Idaho Last Will and Testament Form

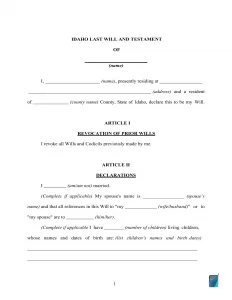

An Idaho last will is a document that contains the final will of its creator (testator) and establishes how and by whom his or her assets will be used after their death.

Below, you will find a last will and testament form for download in two formats (PDF and Word) and tips intended to clear up your questions about estate planning and how to fill out our template.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Idaho Last Will Laws and Requirements

| Requirements | State laws | |

| Statutes | Title 15 – Uniform Probate Code; Chapter 2 – Intestate Succession – Wills | |

| Definitions | 15-1-201. Definitions | |

| Signing requirement | Two witnesses | 15-2-502. Execution |

| Age of testator | 18 and older or an emancipated minor | 15-2-501. Who may make a will |

| Age of witnesses | 18 and older | 15-2-505. Who may witness |

| Self-proving wills | Allowed | 15-2-504. Self-proved will |

| Handwritten wills | Recognized under certain circumstances | 15-2-502. Execution |

| Oral wills | Not recognized | |

| Holographic wills | Recognized under certain circumstances | 15-2-503. Holographic will |

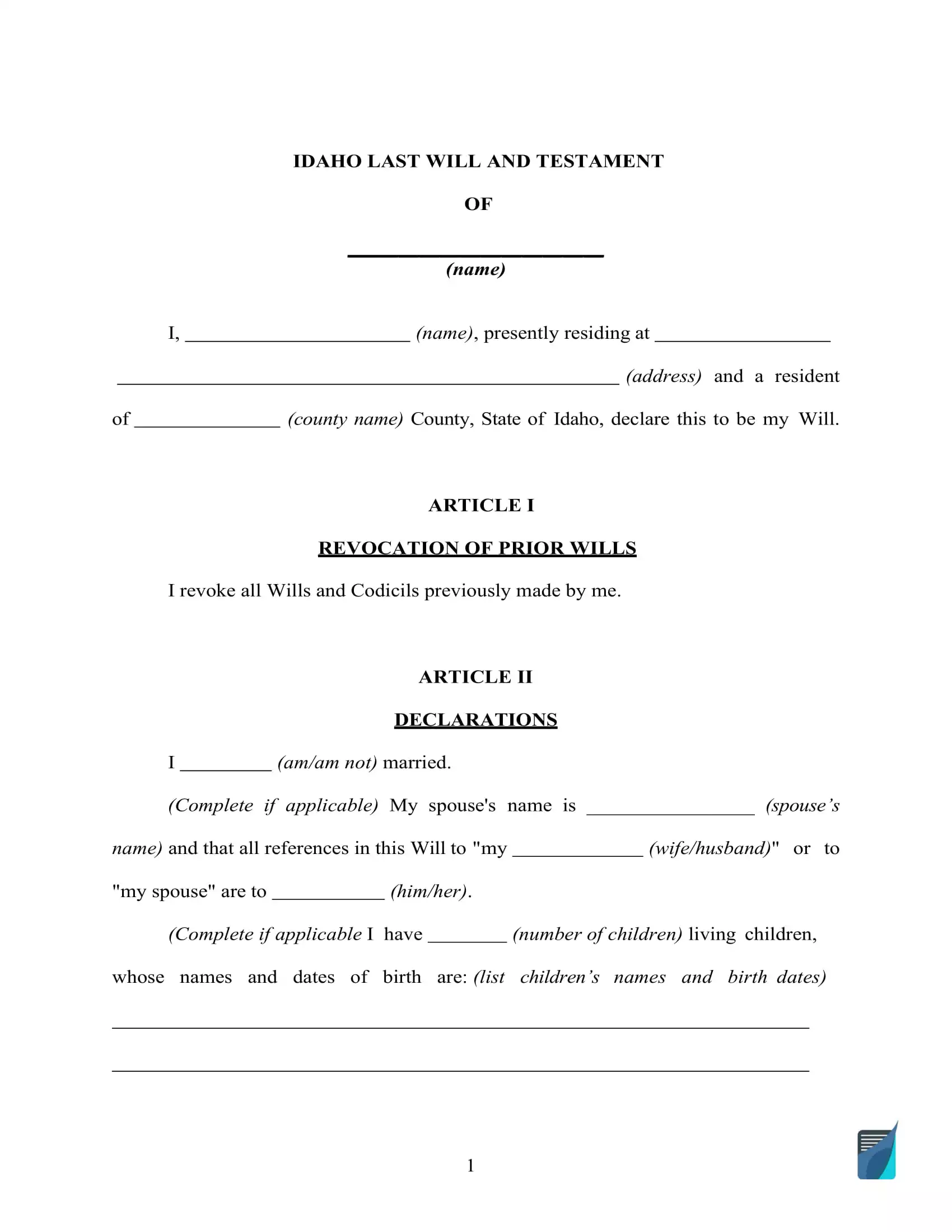

How to Write an Idaho Last Will

1. Think about your options. One thing to bear in mind, first, is if you would like to write the whole thing by hand (holographic will) or work with a fillable last will and testament form available here.

2. Indicate your details. Fill out your full name and address (the city, county, and state of residence) to determine the testator of the will. Check the details you entered as well as the rest of the section, which includes “Expenses and Taxes.”

3. Establish the executor. Determine the executor of your estate and specify their details: full legal name and place of residence, which will generally be within the same state the testator lives in because the majority of states enforce special policies on out-of-state executors. Although it is not obligatory, it’s a wise idea to appoint an additional person to act as an executor in case the first one is unwilling or incapable of executing your last will.

