Free Alabama Last Will and Testament Form

An Alabama last will and testament is a legal instrument containing the instructions of a person (testator) regarding their property distribution in the event of their death, written in the manner prescribed by the state’s law.

On this page, it is possible to get a free last will template that you can fill in and print out to use in Alabama. In addition to that, below, you can find a good amount of details about the last will preparation process and the answers to frequently asked questions regarding the requirements and laws regulating this document in this state.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Alabama Last Will Laws and Requirements

| Requirements | State laws | |

| Definitions | Section 43-8-1 of Alabama Code | |

| Statutes | Title 43 – Wills and Decedents’ Estates; Chapter 8 – Probate Code | |

| Signing requirement | Two witnesses | §43-8-131. Execution and signature of will; witnesses |

| Age of testator | 18 and older | §43-8-130. Who may make a will |

| Age of witnesses | §43-8-134. Who may witness will | |

| Self-proving wills | Allowed | §43-8-132. Self-proved will – Form and execution |

| Handwritten wills | Might be recognized if witnessed according to state law | §43-8-131. Execution and signature of will; witnesses |

| Oral wills | Not recognized | |

| Holographic wills | ||

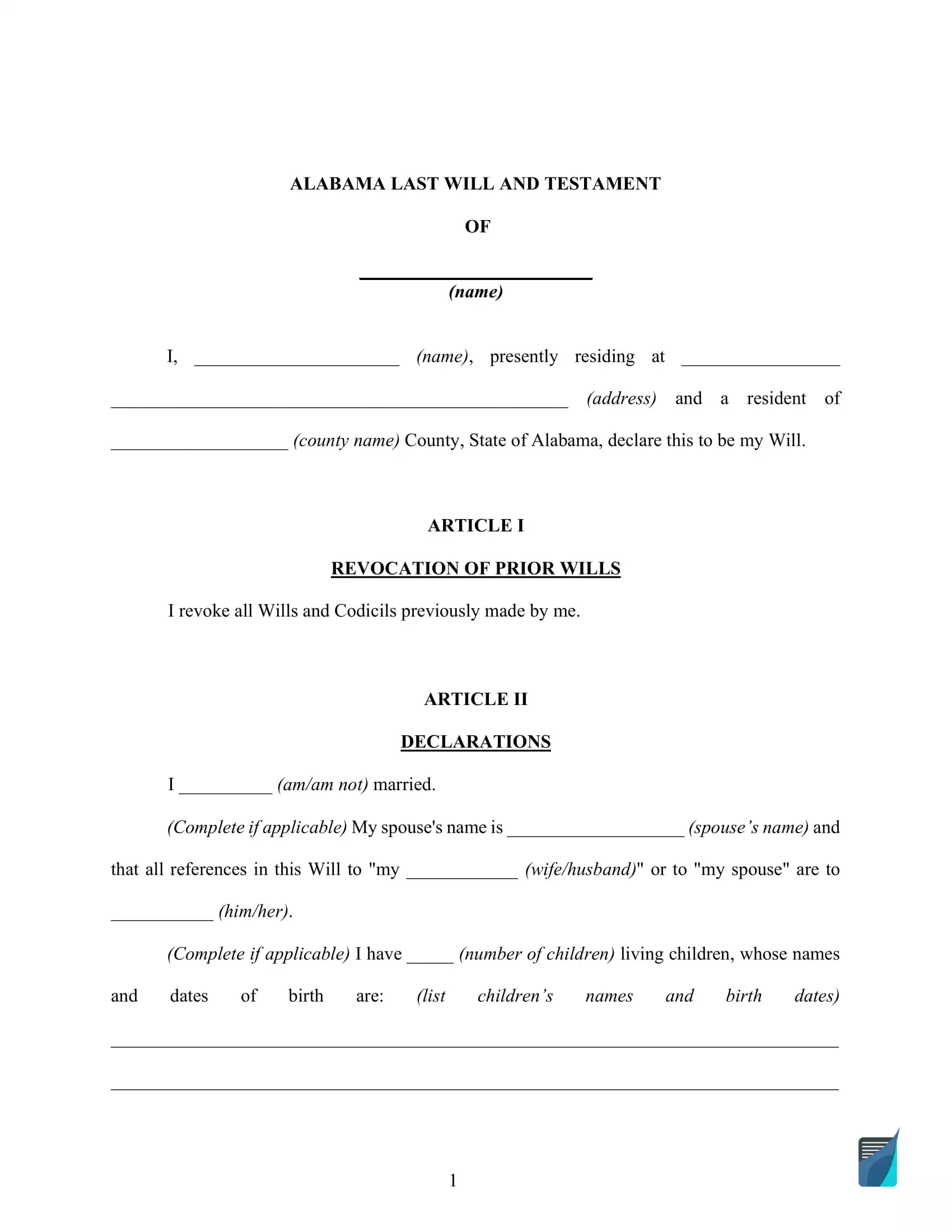

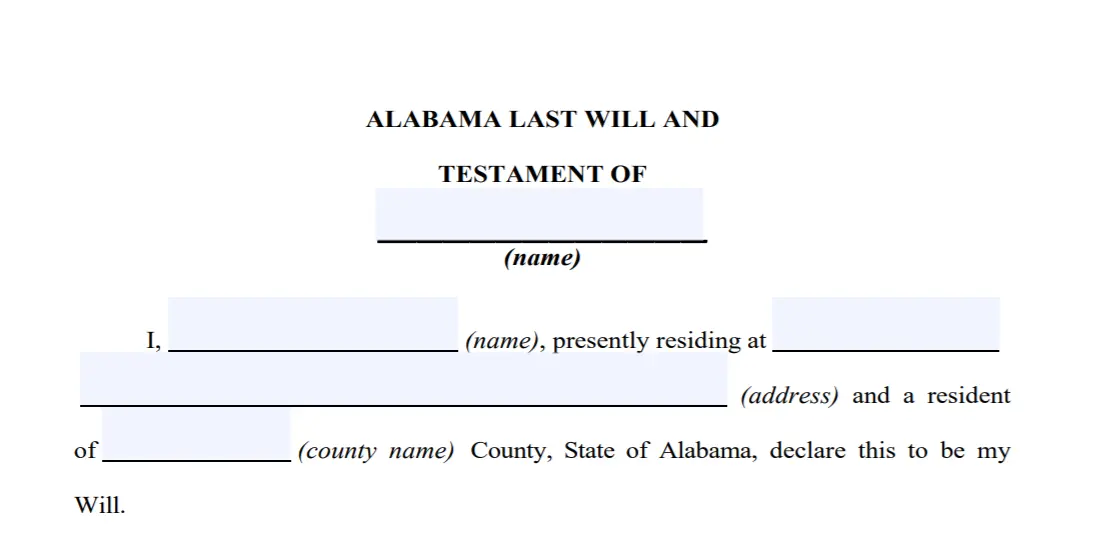

How to Write an Alabama Last Will

1. Consider your alternatives. Prior to beginning, it is advisable to determine if you would like to use the services of a legal professional or create the entire document yourself. If you would like to make the will on your own, pick the type you’ll go for: a handwritten will or perhaps using a free last will and testament template.

2. Specify your information. Establish the testator and their details: full name and address (city, county, and state). Review the details you entered and the rest of the section, including “Expenses and Taxes.”

