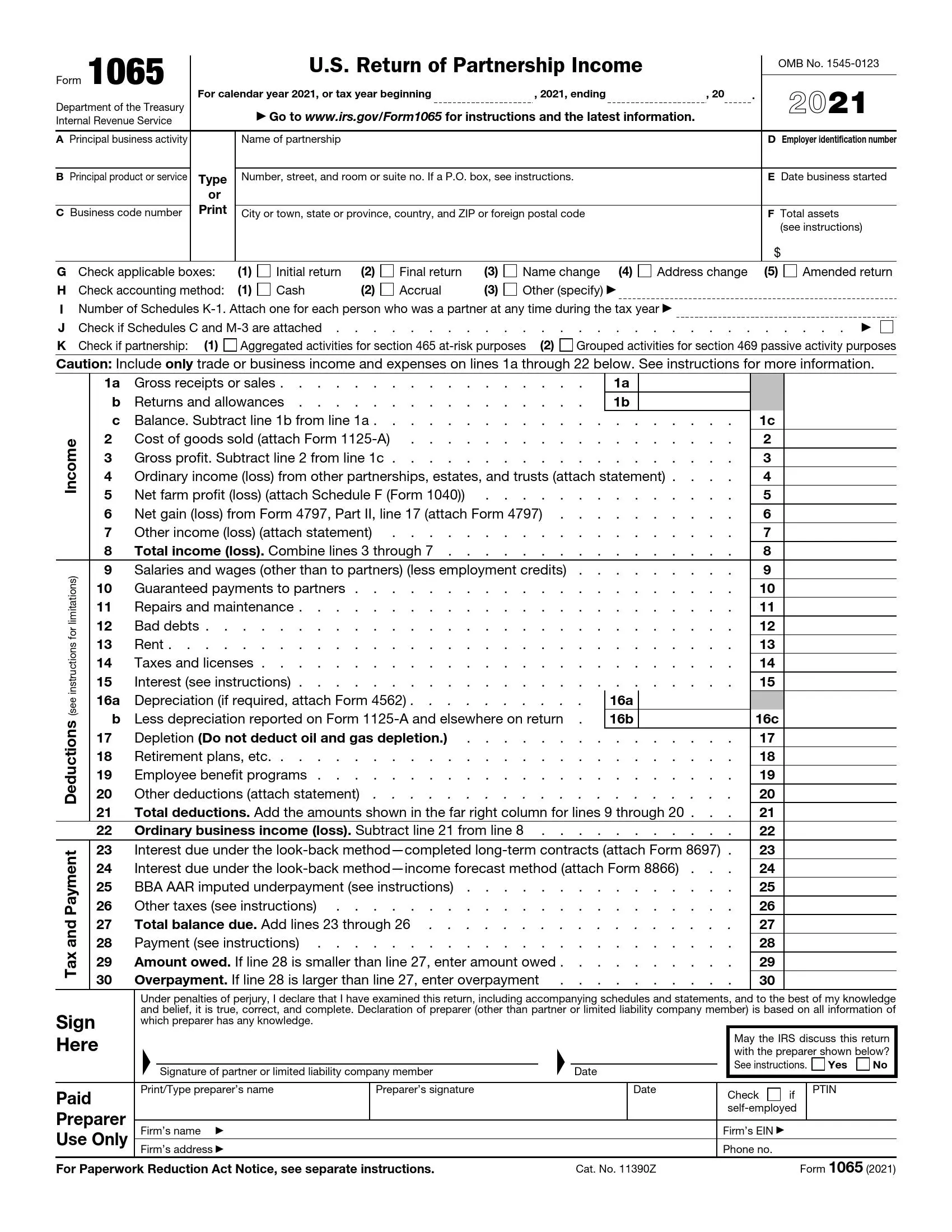

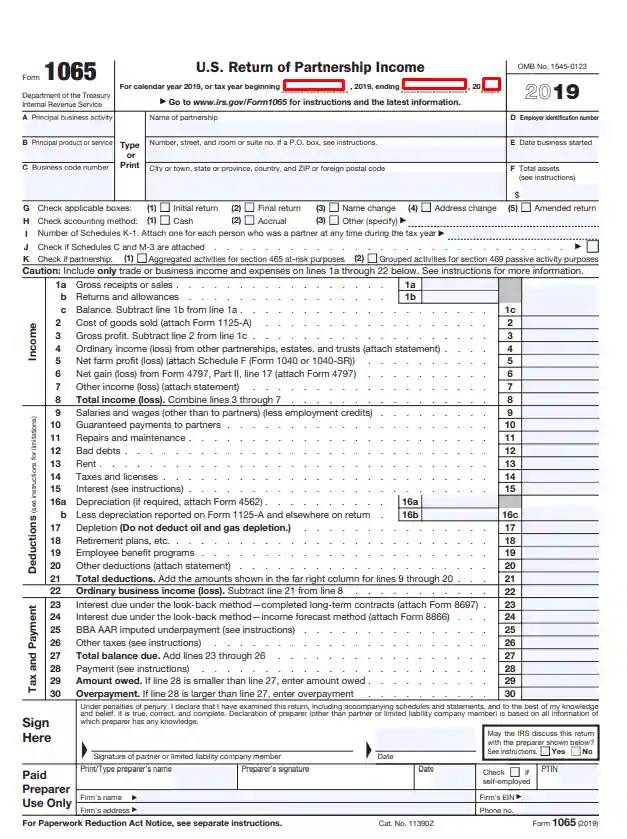

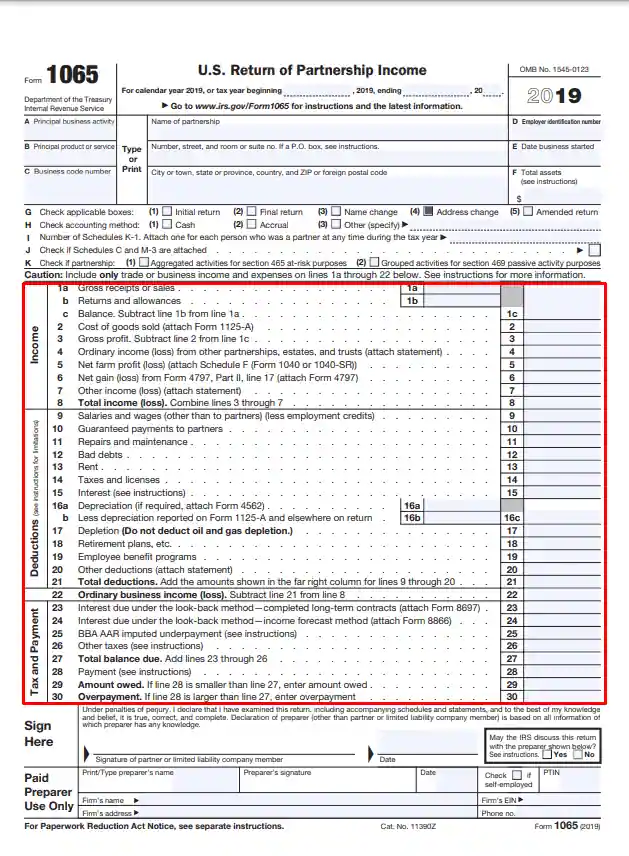

Form 1065, titled “U.S. Return of Partnership Income,” is a tax form used by partnerships to report their financial information to the Internal Revenue Service (IRS). This form details the partnership’s income, gains, losses, deductions, credits, and other financial data. It is essential for partnerships as it helps determine the share of income or loss each partner should report on their tax returns. Form 1065 is critical because it ensures that all income earned through the partnership is properly reported and taxed, avoiding discrepancies in individual partners’ filings.

The purpose of Form 1065 is to report income and provide a transparent mechanism for allocating the partnership’s income and losses among its partners according to their partnership agreement. Each partner receives a Schedule K-1 from the Form 1065 filing, which breaks down their share of the partnership’s financial activities. The partners then use this schedule to fill out their tax returns. Through Form 1065, the IRS ensures that partnerships adhere to tax laws and regulations, allowing for the consistent and accurate reporting of income and deductions across multiple stakeholders involved in the partnership.

Other IRS Forms for Partnerships

Partnerships registered and doing business within the US must report essential information with regard to their finances through the Form 1065. Learn more about other important IRS forms for partnerships.

How to Fill Out the IRS Form 1065

The form is not very difficult to fill out once you have understood the basics of creating it. You have several options when it comes to obtaining the form. The most common option is to visit the IRS official website and to find the return form. Another way of getting it is to make use of our latest advanced form-building software that will help you generate or download the relevant PDF file. With our technologies, you can fill in the information online via computer or laptop and avoid spelling and factual mistakes.

