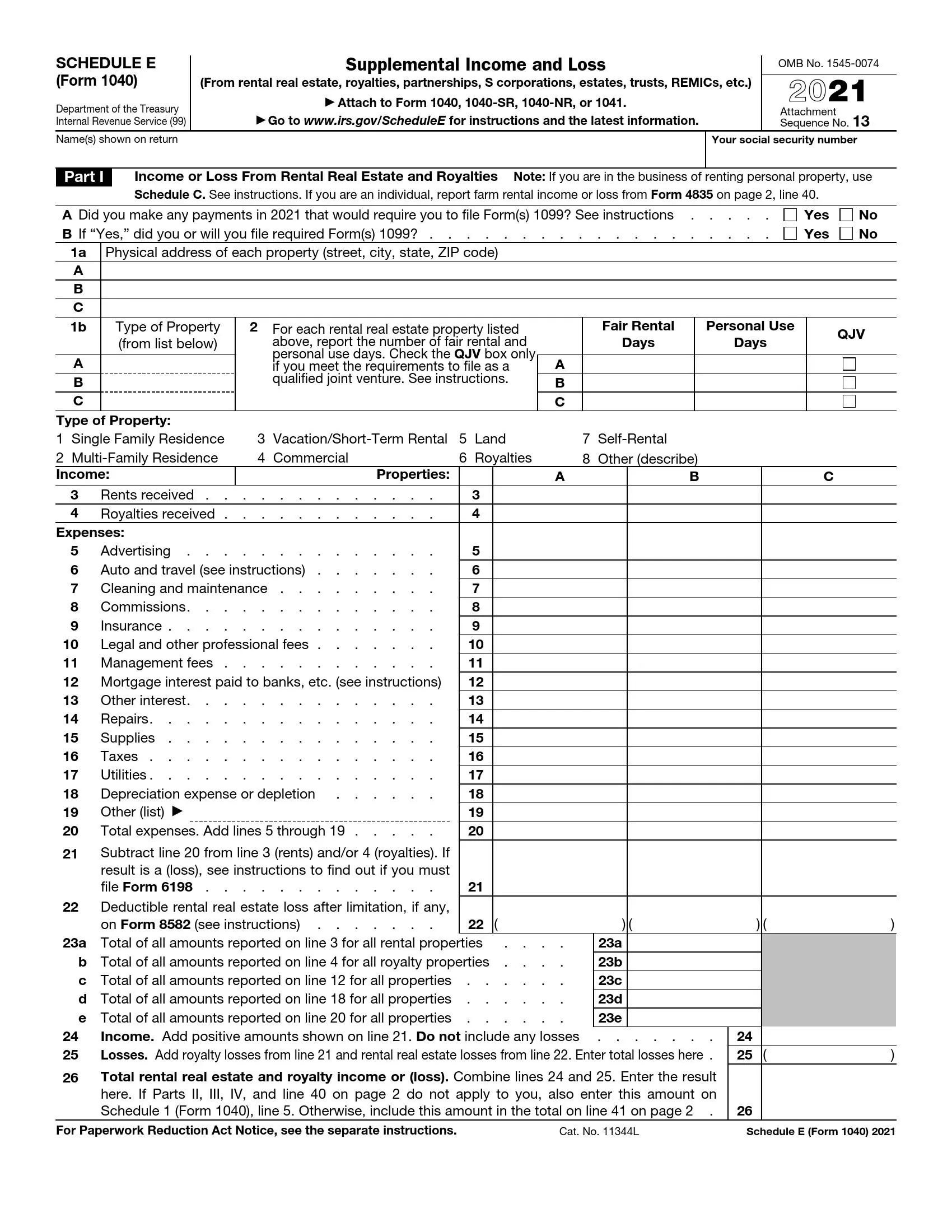

IRS Schedule E is a tax form taxpayers use to report supplemental income and loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in Real Estate Mortgage Investment Conduits (REMICs). It is attached to Form 1040, Form 1040-SR, or Form 1041 (for estates and trusts), depending on the taxpayer’s filing status and situation. Schedule E provides a comprehensive summary of income and expenses related to various passive income sources. Key information provided on Schedule E includes:

- Details about rental real estate properties owned by the taxpayer, including income received and expenses incurred,

- Income from royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs,

- Deductible expenses related to the production of rental income or passive income,

- Any credits or deductions that may apply to the reported income.

This form helps taxpayers calculate their taxable income or loss from passive activities. It also provides the Internal Revenue Service (IRS) with detailed information about income and expenses related to rental real estate, royalties, partnerships, and other passive income sources.

Other IRS Forms for Partnerships

Schedules should be prepared and attached to IRS forms only in specific situations. Read more about schedules our users typically use with tax returns.

How to Fill Out Schedule E Form 1040

You always have the opportunity to choose how to fill Schedule E Form 1040. You can either do it on your own with the assistance of our detailed guidelines, or you can let the form-building software do it for you. That will significantly save your time which you can spend on some more pleasant activities.

If you decide to fill out the form by yourself, in addition to detailed guidelines, you get access to the PDF editor that will allow you to make the form completion process easier and faster.

1. Examine the General Guidelines

It’s not necessary but advisable to read the General Guidelines and Specific Guidelines on the completion of the form before filling it out. Any mistakes in the form completion may lead to the form rejection by the IRS so pay attention to what you’re reading (and what you’re filling in the form afterward).

