Free North Dakota Last Will and Testament Form

A North Dakota last will is a legal instrument that contains the directions of a person (testator) with regards to their assets in case of their death, made in the form prescribed by law.

In case you’re searching for a fillable and printable last will forms valid in North Dakota, you will find one here, as well as the recommendations on last will creation and answers to commonly asked questions.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

North Dakota Last Will Laws and Requirements

| Requirements | State laws | |

| Definitions | Chapter 30.1-01 – Short Title – Construction – General Provisions – Definitions | |

| Statutes | Chapter 30.1-08 – Wills | |

| Signing requirement | Two witnesses | 30.1-08-02. (2-502) Execution – Witnessed wills – Holographic wills |

| Age of testator | 18 or older | 30.1-08-01. (2-501) Who may make a will |

| Age of witnesses | 18 or older | 30.1-08-05. (2-505) Who may witness |

| Self-proving wills | Allowed | 30.1-08-04. (2-504) Self-proved will |

| Handwritten wills | Recognized if meeting certain conditions | 30.1-08-02. (2-502) Execution – Witnessed wills – Holographic wills |

| Oral wills | Not recognized | |

| Holographic wills | Recognized if meeting certain conditions | |

How to Prepare a North Dakota Last Will and Testament

1. Consider your alternatives. One thing to bear in mind, first of all, is whether you wish to write the entire document by hand or use free will forms available online.