The form contains six pages and a great number of boxes and sections that may make the process rather challenging. However, each box and section has comprehensive instructions indicating what details you should insert in this or that document part. To complete the form properly and provide precise information, read our step-by-step guide below. We recommend that you be very attentive during the entire completion process.

After you have completed the form, print several copies and distribute them among the partners in the partnership.

- Specify the Tax Year

For starters, you need to define the taxation period for the calendar year 2019. In the first blank space, enter the month and the day (the beginning of the tax year). The next to spaces require that you add the ending of the year (for instance, December 31, 2019).

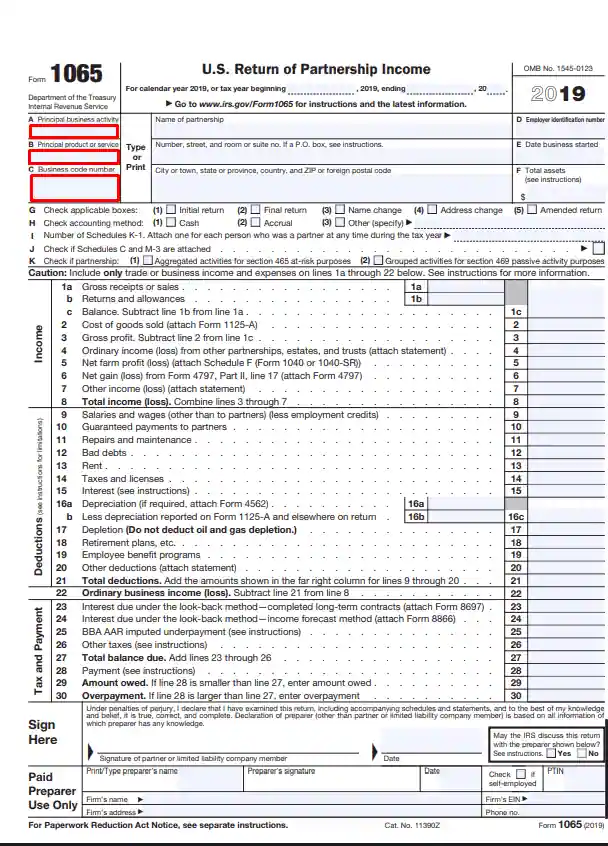

- Define the Type of Your Business Activity

Below the name of the form, you will find three items or sections (A, B, and C). In Item A, insert the type of your primary business activity (for example, “Landscaping Services” or “Manufacturer”). In the next item, you are to enter the primary business product or service (for landscaping services, it might be mowing lawns; if your business activity is manufacturing, define the product you produce (for example, automobile parts). In Item 3, enter your business code number, which you can easily find on the Internet or in the IRS instructions for the form.

- Provide Basic Info about Your Partnership

This section is meant to comprise the essential details about your partnership business. Here, you should write the following:

- Partnership’s legal name

- Partnership’s street address, including street number, room number, or a postal box number (if the partnership receives mail by a post office box)

- Partnership full location address, including city (or town), state (or province), country, and a ZIP code. For partnerships located outside of the United States, enter the country’s postal code as well.

- Employer’s Identification Number (also known as EIN). If your partnership doesn’t have one, you can apply for it online on the official IRS website or submit Form SS-4 by mail or fax.

- Partnership’s start date

- The total value of assets your partnership owns (cash, equipment, tools, etc.). The total amount should be written in US dollars. Keep in mind that you don’t need to fill out this section if you have answered affirmatively question 4 in section B on the next document page.

