Virginia Bill of Sale Form

Virginia bill of sale is a legal document serving as a receipt of a specific transaction, no matter whether you sell or buy property. You may use a Virginia horse bill of sale or Virginia equipment bill of sale to transfer ownership of animals or personal items.

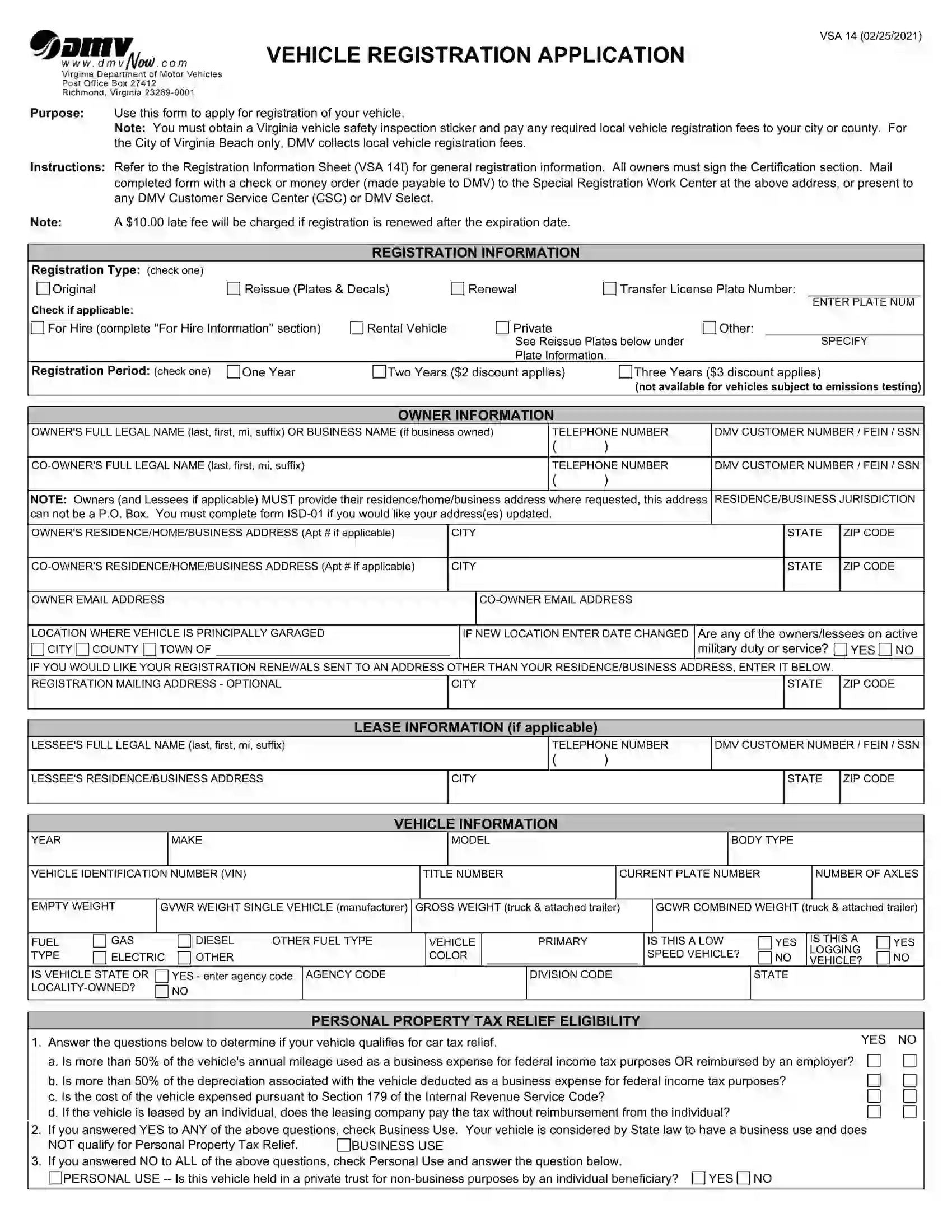

We offer specific Virginia bill of sale forms so you can use the right one for your transaction. You can also take advantage of Virginia’s official forms and the bill of sale. For example, you must use Form VSA 14 to register your vehicle. You will find other relevant documents below.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | Virginia Vehicle Bill of Sale Form |

| Other Names | Virginia Car Bill of Sale, Virginia Automobile Bill of Sale |

| DMV | Virginia Department of Motor Vehicles |

| Vehicle Registration Fee | $30.75-35.75 (electric car – $109) |

| Bill of Sale Required? | No |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 59 |

Virginia Bill of Sale Forms by Type

When selling or buying an item, you are recommended to use particular types of bills of sale (our guide can give more details about various bill of sale forms). In order to conduct your transaction successfully, you need to use the appropriate bill of sale template.

