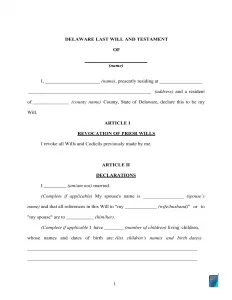

Delaware Last Will and Testament

A Delaware last will is an essential document containing the last wishes of its creator (testator) and establishing exactly how and by whom their estate will be used in the event of their death. Preparing a last will is a smart choice for anybody who wants to avoid conflicts and misunderstandings.

In this article, you’ll find a last will and testament form valid in Delaware and the information intended to clear your smallest doubts concerning estate planning, wills, and how to create this document.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Delaware Last Will Laws and Requirements

| Requirements | State laws | |

| Definitions | § 101. Definitions | |

| Statutes | Title 12 – Decedents’ Estates and Fiduciary Relations; Part II – Wills | |

| Signing requirement | Two witnesses | § 202 Requisites and execution of will |

| Age of testator | 18 and older | § 201 Who may make a will |

| Age of witnesses | § 203 Witnesses; persons competent | |

| Self-proving wills | Allowed | § 1305 Self-proved will |

| Handwritten wills | Might be recognized if witnessed according to state law | § 202 Requisites and execution of will |

| Oral wills | Not recognized | |

| Holographic wills | Not recognized | |

| Depositing a will | Possible with the office of the Register of Wills and Estates of the Delaware county A fee is county-specific | § 2513 Deposit of original wills with Register in New Castle County, Kent County, and Sussex County |

