South Carolina Bill of Sale Form

South Carolina bill of sale secures the transaction between a seller and buyer by recording all the terms of the sale.

Before using a bill of sale, you may need to learn the document’s role and purpose and analyze its various types. We offer SC bill of sale templates that can be customized in less than ten minutes. In addition, you will find essential official forms that may accompany vehicle, boat, and firearm registration.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | South Carolina Vehicle Bill of Sale Form |

| Other Names | South Carolina Car Bill of Sale, South Carolina Automobile Bill of Sale |

| DMV | South Carolina Department of Motor Vehicles |

| Vehicle Registration Fee | $40 (electric car – $120 additionally) |

| Bill of Sale Required? | No |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 23 |

South Carolina Bill of Sale Forms by Type

Each type of bill of sale has its own purpose and is used for different situations. Making a particular bill of sale is crucial because it will include the terms specific to the transaction. That’s why you will have to ensure that you prepare and record the correct bill of sale to successfully complete your deal.

South Carolina vehicle bill of sale is designed to provide parties with an additional layer of security during motor vehicle sales.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

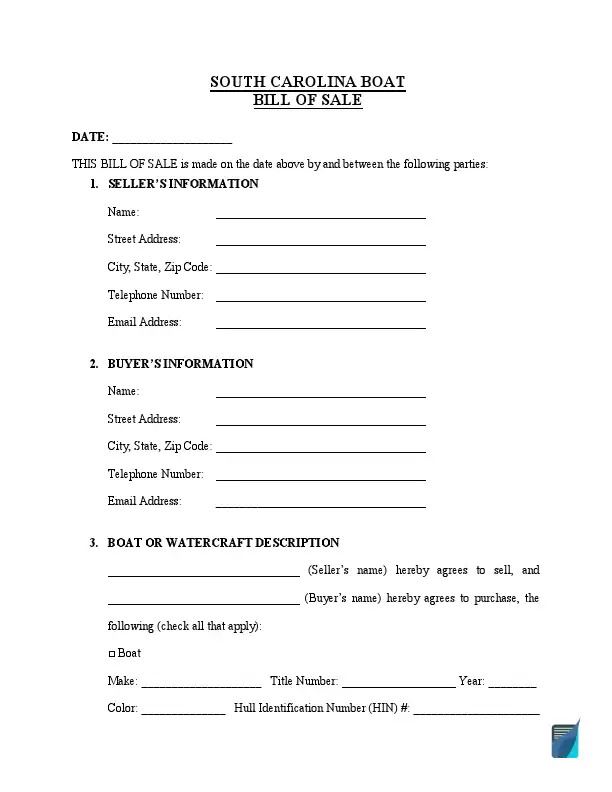

A boat bill of sale will help you finalize the transfer of ownership of a vessel in South Carolina. Verification of a boat serial number may be required.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

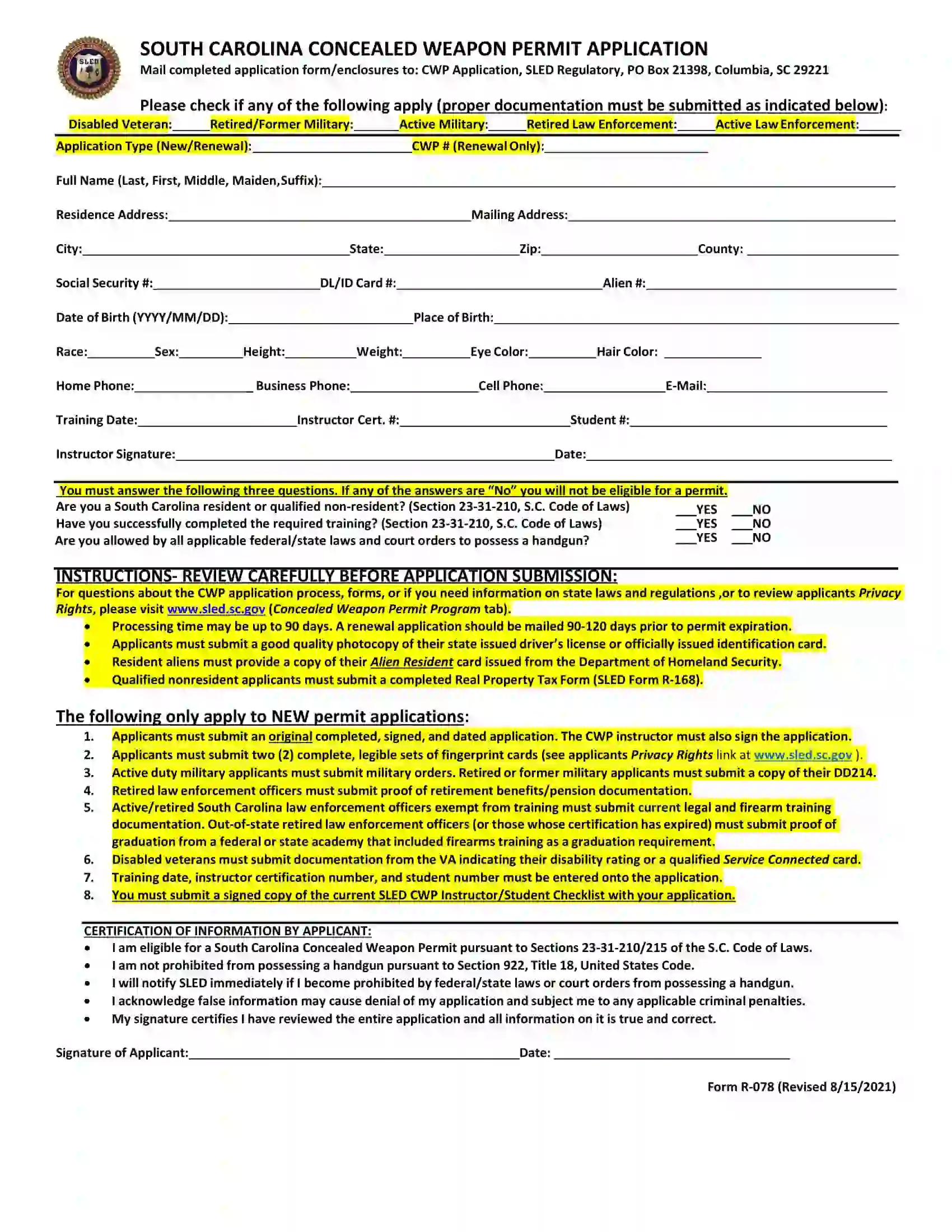

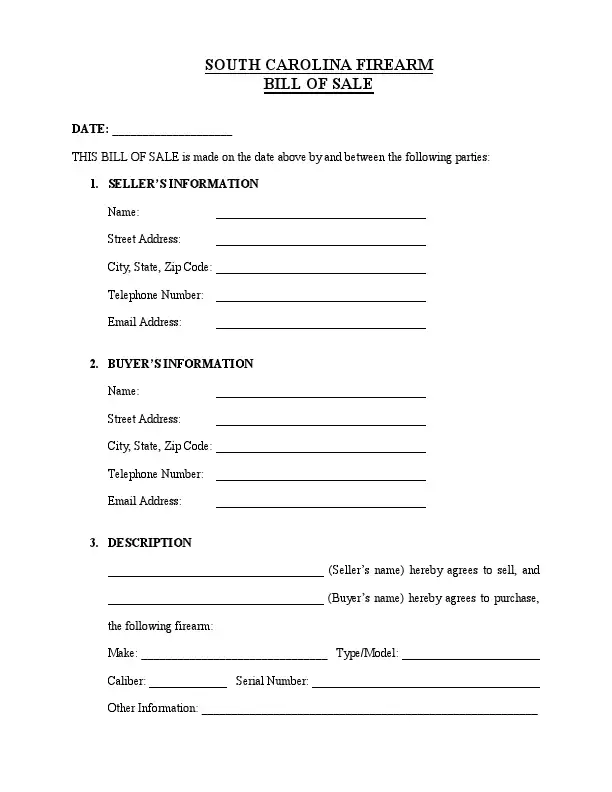

South Carolina firearm bill of sale can help keep track of when a gun changes possession. Buyers are not required to pass a criminal record check when buying a gun in South Carolina.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

