sale Form

Texas bill of sale is a legal document used in private transactions to record the details of a deal between two parties. The information this form contains includes the identifying details of the item(s) sold, the names and addresses of the buyer and the seller, and the terms regarding the item’s condition and warranty.

The main advantage of using bill of sale forms is to have proof that you bought or sold a particular item, which can be used in case of disputes or during the official registration processes.

Down below, you will be able to download bill of sale templates valid in Texas for most transaction types. You can also use our document builder to create a document that is customized entirely to your case.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | Texas Vehicle Bill of Sale Form |

| Other Names | Texas Car Bill of Sale, Texas Automobile Bill of Sale |

| DMV | Texas Department of Motor Vehicles |

| Vehicle Registration Fee | $51.75 |

| Bill of Sale Required? | Yes |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 59 |

Texas Bill of Sale Forms by Type

Basing on the circumstances and types of sales, they distinguish particular types of bills of sale. You’ll want to try and use the right template and register it accordingly with your state regarding the kind of transaction you’re conducting.

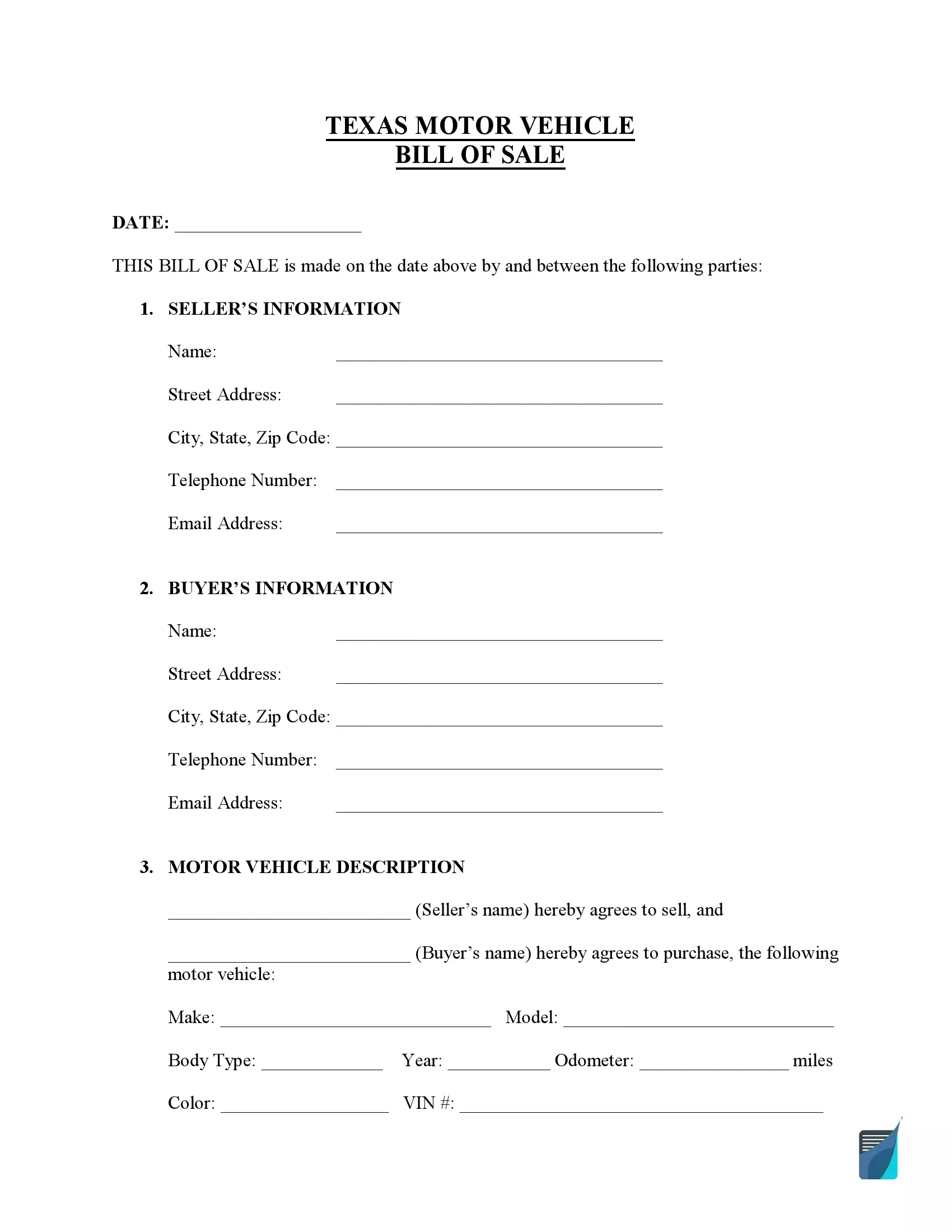

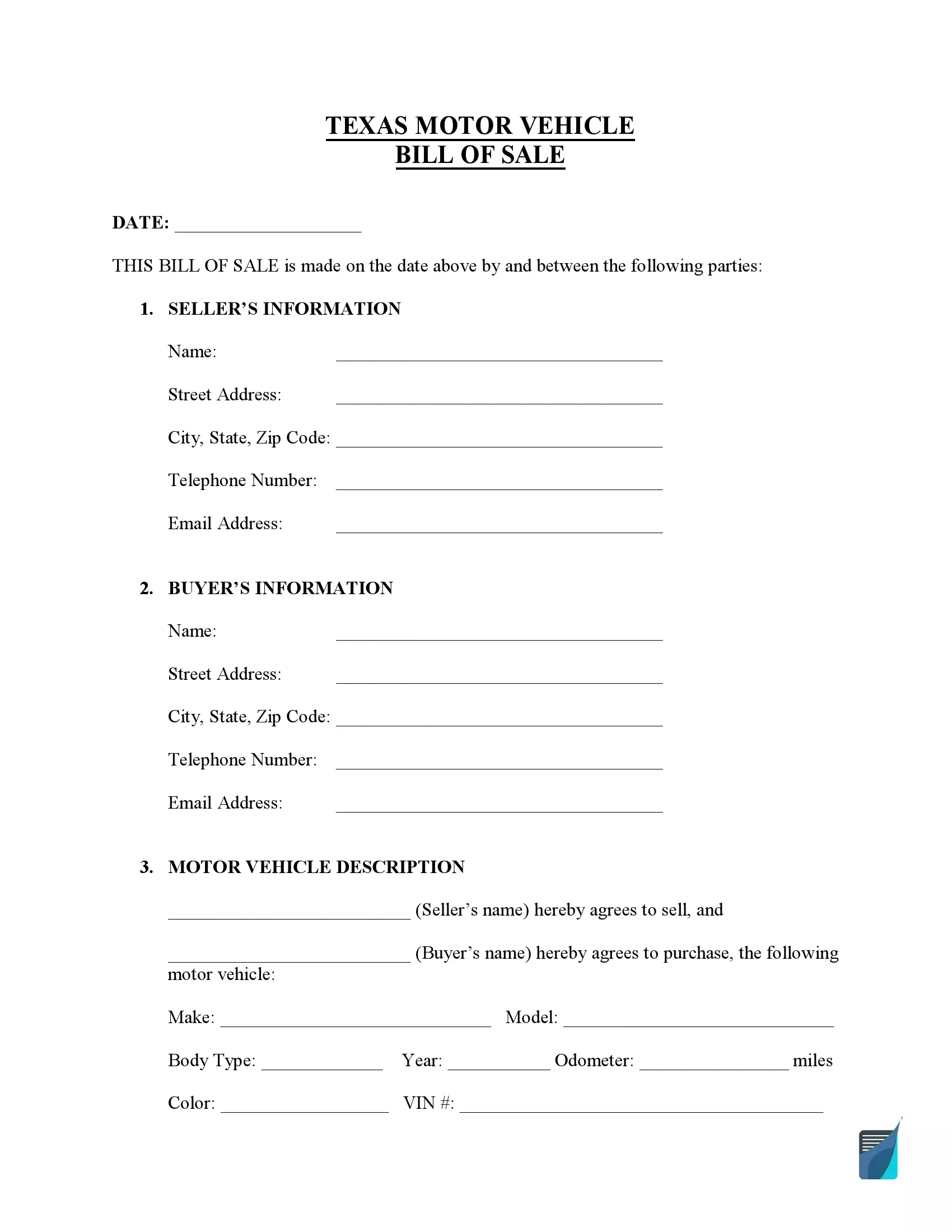

To fill out a Texas motor vehicle bill of sale, specify the following: your vehicle’s make and model, its VIN and mileage, and payment method. Regional tax, registration fees, and other expenses would probably be on the purchaser after acquiring the vehicle. Any information pointed out on the title certificate should also be laid out in the form.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