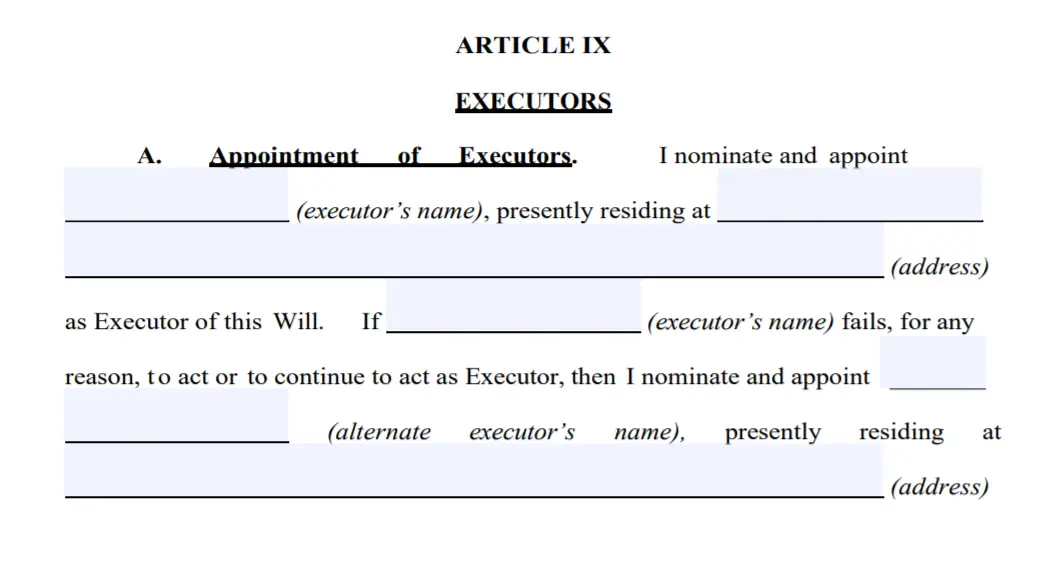

3. Specify the executor. Select the executor of your estate and fill out their details: full name and place of residence, which will normally be in the same state the testator lives mainly because most states impose special policies on out-of-state executors. As a safeguard, you can appoint an alternate executor of the will. That way, you will be able to ensure that even if the originally chosen executor is unable to perform their duties, there’s a second dependable person you can rely on.

