West Virginia Bill of Sale Form

West Virginia bill of sale is a legal document to record private sales of personal property such as motor vehicles, animals, or equipment. West Virginia bill of sale forms are designed to protect both the buyer and seller from any legal issues related to transactions.

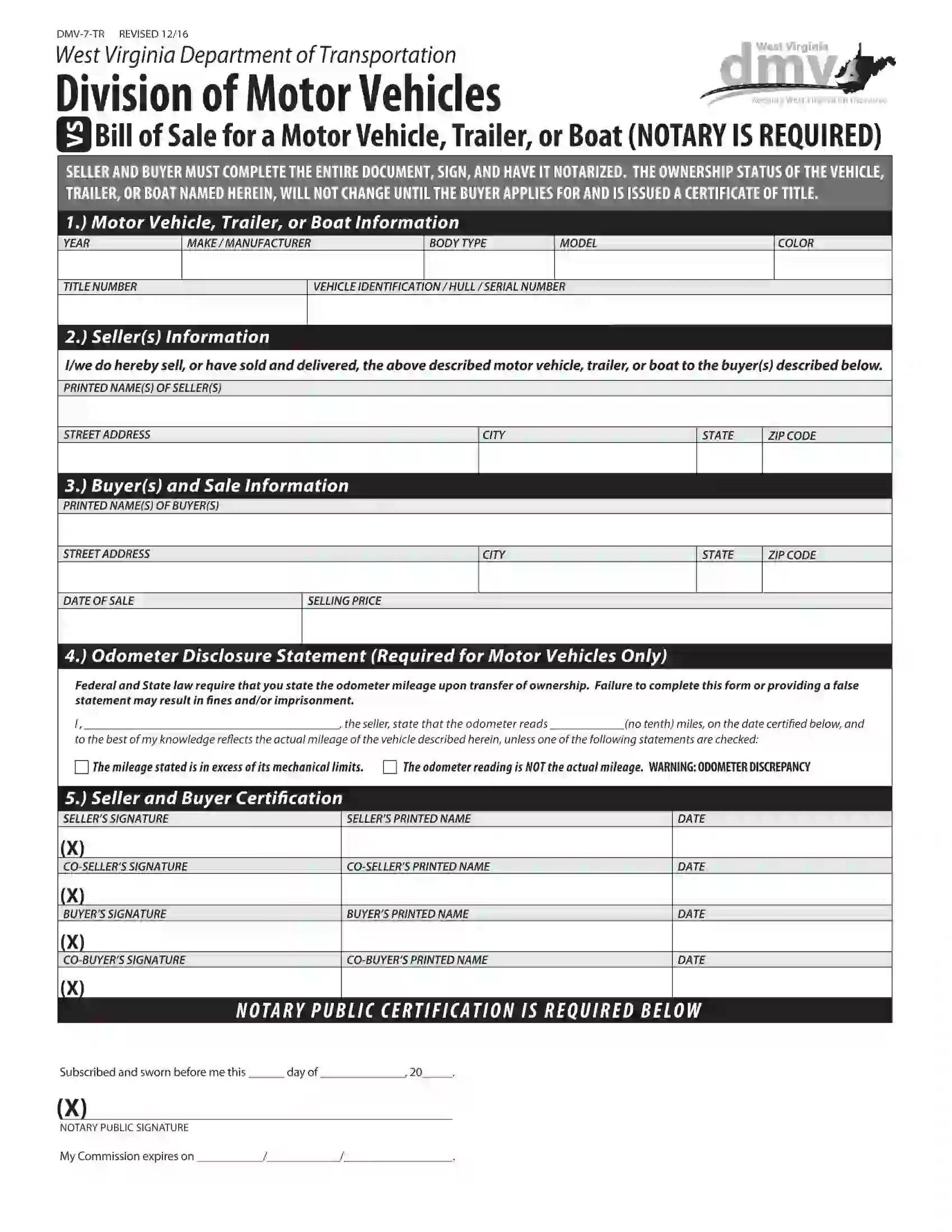

After choosing a suitable bill of sale template, you can create a customized document legitimate in West Virginia within 10 minutes. Also, you can download and use an official form in West Virginia for vehicles and boats – Form DMV-7-TR.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | West Virginia Vehicle Bill of Sale Form |

| Other Names | West Virginia Car Bill of Sale, West Virginia Automobile Bill of Sale |

| DMV | West Virginia Division of Motor Vehicles |

| Vehicle Registration Fee | $51.50-86.50 |

| Bill of Sale Required? | Yes |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 28 |

West Virginia Bill of Sale Forms by Type

Particular sales need specific West Virginia bill of sale forms, and it is crucial to know the differance. Completing a specific transaction will require you to go with the appropriate type of bill of sale registered with your state.

West Virginia bill of sale for a vehicle finalizes the property transfer and allows the new owner to register the vehicle. You are expected to register your vehicle within 30 days of the transaction or from the time of relocating to West Virginia. The base cost of vehicle registration in West Virginia is usually $51.50.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Required |