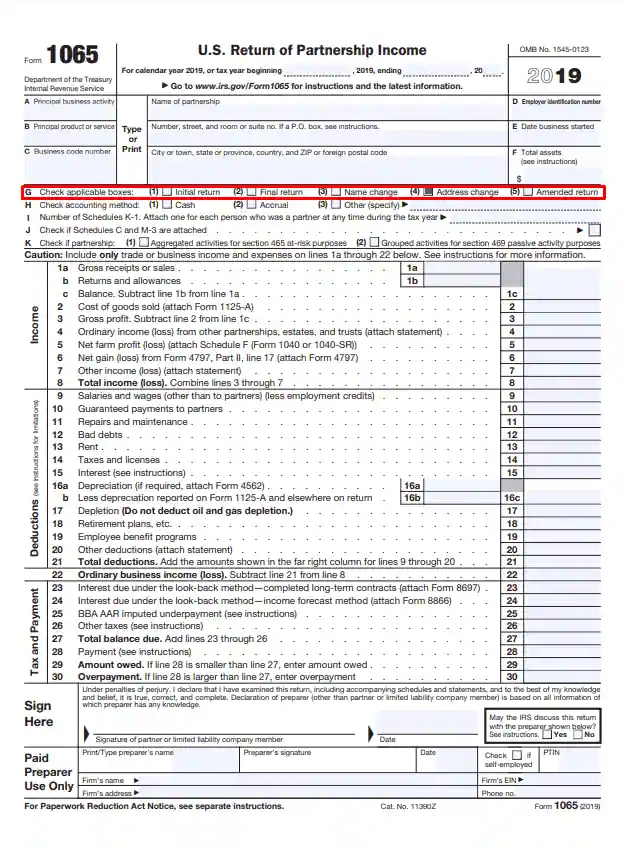

- Choose the Type of Return

In this section, you need to tick the applicable box and define the type of your return. If you started your business during the tax year, you indicated at the beginning of the form. You should select the option “Initial return.” If you have been in this business for a number of years, select another box (“Final return,” “Name change,” “Address change,” “Amended return,” or “Technical termination”).

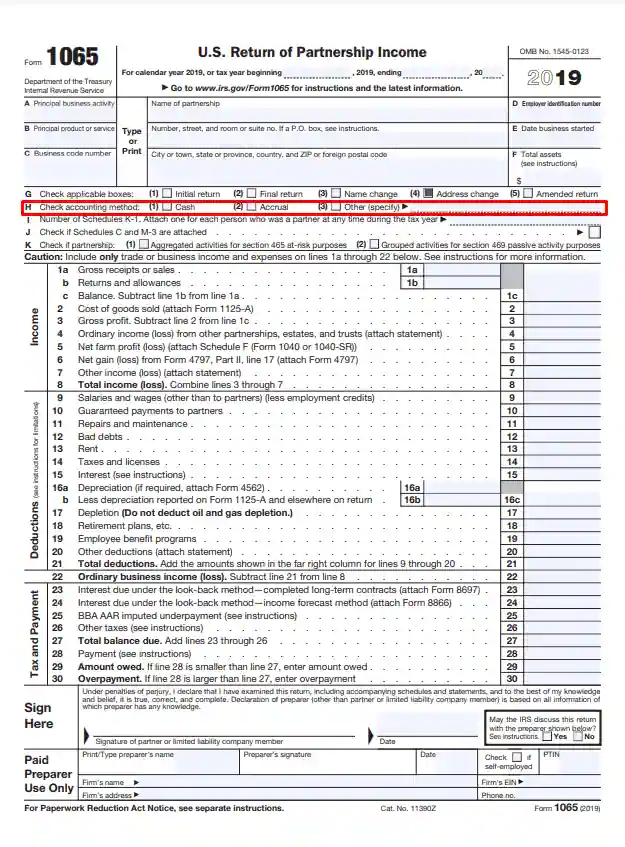

- Select the Accounting Method

Here, you are provided with the two most common options: cash and accrual. In the space near these two options, you can add other methods if the offered items do not suit you.

