Nebraska Last Will and Testament Form

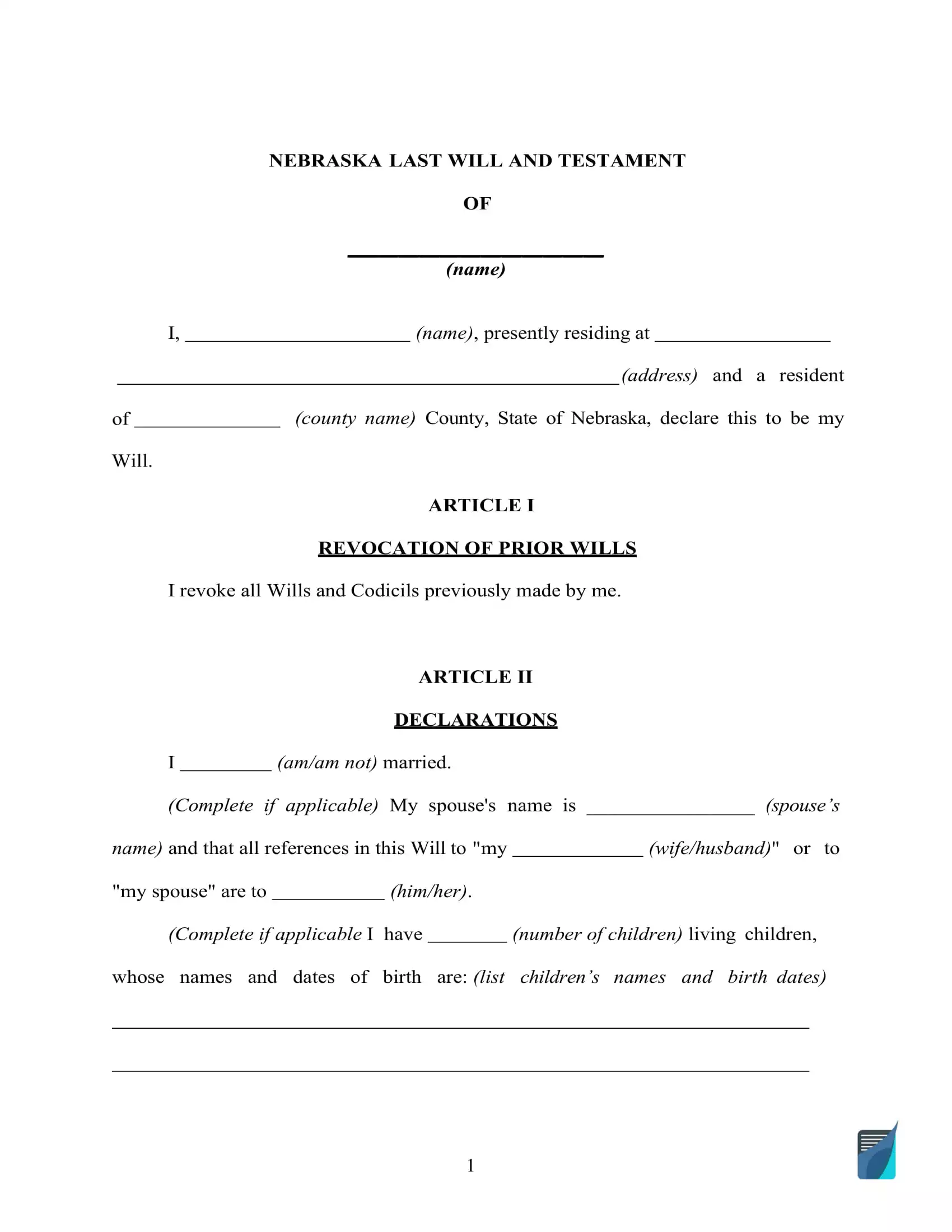

A Nebraska last will and testament is a legal instrument that contains the detailed instructions of an individual creating the will (testator) pertaining to their estate distribution in the event of their death, which must be written in the way prescribed by the state’s law.

Making a last will and testament is a smart choice for just about anyone who would like to avert disputes and misunderstandings regarding their property and is an essential estate planning tool.