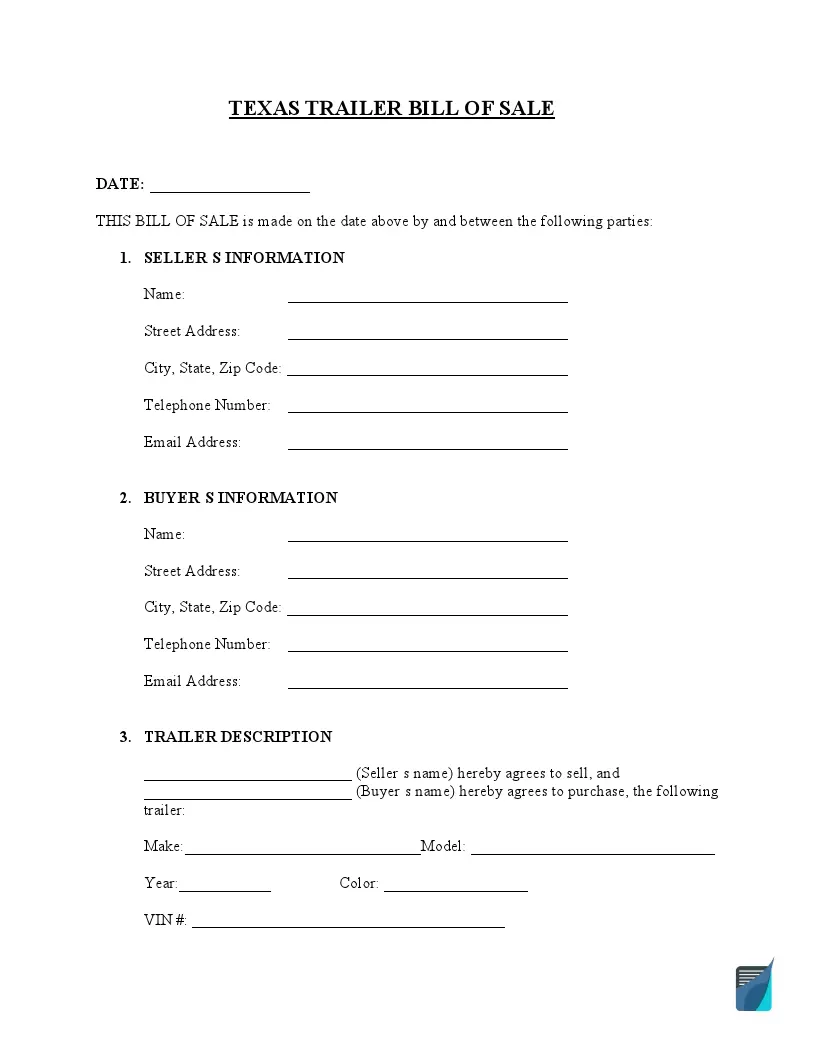

Texas trailer bill of sale was specifically designed for transactions involving various trailers. Use it if you want to buy or sell a trailer.

| Alternative Name | Utility Trailer Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