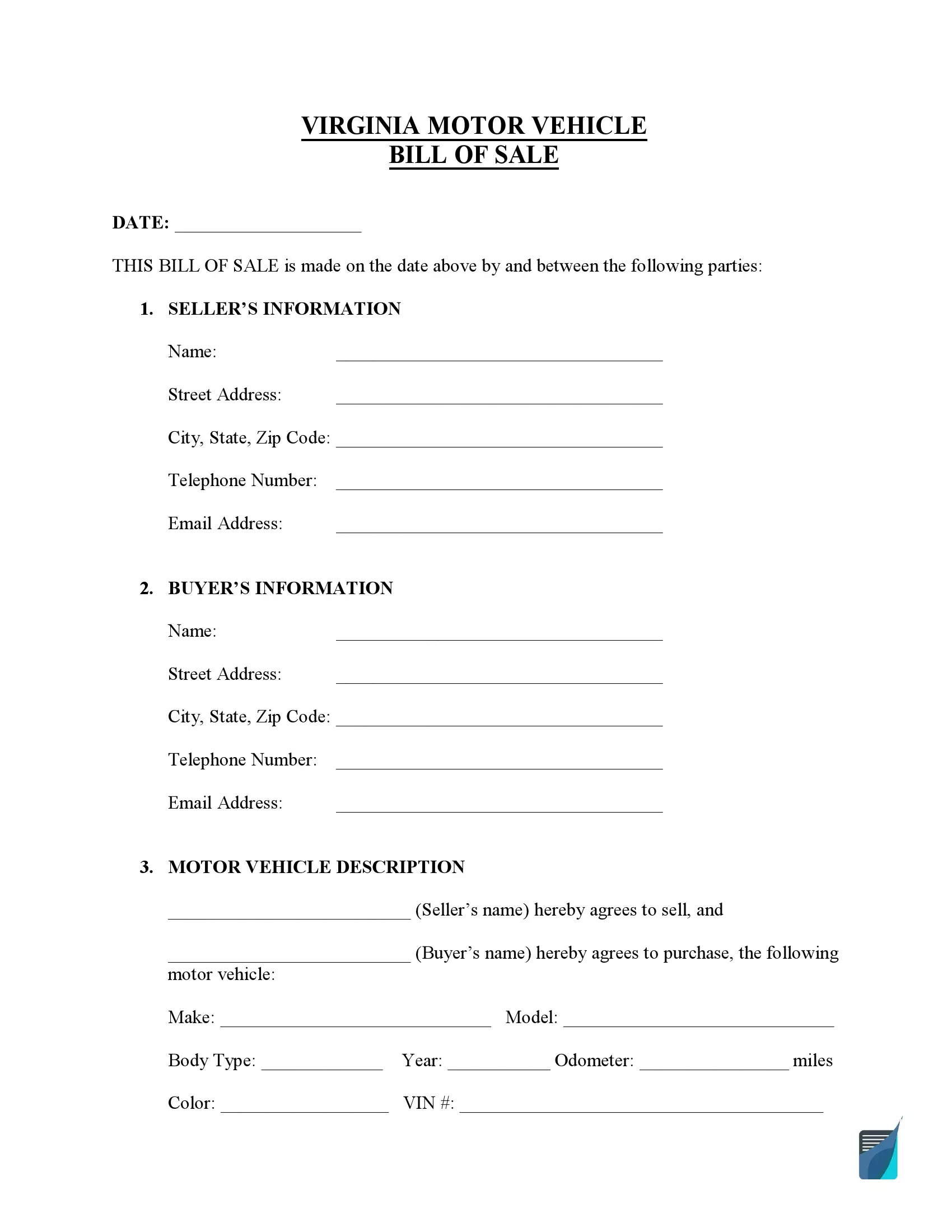

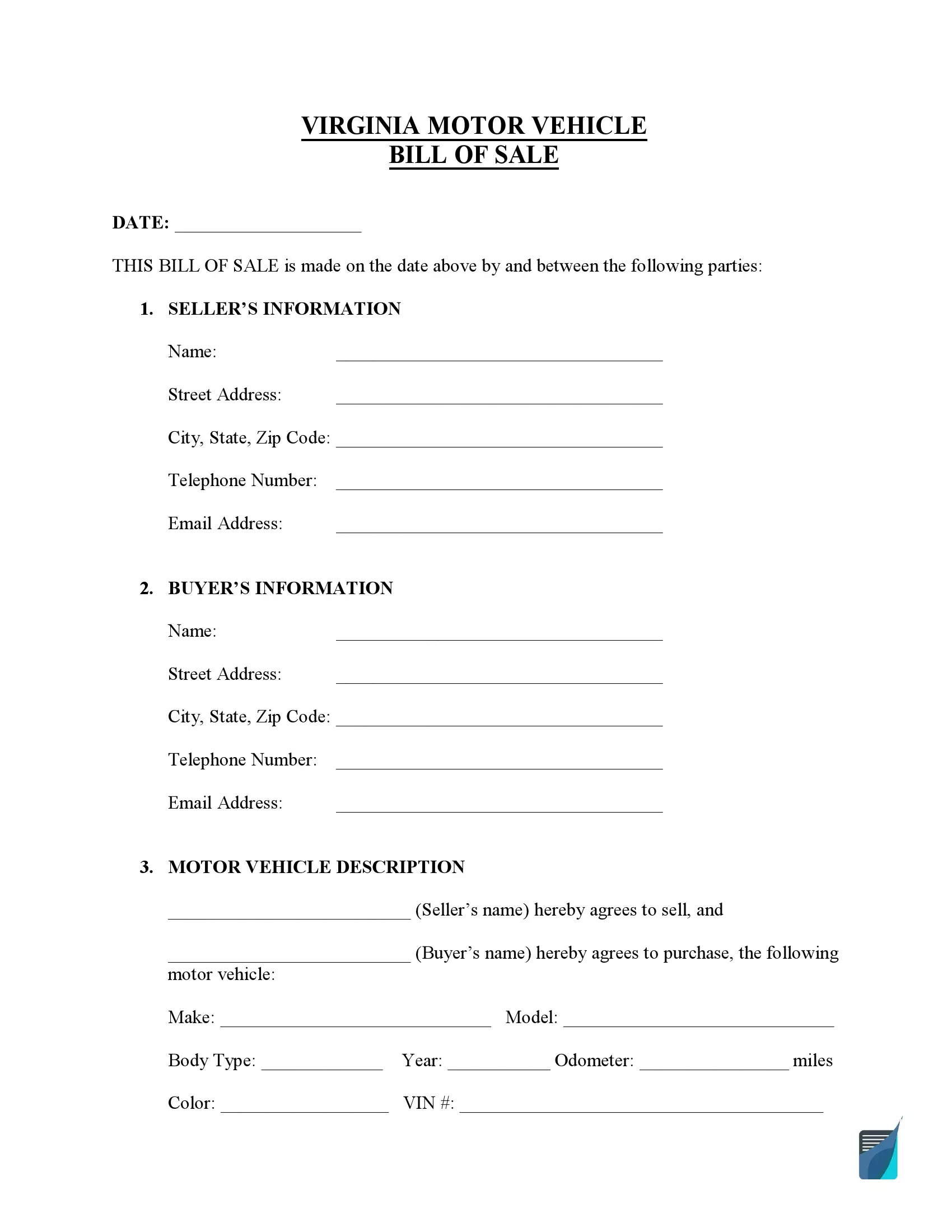

Virginia vehicle bill of sale is used to transfer the vehicle ownership from the seller to the buyer in Virginia. The make, model, vehicle identification number, and current mileage must be indicated in the document.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

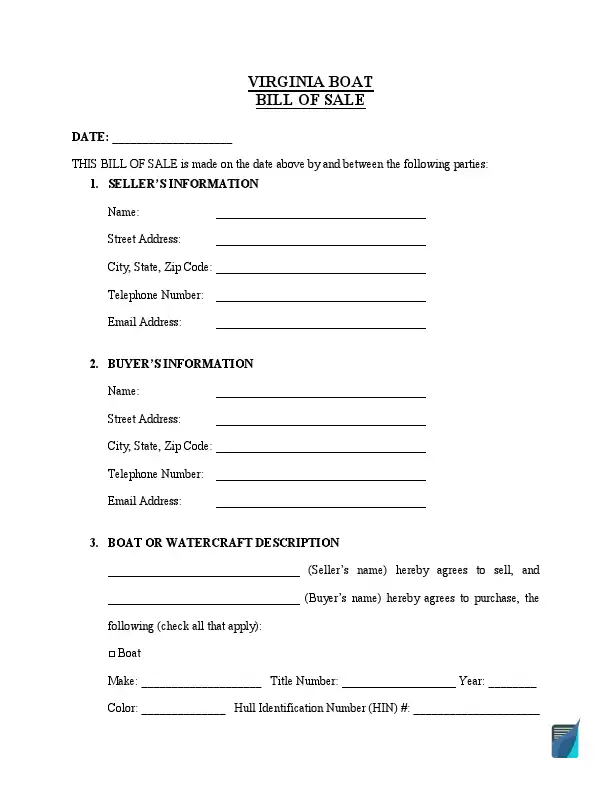

Virginia bill of sale for a vessel is a legal instrument serving as a receipt of selling and buying a boat. Your boat registration in Virginia will be legitimate for three years. If you possess a sailboat more than 18 ft in total length or a motorboat, you must record it. Registration fees will depend on the length of the boat.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

