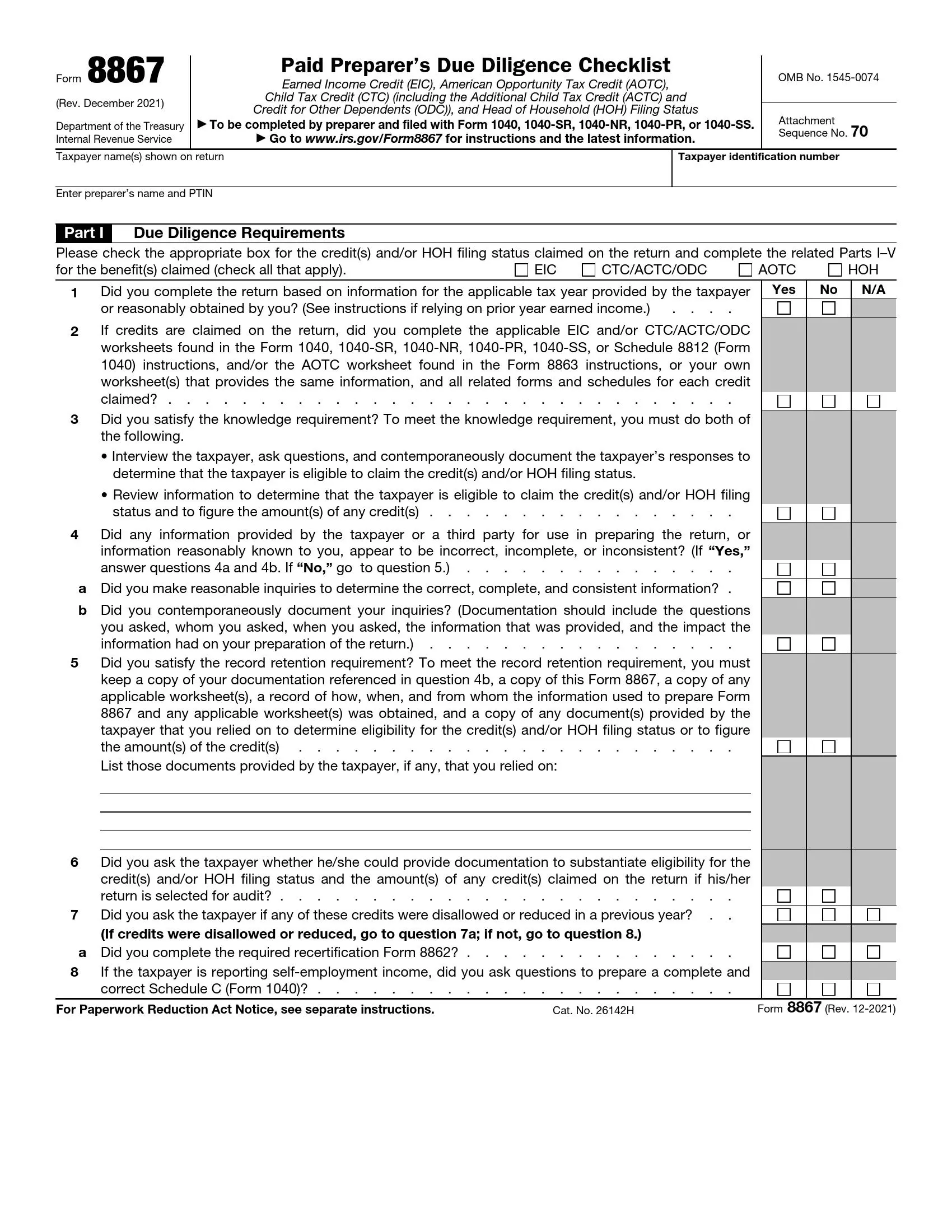

IRS Form 8867, titled “Paid Preparer’s Due Diligence Checklist,” is a form used by tax preparers when filing client returns that claim certain tax credits or the Head of Household (HoH) filing status. This form is designed to ensure that tax preparers meet the IRS’s due diligence requirements, helping prevent improper claims and reduce errors on tax returns.

The form is necessary when claiming the following:

- Earned Income Tax Credit (EITC),

- Child Tax Credit (CTC) or the Credit for Other Dependents (ODC),

- American Opportunity Tax Credit (AOTC),

- Head of Household filing status.

By completing Form 8867, tax preparers confirm that they have asked the necessary questions and obtained the requisite information to determine the taxpayer’s eligibility for these benefits. This process aims to maintain integrity and accuracy in the tax filing process.

Other IRS Forms

In case the information on this page isn’t what you’re looking for, go through some additional IRS forms that could apply to your situation.

How to Fill Out the Template

All preparers who deal with tax forms on a regular basis for a long time now probably know how IRS Form 8867 looks like. If you are yet an inexperienced worker who needs some tips and a general idea of the form’s content, read our brief guide below. It will explain the document’s structure, and information filers must provide.