Reading the General and Specific Guidelines to the form, you get acknowledged with all the juridical terms referring to the property. It’s essential to understand their definition and how and when you can utilize them.

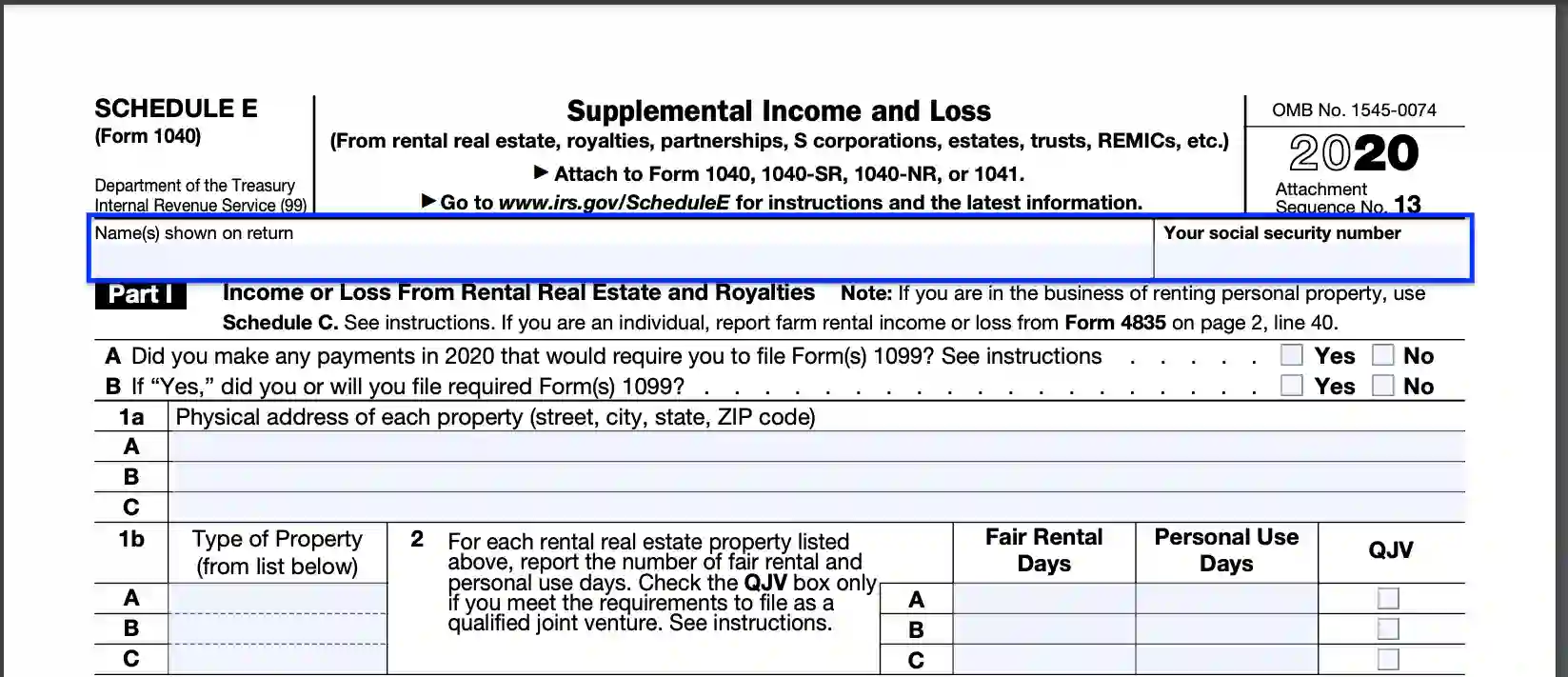

2. Type the Security Number

In the first blank line of the Schedule E Form, register your full name and security number. That’s essential data for the Internal Revenue Service.

3. Give the Details on the Property

Answer whether you made payments, after which you have to fill in the Schedule E Form 1040. Check the right box for the answer (“yes” or “no”).

If you responded with “yes,” then respond if you would complete Form(s) 1099 or not. Check the right box, as well.