| Download | PDF Template |

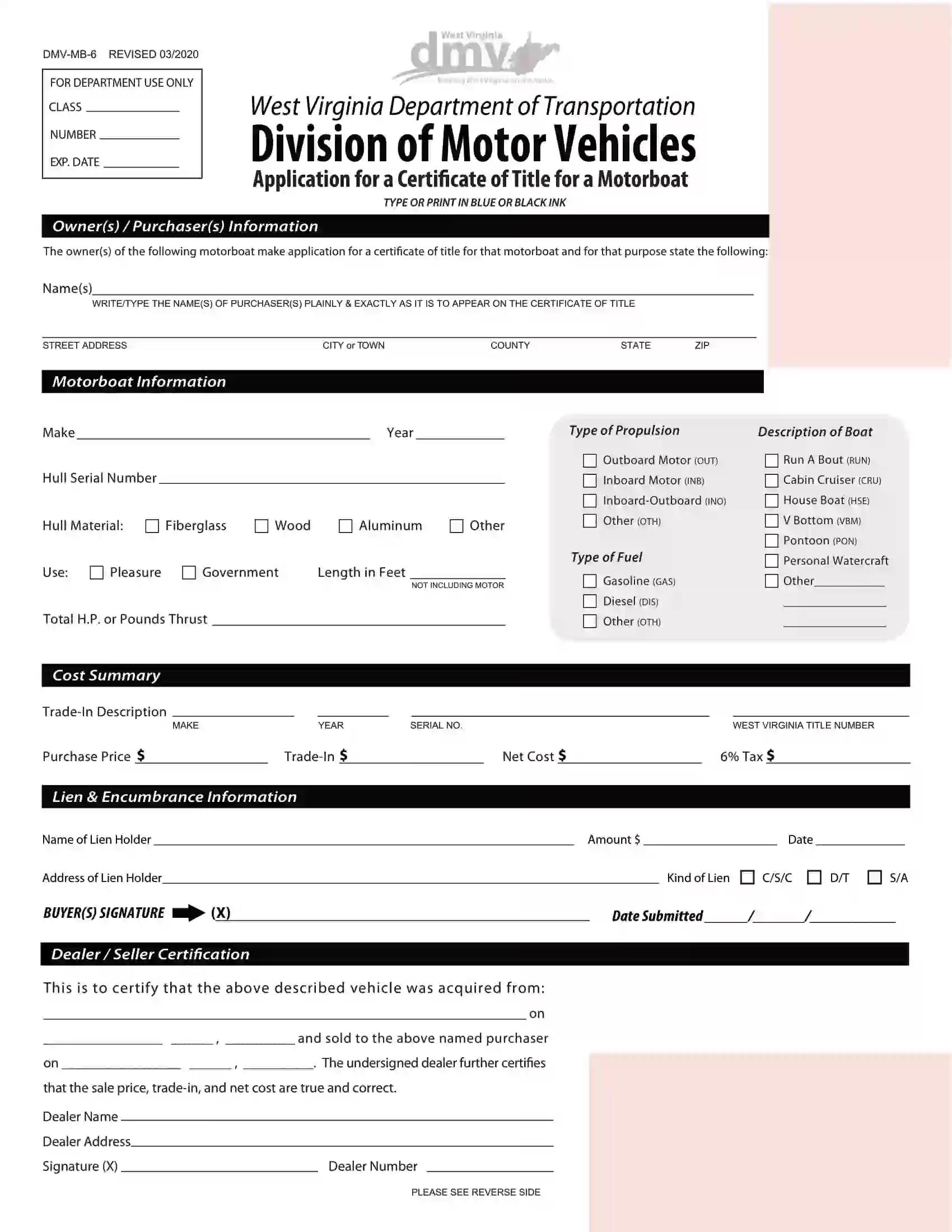

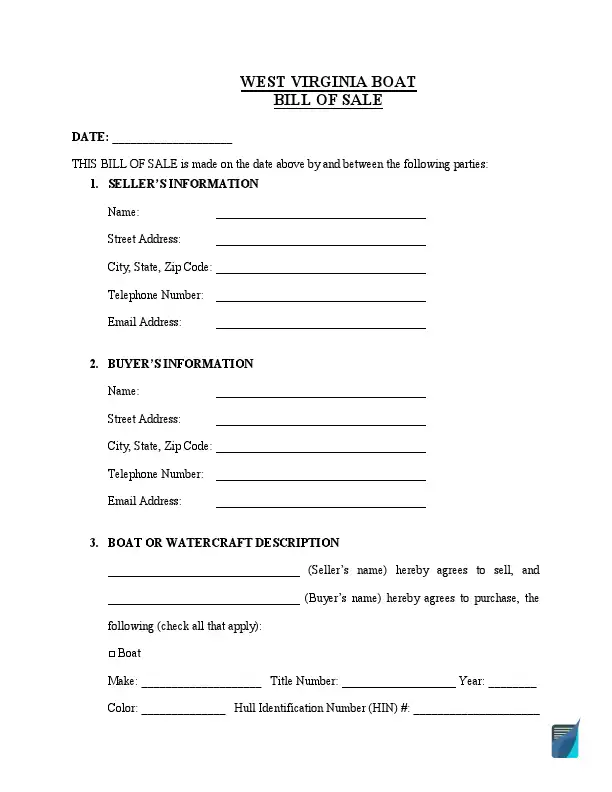

West Virginia bill of sale for a boat proves that a specific boat has a new owner. This bill of sale form is usually required to register your vessel. Boat registrations in West Virginia are generally legitimate for 12 months. Almost all motorized vessels, including personal watercraft, need to be registered. Registration fees vary by the length of the boat.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Required |

