Free Pennsylvania Last Will and Testament Form

A last will and testament is a legal document that contains the details of a person (testator) relating to their estate in the event of death, created in the form prescribed by law.

It is ordinarily a good idea to make a last will and testament. Even if you don’t have a lot of assets, a will can certainly help your family situation and end up being vital to your close relatives after your passing.

Here, you’ll find a Pennsylvania last will and testament form for download and the tips that will eliminate your slightest uncertainties concerning estate planning, varieties of last will, and the ways to write a sound document.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Pennsylvania Last Will Laws and Requirements

| Requirements | State laws | |

| Statutes | Title 20 – Decedents, Estates and Fiduciaries; Chapter 25 – Wills | |

| Signing requirement | Witnesses are needed only in specific cases | § 2502. Form and execution of a will |

| Age of testator | 18 or older | § 2501. Who may make a will |

| Age of witnesses | 18 or older | § 2502. Form and execution of a will |

| Self-proving wills | Allowed | § 3132.1. Self-proved wills |

| Handwritten wills | Recognized if meeting certain conditions | § 2502. Form and execution of a will |

| Oral wills | Not recognized | |

| Holographic wills | Recognized if meeting certain conditions | |

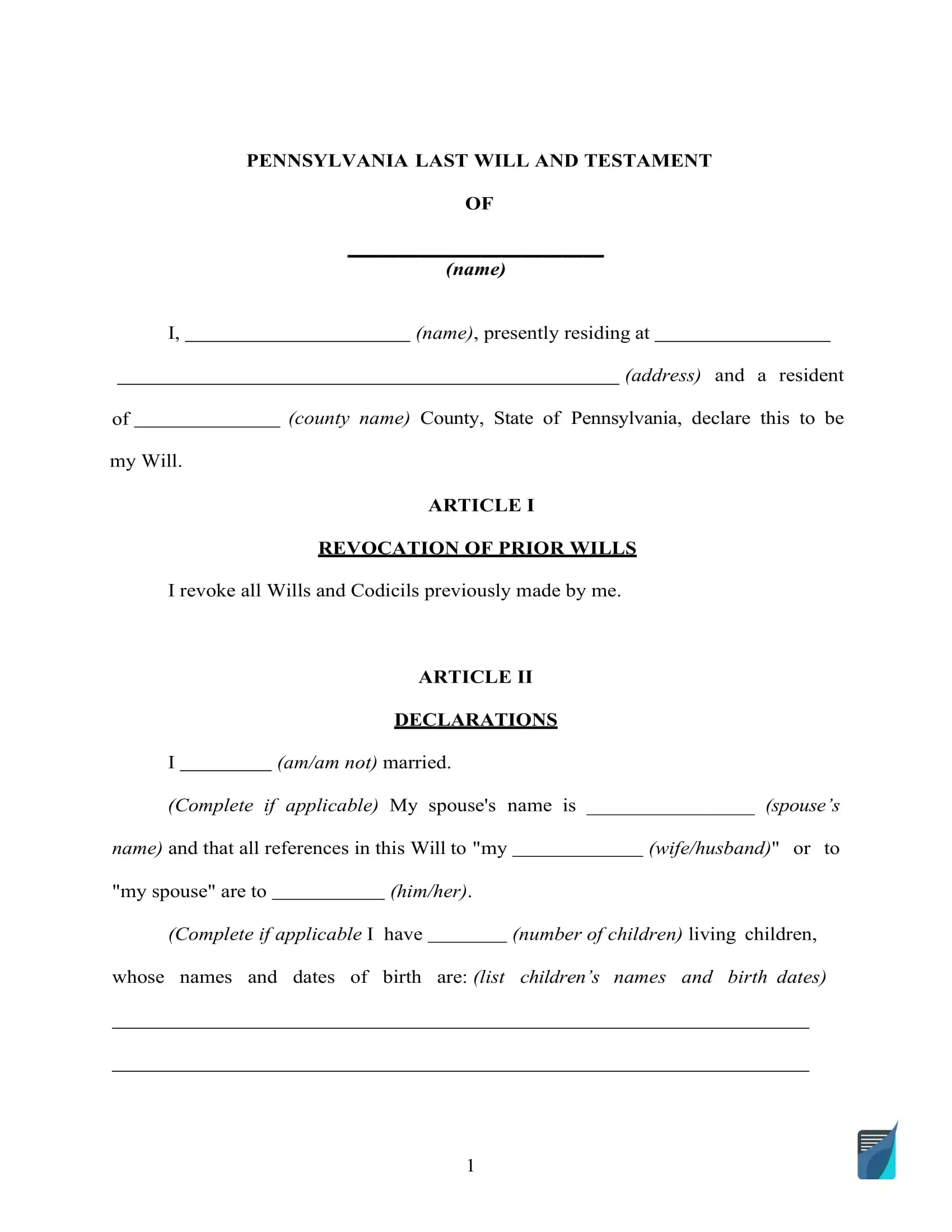

How to Create a Pennsylvania Last Will

- Think about your alternatives. Decide whether or not you prefer to seek the services of attorneys or create your will yourself (either by handwriting it or working with a free last will and testament form).

