Credit Card Authorization Form

A credit card authorization form is a document that allows a merchant, business, or service provider to obtain permission from a cardholder to charge their credit card for a specific transaction or a series of transactions.

In this article, you will learn what a credit card authorization form is, how to fill it in, and where to get and download a template for free.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Who May Need a Card Authorization Form

Consider a café or restaurant that provides lunch catering for a local business. Instead of charging the business for every delivery, which could be cumbersome, the café might ask the business to sign a credit card authorization. This streamlines the process by allowing the café to charge the business’s card for deliveries without negotiating payment methods or obtaining signatures for each transaction.

Another example is a company that leases expensive equipment. To protect themselves from potential damages, the leasing company may use a credit card authorization form to place a hold on the customer’s card every time they pay to lease an item, releasing the hold once the equipment is returned.

Credit card authorization forms are suitable as templates for various business types, including those that bill customers in a recurring manner for goods or services and those that allow customers to place deposits for future purchases.

Why to Use the Form?

One significant advantage of using a credit card authorization form is that it allows businesses to charge a customer’s credit card without the customer being physically present during the transaction. Additionally, it helps protect sellers from chargeback fraud, which occurs when a customer makes an online purchase using their credit card and then requests a chargeback from their bank issuer after receiving the goods or services. Chargebacks can pose a problem for businesses, as the disputed funds may be held, and resolving the issue can be time-consuming and require extensive paperwork.

A credit card authorization form document enables businesses to charge customers at regular or irregular intervals, providing legal permission. A signed document increases the chances of winning a dispute with the card issuer if any issues arise. Merchants, service providers, and organizations that accept credit card payments often use such forms.

For businesses that handle recurring payments, credit card authorization forms offer two key benefits: reducing the risk of customers claiming they never consented to the charges and saving time by eliminating the need to enter credit card information for each payment. These forms streamline the payment process and offer additional protection for sellers and customers.