| Download | PDF Template |

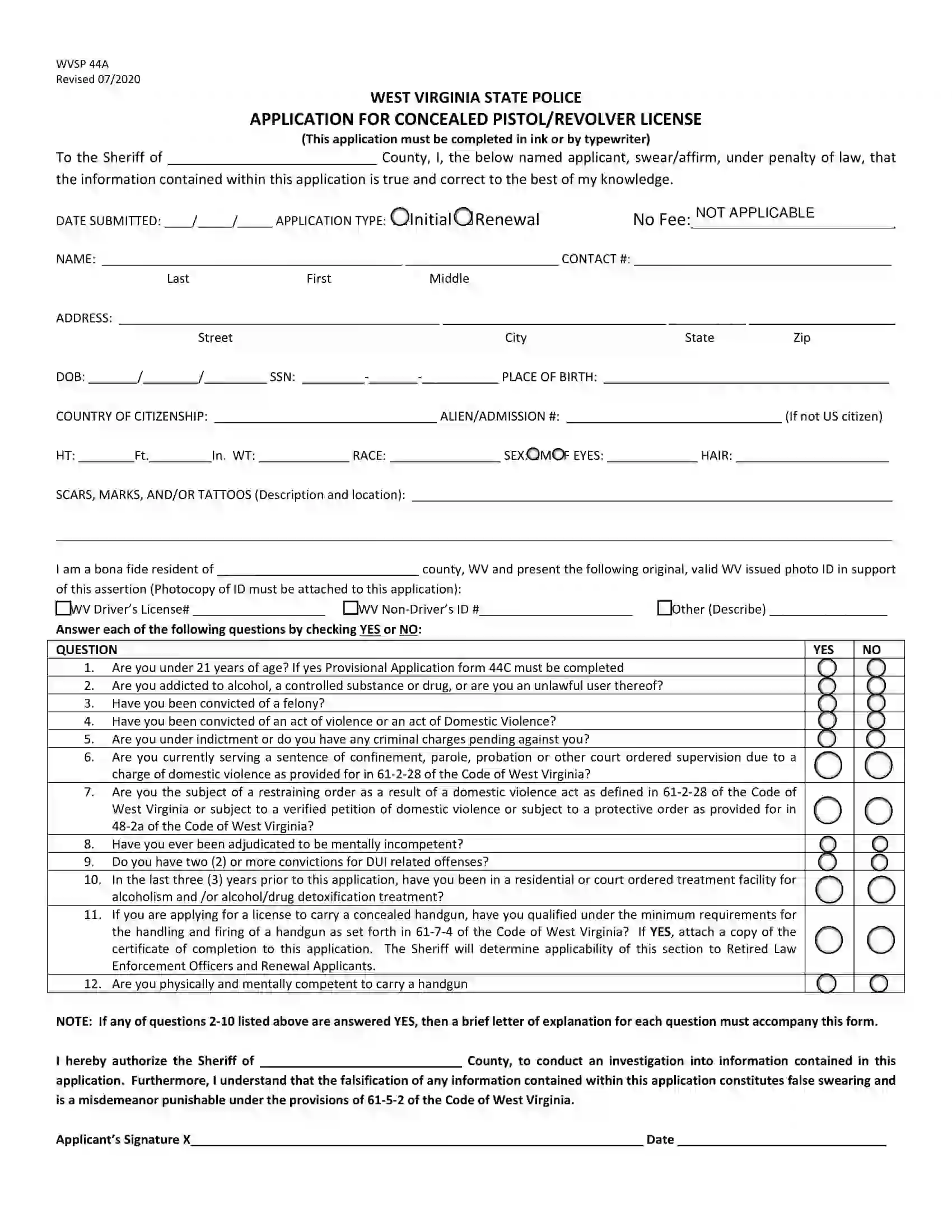

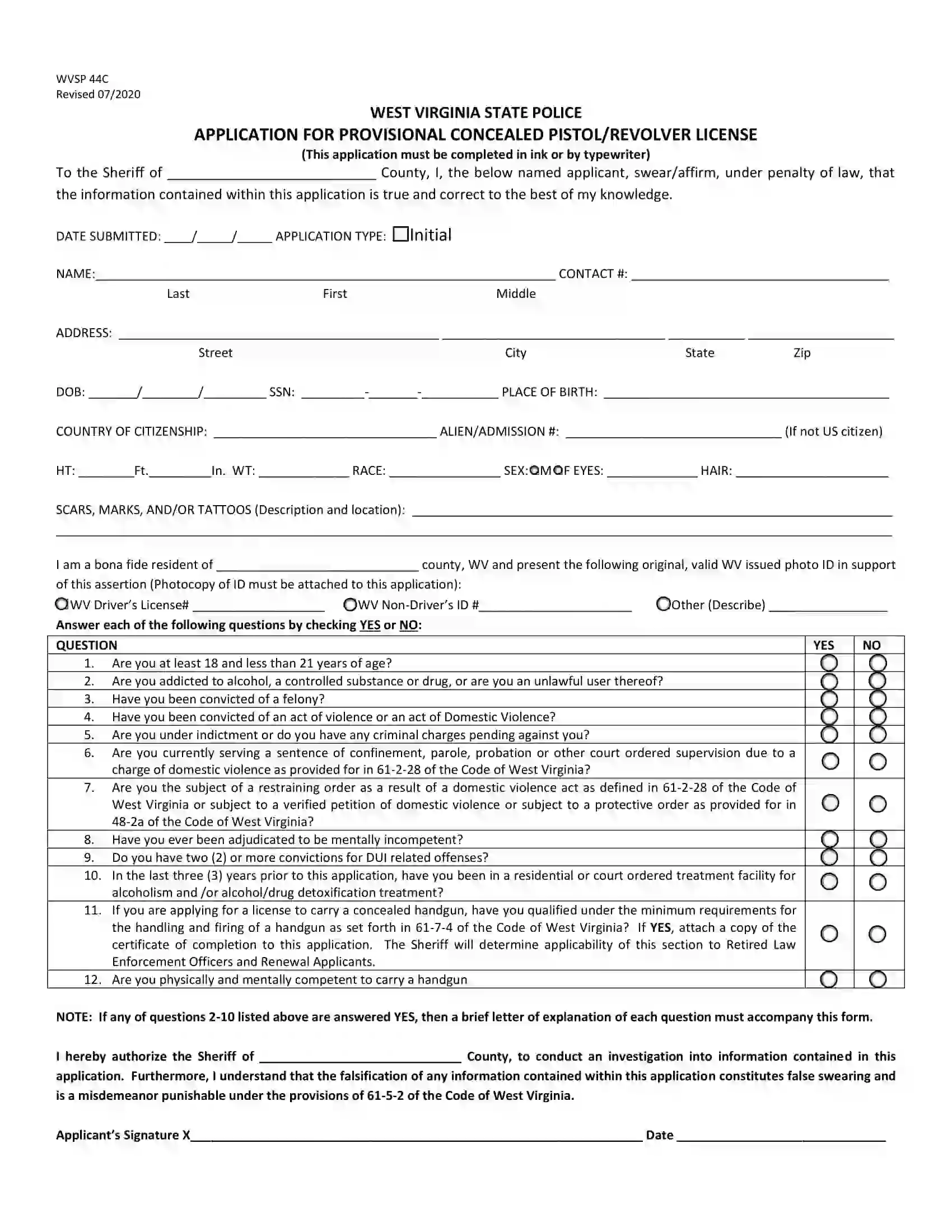

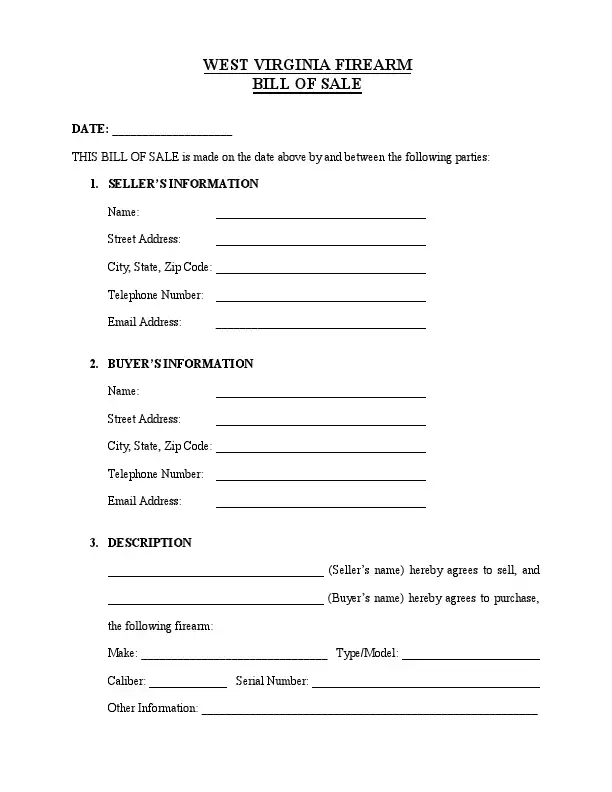

A firearm bill of sale records gun ownership transfers in West Virginia. No background check or other actions are necessary before selling a gun in West Virginia. West Virginia does not have any special law requiring registration of firearms or change of proprietary rights; there’s no firearms state registry. According to West Virginia law, open-carry of handguns in the state is presently allowed for people. No license or permit is required.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

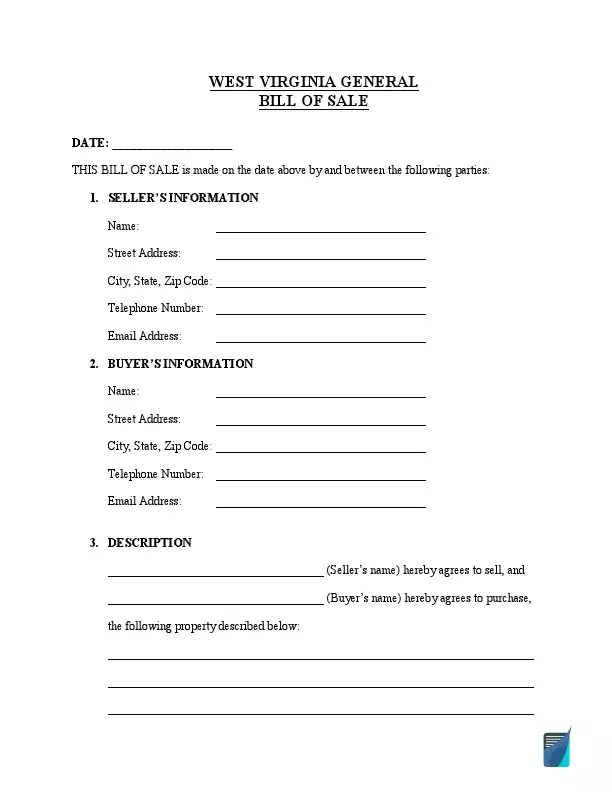

West Virginia general bill of sale may be applied for nearly all bills of sale. You can use it to buy or sell trail cars, supplies, and equipment for livestock.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