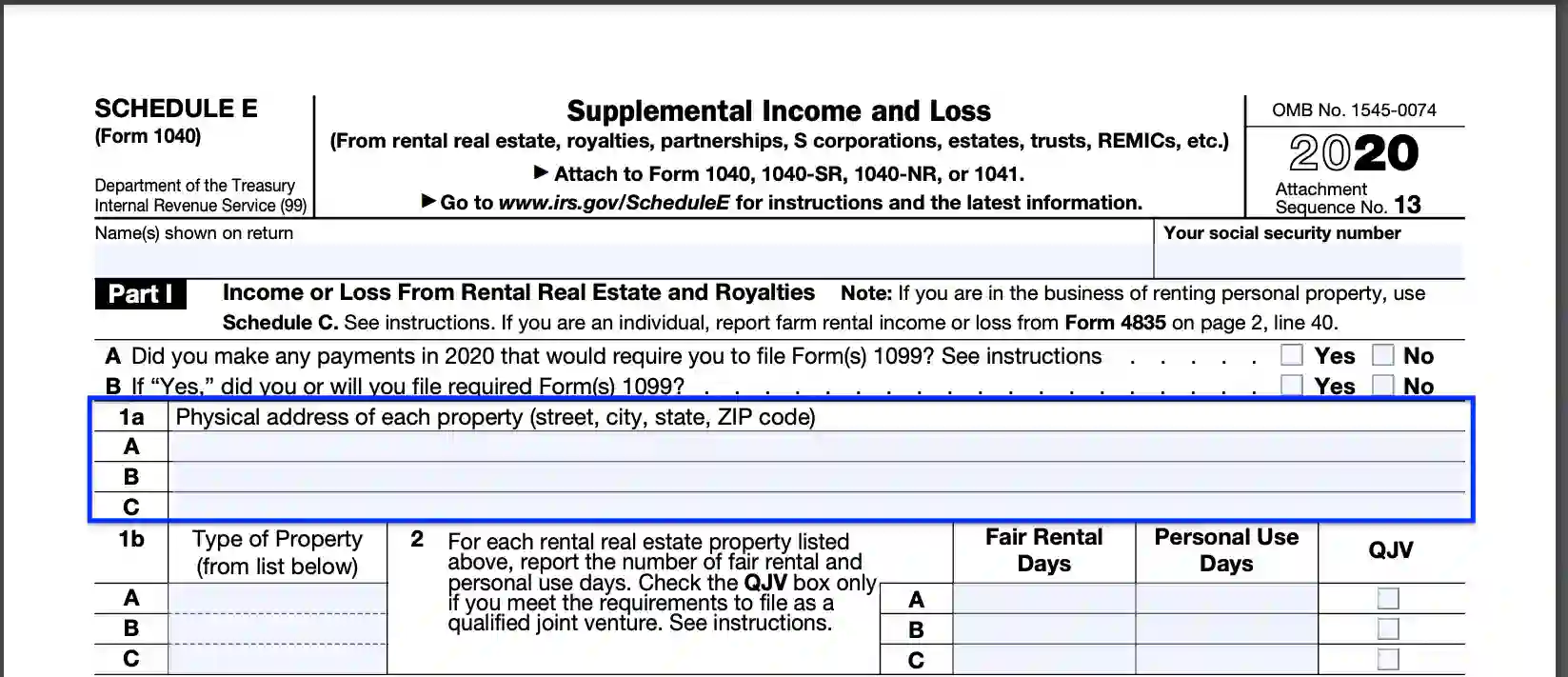

Register characteristics of every kind of property that belongs to you. Enter their full correct addresses consisting of states, cities, streets, and zip codes.

Establish the property’s type, choosing between the following:

- Commercial

- Vacation / Short-Term Rental

- Multi-family Residence

- Self-rental

- Single Family Residence

Register the number of personal use and fair rental days spent on every property’s type.