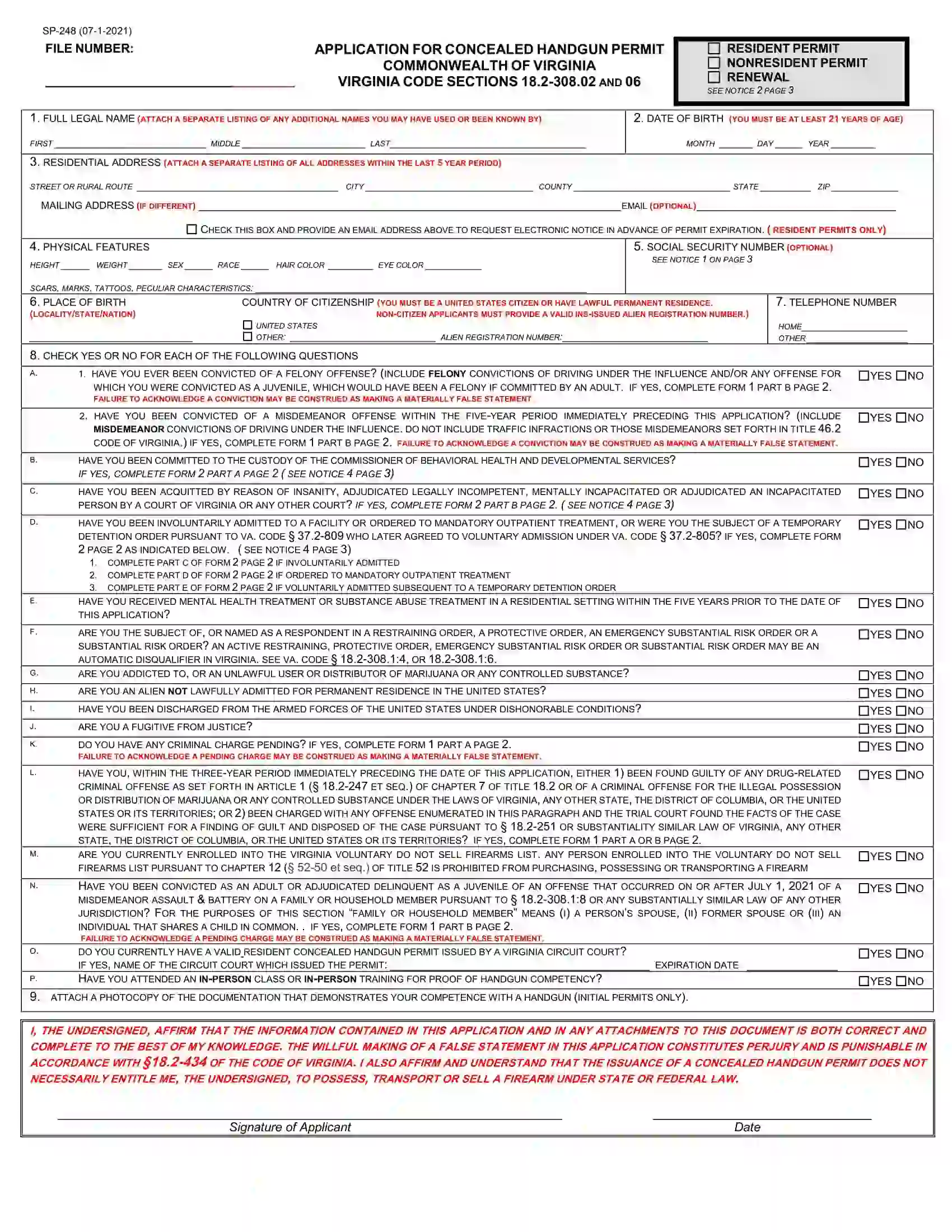

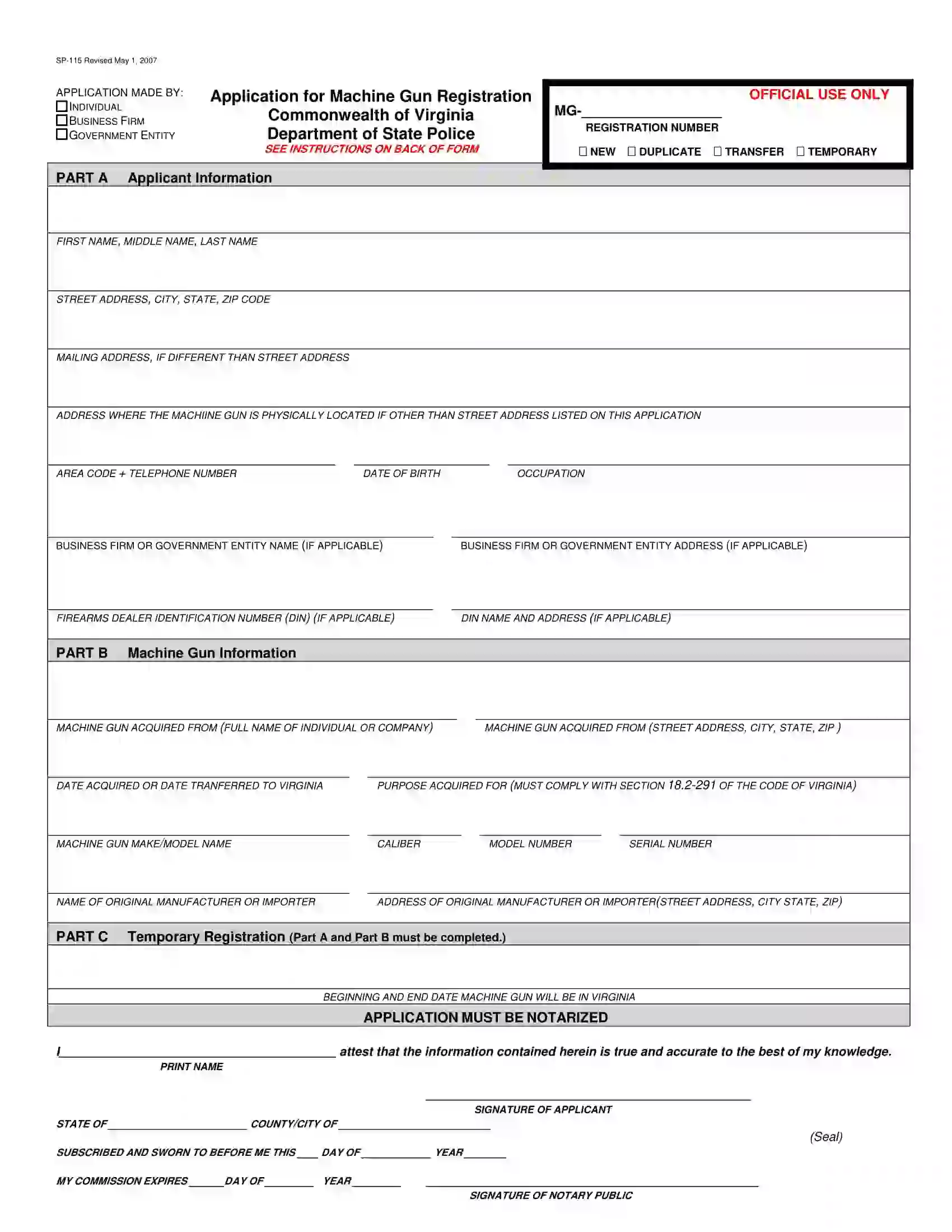

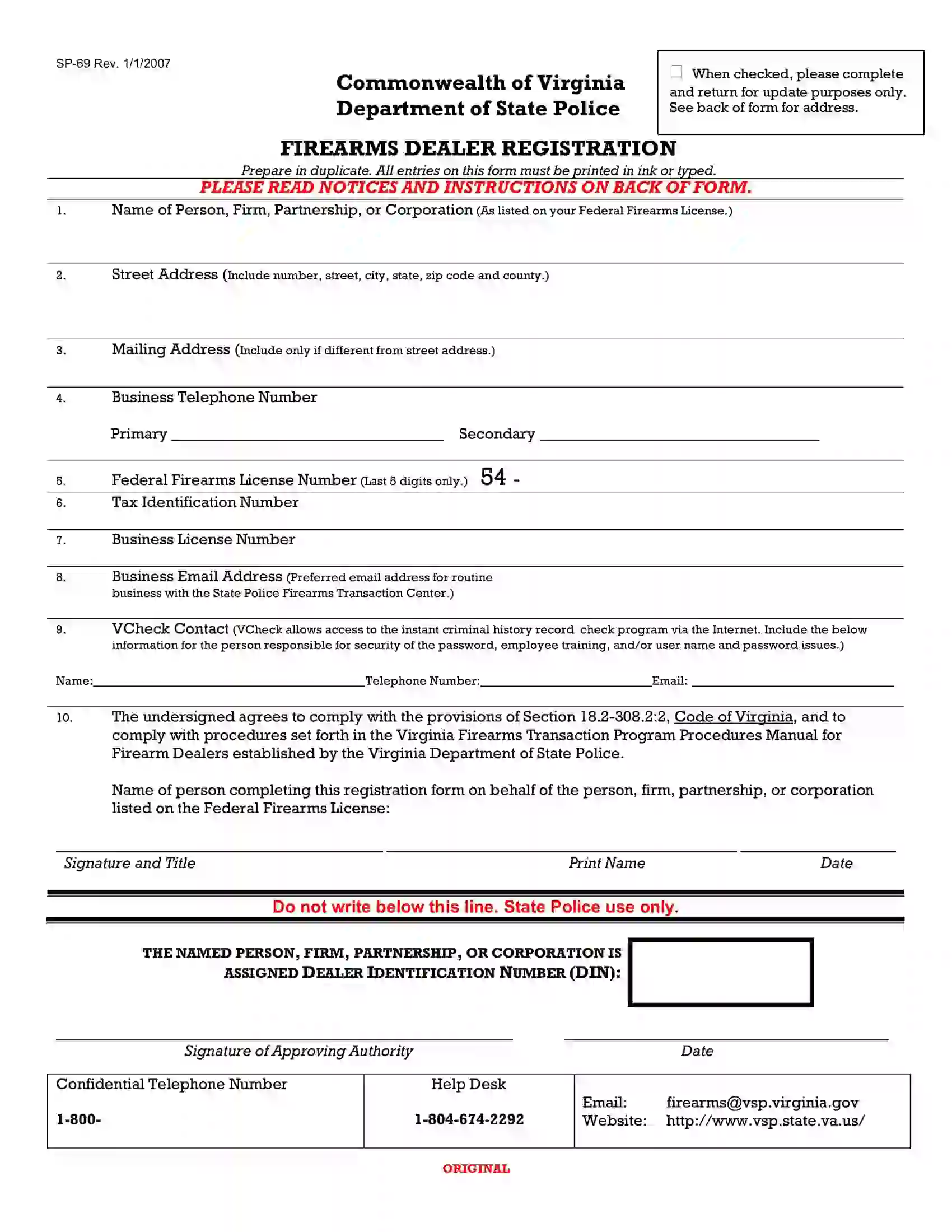

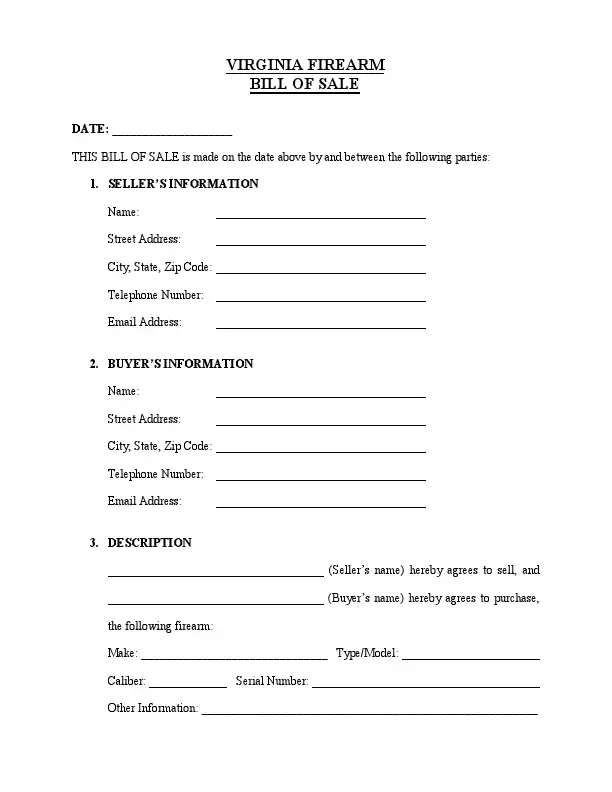

This firearm bill of sale helps keep records every time a gun changes possession in Virginia. No criminal history check is required before selling a firearm. Currently, Virginia allows people to carry handguns in the state openly. Although, there may be restrictions on locations or modes of carrying a firearm without having a license.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