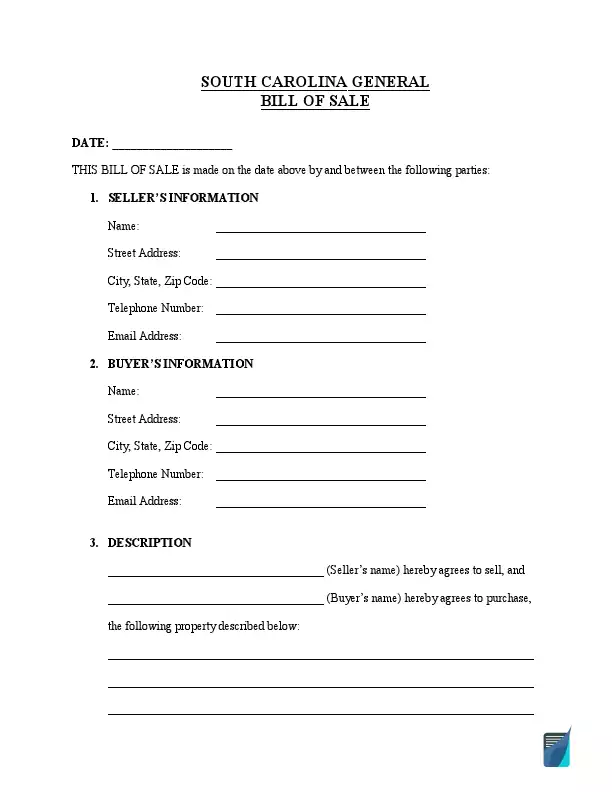

South Carolina general bill of sale covers big-sized property transfers that do not require a specific bill of sale.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

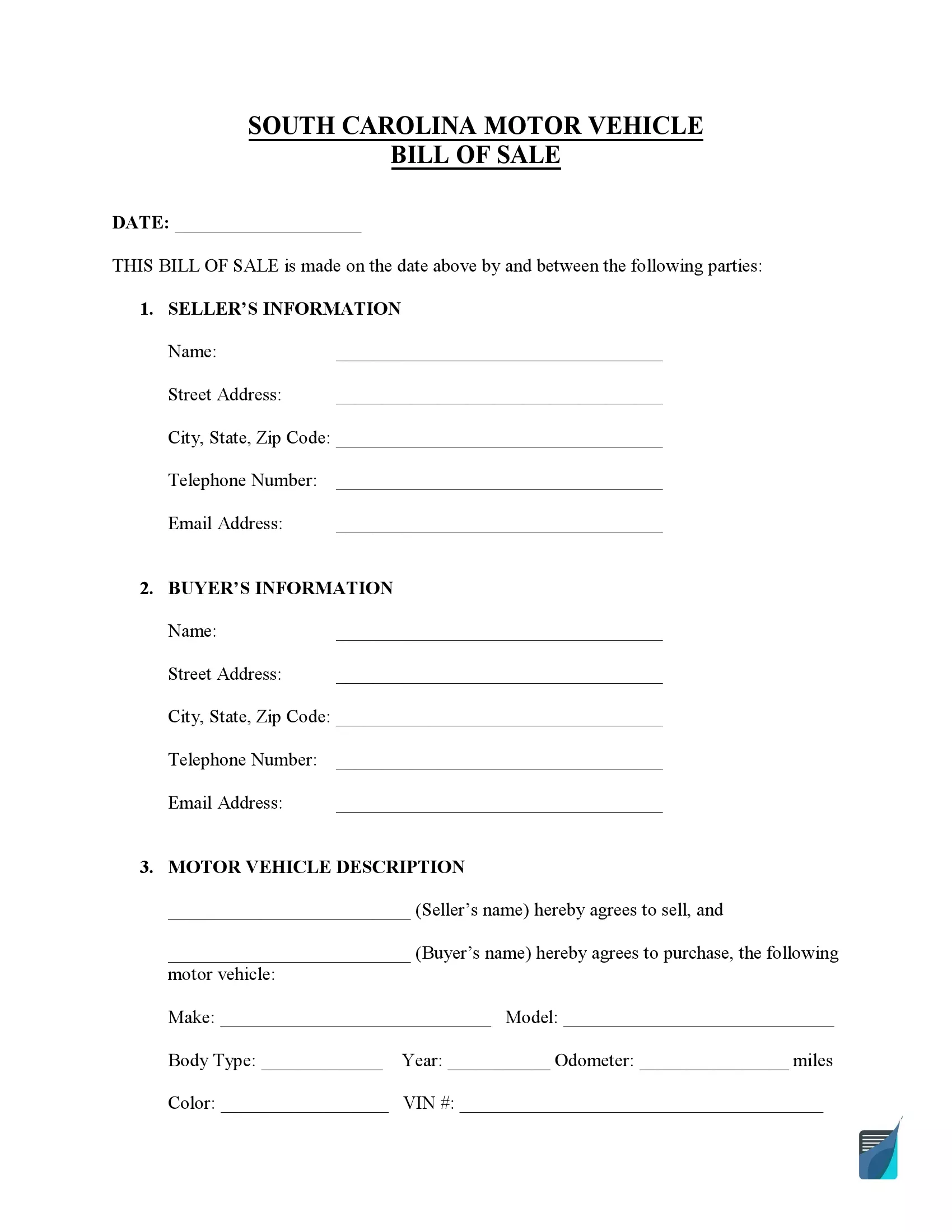

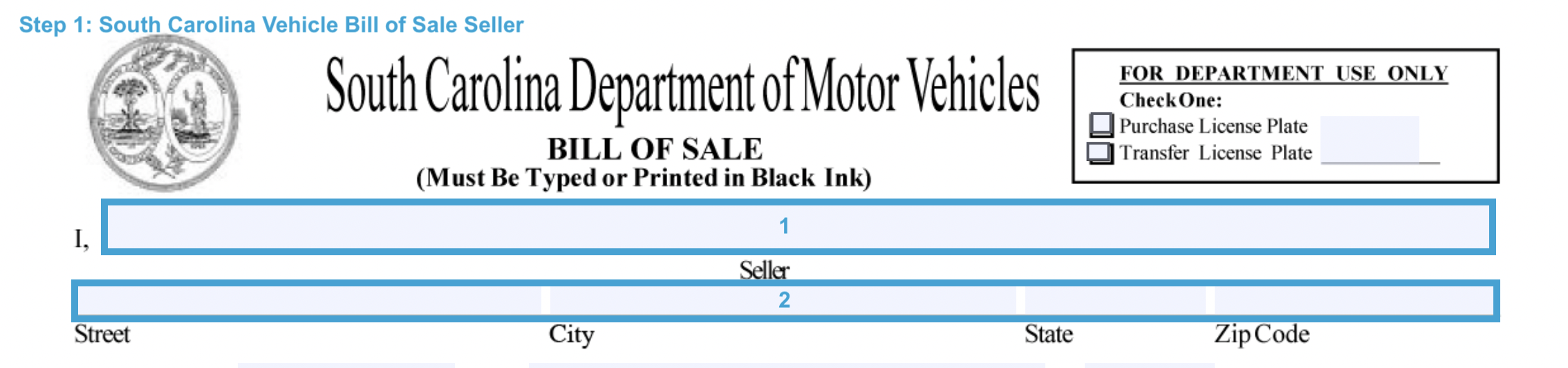

How to Write a SC Vehicle Bill of Sale

When you need to sell or purchase motor vehicles in South Carolina, you are recommended to use a binding document to ensure a secure transaction between parties is safe. The South Carolina DMV offers the official Form-4031, which regulates the relationship between the seller and buyer. Here is a simple way to complete this document within minutes and avoid any confusion.

