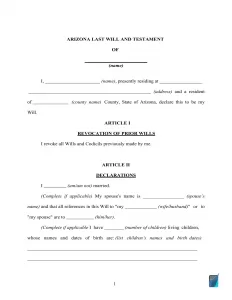

Arizona Last Will and Testament Form

An Arizona last will is a document containing the final wishes of its creator (called a testator) and ascertaining how and by whom his or her property and valuable assets will be used in the event of the testator’s death.

Even when you don’t have too many things to take care of, a will might help your family and end up being critical to the ones you love upon your death as it will remove some of the hassle and paperwork.

If you are in need of a printable and fillable last will and testament form valid in the State of Arizona, you’ll find it on this page below, in addition to some general recommendations.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

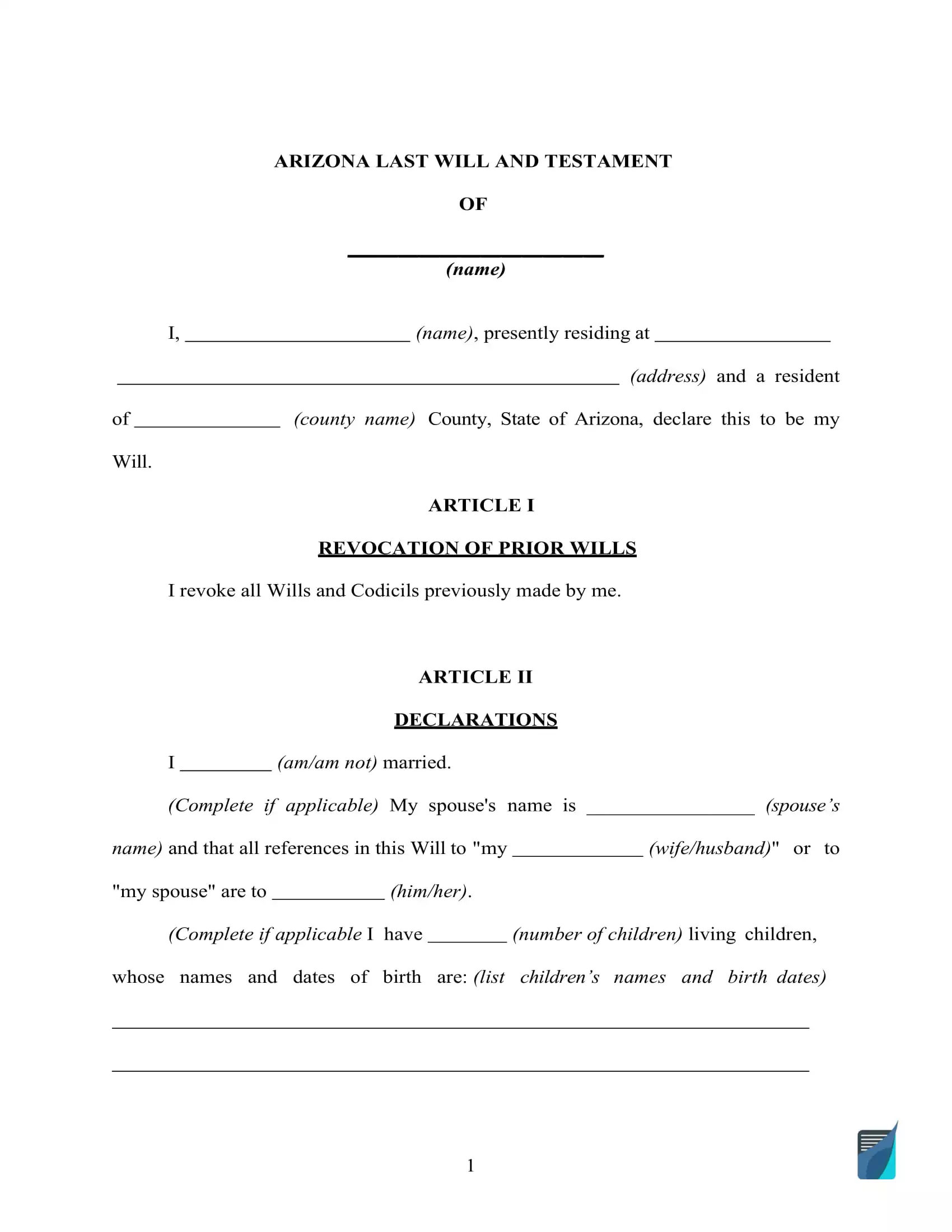

How to Write an Arizona Last Will and Testament

1. Think about your alternatives. One thing to decide upon first is whether you want to write the entire thing by hand (holographic will) or use a fillable last will and testament form that can be found online.

