Tennessee Bill of Sale Form

Tennessee bill of sale is a document used when one person sells a specific item, and another person buys it. This form protects both parties from any legal complications that may arise from the transaction.

Our bill of sale templates vary according to the existing types of transactions. You are free to use our customizable documents and create your unique bill of sale in minutes. You can use the official bill of sale document when selling or buying a vehicle in Oregon. The bill of sale indicates the relevant vehicle-related details such as the year of manufacture, its make, model, VIN, and the price at which the deal is set.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | Tennessee Vehicle Bill of Sale Form |

| Other Names | Tennessee Car Bill of Sale, Tennessee Automobile Bill of Sale |

| DMV | Tennessee Driver Services |

| Vehicle Registration Fee | $26.50 (electric car – $100 additionally) |

| Bill of Sale Required? | No |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 22 |

Tennessee Bill of Sale Forms by Type

Certain transactions require particular bills of sale, and it’s vital to understand which of them you can use in Tennessee. Bills of sale differ in line with the sale type and conditions. Whether you complete a specific transaction successfully or not will depend on the chosen bill of sale form.

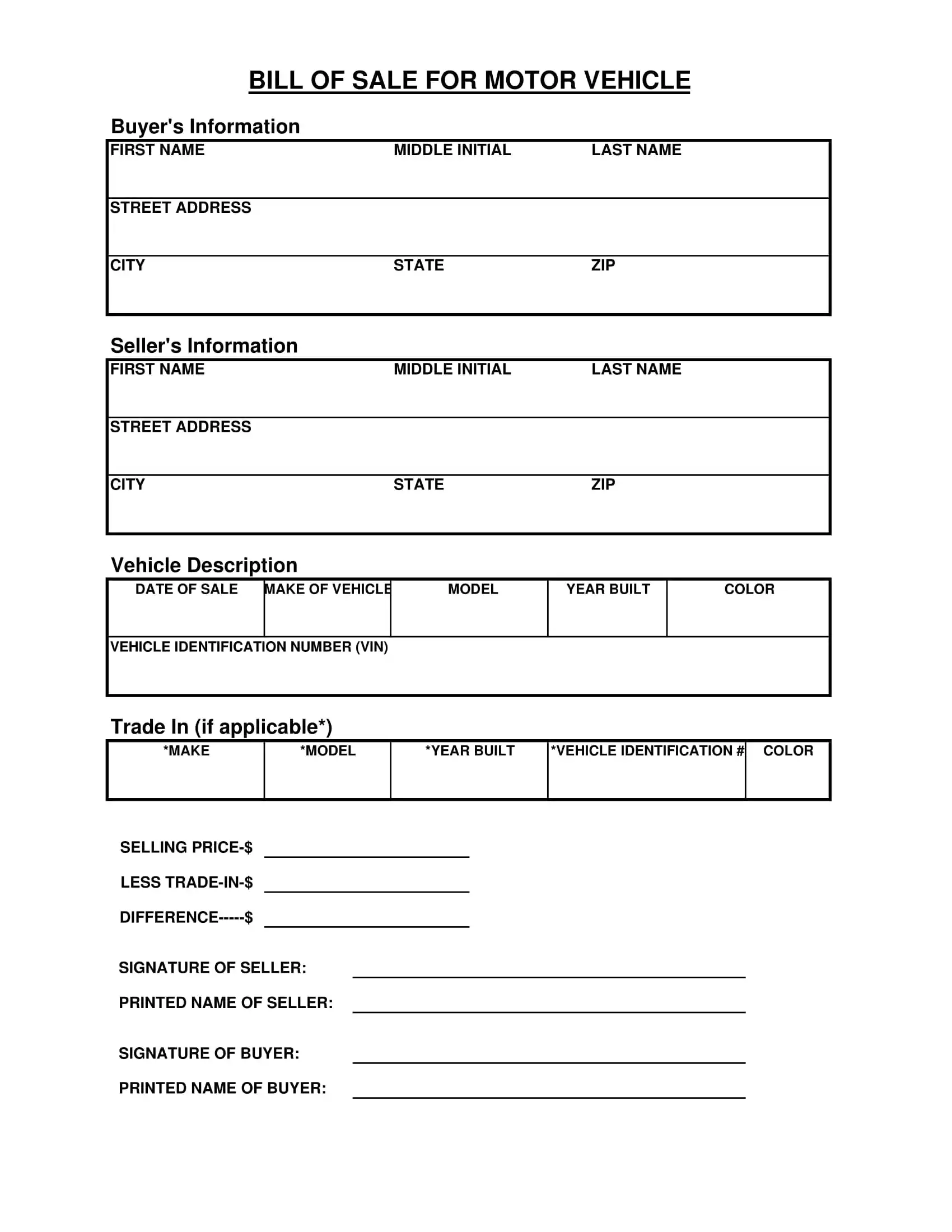

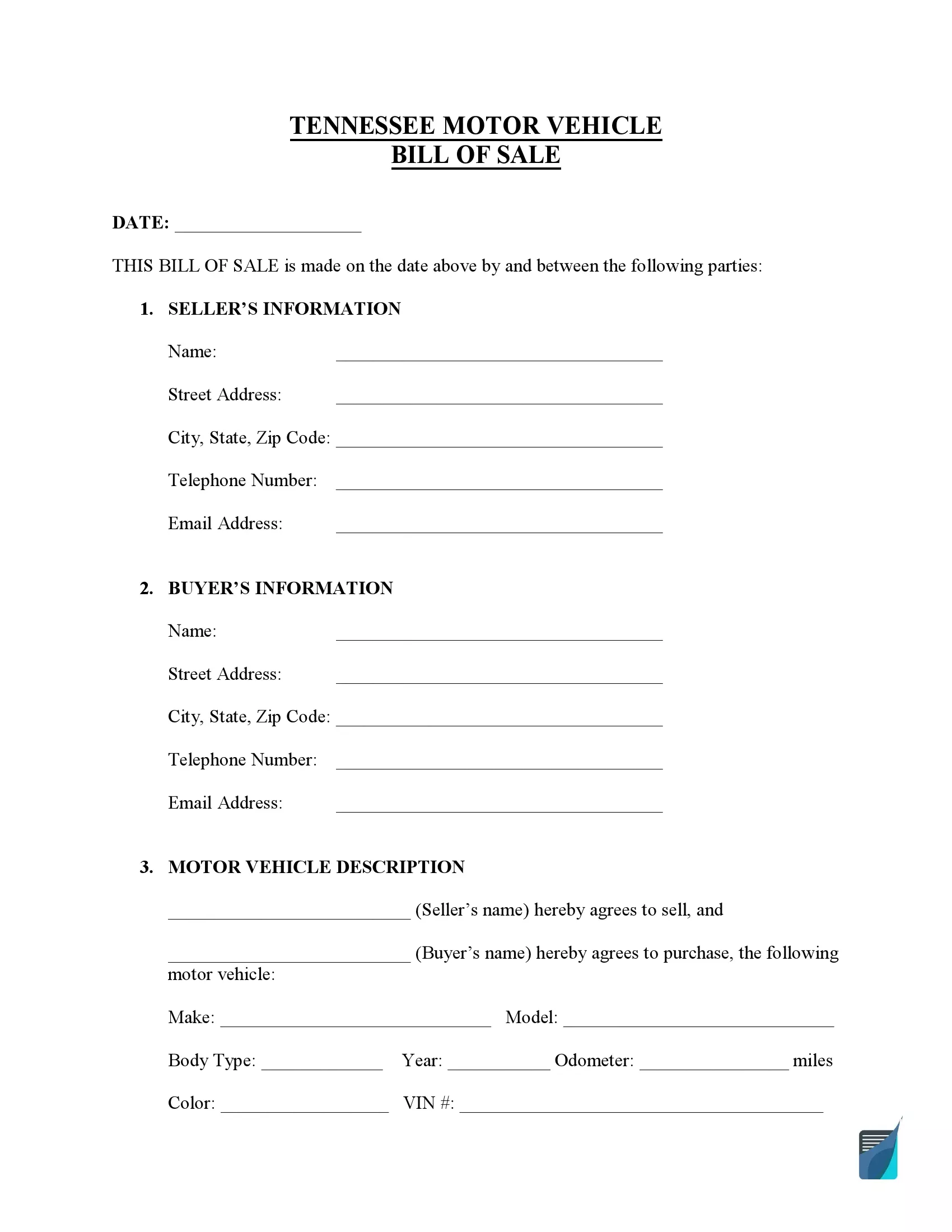

Tennessee motor vehicle bill of sale is an essential legal tool to transfer vehicle ownership from one person to another. Tennessee residents are given 30 days from the purchase or moving to the state to register the motor vehicle. In Tennessee, the vehicle registration fee is about $76, but it’s necessary to consider additional taxes or fees that the local county might charge.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

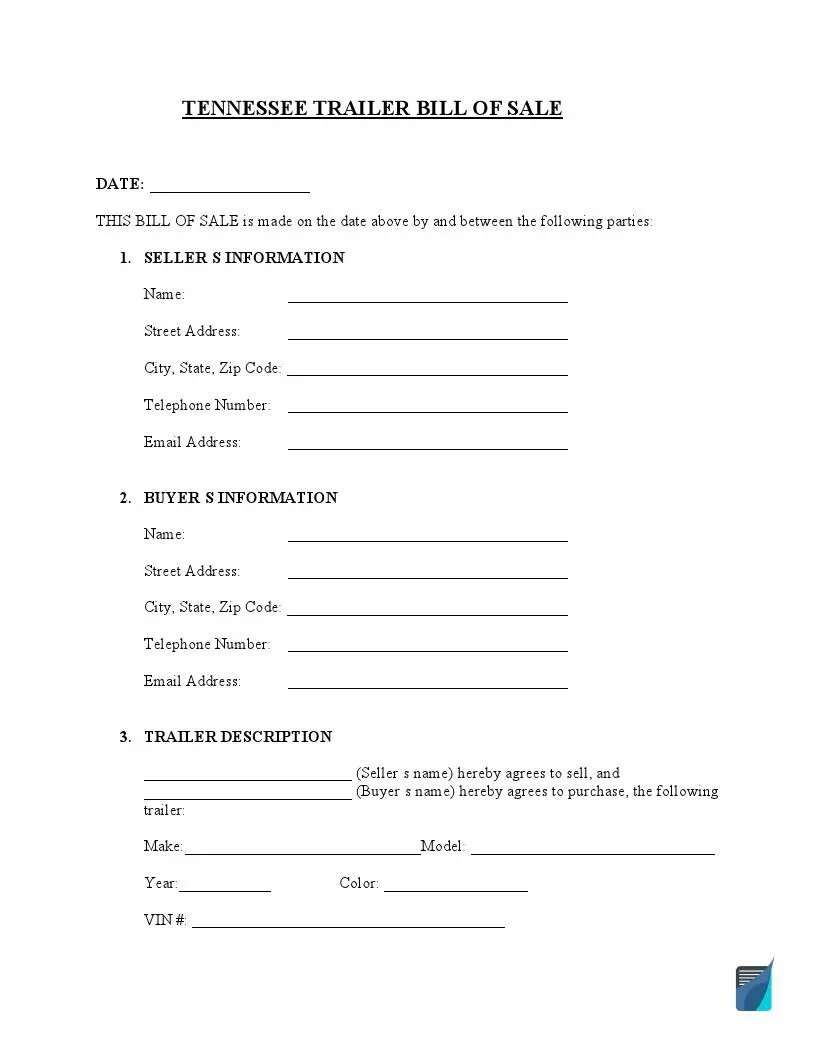

This bill of sale for trailers is used to sell and purchase a trailer in Tennessee. A trailer is attached to a motor vehicle and designed to carry heavy items like boats or huge animals. Trailers cannot operate without motor vehicles. However, you will need to submit a separate bill of sale when registering the trailer with the DMV.

| Alternative Name | Trailer Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