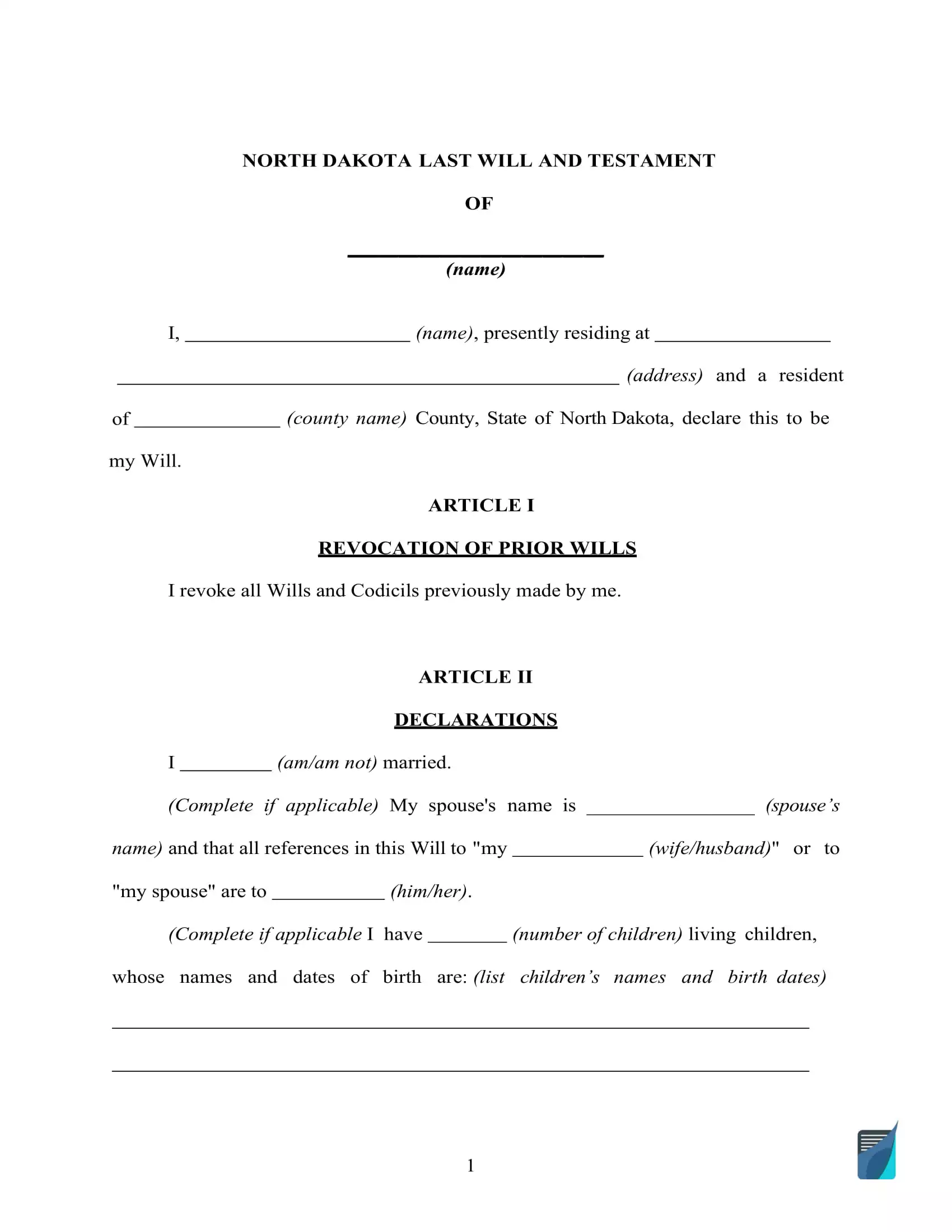

2. Indicate your information. The initial step is establishing the testator by filling out their full name, along with the residential info (city, county, and state). Go through the details you wrote along with the rest of the passage, including “Expenses and Taxes.”

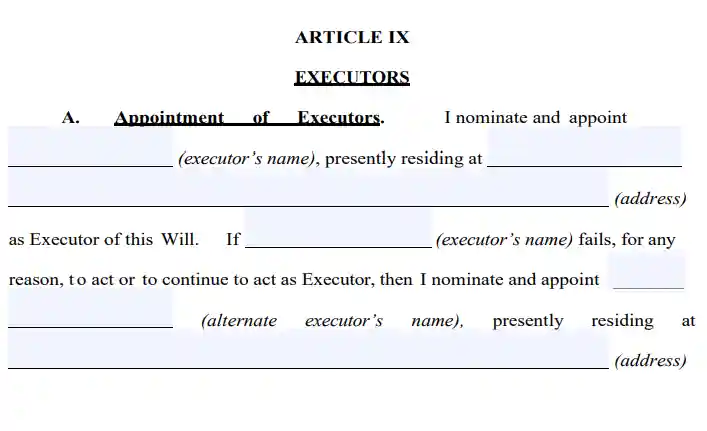

3. Appoint the executor. Select the executor of your property and specify their details: full legal name and place of residence, which will ordinarily be in the same state the testator lives mainly because the majority of states enforce special policies on out-of-state executors. It may well happen that your primary representative will not be able to carry out your will because of a sickness, death, disinclination, or other reasons. In this situation, the court will probably appoint its own representative to handle the duties. To prevent that, you can decide on an alternative executor by providing the same details you did for the primary one.

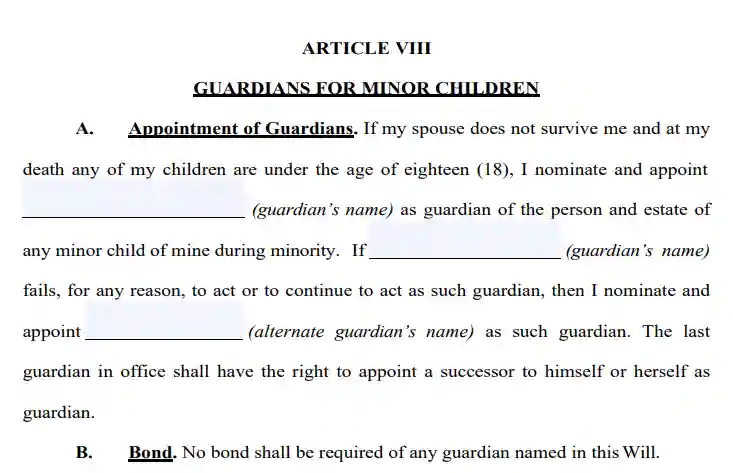

4. Choose the guardian (optional). Should you have minor or dependent children and don’t want the court to pick a guardian for them when you’re no longer on this Earth, it is possible to appoint a friend or acquaintance as a guardian for your children.