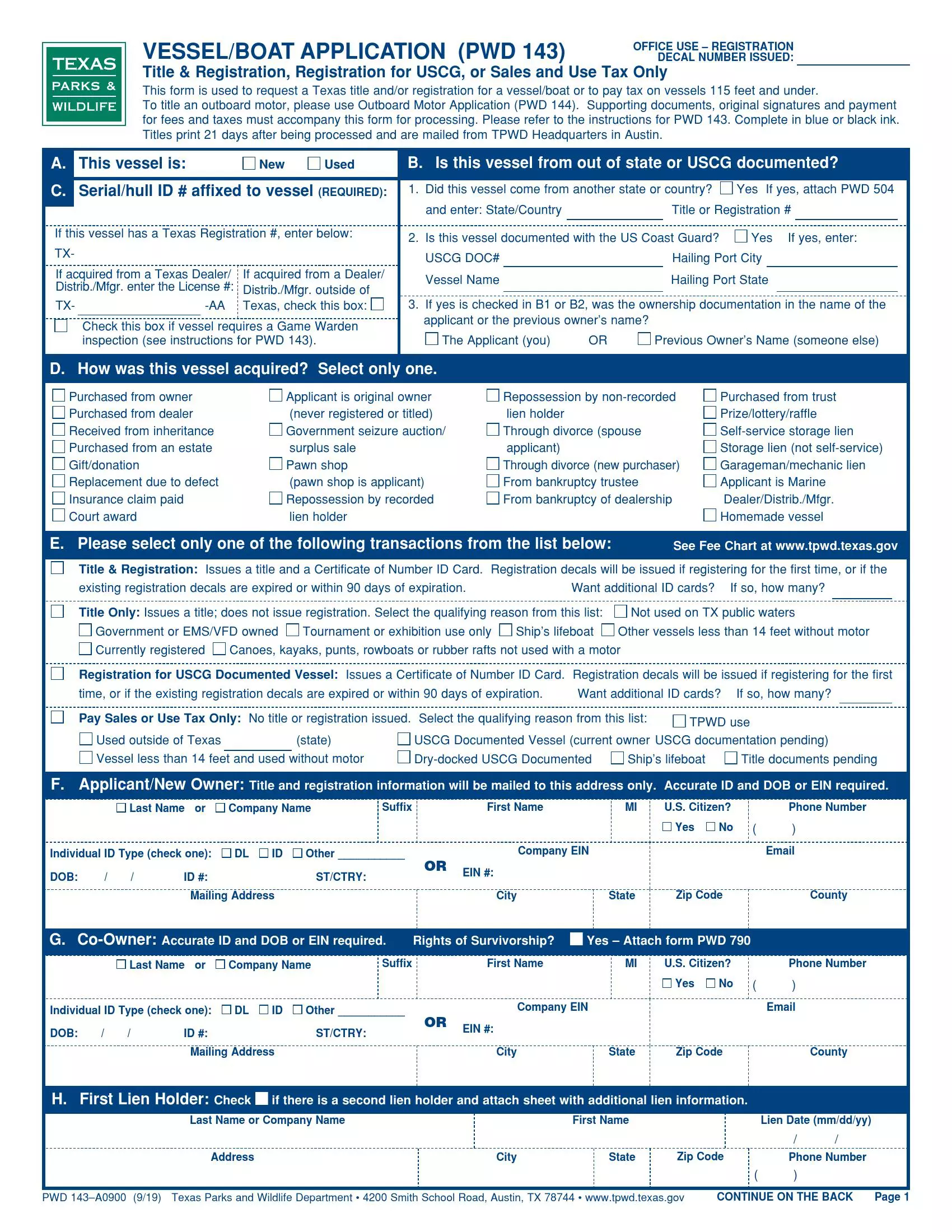

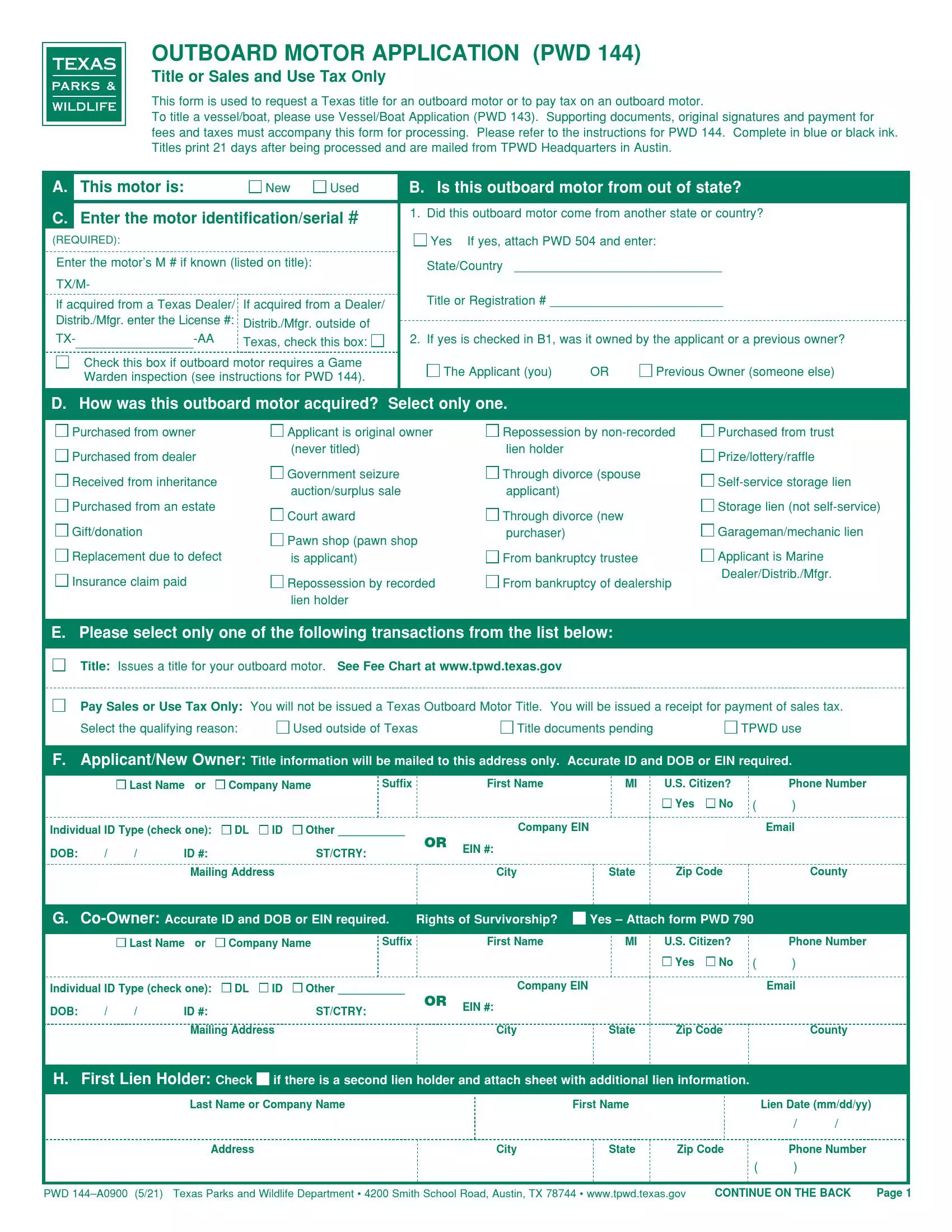

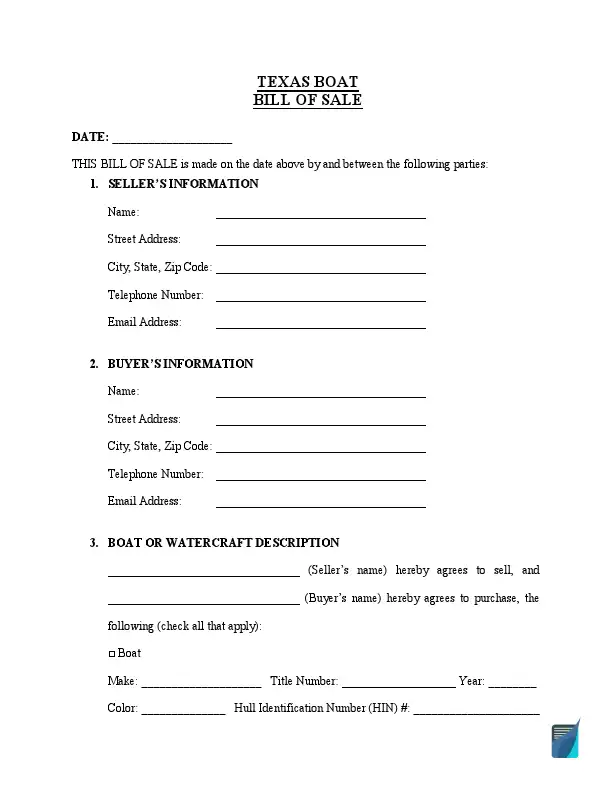

The process for a Texas bill of sale for a boat is very similar. You will need to specify the HIN, engine hours, and any additional identifying elements.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