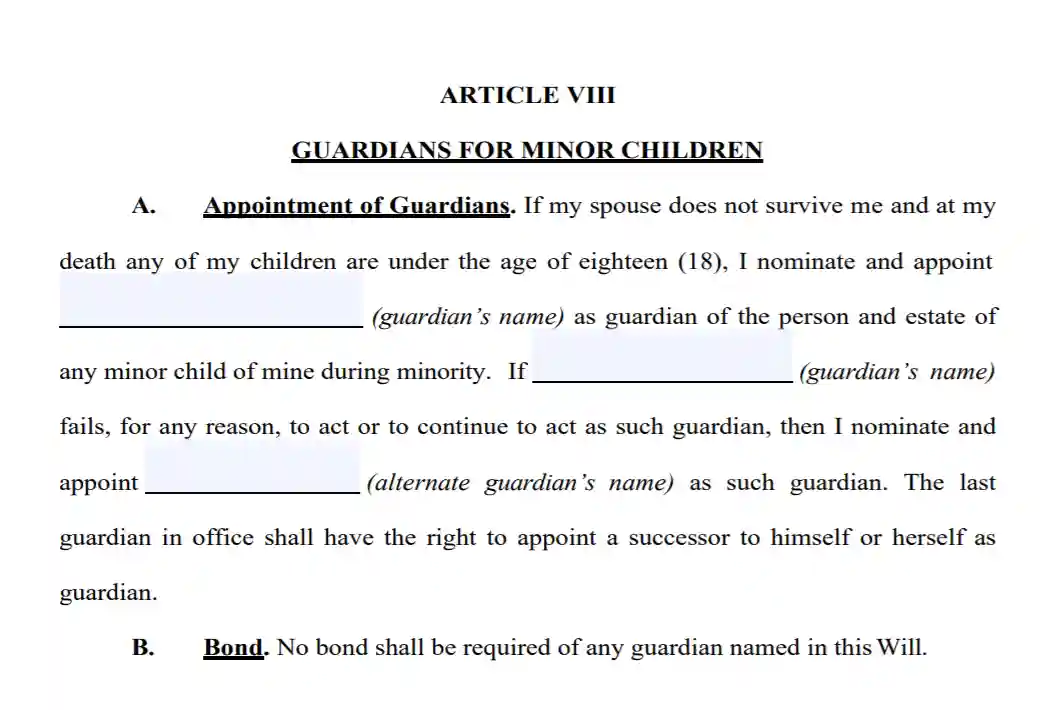

4. Determine the guardian (optional). If you’ve got minor or dependent children and do not want the court to select a guardian for the kids when you’re no longer on this Earth, you can choose someone you know as a guardian for your children.