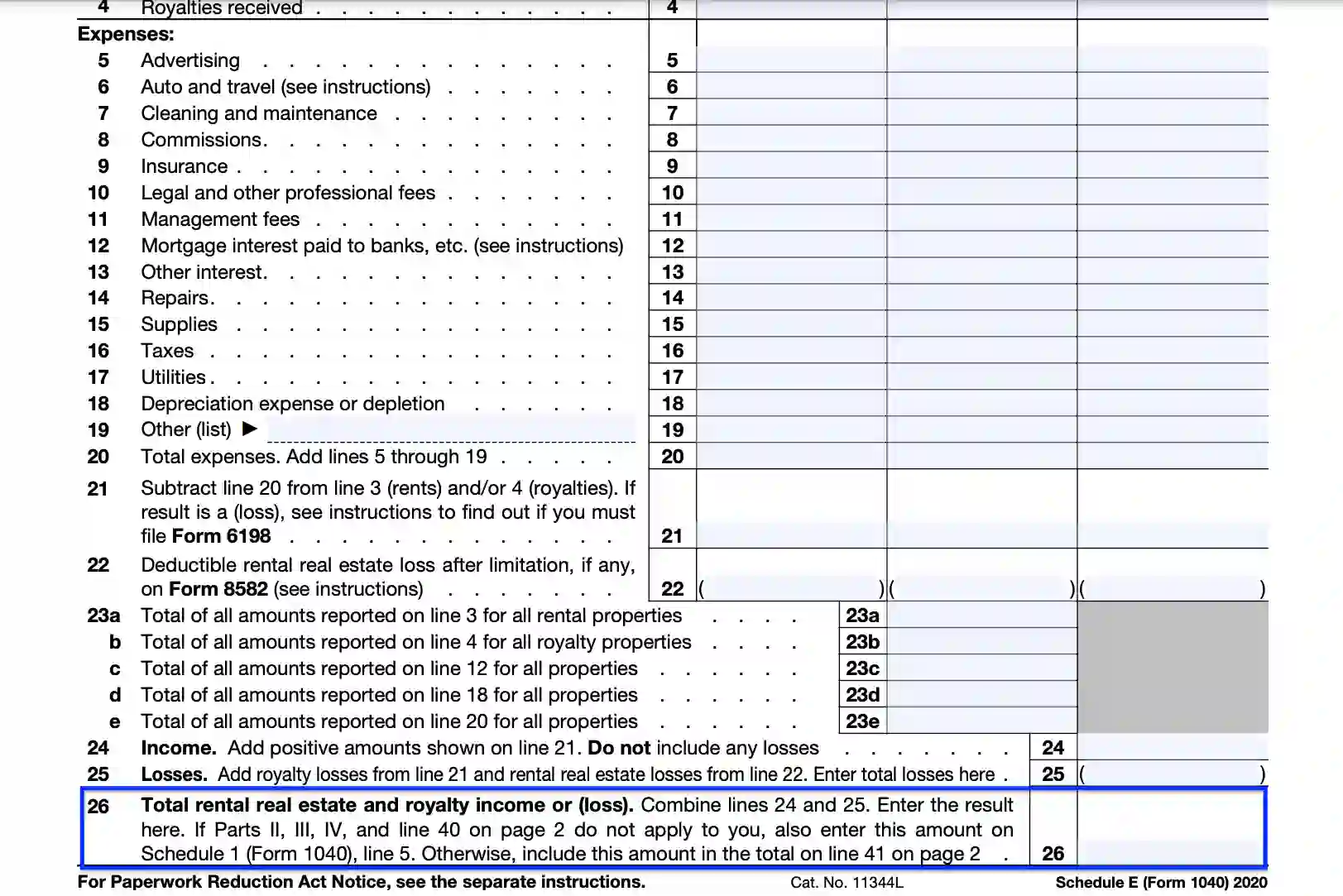

Enter all the costs spent on the property and the profit you got from it. Give the total sum of the costs.

Write down the total rental real property and royalty earnings or loss.

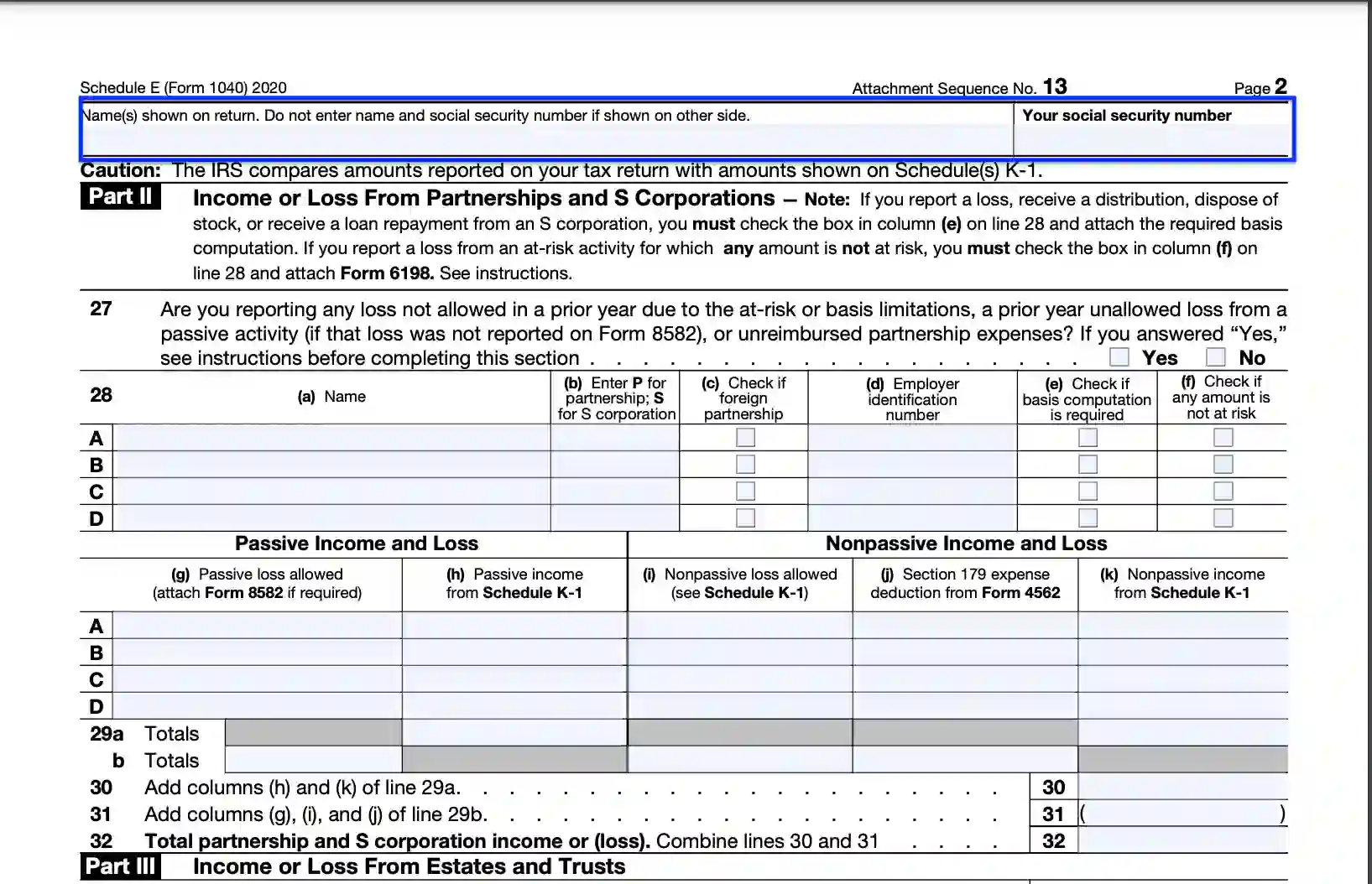

Write your correct name and security number.