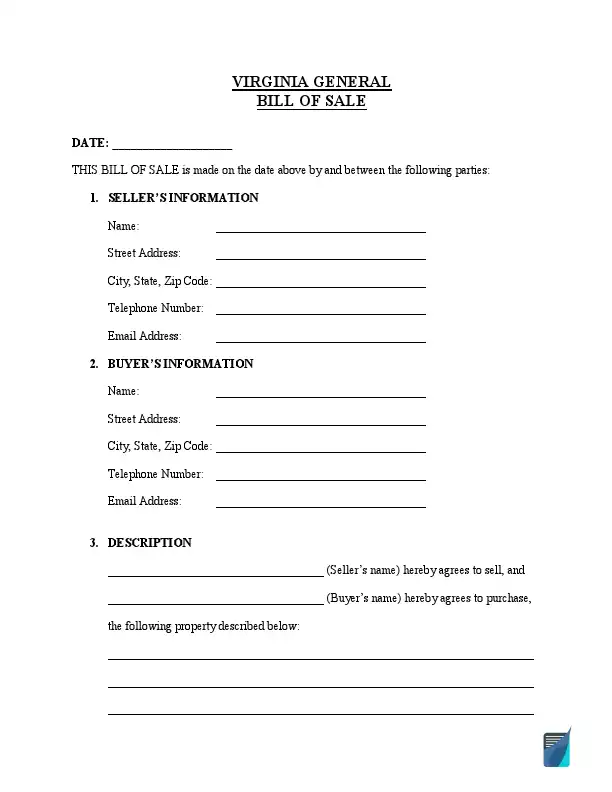

Virginia general bill of sale can be used for almost all private transactions, including selling or buying vehicle accessories, equipment, tools, and different types of appliances.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

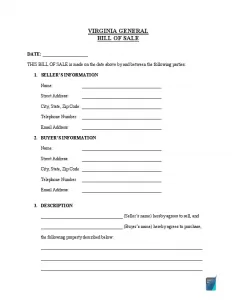

How to Write a VA Vehicle Bill of Sale

You are encouraged to read the instructions below to fill out our bill of sale template without trouble. If your local authorities provide the official bill of sale form, you can use it in the transaction.

Step 1: Specify when the document is created

The bill of sale template begins with the section where you need to type in the document’s creation date.

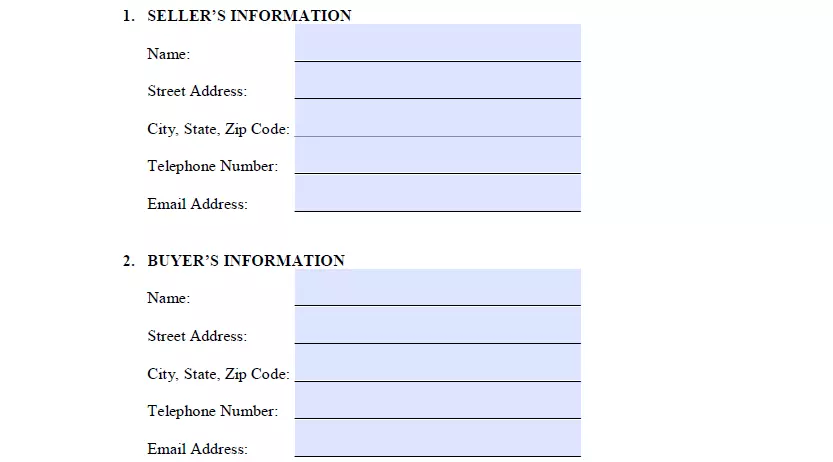

Step 2: Enter the buyer’s and seller’s particulars

The following sections are for buyer’s and seller’s contact information, including:

- Full legal name

- Street address

- City of residence

- State

- Zip code

- Telephone number

- Email address

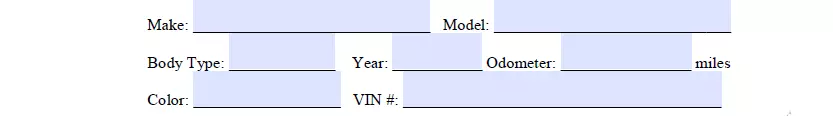

Step 3: Define the vehicle being sold

The essential part of the document is to describe the vehicle being sold, such as:

- Make (manufacturer)

- Model

- Body type

- Model year (MY)

- Odometer reading

- Car’s color

- Identification Number (VIN)

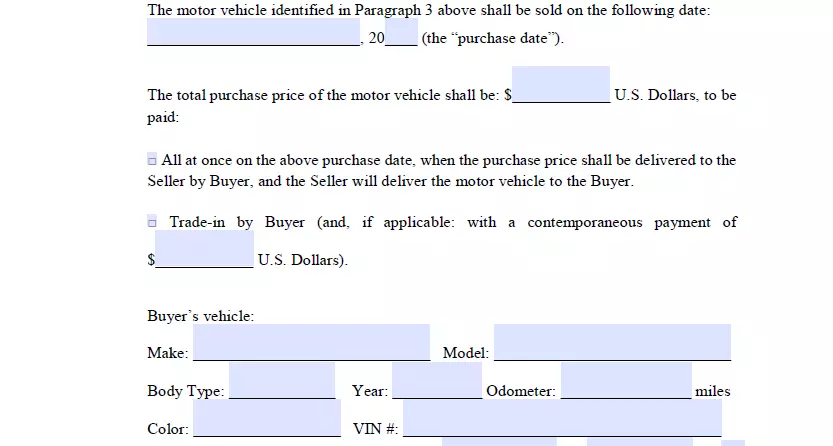

Step 4: State the purchase price and payment method

This step involves indicating the exact date of the sale and the purchase price approved by each party. After that, you’ll need to indicate the selling method:

- The whole sum straight away. It’s one of the more straightforward options: the property owner gets the total sum from the buyer in a single payment and presents the motor vehicle to the purchaser on the same day.

- Trade-in. Using this option, the seller agrees to trade their car for the purchaser’s motor vehicle with an extra payment from the buyer. The buyer’s vehicle description must also be in the document.

- Several payments. Here, you will need to specify the dates when the buyer has to provide the initial and the last payments, together with their amounts.

And after that, it’s necessary to specify how the buyer pays:

- Cash

- Cheque

- Cashier’s cheque

- Money order

Finally, specify if the purchase price contains all applicable taxes.

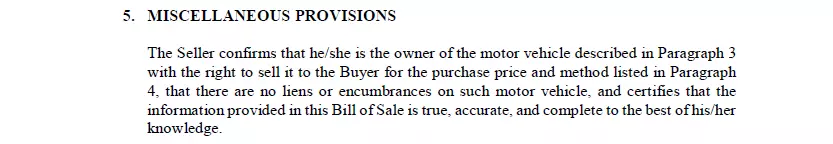

Step 5: Read the miscellaneous provisions

These generally say that the buyer obtains the property in “as-is” condition and is responsible for it once the purchase is finished.