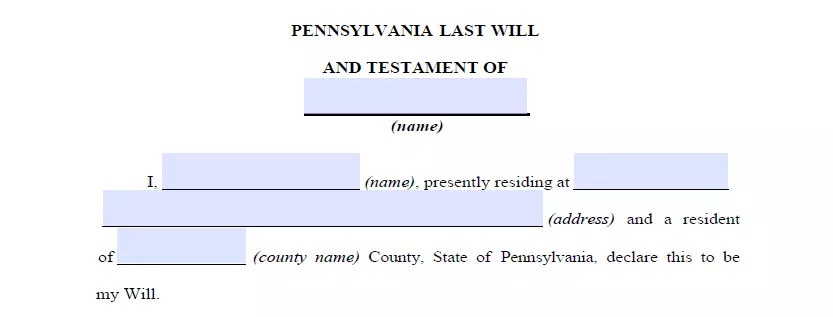

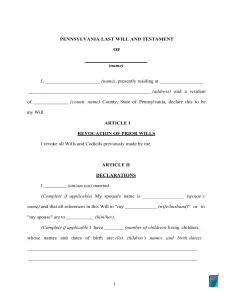

- Indicate your details. Step one is establishing the testator by providing their full name, together with the residential details (city, county, and state). Go over the details you entered along with the remainder of the section, which includes “Expenses and Taxes.”

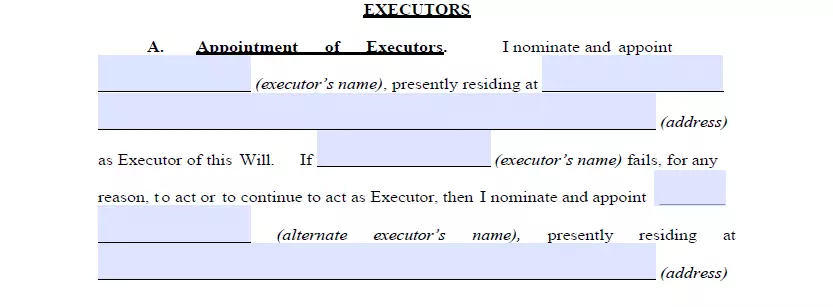

- Establish the executor (or executrix). The next step is to choose the executor of your last will and testament, the person responsible for ensuring that every little thing you write in this document gets done. To do this, you will need to indicate the executor’s full legal name, along with their residential information (city, county, and state). Be sure you appoint someone who lives in the same state as you do. If you don’t, there’ll be much more red tape and unnecessary hassle in the process as a consequence of various special policies every state has relating to out-of-state executors. It might happen that your primary representative will not be able to execute your last will as a result of an illness, passing, disinclination, or some other factors. In this case, the court will designate its own agent to carry out the duties. In order to avoid that, you can select a second executor by providing the same information you did for the first one.

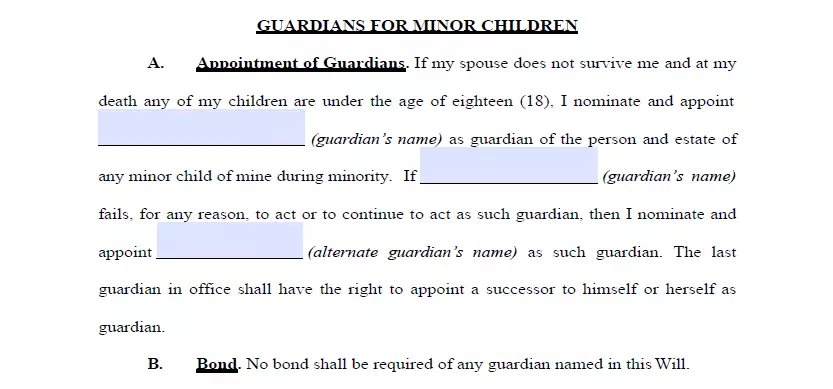

- Indicate the guardian (optional). Should you’ve got underage or dependent children and don’t wish the court to decide on a guardian for the kids when you’re no longer on this Earth, it’s possible to specify someone you know as a guardian for your children.

