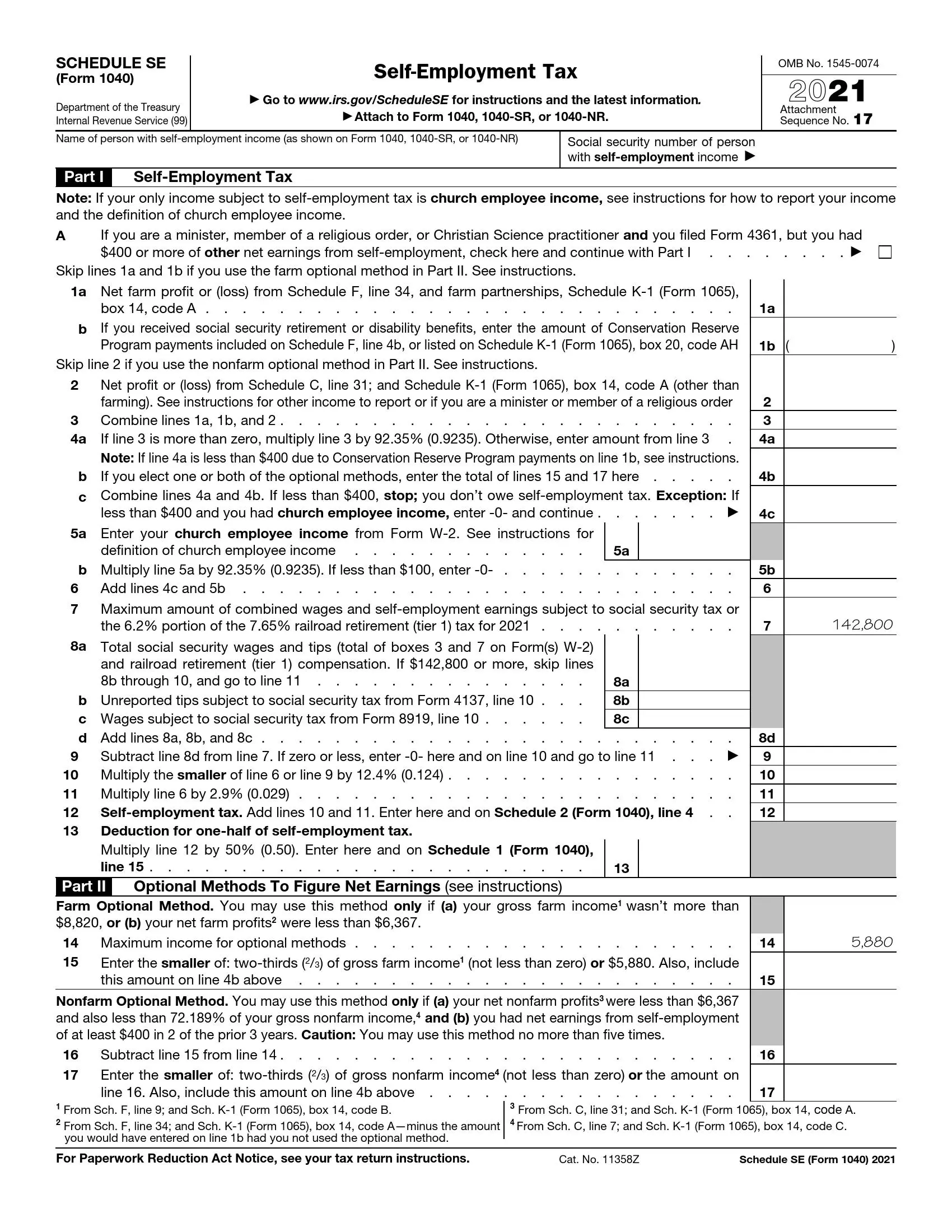

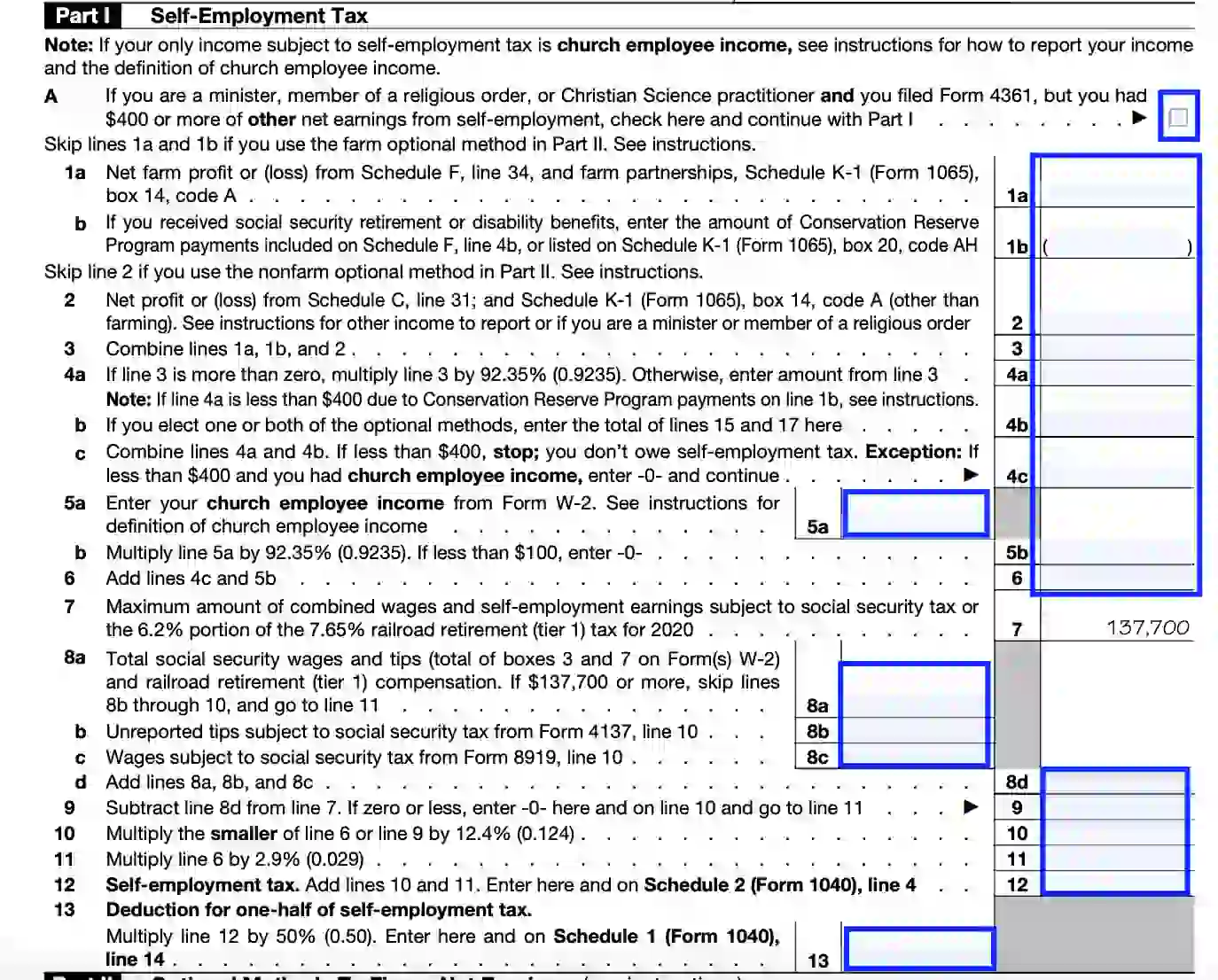

IRS Schedule SE (Form 1040), titled “Self-Employment Tax,” is used by individuals to calculate the tax due on net earnings from self-employment. This form is essential for anyone who works as a sole proprietor, partner in a partnership, or other self-employed individual, including those who earn income as independent contractors. Self-employment tax consists of Social Security and Medicare taxes, primarily for individuals who work for themselves. Schedule SE for Form 1040 includes:

- Calculating the net earnings from self-employment based on the profit reported on Schedule C, Schedule K-1, or other relevant forms,

- Determining the amount of Social Security and Medicare taxes due based on those net earnings,

- Deduction for half of the self-employment tax to adjust gross income on Form 1040.

Filing Schedule SE allows self-employed individuals to contribute to their Social Security and Medicare benefits, similar to how these contributions are automatically withheld from the paychecks of traditional employees.

Other IRS Forms for Partnerships

Before filing an individual’s tax return, you need to carefully read about schedules to IRS forms and choose the one based on your specific financial situation.

How To Complete This Schedule?

We suggest you use our form-building software to fill it out. You can download the current version on our website.

If there are any doubts or difficulties in any part of the paper, the best solution is to seek professional advice.

Identify yourself

Before starting the calculating part, you need to provide your full name and Social Security number.

Complete Part 1

To complete this part accurately, you need to carefully read the guidance that you can find on the Internal Revenue Service website. Please note that not all lines are subject to your completion. The need to fill them out depends on the type of your vocation and financial indicators. But do not worry, everything is written in detail in the lines of the form themselves.