In case you are in search of a fillable Nebraska will template, you’ll find one below in two formats: PDF and DOCX. Besides that, you can check the requirements and relevant laws in this state, along with some general writing tips.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Nebraska Will Laws and Requirements

| Requirements | State laws | |

| Statutes | Chapter 30 – Decedents’ Estates; Protection of Persons and Property | |

| Definitions | 30-2209. General definitions. | |

| Signing requirement | Two witnesses | 30-2327. Execution |

| Age of testator | 18 or older | 30-2326. Who may make a will |

| Age of witnesses | 18 or older | 30-2330. Who may witness; interested witness; intestate share |

| Self-proving wills | Allowed | 30-2329. Self-proved will |

| Handwritten wills | Recognized if meeting certain conditions | 30-2327. Execution |

| Oral wills | Not recognized | |

| Holographic wills | Recognized if meeting certain conditions | 30-2328. Holographic will |

| Depositing a will | Possible with a Nebraska County Court ($2 fee) | 30-2355. Deposit of will with the court in testator’s lifetime |

How to Prepare a Nebraska Last Will

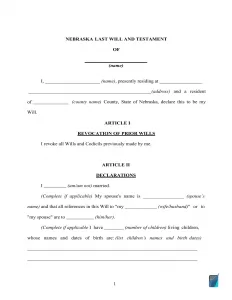

1. Indicate your details (if you are the one creating a will). Establish the testator and their details: full legal name and address (city, county, and state). Go over the remaining portion of the passage, including the details you’ve entered.

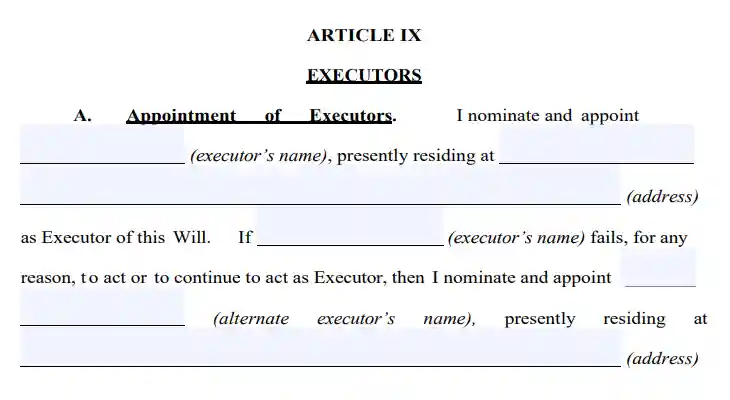

2. Choose the executor (personal representative). Choose the executor of your estate and indicate their details: full name and place of residence. It is advised to select someone who resides in the same state the testator lives in.

Note: an executor must be at least 19 years old in Nebraska. (30-2412)

It might be wise to appoint an alternative person to act as an executor in the event the first one is unwilling or incapable of carrying out your will.

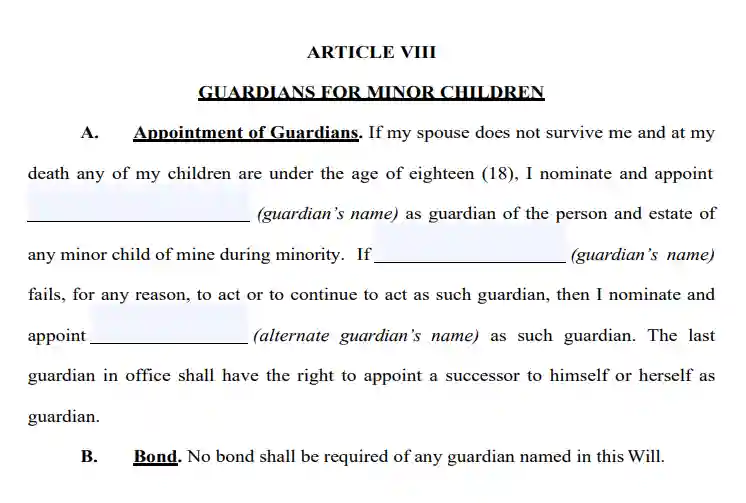

3. Determine the guardian (optional). Should you have underage or dependent children and don’t wish the court to choose a guardian for the kids when you’re no longer here, it is possible to select a friend or acquaintance as a guardian for your children.