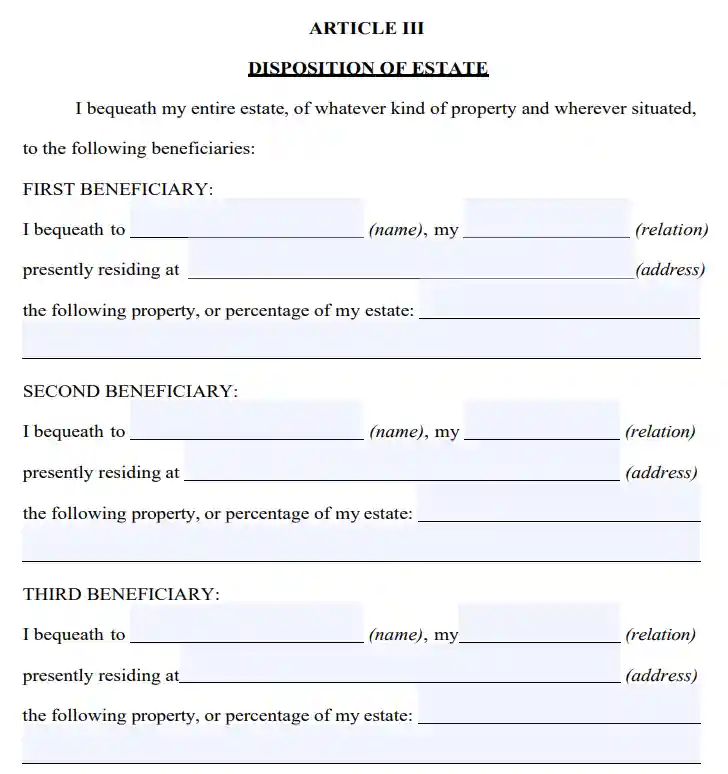

5. Indicate your beneficiaries. This is where you specify those who will receive your assets. For every named beneficiary, indicate the next details: full legal name, address, and the way they are related to you.

6. Distribute assets. If you have an asset allocation in mind that is not proportional, you can explain it within this part. Cash, stocks, real estate, business ownership, money for unresolved arrears, as well as any physical things of monetary worth in your possession can be mentioned in your last will. Yet, joint and living will property, along with your life insurance, can’t go in your last will.