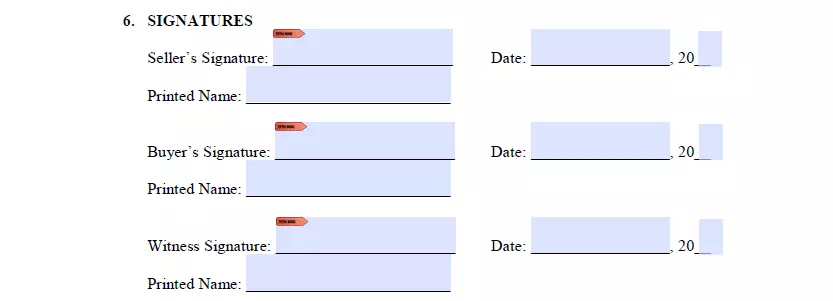

Step 6: Put your signature(s) in the appropriate fields

Usually, the signature of the purchaser isn’t required. Nonetheless, you will be more protected against legal problems if all sides sign the bill of sale form. The buyer and seller could also find someone who will attest to the deal and sign the form.

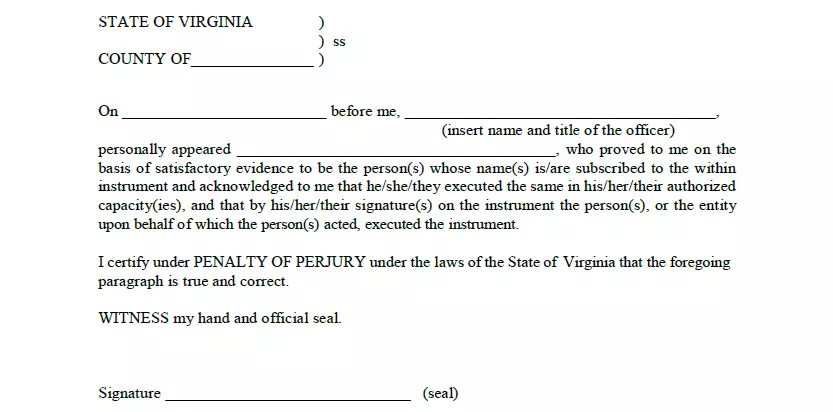

Step 7: Notarize the document

Although notarization is rarely required, it functions as an additional safeguard against legal issues.

The original bill of sale copy must be presented to the purchaser because they will need it to receive their new motor vehicle title. There are two approaches here: you need to either fill out and sign two identical bills of sale or make a duplicate for the seller to store.

Registering a Vehicle in Virginia

New motor vehicle owners should remember that they can only operate on Virginia roads once they officially register. To accomplish this, they need to attend the local division of the Virginia DMV (Department of Motor Vehicles) and present the following documents, including vehicle registration forms:

- Title for the vehicle signed over by the previous owner to the buyer

- Completed motor vehicle bill of sale template

- Photo or scan of ID

- Proof of residency matching the one indicated in the buyer’s ID

- Receipt for the payment of all titling and registration taxes and fees

- Inspection certificate for the purchased vehicle

A Virginia vehicle bill of sale form differs for vehicles that have been in use for less than five years and for those that are 5+ years old. The completion of Vehicle Price Certification accompanies the sale of used vehicles over five years old. The form includes all the relevant details about the motor vehicle (make, model, body type, VIN, and color). The seller and buyer also need to specify the price and sign the document, proving that all the data about the motor vehicle and the deal are valid.

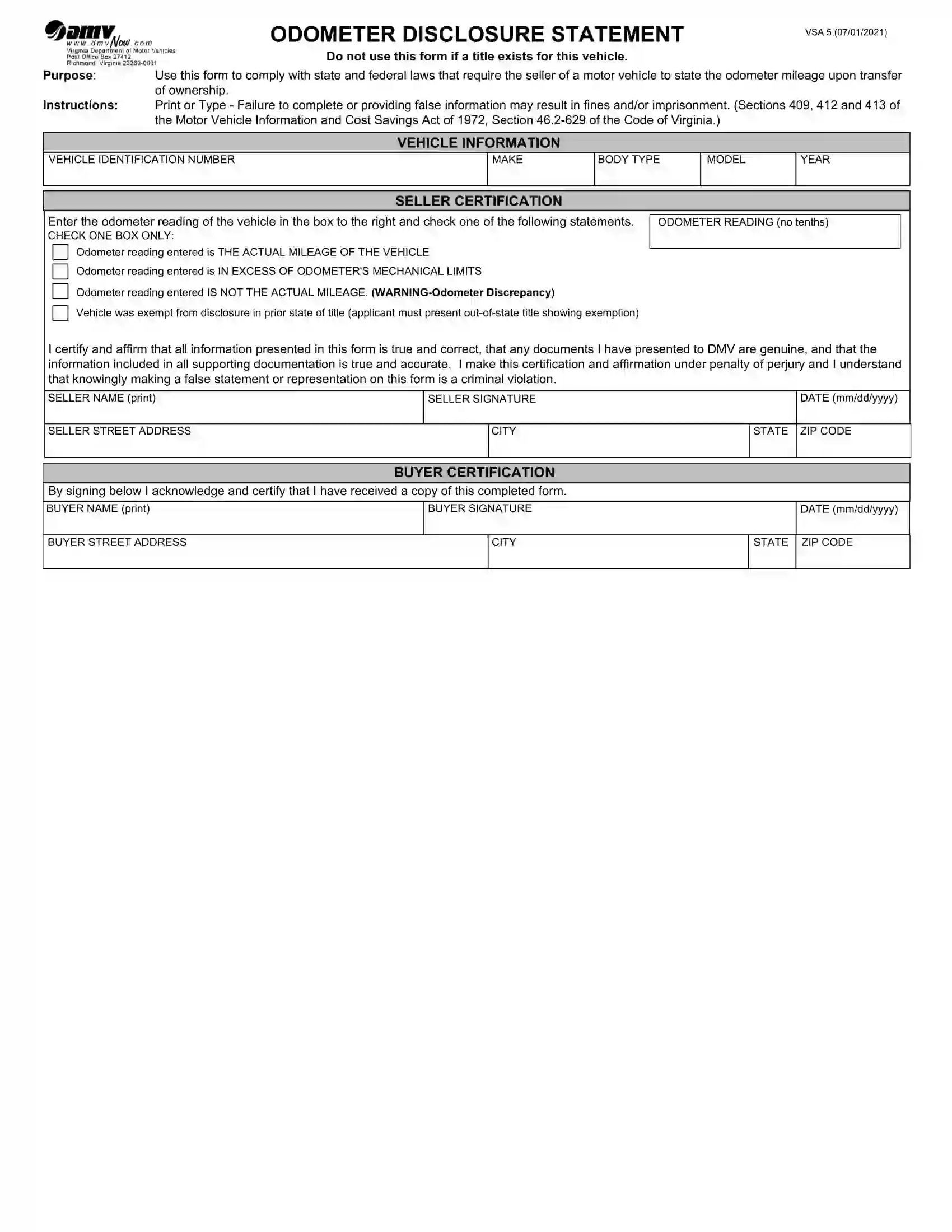

You should complete an Odometer Disclosure Statement and submit it to the Virginia DMV to register motor vehicles with no title. It contains all the vehicle information, seller certification details, odometer details, and buyer certification. The document is required for motor vehicles that are 10+ years old.

Tax calculations are made based on the relevant Virginia legislation. Since July 2016, the motor vehicle sales and use (SUT) tax is calculated at 4.15% of the vehicle’s gross sales price (minimum $75). If a motor vehicle was bought from a dealer, the dealer’s processing fee is also included in the gross sales price of the registered item. The tax fee is levied at the moment of the motor vehicle’s titling.

Owners of all-terrain and off-road motor vehicles should go through a different registration procedure. As these types of vehicles do not fall within the regular motor vehicle category, their registration requires the presentation of the VSA-17A form, odometer reading, the MCO or MSO, a dealer license number (for motorcycles), the bill of sale, and proof of address. All-terrain vehicles and off-road motorcycles do not require titling by Virginia law.