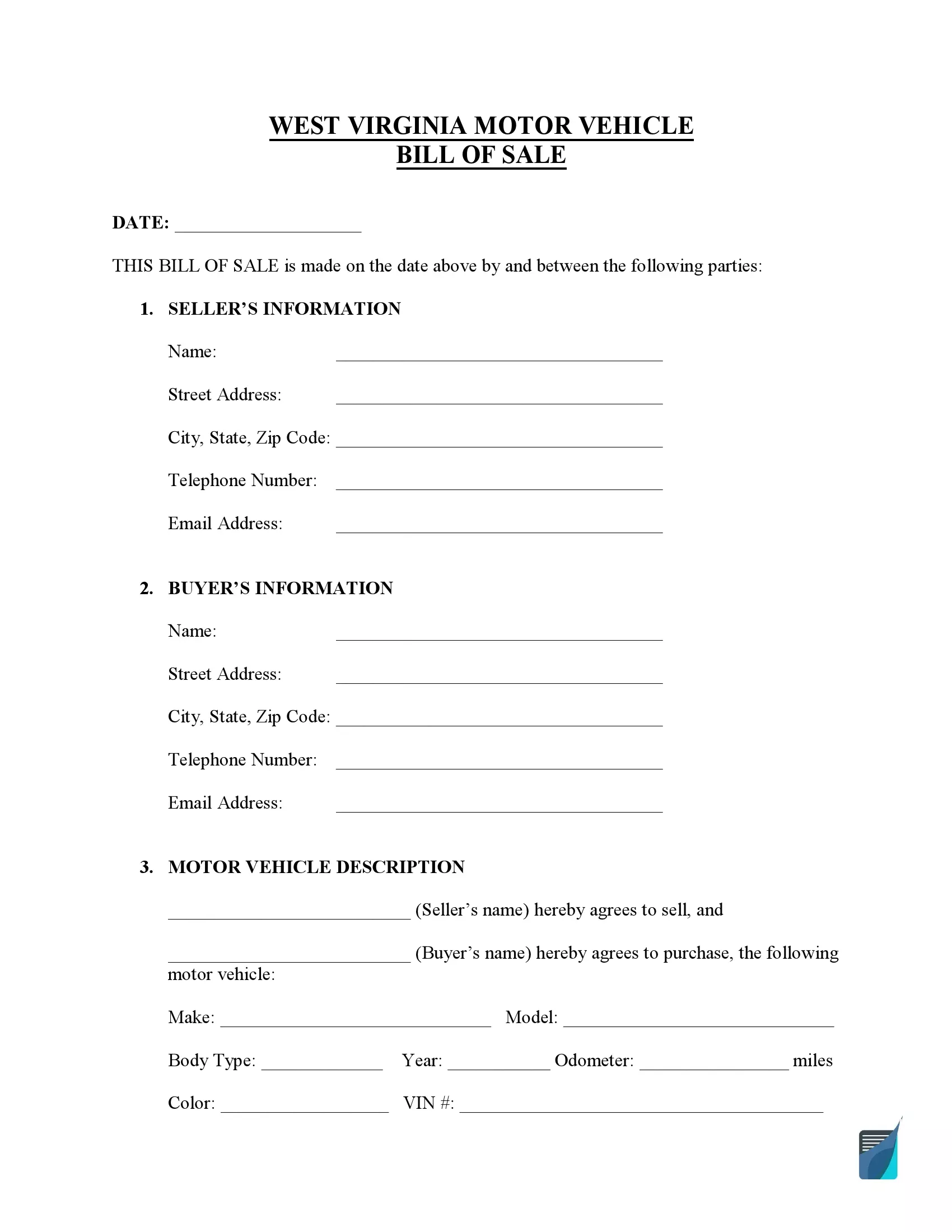

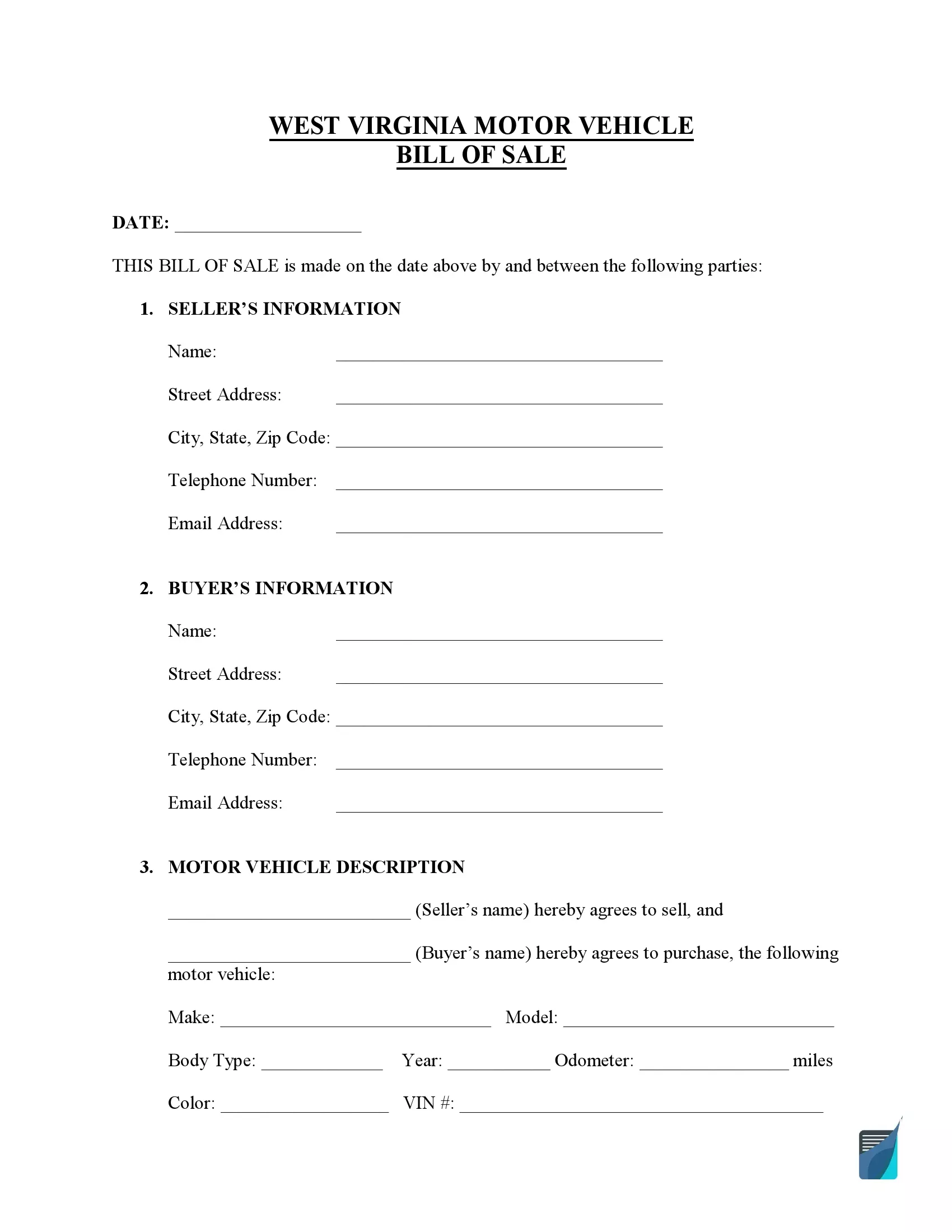

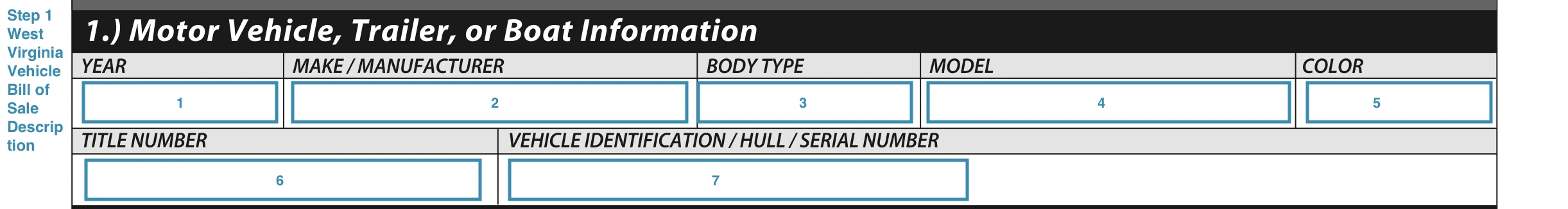

How to Write a WV Vehicle Bill of Sale

If you struggle to complete the ofiicial template of the bill of sale supplied by the West Virginia Division of Motor Vehicles, feel free to follow this comprehensive guide.

Step 1: Enter the vehicle’s description

At the beginning of the template, it’s necessary to type in the detailed description of the motor vehicle being sold:

- Year of manufacture

- Make (manufacturer)

- Vehicle’s body type

- Vehicle’s model

- Color

- Title number

- Vehicle Identification Number (VIN)

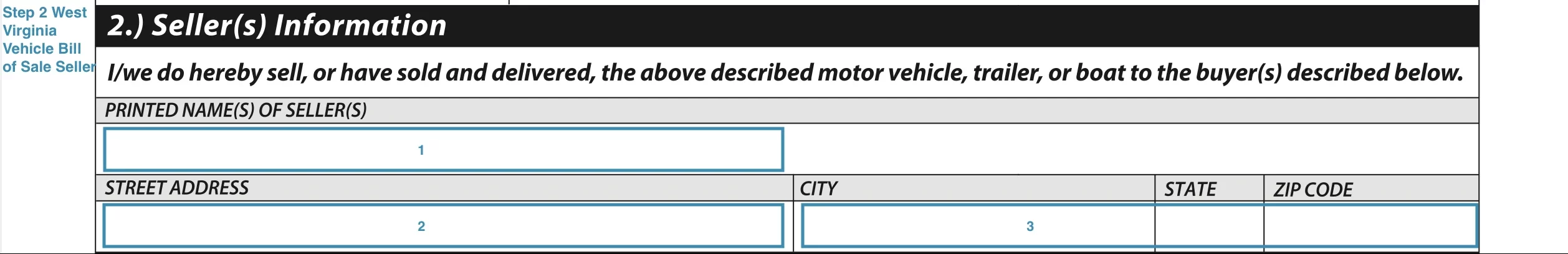

Step 2: Type in the information about the seller