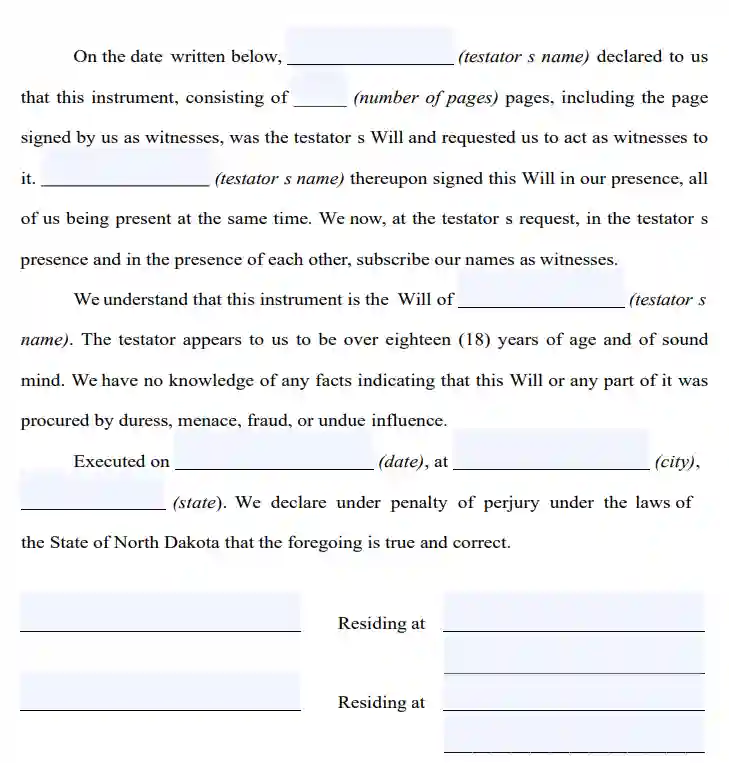

7. Continue with the witnesses putting the signatures at the end of the document. According to the North Dakota Century Code, for a will to be legally correct, it has to be signed by two witnesses. Only someone who is not your beneficiary and is of 18 years or more can be picked as a witness. Think about selecting witnesses who are younger than you to ensure they will likely be present in the event the will is contested in the court or if any other problem takes place. After a thorough revision of each passage in your will, all parties involved (you and the two witnesses) must fill out their full names and full addresses and sign the document.

Create a Free North Dakota Last Will and Testament

Other North Dakota Forms

Frequently Asked Questions

Is last will notarization necessary by North Dakota law?

North Dakota statute affirms that a last will can be valid without getting a notary public to certify it. Even so, you can make your last will self-proving by attaching an affidavit to it, and you will have to go to a notary if you wish to do that. Notarization lets avoid the need to sign a will by witnesses. Making your will self-proving could be a great choice because it speeds up the probate and grants another level of security if your will’s legitimacy is doubted.

Should I attach a self-proving affidavit to my will in North Dakota?

It’s not necessarily in North Dakota. Nonetheless, if you wish to add a self-proving affidavit, it will be quite useful as the document acts as a substitute for in-court testimony of witnesses in the course of probate.

Can you leave out your children or spouse from a last will and testament?

In North Dakota, there is no such concept as community or marital property. This requires that all possessions gained or increased in the marriage ought to be evenly shared between both marriage partners. North Dakota law permits you to exclude your marriage partner from your last will and testament, yet your spouse will be entitled to a set minimum number of your assets.

With regard to others, it’s legal in North Dakota to disinherit family members in your last will. Your adult children (of 18 years and above) or other relatives can be legally disinherited in your last will.

Can a signed, typewritten will be revised in North Dakota?

Yes, it’s possible to alter it.

As outlined by North Dakota law, you’re allowed to modify or cancel the will in case you aren’t obligated by a lawful contract that says otherwise.

In addition, it’s a good idea to improve your last will at the time you go through a major life event, including:

- Birth or adoption of a child

- You got divorced or married

- You purchased or sold real estate or a significant piece of property.

- Your financial position has changed greatly

What will be the consequences of having lost a last will and testament?

North Dakota law implies that a last will can be recognized if it is lost or damaged. However, only the original of the last will can be admitted by the probate court.

As indicated by North Dakota law, the will’s absence will be assumed as its annulment. That suggests that the executor should provide proof of the last will and testament’s legality, which may prove to be rather troublesome.

For holographic last wills, the process may get a lot more complicated because sworn witnesses and testimony are demanded. The reason behind not providing the will and its details has to be demonstrated as well.

How does a disadvantaged individual sign their last will and testament?

Based on the North Dakota Estate Code, it will be possible for an individual to sign their will providing it is your (as a testator) instruction and with you present. Voice communication, a positive response to an inquiry, or body gestures are the ways you can use to express that you prefer a particular individual to sign your will.

It is possible to have a notary public sign the name of a testator who is physically unable to do it in case the testator directs the notary public in the presence of a witness. It is important to mention that such witnesses can’t have an interest (equitable or legal) in any properties and assets that are the subject or can be affected by such a document (the last will).

Other Documents Related to Wills in North Dakota

| Related documents | Times when you might want to make one |

| Codicil | You need to slightly modify your will without making a new document from scratch. |

| Self-proving affidavit | You want to keep from possible difficulties in the probate court. |

| Living will | You want to state your wishes about the end-of-life treatment and life-prolonging procedures. |

| Living trust | You would like to avoid probate by placing your property in the possession of a trust. |

Last Will and Testament Forms for Other States