Short Virginia Bill of Sale Video Guide

Relevant Official Forms

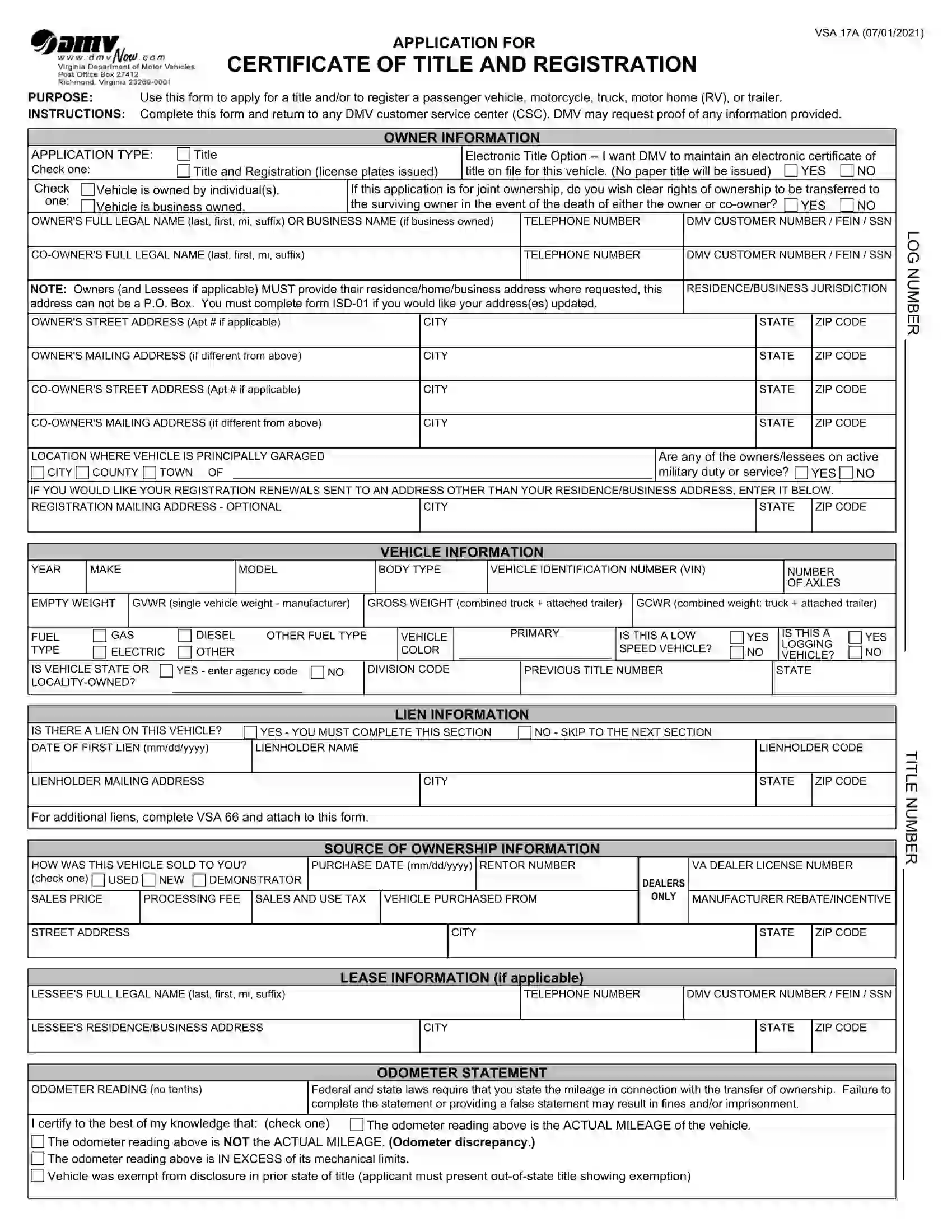

Application for Certificate of Title and Registration (Form VSA 17A) is designed for vehicles that do not have Virginia title yet.

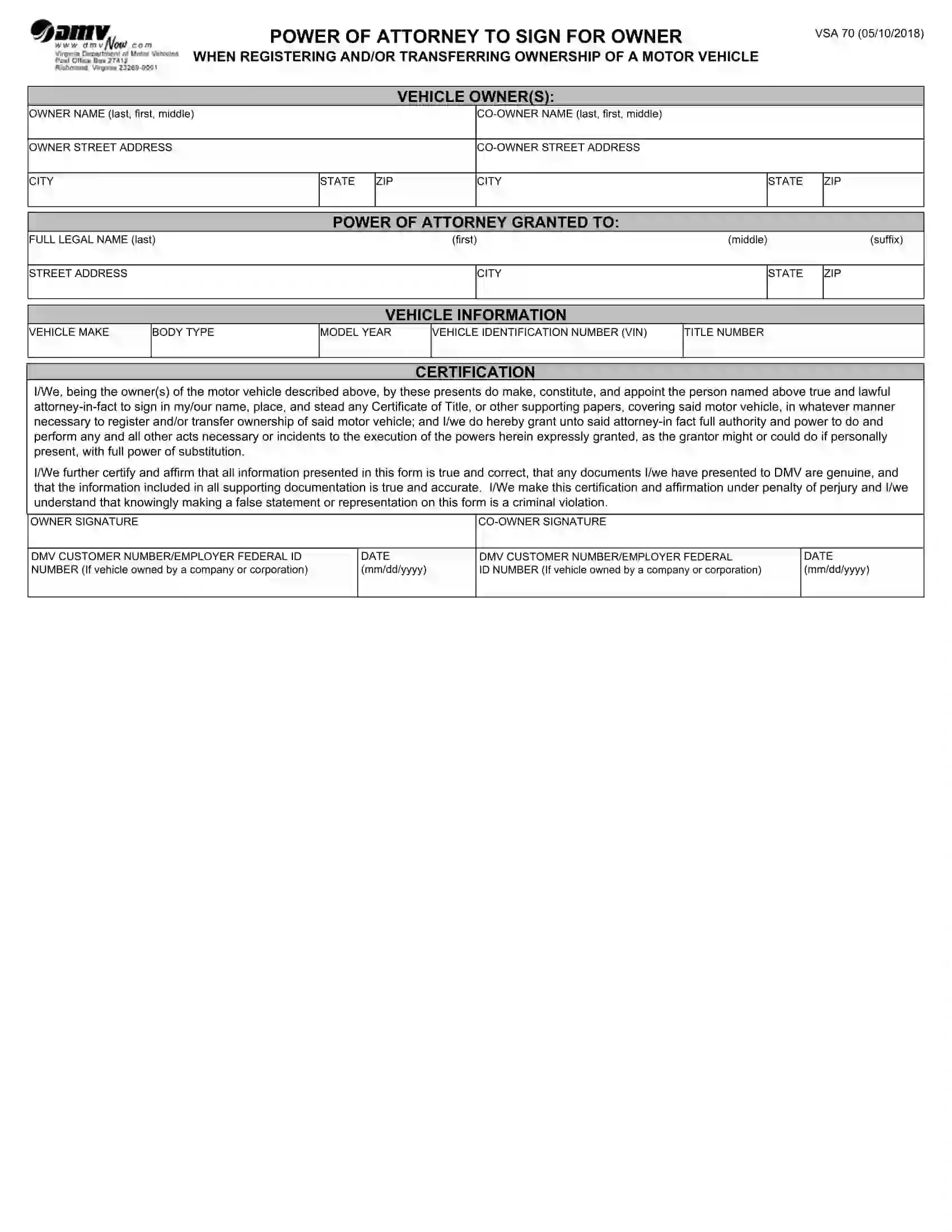

Form VSA 70 (Power of Attorney) is signed to appoint another person to register and/or transfer ownership of a motor vehicle for the owner.

