Free North Carolina Durable Power of Attorney Form

In North Carolina, as in every other state of the U.S., you can choose a person who will act on your behalf when dealing with issues you cannot consider for some particular reasons. Before delegating certain responsibilities, you have to complete a special form.

A Durable Power of Attorney is one such form. It is used when an individual wants to appoint an agent to manage financial affairs in case of an individual’s unavailability or incapability. Keep in mind that, unlike a medical power of attorney form, the durable power of attorney form is not meant for making legal healthcare decisions. There are lots of reasons a person cannot manage their responsibilities:

- an individual has been deployed to another country to perform military tasks;

- a person has gone on vacation that has been involuntary extended;

- an individual has become mentally or physically incapable of carrying out their financial duties.

North Carolina power of attorney templates – download other power of attorney documents for North Carolina along with guidelines.

When deciding to complete the form, make sure that the person you want to assign as an agent is someone you trust most and is unlikely to take advantage of the situation. Your decision should not be spontaneous. Weigh all the considerations carefully when selecting an attorney-in-fact. According to Section 32C-1-102 of NC General Statutes, the form is “durable” because it remains valid even when you are on the verge of death due to some severe health problems causing incapacity. Also, the form remains in effect unless you revoke it. You can limit the agent’s authority at any time as long as you are of sound mind and able to make decisions yourself.

North Carolina Signing Requirements and Laws

To complete the form and sign the document, you must reach the age of majority (in North Carolina, the age of 18). Prepare all necessary documentation from a medical organization proving that you are mentally competent to make serious decisions.

As written in Section 32C-1-105 of the state law, the DPOA form must be acknowledged and signed by a notary public. No presence of witnesses is required. You can find all general requirements for the form and responsibilities of the principal and the agent in Chapter 32C of NC General Law.

There are several options that you have when designating an agent. The main requirement you are to meet is choosing an adult person (who is 18 years old or older) who is financially competent. An attorney-in-fact can be:

- your close and trustworthy friend;

- your close relative;

- a professional agent or business entity.

North Carolina Durable Power of Attorney Form Details

| Document Name | North Carolina Durable Power of Attorney Form |

| Other Names | North Carolina Financial Durable Power of Attorney, NC DPOA |

| Relevant Laws | North Carolina General Statutes, Chapter 32C |

| Signing Requirements | Notary Public |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 37 |

| Available Formats | Adobe PDF |

Popular Local Durable POA Forms

Durable power of attorney forms enable you to choose a representative who can take care of your financial affairs even when you end up unable to make decisions yourself. Below are the states DPOA documents are downloaded in most often.

Steps to Complete the Form

Once you have got acquainted with all the requirements and laws, you can complete the document. In the state of North Carolina, the form consists of seven pages. However, it will not take much time to fill it out as the general information for the principal and agent make the bulk of the form. We have created a comprehensive guide with essential steps you are to take when filling out the form. We hope that it will make the process of completing the form much easier.

1. Obtain the DPOA Form

To begin with, the process of completing the form starts with obtaining the template. You can make use of our form-building software that helps you to download the form very quickly. Keep in mind that you are allowed to input the information on a computer or laptop, but you are to print the document to sign it.

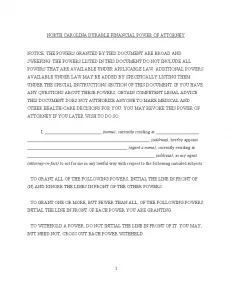

2. Read the Introductory Information Carefully

The NC DPOA form starts with basic details about the document itself. The details include general information about the essence of the document and the main requirements regarding your agent. Keep in mind that if your agent becomes incapable of managing financial issues on your behalf, the document becomes invalid unless you appoint a successor agent.

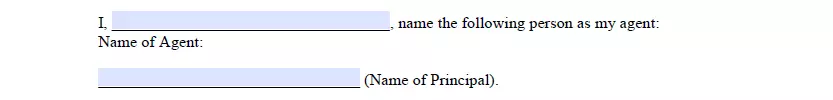

3. Enter Personal Details of the Parties

After you have finished reading, you can proceed to the next part of the document. In this section, you are to insert the principal’s full name. In the second line, the principal is to insert similar information about the attorney-in-fact.

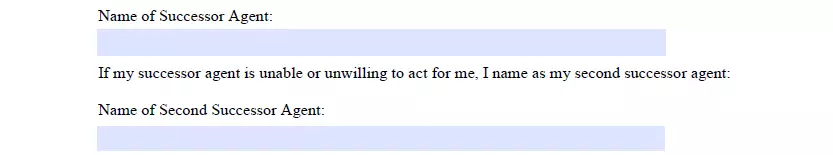

4. Choose a Successor Agent (If Necessary)

You can choose whether to fill out the section or not. If the agent you have chosen in the first place has become unable to take responsibilities and perform tasks on your behalf due to a severe illness, death, or some other reason, you can choose another agent to do it. The form allows you to designate a second successor agent. The principal must enter the personal details of the agents.