Step 1: Identify the seller

As this form is being completed on behalf of the seller, the latter needs to provide their full name and contact details. Be sure to type all the requested information, including:

- Full name

- Street address

- City

- State

- Zip code

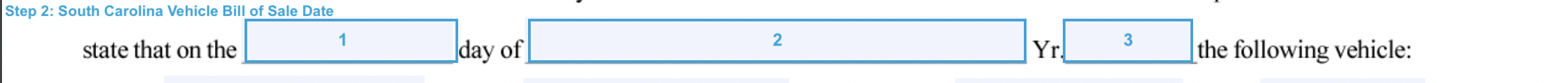

Step 2: Indicate the date

You need to specify when the transaction is made in the corresponding field. Provide the actual date in the day-month-year format.

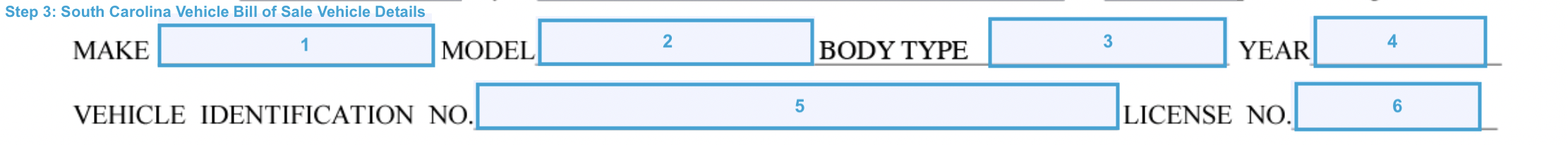

Step 3: Give the vehicle details

The document must clarify the subject of the purchase. You need to describe in detail the vehicle that is being sold. This form will be later used during vehicle registration; thus, check twice if all numbers and data are correct. The vital information about the vehicle is as follows:

- Make

- Model

- Body type

- Year (of Production)

- Vehicle Identification Number

- License number

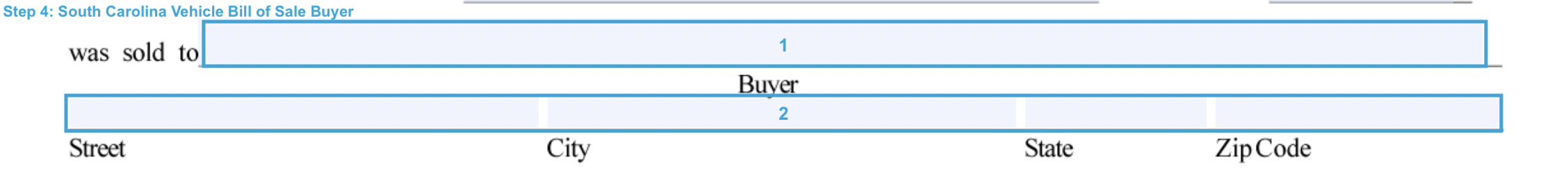

Step 4: Identify the buyer

Next, you need to indicate who obtains the ownership rights through the transaction. Include the buyer’s full name and their address of residence (street address, city, state, and zip code).

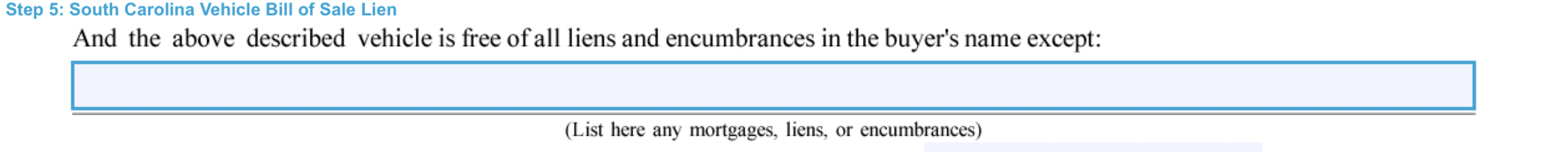

Step 5: Specify the lien information

The seller must inform if there are any liens or mortgages for the sold property.

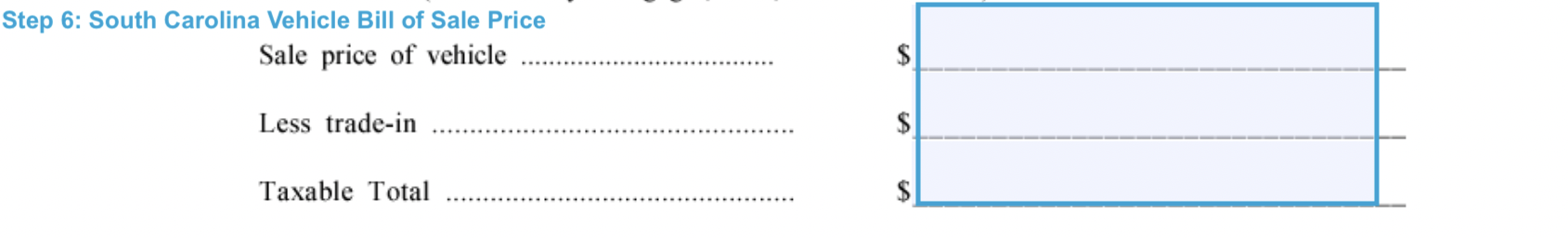

Step 6: Indicate the pricing details

The document must contain the actual pricing information that both parties agree upon the purchase. This payment structure includes:

- The vehicle’s sale price. This is a total price in US dollars that the buyer needs to pay for the vehicle. It does not include charges, taxes, and other fees.

- Less trade-in. If the agreement includes exchanging an old vehicle for a new one, the trade-in is the sum the buyer needs to pay additionally. This sum is formed by reducing a trade-in allowance of a vehicle sale price.

- Taxable total. The total retail price is taxable. That is why the buyer needs to pay some percentage added to the final purchase price.

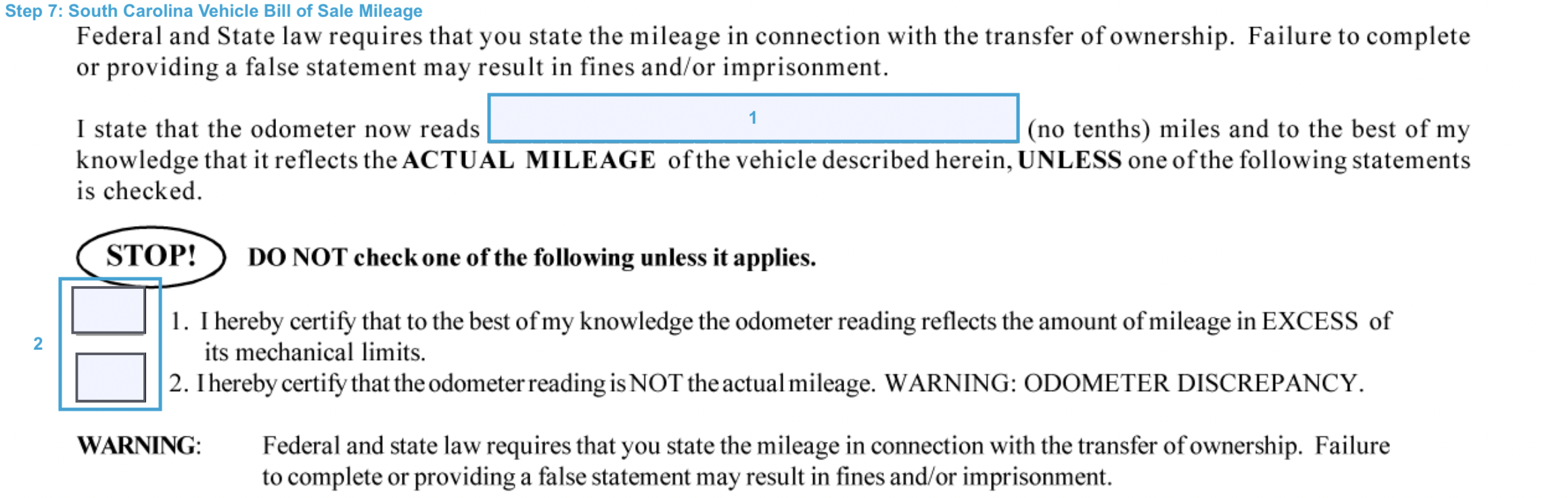

Step 7: Specify the odometer reading

According to the DMV regulations, the seller must provide the actual odometer reading before selling the vehicle. If it is not possible to provide the actual mileage of the vehicle, you need to select one of the two statements that correspond to your situation:

- Odometer reading reflects the amount of mileage in excess due to its limits.

- The odometer is not working correctly and doesn’t show actual mileage.

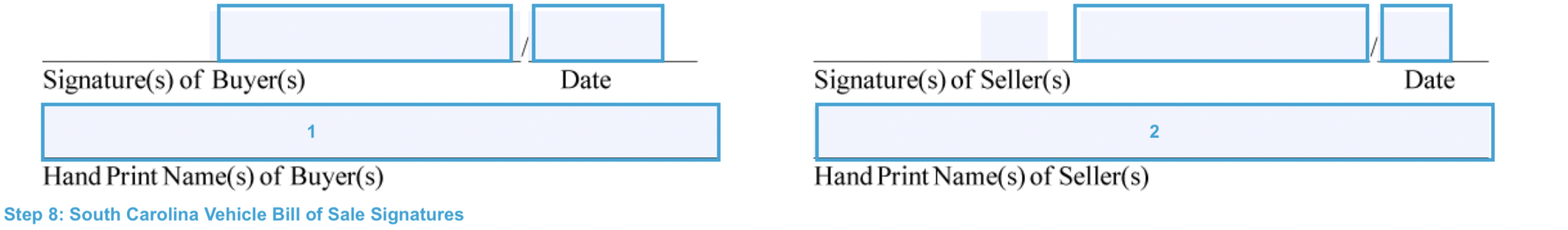

Step 8: Provide the signatures

Lastly, to authorize the transaction, both parties must sign the document. Be sure to provide the date of the signature and full print names of the buyer(s) and the seller(s).

Registering a Vehicle in South Carolina

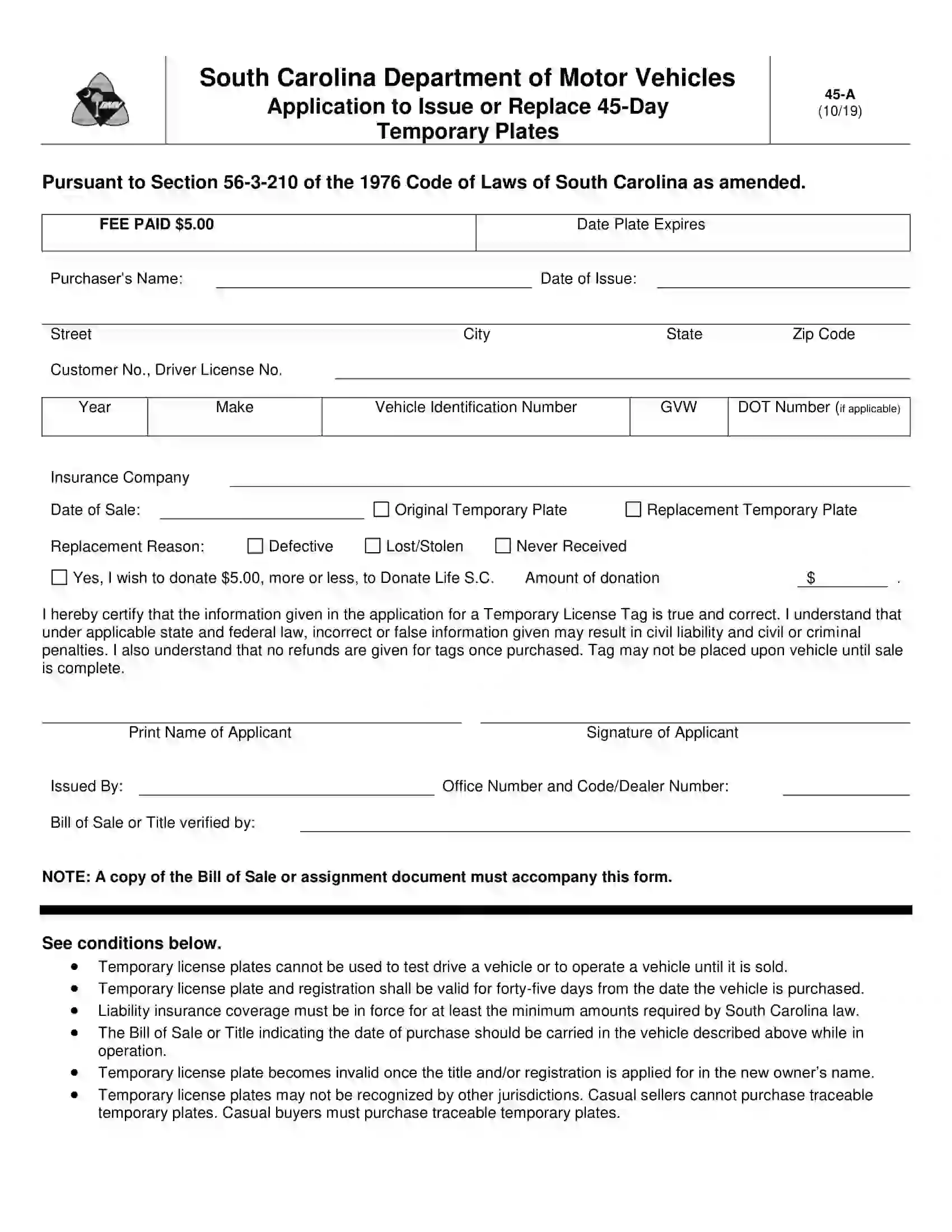

Once the private sale of a motor vehicle is complete, the new owner has 45 days to complete its registration. Those who buy vehicles from dealers don’t need to undertake the registration procedures as the agent files all the documents. Those who obtained a vehicle in a private deal should visit a local office of SC DMV and submit the following documents:

- A vehicle bill of sale template filled out and signed by both parties

- Receipt of the paid tax

- Receipt of paid registration and titling fees

- Valid auto insurance

- The title signed over to the new owner by the previous one

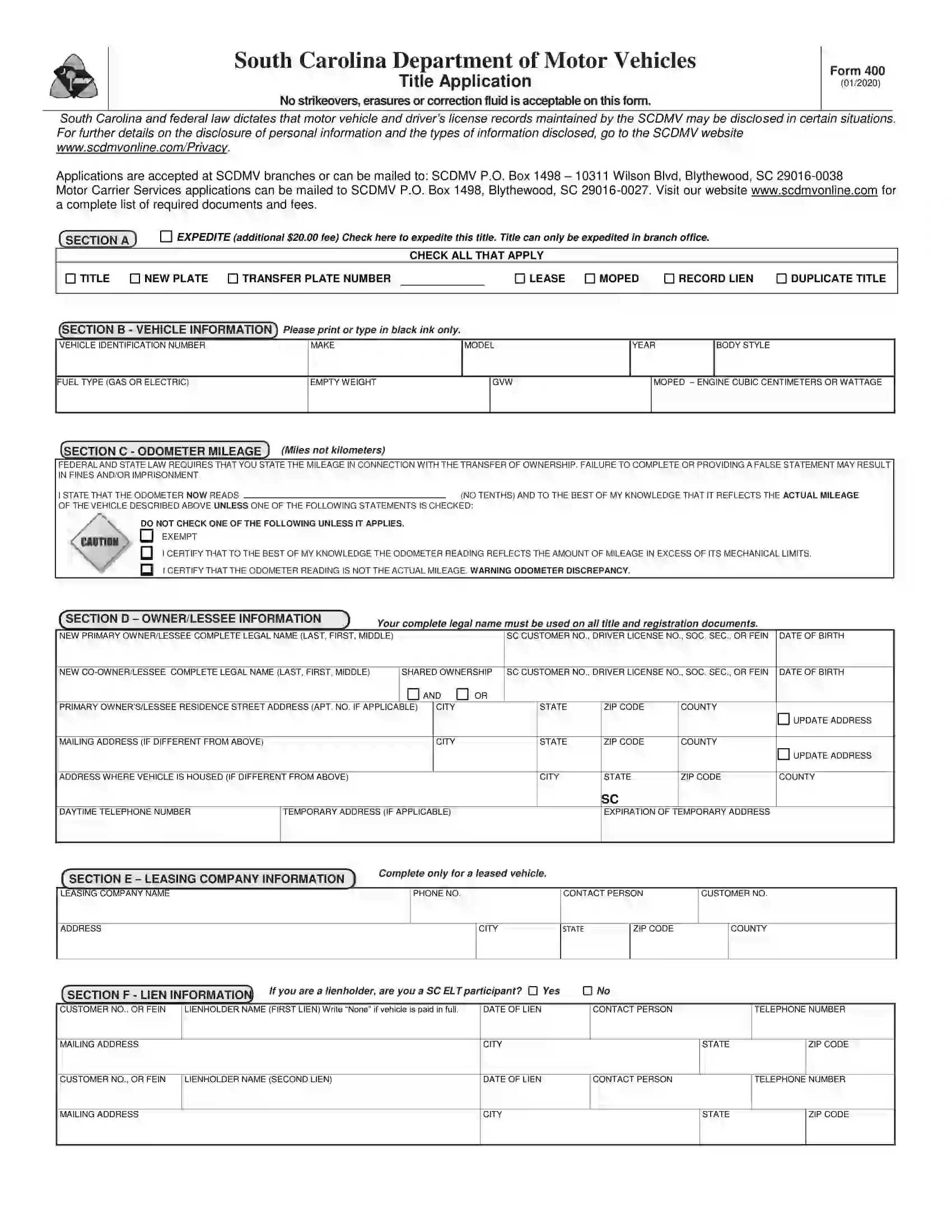

- Application for Certificate of Title and Registration (SCDMV Form 400)

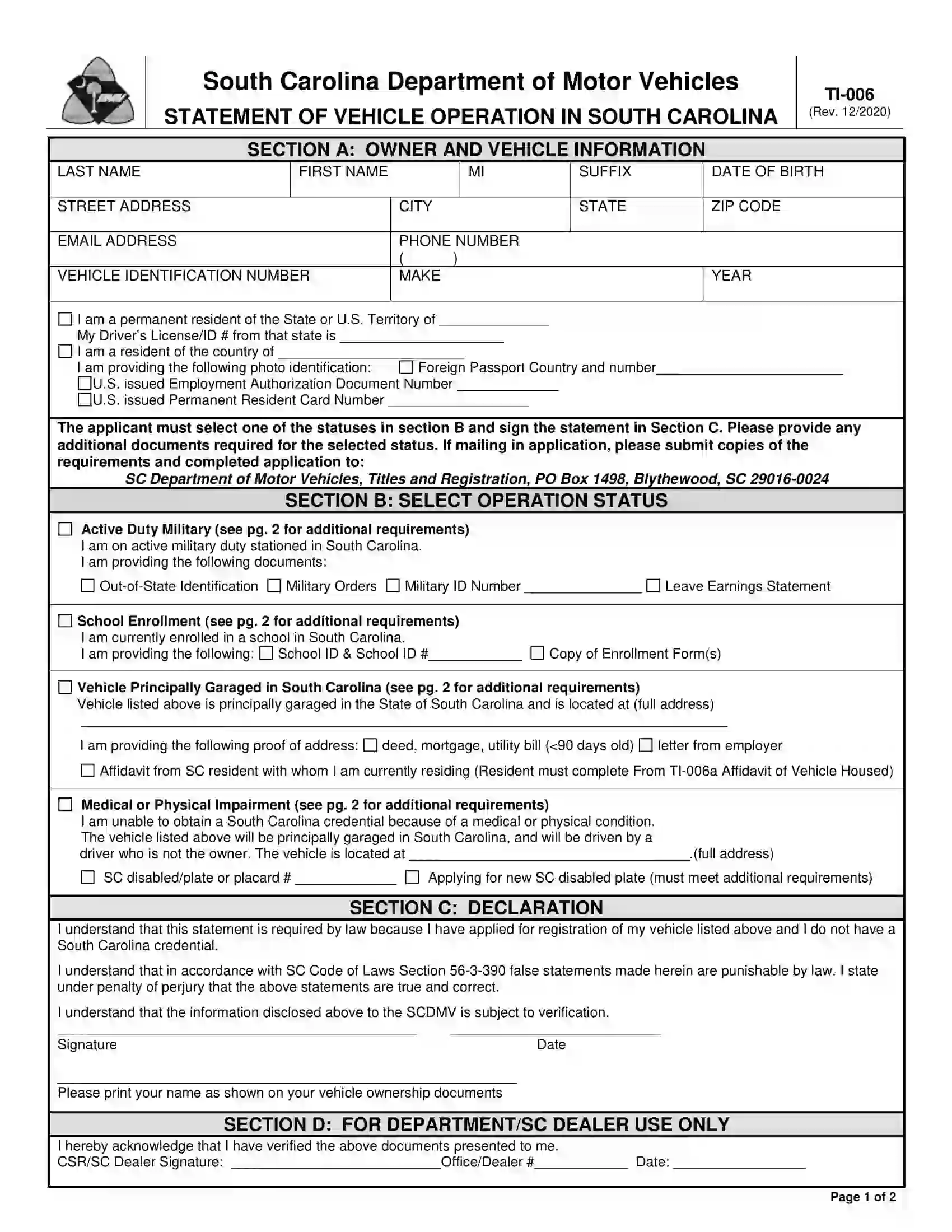

- Completed Statement of Vehicle Operation in South Carolina (SCDMV Form TI-006) (the document needs to be filled out by those who don’t have an active SC driver’s license)

The registration fees for a new vehicle in South Carolina include a standard $40 fee for passenger cars, a titling fee of $15, a discounted fee for people older than 64 ($38), and a $36 fee for older adults (65+ years old) having a disability. Electric vehicles are charged at a rate of $120 in addition to the regular registration fee, while hybrids require an extra fee of $60.

Besides the standard registration fees mentioned above, the new owner of a motor vehicle should cover the gross vehicle weight (GVW) fee starting at $46 for a vehicle weighing 1-4,000lbs and ending at $116 for a vehicle weighing 9,001-10,000 lbs.

SC DMV also imposes late registration penalties for those who have failed to complete the registration process in due time. In this way, a delay of 15 days (registration in 46-60 days after the purchase) is punishable with a $10 penalty, 61-75 days after the purchase – with a $25 penalty, 76 to 135 days – with a $50 fine and a delay of over 135 days – with a $75 fee.