4. Register Information on the Loss and Earnings from Partnerships

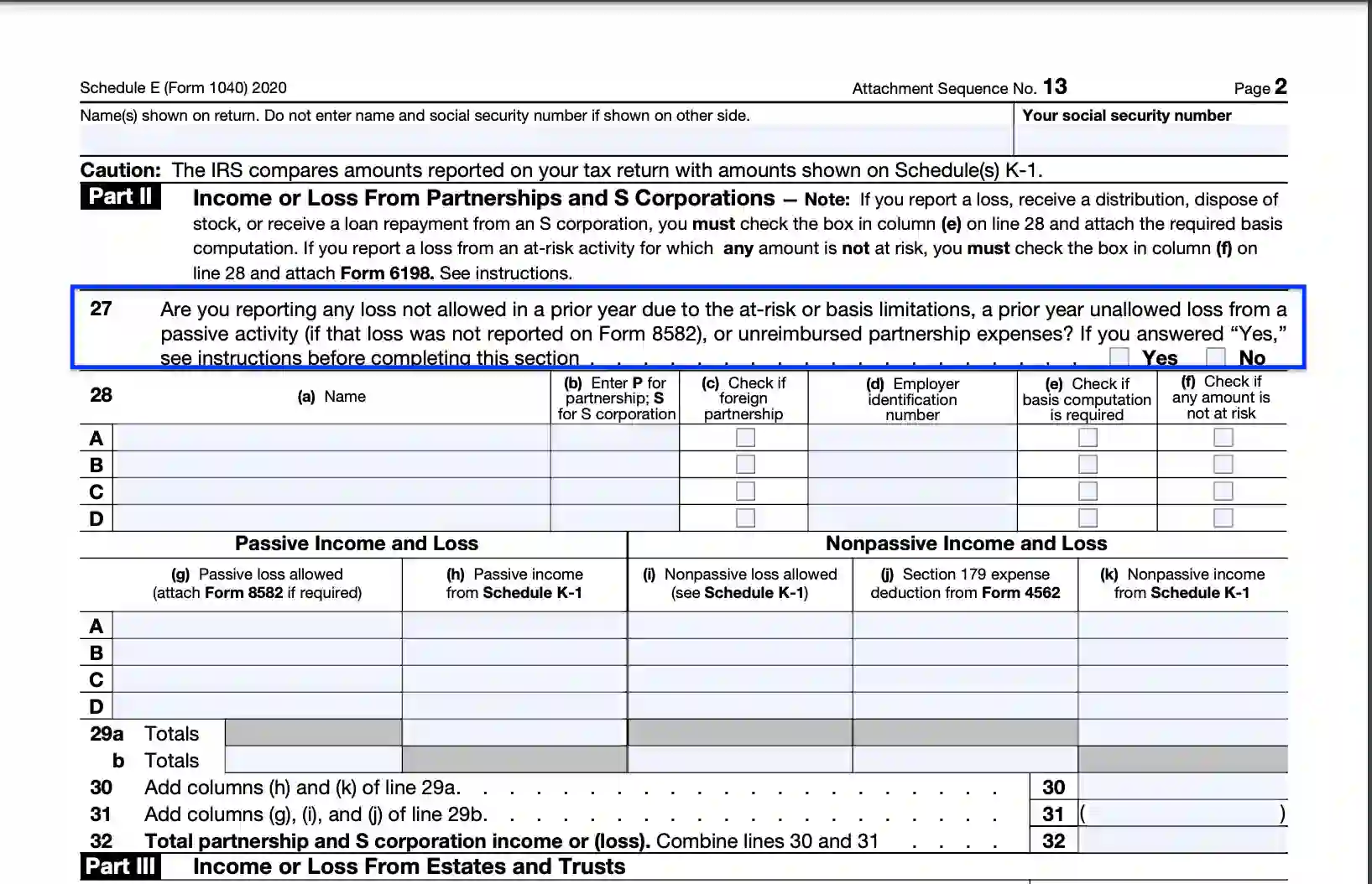

Register whether you have any loss from the passive activity or not. Check the right box with. If your answer is “yes,” then examine the General Guidelines and Specific Instructions before moving to the further completion of the form.