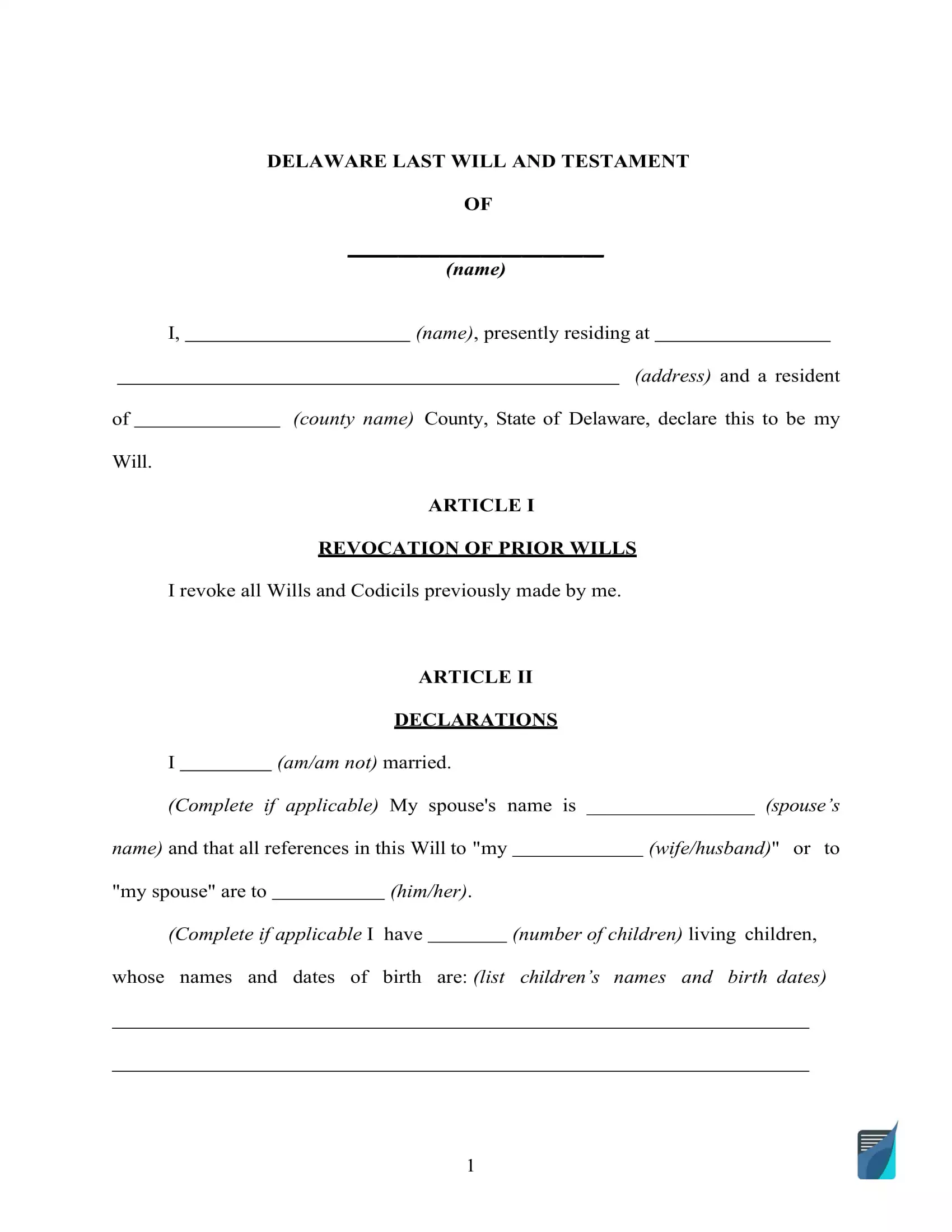

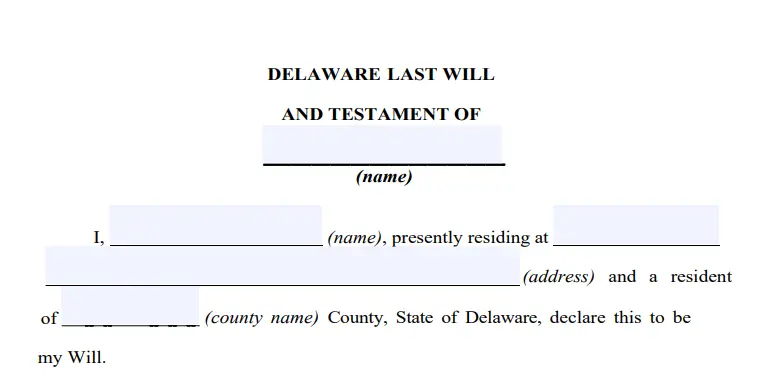

How to Prepare a Delaware Last Will

1. Think about your options. Determine if you need to hire lawyers or make last will and testament yourself (either by handwriting it all or getting a free will template).

2. Specify your information. Step one is establishing the testator by filling out their full legal name, followed by the residential info (city, county, and state). Reread the remaining portion of the passage, including the information you have written along with the “Expenses and Taxes” paragraph.

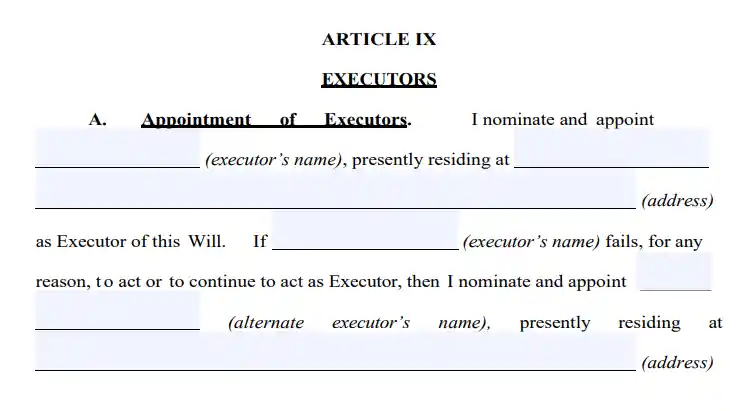

3. Choose the executor. Determine the executor of your property and enter their particulars: full name and place of residence, with the latter being in the same state the testator lives since the majority of states enforce special regulations on out-of-state executors. Although it is not required, it makes sense to choose one more person to act as an executor in case the first one is unwilling or incapable of carrying out your last will and testament.