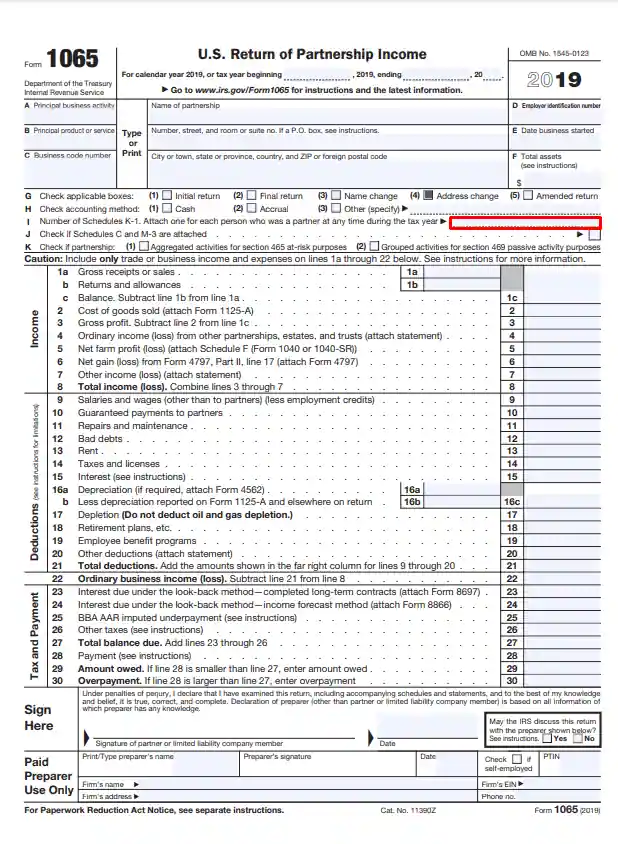

- Specify the Number of Schedule K-1 Documents

You are to complete Schedule K-1 for each partner in your business. This paper is attached to the form under discussion. It includes info about incomes, losses, and dividends. In this section, write the number of the above-mentioned documents (it is equal to the number of all partners in the partnership) you attach to the form.

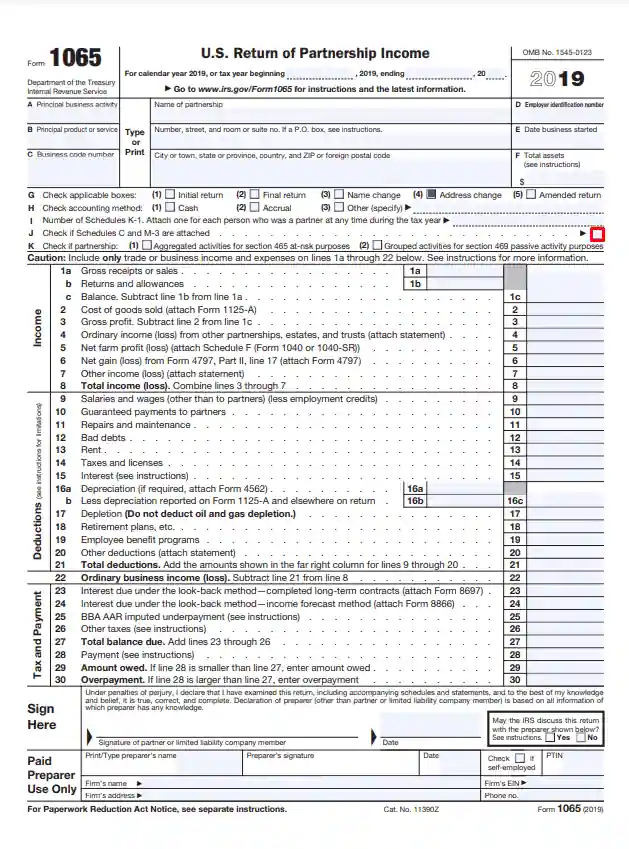

- Specify if You Attach Schedules M-3 and C

In this part of the document, you are to tick the box only if you are required to submit Schedules M-3 and C. Read the IRS instructions carefully to find out if you must do it or not. In case you have any doubts and questions, we strongly recommend seeking professional legal advice.

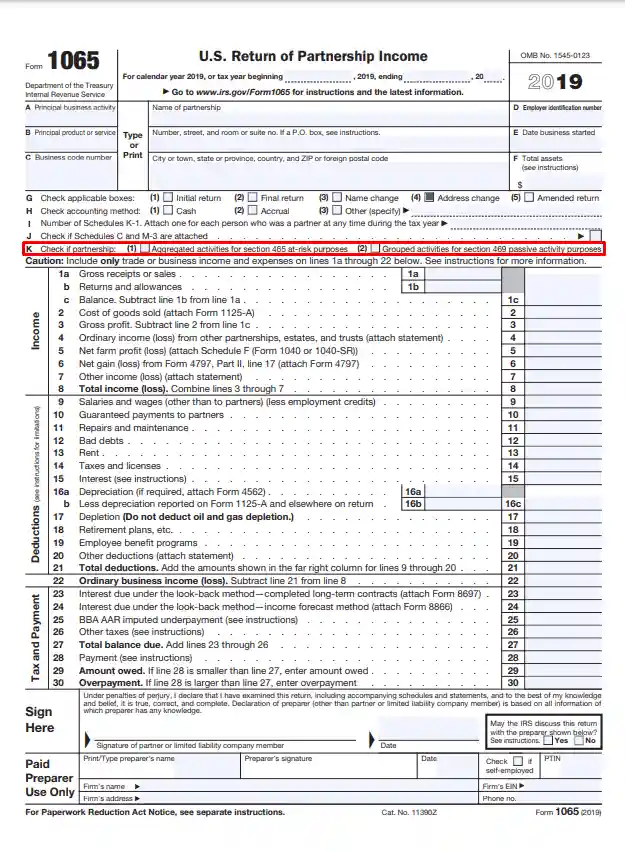

- Provide More Info about Your Partnership

You are to select the appropriate box and provide a bit more information about the partnership regarding the activities in which it participates.