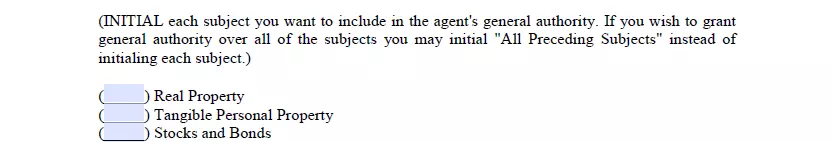

5. Give Your Attorney-in-Fact General or Limited Powers

Read the long list of the responsibilities that you can delegate to your agent carefully and choose those financial operations you want to entrust to your attorney-in-fact. We recommend deciding which financial situations you want to assign in advance. You can insert your initials in the spaces near the power you want to assign to your agent. Below is the list of all possible responsibilities:

- Property (either personal or real) matters;

- Tax issues;

- Insurance matters;

- Claims and litigations;

- Business and banking related transactions;

- Entity operations;

- Trusts transactions;

- Financial operations that involve stocks, bonds, and commodities;

- Government benefits;

- Charitable gifts;

- Retirement plan operations.

You can put initials in the last space, “All Preceding Subjects,” to choose all the above-mentioned powers automatically.

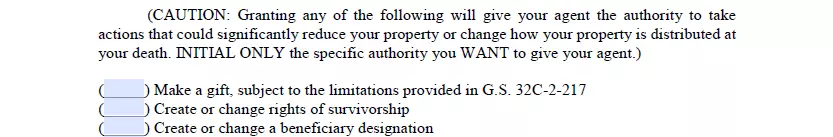

6. Initial the Specific Authority

The next section of the document is optional. The list of powers is provided below. Next to each power, you will see a line for your initials. Keep in mind that if you don’t write your initials there, the appointed agent is not allowed to perform the tasks. Below the list, there is a section in which you can prohibit your agent from granting the above-mentioned authority to another agent. If you are not satisfied with the powers provided, add other instructions in the blank lines below.

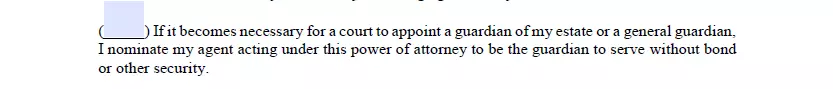

7. Name Your Guardian

Sometimes a court may require that you should designate a guardian. If you want to appoint your agent a guardian of the estate or a guardian of general nature, you must put your initials near the statement.

8. Read the Statements Carefully

Before signing the document, read all the statements several times to make sure that you have understood all of them. If something remains unclear to you, consult your lawyer.

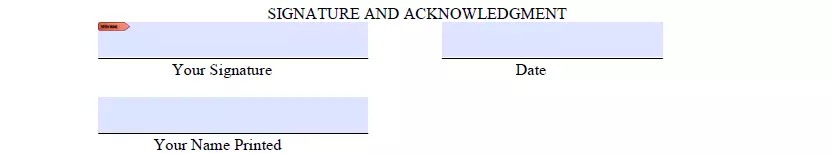

9. Sign the Document and Insert the Date

After you have read all the conditions, you can sign the paper at the bottom of the fourth page. Do not forget to insert the date on which you execute the Durable Power of Attorney.

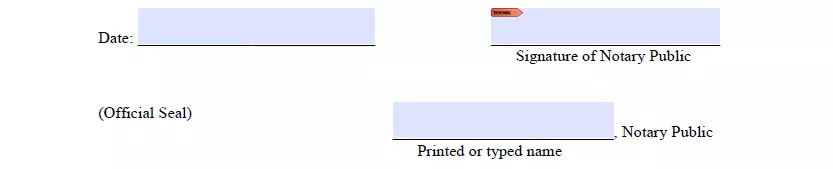

10. Ask Notary Public to Verify the Document

As the law states, the form must be acknowledged and signed by a notary public. Only the notary public, who was present during the procedure, can put the necessary information in this section. The notary agent must insert the date of the form’s execution and the place in which it took place.

11. Let the Agent Read the Information Below Carefully

The form ends with the text consisting of two pages and informing the agent about their duties. The agent must read all the information provided to avoid any confusion and uncertainty. One of the points worth mentioning is that the durable power of attorney becomes invalid when the principal dies. It means that the agent cannot manage any property or financial matters after the principal’s death.

Different essential North Carolina templates readily available for download on our site and can be personalized in our simple document constructor.

Other Durable POA Forms by State

Download a Free North Carolina Durable Power of Attorney Form