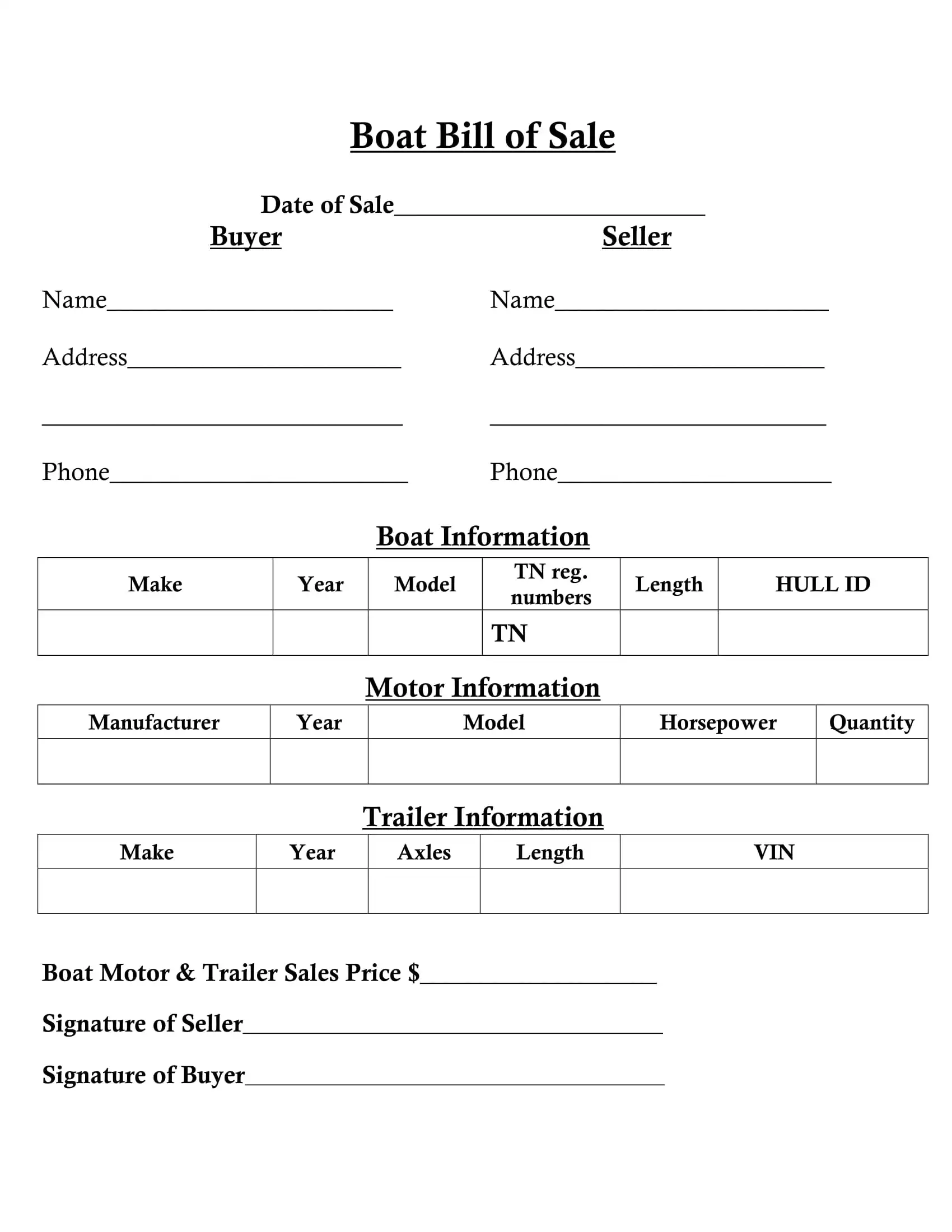

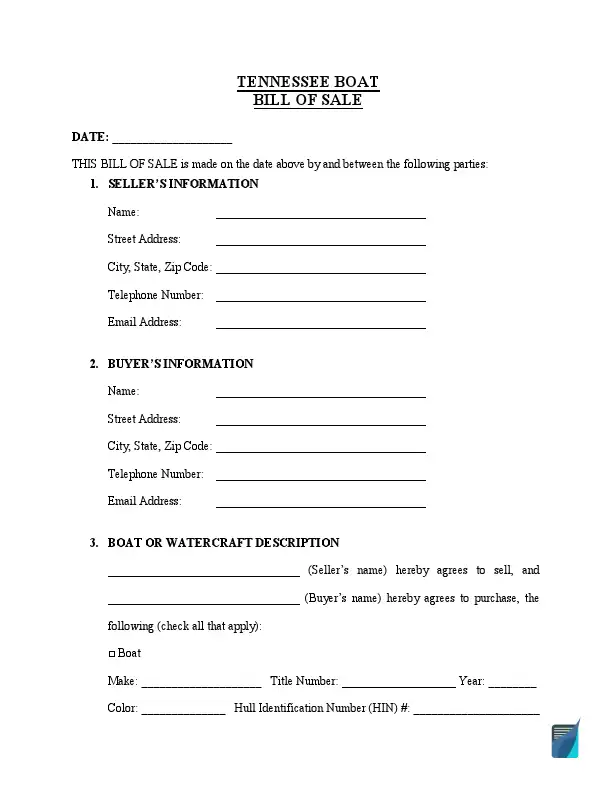

Tennessee boat bill of sale transfers the proprietary rights of one person to another concerning a specific vessel. When applying for a boat registration, you will need to choose the registration period. The validity time of boat registrations in Tennessee ranges from one to three years. All motorboats and sailboats have to be registered in the state of Tennessee.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