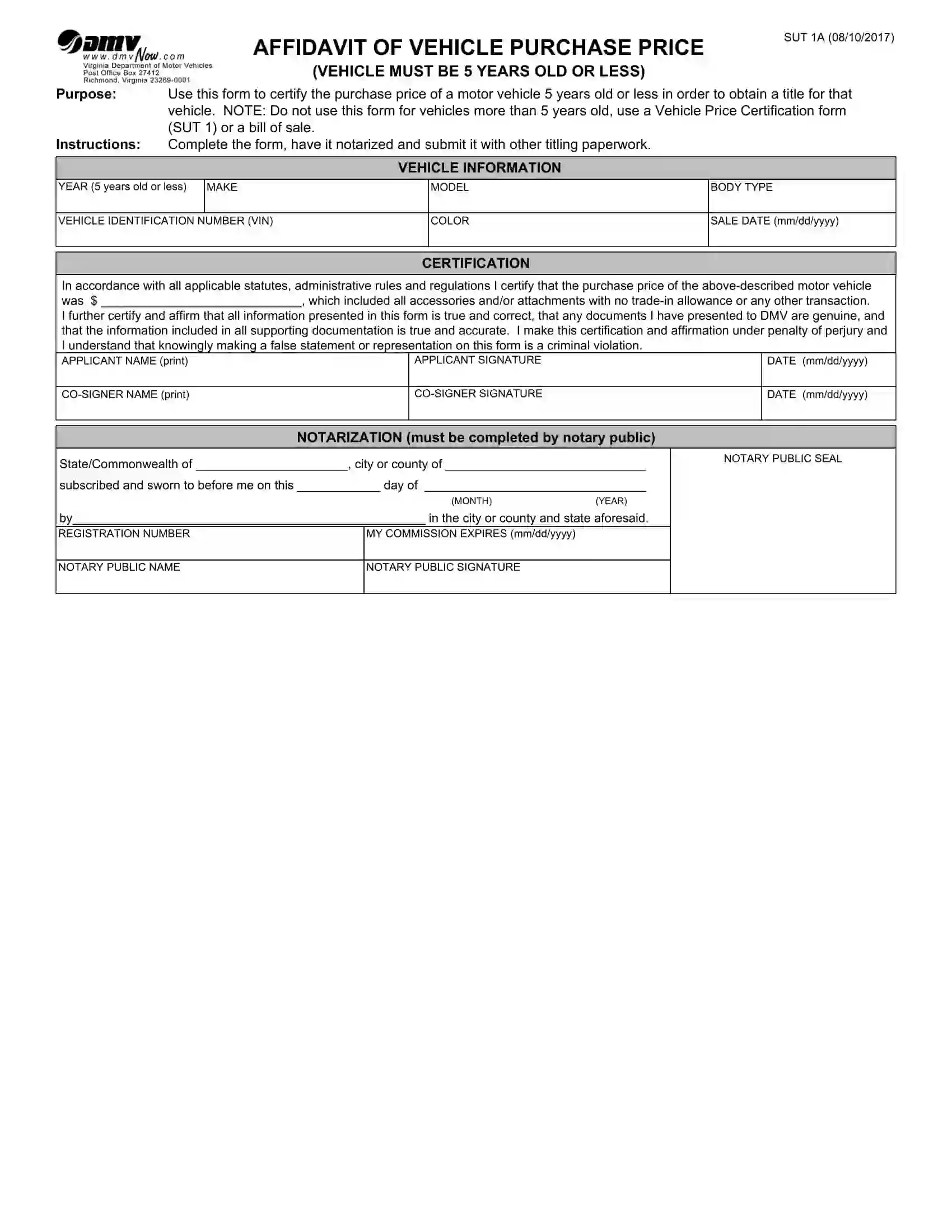

Affidavit of Vehicle Purchase Price, known as Form SUT 1A, is used to certify the purchase price of a vehicle five years old or less in order to obtain a title.

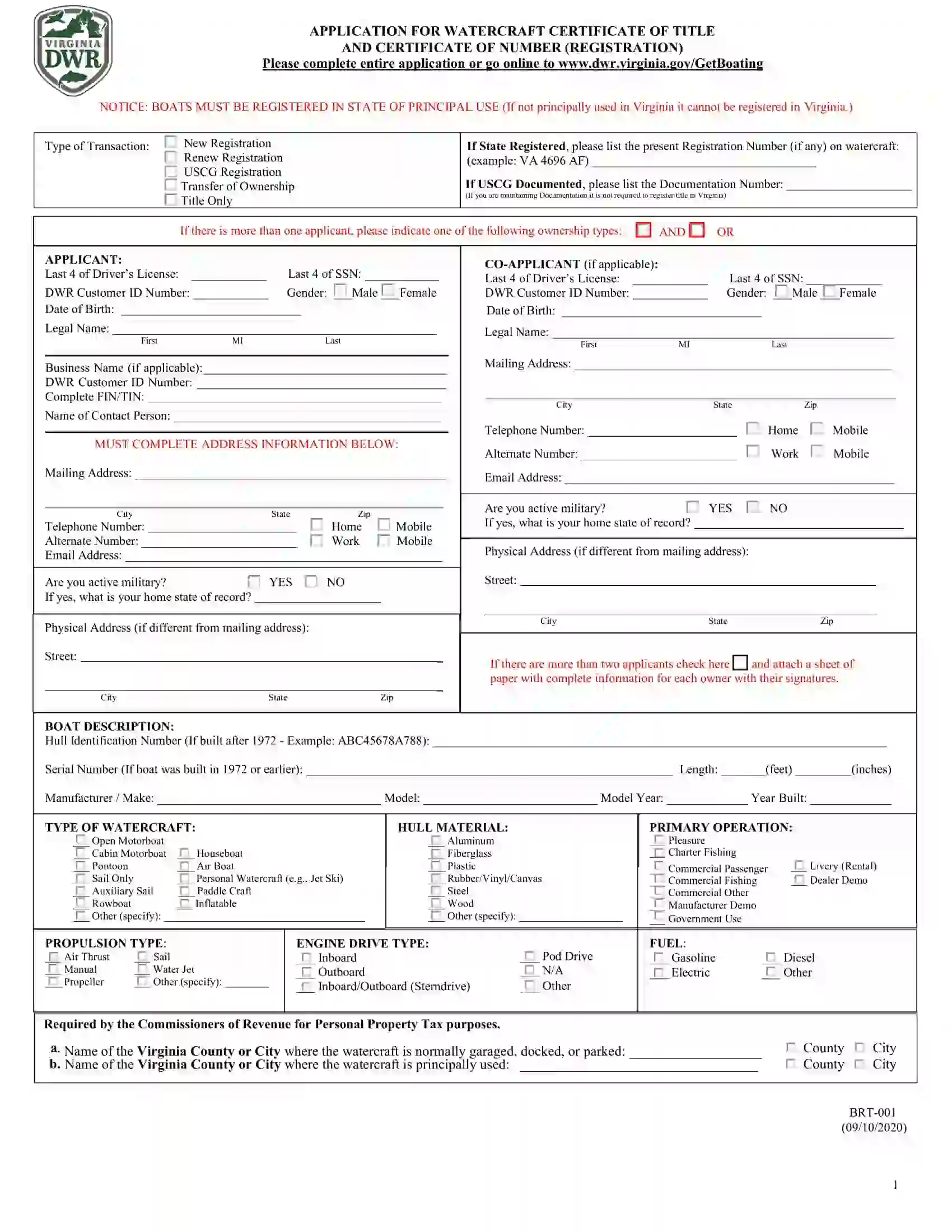

Application for Watercraft Certificate of Title and Certificate of Number (Registration)

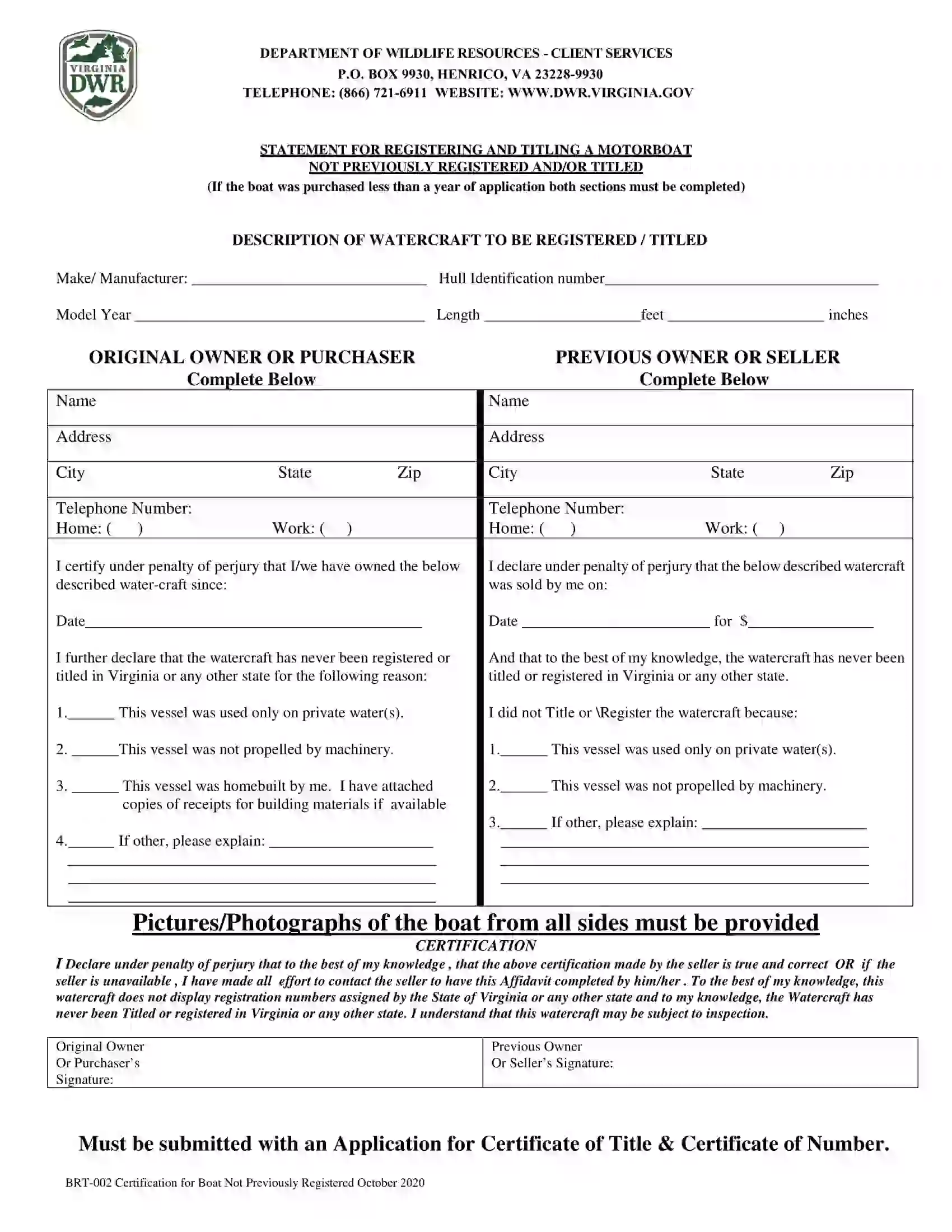

Statement for Registering and Titling a Motorboat (Form BRT-002) is used for previously not registered and/or titled motorboats. This form must be submitted with an Application for Certificate of Title and Certificate of Number.