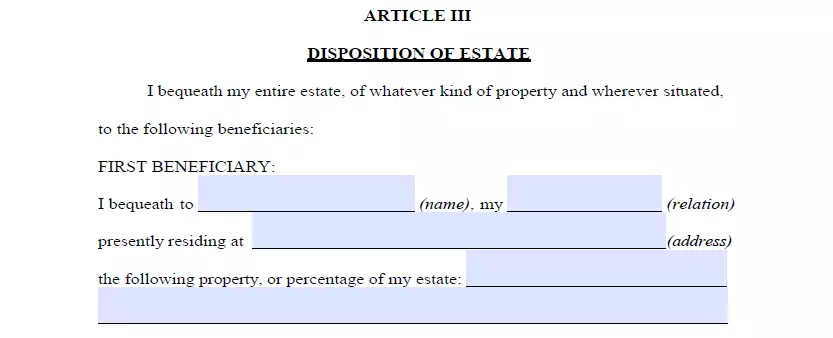

- Indicate your beneficiaries. At this point, specify individuals to whom you would like to pass down your property and assets, that is, your beneficiaries. For every inheritor, indicate these particulars: full legal name, address, and the way they are related to you.

- Distribute possessions. You can define which of your inheritors receives this or that piece of property. If you don’t, the assets are going to be divided evenly among the beneficiaries. Money for arrearage, realty, shares, company control, cash, as well as any tangible things of monetary worth in your possession can be mentioned in your last will and testament. Please be aware that there are things that cannot be distributed in the last will, for instance, life insurance and joint and living will property.

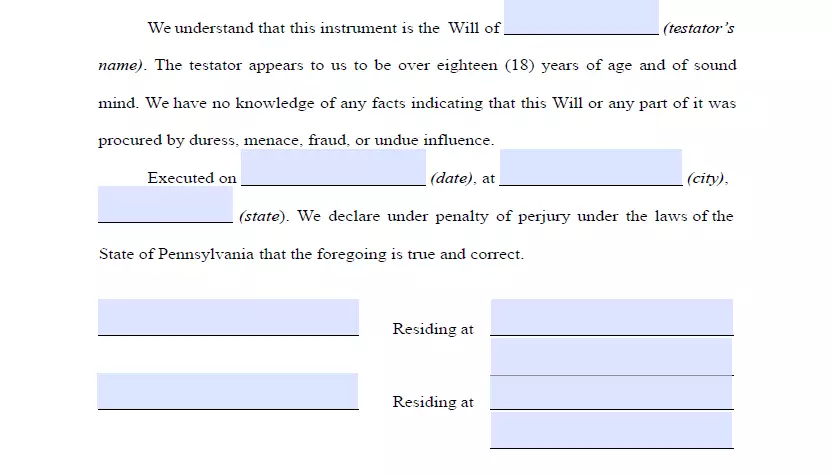

- Ask witnesses to sign the document. Pennsylvania Consolidated Statutes stipulate does not require the presence or signs of two witnesses. The witnesses are needed if a testator cannot sign the will themselves or can sign only with a mark. The witnesses have to be over 18 years old and have no interest in your last will, meaning they can’t be beneficiaries. Now, you have to sign the paper after filling out your full legal addresses and names. Don’t neglect to sift through every sentence before concluding the matter.

Get a Free Pennsylvania Last Will Template

Frequently Asked Questions

What is the main difference between 'Power of Attorney' and 'Executor'?

The primary distinction between the two documents is that once you are gone, the agent you assign through power of attorney loses their official authority to take care of any matters on your behalf. Among various power of attorney types, the two following ones are believed to be fundamental:

- General power of attorney – lets you name a proxy (agent) who’ll be able to manage your monetary and legal matters in your stead. However, this document will become void in case the PoA author passes away or becomes incapacitated.

- Durable power of attorney – gives the same authority to the proxy as the first type but continues to be effective even when the person on behalf of whom the agent acts becomes incapacitated.