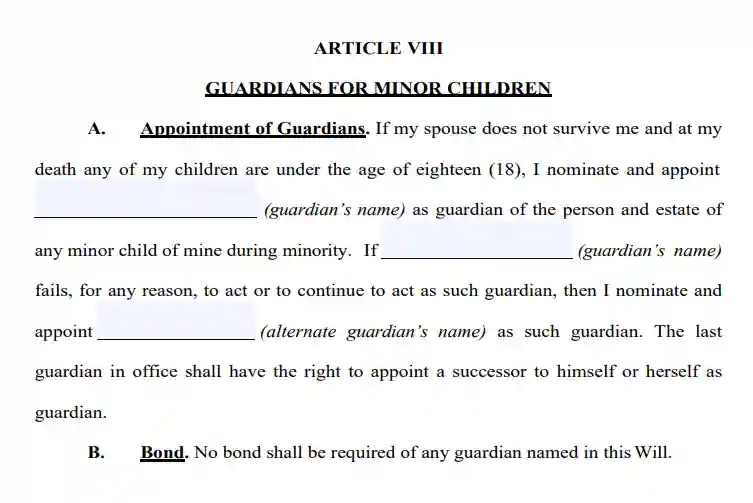

4. Indicate the guardian (optional). You can choose a trusted person as a guardian in the event that you have underage or dependent children that need to be taken care of. In case there are no directions concerning who exactly should look after your children, the guardian will be selected by the court.

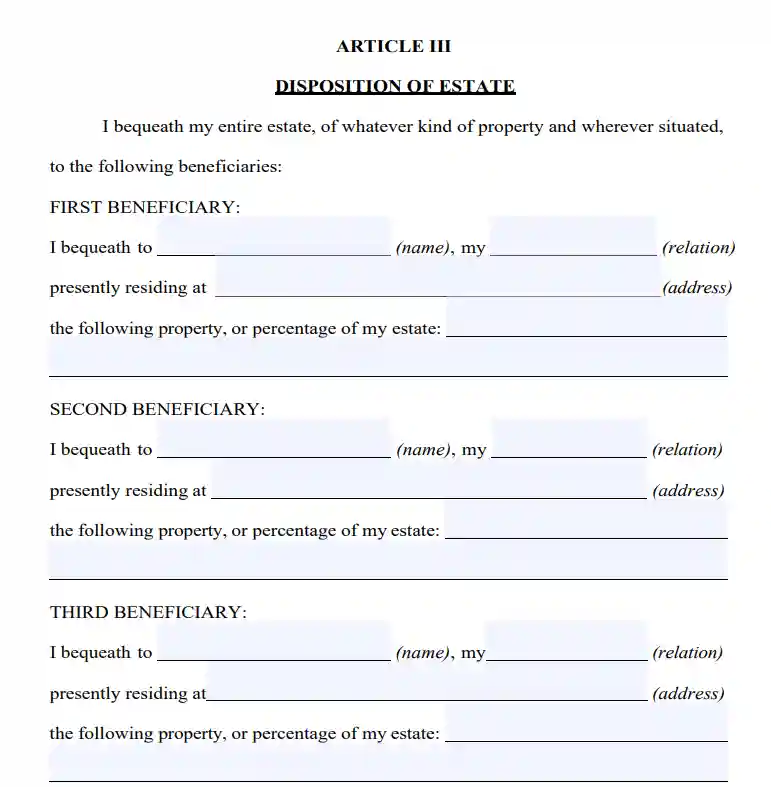

5. Indicate your beneficiaries. At this point, indicate individuals to whom you wish to hand on your property, that is, your beneficiaries. For every inheritor, enter the next particulars: full legal name, address, and the way they are related to you.

6. Designate assets. It’s possible to define which of the beneficiaries receives this or that piece of property. If you don’t, the assets are going to be distributed equally amongst the listed beneficiaries. Cash, shares, realty, business control, money for outstanding debts, and any material things of financial worth that count among your possessions can be in your last will. Please be aware that there are things that cannot be distributed in your will, for instance, life insurance and shared and living will assets.