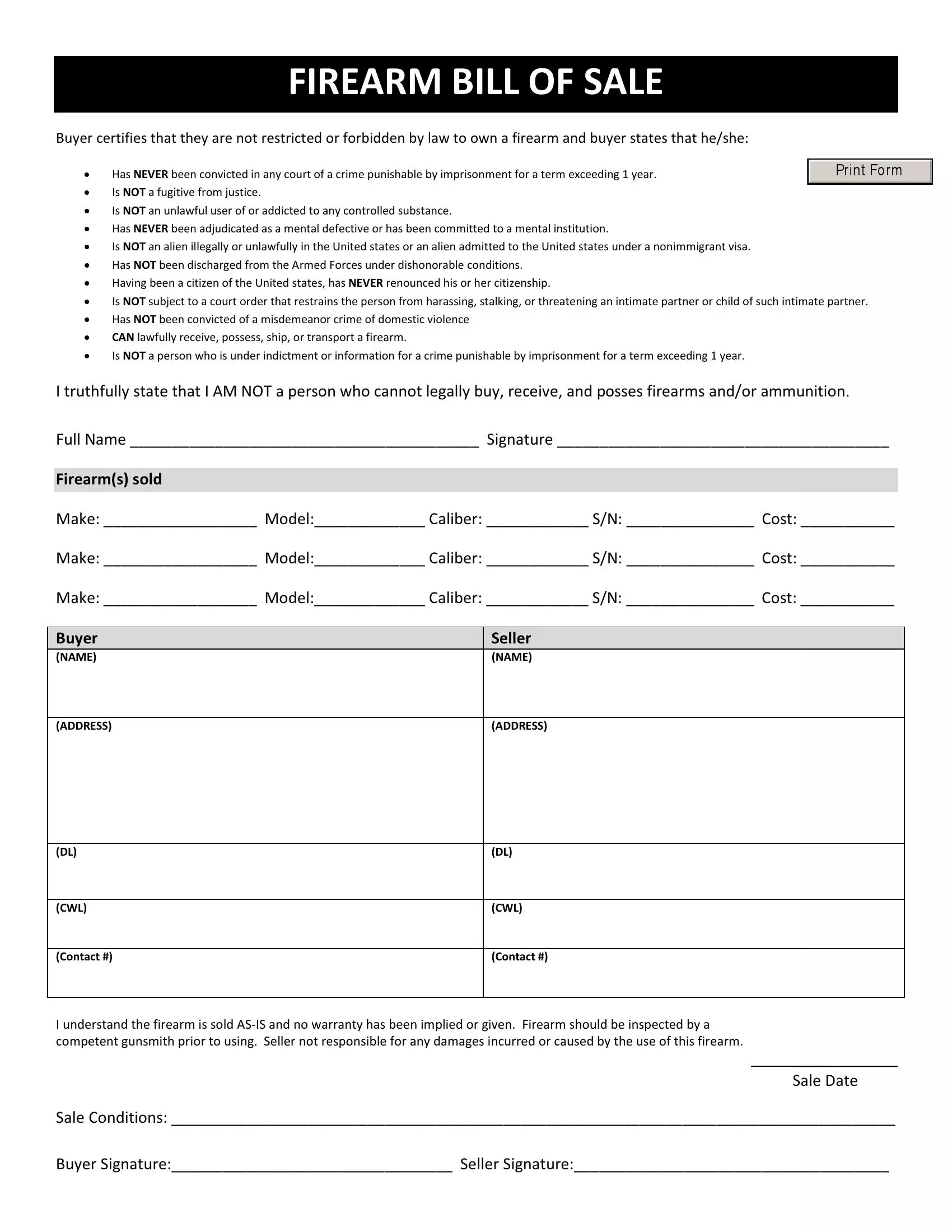

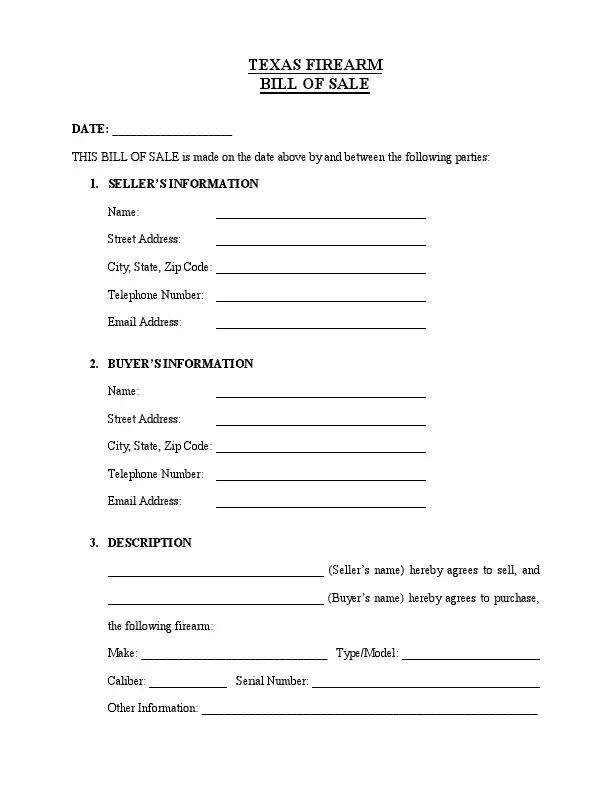

Texas firearm bill of sale is used for selling or buying various guns via private deals. Texas doesn’t require a background check or other actions before selling a gun. There’re several things that are still needed to be mentioned on the bill of sale: the make, caliber, and model of the firearm. The cost and the serial numbers of all guns and the individual details of the purchaser and the seller must also be stated.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

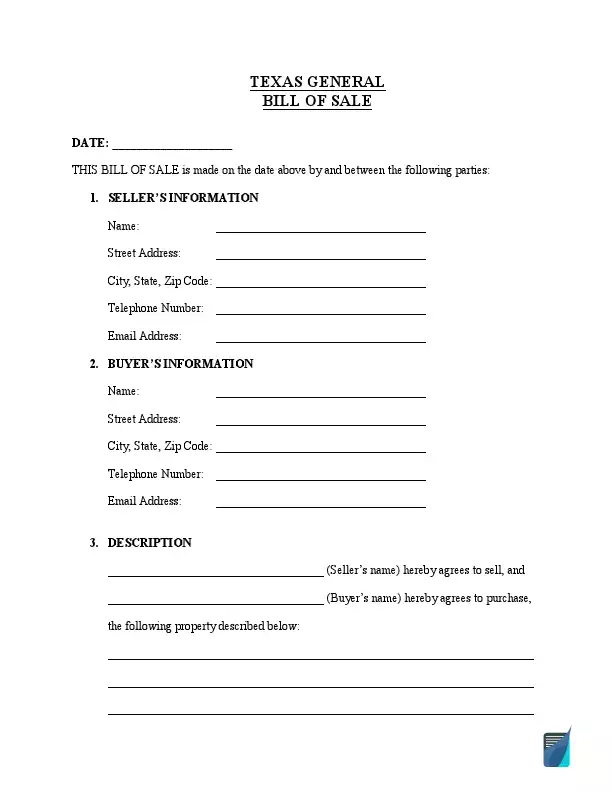

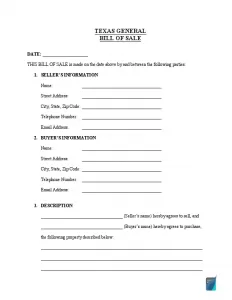

It is possible to use a general bill of sale for practically any property only when there isn’t a more specific form available.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

How to Write a TX Vehicle Bill of Sale

You are recommended to read the following guidelines based on our custom-made template. They can help you complete the document with no hassle.

Step 1: Specify the bill of sale creation date:

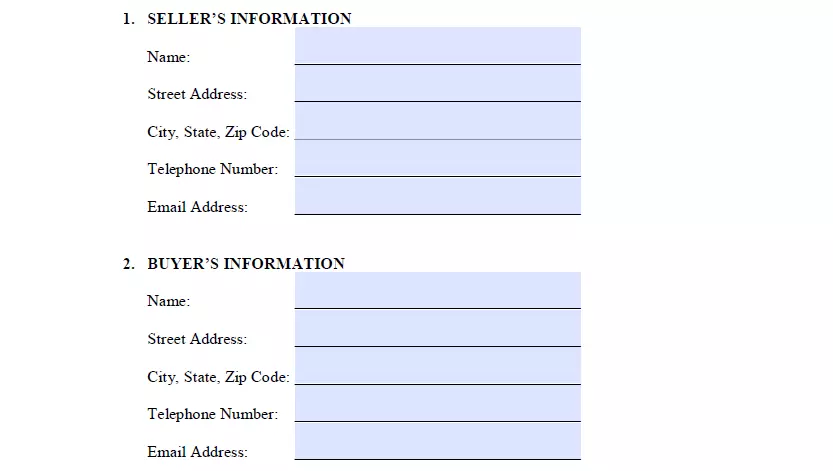

Step 2: Indicate the buyer’s and seller’s specifics:

- Name

- Street address

- City

- State of residence

- Postal code

- Phone number

- Email address

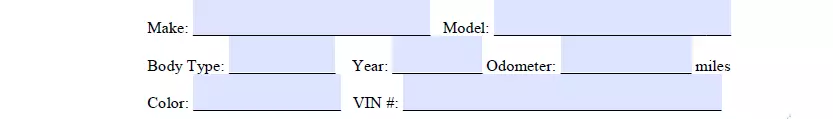

Step 3: Provide the motor vehicle detalis:

- Make

- Car’s model

- Body type

- Model year (MY)

- Odometer reading

- Color

- Identification Number (VIN)

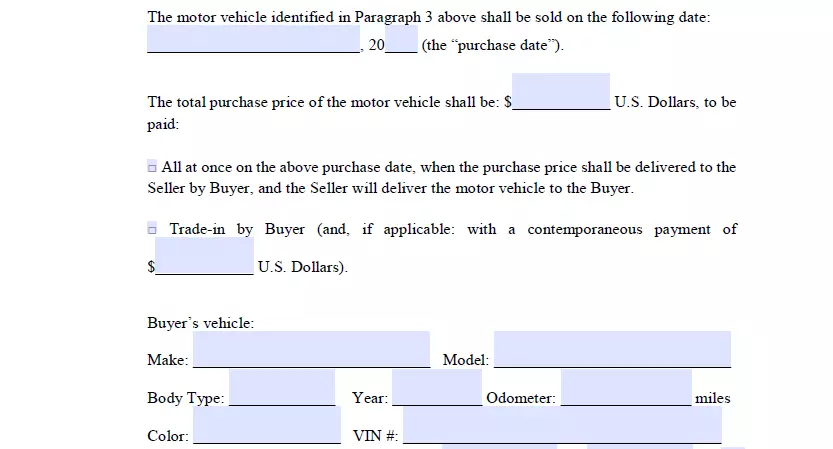

Step 4: Specify the purchase price and payment method

This part involves specifying the date of the transaction and the full sum approved by both sides of the deal. You have to furthermore indicate the sale method the buyer will opt for:

- Giving the entire amount as a one-time transaction. The property owner is provided with the entire amount of money from the buyer in one payment and delivers the motor vehicle to the purchaser on the same day.

- Trade-in. This enables the buyer to trade their motor vehicle (usually with a supplement) for the owner’s motor vehicle. In this case, the document also have to contain the buyer’s vehicle particulars.

- A number of payments. With this method, you need to indicate the dates when the purchaser must deliver the initial and the final payments, along with their sums.

The next step is considering the way of payment:

- Cash

- Cheque

- Cashier’s cheque

- Money order

Finally, check whether the purchase cost includes all applicable taxes.

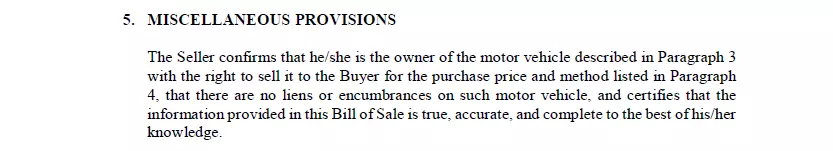

Step 5: Go through the standard provisions

It’s recommended to read the standard provisions to confirm that both sides are aware of them. The “as-is” paragraph points out that the property owner provides no warranties and will not be liable for repairs after the transfer.

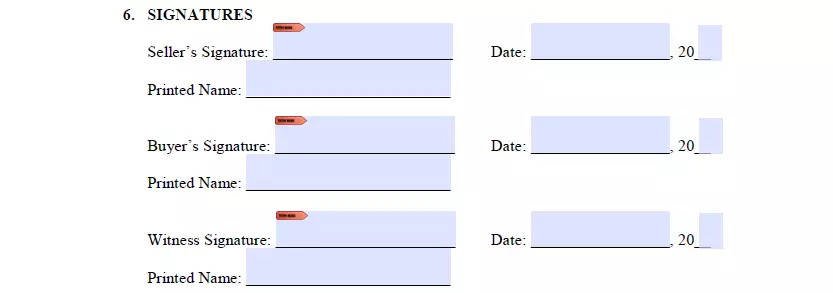

Step 6: Sign the form in the corresponding fields

The purchaser is generally not requested to sign the bill of sale. However, you’ll be more protected against legal issues if all parties sign the form. You may additionally have one or several witnesses verify the deal.

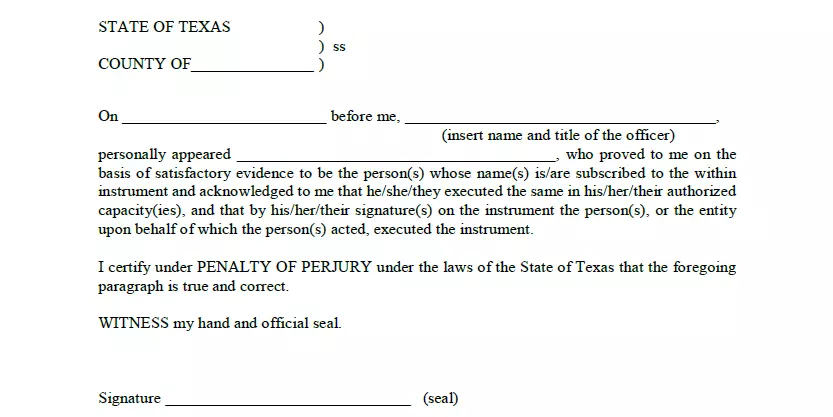

Step 7: Have a notary public certify the document

Notarization is usually optional, but it can provide more legal protection.

The original bill of sale copy has to be given to the purchaser because they will likely require it to receive a title to their new motor vehicle. As a seller, you may either get a copy and keep it or have a pair of identical documents signed and completed by both parties.

Registering a Vehicle in Texas

Once the sale is complete, the vehicle buyer should proceed to its registration to obtain new plates and a certificate of title. The procedure is undertaken at the County Tax Office. Registration should be initiated not more than 30 days after the deal.

If the buyer plans to drive the vehicle until the registration is complete, they should get a temporary license plate, also known as a temporary tag or temp tag. You may also apply for a vehicle transit permit and have up to five days to drive a newly purchased vehicle without the license. It’s possible to obtain one in the local DMV office or county tax office. The document can come in handy if the buyer needs to bring the vehicle to the inspection site or re-register it due to moving to the new state of residence.

The documents required from the motor vehicle’s seller include:

- Form VTR-40, which is an official odometer disclosure statement

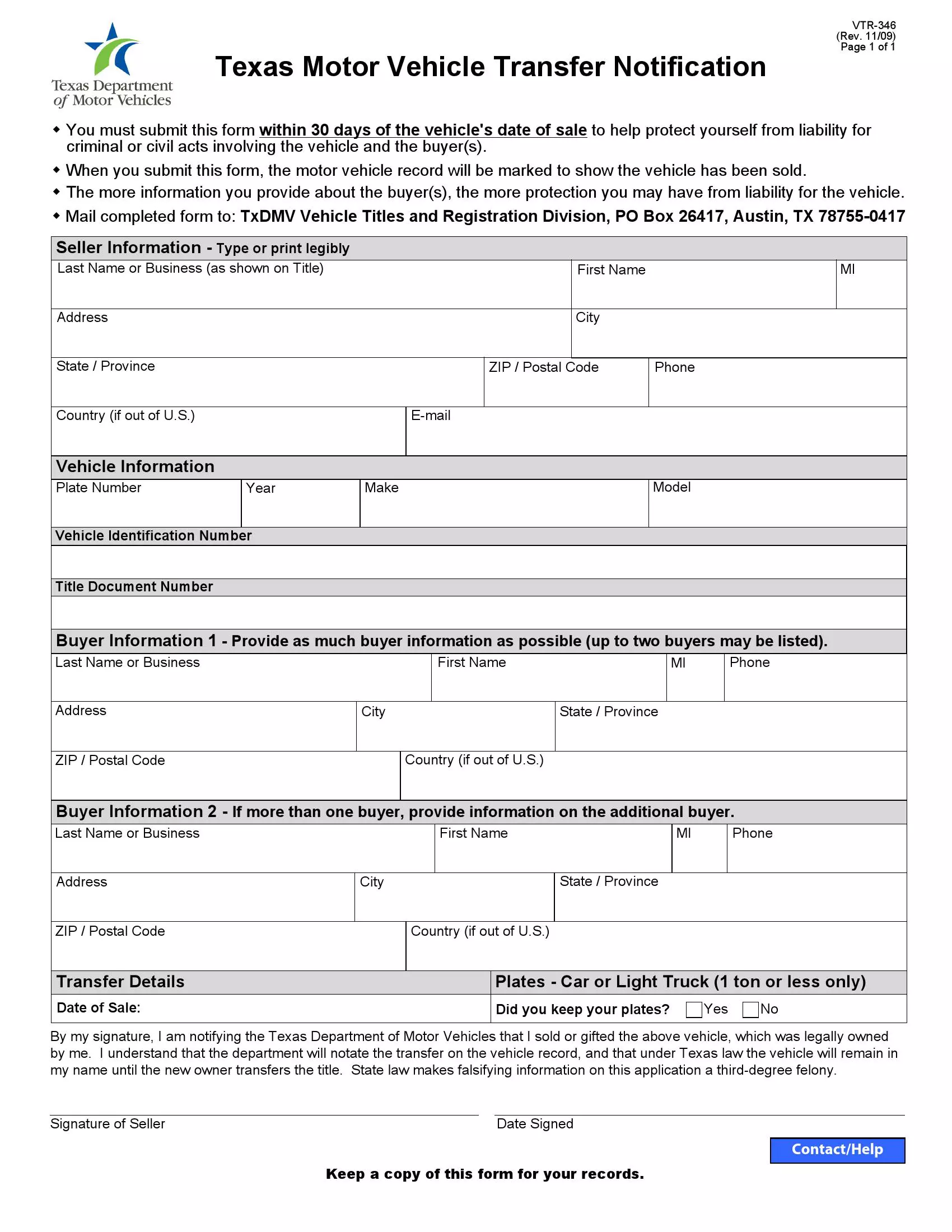

- Form VTR-346, which is the Texas Motor Vehicle Transfer Notification

These documents need to be sent to the TxDMV Vehicle Titles and Registration Division in Austin. The more detailed information about the vehicle’s buyer is provided, the better.

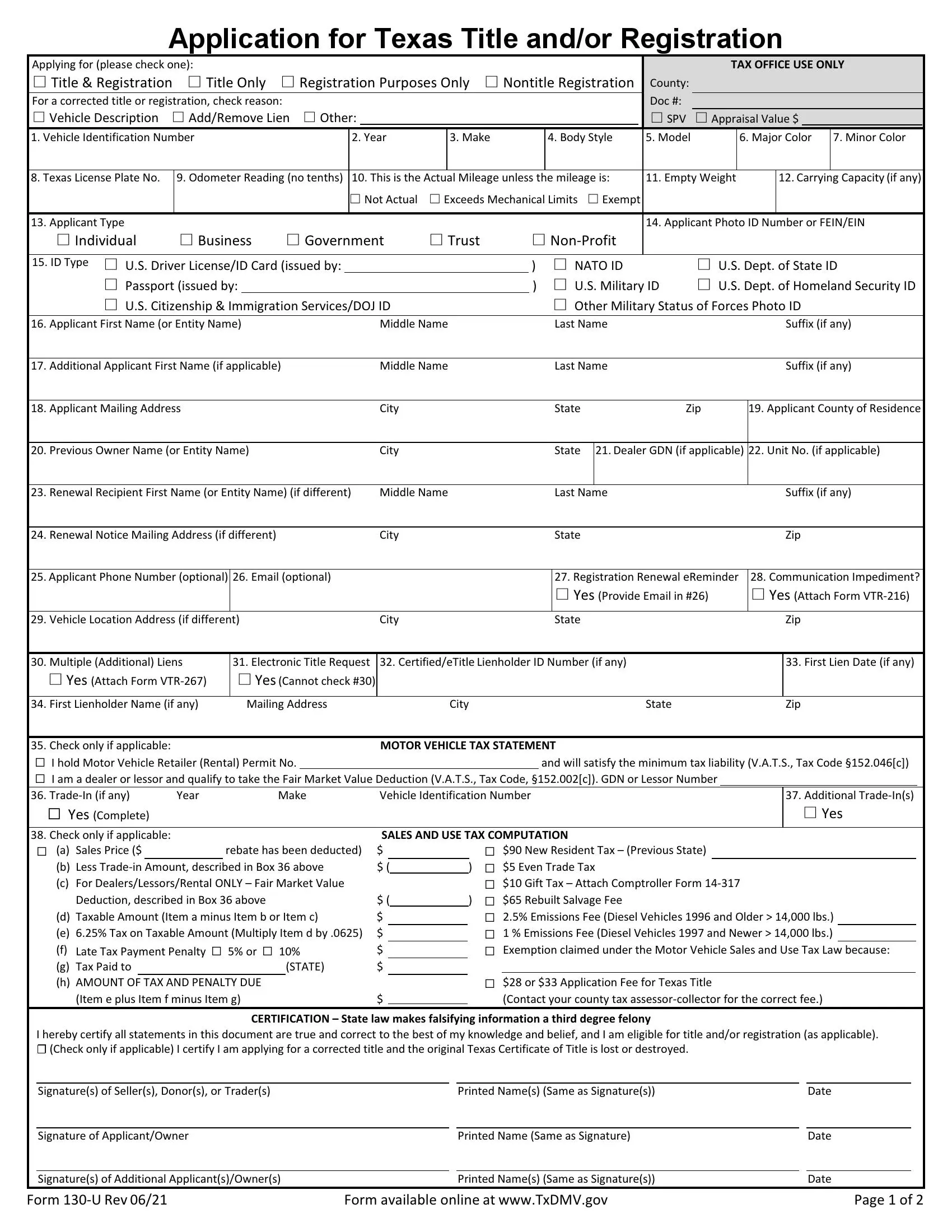

The documents needed for filing a registration application by the new owner include:

- Form 130-U or Application for the Texas Certificate of Title

- Motor vehicle bill of sale form

- Results of the vehicle’s technical inspection

- Active car insurance

- Valid driver’s license

- State ID as identity proof

- Receipt for paying all associated fees and taxes

Those who have a lien on their vehicles should also file a completed Form VTR-272, an application for registration purposes only.

The bill of sale may also be helpful for those who purchase a motor vehicle without a certificate of title. In such cases, the form serves as a vital supportive document containing all of the essential data about the vehicle and the transaction’s parties. Those who have bought a vehicle without a title may also apply for a bonded title for the sake of transferring ownership. The issuance of the bonded title is subject to a $15 administrative fee.

The vehicle purchase tax in Texas equals 6.25% of the new vehicle’s purchase value and 80% of the standard presumptive value of used vehicles (bought in a private sale, not from a dealer). The annual registration fee in Texas depends on the vehicle’s weight, ranging from $50.75 for passenger vehicles and trucks less than 6,000 lbs in weight to $850 for vehicles weighing 70,000-80,000 lbs. A standard fee for motorcycles and mopeds is $30.

Relevant Official Forms

Application for Texas Title and/or Registration is used to apply for title or registration, or both. Instructions inside.