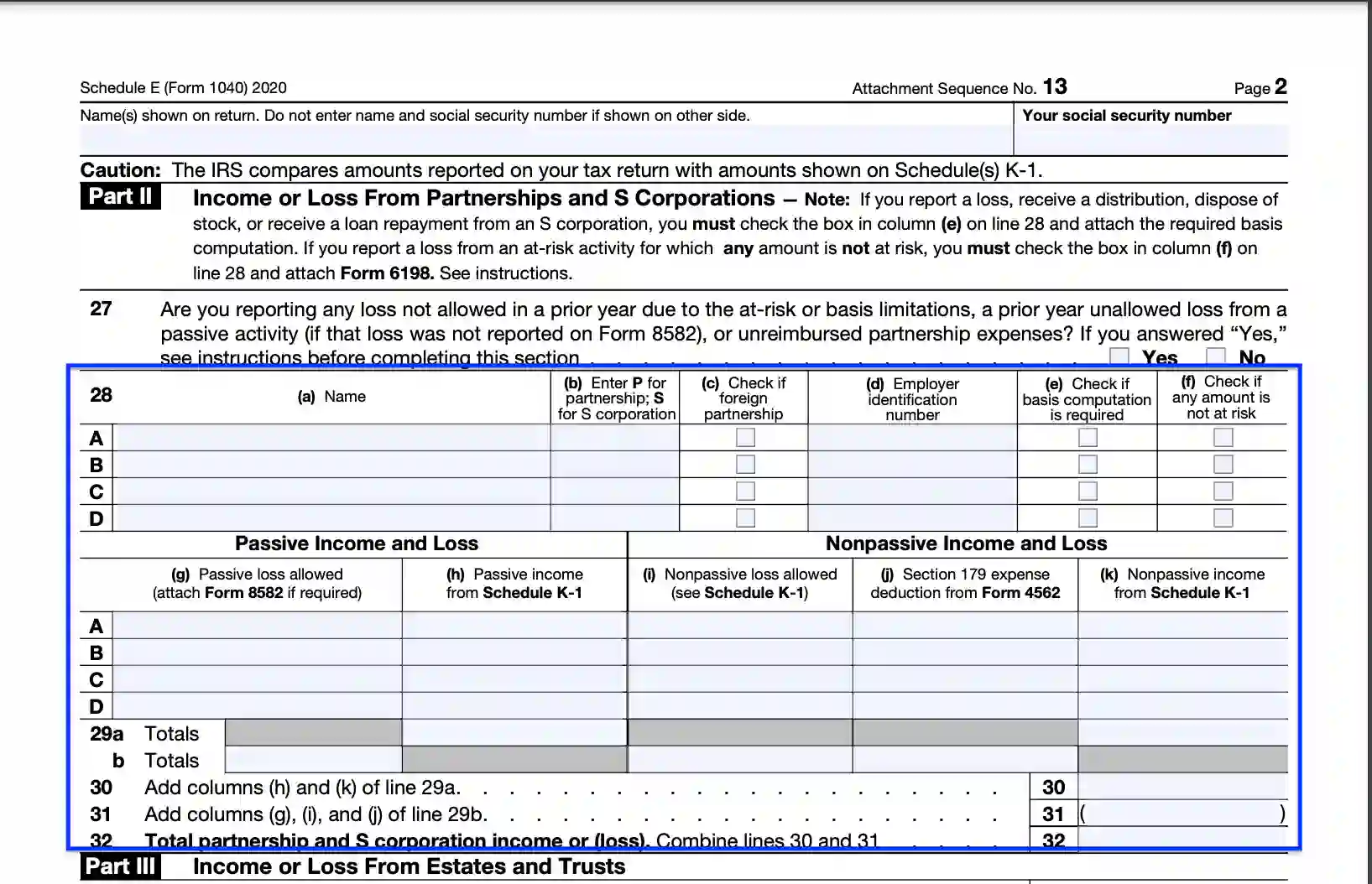

Write down all samples of such losses. Register the property’s name, the type of the organization, its identification number. State if any amount is not at risk and whether the basic computation is required. Check the right box.

Enter information on all the earnings and losses. Give a detailed specification. Register the total earnings and loss you got from the S corporations and partnerships.