4. Establish the guardian (optional). In the event you’ve got underage or dependent children and do not wish the court to choose a guardian for them when you’re no longer on this Earth, it is possible to specify someone you know as a guardian for your children.

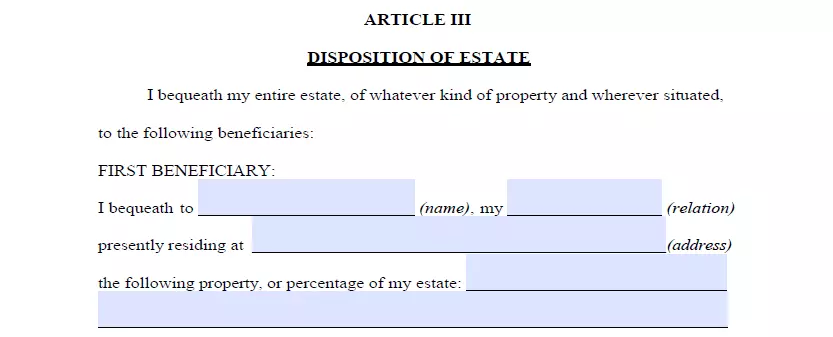

5. Indicate your beneficiaries. At this stage, you specify those who will receive your assets. Enter their full names, addresses, and your relationship to them (spouse, child, friend).

6. Assign property. List your assets and explain how you would like to distribute them amongst your beneficiaries if you have something under consideration other than dividing the assets equally. Assets may include money for outstanding arrears, real estate, shares, company control, cash, and any physical items of monetary value in your possession. Please notice that there are things that cannot be distributed in your last will and testament, such as joint and living will assets and life insurance.

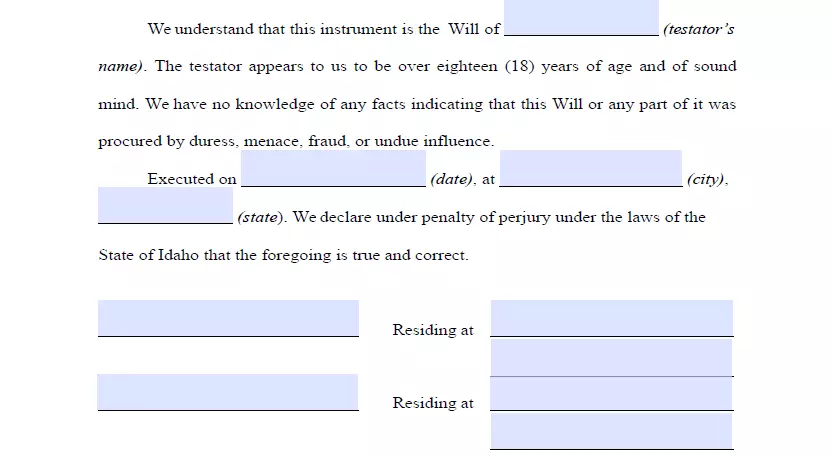

7. Ask witnesses to finalize the document. Idaho Statutes stipulate that no less than two witnesses must sign a will so that it is viewed as valid. You’ll be able to name another person as a witness provided that they’re older than 18 years and are disinterested in your heritage. As an additional precaution against situations when your will is contested or other problems, it makes sense to assign a witness who’s younger than you to be sure they’ll still be there after you depart this world. At this point, you (and your two witnesses) have to sign the document after filling in your full legal addresses and names. Don’t forget to check each section carefully prior to finalizing the matter.

Get a Free Idaho Last Will Template

Frequently Asked Questions

Must I notarize my will in Idaho for it to be valid?

Idaho statute affirms that a will can be valid without notarization. But in case you wish to add a self-proving affidavit to the last will, you must notarize it. A self-proved last will would make probate faster since the court can approve it without speaking to the witnesses.

Can you exclude your children or spouse from your will?

In regards to your spouse, it’s important to emphasize that Idaho is a community property state, which means that all the properties and assets that were acquired during the marriage or that increased with money earned while in the said marriage, belong to each of the marriage partners evenly. This can make it impossible to disinherit your marriage partner in this state.

Idaho law enables you to exclude your marriage partner only with regards to those possessions you manage, which in Idaho are usually known as “separate property.” As an alternative, it’s possible to conclude a prenuptial agreement to reallocate the rights for community property in different ways. Except for your spouse, you can disinherit any other members of your family.

Can a will be modified in Idaho after it has been signed?

Yes, you can change your will after signing it. As outlined by Idaho law, it is possible to alter or cancel your last will at any time. However, in case you’re obligated by a legal contract (e.g., a divorce agreement) not to do it, you might not be able to change or revoke your last will.

If the testator is physically unable to sign the will, what should they do?

Only per your instruction and in your presence is another person allowed to sign your last will (Section 15-2-502). If notarized, the notary public should also add “Signature affixed by (the name of the person signing the will) at the direction of (the name of the testator)” or a phrase similar in wording to this one (section 51-109).

It is important to note that the person signing the document on behalf of the testator cannot be a witness in the same or the notary public certifying the document.

| Related documents | Instances when you might need to create one |

| Codicil | You need to make a single or several small alterations to your will. |

| Self-proving affidavit | You wish to expedite the probate later on. |

| Living will | You would like to indicate precisely what medical care you expect if you can’t express that yourself. |

| Living trust | You need extra confidentiality and safety when the time to distribute your possessions comes. |

Last Will and Testament Forms for Other States