The next section requires the seller’s contact details to be filled out, such as:

- Full name

- Street Address

- City

- State

- Zip Code

If there is joint ownership, provide the name of the second seller as well.

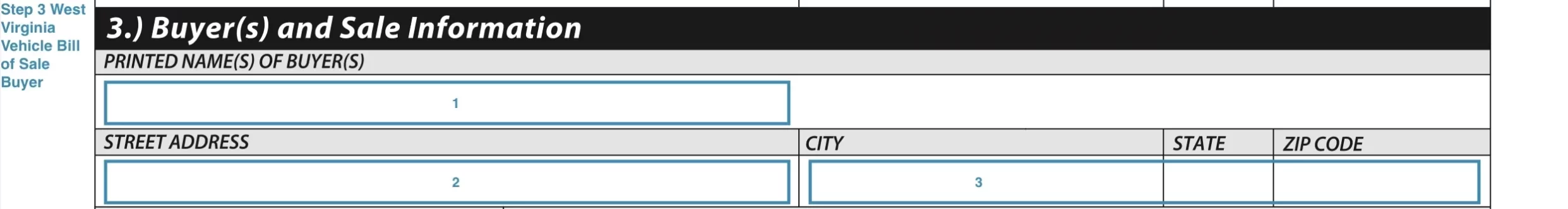

Step 3: Provide the contact details of the purchaser

You will also need to identify the buyer of the vehicle, specifying the following details:

- Full name

- Street Address

- City

- State

- Zip Code

If there is more than one buyer, you will also need to identify co-buyers.

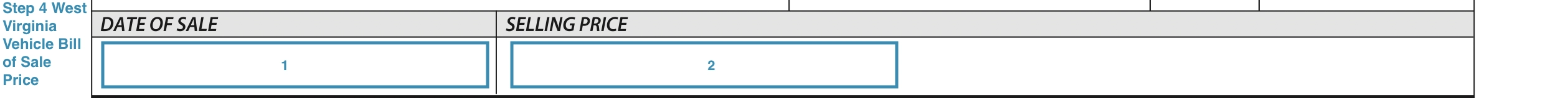

Step 4: Specify the purchase price and date

The third step is to clarify the date of the purchase and the negotiated price the buyer will pay for the vehicle.