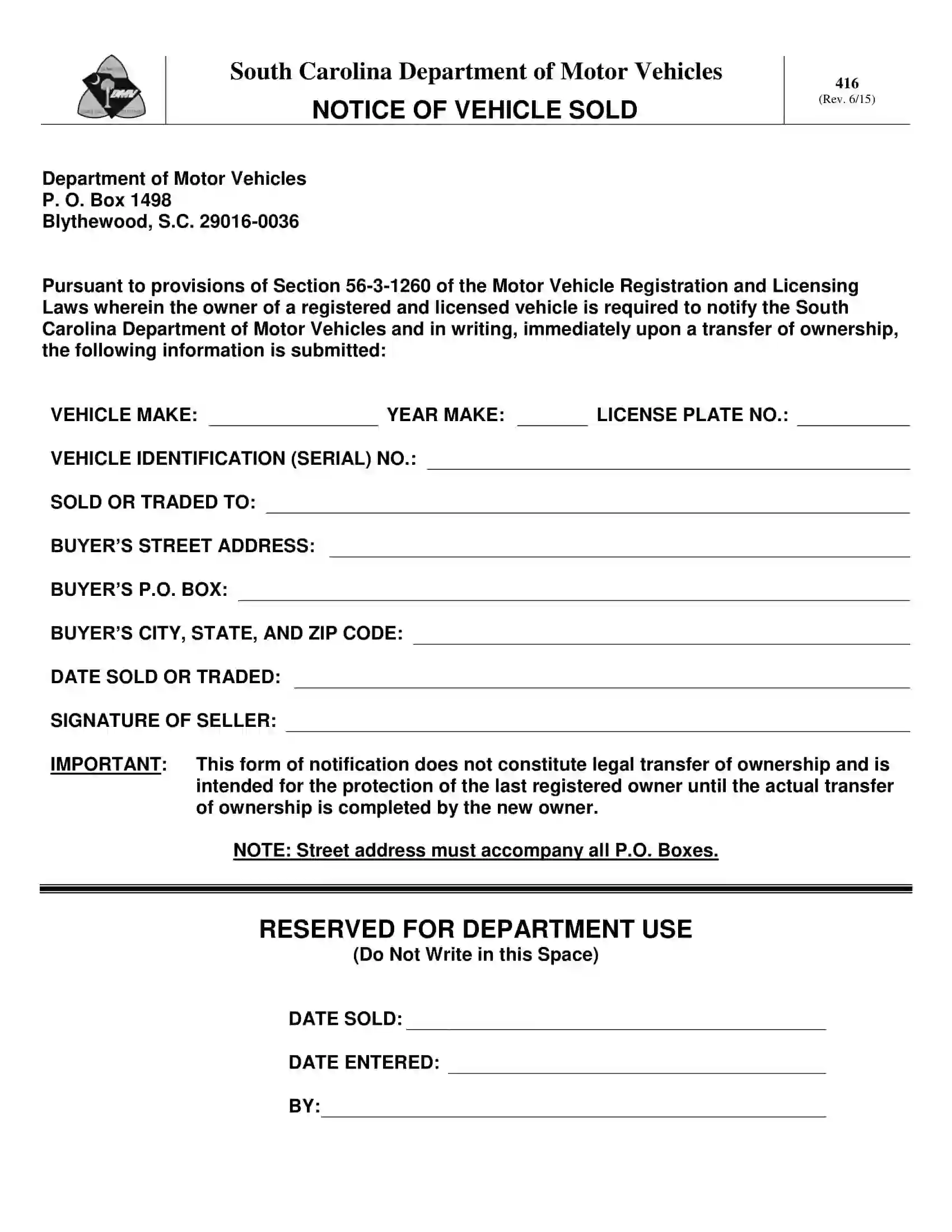

Relevant Official Forms

A South Carolina Title Application for a Motor Vehicle (Form 400) is submitted when a person needs to register a vehicle and obtain a title.

Application to Issue or Replace 45-Day Temporary Plates (Form 45-A) is used to apply for a temporary license tag to drive while the vehicle registration is in progress.

Form TI-006, known as Statement of Vehicle Operation in South Carolina, is required to be submitted along with the application for title and/or registration.

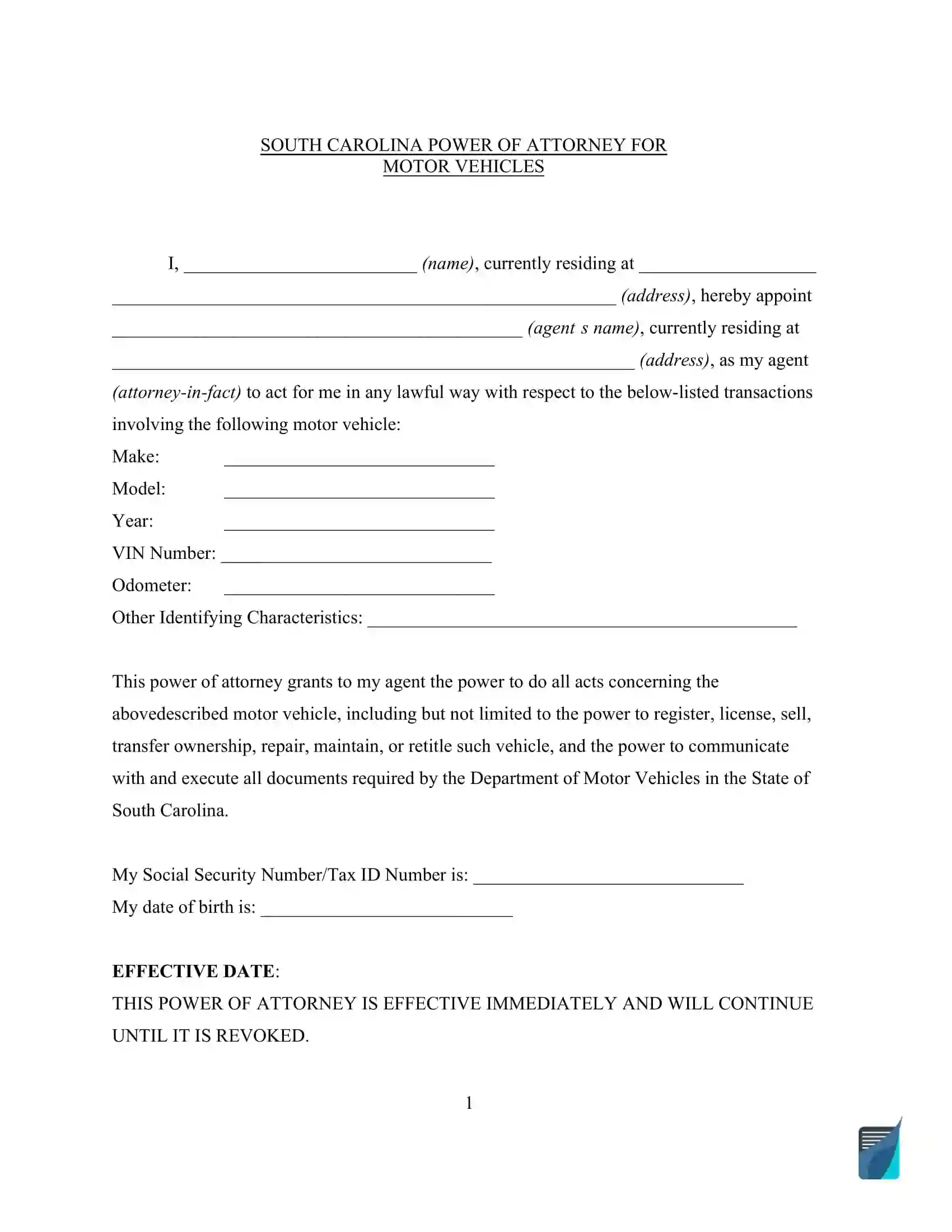

A motor vehicle power of attorney is used to designate a representative who will manage all the affairs concerning a vehicle on behalf of the owner.