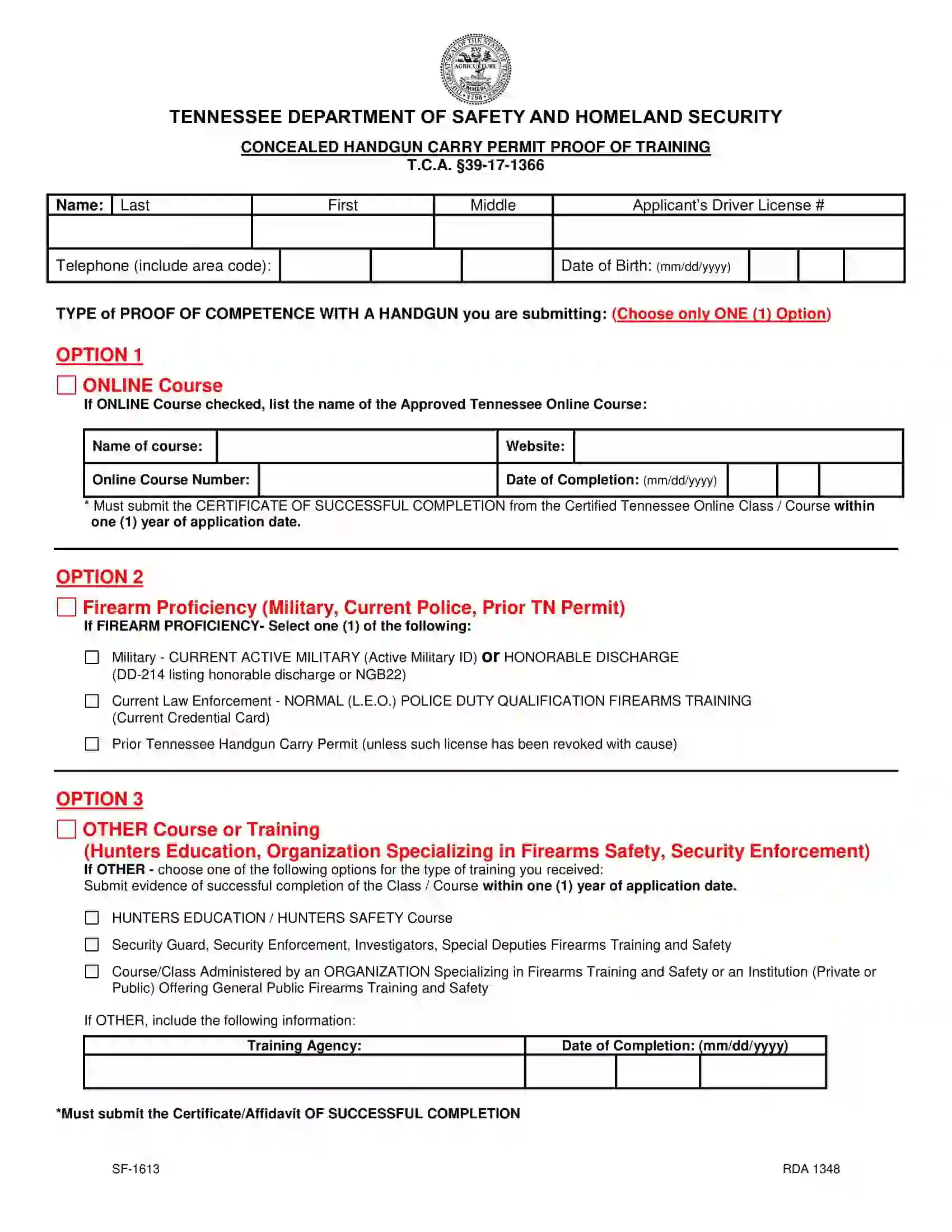

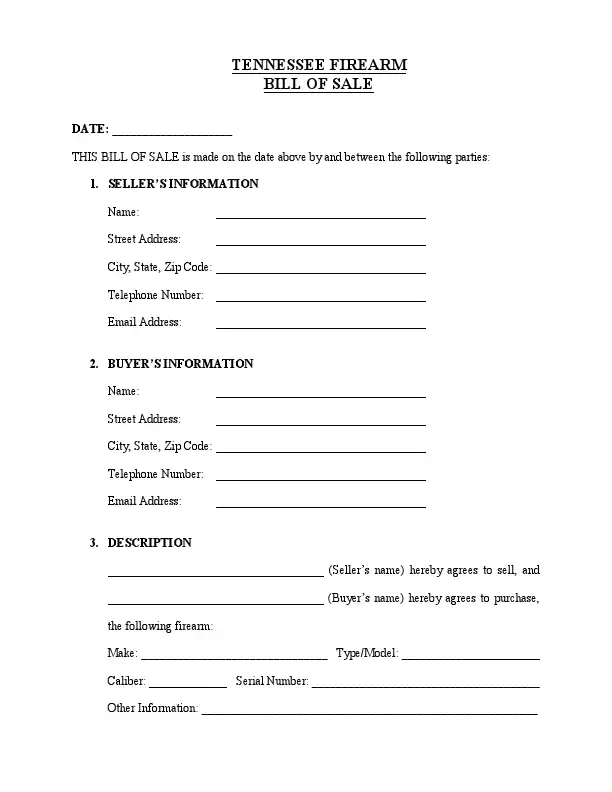

This firearm bill of sale finalizes the sale of a firearm. It records all the transaction details, including the gun’s model, make, caliber, and serial number, as well as the parties’ information and the purchase price. You don’t have to register a firearm if you live in Tennessee. However, an individual must obtain an official permit to carry a gun. Tennessee residents may carry handguns openly in the state, but the latter should be worn in either a hip or shoulder holster.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

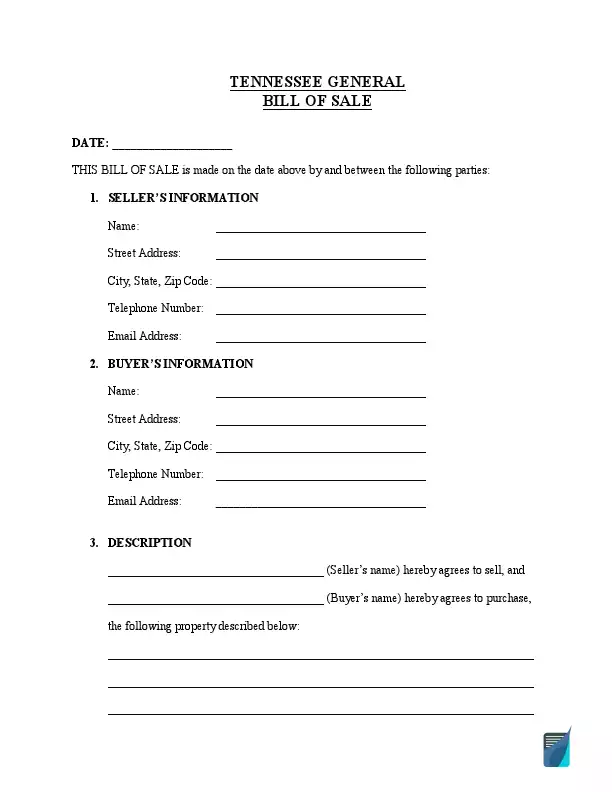

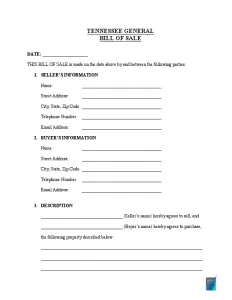

Tennessee general bill of sale serves as an additional level of security when selling or purchasing personal property or equipment. This template comes in handy if there is no specific template available.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

How to Write a TN Vehicle Bill of Sale

Tennessee vehicle bill of sale helps identify the change of vehicle’s ownership and contains the personal data of the seller and buyer. In this way, the parties receive vital legal evidence with all its details properly notarized.

For secure purchases and title transferring, the Tennessee state provides an official template that private individuals may use during title ownership change. Make the following steps to fill out the form with no errors.

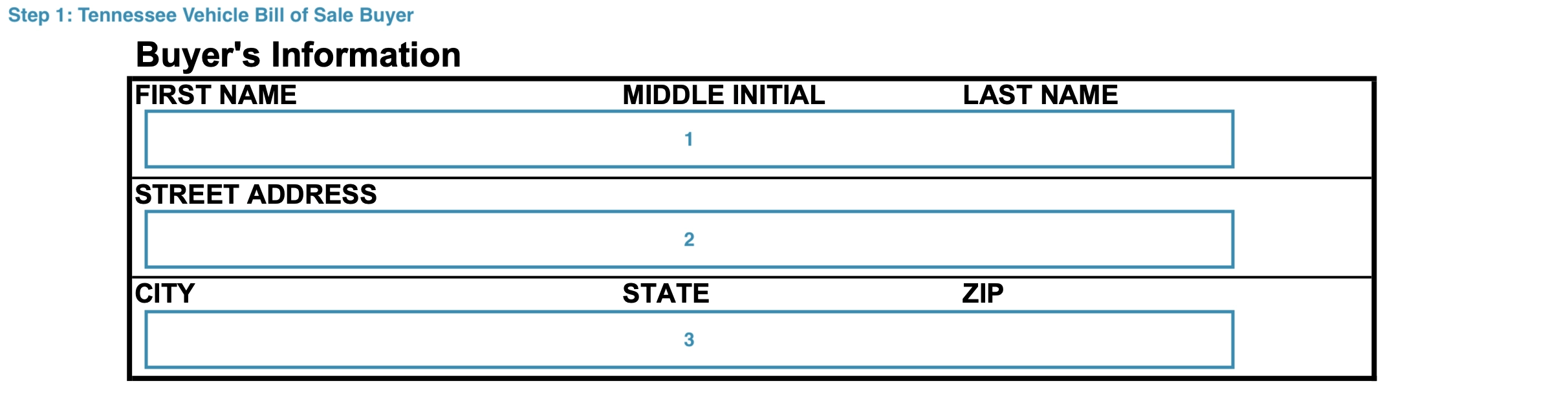

Step 1. Write down the buyer’s information

First, you must specify the buyer’s name and contact details, including:

- Full Legal Name

- Street Address

- City, State, Zip Code

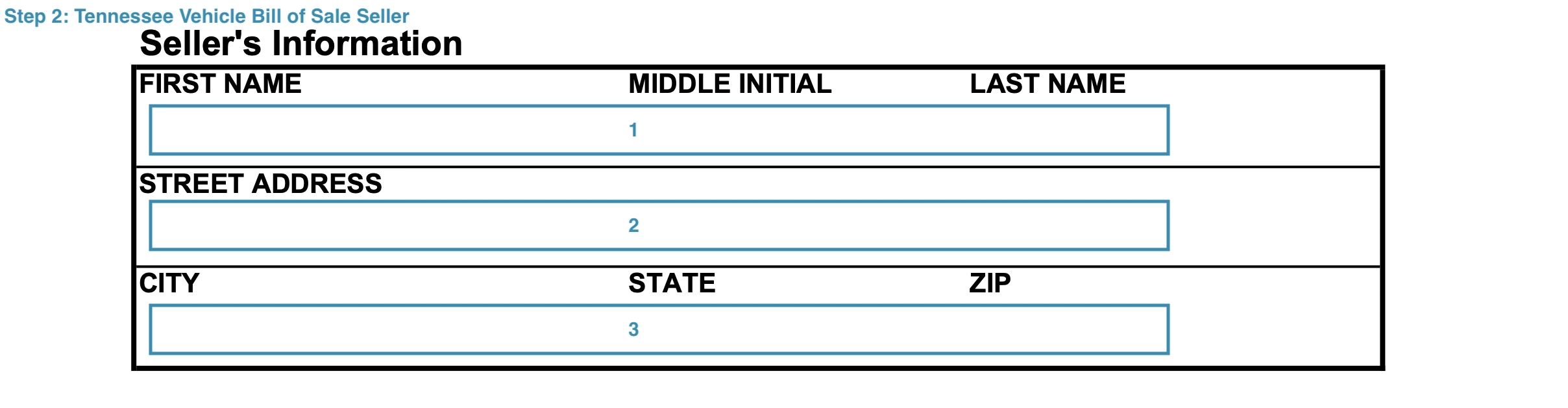

Step 2. Type in the information about the seller

The next step is to include the seller’s details, such as:

- Full Legal Name

- Street Address

- City, State, Zip Code

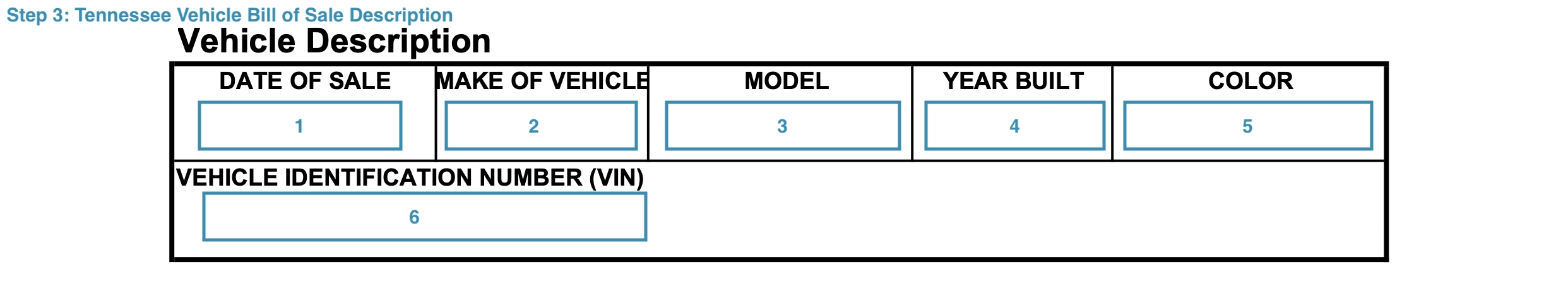

Step 3. Specify the details about the vehicle

This section is devoted to the vehicle description. It must be very detailed and include the following:

- Date of Sale

- Make of Vehicle

- Model

- Year of production

- Color

- Vehicle Identification Number (VIN)

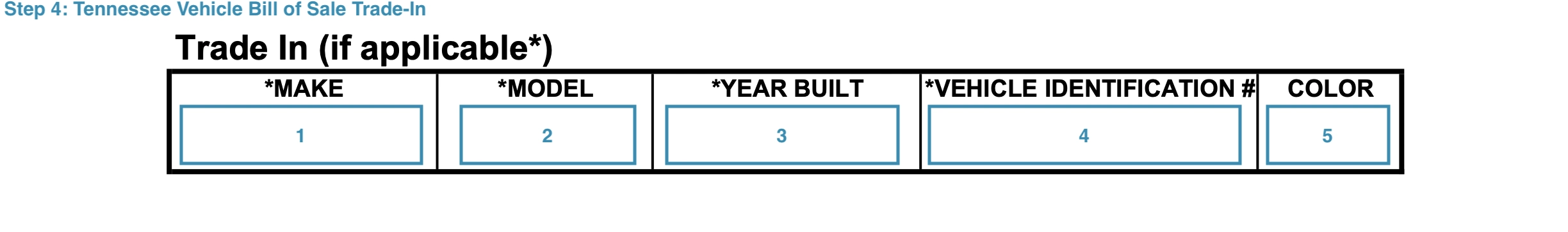

Step 4. Specify the trade-in

If you are trading in one vehicle for another, provide the information about the trade-in:

- Make of Vehicle

- Model

- Year of production

- Vehicle Identification Number (VIN)

- Color

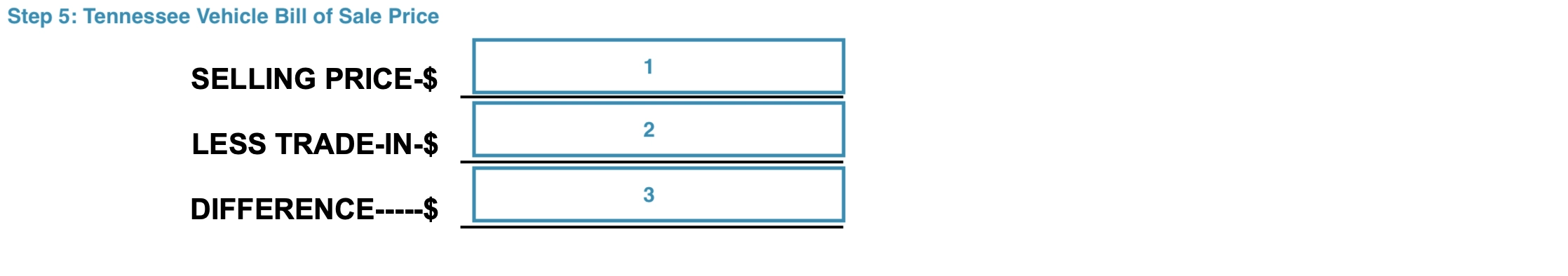

Step 5. Type in the selling price

If it’s a trade-in transaction, include the difference of selling price and less trade-in.