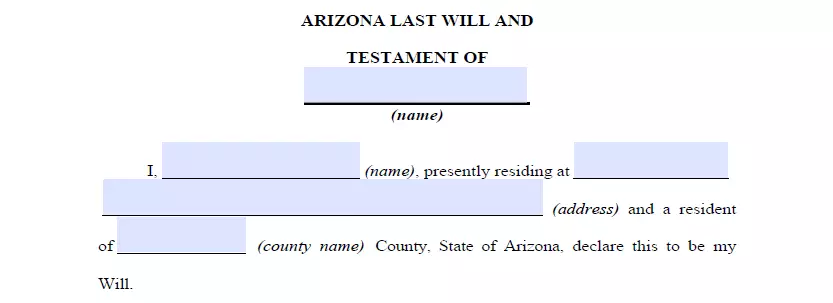

2. Indicate your details. Step one is to identify yourself as the person creating the will (the testator). You’ll need to provide your name, address, and date of birth.

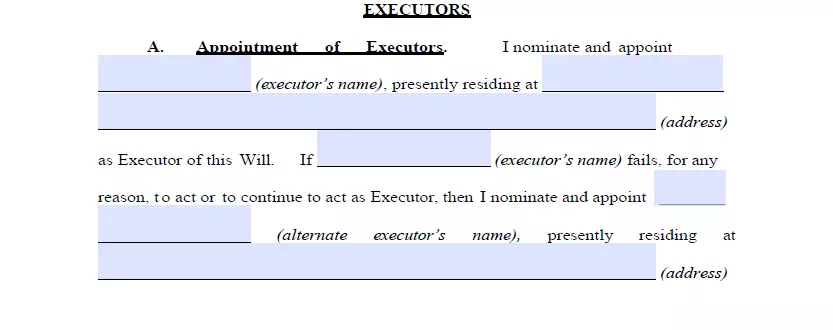

3. Choose the executor. You’ll need to appoint someone to carry out your wishes after you die (the executor). This person will be responsible for managing your assets and distributing them according to your will. You’ll need to provide their name and contact information. The majority of states have specific legislation regarding out-of-state executors and agents, which in most cases translates to significantly more hassle and red tape. Therefore, it is advised to appoint someone who resides in the same state as you. Although not required, it’s wise to choose one more person to be your executor in case the first one is unwilling or incapable of carrying out your will.

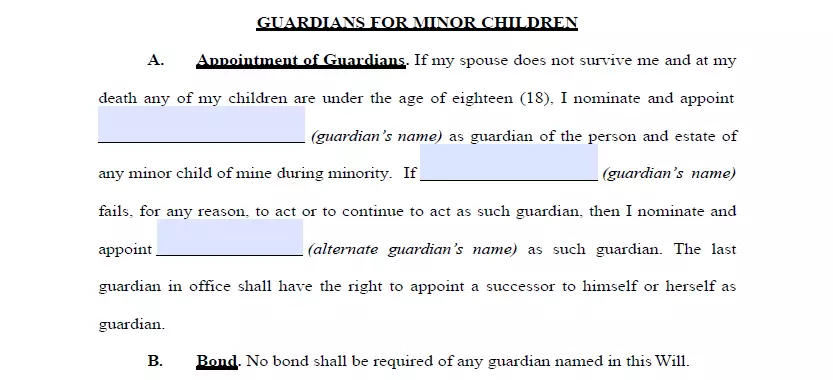

4. Appoint the guardian (optional). You can include a few optional sections in your will, such as funeral arrangements and guardianship for minor children. These are not required but may be helpful to include. Should you have underage or dependent children and do not want the court to decide on a guardian for them when you are no longer here, you can appoint somebody you know as a guardian for your children.

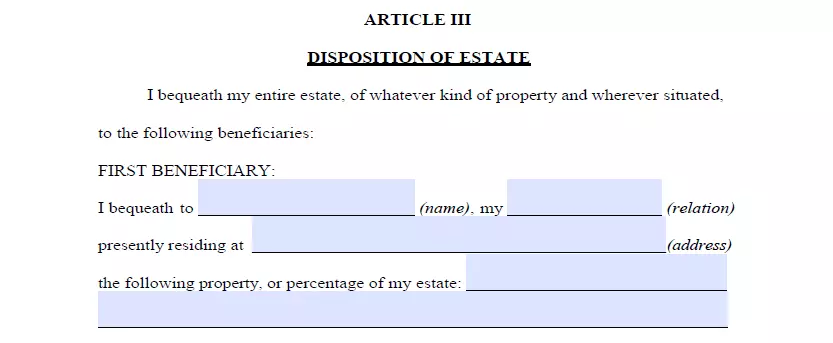

5. Specify your beneficiaries. In this section, you’ll need to list the people or organizations receiving your assets after you die (the beneficiaries). You’ll need to include their names and contact information.