Not to be mistaken in drawing up the document, you must know and have with you the following data:

- net earnings from self-employment for the tax year;

- net loss or profit (Schedule C, C-EZ, K-1);

- W-2 (if in the reference tax year you also had income from an employer in addition to your independent activity);

- net farm loss or profit (Schedule F).

It will be important to mention that you do not demand to fill out multiple schedules if you have various self-employed activities. You can add up all gains or losses and complete the document once.

See if you can use optional methods (Part 2)

You can decide to use farm or nonfarm optional methods, or you even can do both of them. This will be profitable if you have had little income or loss from your business. The instructions for the Schedule SE indicate whether you are eligible to use this system. Its advantages are in providing credits to cover your social security.

We encourage you to get legal advice on whether these methods are appropriate for you.

Fill in if you want to defer taxes (Part 3)

Self-employed taxpayers are allowed to defer payment of some of their taxes. This may seem like a tempting prospect, but we advise you to weigh the pros and cons because you still have to pay. But for many people, this delay can play the role of a lifesaver and give the opportunity to profitably use this money before paying.

You may be intimidated by the number of digits, calculations, and paperwork. If you do all the documents yourself at least once, then you can easily do it again. You will require to fill out the same forms from year to year, so by arranging this earlier, and you will be ready to handle it much faster in the future.