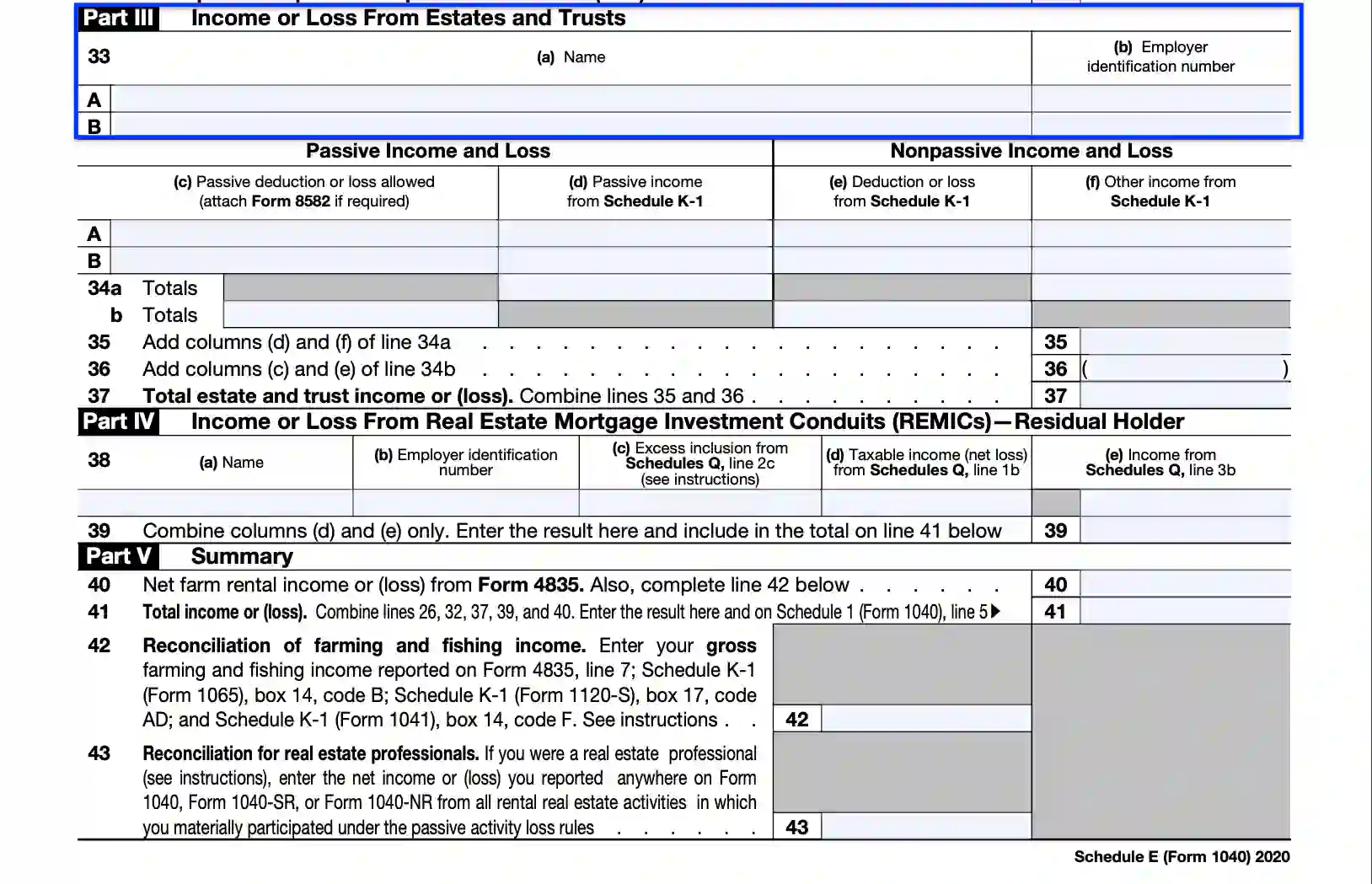

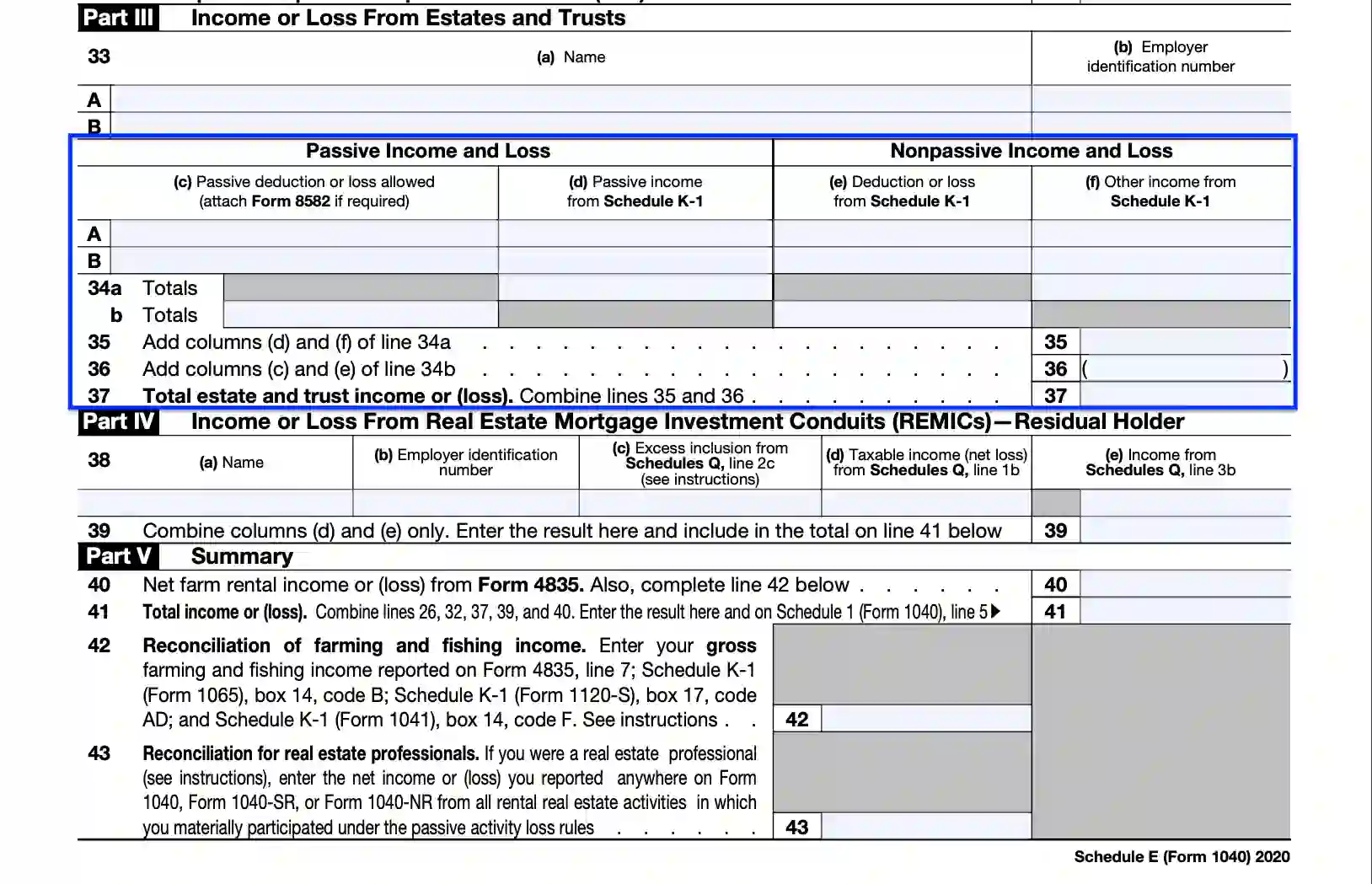

5. Enter Information on the Earnings and Loss from Trusts and Estates

Write down the names of trusts and estates and their identification numbers.