6. Allocate assets. Write down your assets and describe the way in which you wish to distribute them amongst your inheritors if you have something in mind apart from dividing the property commensurately. The property might include money for arrearage, real estate, shares, business ownership, cash, as well as any tangible things of financial value that count among your possessions. Please be aware that there are things that cannot be distributed in the last will, such as life insurance and shared and living will property.

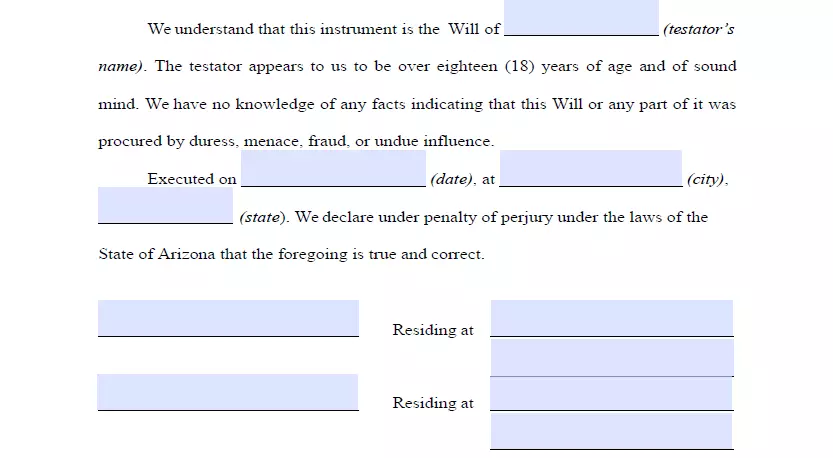

7. Proceed with the witnesses putting the signatures at the end of the document. As per Arizona Revised Statutes, for any last will and testament to be considered valid, it must be signed by two witnesses. Only somebody who is not your beneficiary and is of 18 years or older can be selected as a witness. As a possible extra preventative measure against the cases when the will is contested or other problems, it seems sensible to appoint a witness who is younger than you to make sure they will be there after you depart this world. Now, you (and your two witnesses) must sign the paper after filling out your full legal addresses and names. Do not forget to check each sentence thoroughly prior to concluding the matter.

Arizona Last Will Laws and Requirements

| Requirements | State laws | |

| Definitions | 14-1201 – Definitions | |

| Statutes | Title 14 – Trusts, Estates and Protective Proceedings | |

| Signing requirement | Two witnesses | 14-2502. Execution of paper wills; witnessed wills; holographic wills; testamentary intent |

| Age of testator | 18 and older and of sound mind | 14-2501. Who may make a will |

| Age of witnesses | 14-2505. Witnesses; requirements; definition | |

| Self-proving wills | Allowed | 14-2504. Self-proved wills; sample form; signature requirements |

| Handwritten wills | Recognized if meeting certain conditions | 14-2502. Execution of paper wills; witnessed wills; holographic wills; testamentary intent |

| Oral wills | Not recognized | |

| Holographic wills | Recognized if meeting certain conditions | 14-2503. Holographic will |

Create a Last Will Valid in Arizona

Frequently Asked Questions

Should I attest my last will in Arizona for it to be valid?

Arizona statute affirms that a will can be valid without having a notary public authorize it. But, you’ll need a notary if you’d like to make your last will self-proving by attaching an affidavit to the document. A self-proving last will can make probate faster because the court can recognize it without getting in touch with the witnesses who signed it.

What does it mean to be testamentary capable?

Testamentary capacity is used to describe the testator’s (the individual writing the will) legal and mental capability (sound mind) to write and change their last will.

In most states, to write a will, you have to be of sound mind and at least 18 years old. “Sound mind” signifies that you don’t have any kind of mental illnesses (dementia, senility, insanity, etc.) that don’t allow you to have an understanding of the aftermaths of your actions.

In Arizona, is it possible to change a typewritten will after signing it?

Yes, it is possible.

Based on Arizona law, you are allowed to change or annul or change your will if you are not obligated by a lawful agreement that mentions otherwise.

What will happen in case I lose my last will?

In line with Arizona law, the absence of the will is regarded as its repeal. This suggests that the executor should prove the last will’s credibility, which in turn can become rather complicated.

| Related documents | Times when you might want to create one |

| Codicil | You need to slightly modify your last will without writing a new one. |

| Self-proving affidavit | You want to save time and legal fees for your will’s witnesses. |

| Living will | You would like to be sure your end-of-life treatment is done as outlined by your wishes. |

| Living trust | You want to avoid probate by having your assets in the possession of a trust. |

Last Will and Testament Forms for Other States