Although we have included the guide in this review, it is important that you go to the Service’s site and find their instructions there. All form filers must be guided by these instructions first and foremost, especially tax professionals and paid preparers.

Get the Form

As you might already know, each document has its instructions, rules, and template. You must ensure that the template you are filling out was issued this year. Check the year on the form’s first page before completing it.

If you need a guarantee that the form you plan to use will work, we recommend using our form-building software to download the template easily. Besides IRS Form 8867, we offer many other legal templates one may seek. Another way to get the right form is to go to the Service’s official webpage.

Identify Your Client and Yourself

You have to introduce your client (the Service will consider them a taxpayer, of course) and yourself as a preparer who has created and submitted your client’s documents.

Enter the client’s name and ID number as written in their tax return. Below, write your full name and PTIN (preparer tax identification number).

Choose the Credit

You have to select which credit your client has claimed in their form (EIC, HOH, AOTC, and others). Mark the relevant box and choose the applicable form’s part(s) to fill out.

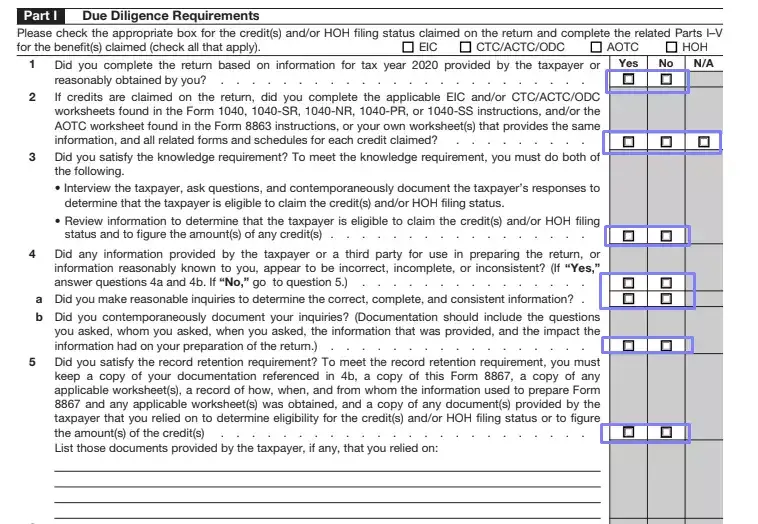

Answer Multiple Questions

Then, you will see eight questions; most of them require a “yes or no” reply. Answer every question step by step, providing truthful details about working with your customer. If demanded, give additional information. Generally, all questions are about the information your customer has provided you with and various documents.

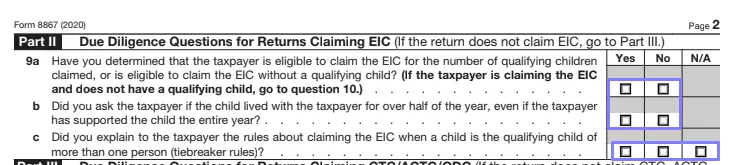

Complete the Applicable Part(s)

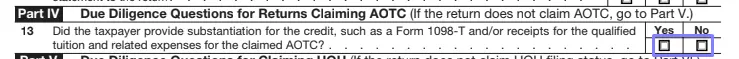

After all the questions are replied to, you have to choose the part to fill out, as we have mentioned before. For EIC, go to Part II; CTC, ACTC, or ODC require completing Part III; fill out Part IV for AOTC and Part V for HOH, respectively.

Again, all parts require simple answers: either yes or no. If your client has claimed several of those credits, fill out every relevant part.

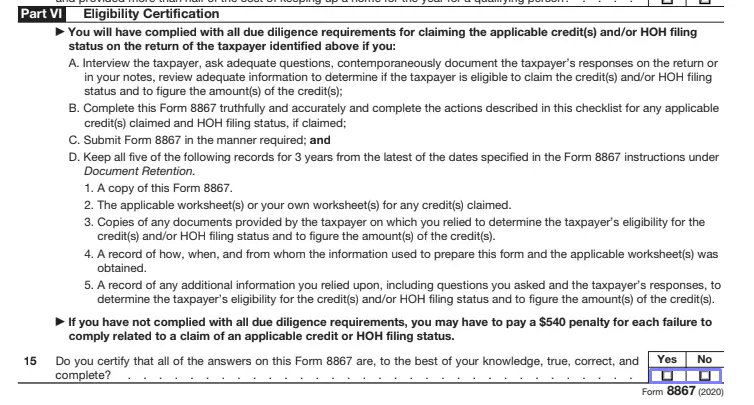

Answer the Question in Part VI

You have to read the notice before answering the last question. When you have read and understood it all, verify all your answers by answering the question in line 15 and checking a suitable box there.