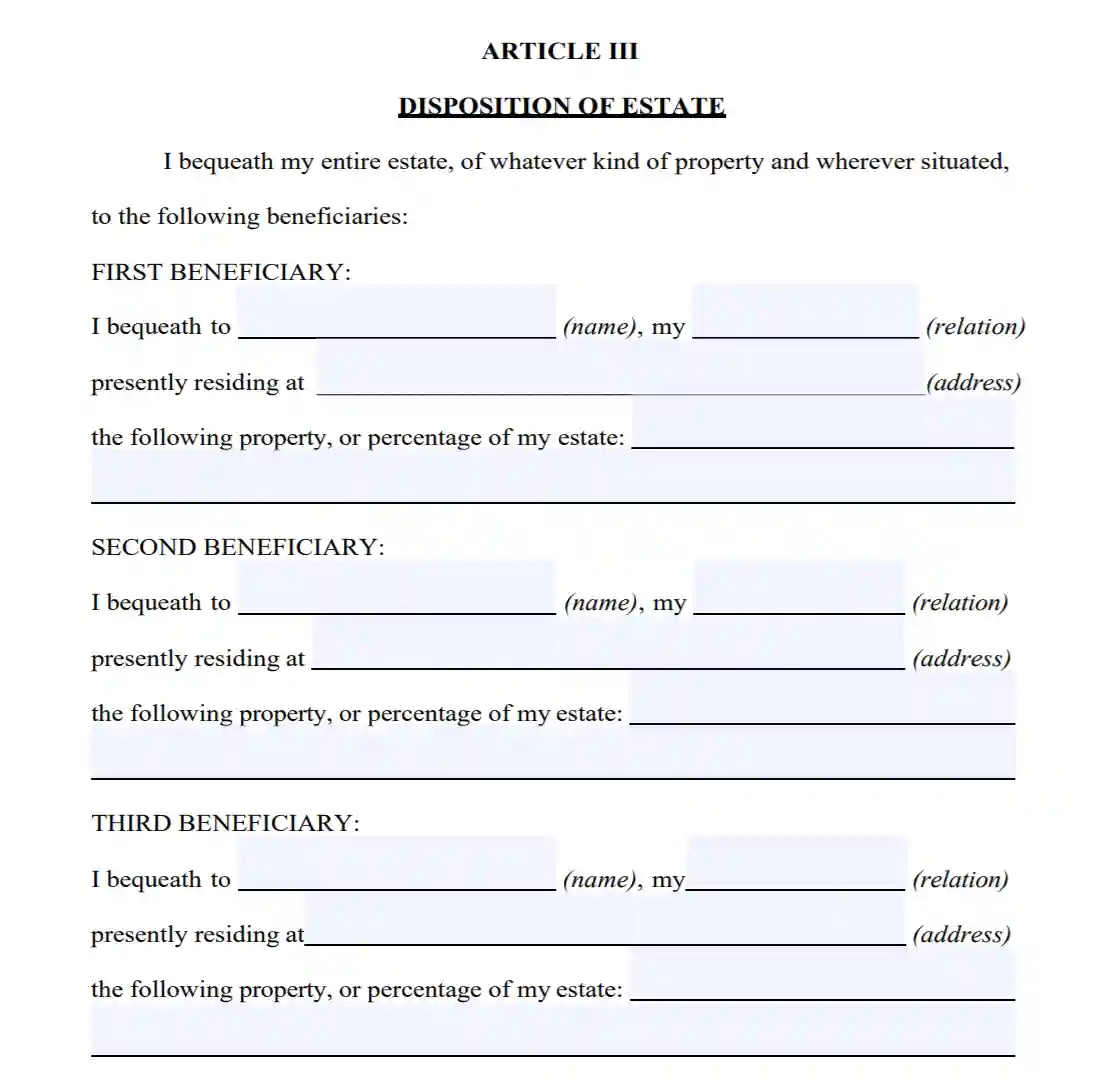

5. Indicate your beneficiaries. Now specify all those to whom you wish to leave your property, that is, your beneficiaries. Write their full names, places of residence, and your connection to them (spouse, child, friend).

6. Allocate assets. It is possible to indicate which of your inheritors gets this or that piece of property. Otherwise, the assets will be allocated evenly amongst the beneficiaries. Assets might include money for arrearage, real estate, stocks, business control, cash, as well as any physical things of monetary worth you own. Please notice that there are things that cannot be distributed in the last will, such as life insurance and joint and living will property.

