Free Alaska Durable Power of Attorney Form

The Alaska durable power of attorney is a legal document that allows an individual, known as the principal, to appoint another person, called the agent or attorney-in-fact, to manage their financial affairs. The “durable” aspect means the power of attorney remains in effect if the principal becomes mentally incapacitated. This ensures continuous management of the principal’s financial matters without court intervention.

The principal can specify the extent of the agent’s authority, from handling specific transactions to managing all financial affairs, including real estate, banking, investments, and tax matters. The durable POA can be effective immediately upon signing, or it can be springing, meaning it only takes effect under certain conditions, such as the principal’s incapacitation.

The durable power of attorney for finances doesn’t allow an agent to handle medical decisions. To oversee end-of-life treatments, consider additional Alaska POA forms.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Alaska Signing Requirements and Laws

Certain signing requirements and legal stipulations, outlined in the Alaska Statutes, must be followed to ensure that a durable power of attorney is legally binding and recognized under state law.

The Alaska Statutes 13.26.600-13.26.680 cover the creation and use of durable powers of attorney. These sections emphasize the need for specific formalities to be observed during the signing process to safeguard the principal’s interests and ensure the enforceability of the document. To create a valid durable power of attorney in Alaska, the document must be:

- Written. The power of attorney must be in writing, clearly articulating the powers granted to the agent.

- Signed. The principal must sign the document, affirming their decision to grant authority to the agent.

- Notarized. A notary public must notarize the document. This step is crucial as it confirms the principal’s identity and attests to the document’s voluntary nature.

Although Alaska law does not mandate witnesses for signing a POA, including one or two disinterested witnesses can lend further credibility to the document, particularly in cases involving significant assets or complex family dynamics. The document should be signed without external pressure, ensuring it represents the principal’s true intentions.

According to Alaska law, the principal can revoke the power of attorney at any time as long as they are mentally competent. This revocation must be communicated to the agent and any institutions or individuals relying on the document.

Alaska Durable Power of Attorney Form Details

| Document Name | Alaska Durable Power of Attorney Form |

| Other Names | Alaska Financial Durable Power of Attorney, AK DPOA |

| Relevant Laws | Alaska Statutes, Section 13.26.600 |

| Signing Requirements | Notary Public |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 37 |

| Available Formats | Adobe PDF |

Popular Local Durable POA Forms

Durable POA documents are used in each and every state. Take a look at other popular DPOA forms frequently filled out by Americans.

Steps to Complete the Form

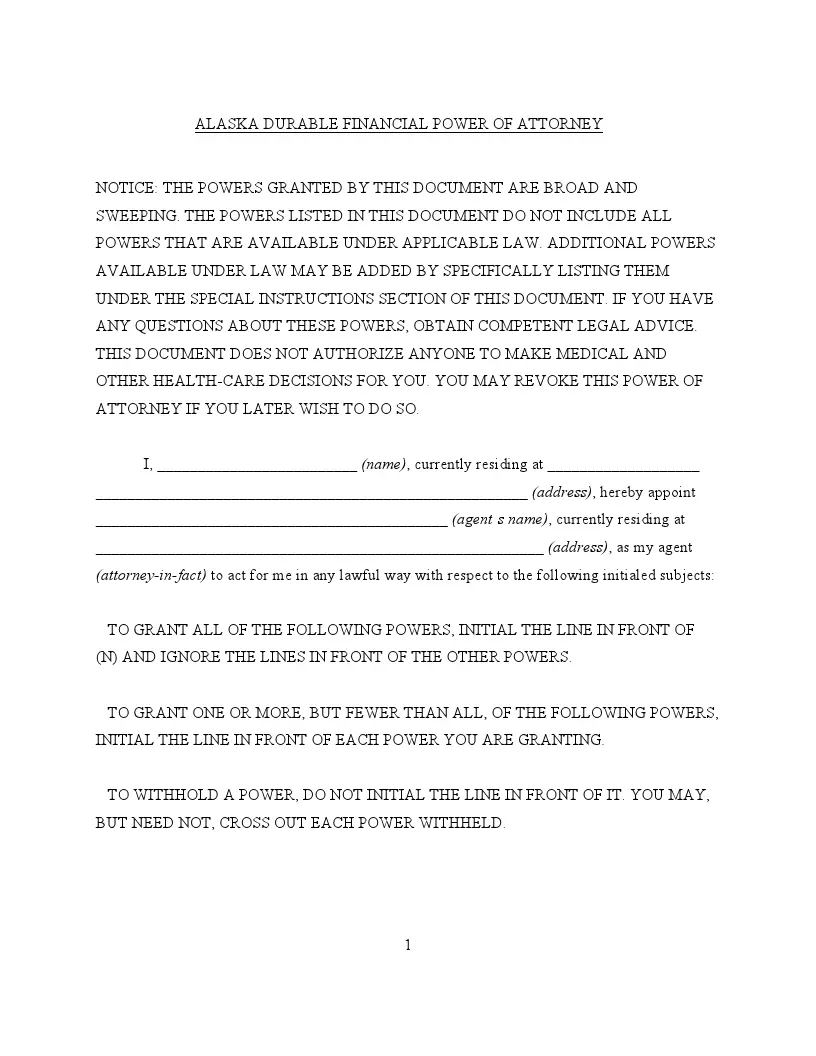

Completing the Alaska durable power of attorney requires careful attention to detail to ensure it accurately reflects your wishes and is legally valid. Below, you’ll find detailed guidance on filling out this form.

1. Designation of Agent

Start by identifying the person you wish to appoint as your agent. Include their full name, address, and contact information. If you want to appoint a co-agent, provide their details in the designated section. You must trust the individual or individuals you appoint, as they will have significant control over your financial decisions.

2. Specifying the Powers to Grant

You must explicitly indicate which powers you are granting to your agent. The form lists multiple categories, such as real estate, banking, and insurance transactions. Check the appropriate boxes next to the powers you wish to assign. Any power not explicitly granted by checking “Yes” will not be assigned to your agent.

3. Effective Date and Duration

Determine when the POA will go into effect. You can choose for it to become effective immediately upon signing, or you can opt for a “springing” power of attorney, which only becomes effective if you become incapacitated. Also, decide if you want the POA to be durable. If you choose durability, your agent will retain their powers even if you become incapacitated. Otherwise, specify if or when the power of attorney should terminate.

4. Signing and Notarization

Once you have completed all sections of the form according to your preferences, you must sign the document in the presence of a notary. The notary will verify your identity and witness your signature, which is crucial for the document’s legal validity.

5. Distribution of the Document

After notarization, distribute copies of the power of attorney to relevant parties, such as financial institutions and the agent(s) you have appointed. Keep a copy for your records and provide your attorney with one.

6. Optional Provisions

If applicable, fill out any optional sections, such as appointing an alternate agent or nominating a guardian or conservator. These sections allow you to plan further for circumstances where your first-choice agent cannot serve.

7. Revocation and Amendments

Remember, you can revoke or amend the durable power of attorney anytime, provided you are mentally competent. To revoke, you must either create a new document or complete a notarized revocation statement. Distribute this revocation as you did the original document to ensure all parties know about the change.

Listed here are various other Alaska documents filled out by our users. Try our step-by-step builder to customize these forms to your needs.

Download a Free Alaska Durable Power of Attorney Form