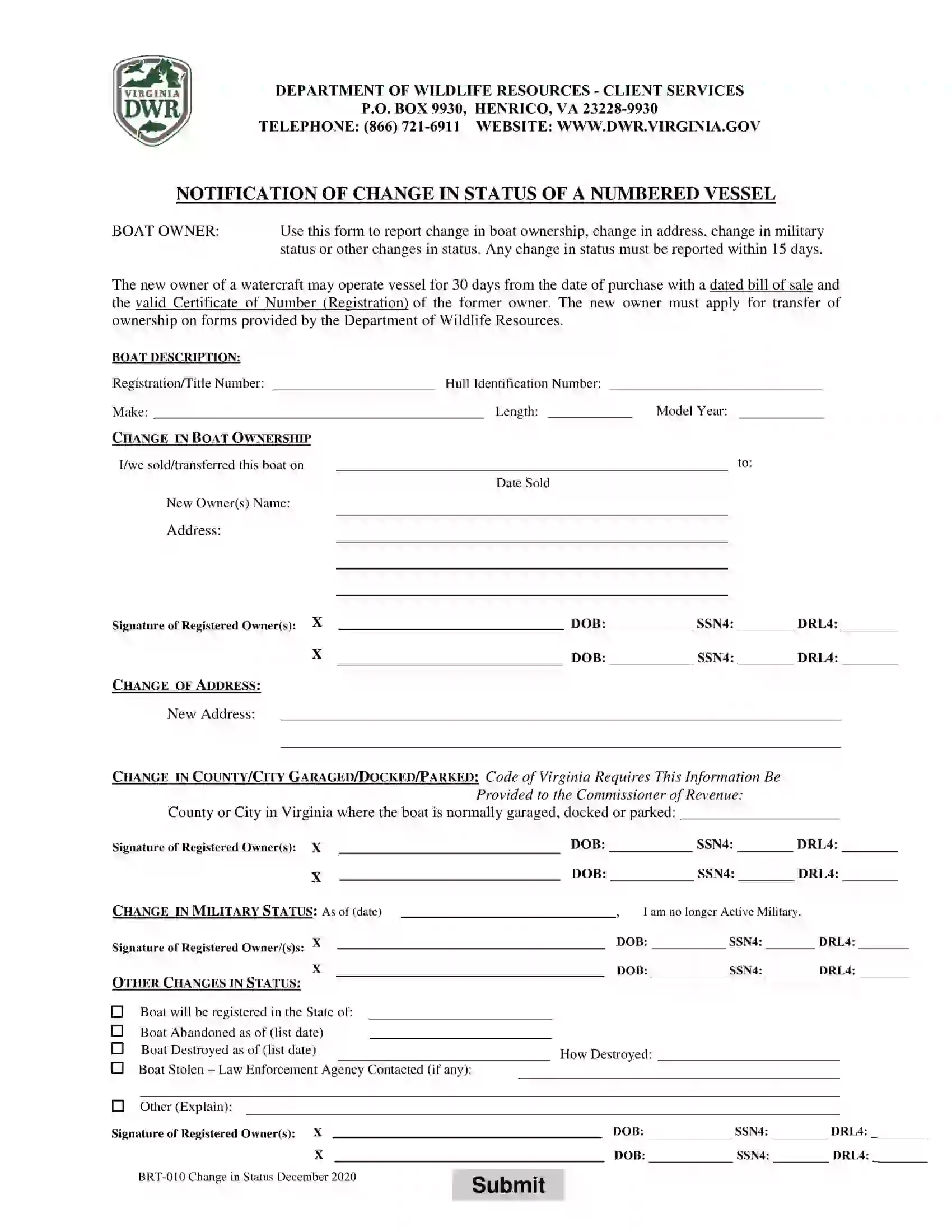

Form BRT-010 or Notification of Change in Status of a Numbered Vessel reports the change of boat ownership.

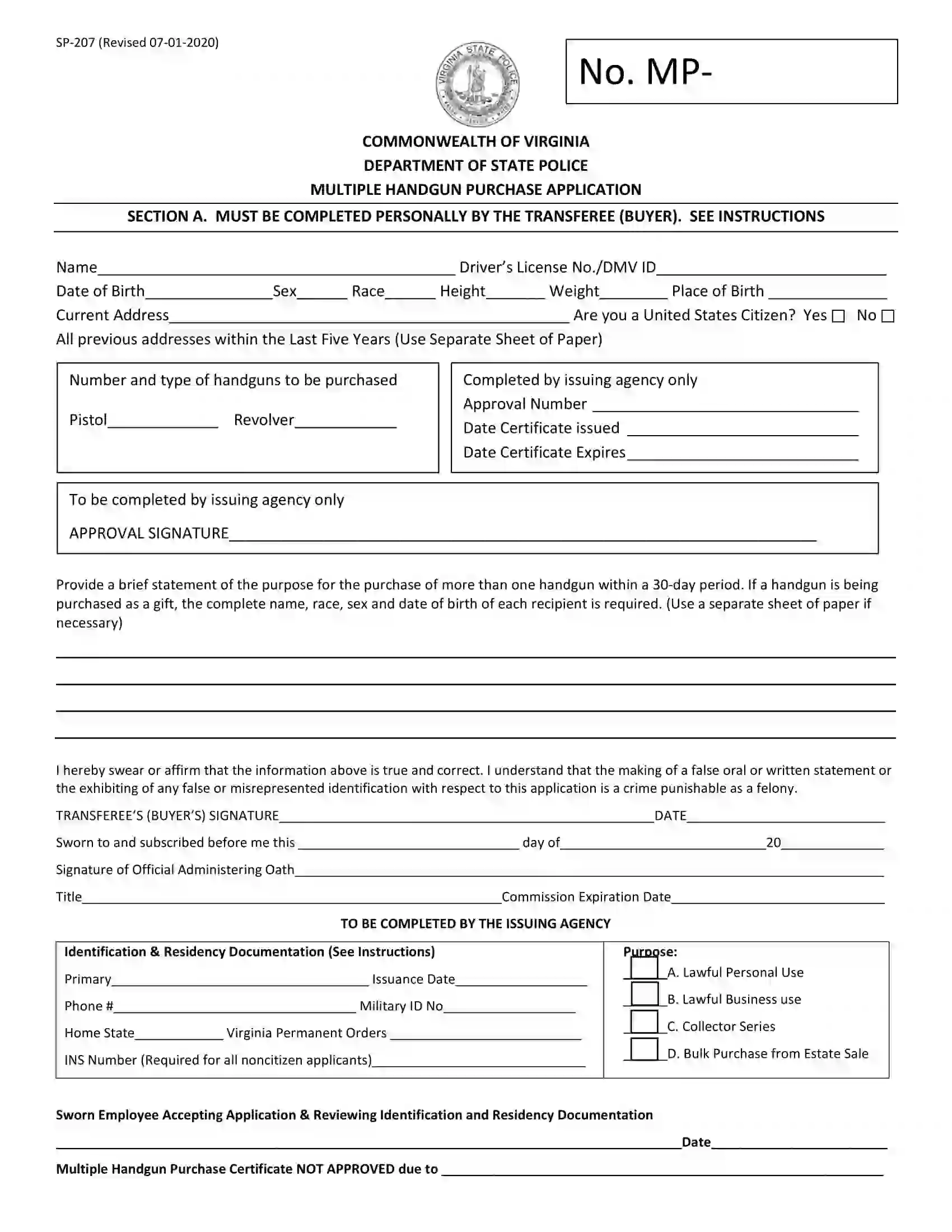

Multiple Handgun Purchase Application (Form SP-207) is used to apply for multiple firearms purchase by the same purchaser within a specific period.