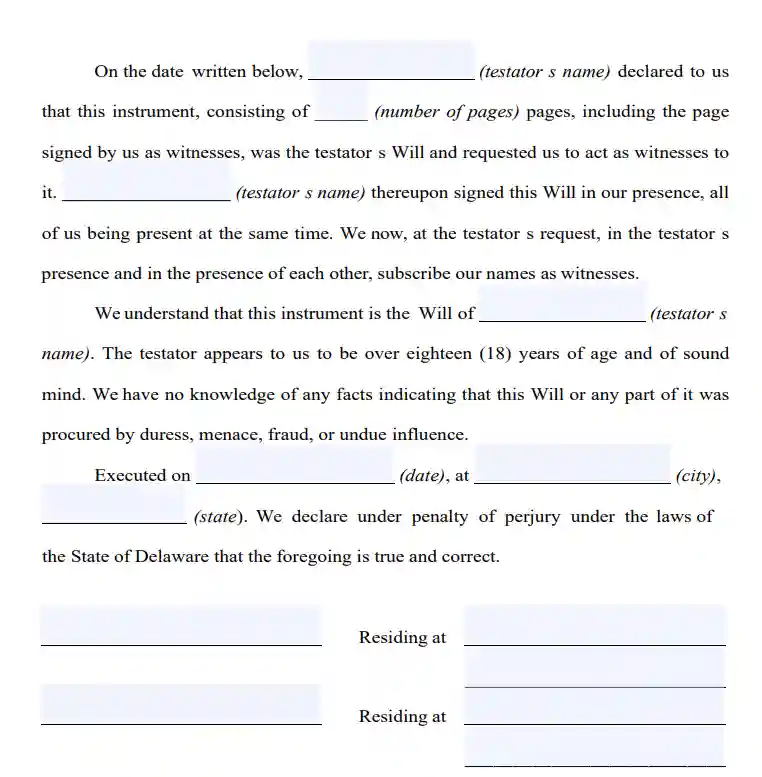

7. Continue with the witnesses putting the signatures at the end of the document. According to Delaware Code, for a last will to be valid, it has to be signed by two witnesses. You are able to name another person as a witness only when they’re older than 18 years and uninvolved in your heritage. As a possible additional preventative measure against situations when your will is challenged or some other problems, it’s advisable to appoint a witness who is younger than you to ensure they’ll be there after you pass away. At this point, you (as well as your two witnesses) have to sign the document after filling in your full legal addresses and names. Don’t neglect to review every paragraph carefully prior to finalizing the matter.

Create a Free Delaware Last Will

Frequently Asked Questions

Is will notarization necessary by Delaware law?

A last will and testament in Delaware is effective without a notary certification. Nonetheless, you will need a notary if you wish to make your will self-proving by adding an affidavit to the document. A self-proving last will makes probate simpler since the court can recognize it without contacting the witnesses who are involved.

Is it mandatory (in DE) to add a self-proving affidavit to my last will?

It is not strictly required in Delaware. Still, in case you make a decision to include a self-proving affidavit, it can be very useful as the document functions as an alternative for in-court testimony of witnesses during probate.

Can you leave out your children or spouse from a last will?

In Delaware, there is no such term as community or marital property. The term means that all possessions gathered or increased while in the marriage have to be equally distributed between the spouses.

In Delaware, you are able to disinherit your marriage partner, but your spouse will be entitled to a certain minimum of your property.

Aside from your marriage partner, Delaware law allows you to disinherit other members of your family. By including particular disinheritance paragraphs to your last will and testament, you’ll be able to leave your children (those of 18 years and older) or other members of the family out from obtaining any of the belongings.

Can a signed, typewritten last will be revised in Delaware?

Yes, you are allowed to revise it.

Based on Delaware law, you can alter or repeal the will if you aren’t obligated by a legal contract stating the opposite.

Also, it is a good idea to revise your last will and testament whenever you go through a major life event such as:

- Adoption or birth of a child

- You got divorced or married

- Purchasing or selling real estate

- Your money situation has changed noticeably

What are the consequences of losing a will?

In Delaware, the law indicates that the court can accept a last will in case it has been destroyed or lost. But, nothing but the original of the last will may be approved by the probate court.

Delaware law gives a supposition that the absence of the will means it has been annulled. That places the obligation on the proponent of the last will to provide proof of the said last will.

For a holographic last will, you may require sworn witnesses and testimony to show. This will make the process more troublesome. The reason behind not providing the will and its contents is to be demonstrated too.

In case I'm physically incapable of signing my will, what am I to do?

As per Delaware Estate Code, it is possible for someone to sign his or her will, given that it is your (as a testator) directive and with you present. It’s possible to give a particular directive using several methods, which include verbal communication, a positive answer to a question, or body gestures.

A notary can sign the testator’s name if the latter can’t do it on account of a physical disability. The notary public needs to be instructed to do it in the presence of a witness. This witness is chosen just like someone could decide on an executor – they cannot have any legal or equitable interest in any assets being the subject of or impacted by the last will and testament.

Other Documents Related to Wills in Delaware

| Related documents | When to make one |

| Codicil | There are several small adjustments you’d like to make to your last will. |

| Self-proving affidavit | You want to save time and legal fees for your witnesses. |

| Living will | You would like to ensure that, if you become incapacitated, you get treated the way you would like to. |

| Living trust | You want to deal with your end-of-life matters without probate. |

Last Will and Testament Forms for Other States