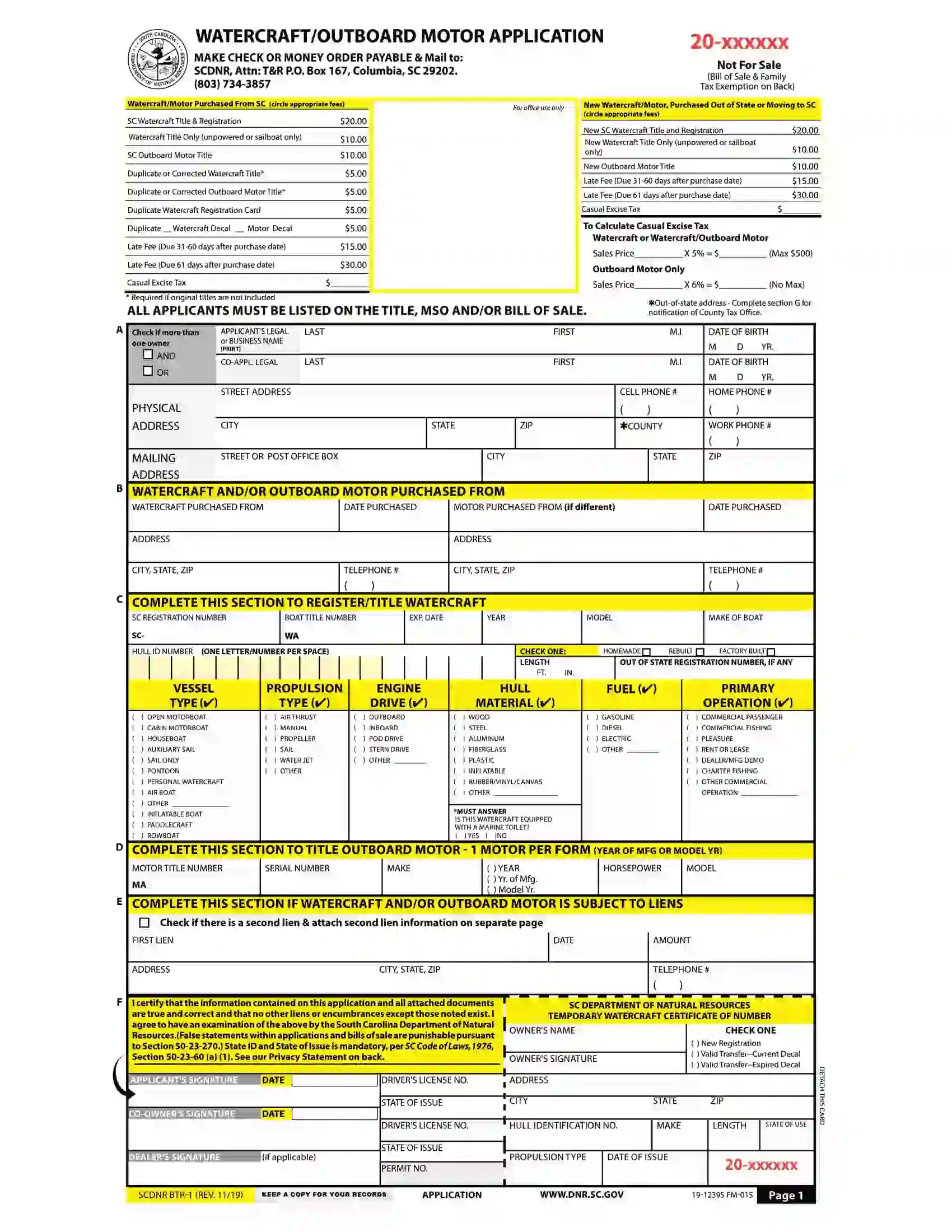

Form FM-015, known as Watercraft Motor Application and Bill of Sale, is used to record the transaction between a seller and buyer and apply for a boat title.

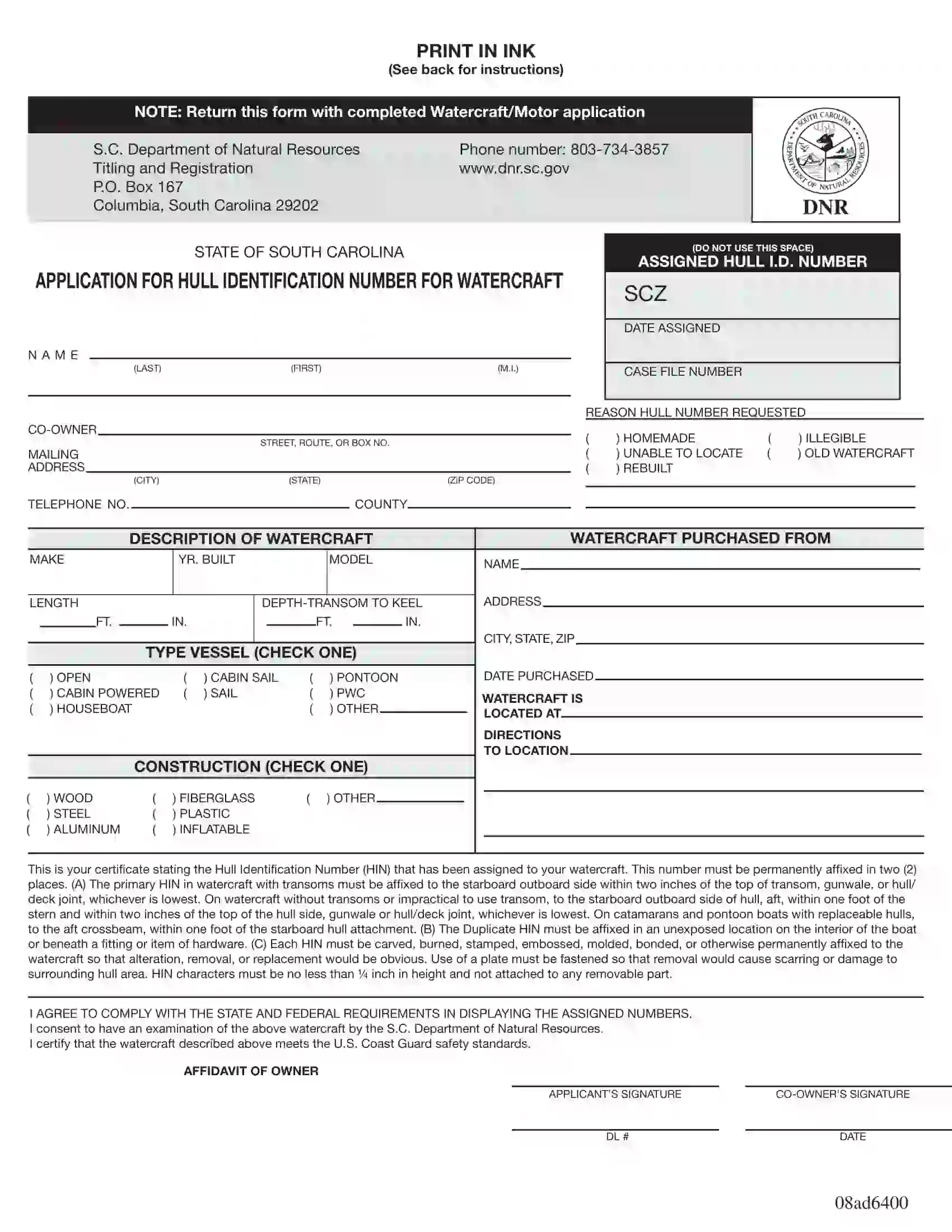

Application for Hull Identification Number for Watercraft can be used to obtain a hull identification number (HIN), for example, if a person buys a homemade watercraft.