An executor is someone you have confidence in and assign to make sure the will’s directions are performed. You can name one person to act as an attorney-in-fact and a will executor.

Is a Pennsylvania will form good without notarization?

Pennsylvania law affirms that a last will can be valid without having a notary public certify it. But, you could make your last will self-proving by adding an affidavit to the document, and you’ll need to hire a notary if you want to do that.

Should you use an attested or holographic will?

A holographic will is handwritten. To be effective, the document needs to be wholly in the handwriting of the testator, as well as dated and signed by him or her. But, such wills are generally viewed as a short-term option. You would like to substitute such will with an attested one as early as you can by using an attorney’s support or a fillable template. An accurate and detailed will would be much better for the future probate procedure since holographic wills could include unclear conditions that can easily delay probate and make it more pricey and/or more difficult to put in force.

An attested will is a typewritten document that’s often based upon a fillable form available online or made with the assistance of an attorney. For it to be regarded as valid, it has to be signed by the testator and two credible witnesses older than 18 in the testator’s presence. But, the latter isn’t necessary in Pennsylvania.

The testator has to meet testamentary capacity prerequisites to be able to make and modify their last will, including being of sound mind.

In most states, to write a will, you have to be of sound mind and at least 18 years old. “Sound mind” implies that there is not any kind of psychiatric disorders (dementia, senility, insanity, etc.) that doesn’t let you have a full understanding of the consequences of your actions.

Is it required (in Pennsylvania) to include a self-proving affidavit to my will?

According to Pennsylvania law, you do not need to add a self-proving affidavit to your last will. But, it isn’t a bad choice to include this document. At the time of probate, it would function as an alternative for the witness testimony in court and speed up the procedure.

Can you leave out your children or spouse from a last will?

If you wish to disinherit your marriage partner, you will be able to do it. Pennsylvania is not a community property state. Often called marital property, that is a type of ownership of the assets presented by the systems of law that says that 1/2 of all properties and assets (along with debts) of one spouse is owned by another and stays such upon divorce.

Pennsylvania law allows you to cut your spouse out of your last will completely. However, your marriage partner is admitted of a set minimum number of your assets.

Except for your marriage partner, Pennsylvania law permits you to disinherit any other member of your family. With the addition of certain disinheritance sections to your last will and testament, you will be able to leave out your children (those of 18 years and above) or any other members of the family from obtaining any of your possessions.

Can someone amend my will?

No, only you can change your last will. There’s just one situation when a third party is permitted to get involved. If you are physically incapable of signing your last will and testament, a third party is allowed to do it in your stead yet only in your presence.

Can a signed, typewritten will be modified in Pennsylvania?

Yes, it’s possible.

In Pennsylvania, if you haven’t concluded a contract stating the opposite, you can cancel or alter your last will and testament anytime.

It would also be good to amend your last will and testament in such cases:

- Birth or adoption of a child

- Divorce or marriage

- Selling or buying real estate

- Your money situation has changed noticeably

What if I have lost my will?

Pennsylvania law claims that a will can be accepted in case it has been lost or destroyed. However, the probate court is not likely to admit anything except for the original of the will to probate.

By Pennsylvania law, the absence of the will can be assumed as its annulment. This implies that the executor will have to prove the will’s credibility, which might be very troublesome.

For holographic last wills, the situation can become much more troublesome since sworn witnesses and testimony will be demanded. In addition, you’ll also have to provide evidence of the actual reason why the will and its elements can’t be produced in ways that will show it hasn’t been canceled.

What does one have to do in case they can't physically sign his or her last will and testament?

Pennsylvania Estate Code enables another individual to sign your last will and testament just per your directive and in your presence. It’s possible to give a corresponding instruction by several methods. They include verbal communication, a positive answer to an inquiry, or body gestures.

It is possible to have a notary sign the name of a testator who is physically unable to do it if the latter guides the notary with a witness present. It is worth noting that these witnesses can’t have an interest (equitable or legal) in any properties and assets that are the concern or might be influenced by this type of a document (the last will and testament).

| Related documents | When to make it |

| Codicil | Your last will requires one or several minor modifications. |

| Self-proving affidavit | You want to keep from potential difficulties during the probate. |

| Living will | You want to make sure that, if you are incapacitated, you are treated the way you would wish to. |

| Living trust | You want to avoid probate by putting your assets in the possession of a trust. |

Last Will and Testament Forms for Other States