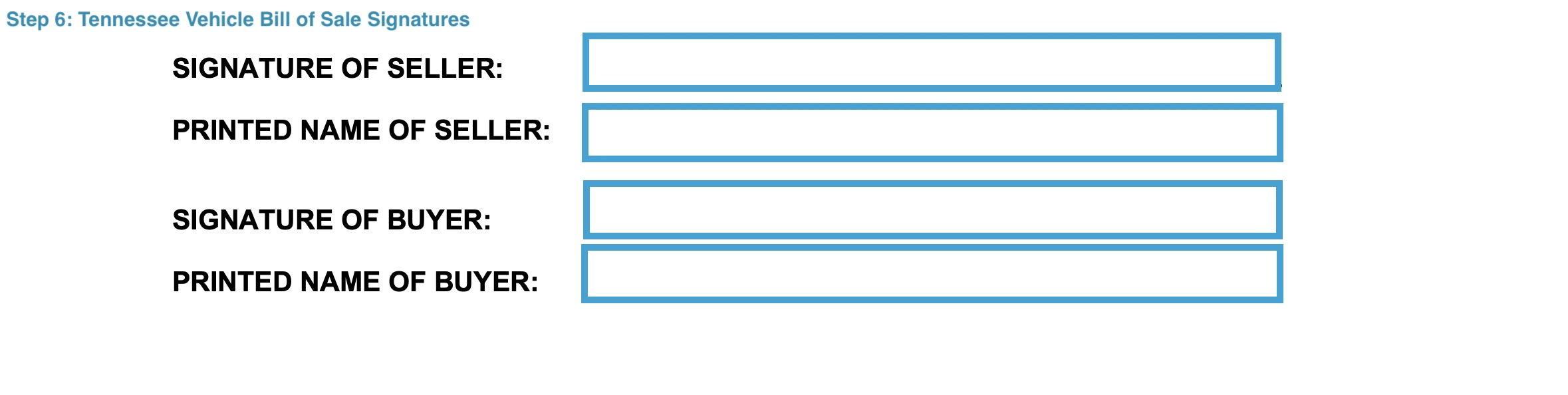

Step 6. Provide the parties’ signatures

Both seller and buyer need to sign this document to make it valid. The notarization isn’t necessary but is possible if any party requires the presence of a notary public.