State all the losses and earnings from property and trusts. Give the total loss and earnings from trusts and estates.

6. Enter the Details of the Earnings and Loss from REMICs

Type names and ID numbers of REMICs. Write down the total loss and earnings.

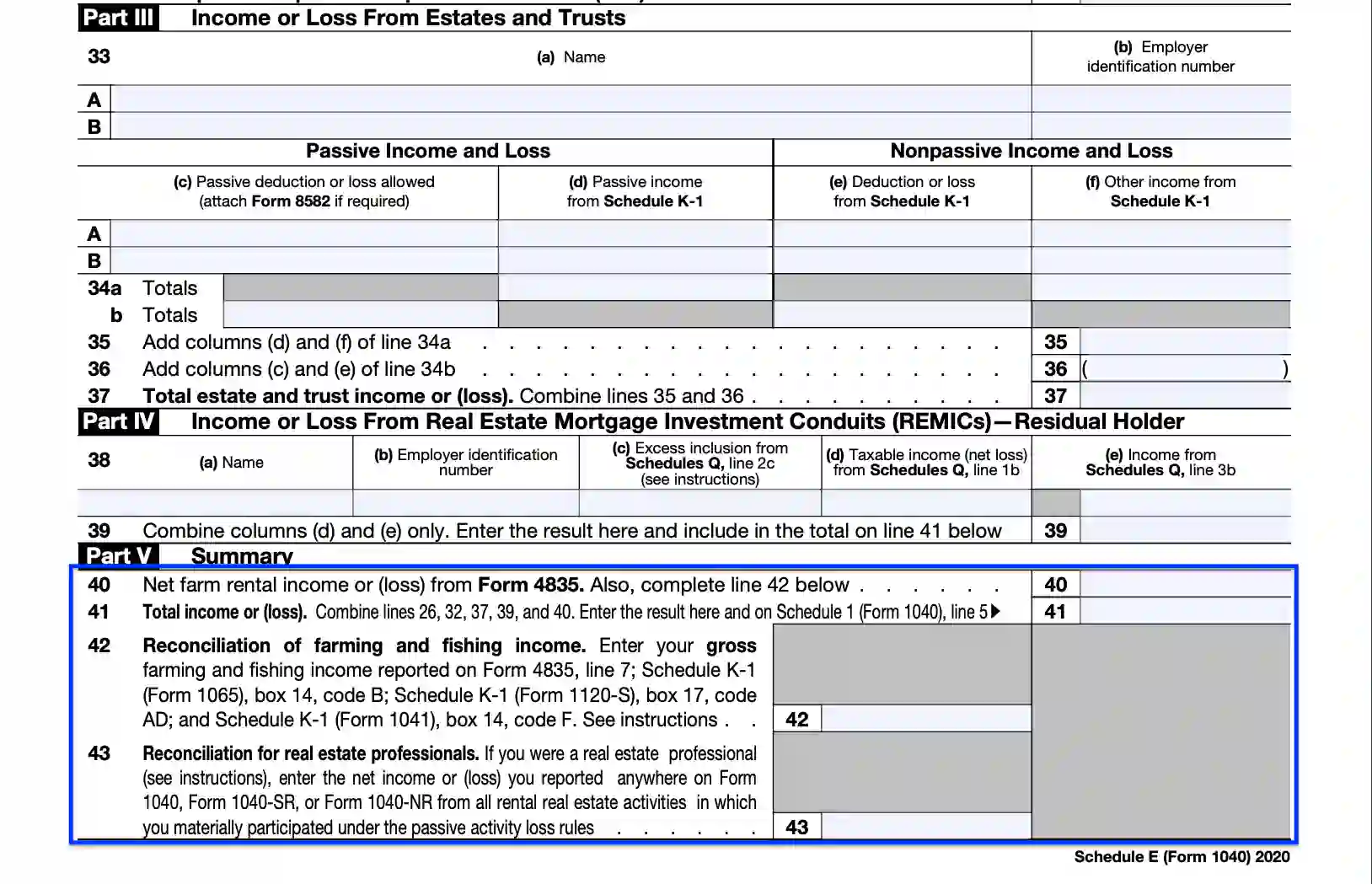

7. Give the Information on the Total Loss and Earnings

Write down the total earnings and loss from the losses and earnings listed previously in the form. Also, enter your fishing and farming earnings from Form 4835.

If you’re a real property expert, register the net loss and earnings from Form 1040, Form 1040-NR, or Form Form 1040-SR.

8. Deliver the Finished Form to the Supervising Body

Deliver the finished form to the Internal Revenue Service (IRS).