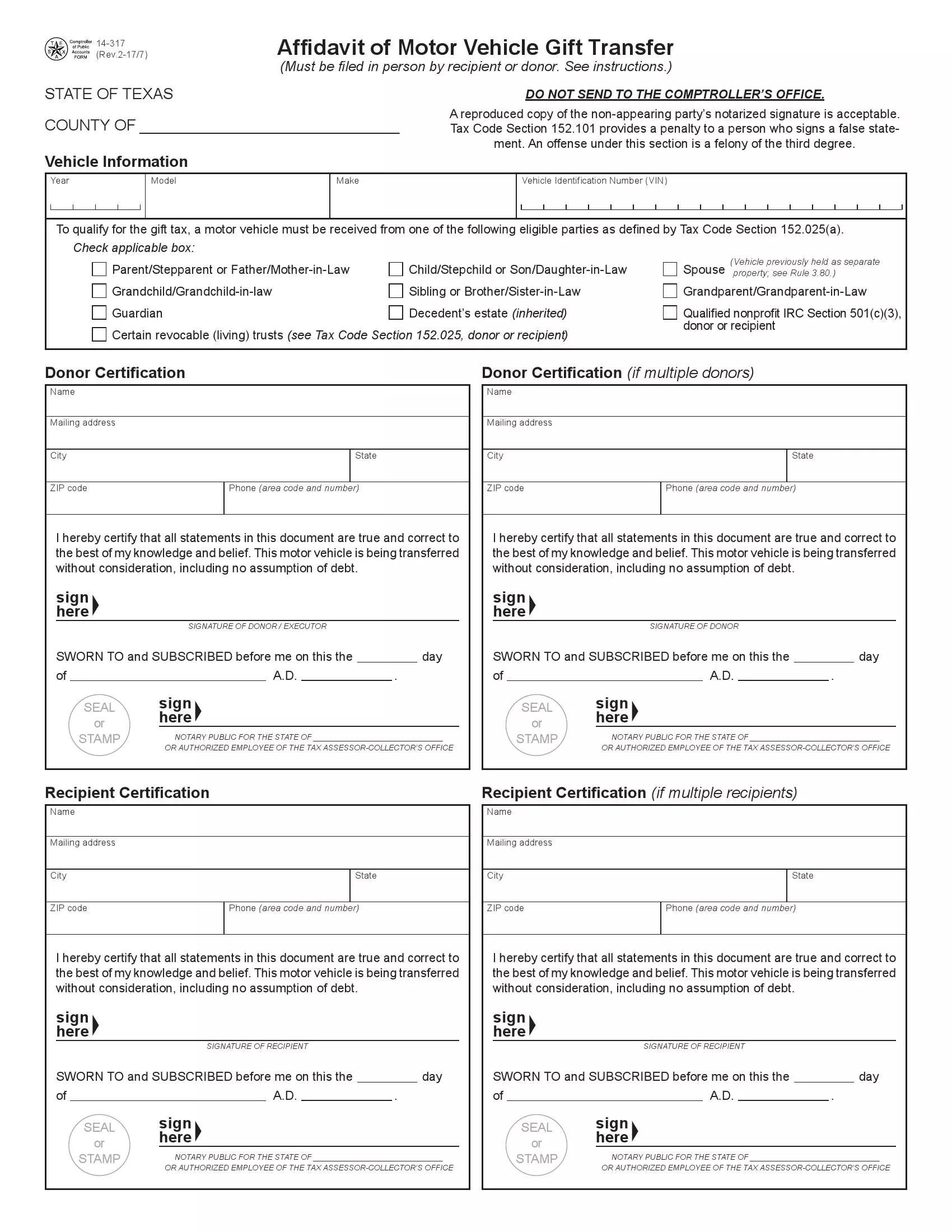

Affidavit of Motor Vehicle Gift Transfer is used if the vehicle is given as a gift or donated with no consideration.

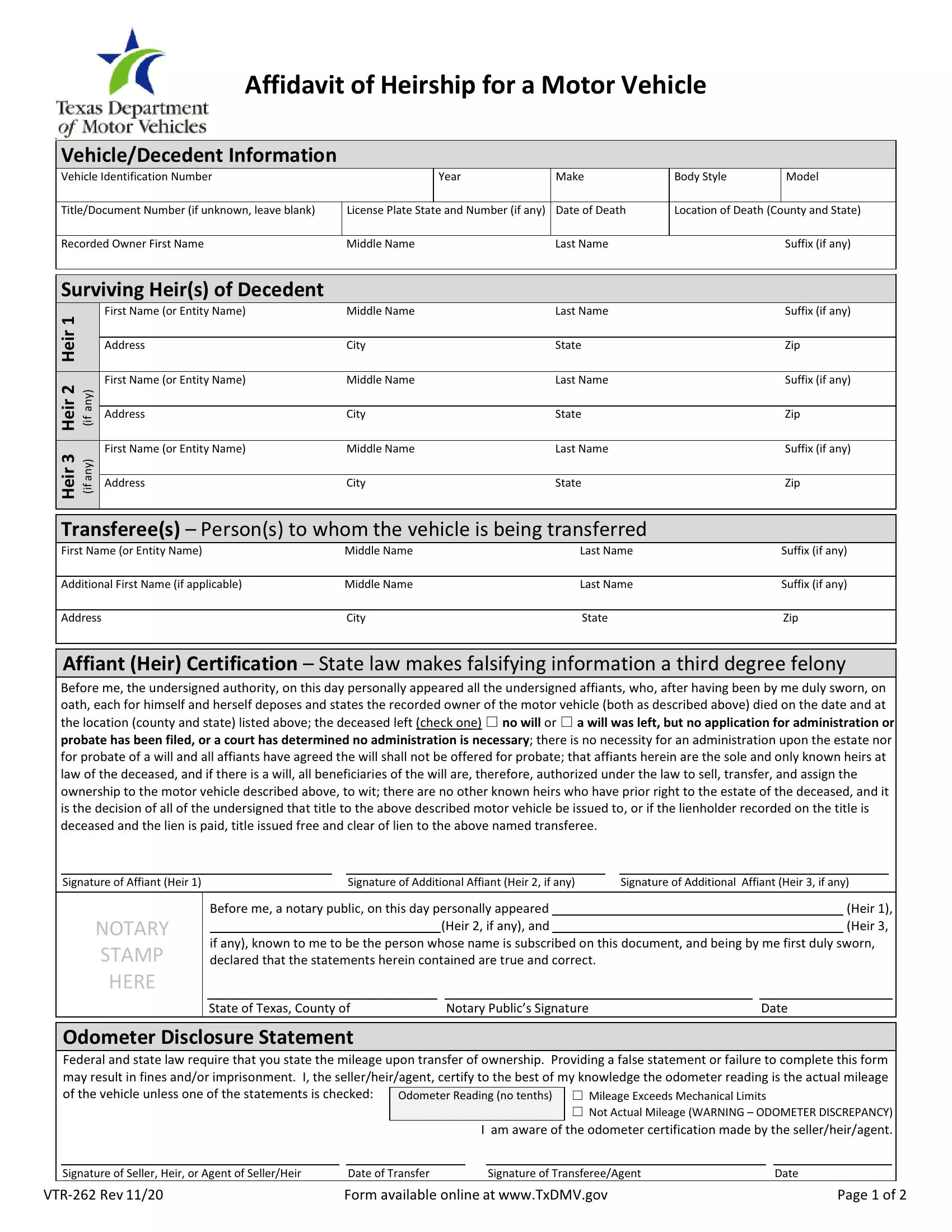

Use this Affidavit of Heirship for a Motor Vehicle if you inherited the vehicle.

Submit within 30 days of the sale if you are the seller to protect yourself from any possible liability for acts that involve the vehicle.