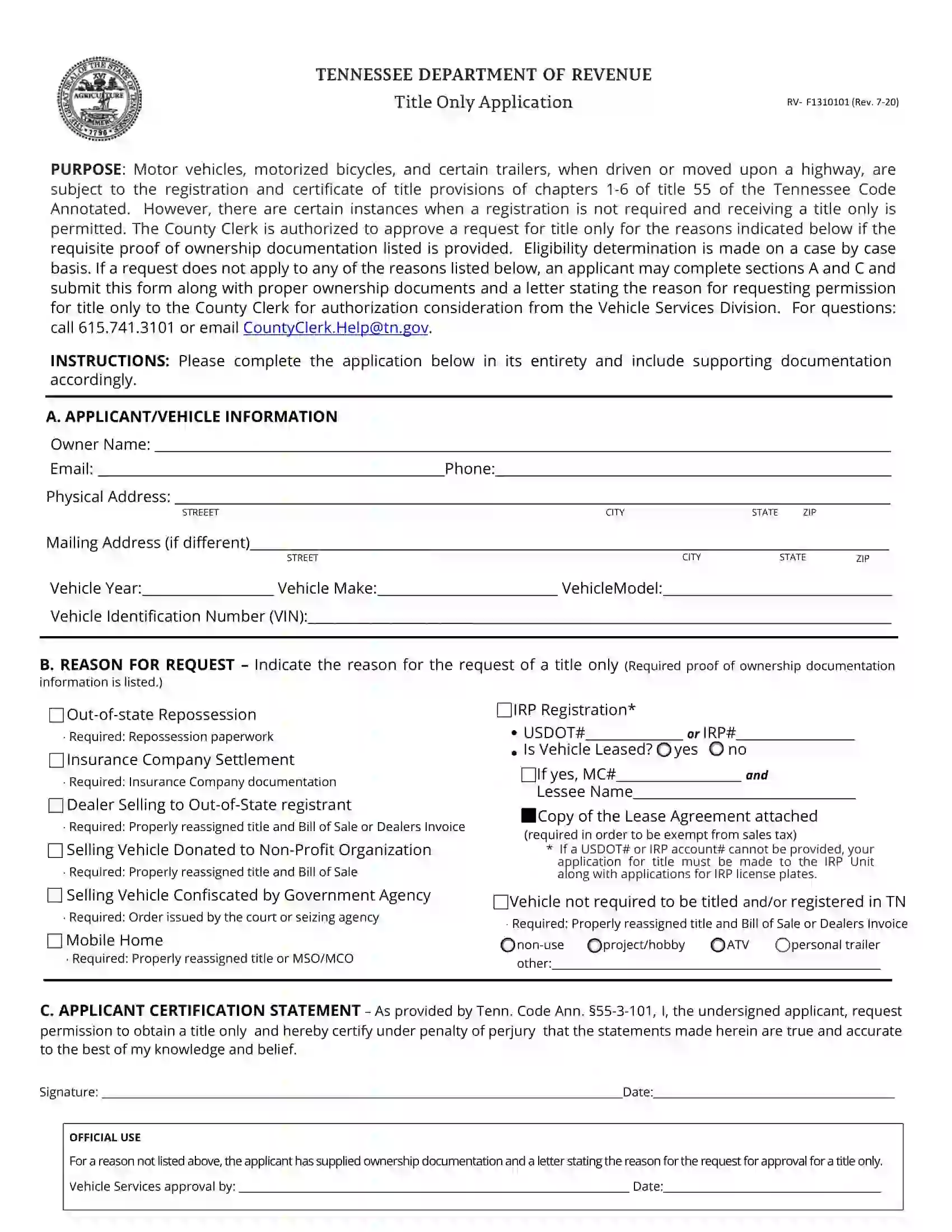

Registering a Vehicle in Tennessee

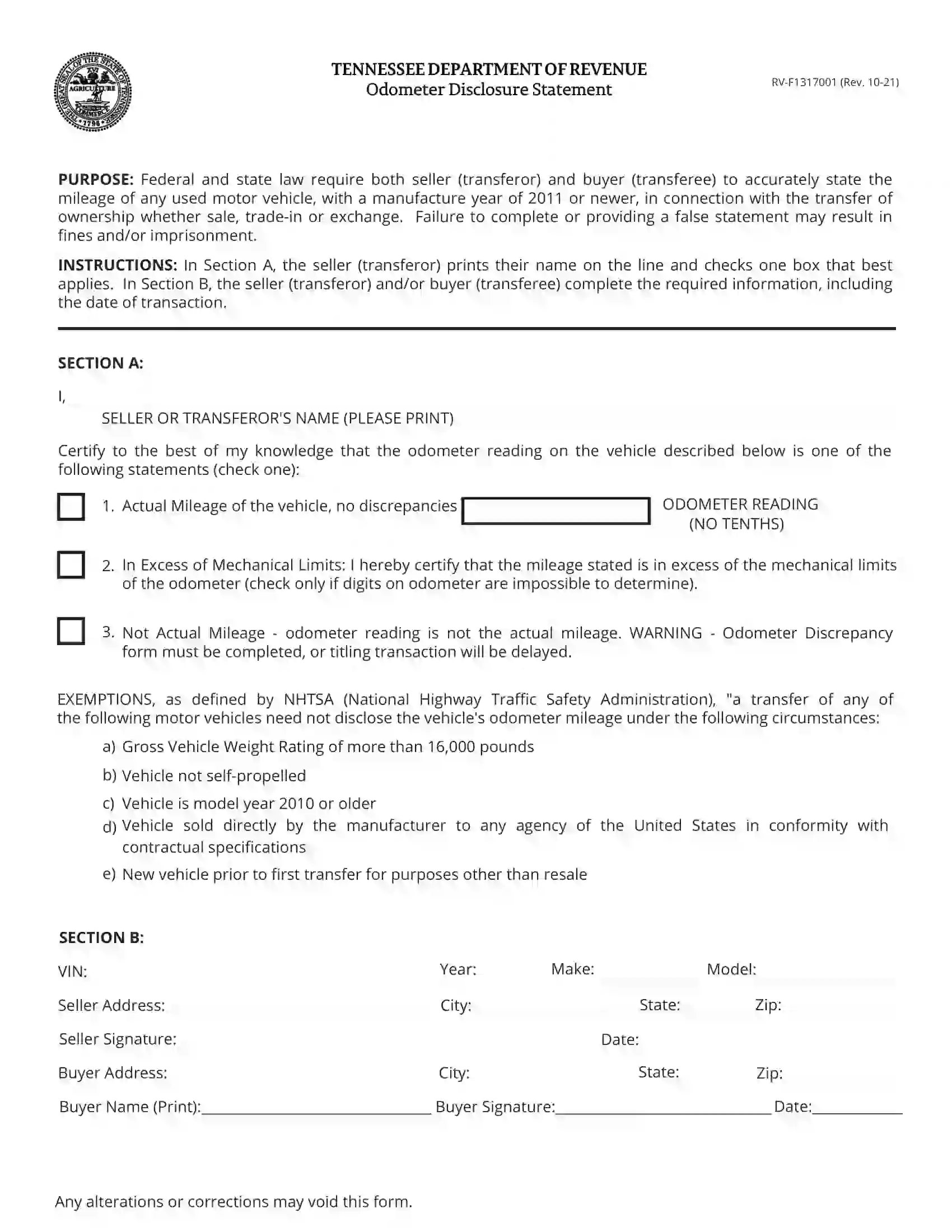

All new and used vehicles must be registered by their new owners at the local county clerk’s office. This rule applies to both private and commercial motor vehicles. The title, identification, residency documentation, odometer disclosure statement (if required), and payment of all relevant registration costs are all required for Tennessee residents to register their cars. They can obtain a temporary permit to drive, giving them time to collect the necessary documentation. The new vehicle owners need to collect and submit the following documents to complete the registration:

- Personal ID

- Proof of residence

- A valid certificate of title signed over by the previous owner to the new one

- Odometer disclosure statement (applicable for the motor vehicles less than 10 years old)

- A motor vehicle bill of sale

- Copy of current registration (for situation in which the new vehicle’s owner wishes to transfer an existing plate to it)

- Affidavit of non-dealer transfers (the document should be completed and filed by the person to whom a motor vehicle was gifted, sold at a suspiciously low price, or given to them as a lineal relative).

The new owner should also provide sufficient evidence of paying all taxes and fees for the vehicle’s acquisition. In the state of Tennessee, such purchases are subject to a sales or use tax. The maximum at which the tax is set equals $36 on the first $1,600 of the car’s purchase price (which is the city or county sales tax). A single article tax equals 2.75% of the entire car price but no more than $3,200.

Personal vehicle registration in Tennessee is charged at $26.50 per personal vehicle. Commercial vehicles are subject to stratified fees, with a vehicle with less than 7 seats subject to a $49.88 fee, with 7-15 seats – to a $99.38 fee, with up to 25 seats – to a $165.38 fee, all up to $330.38 for a commercial motor vehicle withy 35+ seats. Semi-trailers and tractor trailers are charged $20.

Those who import a motor vehicle from another country need to provide Form HS-7 Declaration and a photo of the vehicle’s Federal Motor Vehicle identification number in addition to the documents mentioned above.