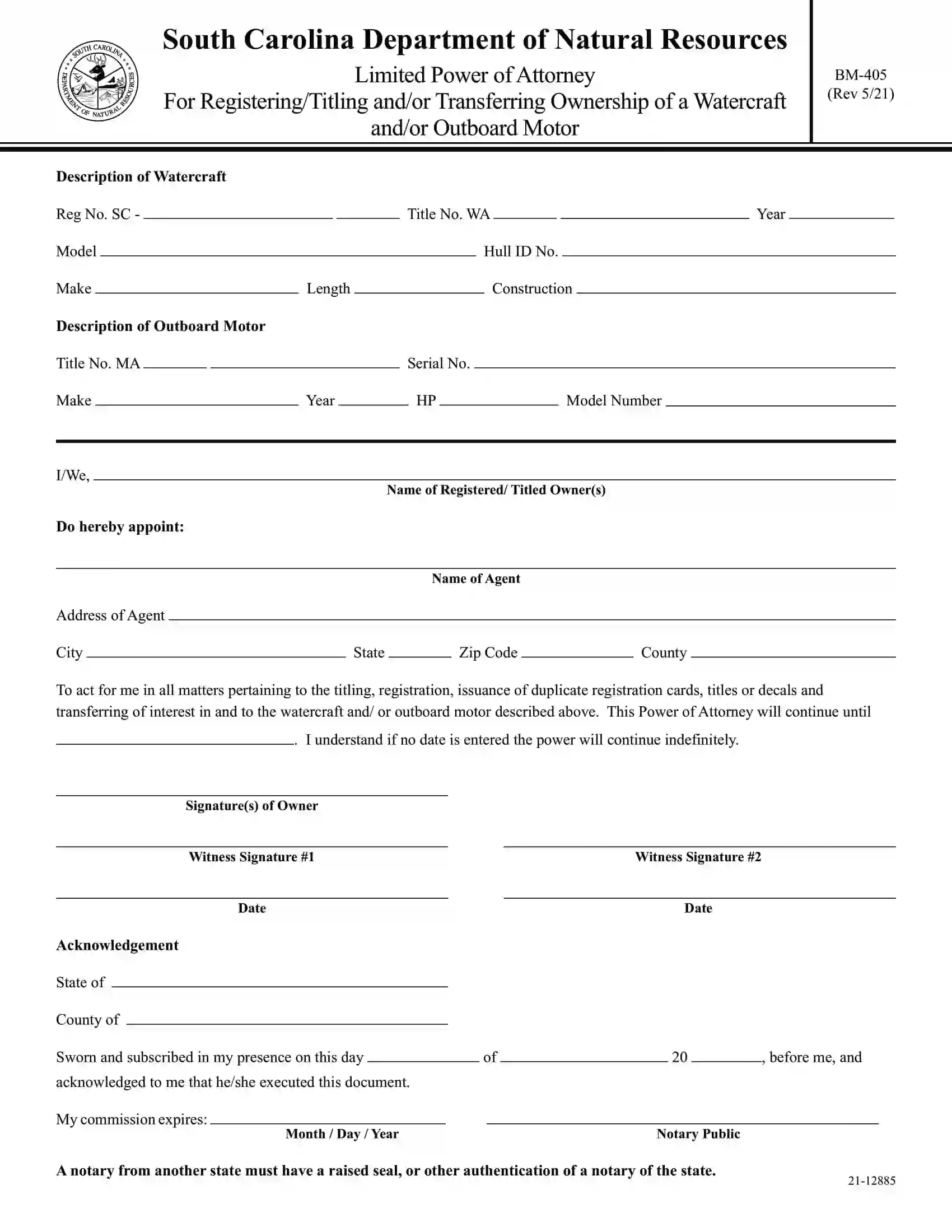

A limited power of attorney (Form BM-405) is used for registering, titling, and transferring ownership of a watercraft or outboard motor in South Carolina.

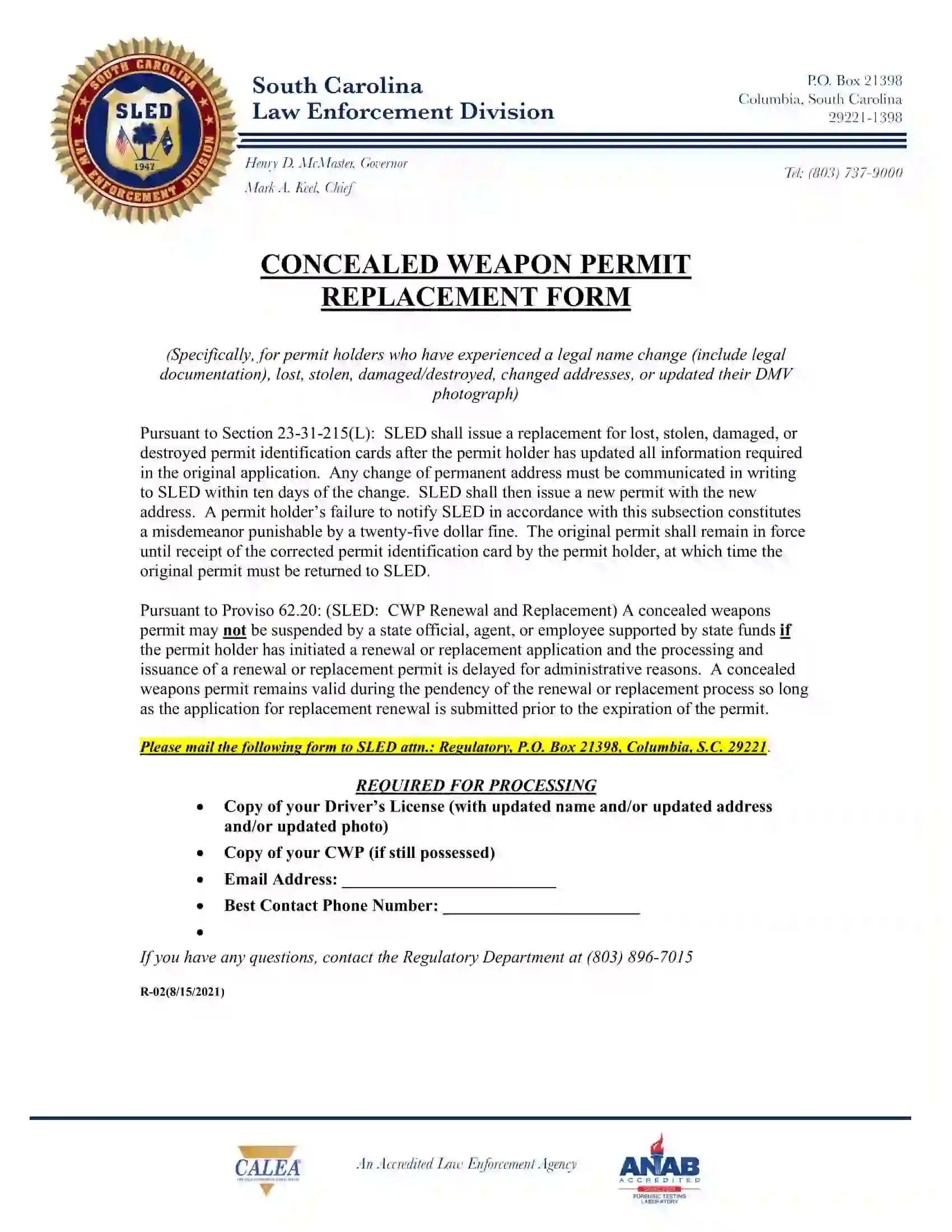

A Concealed Weapon Permit Replacement Form (Form R-02) is designed for permit holders whose permit is lost, stolen, damaged, or destroyed.

South Carolina Bill of Sale Short Video Guide

Other South Carolina Forms