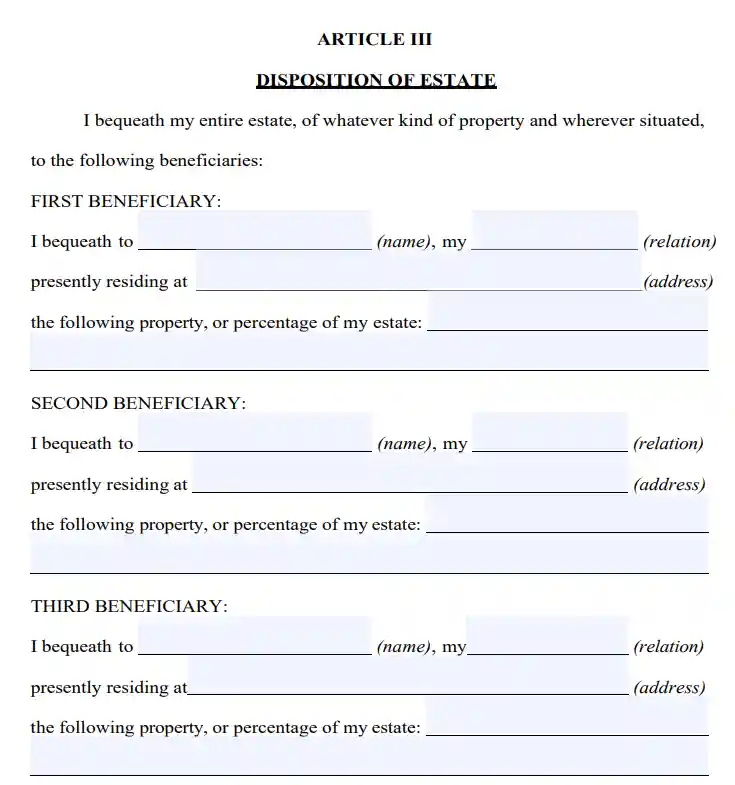

4. Indicate your beneficiaries (heirs) and assign your property accordingly. At this stage, you must specify those who are going to inherit your property or its part. Enter their full names, places of residence, and your relationship with them (spouse, child, friend, etc.).

In case you’ve got an asset distribution plan that’s different from even, it’s possible to describe it within this section. Keep in mind that joint and living trust property can’t go in your last will.