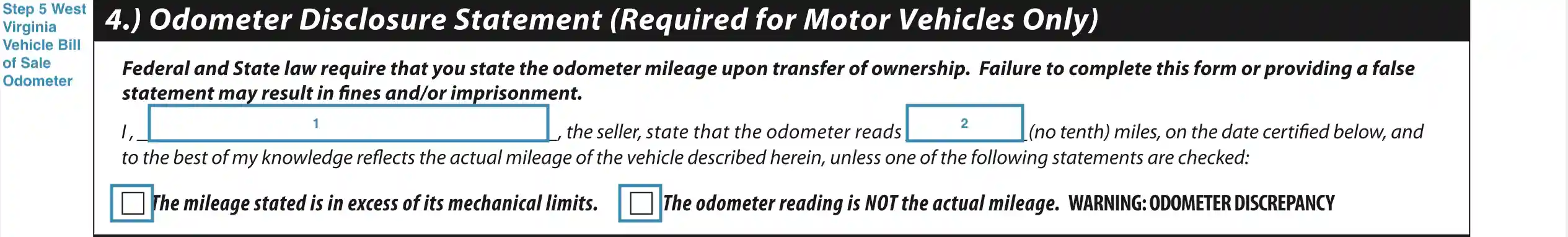

Step 5: Indicate the odometer reading

In this section, you will need to provide the details about the latest odometer disclosure statement for a motor vehicle transaction. The seller must type in the vehicle’s actual mileage. If there is an odometer discrepancy or the mileage is in excess of the mechanical limits, you will have to indicate that by checking the appropriate boxes.

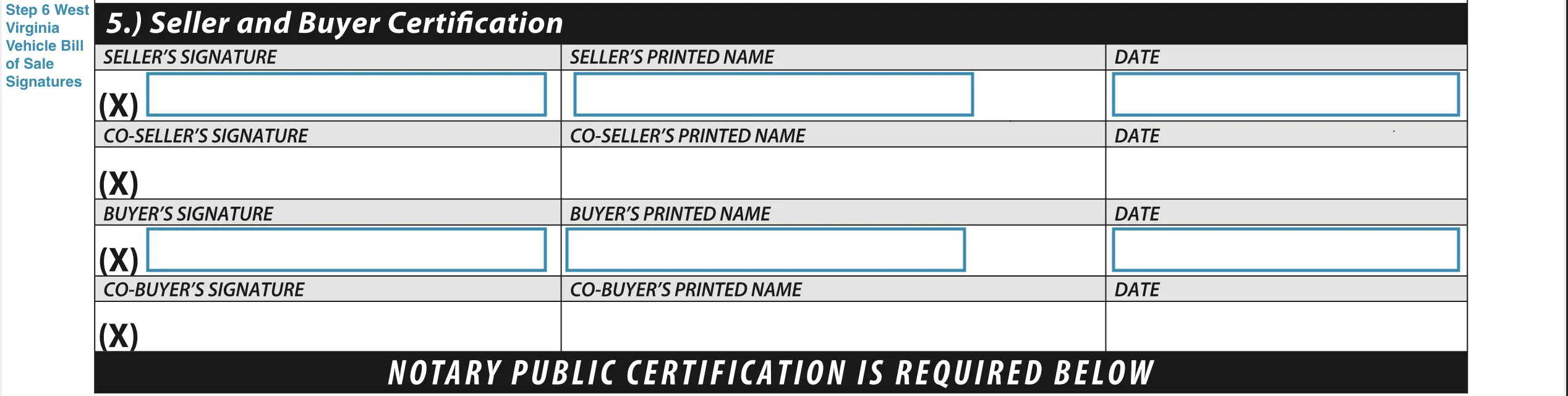

Step 6: Provide the seller and buyer certification

Both the buyer and seller must certificate their agreement on all information provided in the document by signing it.

Step 7: Notarize the form

In West Virginia, the official vehicle bill of sale form must be notarized.

The bill of sale form could be requested in the course of title transfer, so the purchaser needs to have the original. There are two approaches here: you should either prepare and sign a pair of identical documents or make a copy for the seller to keep.

Registering a Vehicle in West Virginia

If the vehicle is obtained in a private sale or a new state resident wishes to register their vehicle to operate on West Virginia roads, they should file the bill of sale together with other registration documents to the West Virginia Department of Transportation (DOT). The documents required for the registration process include the following:

- Document proving that the vehicle has been properly signed over to the new owner

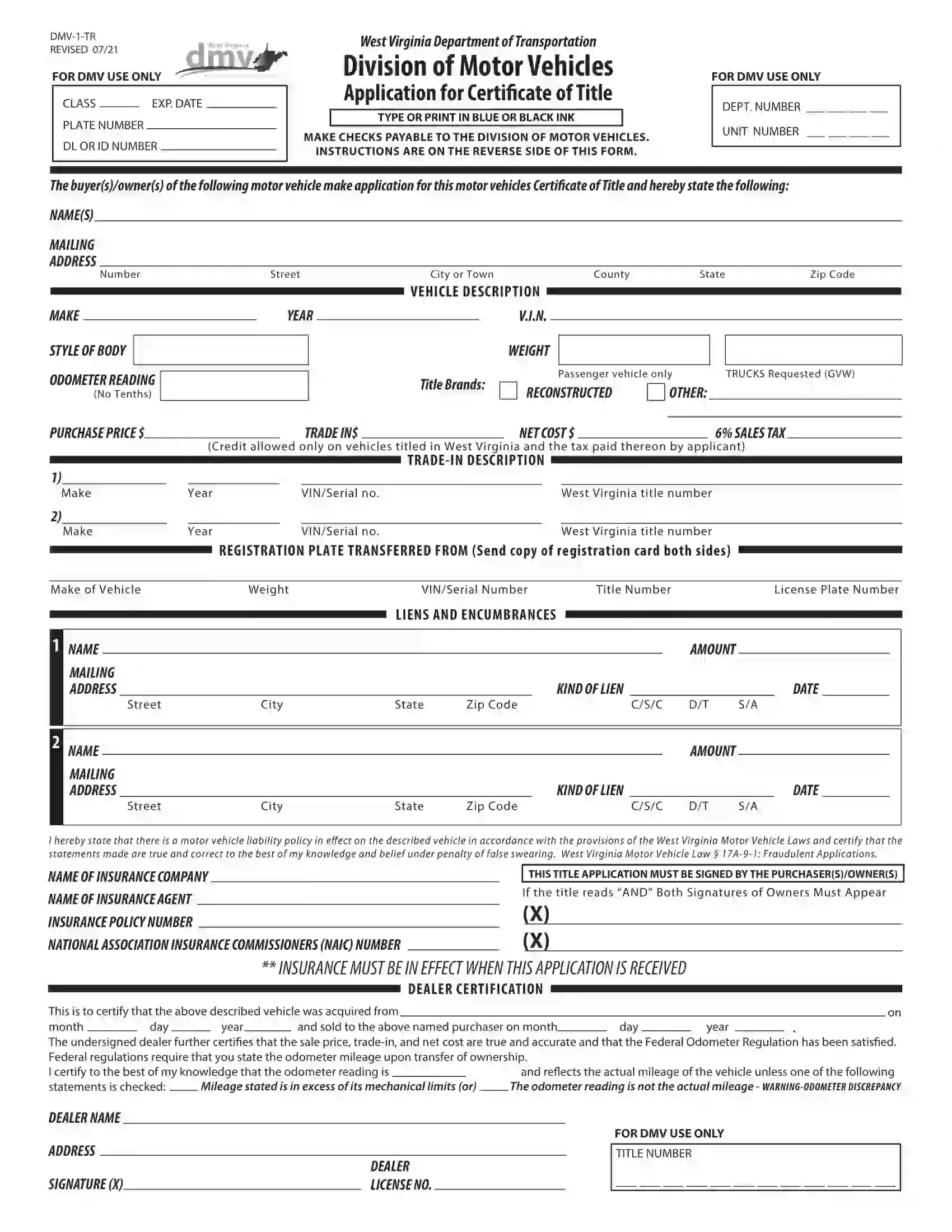

- Completed Application for Certificate of Title for a Motor Vehicle (Form DMV-1-TR)