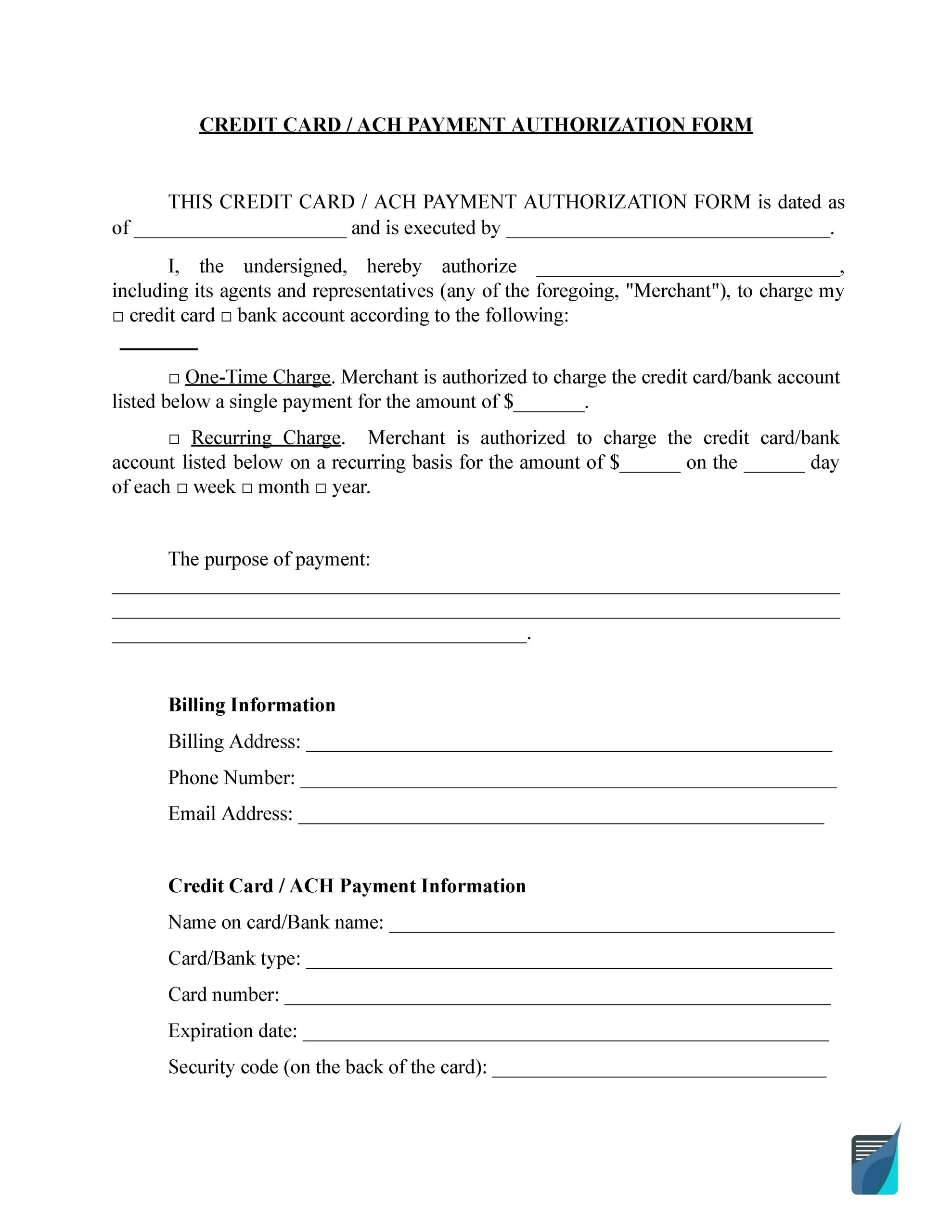

What to Include in Card Authorization Forms

Typical credit card authorization forms will include:

- Card details: Information about the card (debit or credit), account holder’s name, card number, end date, and billing address.

- Card security code (CSC): A 3- or 4-digit security code is usually found on the back of the card (Visa, MasterCard, and Discover) or the front (American Express).

- Seller’s details: The name and type of business or service provider.

- Authorization statement: Specific language indicating that the customer authorizes the seller to charge the provided card for the transaction(s).

- Authorization type: Clarify whether the authorization is for a one-time transaction or a recurring payment.

- Description of goods or services: A brief description of the product(s) or service(s) being purchased, if applicable.

- Transaction amount: The total amount the bank account holder authorizes the merchant to charge, if applicable.

- Date of transaction(s): The date(s) when the transaction(s) will occur or the billing period, if applicable.

- Customer’s name and signature: The cardholder’s printed name and signature confirm their agreement to the charges.

- Date of authorization: The date when the customer signs the form.

Including these elements in a card authorization form ensures a robust document that complies with regulatory standards and protects against potential disputes.

How to Use Card Authorization Forms

By following these steps, businesses can use credit card authorization forms to facilitate transactions and protect themselves from potential payment-related issues.

Step 1. Get the Customer’s and Account Information

Once the buyer and seller have agreed on the purchase terms, they can complete the written consent form. The form should contain enough information for the payment processor, typically including the customer’s name, card number, expiration date, and billing address.

Step 2. Choose the Type

The credit card authorization form should indicate whether the authorization is for a recurring basis, a one-time charge, or recurring transactions.

Step 3. Obtain the Signature of a Customer

Finally, have the customer sign the form to confirm their consent to the charges. Keep the signed form on file for your records and in case of any disputes.

How to Fill Out a Credit Card Authorization Form

The process of charging a credit card or customer’s bank account is fairly simple, especially if you use our website’s ready-made forms and instructions. You must download a free form and complete the information according to our simple instructions.

Step 1. Choose the Authorization Type

Select either the “Recurring Charge” or “One (1) Time Charge” option, depending on whether you want to authorize regularly scheduled monthly charges or a single charge.

Step 2. Complete the Authorization Details

For the chosen authorization type, fill in the required fields:

- Your full name

- The merchant’s name

- The charge amount

- The date (or day of each billing period for recurring charges)

- The frequency of the charge (e.g., week, month, etc., for recurring charges)

- A description of the goods or services being purchased

Fill in Your Billing Information

Provide the necessary billing details, including:

- Billing address

- Phone number

- City, state, and zip code

- Email address

Step 4. Enter Your Payment Information

Choose either the Bank (ACH) or Credit Card option, and fill in the required fields for the customer’s or third party’s credit card information:

For Bank (ACH):

- Checking or Savings account

- Name on account

- Bank name

- Account number

- Routing number

For Credit Card:

- Visa, MasterCard, Amex, or Discover

- Cardholder name

- Account number

- Expiration date (month and year)

- CVV (card security code)

Step 5. Review the Terms and Sign the Form

Read the terms and conditions carefully. By signing the form, you agree to the outlined terms and authorize the specified charges. If you understand and agree with the terms, sign the form, and print your name. Also, provide the date of your signature.

Once the form is completed, submit and mail it to the merchant as required. Retain a copy for your records, and remember to notify the merchant in writing if you need to make changes or cancel the authorization.