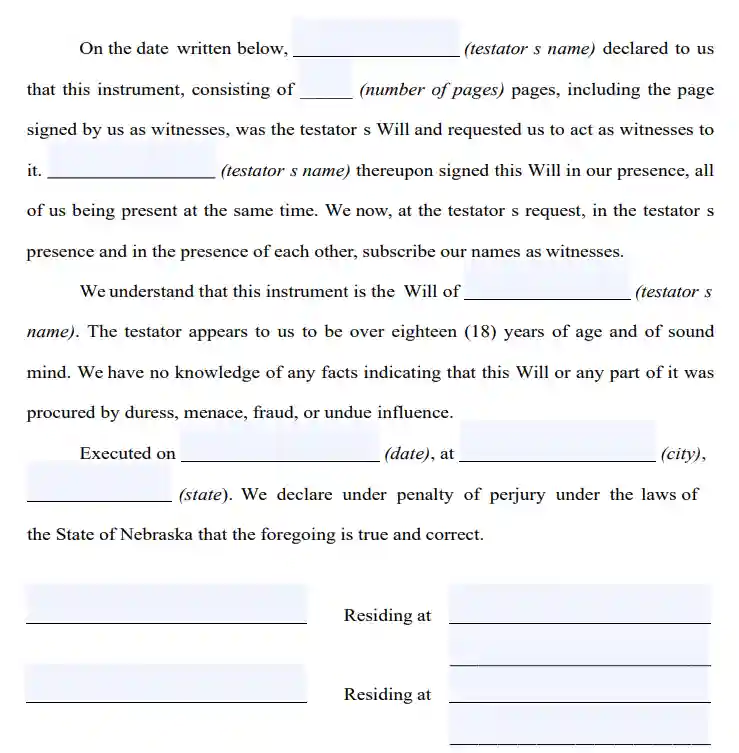

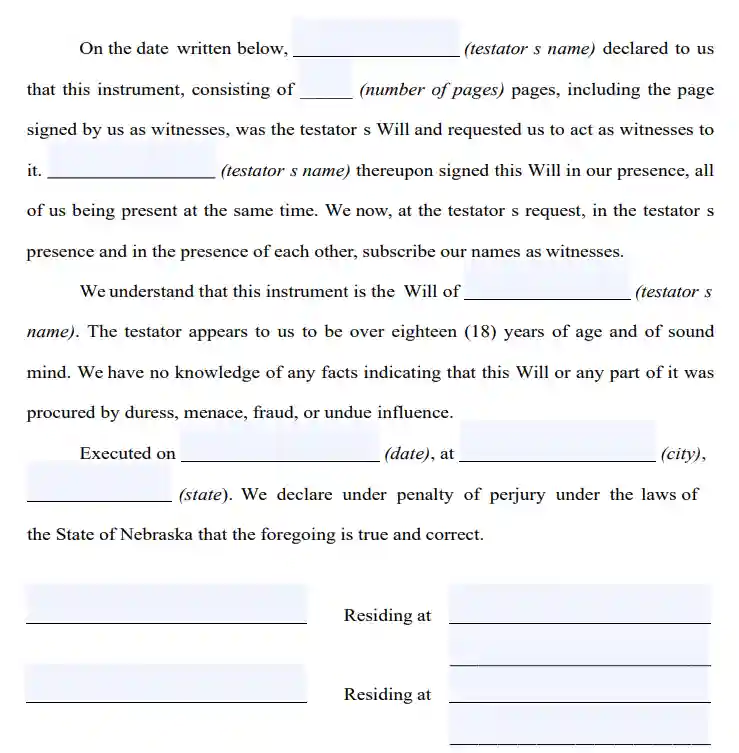

5. Continue with the witnesses signing the document. Nebraska Revised Statutes (30-2327) stipulate that at least two witnesses have to sign a will for it to be deemed valid. Only someone who isn’t your beneficiary (not interested in your estate) and is of 18 years or more could be chosen as a witness. Think about picking witnesses who will likely be present in the event the will is contested in the court or if some other issue takes place. Remember to review every section carefully before finalizing the matter.

Get a Free Nebraska Last Will and Testament

Frequently Asked Questions

Must I notarize my will in Nebraska for it to be valid?

No, according to Nebraska law, a last will can be valid without notarization. But, it is possible to make your will self-proving by attaching an affidavit to it, which will require a notary acknowledgement. Making your last will self-proving quickens the probate and grants one more layer of security in the event the will’s credibility is challenged.

What's better: an attested or holographic last will?

In order to create a holographic will, you’ll have to write the whole thing by hand. Such wills tend to be typically used in emergencies until a typewritten document can be put in place (whether by a legal professional or using a fillable template). Holographic wills can have ambiguous directions and may miss crucial terms, so they are more difficult to put in force and can delay the probate substantially. Hence, it’s usually recommended to either use a template or a document builder if you want to write the will yourself.

What does it imply to be testamentary capable?

The testator has to meet testamentary capacity prerequisites in order to make and change their last will. In Nebraska, to prepare a last will and testament, you have to be of sound mind and 18 years old or more. “Sound mind” signifies that you don’t have any kind of mental illnesses (dementia, senility, insanity, etc.) that don’t allow you to have an understanding of the aftermaths of creating a will or be aware of your property and beneficiaries.

Can you exclude your spouse from a last will?

No, you cannot simply disinherit your spouse in Nebraska because they can renounce what is written in your will and opt for an elective share of your augmented estate, along with some other allowances (see 30-2322 and 30-2324). The only way to influence this is by entering into a prenuptial or postnuptial agreement where your spouse would waiver their right to this elective share.

Is it possible to change my last will in any way without my assent?

No, only you can change or revoke your will. There can be just one situation when another person is permitted to intervene. It is when you are physically unable to sign your own will, a notary public is permitted to do it in your stead yet only with you and two witnesses present and by your direction. The witnesses must also sign along with the notary (see 64-105.02).

| Related documents | Cases when you may want to create one |

| Codicil | You wish to make a single or several slight alterations to your will. |

| Self-proving affidavit | You want to save time and legal fees for your will’s witnesses. |

| Living will | You want to specify what heath care treatment you prefer if you cannot express that by yourself. |

| Living trust | You would like to deal with your end-of-life matters without probate. |