- Filled and signed motor vehicle bill of sale (Form DMV-7-TR)

- Odometer Disclosure Statement for vehicles not older than ten years

- Valid auto insurance

- Copy of the buyer’s driver’s license

- Proof of residence and ID

- Payment of all related taxes and fees

- Technical inspection sticker (for vehicles that don’t have it, the inspection should be completed within 10 days after the vehicle’s registration with the new owner)

Registering a new or used vehicle includes a $15 title fee, a 6% titling sales tax (for vehicles costing $500+), and a $30 tax for vehicles priced less than $500. In some instances, the $10 lien fee is also applicable.

A notarized bill of sale is required for vehicle purchases from individuals and when the price for that item is set at 50% below the current NADA Clean Loan Book value. Otherwise, the tax deduction will be calculated based on the value assigned to that vehicle type by NADA.

For cases when the vehicles are purchased privately from individuals, and their actual purchase price is above the one set by NADA, the tax deduction is calculated from that sum. All used vehicles that are two years old and less are taxed based on the value established by NADA, regardless of the price indicated in the notarized bill of sale.

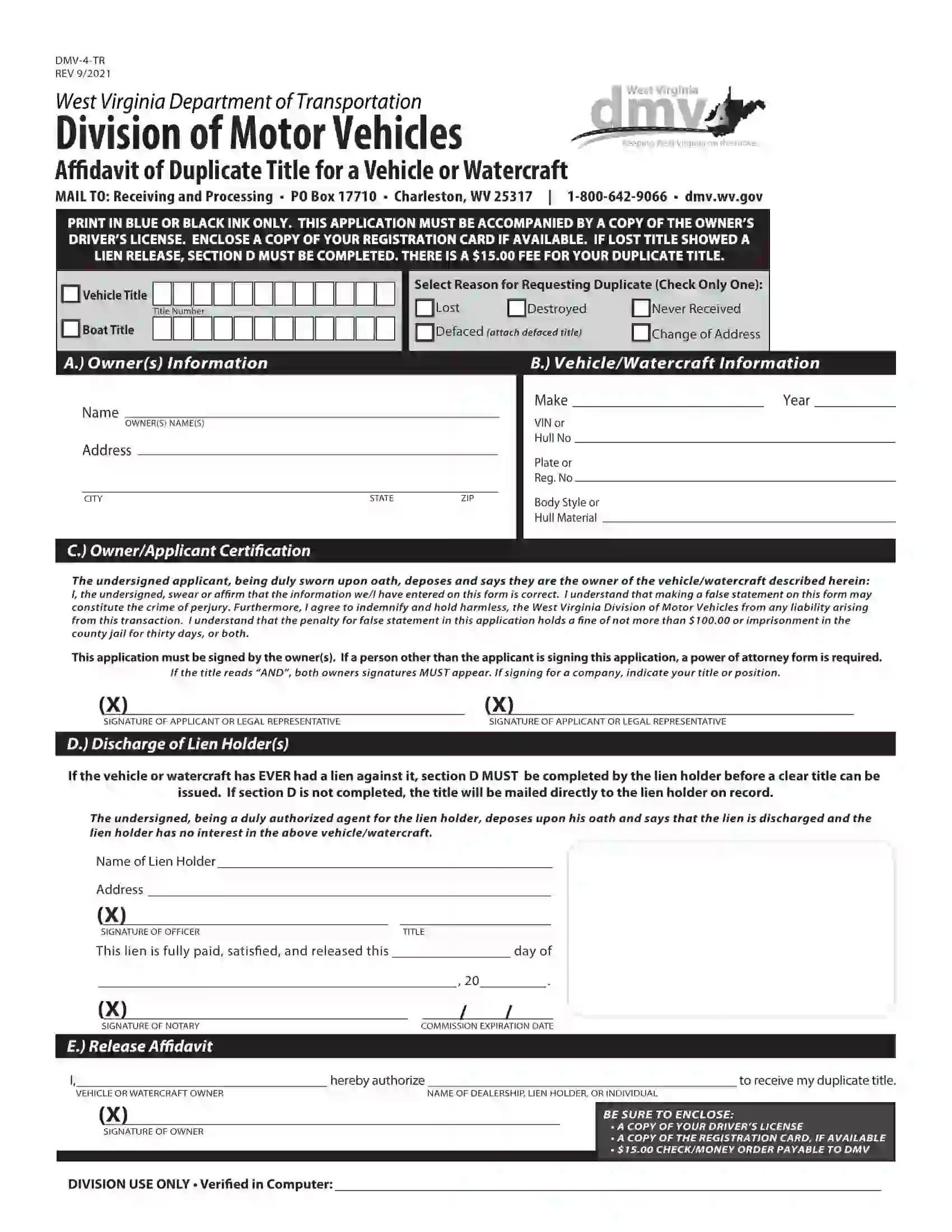

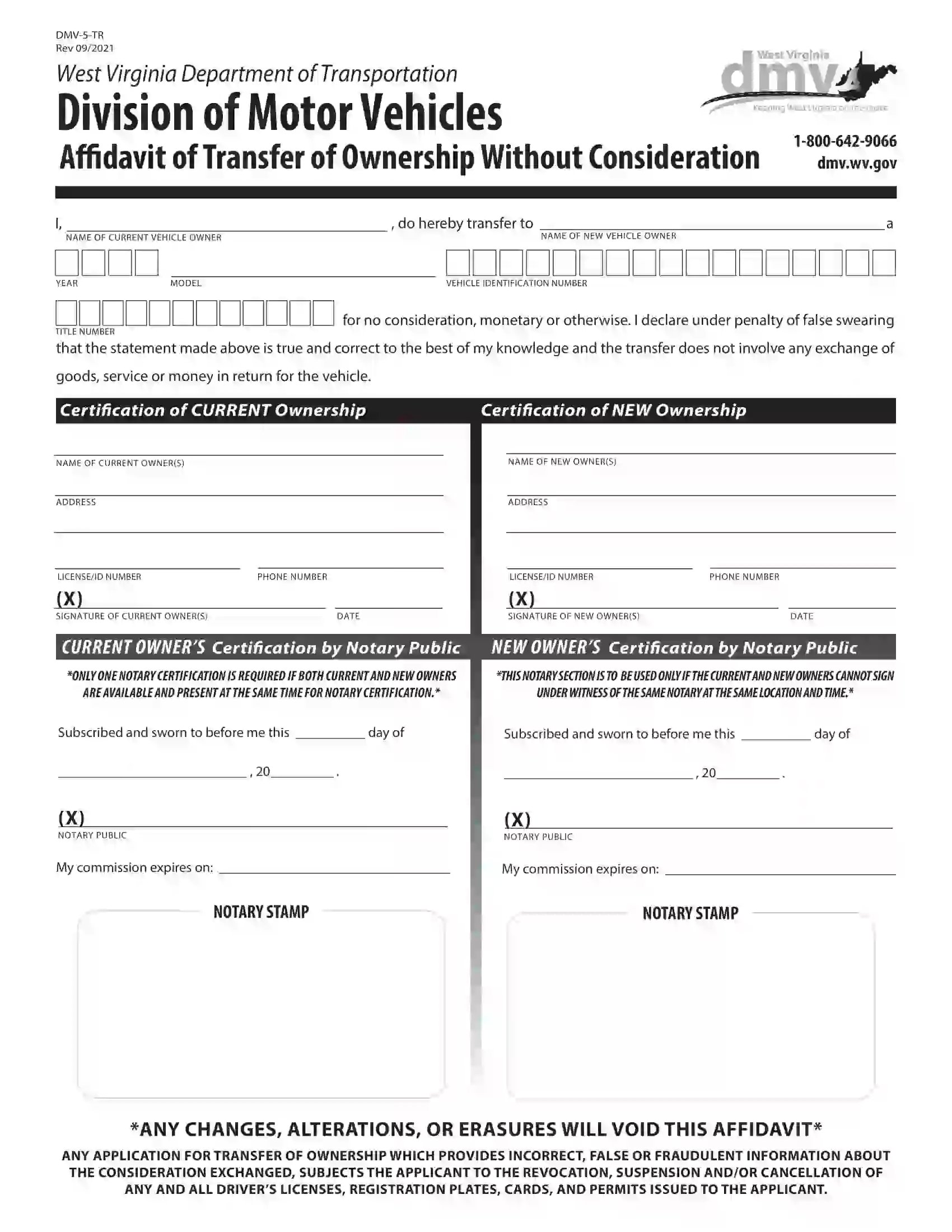

Those who present or receive a vehicle as a gift or coverage of a lien should remember that the 6% tax is still applicable to such items. The new owner should submit an Affidavit of Transfer of Ownership Without Consideration to register a gifted vehicle, known as Form DMV-5-TR, in West Virginia.

Relevant Official Forms

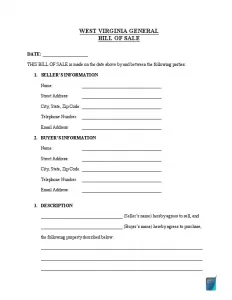

Form DMV-1B or Verification of Vehicle Identification Number is used by a law enforcement officer to examine and verify the vehicle identification number (VIN).

Form DMV-5-TR is known as Affidavit of Transfer of Ownership Without Consideration and used to prove that the vehicle is transferred for no consideration, monetary or otherwise.

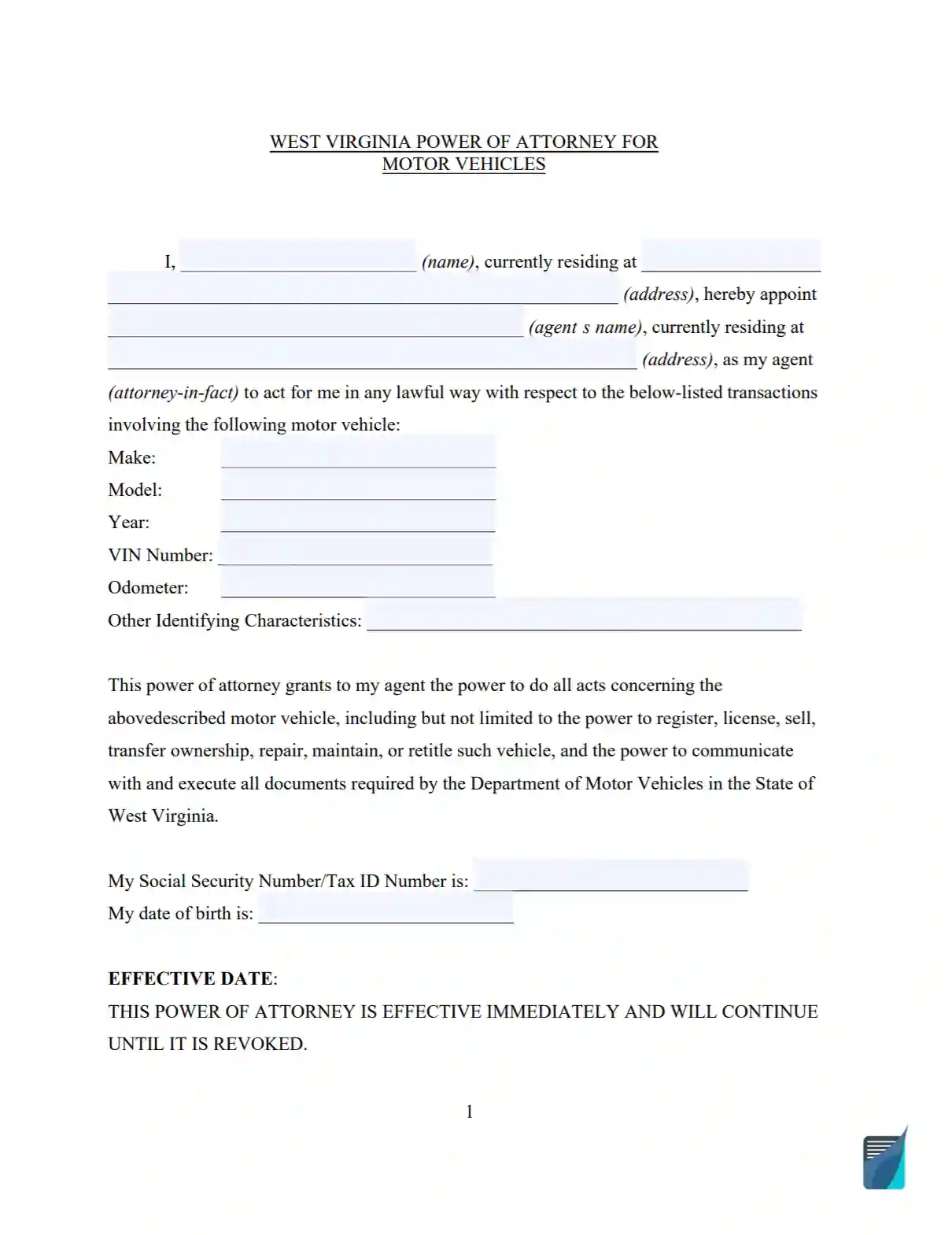

A motor vehicle power of attorney, known as Form DMV-9-TR, allows to appoint a representative to handle the matters related to the vehicle.

Short West Virginia Bill of Sale Video Guide

Other West Virginia Forms