- Fill Out Sections 1a-22

Now, you can proceed to the next part, where you have to fill in the required data next to each line (in total, there are 22 lines). All the lines are divided into two groups:

- Income (includes gross receipts or sales, returns, total profit, etc.)

- Deductions (include salaries and wages, debts, rent, taxes, etc.)

- Tax and Payment

In the final line of each group, write the total amount of income, deductions, or balance due. In the form, there are instructions that will help you calculate the total amount.

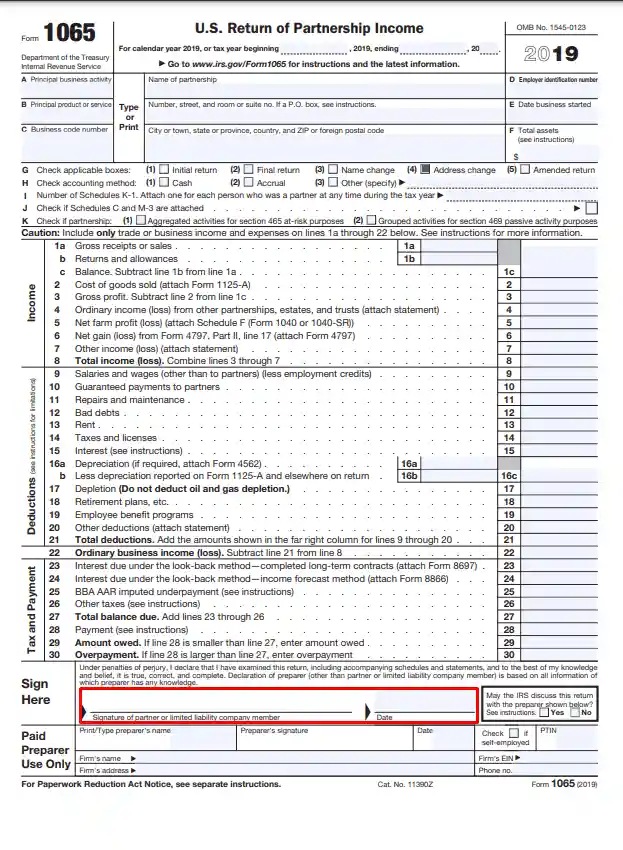

- Sign the Paper

At the bottom of the document, you will find space for the partner’s or LLC member’s signature. You are allowed to place your own signature. It is also mandatory to date the document. Before acknowledging the document, you should double-check the data submitted to avoid mistakes and penalties.

