Free Vermont Durable Power of Attorney Form

The Vermont durable power of attorney is a legal document that allows you to appoint someone you trust to manage your financial affairs. This form can take effect immediately or only if you cannot handle your finances due to, for example, illness or incapacity. In a power of attorney arrangement, the “principal” is the person who grants authority, while the “agent” or “attorney-in-fact” is the individual designated to act on the principal’s behalf.

The powers granted include handling financial transactions, managing real estate, dealing with tax and legal matters, and overseeing government benefits and business operations. The principal can specify the extent of these powers, which can be comprehensive or limited. In Vermont, health care decisions are generally not covered under a durable power of attorney. For such cases, consider other Vermont POA forms.

In Vermont, like in many other states, the form must meet specific legal requirements to be valid. It should also clearly identify the principal and the agent and specify the powers granted. A durable power of attorney is a handy tool for estate planning, ensuring that the principal’s finances are handled according to their wishes, even when they cannot manage them personally.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Vermont Signing Requirements and Laws

The laws governing the execution and requirements for a durable power of attorney are specified under Title 14, Chapter 127 of the Vermont Statutes, known as the Vermont Uniform Power of Attorney Act. This document is defined as a power of attorney that remains effective even if the principal becomes incapacitated or is otherwise unavailable, as per 14 V.S.A. § 4002(2). This way, the agent can continue to act on the principal’s behalf without interruption due to the principal’s mental or physical health conditions.

The term “power of attorney” is broadly defined in 14 V.S.A. § 4002(9) as any writing or record that grants an agent the authority to act in place of the principal. This broad definition includes a variety of potential powers and actions that the agent can undertake on behalf of the principal.

According to 14 V.S.A. § 4005, the principal must sign the document, and this signature must be acknowledged before a notary public to affirm the identity and voluntary nature of the principal’s execution of the document. Additionally, Vermont provides a statutory form for the power of attorney in 14 V.S.A. § 4051, which helps to standardize the process and ensure that all legal bases are covered. This form can ensure that the document adheres to state laws and is executed correctly.

Under Vermont law, a power of attorney terminates under several conditions, such as the principal’s death, revocation of the power, or the accomplishment of its specific purpose, as outlined in 14 V.S.A. § 4010. This statute also clarifies the scenarios leading to an agent’s authority cessation.

Vermont Durable Power of Attorney Form Details

| Document Name | Vermont Durable Power of Attorney Form |

| Other Names | Vermont Financial Durable Power of Attorney, VT DPOA |

| Relevant Laws | Vermont Statutes, Title 14, Section 4005 |

| Signing Requirements | Notary Public |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 37 |

| Available Formats | Adobe PDF |

Popular Local Durable POA Forms

Durable POA documents are used in each and every state. Take a look at other popular DPOA forms frequently filled out by Americans.

Steps to Complete the Form

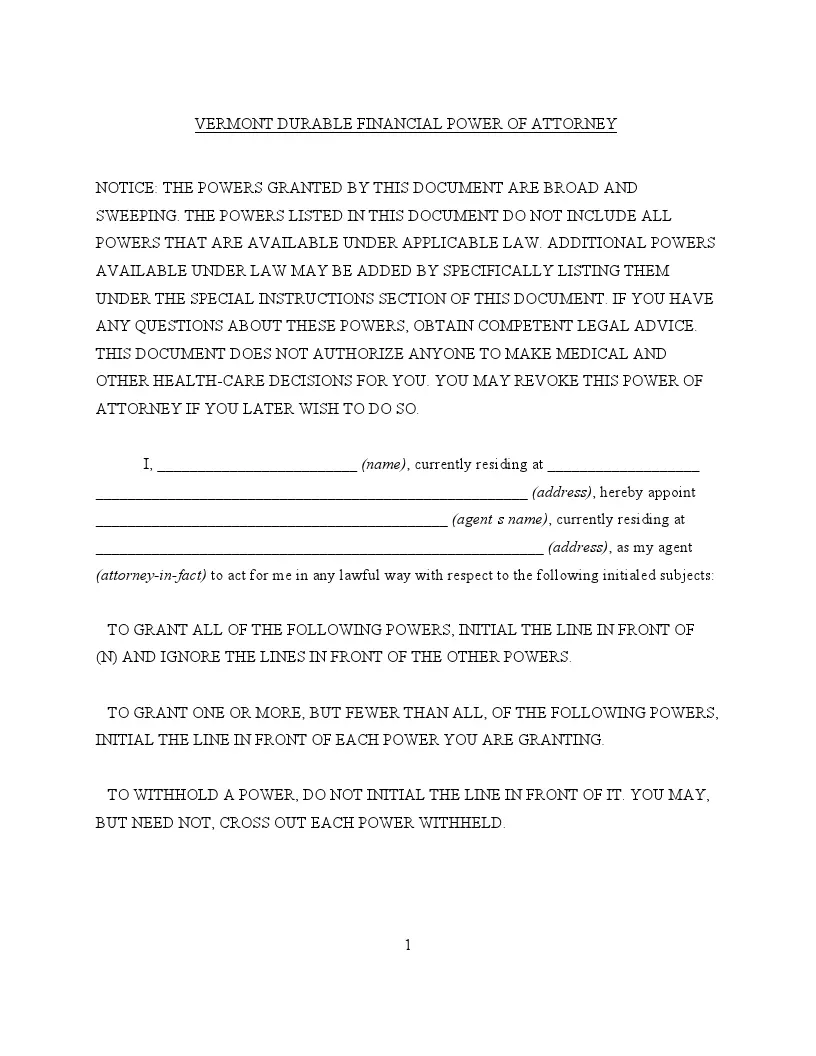

Completing the Vermont durable power of attorney involves a detailed process that ensures that your financial affairs are handled according to your wishes, especially in circumstances where you may not be able to handle them yourself. The form is designed to be straightforward, and following the steps carefully will help you create a valid legal document.

1. Identify the Principal and Agent

Identify yourself as the Principal by providing your full legal name, address, and contact information. Then, designate your agent — the person who will act on your behalf — by entering their name, address, and telephone number. If you have previously issued powers of attorney that you wish to revoke with this new document, make sure to initial the appropriate statement.

2. Assign Authority

Decide the extent of the power you are granting to your agent. You can select specific areas, such as real estate, financial institutions, taxes, etc., by initialing next to each relevant item on the form. If you want the agent to have broad authority across all listed areas, you can initial under “All Preceding Subjects.”

3. Designate Successor Agents

Optionally, you can designate a successor who will take over if your primary agent cannot fulfill their role. Provide the name, address, and telephone number of any successor agent. You may also specify the conditions under which this transfer of authority would occur.

4. Specify Effective Date and Special Instructions

Indicate when the power of attorney will become effective. If it is to be effective immediately, do not initial any conditions. If it is to become effective upon your incapacity, initial the appropriate statement. Use the “Special Instructions” section to provide any specific guidance or limitations you want to apply to the powers granted.

5. Sign and Notarize the Document

After filling out the form, review it to ensure all information is correct and reflects your wishes. Then, sign the document in the presence of a notary public. The notary will verify your identity and witness your signature, then notarize the form to make it legally binding.

After the form is fully executed, provide your agent with a copy and discuss the responsibilities and expectations you have set. It’s advisable to keep the original document safe and provide copies to relevant financial institutions or legal entities that may need it.

Listed here are various other Vermont documents filled out by our users. Try our step-by-step builder to customize these forms to your needs.

Download a Free Vermont Durable Power of Attorney Form