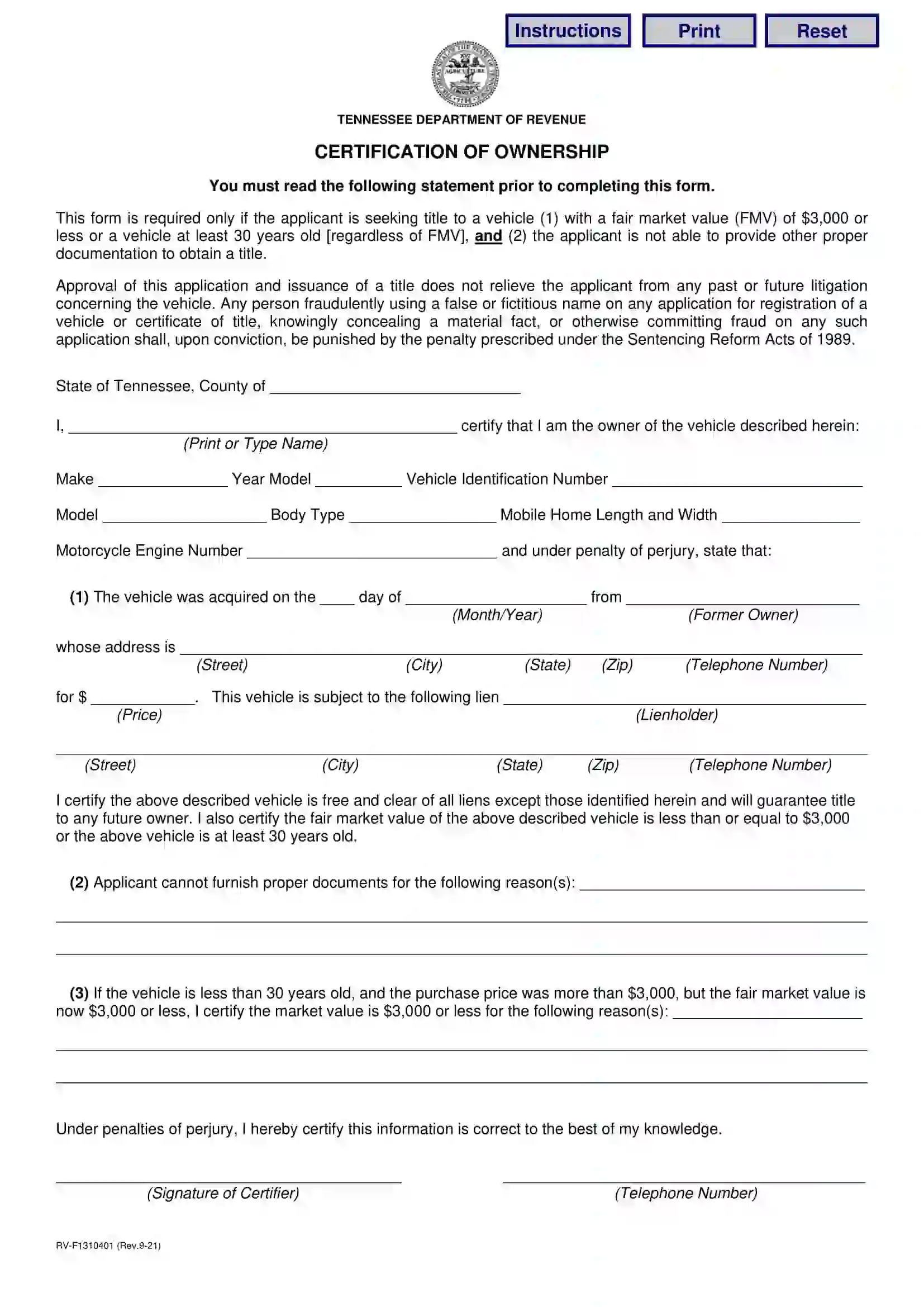

Relevant Official Forms

Form RV-F1310401 or Certification of Ownership is used when it’s impossible to provide other proper documentation to obtain a title.

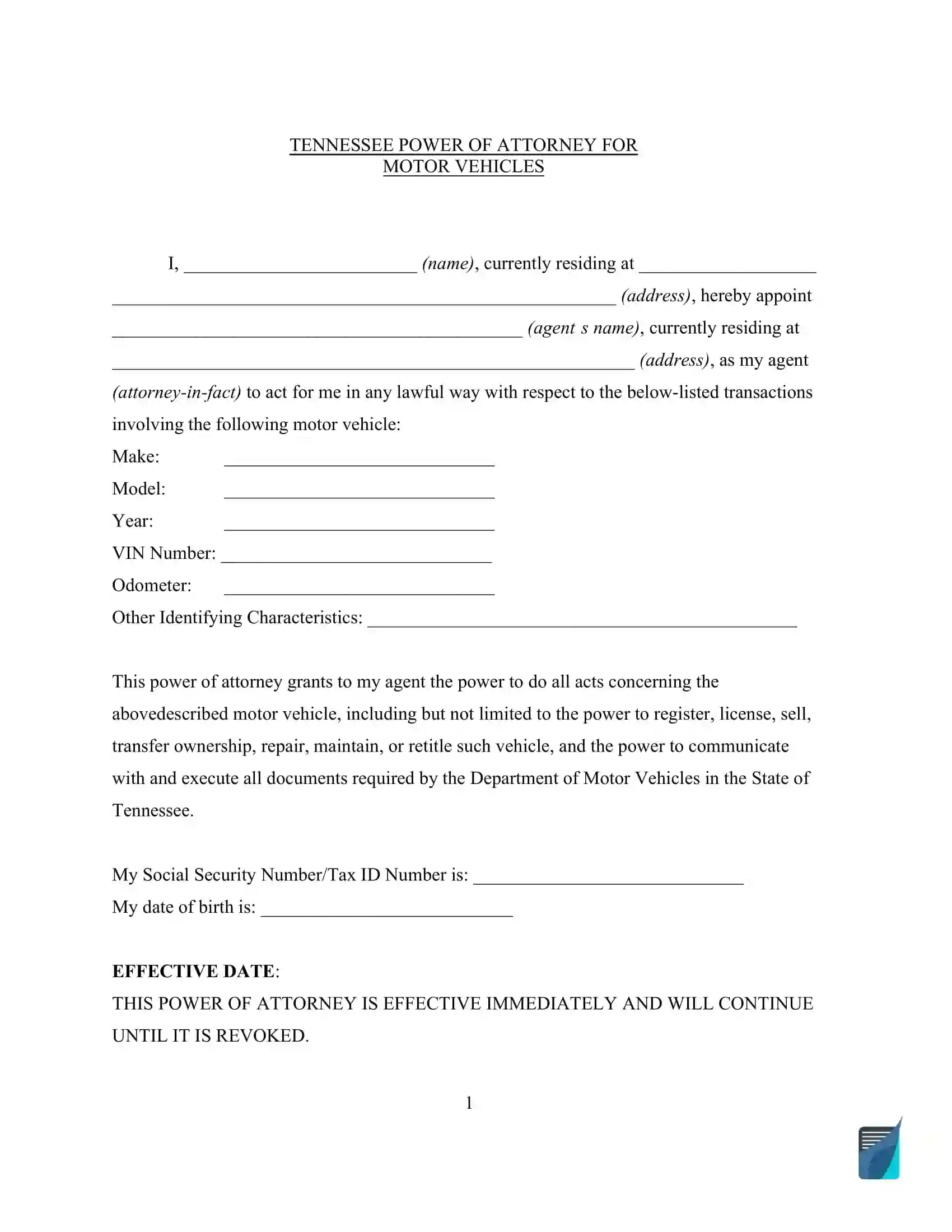

A vehicle power of attorney is a legal document allowing a person to appoint someone else to handle the matters concerning the vehicle.

Short Tennessee Bill of Sale Video Guide

Other Tennessee Forms

Other Bill of Sale Forms by State