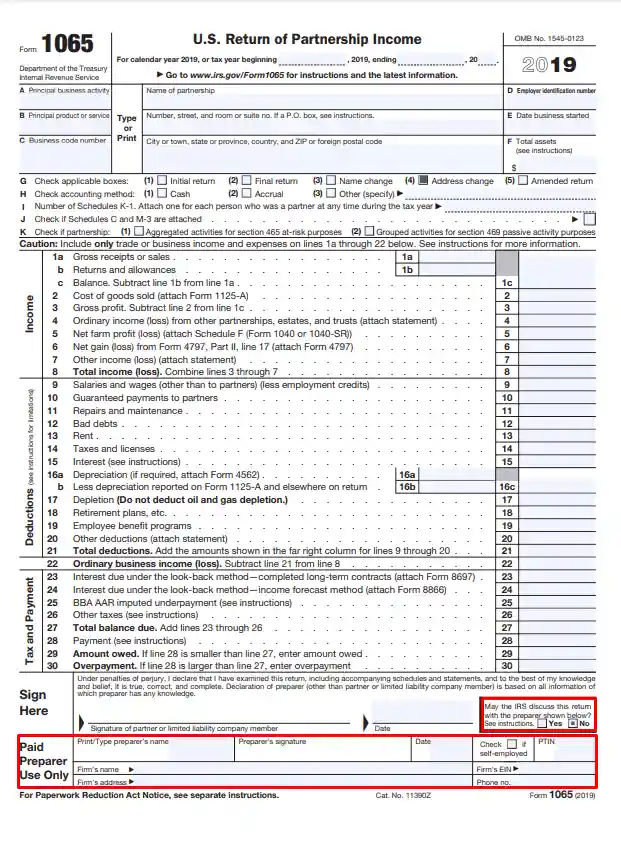

- Provide the Preparer’s Details

If you are hiring a tax professional to complete the form for you, let your paid preparer fill out this section. They should provide their name in a print or type format and PTIN, place their signature and the current calendar date, specify if they are self-employed or work in a firm (in this case, they are to enter the firm’s name, EIN, and address), and provide contact information (typically, phone number).

If you allow the IRS to negotiate the return details with the authorized third party, tick the “Yes” box in the section above.

- Complete Schedule B

The next part of the document consists of 28 sections where you need to choose either the “Yes” or “No” box. However, there are only a few sections on which you need to focus. For example, in Section 1, you are to select the type of your business entity. The most common type is domestic limited liability companies. In the vast majority of other boxes, you will answer “No” as these sections deal with foreign entities. We suggest turning to a tax professional for legal assistance when completing this part.

Section 4 is also worth focusing on. It deals with the total receipts and assets of the partnership and additional documents. If you meet the following conditions, check “Yes” in the boxes. Some of the issues mentioned further are not likely to apply to a small business.

In part below Section 25, you can assign a partnership representative. You are to insert their personal information, including the full legal name, U.S. address, and contact information.

So, if you want to complete this part successfully, you need to read all the instructions and questions carefully or ask a legal specialist to assist you.

- Complete Schedule K

This part of the document is a more detailed version of the section on the first page. You should insert almost the same information in the boxes of Schedule K as it deals with income, deductions, credits, foreign transactions, tax items, self-employment, etc.

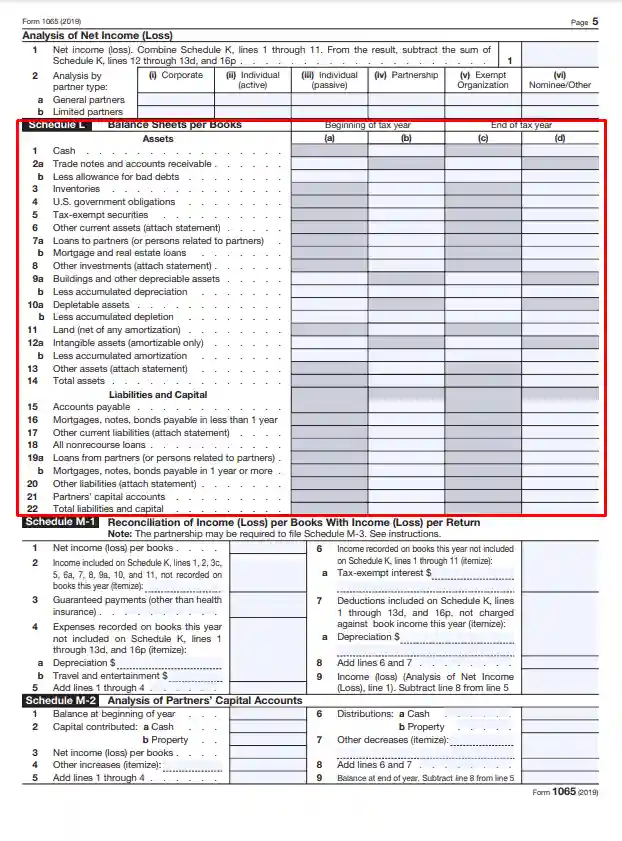

- Provide the Net Analysis

Write down the amount of net income and specify how much each of these particular limited or general partners got paid out of that net income.

- Complete the Balance Sheets Part

This section contains 22 units, which the declarant should fill out, distributing all types of assets and liabilities among two columns: the “beginning of the tax year” and the “end of the tax year.” Write all amounts in US dollars.

- Submit Schedule M-1

If the total value of assets equals or exceeds ten million dollars, the partnership may be asked to submit Schedule M-3 instead of M-1. In this part, include income not recorded on the partnership’s book and other details. Follow the instructions in each section.

- Fill out Schedule M-2

Indicate if there are changes in the partners’ capital accounts, show how much they contributed to the partnership and how much money is distributed to each partner.