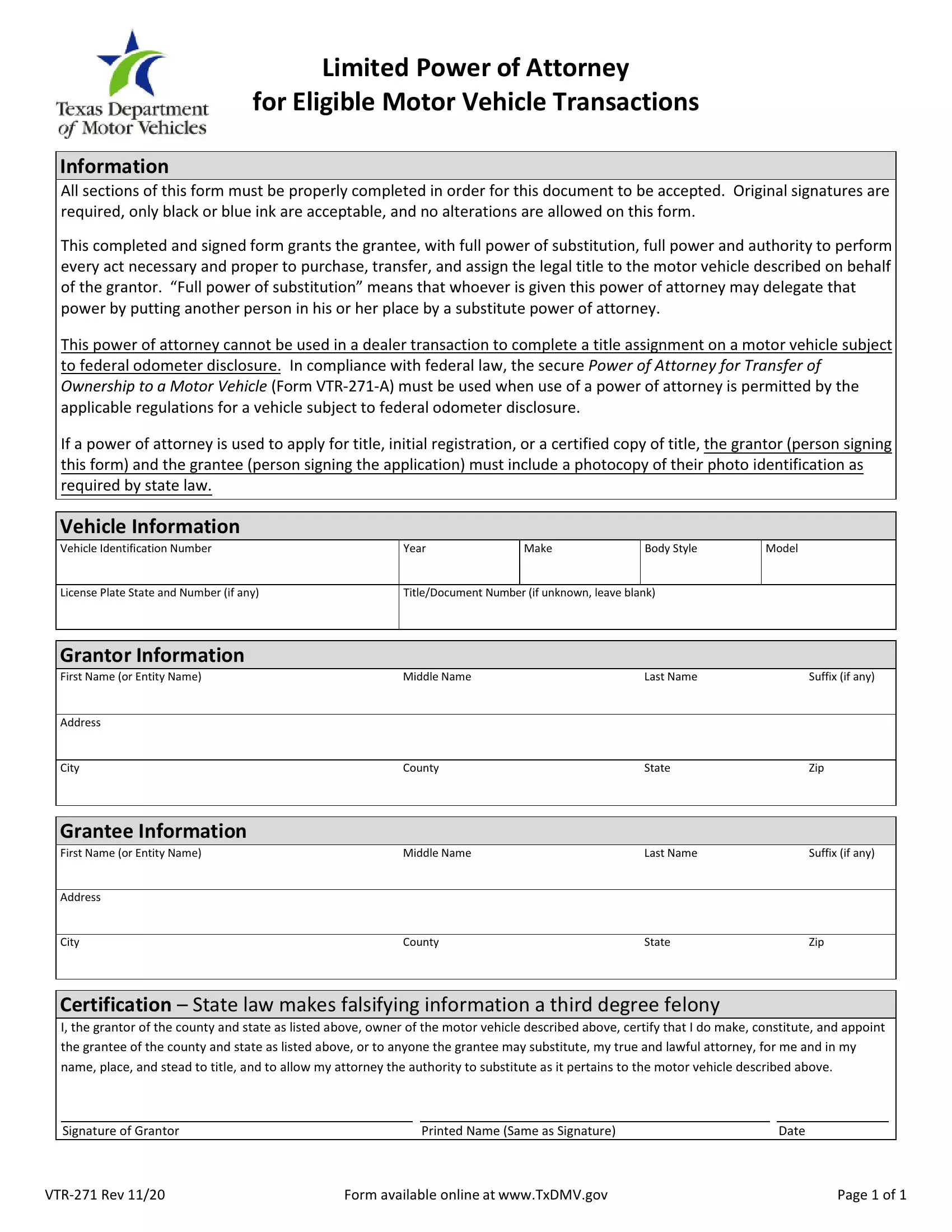

A vehicle power of attorney that you can use to appoint an agent that would be able to act on your behalf in matters related to vehicle registration.

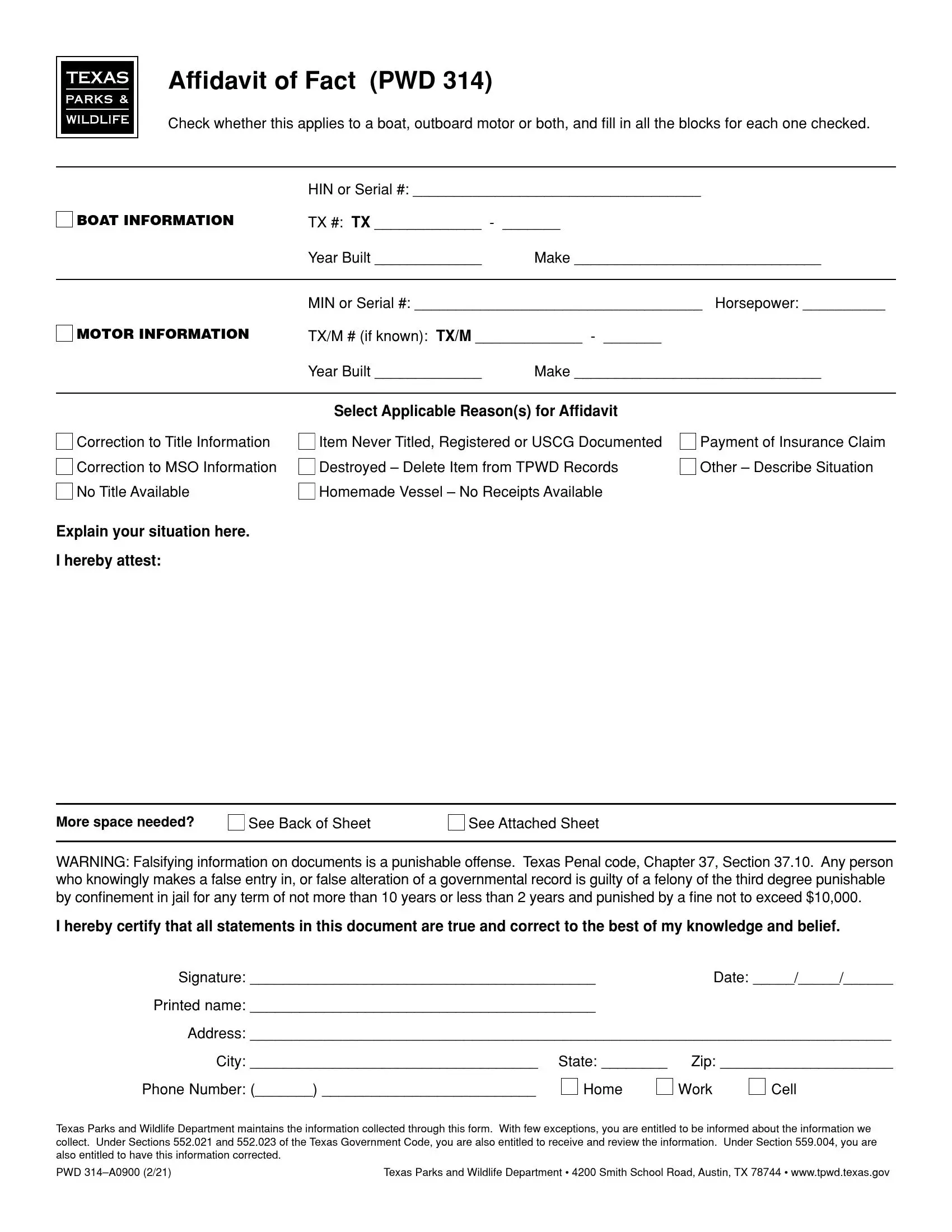

Affidavit of Fact is used for previously owned vessels that have never been documented in any way.

Short Texas Bill of Sale Video Guide