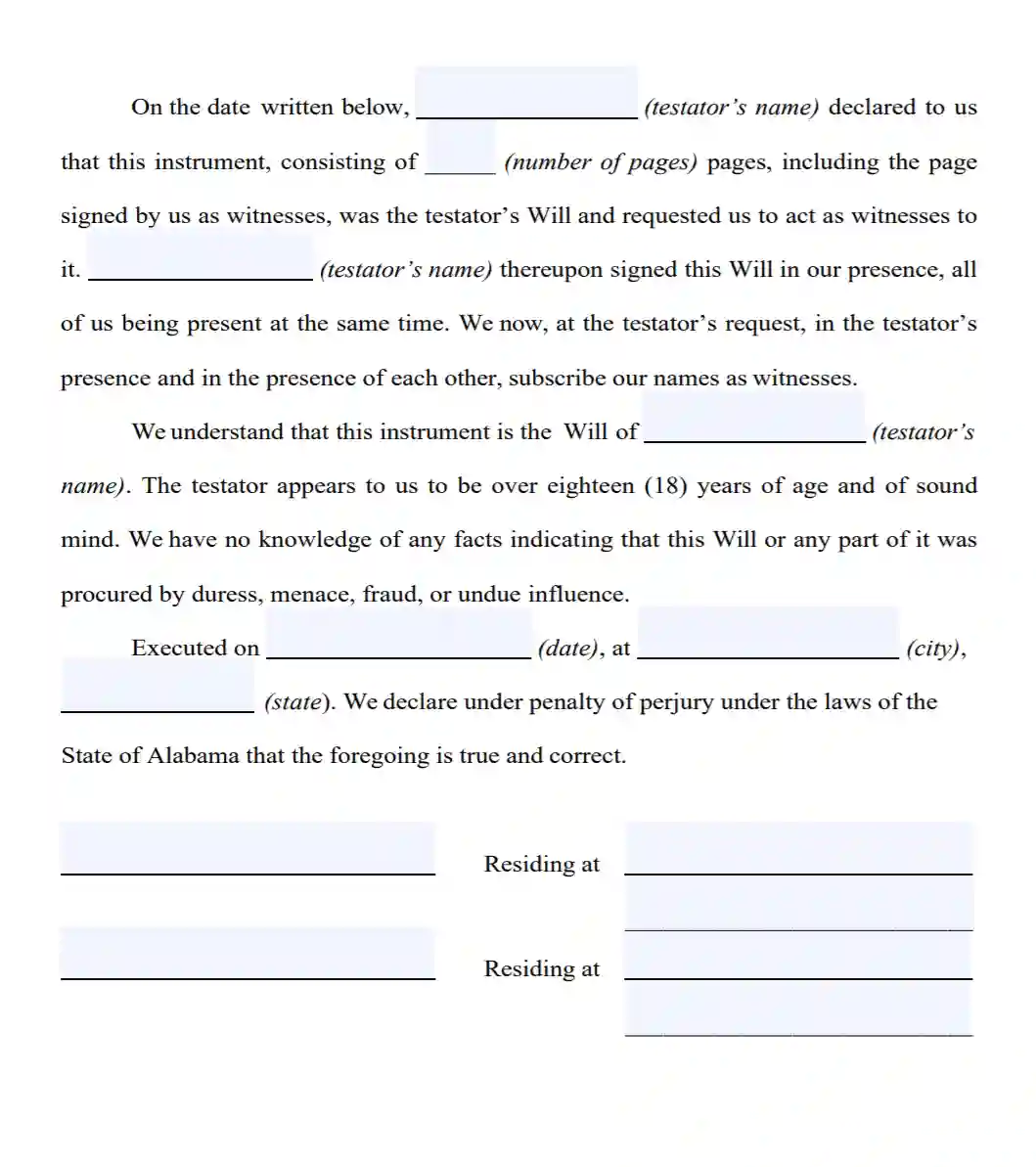

7. Proceed with the witnesses putting the signatures on the document. As per Alabama Code, for any last will to be legitimate, it needs to be signed by two witnesses. It is possible to appoint somebody as a witness provided that they’re older than 18 years and are disinterested in the bequest. Think about choosing witnesses younger than you so that they will be present in the event the will is contested in court or any other problem occurs. After a complete review of each section in your last will, all parties involved (you and the two witnesses) have to fill out their full names and full addresses and sign the paper.

Create a Free Alabama Last Will and Testament

Frequently Asked Questions

Is will notarization needed by Alabama law?

Alabama statute says that a last will can be valid without getting a notary public to certify it. But, you can make your last will self-proving by attaching an affidavit to the document, and you’ll need to hire a notary if you’d like to make it happen. In the event that you make your last will self-proving, the court won’t have to make contact with the witnesses to establish the credibility of the document, which is going to expedite the probate.

Can you leave out your children or spouse from a last will and testament in Alabama?

Should you want to disinherit your marriage partner, it will be possible. Alabama is not a community property state (also known as marital property). This is a type of asset ownership presented by the law that declares that 50% of all properties and assets (including arrears) of one marriage partner is owned by another and continues to be such upon divorce. In Alabama, the law allows you to disinherit your spouse but enables your partner to have a particular minimum number of your assets.

Except for your husband or wife, Alabama law allows you to disinherit any other member of your family. That applies to your adult children (no younger than 18) and any other family members; only include disinheritance paragraphs to your will.

Can a signed, typewritten last will and testament be modified in Alabama?

Yes, it is possible to alter it.

In Alabama, if you haven’t engaged in a contract saying the opposite, you are allowed to annul or alter your last will at any moment.

What will be the consequences of having lost a last will and testament?

In case the will has been lost or destroyed, as per the Alabama law, the court can recognize it. But, the probate court is not likely to admit anything other than the initial version of the last will and testament to probate.

Alabama law offers a presumption that the will’s absence means it has been annulled. This puts the obligation on the advocate of the last will and testament to present proof of the said last will.

The process will get far more difficult when considering a holographic will. In order to provide proof of its validity, the court requires testimony and sword witnesses. The cause for not producing the last will and its contents has to be proven too.

| Related documents | When to create it |

| Codicil | You would like to make a single or a few small modifications to your will. |

| Self-proving affidavit | You would like to expedite the probate later on. |

| Living will | You want to express your wishes regarding the end-of-life medical care and life-prolonging measures. |

| Living trust | You want to take care of your end-of-life matters without probate. |

Last Will and Testament Forms for Other States